Docs

Chargebee-Adyen integration provides fraud detection and prevention solutions powered by network-wide insights and machine learning technology. This helps businesses identify and prevent fraud in real time.

To know more about how Adyen risk management works, refer to this webpage .

With Adyen RevenueProtect integration with Chargebee, Chargebee allows you to deal with suspicious and fraudulent transactions on the transaction and customer levels.

Every Chargebee transaction that goes through Adyen's payment gateway is evaluated by RevenueProtect and is categorized into three:

Make sure you enable RevenueProtect -related features at Adyen so that Chargebee receives fraud information from Adyen.

Adyen risk management works only for transactions that go through Adyen's Payment Gateway.

When the customer makes a transaction, Adyen flags it as suspicious and reports it to Chargebee. It reflects your Chargebee App, and you receive an email notification about it. Chargebee then marks the customer as suspicious, and you can later mark them as safe or fraudulent.

Identify the suspicious transaction either by clicking on the link you received via email or by navigating to Logs > Transactions, where you can filter the transactions using the Is Suspicious filter.

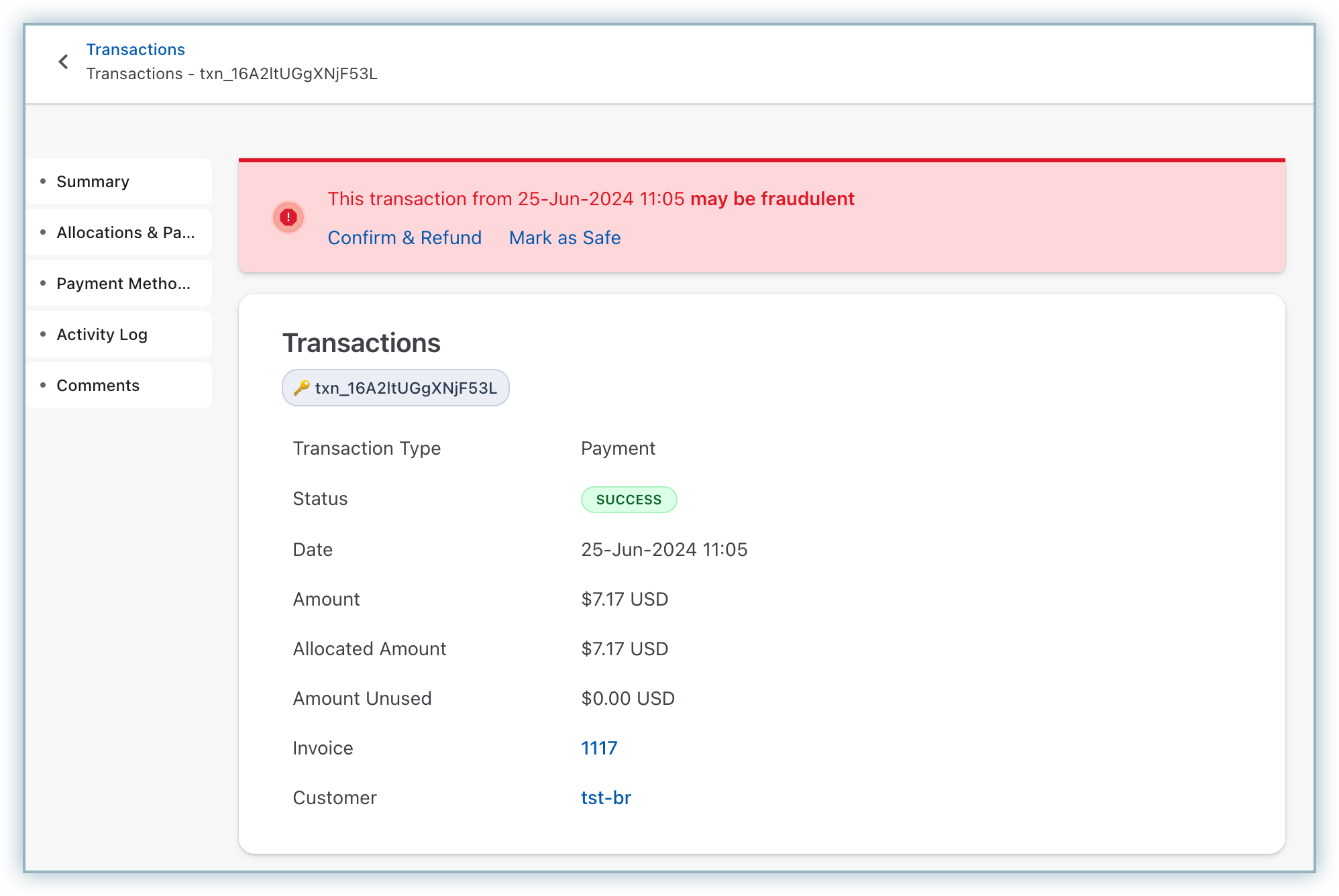

Selecting the suspicious transaction redirects you to the Transactions details page as shown below:

You can conclude whether or not the transaction is legitimate based on the customer who made the transaction and their transaction history.

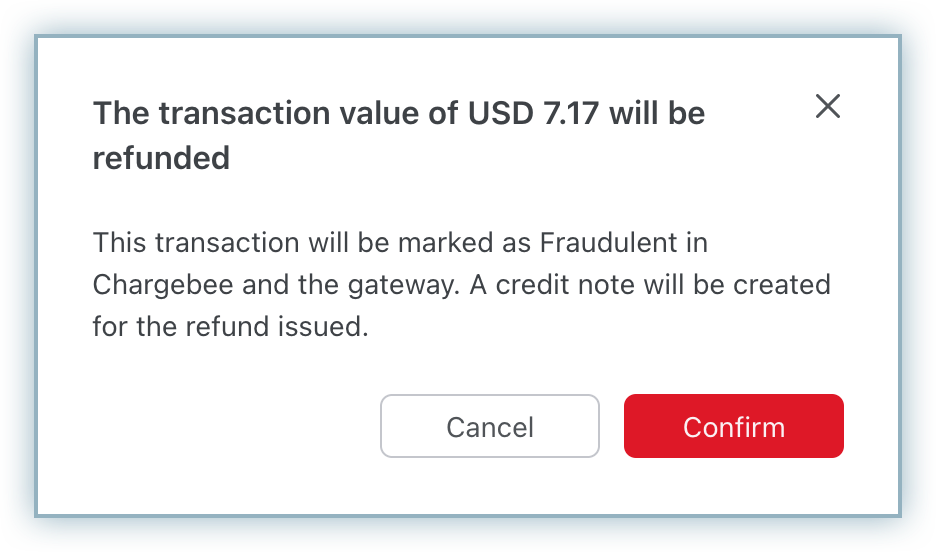

If you are convinced that the transaction is fraudulent,

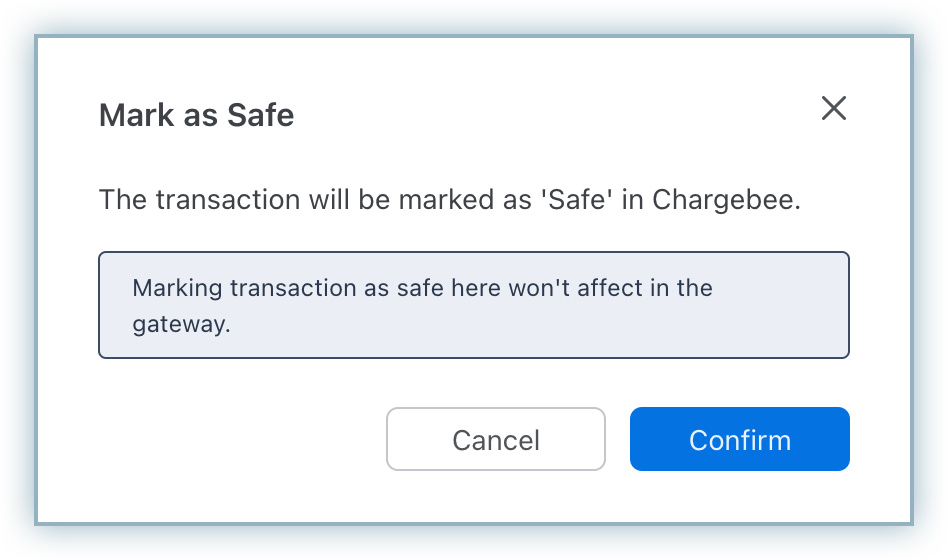

If you find the transaction to be genuine, click Mark as Safe. Once marked safe, it reflects automatically in your Chargebee site.

