Docs

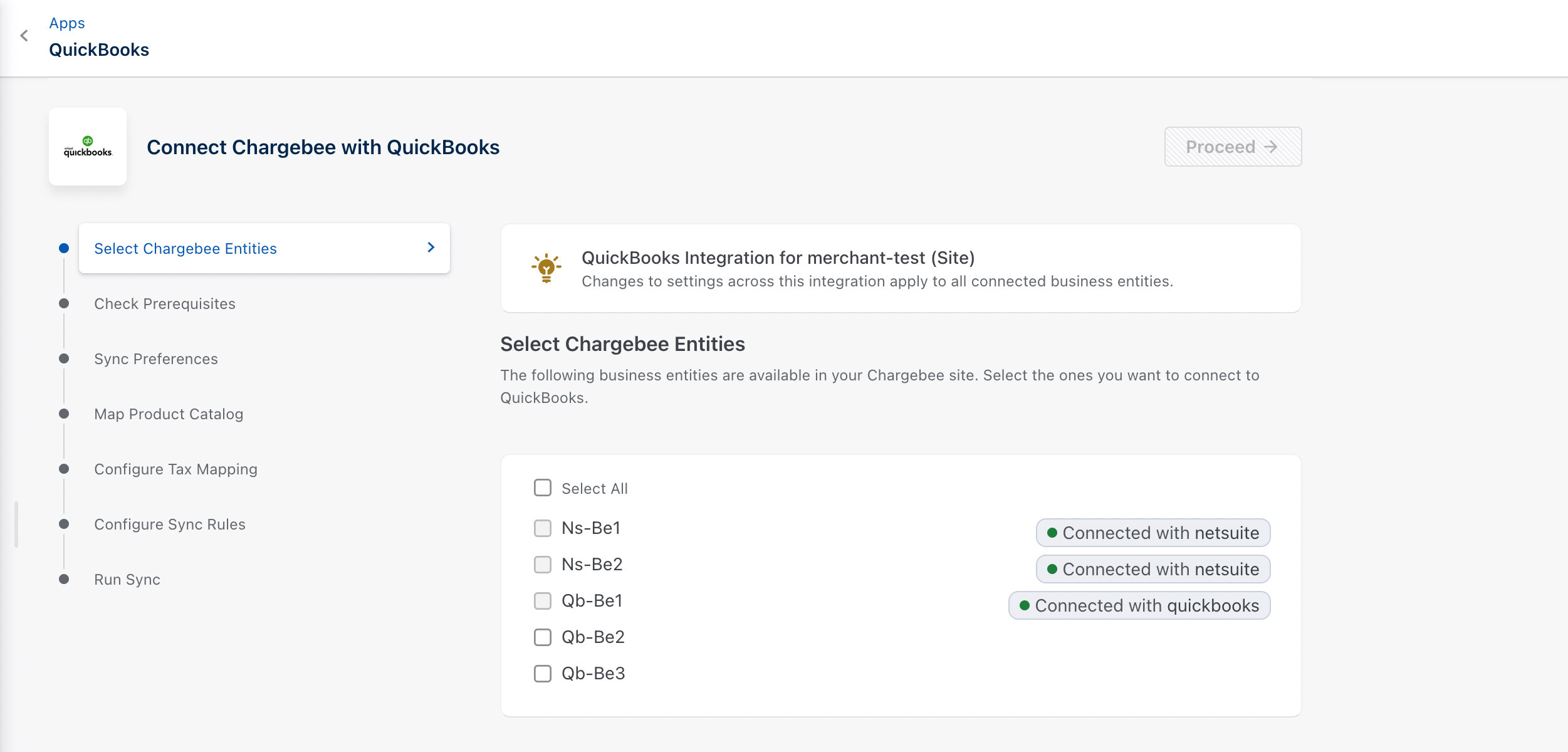

Chargebee Billing site users with multi-business entity feature enabled will have access to one or more sites and can select from the respective list of entities to connect with QuickBooks.

You can choose to connect either from site or business entity level.

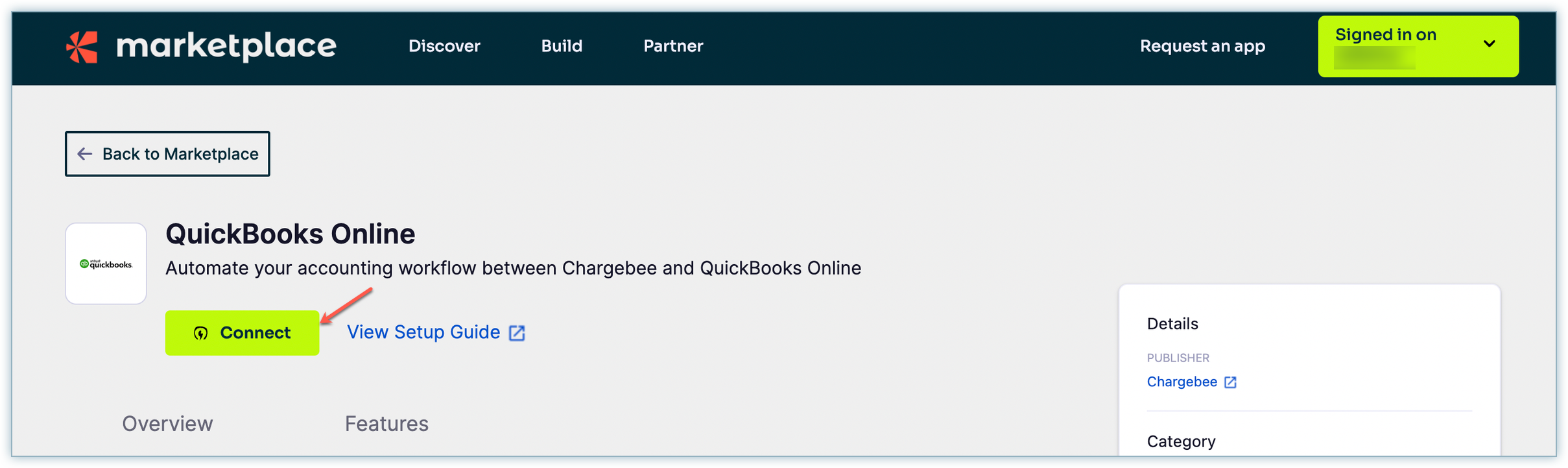

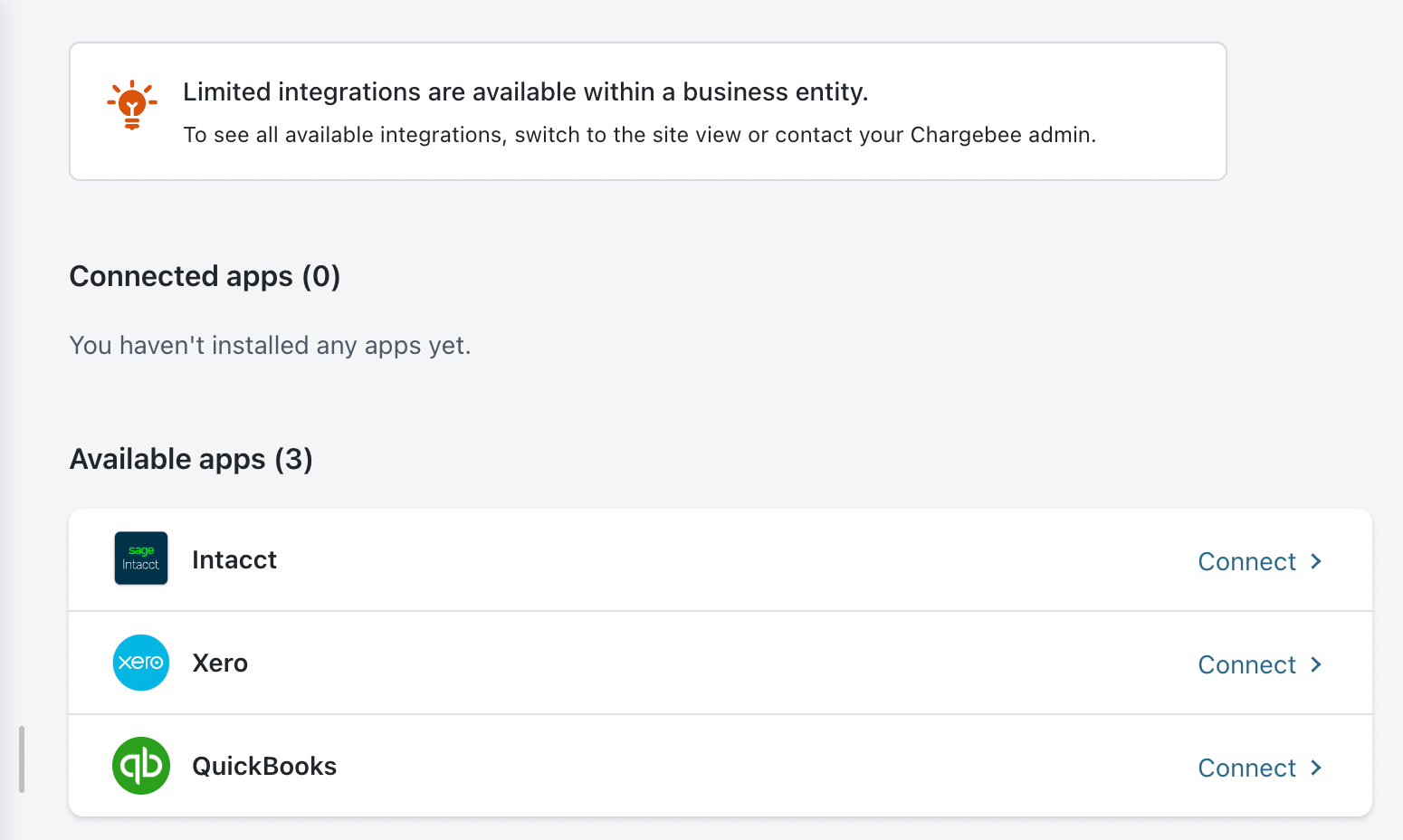

Navigate to Apps and select QuickBooks from the list of apps. If you choose the business entity-level view, the Apps page will exclusively display the apps associated with the selected business entity of your site. Regardless of any existing connections at the site level, a complete configuration will occur from the beginning.

Only one accounting integration app can be connected at the business entity level.

Ensure that at least one business entity is linked at the site level prior to establishing connections at the business entity level to ensure that auto-sync works as expected.

