Docs

taxes, Collect, Configure, physical, digital, SaaS, good, products, eu, VAT

33341796

2022-07-04T14:24:11Z

2025-02-12T08:24:04Z

157

0

0

254914

Can I configure taxes for both digital and physical products if am selling within the EU?

How to collect taxes when you are selling both physical and digital products in the EU?

Configuring multiple tax profiles

Summary

As a business, you might be selling both digital products as well as shipping physical products to customers based out of the EU. You would want to collect taxes in both cases. However, there are certain differences in the way taxes are collected for physical and digital products. This article covers the process of collecting taxes in both cases.

Solution

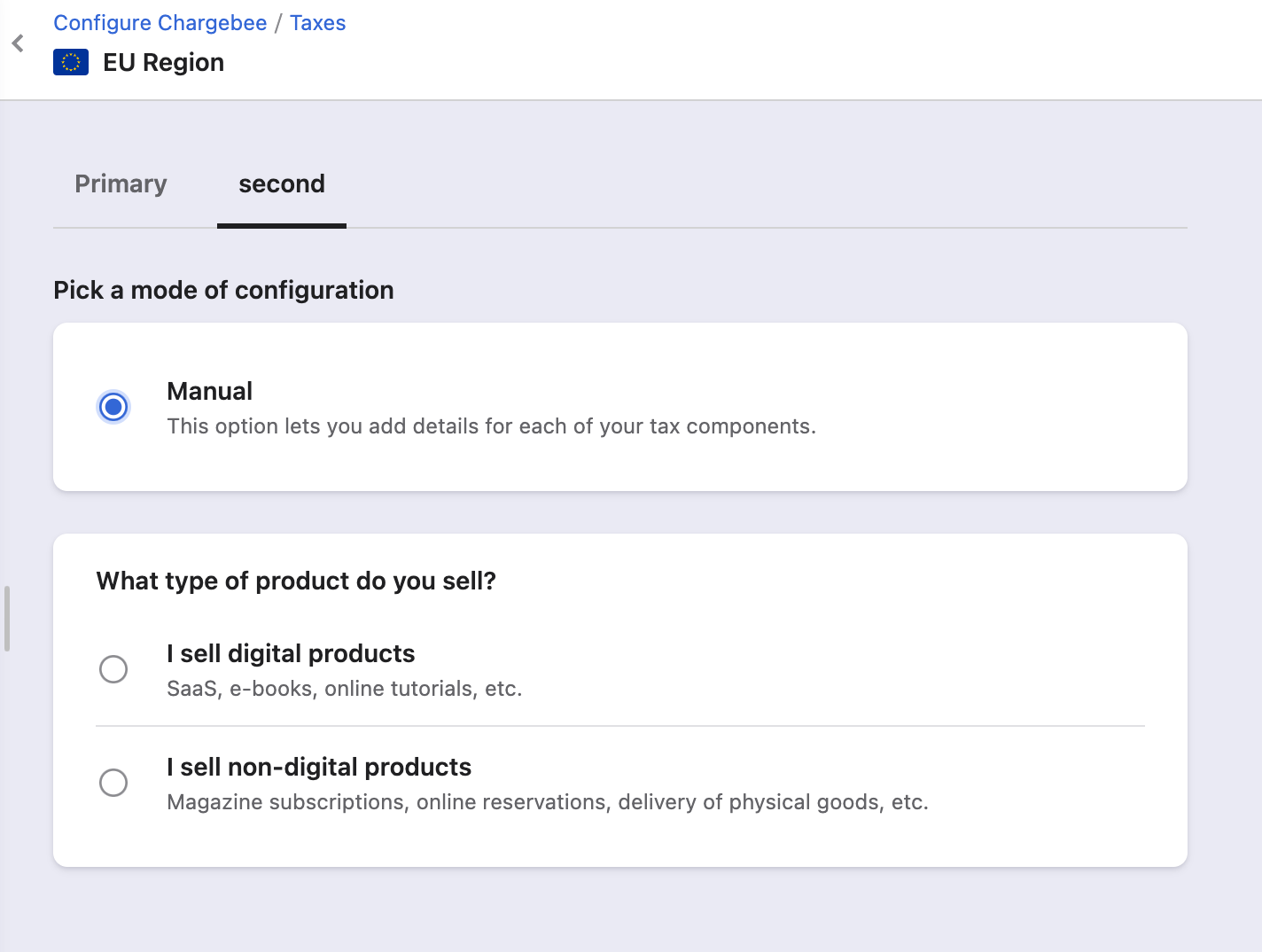

The first step would be to configure 2 different tax profiles - one for digital and one for physical.