Identify the suspicious customer either by clicking on the link you received via email or by navigating to Customers, where you can filter the customers using the Is Suspicious filter. Follow the steps here to get the customer-level information.

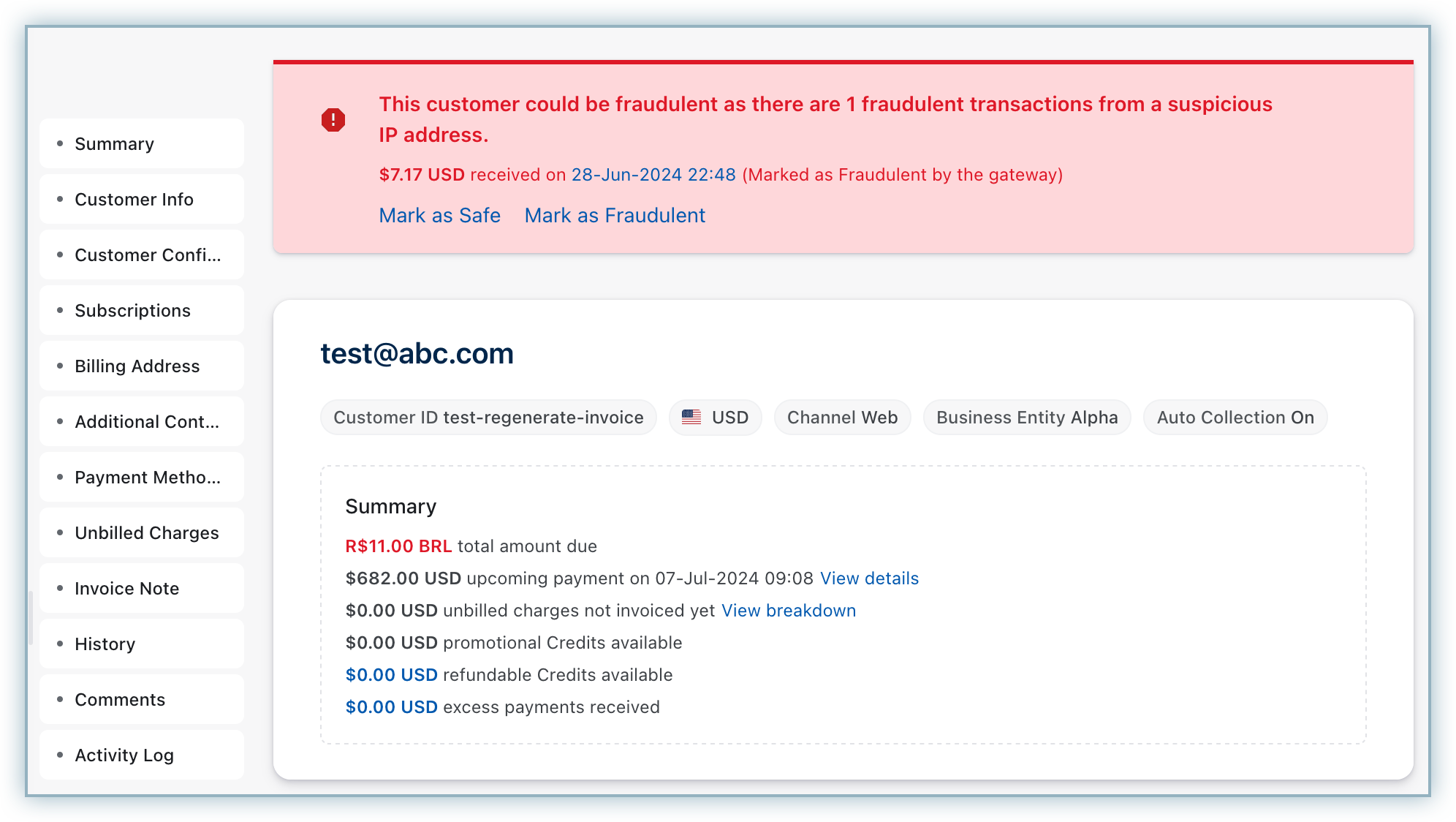

Selecting the suspicious customer takes you to the customer details page, as shown below:

