Docs

VAT, validation, not, working

VAT validation feature

39561979

2023-01-31T12:58:15Z

2023-01-31T13:47:31Z

463

0

0

257745

VAT validation feature

Scope

How does VAT validation work?

VAT validation did not happen when a wrong VAT number was given at checkout and it did not charge the VAT from the end customer

Solution

When VAT validation is disabled

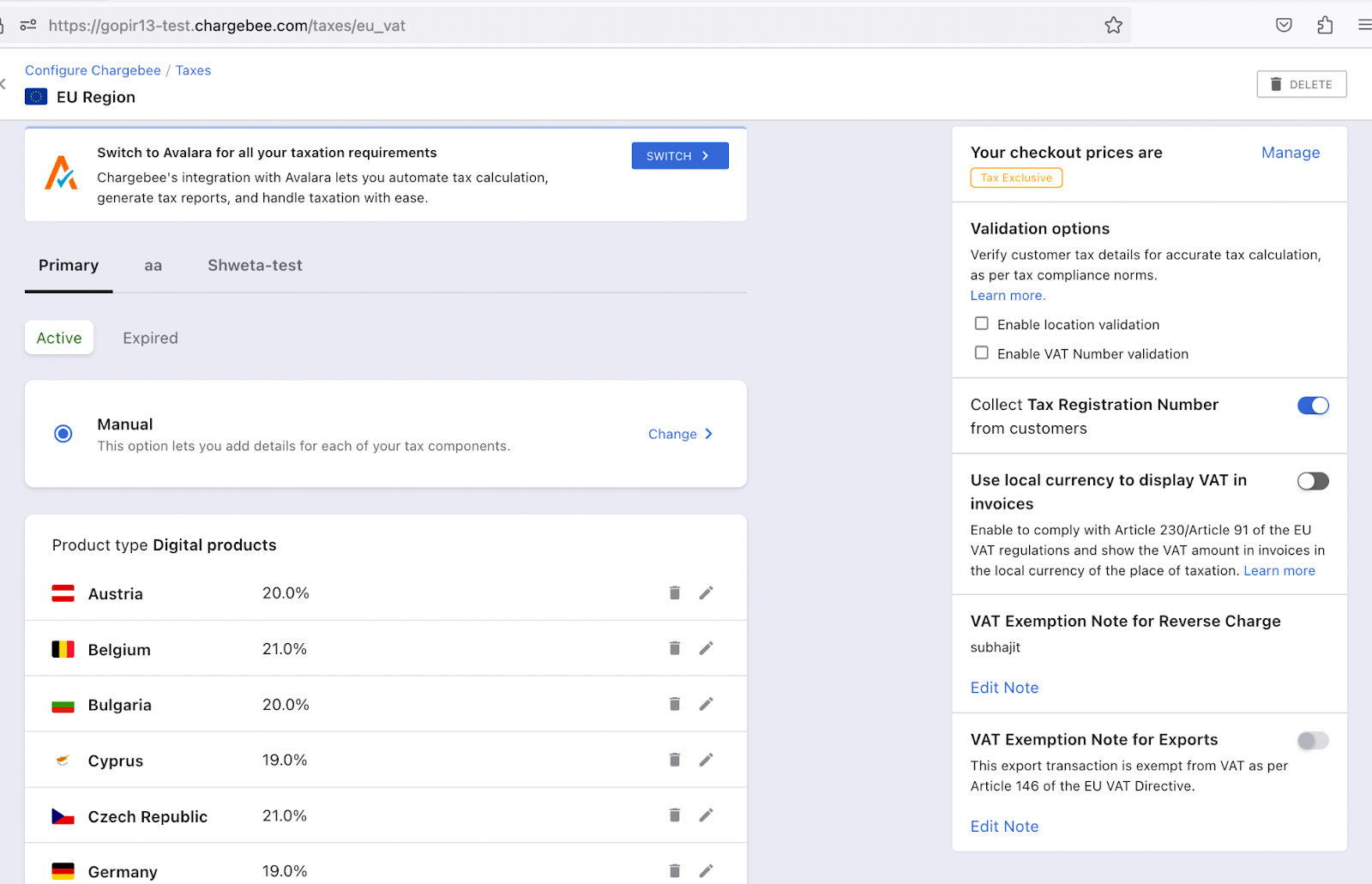

Go to Configure Chargebee -> Taxes → EU region → Disable VAT validation → enabled Tax registration number for customers

