Docs

Vertex Advantage (previously known as Taxamo) is an all in one tax automation software for digital businesses.

It is designed to assist businesses in managing global tax compliance and provide solutions for tax calculation, invoicing, and reporting across various jurisdictions.

You can integrate your Chargebee site with Vertex to automate tax application for your Chargebee invoices and credit notes.

Vertex Advantage integration is currently in beta, you can reach out to the chargebee support team for activation.

Additionally, Taxamo also offers comprehensive support for tax registration number validations worldwide.

Vertex Advantage supports tax calculation for digital products. You can check the list of countries supported using this link.

The Chargebee integration now includes real-time validation capabilities through the sources supported on the Vertex Validator. For a detailed list of supported countries and their validation types, please refer to this link. Look for countries marked under "Validation Type" as "Database" for accurate information.

Before integrating your Chargebee site with Vertex Advantage, ensure that the following prerequisites are verified on respective applications:

Organization Address: The organization address that is configured in your Chargebee site is used as the origin address for tax calculation by Vertex Advantage. Ensure that your organization address in Chargebee is added and up-to-date. You can verify and update your organization address on your Chargebee site by navigating to Settings > Configure Chargebee > Business Profile.

Customers' Address for Tax determination:

Using Hosted Pages: If you're using Hosted Pages, ensure you set up the following:

Tax Registration Number Validation: If you're seeking to utilize tax registration number validation, the following information is pertinent to your needs:

Customer Tax Registration Number

You need to start collecting tax registration numbers from your customers. To do so ensure that you have enabled the configuration to collect tax registration numbers in the tax configuration page. You can do this in the following two ways:

