Two of the most frequently returned response codes, card_declined and processor_declined indicate that the customer's bank is unwilling to accept the transaction - the errors are returned when payment authorization has been declined at the issuing bank. The causes for either are diverse and difficult to pin down without contacting the bank, but typical ones include:

High level of recent activity on the card

Incorrect card number or expiration date entered on the checkout page

Insufficient funds in the associated bank account

The credit card being over its limit

Rejection based on fraud filters at the bank

Being a soft decline (the result of a temporary issue), the best way to troubleshoot this error is to simply retry the card at a later time.

Alternatively, you could try the following as it has been known to help with decline rates:

Step 1:

For V2 checkout pages -

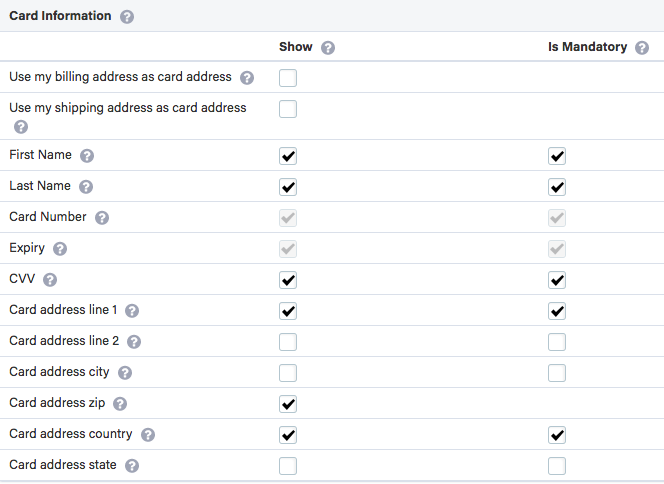

Check if the card address fields have been enabled in your Chargebee account under Settings » Customer-facing essentials » Checkout and Self-Serve portal » Field Configurations (on the left panel) » Card Information. Enable them as shown in the image.

For v3 checkout pages -

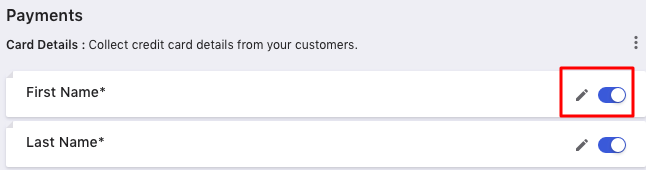

Go to Settings » Customer-facing essentials » Checkout and Self-Serve portal » Fields » Payments (on the left panel) and enable the same fields shown in the image above. To make a field mandatory click on the Edit icon of that particular field.

Step 2: If you've enabled the fields as above and still see this error, please check the label associated with this particular payment in Stripe. If the payment has been marked as 'fraudulent' by Stripe and you believe the customer to be genuine you can use the Mark as safe option.

Step 3:

If you've enabled the fields and see no label associated with the payment in Stripe, ask the customer to contact the card issuing bank for more information.