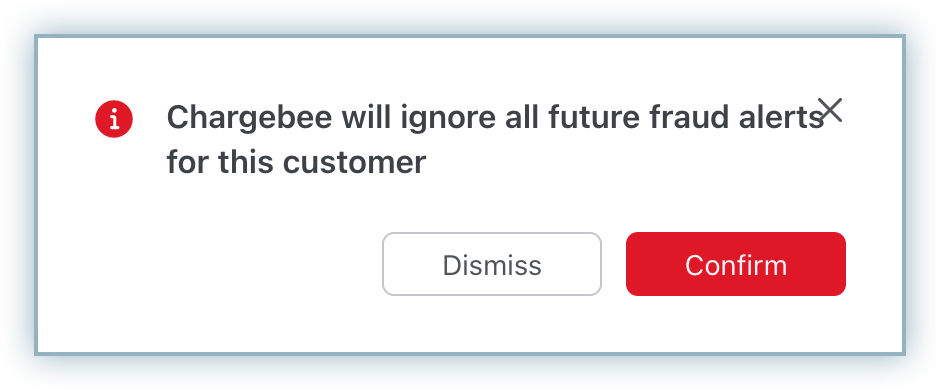

To mark the customer as safe after verifying the transaction made, click Mark as Safe. This marks the current and all future transactions as safe. Once marked safe, Chargebee ignores all future fraud or suspicious alerts from Adyen for this customer. This change does not reflect in Adyen automatically. You have to mark the transaction as safe in your Adyen dashboard manually.

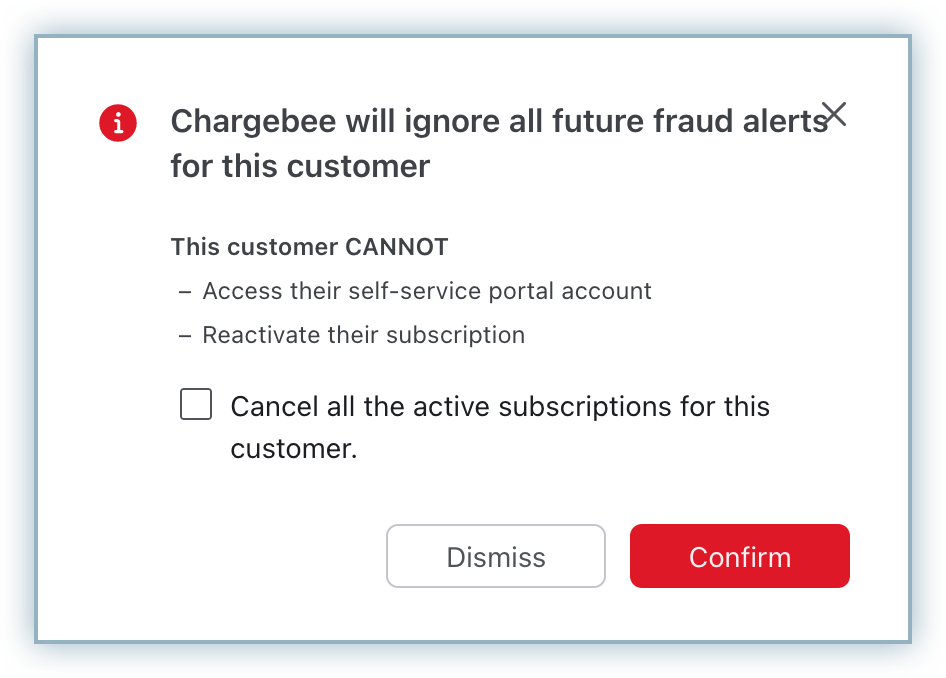

After verifying the transaction, if you find the customer fraudulent, click Mark as Fraudulent. This marks the current transaction as fraudulent. A credit note is created for the transaction, and their self-service portal(if available) is disabled. Moreover, the customer is not able to reactivate their canceled subscription.

After that, you are asked whether you want to cancel all other subscriptions of the same customer.

If you decide not to cancel the subscription, the customer must use another mode of payment to renew it.

Clicking on Ignore ignores the current transaction made by the Customer. However, you will be notified of fraudulent transactions in the future.