In the above screenshot, VAT Number Validation is not enabled

Checking VAT steps:

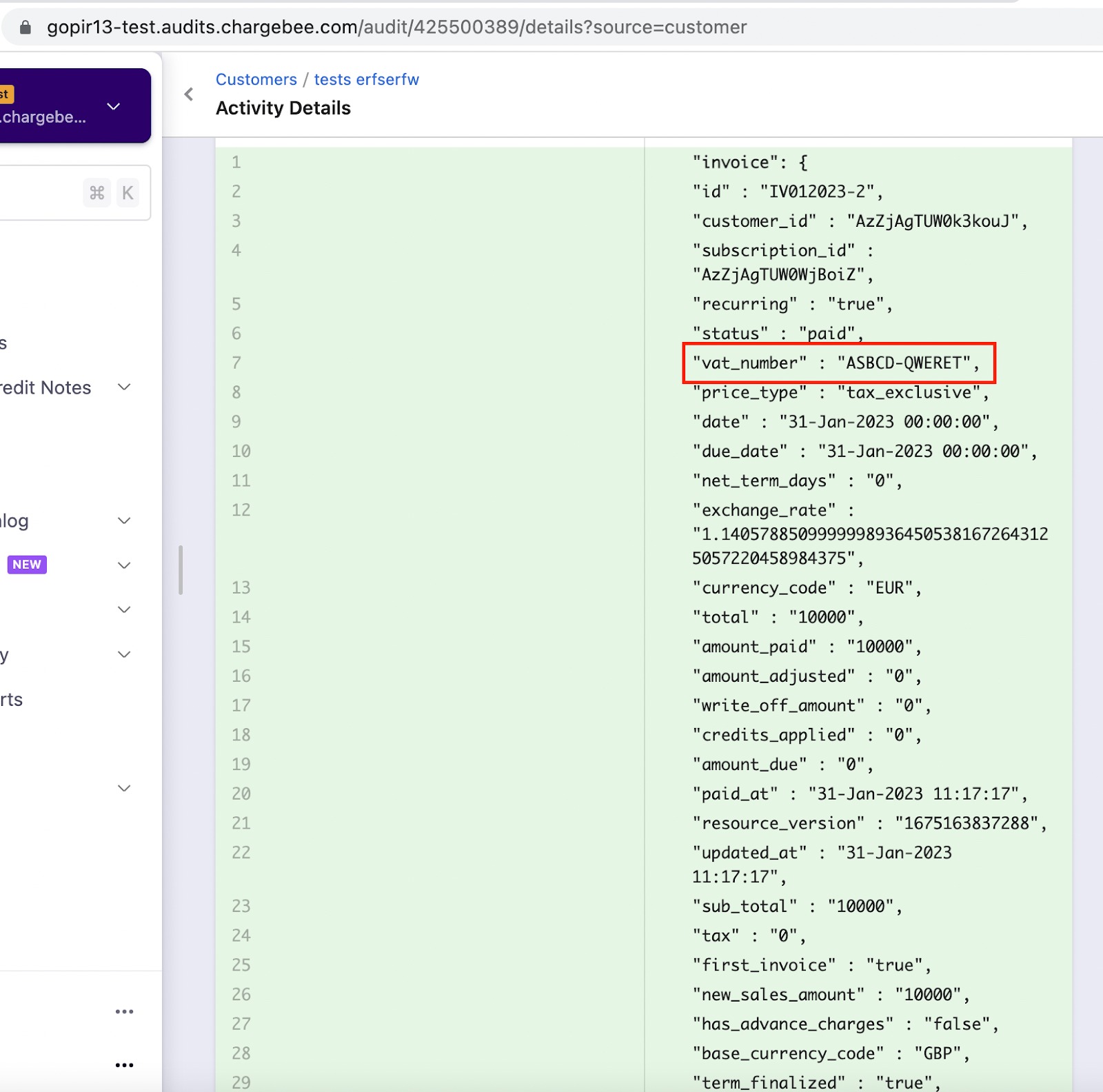

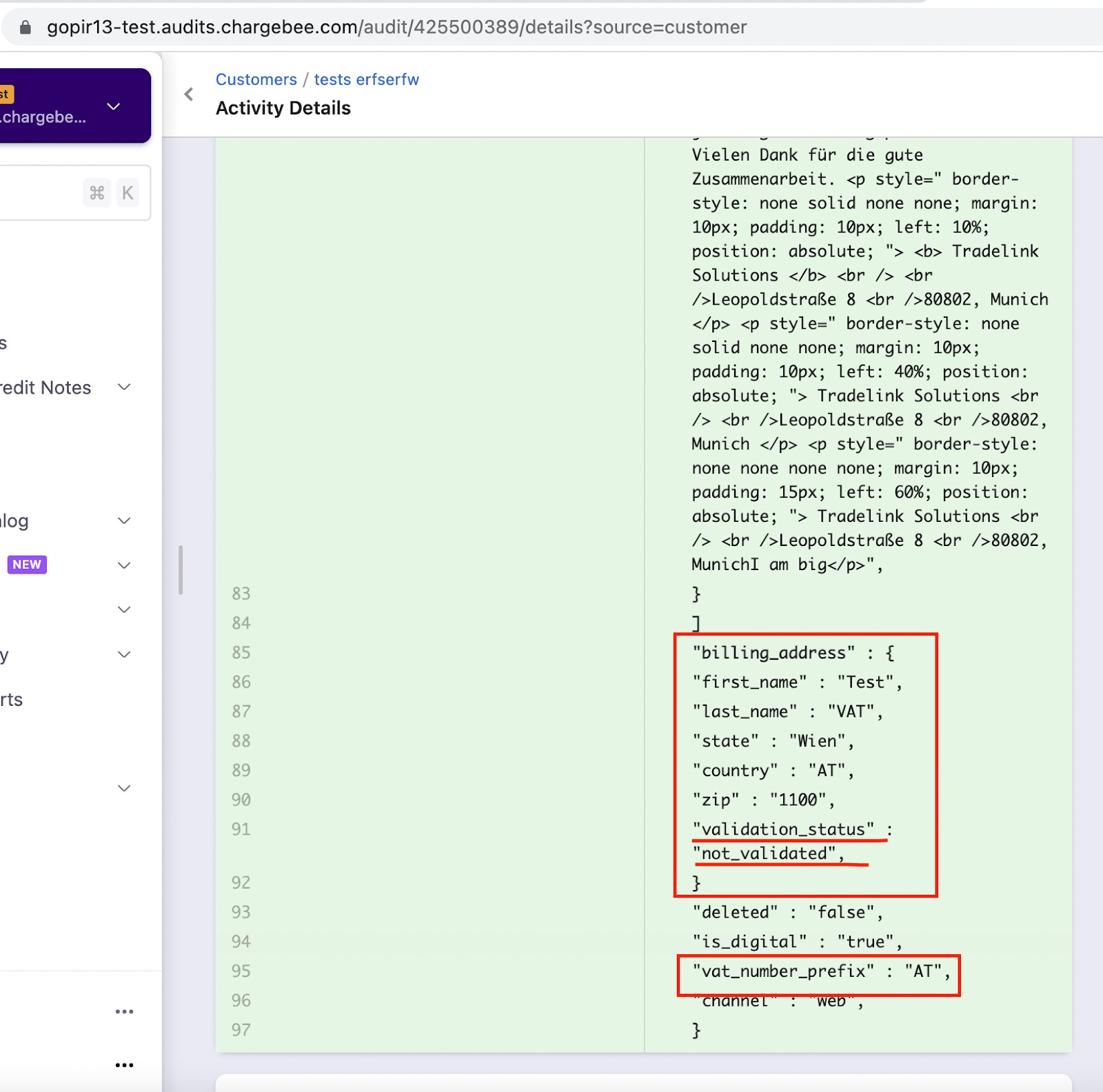

Create a customer on Chargebee UI, provide the VAT number as ASBCD-QWERET and the billing address Austria, zip code 1100, state code: Wien.

The customer will be created and then create a subscription which will generate an invoice.