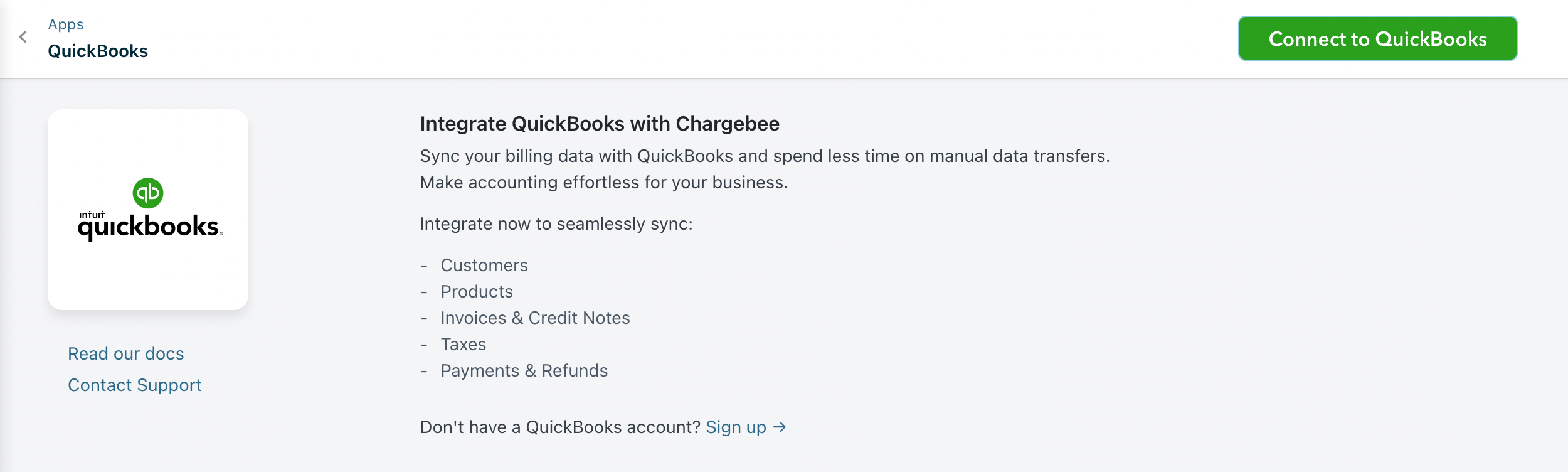

Click Connect to QuickBooks to get started with the integration.

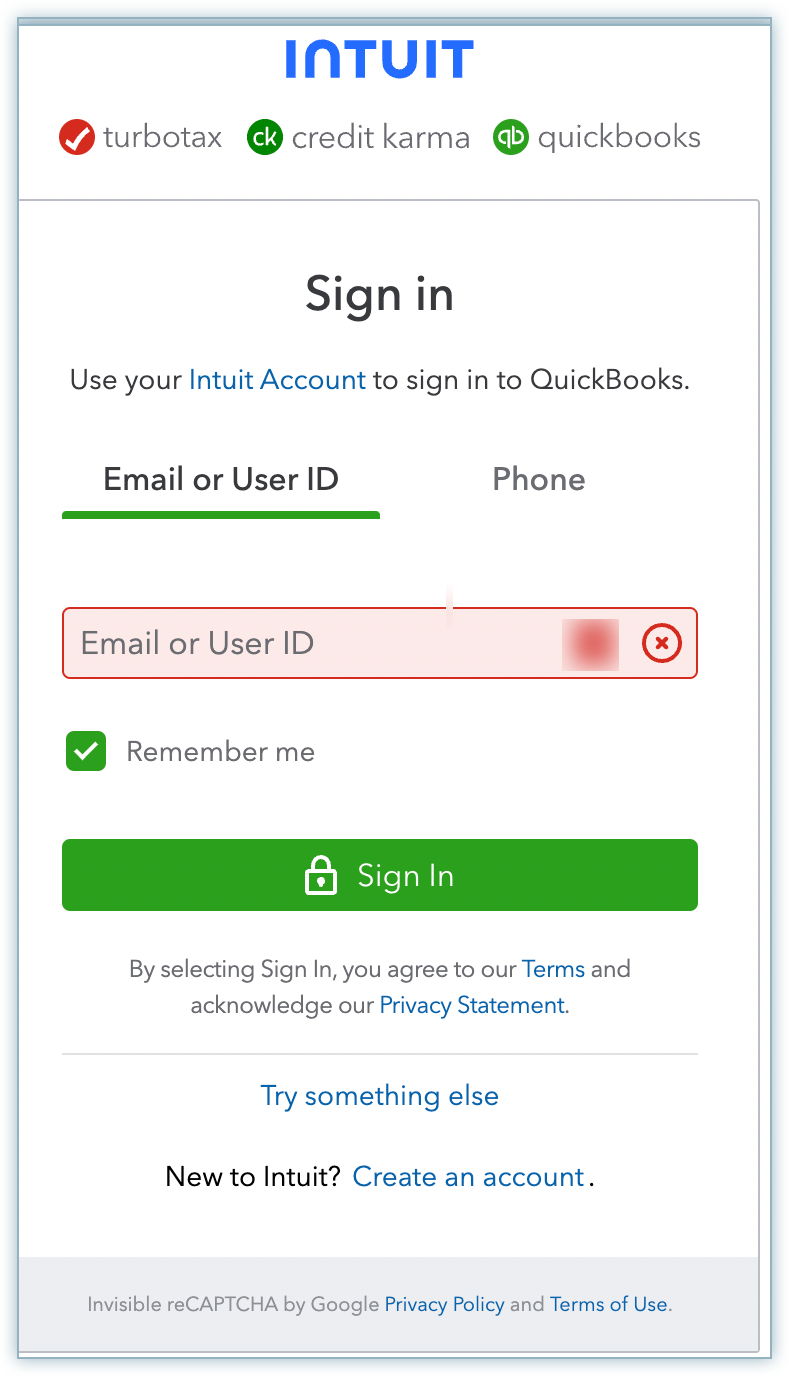

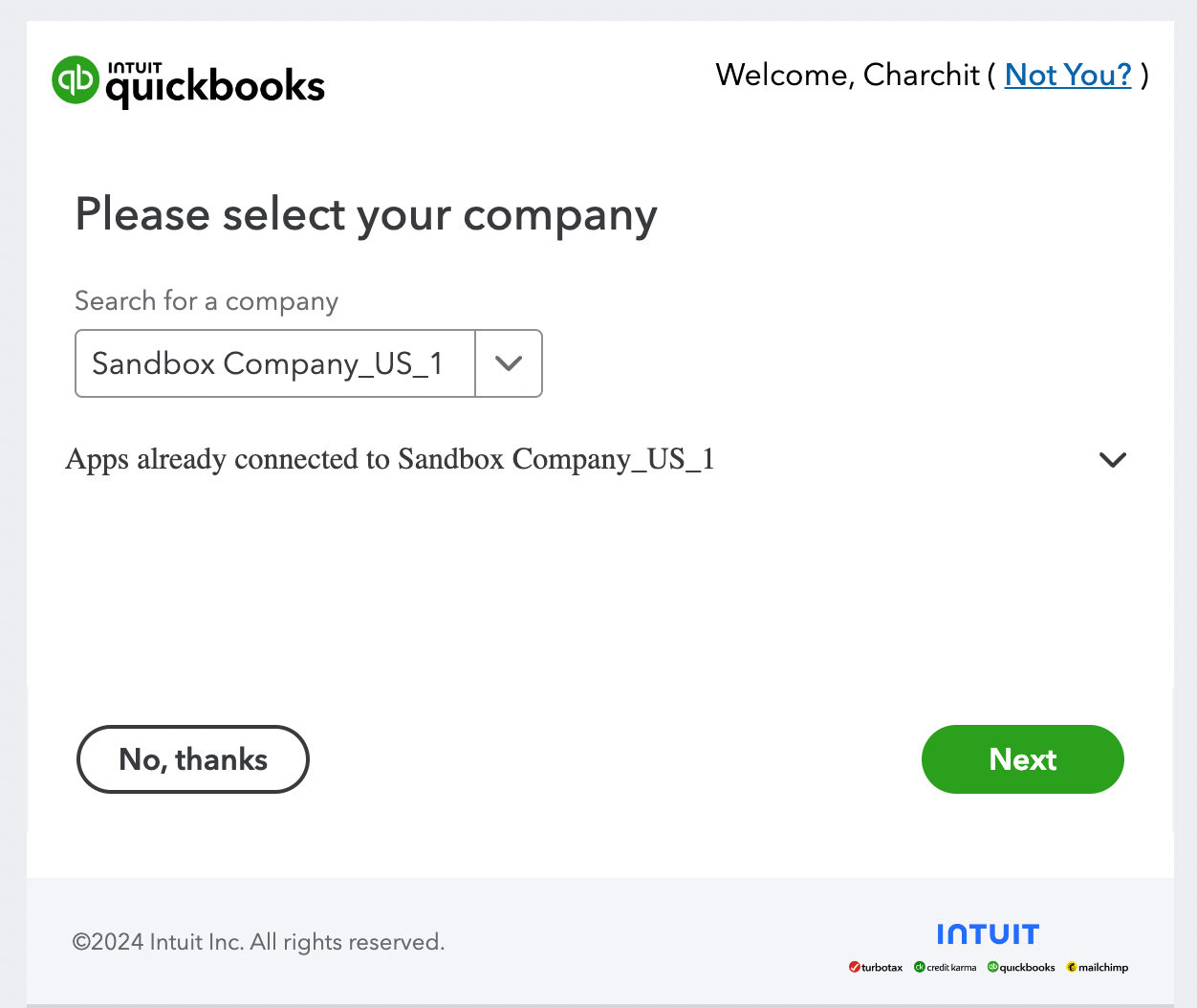

Login to your QuickBooks account.

Select your company using the drop-down and provide access to the data.

When the multi-business entity feature is enabled and you are connected at the site level with multiple business entities, the following page appears. Select from the list of business entities that you want to connect with and click Proceed.