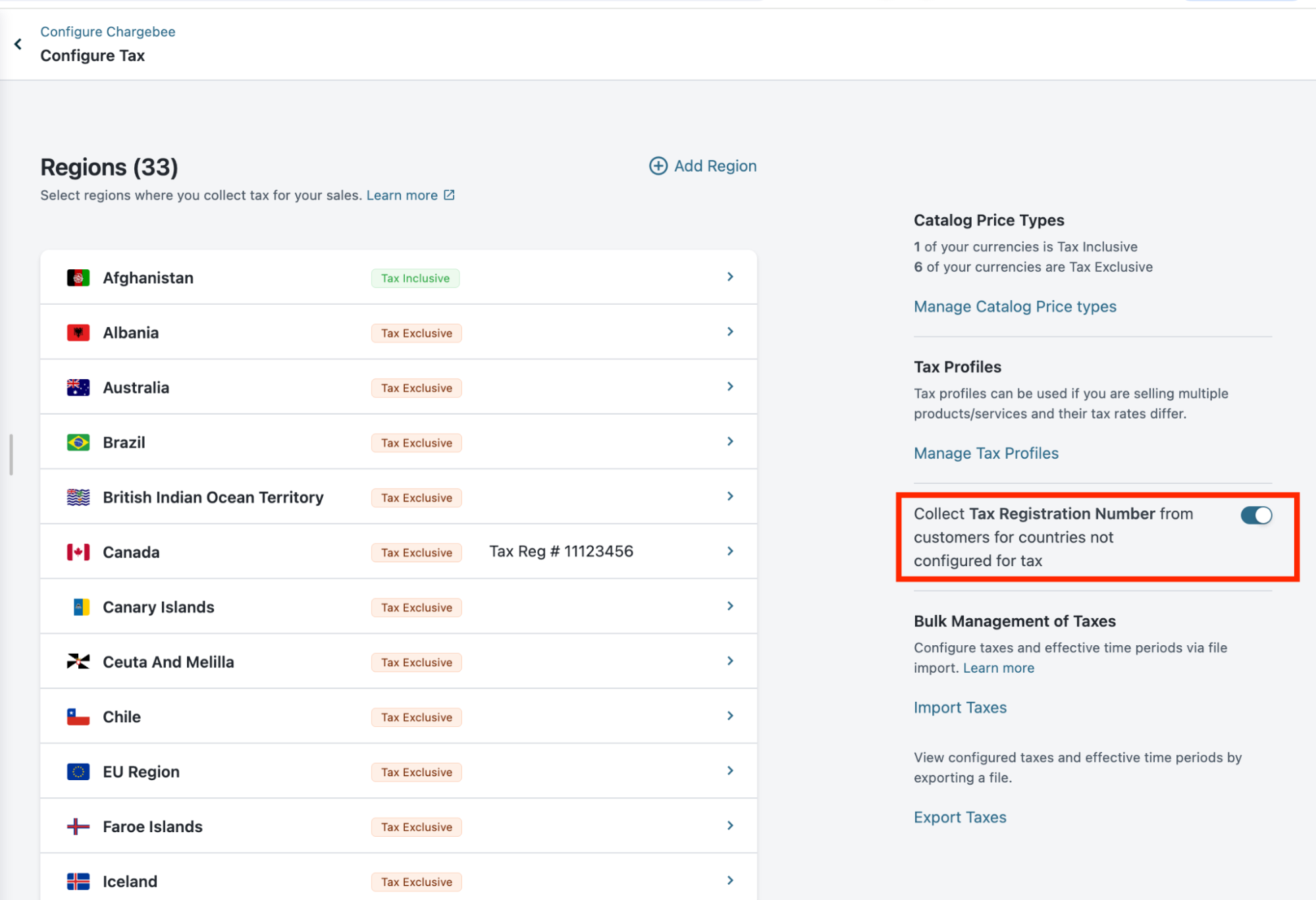

Navigate to Settings > Configure Chargebee > Taxes > Enable "collect tax registration number from customer for countries not configured for tax". This will allow you to collect Tax IDs in regions where you haven't configured any taxes yet.