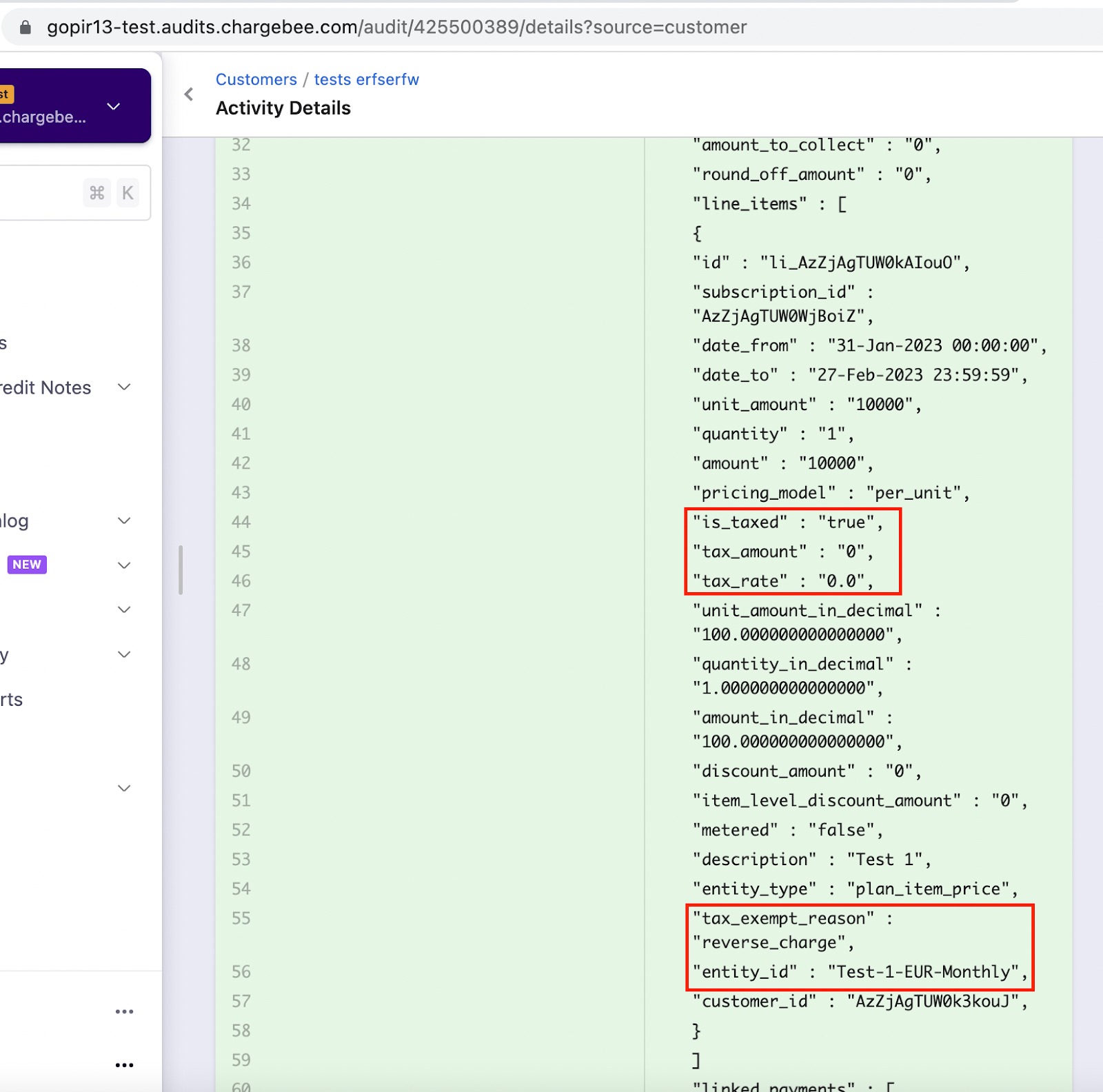

We can see in the invoice JSON that the tax did not apply and the “tax_exempt_reason”: “reverse_charge”,%%% cbext

Refer to this video for a use case with VAT number validation disabled. This is the expected behavior when VAT validation is turned off.

When VAT Number validation is enabled

When VAT validation is enabled on the site settings, the system will not allow adding the VAT number as it will throw a validation error while customer creation. Refer to this video for testing the VAT validation-enabled use case.