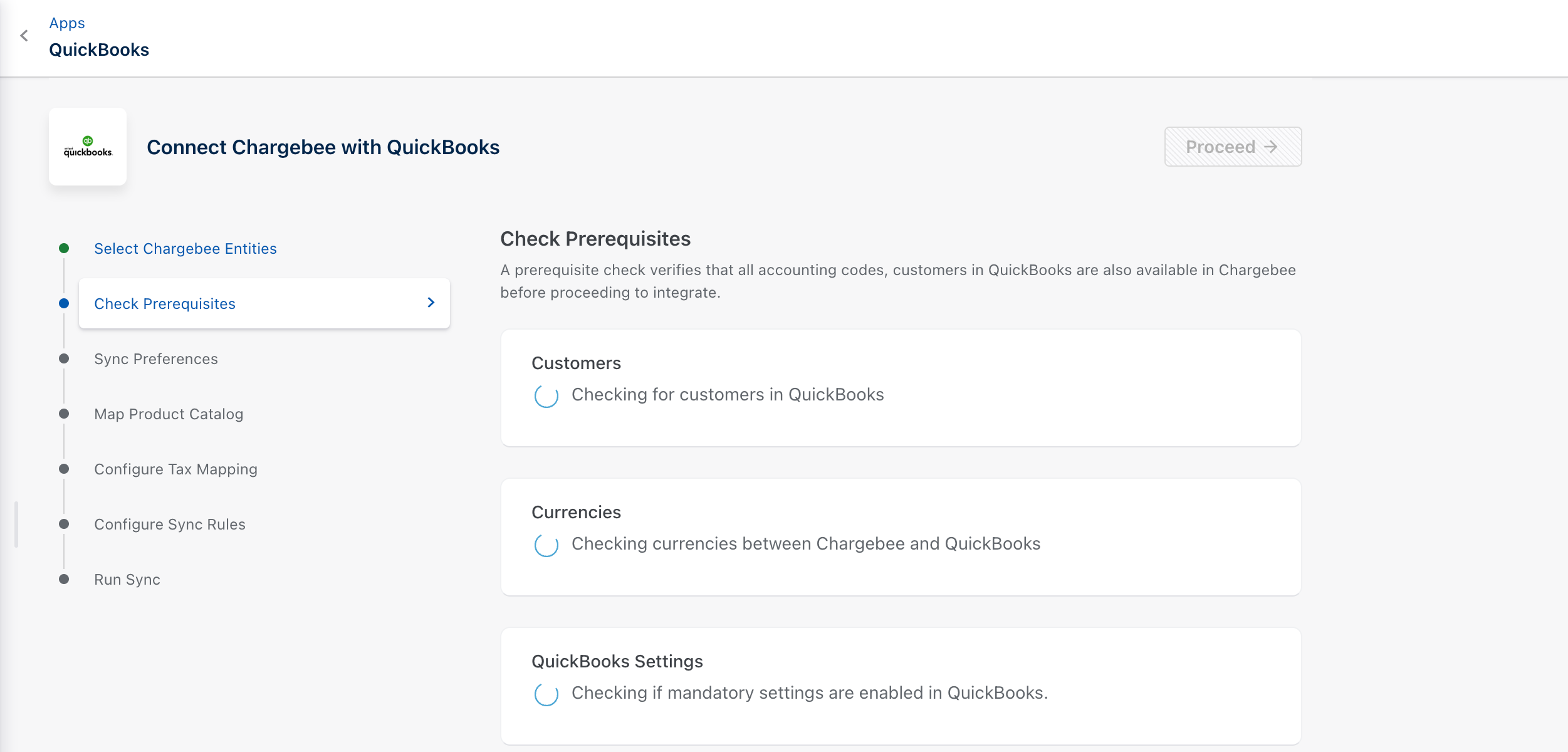

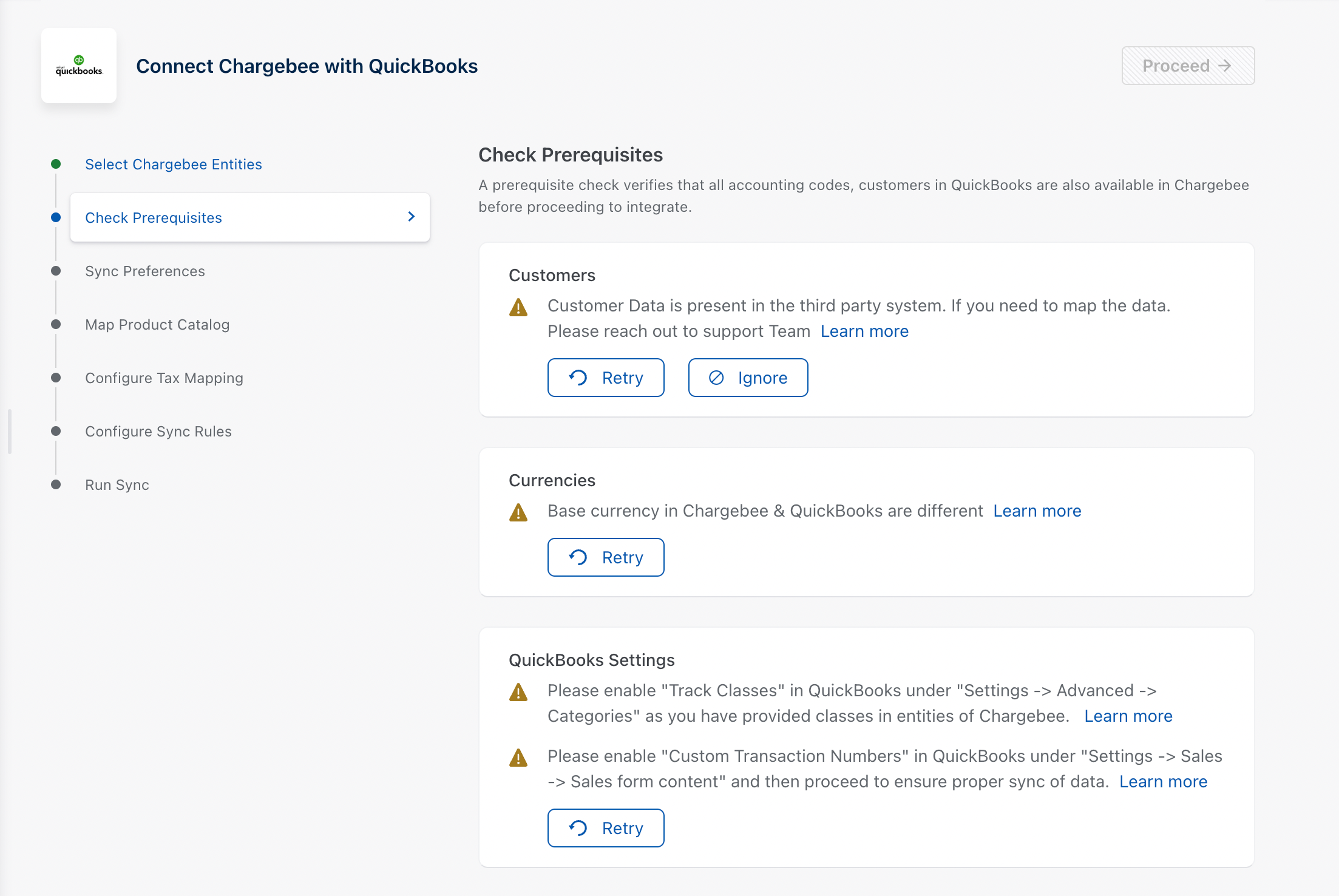

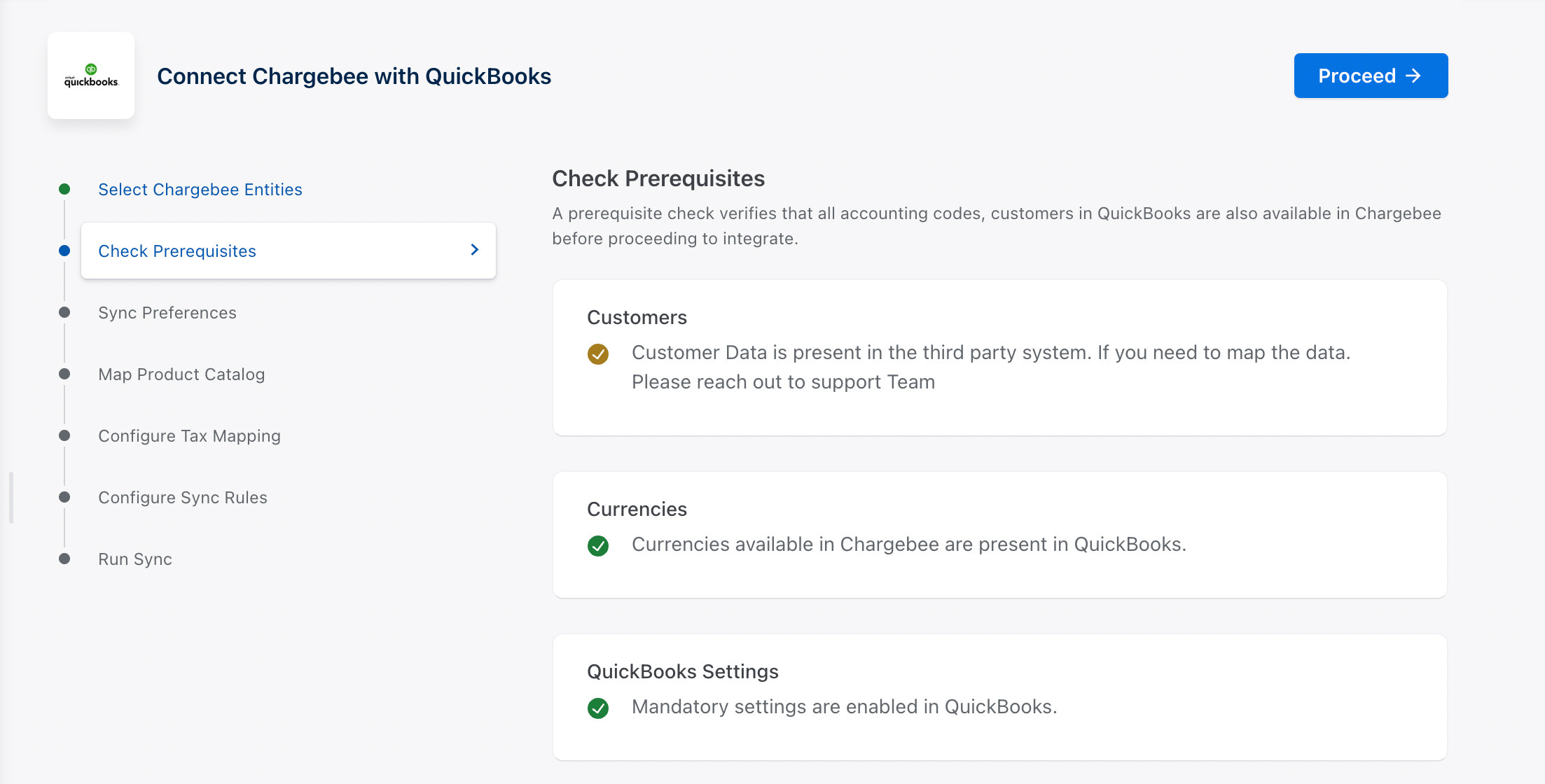

Chargebee performs a checklist in QuickBooks. This prerequisite verifies if the accounting codes, customers, and their currencies in QuickBooks are available in Chargebee before proceeding with the integration.

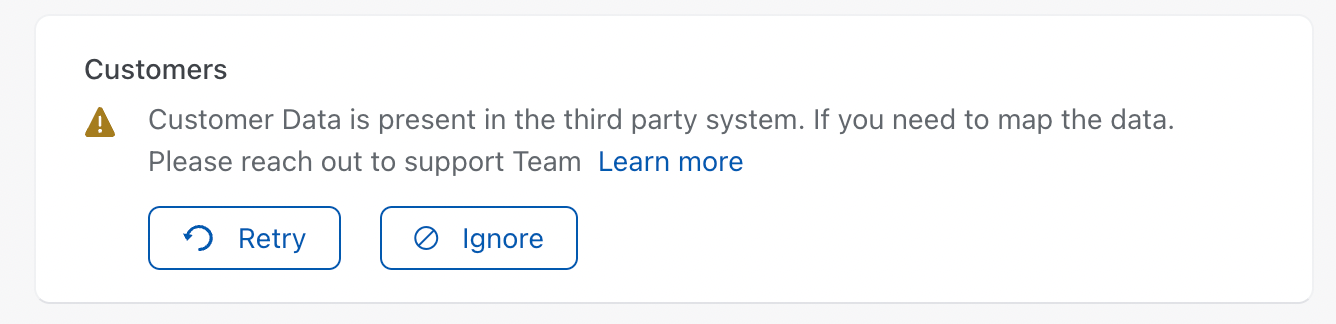

The following error message will be displayed if customer data already exists in QuickBooks. In such cases, you can contact eap@chargebee.com.

Further, if there are any configuration issues in Currencies Setup or Preferences, it will be displayed as shown below.

Once the above errors are addressed, the Proceed button is enabled. Click Proceed to move to the next step.