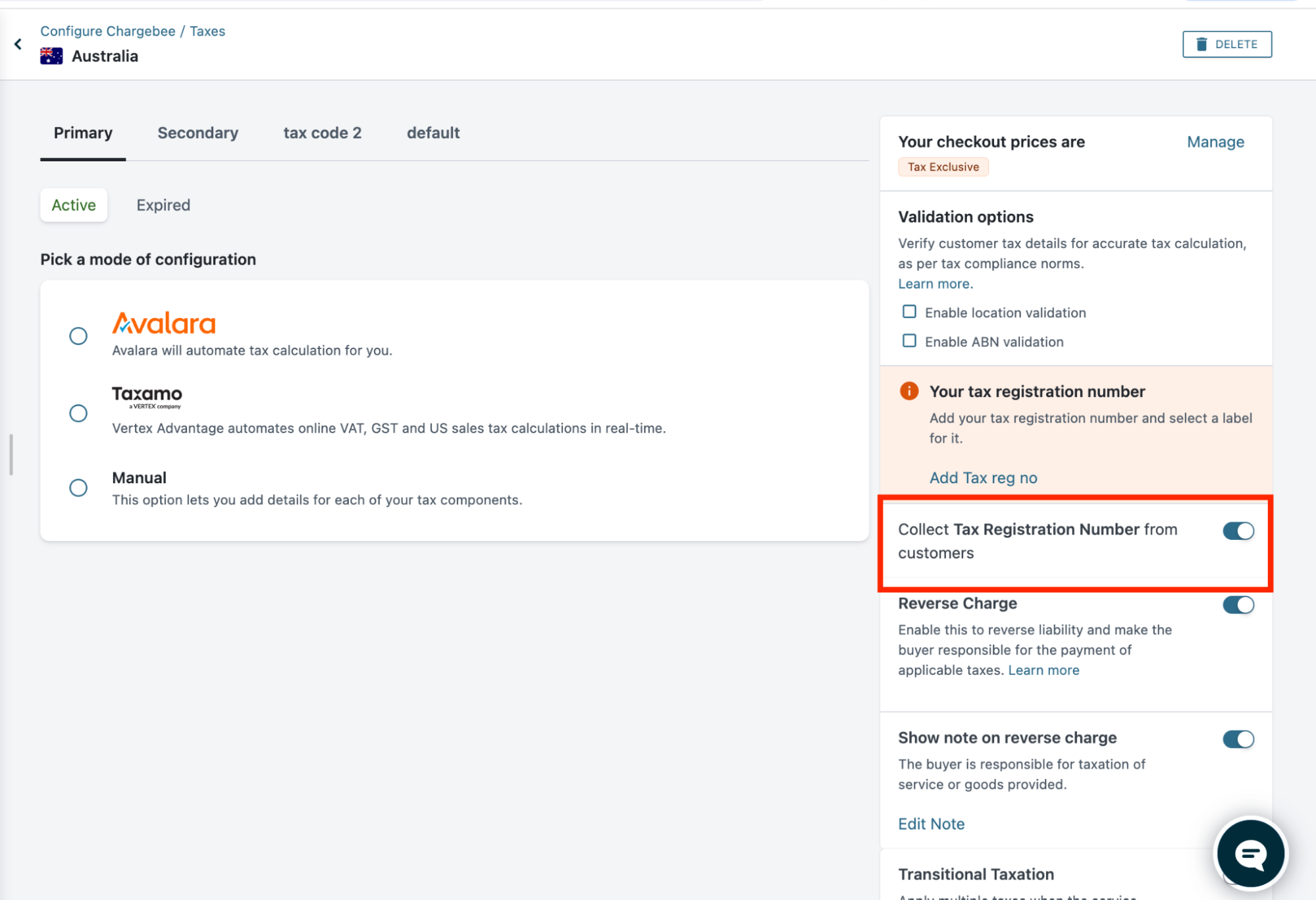

Navigate to Settings > Configure Chargebee > Taxes > click on the region> Enable "Collect tax registration numbers from customers".

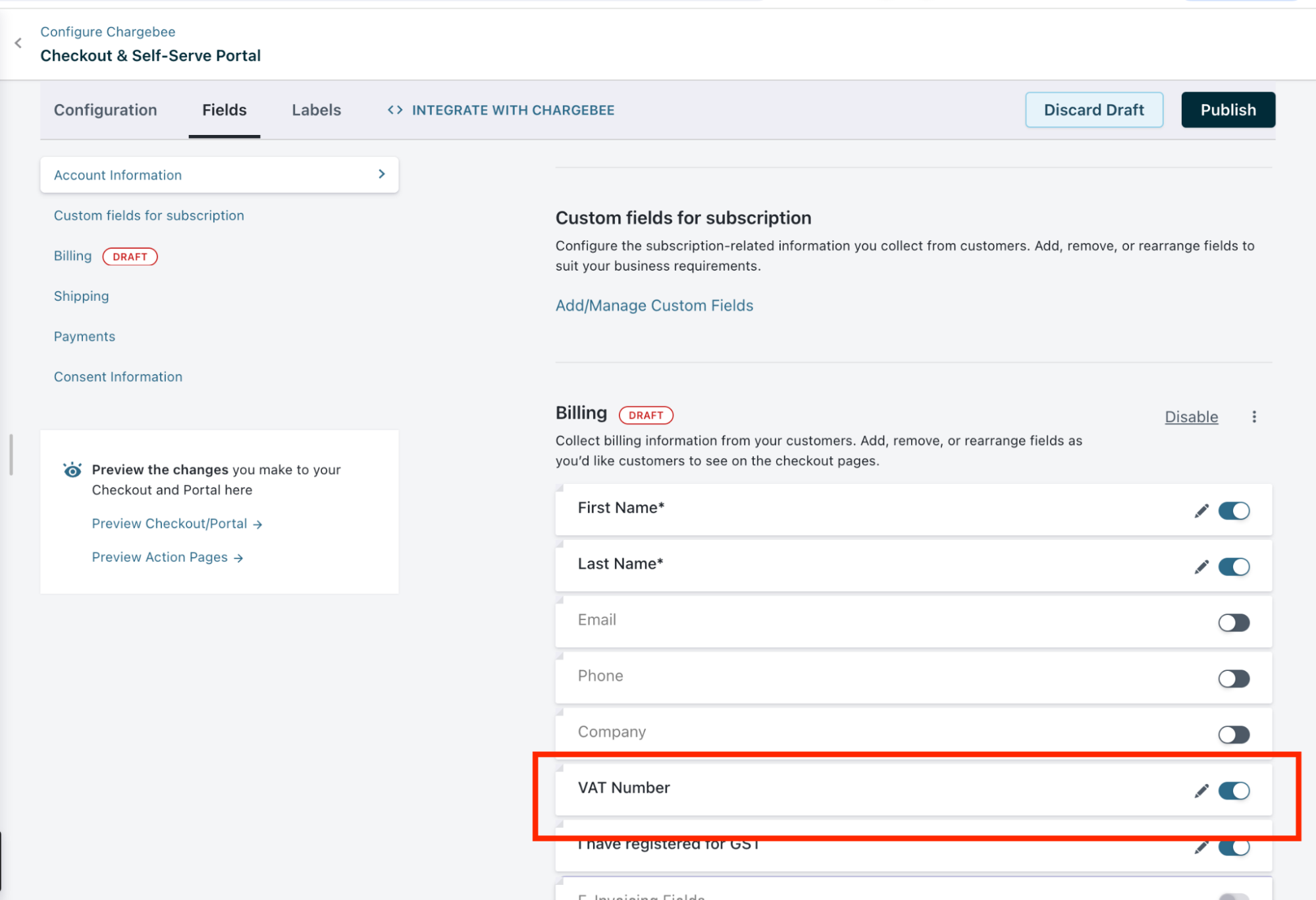

If you're using Hosted Pages, ensure you enabled the tax registration fields on the checkout settings. Navigate to Settings > Configure Chargebee > Checkout & Portal > Fields and enable "VAT Number".

