Docs

amount, credit, date, invoice, month, Reversal, sum, summary, tax, void, applied, filter, notes, total

How to calculate Tax Reversal for a month?

Tax Reversal gives you the sum of the tax amount applied all over the voided invoices (Voided at dat

35484171

2020-06-21T19:03:49Z

2020-06-21T19:09:11Z

156

1

0

246676

How to calculate Tax Reversal for a month?

Summary

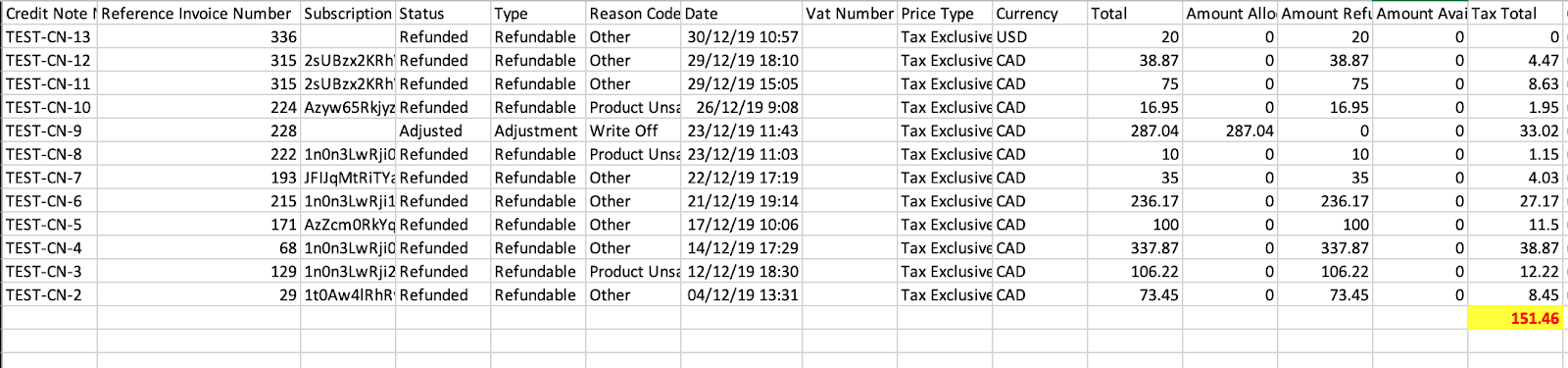

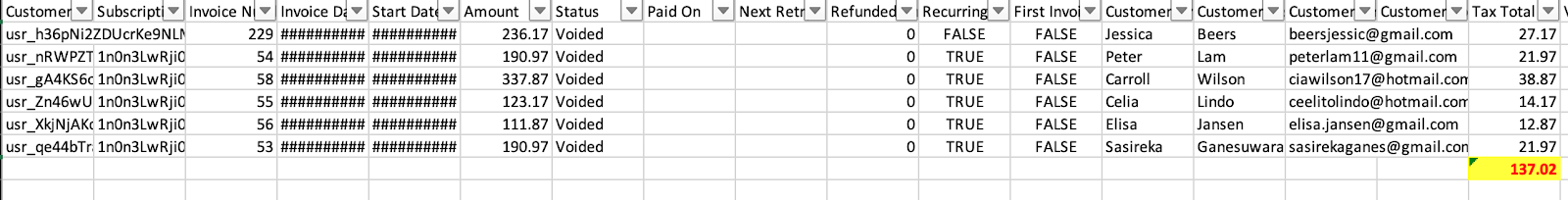

Tax Reversal gives you the sum of the tax amount applied all over the voided invoices (Voided at date filter applied) and the tax applied over the credit notes.

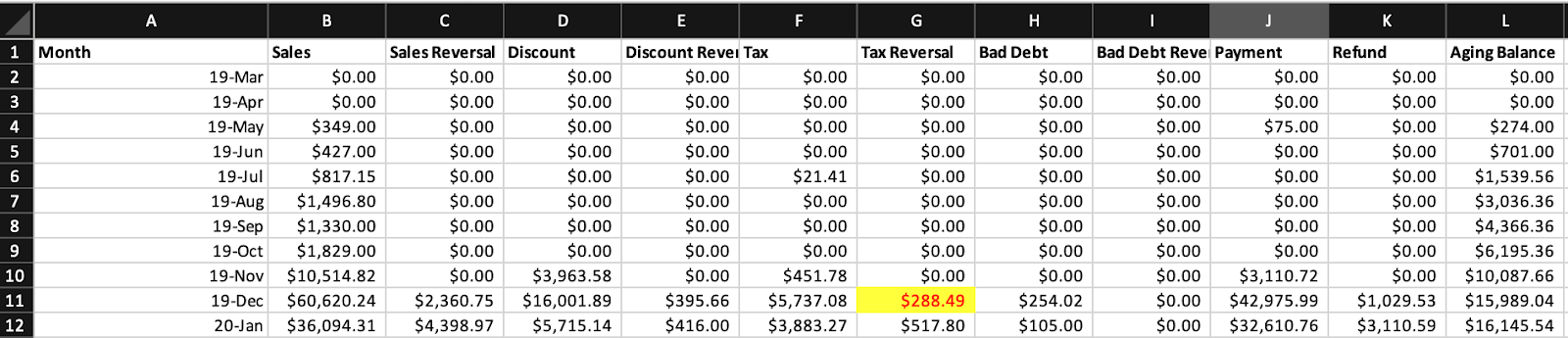

For example, consider the below account summary details:

For the month of December-2019, Tax reversals are mentioned as $288.49 in the Account summary report. This amount includes a collection of, credit notes and voided invoices.

The total amount of $288.49 can be obtained by summing up (a) and (b) as mentioned in the account summary report.