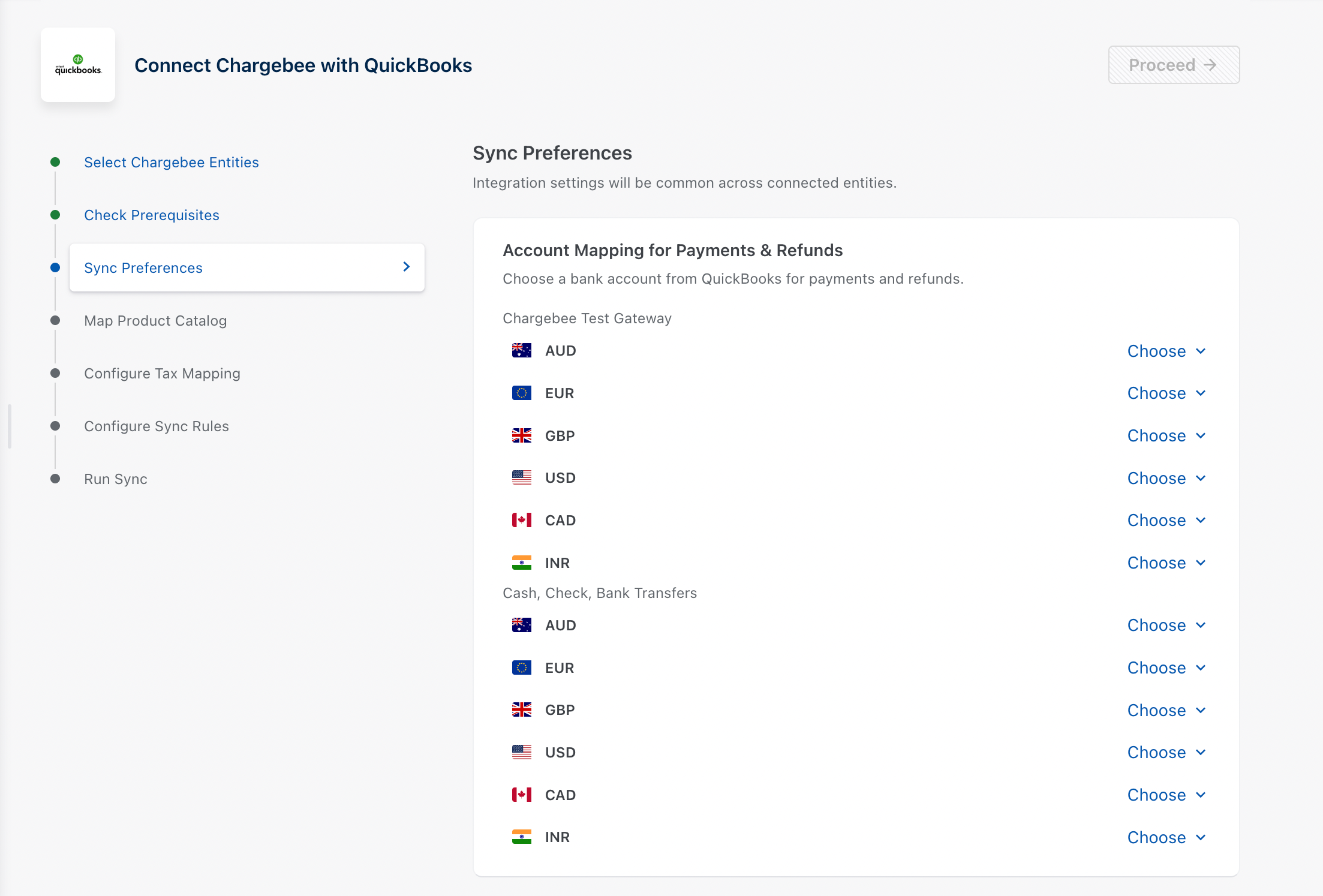

You need to perform account mapping for payments, invoice line items, and refunds to ensure that the integration settings are common for all connected business entities.

Business entities selected at the site level will share a common configuration.

Payment transactions recorded in Chargebee can be mapped to payment accounts in QuickBooks. For reconciliation purposes, you can select a clearing or undeposited funds account. If you have multiple currencies, payment gateways, or payment methods enabled, you can choose specific payments or checking accounts.

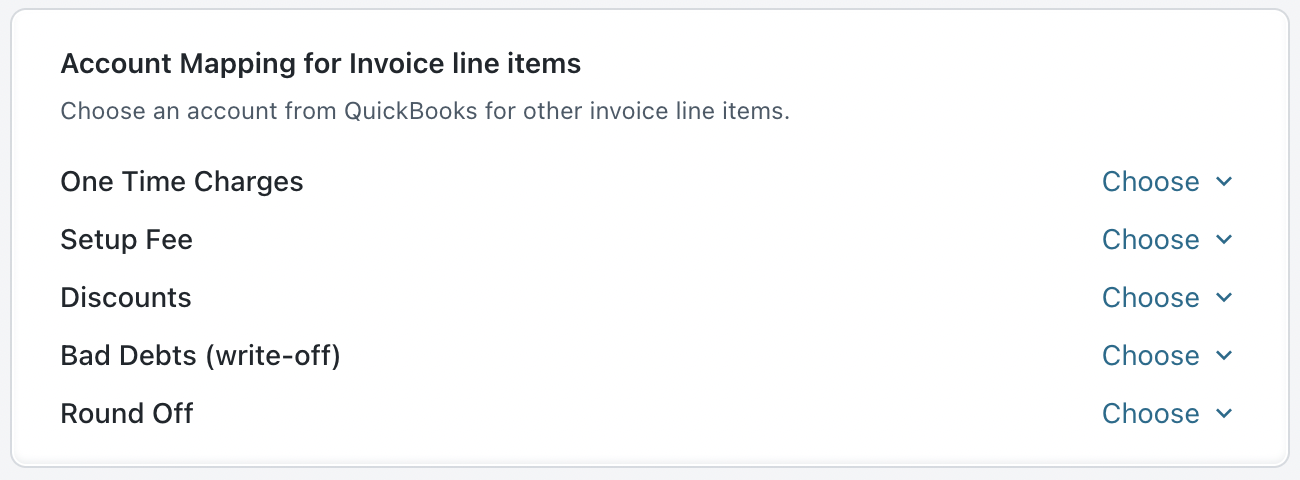

Account mapping for invoice line items involves assigning specific accounts or categories to each line item on an invoice.

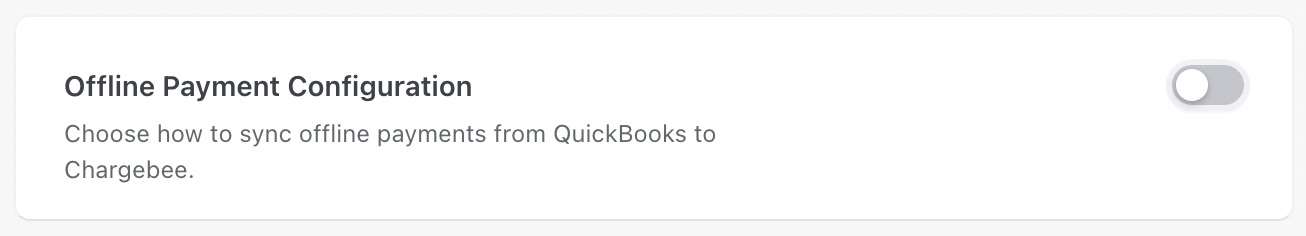

Offline Payment Configuration offers flexibility for syncing offline payments from QuickBooks to Chargebee automatically. You can enable this configuration to allow sync to handle offline payments automatically or disable it, in case you need to record offline payments manually in Chargebee.

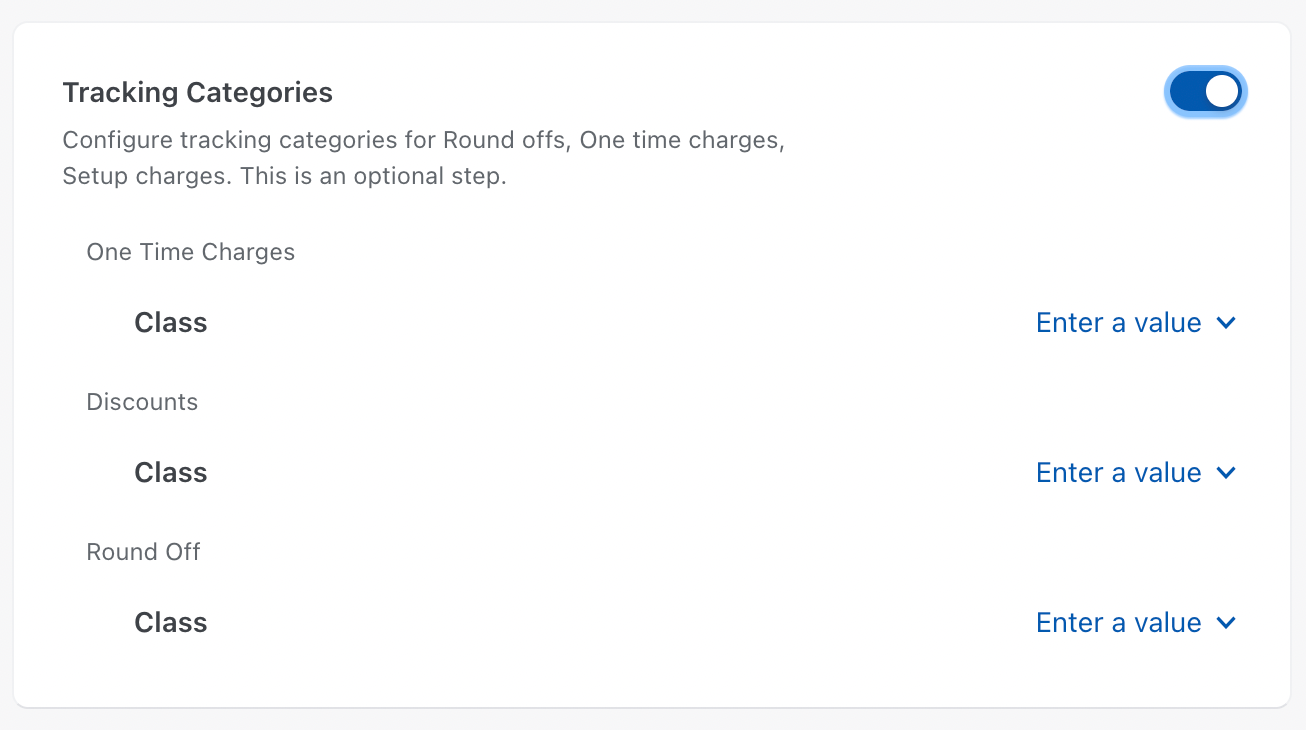

You can send tracking category information from Chargebee for invoice line items when Tracking Categories is enabled.

This allows you to sync voided invoicesin QuickBooks. If this configuration is enabled, voided invoices will be synced as Credit Notes in QuickBooks.

