Scope

How to tax-exempt a customer on Avalara integration?

Is there any option to exempt a customer from Avalara?

Summary

In Chargebee in order to exempt a customer from being charged for tax, we need to add Avalara Entity code/Exemption number on the Customer details page in Chargebee and also mark the customer as tax-exempt at Avalara as well post which the customer will be completely marked as tax-exempt

Solution

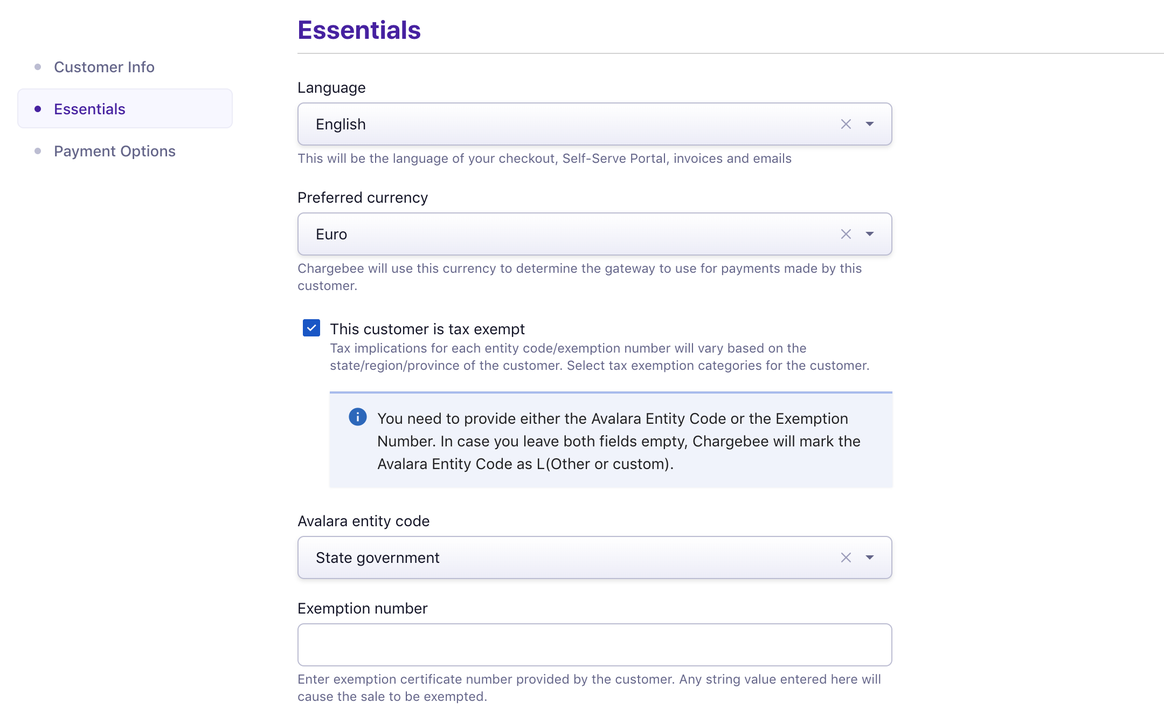

If you'd like a particular customer to be exempted from tax, you could do so while creating the customer in Chargebee by:

Enabling the option This customer is exempted from tax payment.

Specifying the exemption reason using Avalara Entity Type or the Exemption Number field. If you don't provide either, then Chargebee will default the Avalara Entity Code to “Other or custom”.

Note

1. Tax exemption rules vary per US State and Territory/ Canadian Province.

2. A customer flagged as exempt from taxes (based on the Entity Code/Exemption Number provided) may be taxed in a state/province, but may not be taxed in another state.

3. If Avalara returns taxes for a state/province, then Chargebee will apply the taxes in the invoice in this case, even though the customer is marked as exempt.

Shown below is the details page of a customer with the Avalara tax fields

2. Add an exempt customer - Avalara

Follow the steps from this [link](https://help.avalara.com/Avalara_ECM_Essentials/Add_an_exempt_customer)[](https://help.avalara.com/Avalara_ECM_Essentials/Add_an_exempt_customer)[](https://help.avalara.com/Avalara_ECM_Essentials/Add_an_exempt_customer)[](https://help.avalara.com/Avalara_ECM_Essentials/Add_an_exempt_customer) to add a tax-exempt customer in Avalara.