If a majority of your plans are for digital services, then your primary tax profile can be configured for digital services while the second tax profile could be for physical services or vice versa if the majority of the plans are physical.

While creating/configuring the tax profile, you will be prompted to define it as digital/non-digital

Digital products - the tax configured for each country on the tax settings page will be applied.

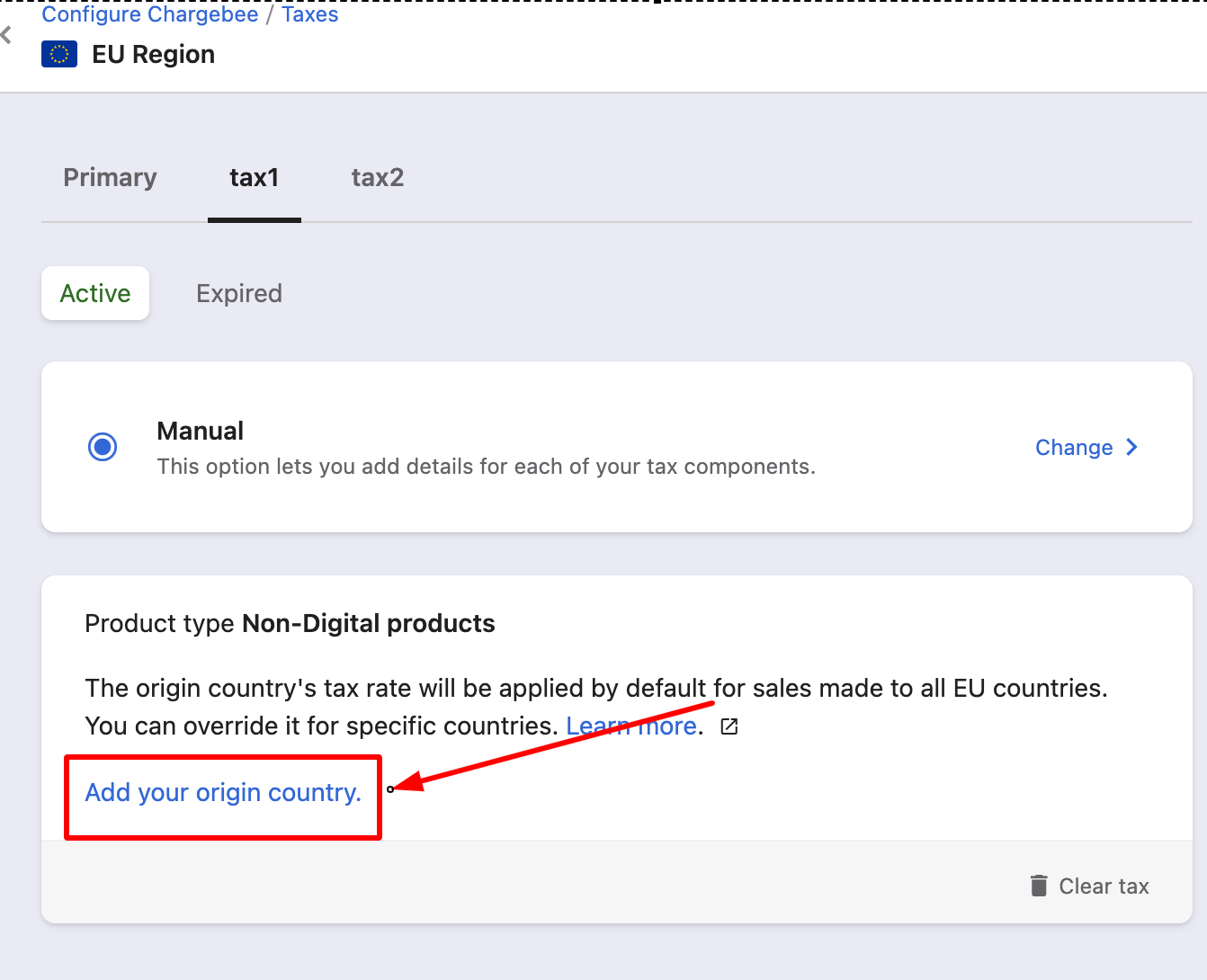

Physical products - If you are selling physical products to a number of countries within the EU, the VAT rate of your country is applied and not the end customer country's VAT rate.

While configuring the tax, you would have to first add your origin country as shown below.