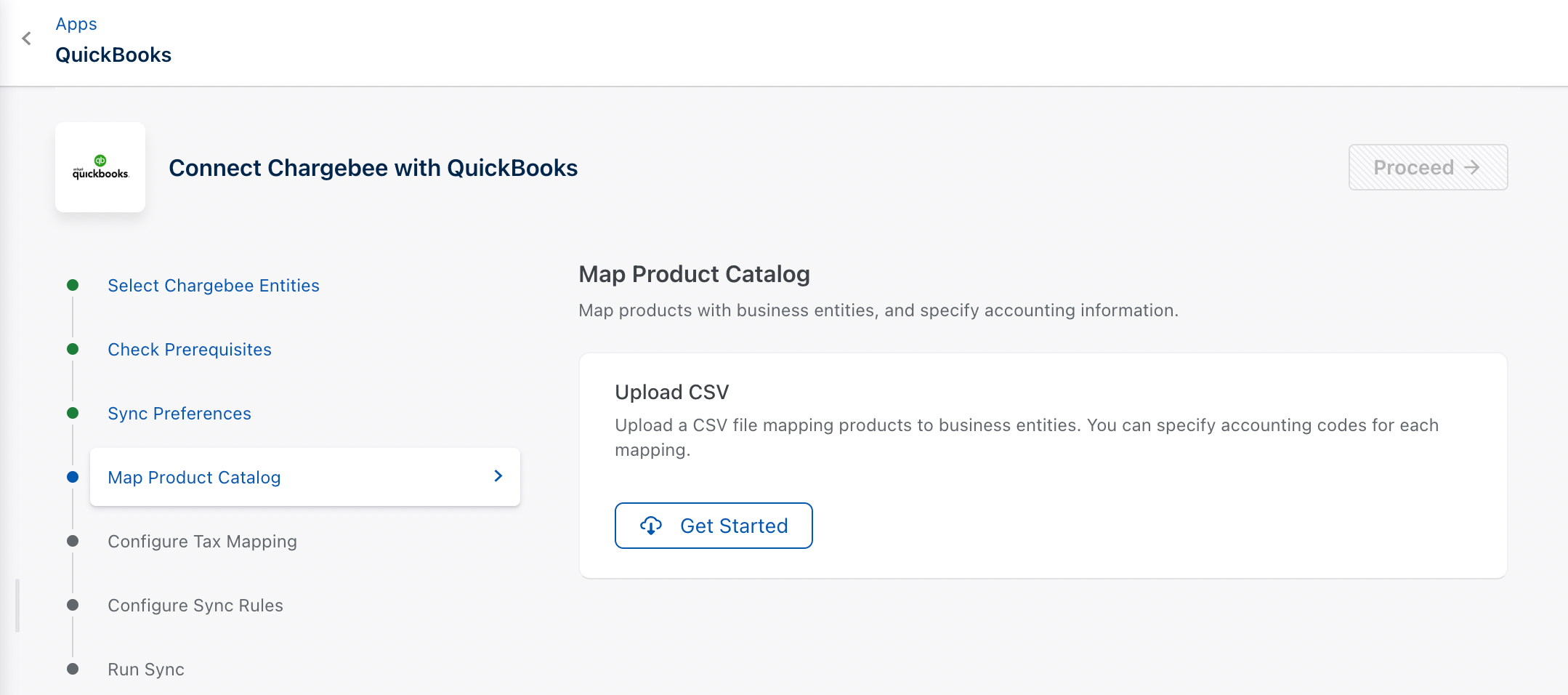

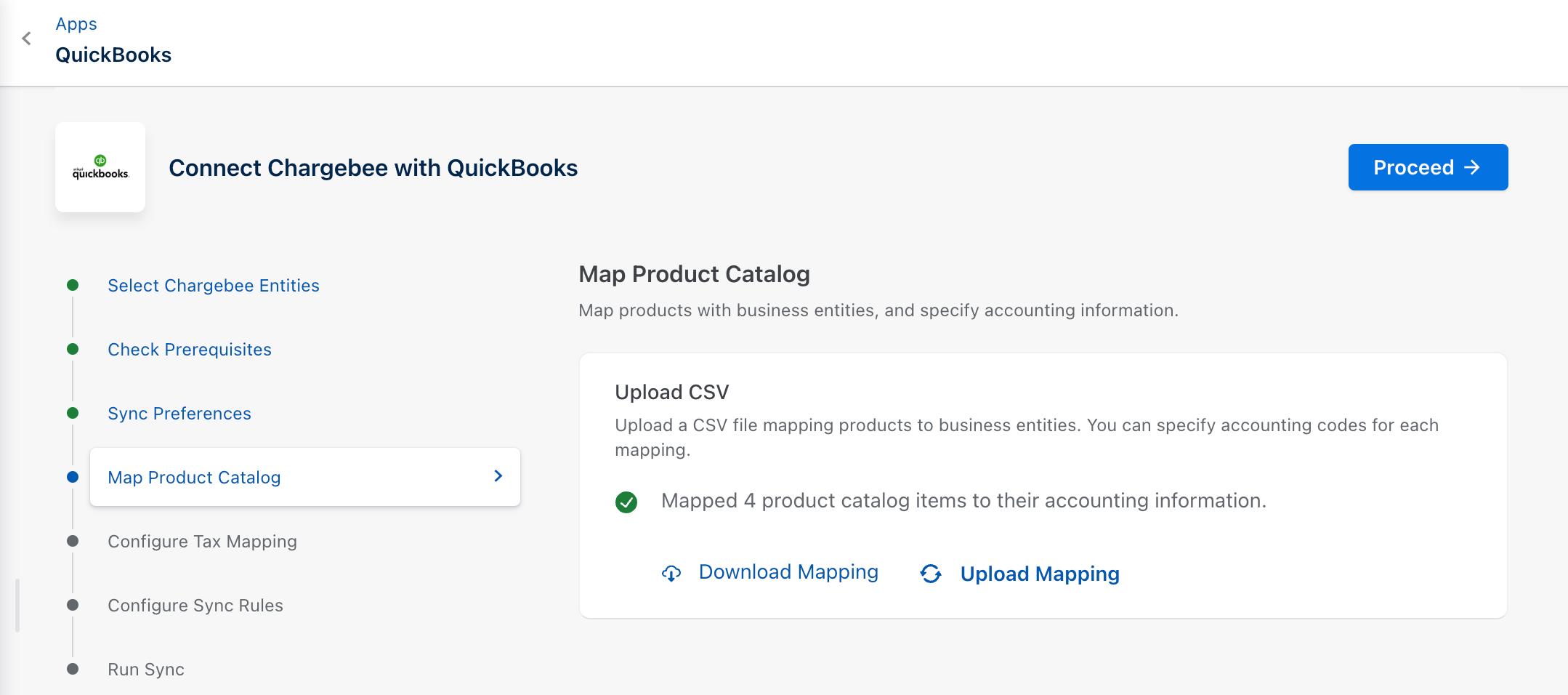

Within Chargebee, items are configured at the site level, and different accounting attributes, such as accounting code, SKU identifier, and tracking category cannot vary for each business entity. To enable distinct accounting fields for each business entity, map the product catalog, which allows you to assign the necessary data at the business entity level according to specific requirements.

The Map Product Catalog feature is deprecated for test sites, and the product catalog step will no longer be available except for sites using Multi Business Entity with Product Catalog. Deprecation for all live sites is also planned. New users should configure price points for the plan, addon, and charge under Accounting Details.

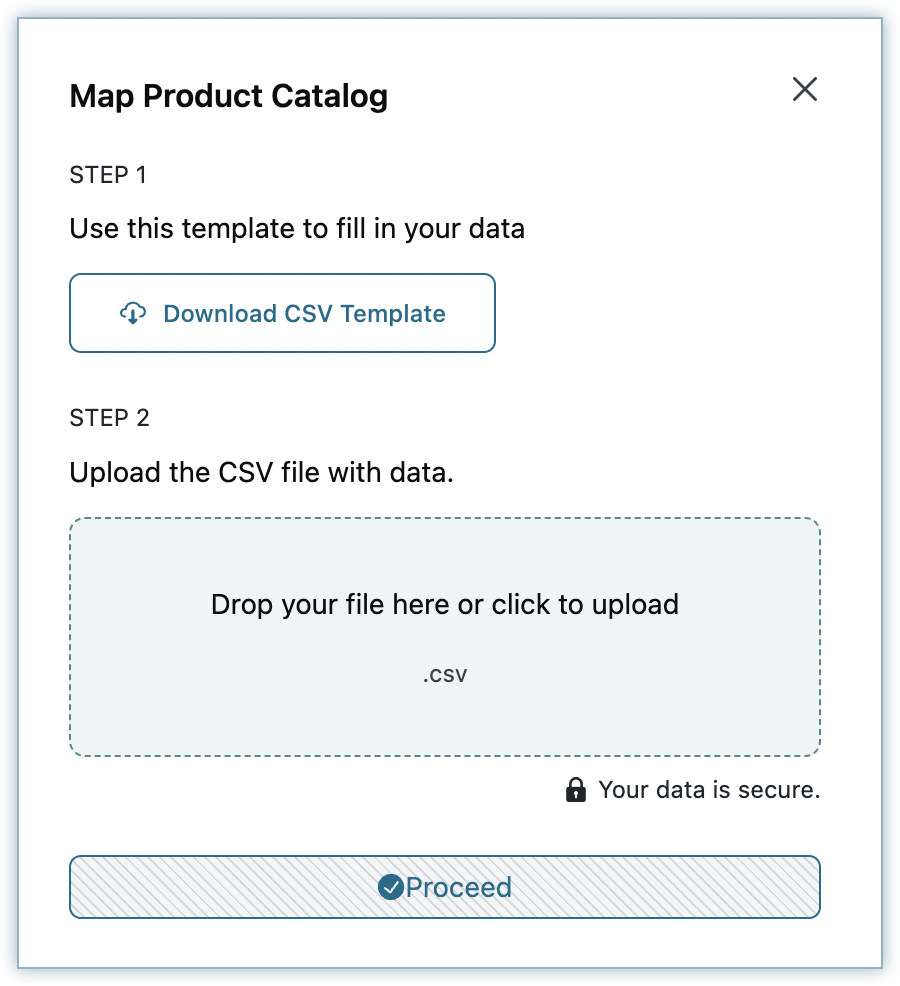

Upload a CSV containing mapping details between products and business entities. Within these mappings, specify accounting codes for each entry.

The sample downloaded CSV file contains the following fields:

| CSV Field Name |

Description |

Additional Info |

|---|---|---|

| PRODUCT_ID |

Unique identifier for Chargebee's item prices. |

|

| PRODUCT_NAME |

Name of the Item price in Chargebee's Product Catalog. |

|

| SKU |

SKU of the product |

This field is used to map the existing items from QuickBooks to the respective plan or addon in Chargebee. It can be used as an alternative name for plan or addon and its character limit should not exceed 30 characters. |

| ACC_CODE |

The accounting code associated with the item |

The Accounting code field should be filled for all the plans and addons. |

| ACCOUNTING_FIELD1 |

Accounting Category 1 |

If you have classified Track Classes for your products in QuickBooks and would like to sync data specific to it, enter the information here |

| BE_NAME |

Name of the business entity |

This will be displayed in case of site-level view. In the case of the Entity Level view only the respective business entity will be displayed |

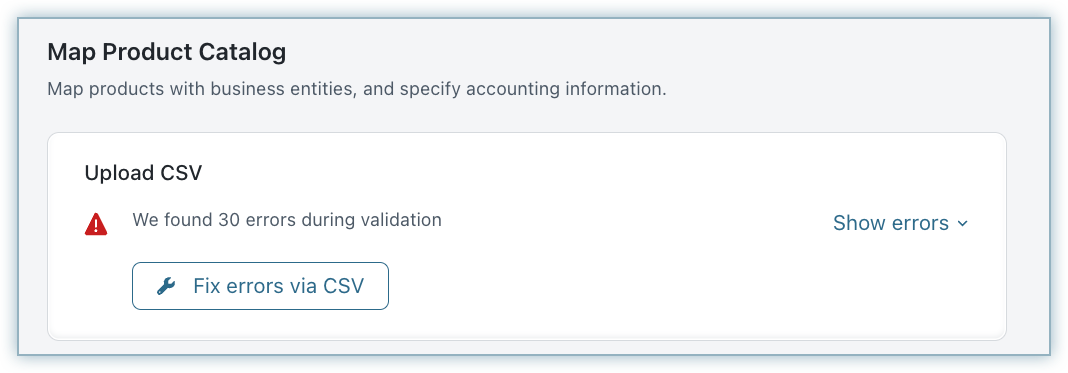

If there are any errors during validation, an error message is displayed. This can be fixed by re-uploading the file with the correct mapping.

Upon successful validation, you can see the successfully mapped records as shown below.

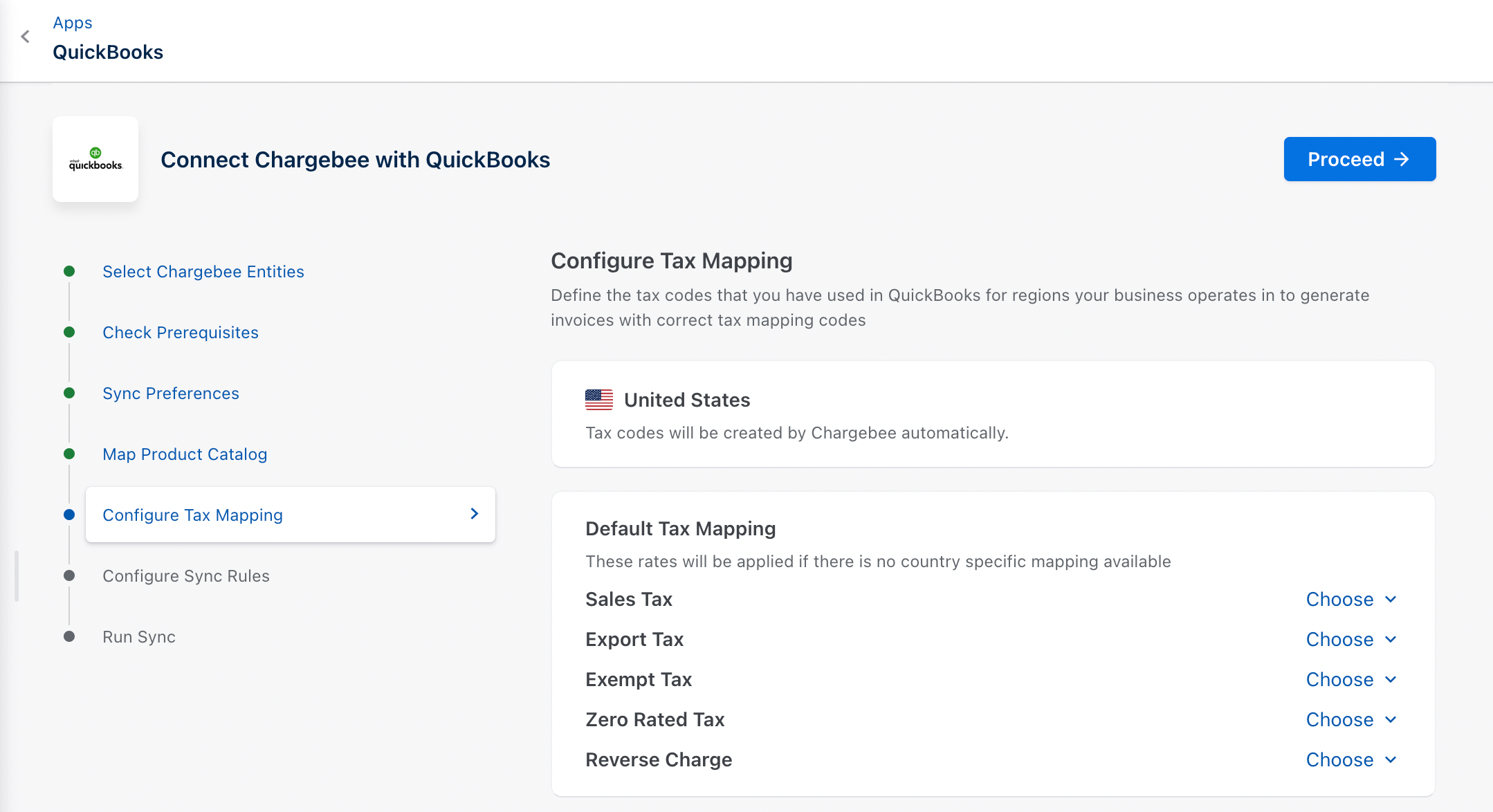

Map tax codes, which will sync invoices and credit notes.

This step will be available only if you have enabled taxes on your Chargebee site.

Chargebee retrieves both the default and custom tax rates created from your QuickBooks account. You can select a tax rate from the drop-down list and map for each category and region.

Chargebee will create Tax Rates in QuickBooks automatically. Mapping tax code manually for the US edition of QuickBooks is a tedious process.

Select from the list of default tax rates created in QuickBooks.

| Category |

Select a Tax Rate from QuickBooks |

|---|---|

| Sales |

Select a Tax code to map all your taxable sales, for example, New Zealand's 15% GST. |

| Exempt |

Select a Tax code to map sales exempt from taxes - Customers or Products can be exempted. |

| Export |

Select a Tax code to map sales to any other country outside your taxable region. |

| Reverse Charge |

Select a tax code for B2B sales with a valid Tax registration number. |

UK organization in QuickBooks supports EU VAT Returns filing within the application. QuickBooks creates default Taxes to facilitate accurate VAT Liability reporting.

While configuring taxes in Chargebee, you can select from one of the default Tax rates created in the QuickBooks UK version.

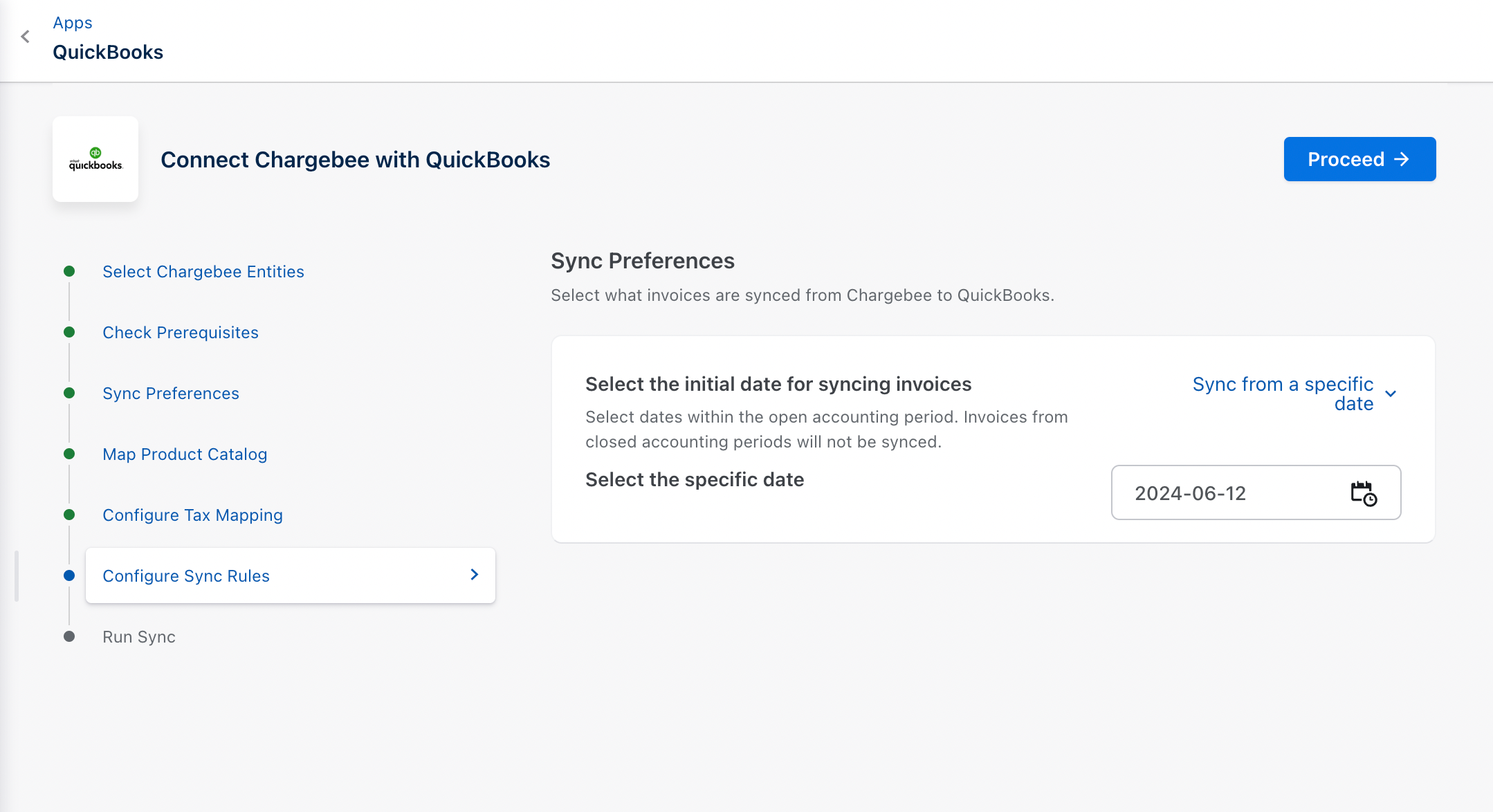

Choose to sync invoices from Chargebee to QuickBooks on a specific date by selecting the relevant date using the date picker.