The tax rate of the country that you configure here will be applied to all the invoices that contain the physical products sold to EU customers.

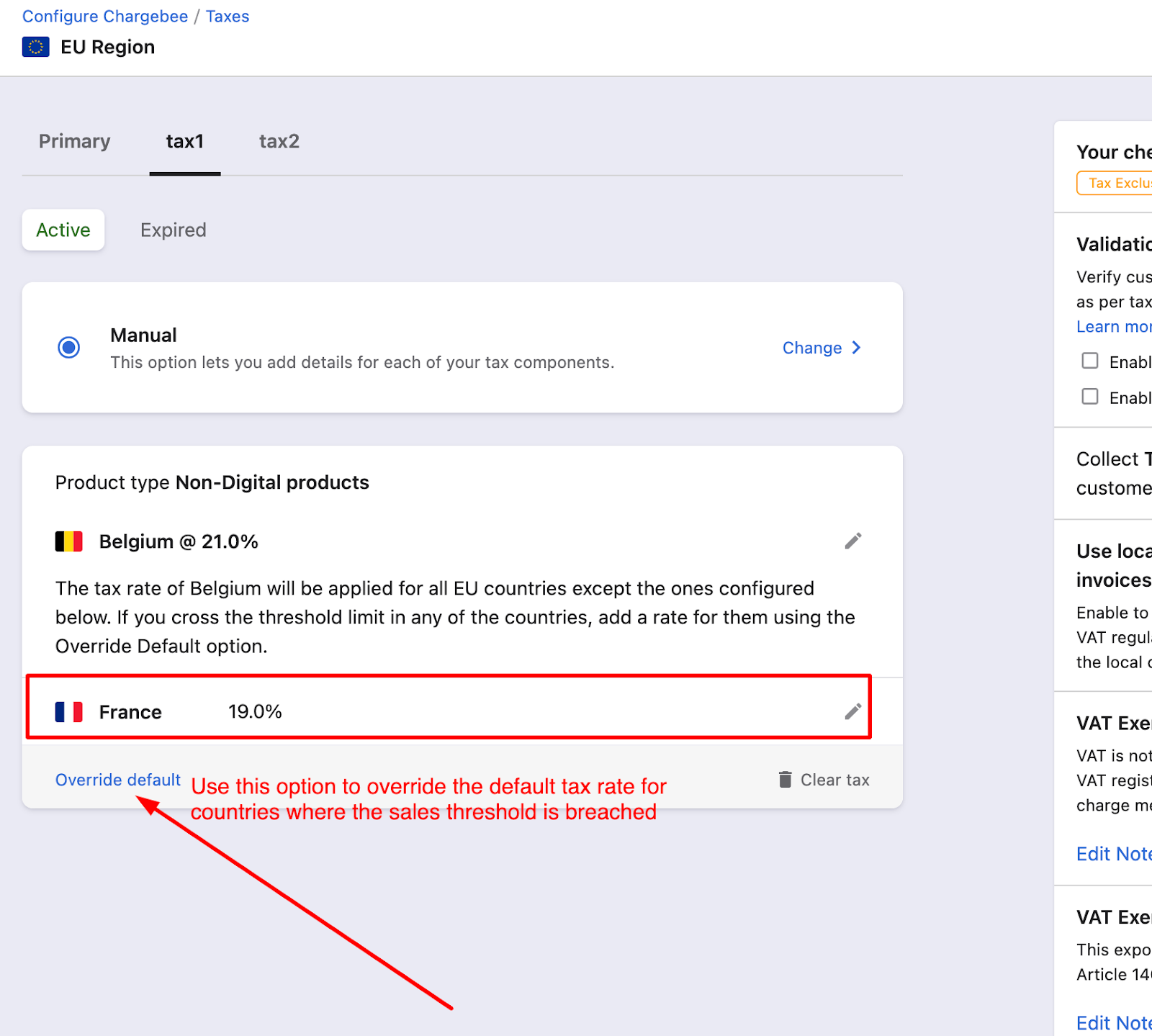

For physical products, once you cross a certain threshold of sales per annum in a particular country/ the countries (the threshold figure differs from country to country) you will have to register for VAT in the member states where you have a commercial presence. In this case, the tax rate of the customer's country should apply even for physical products.

For example: if Belgium is the country of origin of your business and if you have crossed the sales threshold in France, then you have to override the default value for France and configure the France tax rate. Once done, for French customers alone, the France tax rate will be applied for all physical products going forward while for the rest of the EU, the origin country tax will be applied (until the threshold is breached and configured).%%% cbext