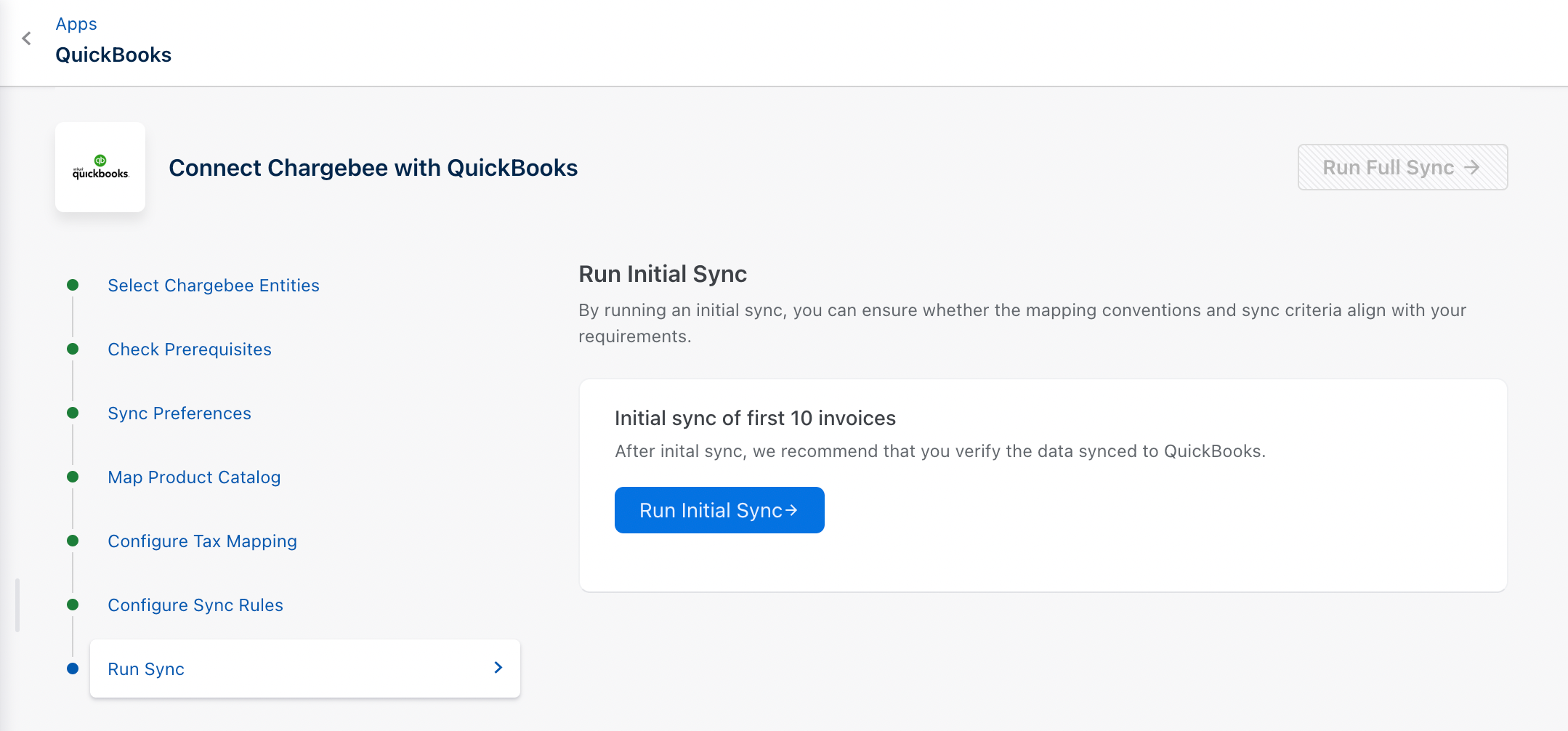

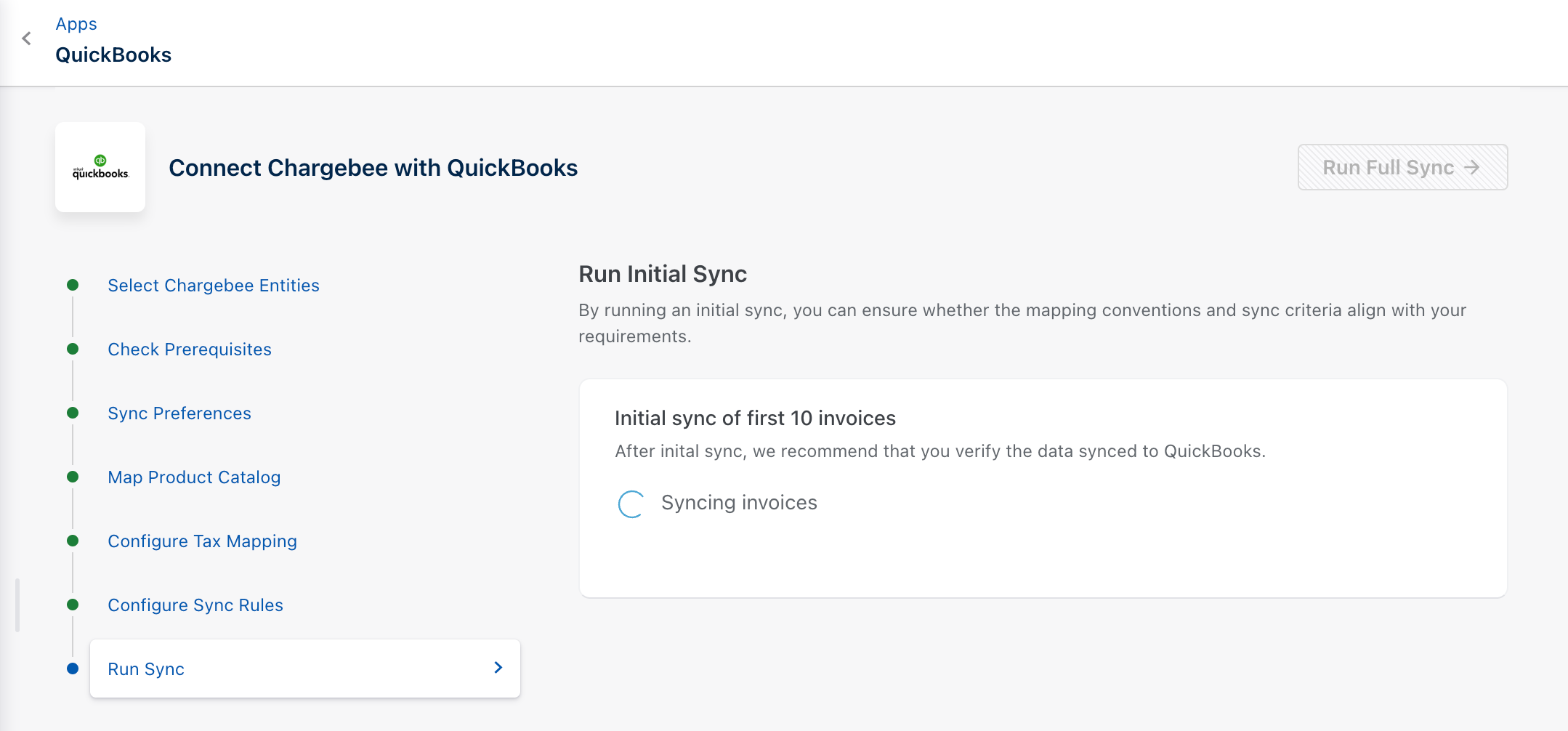

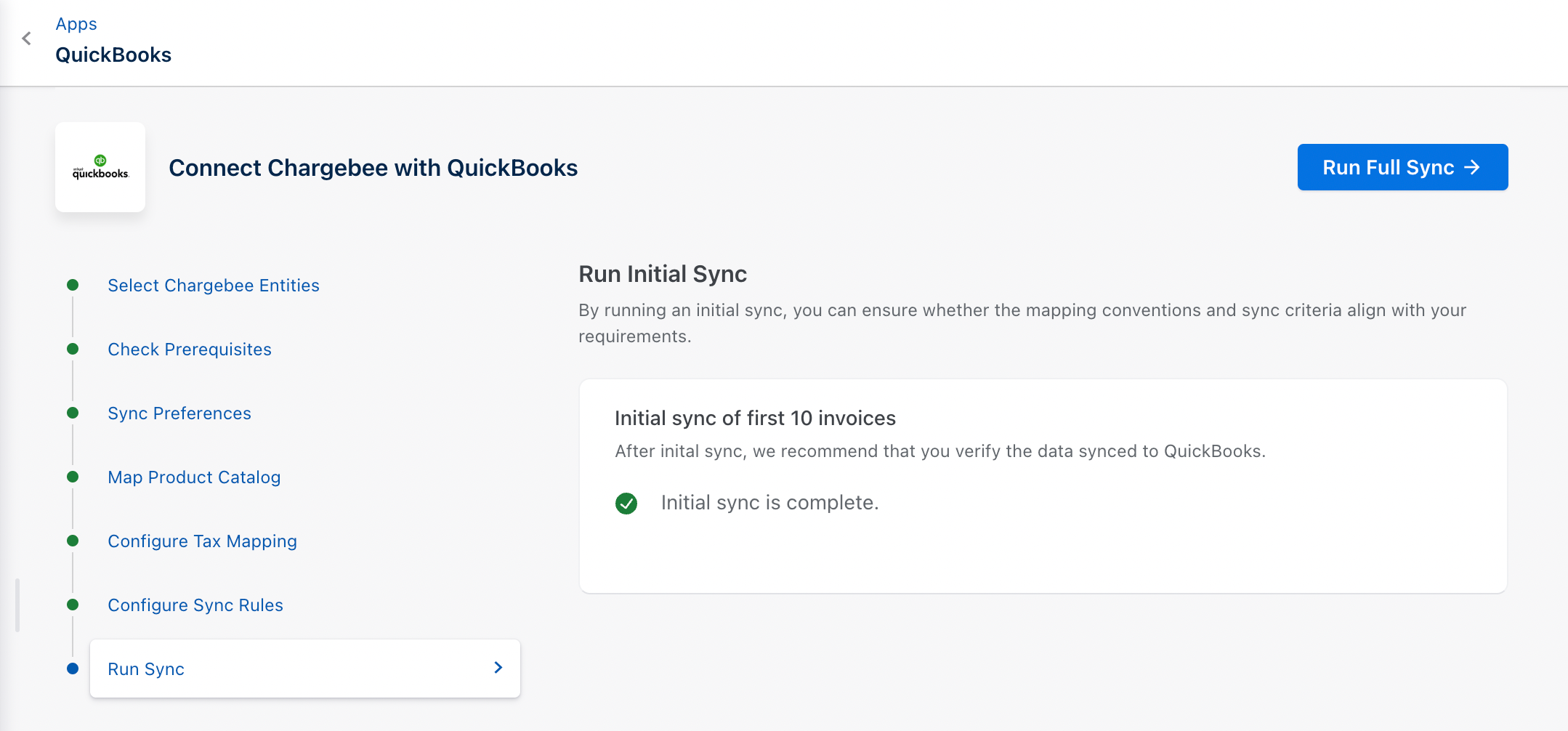

Once the configuration is complete, click Run Initial Sync to begin the sync.

Chargebee will sync the first 10 invoices, to ensure that mapping, conventions, and sync criteria align with your requirements.

Review these 10 invoices in QuickBooks. If the sync works as expected, you can click the Run Full Sync.

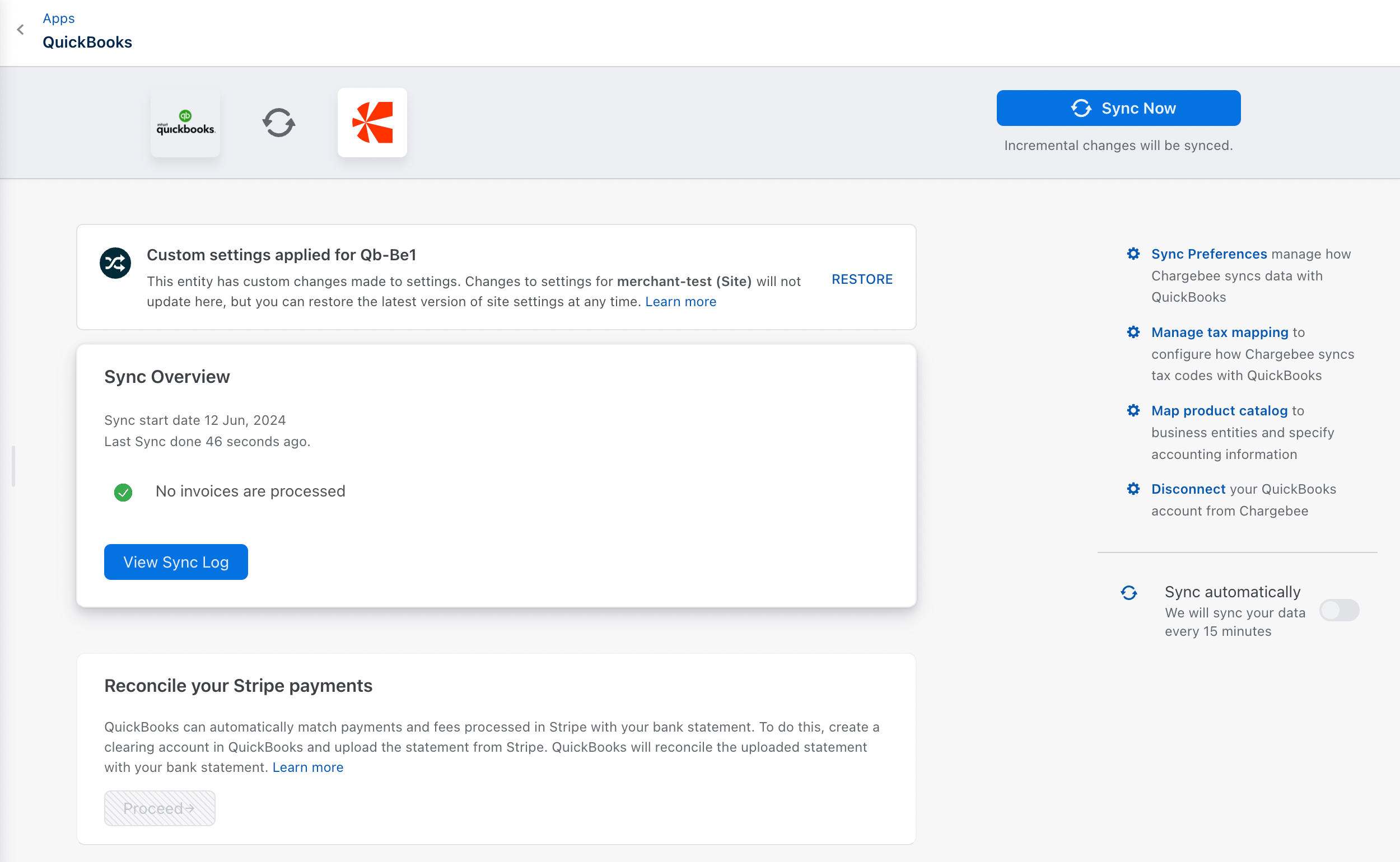

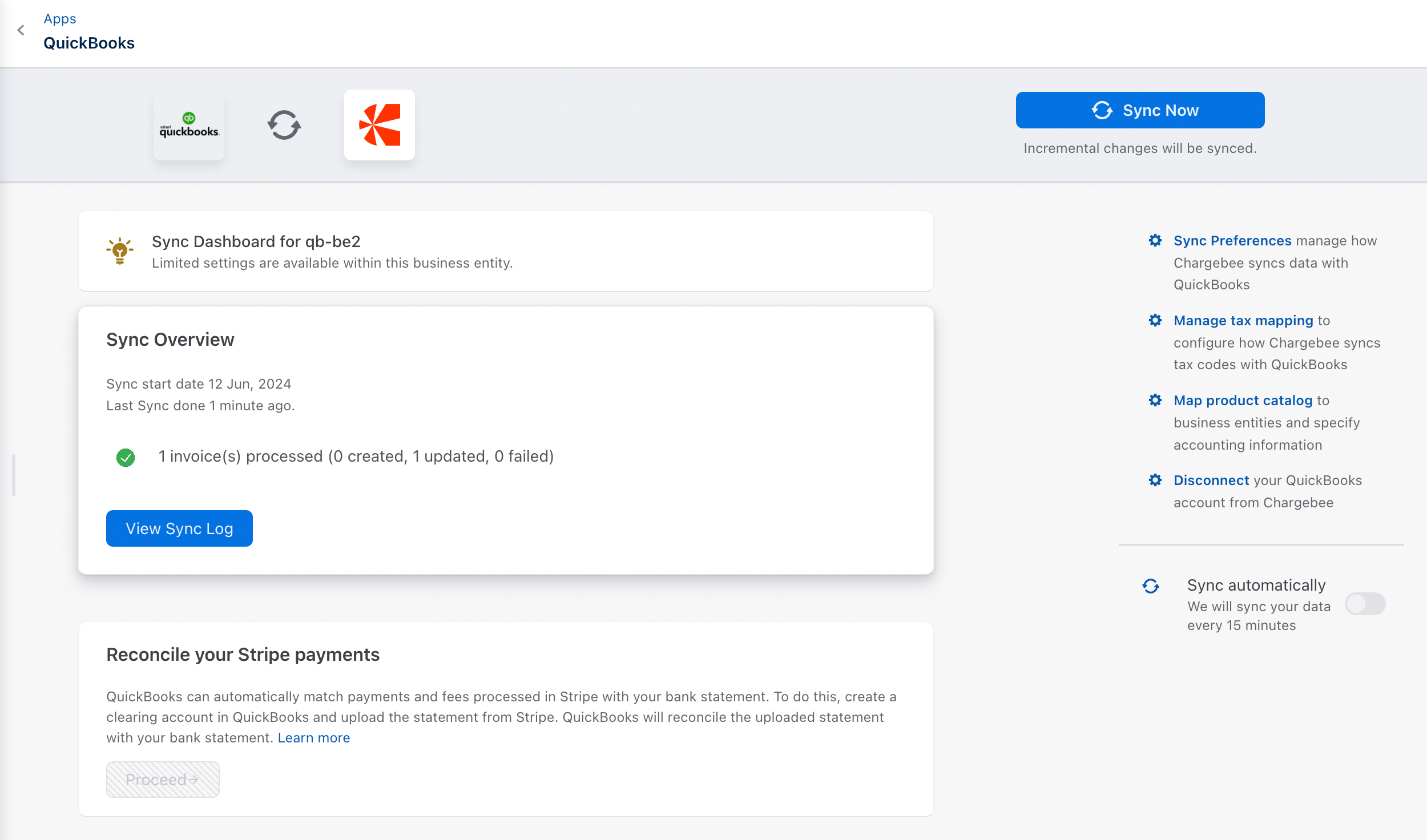

When you trigger Run Full Sync, the sync dashboard is displayed, where you can view or manage settings. This screen is displayed for the business entity that is independently connected at the business entity level, not through the site level.

This screen is displayed for the business entity that is connected at the business entity level through the site level.

Settings cannot be edited at the business entity level if already connected through the site level. Changes can be made only at the site level.

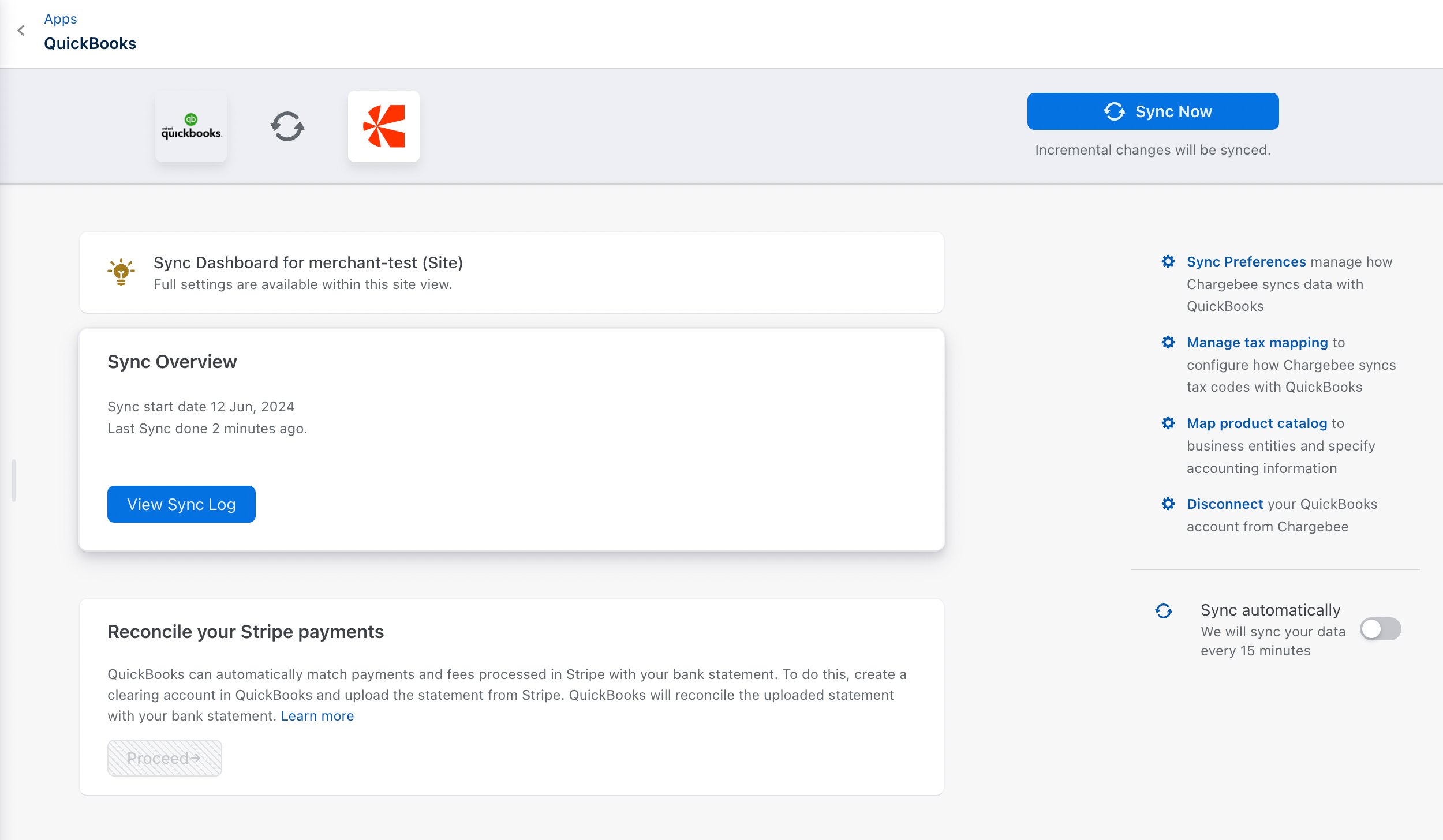

This screen is displayed at the site-level view where you can edit the settings.

After setting up the integration, you can configure the daily schedule to sync all the information to QuickBooks automatically. Invoices and related information will be synced once every 24 hours. You can choose to disable auto-sync if required.

You must enable auto sync at the site level. Only then business entity-level auto sync will be triggered.

Sync data from Chargebee to QuickBooks immediately using this option.

Edit the configurations or GL Account mapping provided during the setup process.

For any new business entities created in Chargebee, you need to add mapping for the business entity at the site level if this business entity needs to share configurations. Connect it independently if you prefer to have different site settings for that business entity

Add or update the mappings for the Chargebee records (Invoices, Customers, Credit notes, and Transactions.

Adjust the tax mapping configured during the setup process. If new tax regions are added in Chargebee settings, update the tax mapping in this section accordingly.

Manage and update the product catalog.

Disconnecting will unlink this integration, and to reconnect, you will need to perform all setup steps again.