Sign up and set up your Vertex Advantage account. Refer to Vertex User guide to learn about setting up your account.

Tax Payers: You must configure your Tax Rates and Jurisdictions in your Vertex Advantage account to capture what you want to tax and where, based on your tax obligation.

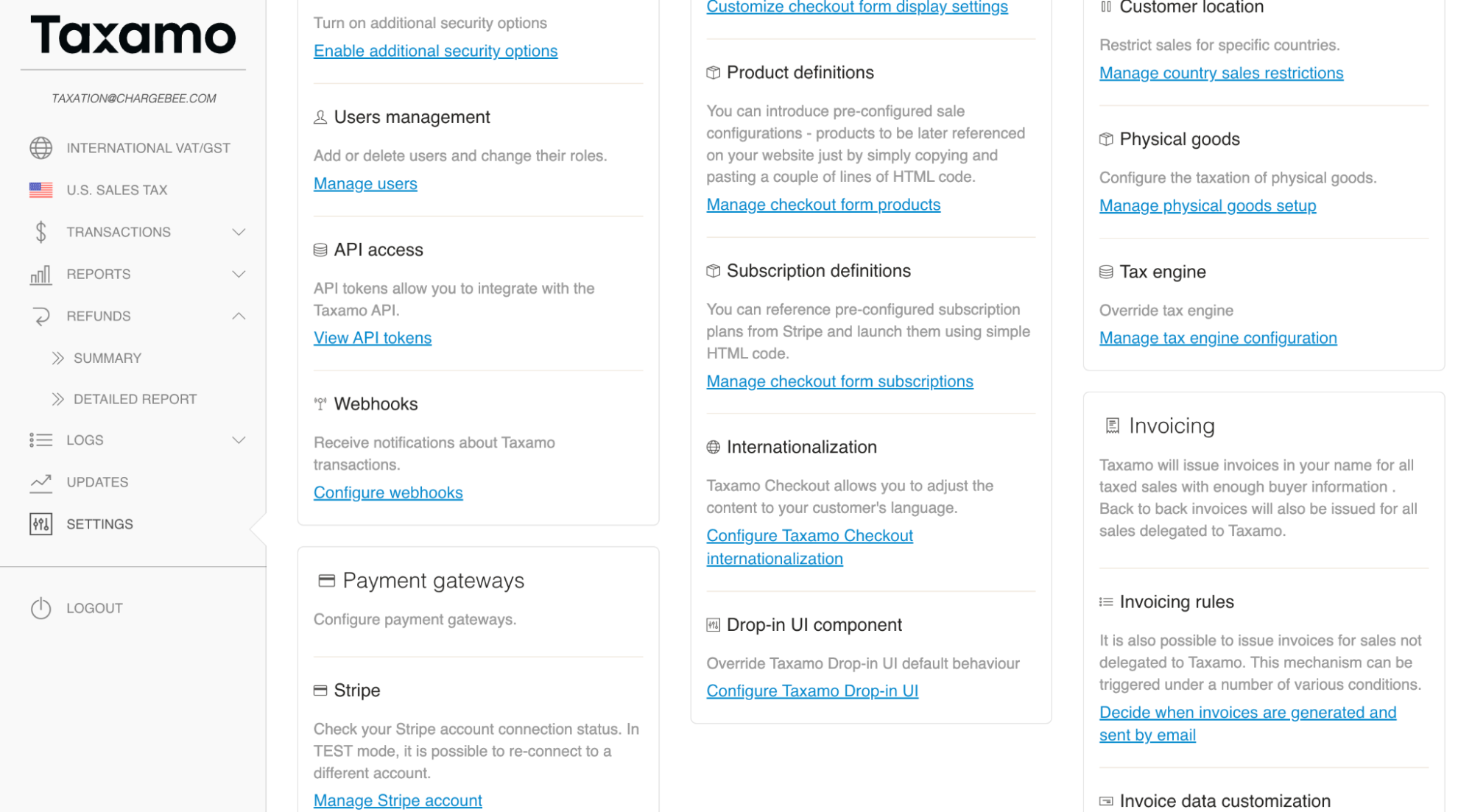

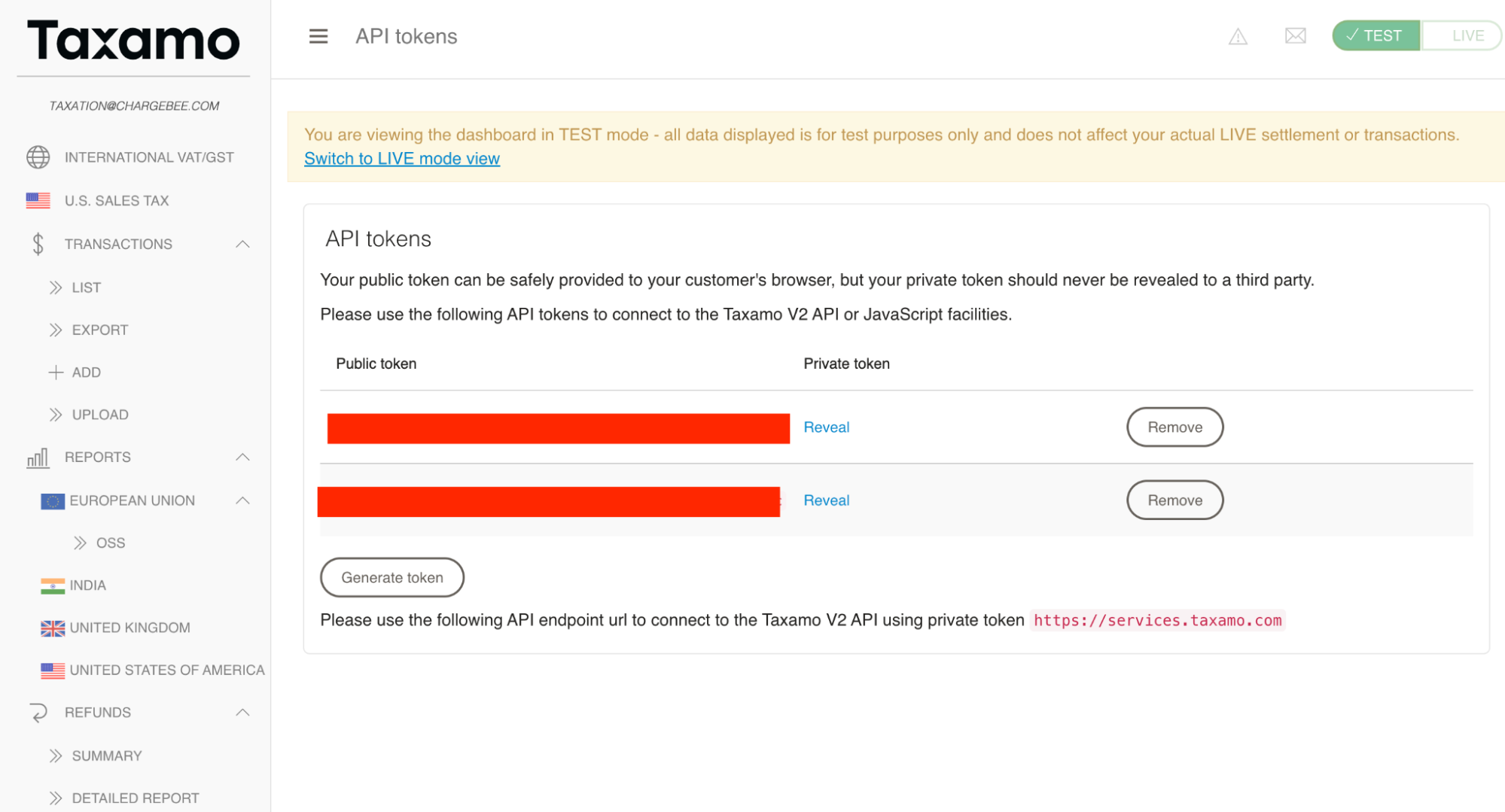

Credentials: You must retrieve the API key from your Vertex account to connect the two applications. Follow these steps below to retrieve API for Chargebee:

Login to your Vertex account.

Click Settings > API access > View API tokens.

On the API tokens page, Create a new token by clicking on the button "Generate token".

Click on the reveal private key option and then Copy the Private key that gets displayed and store them safely for later use.

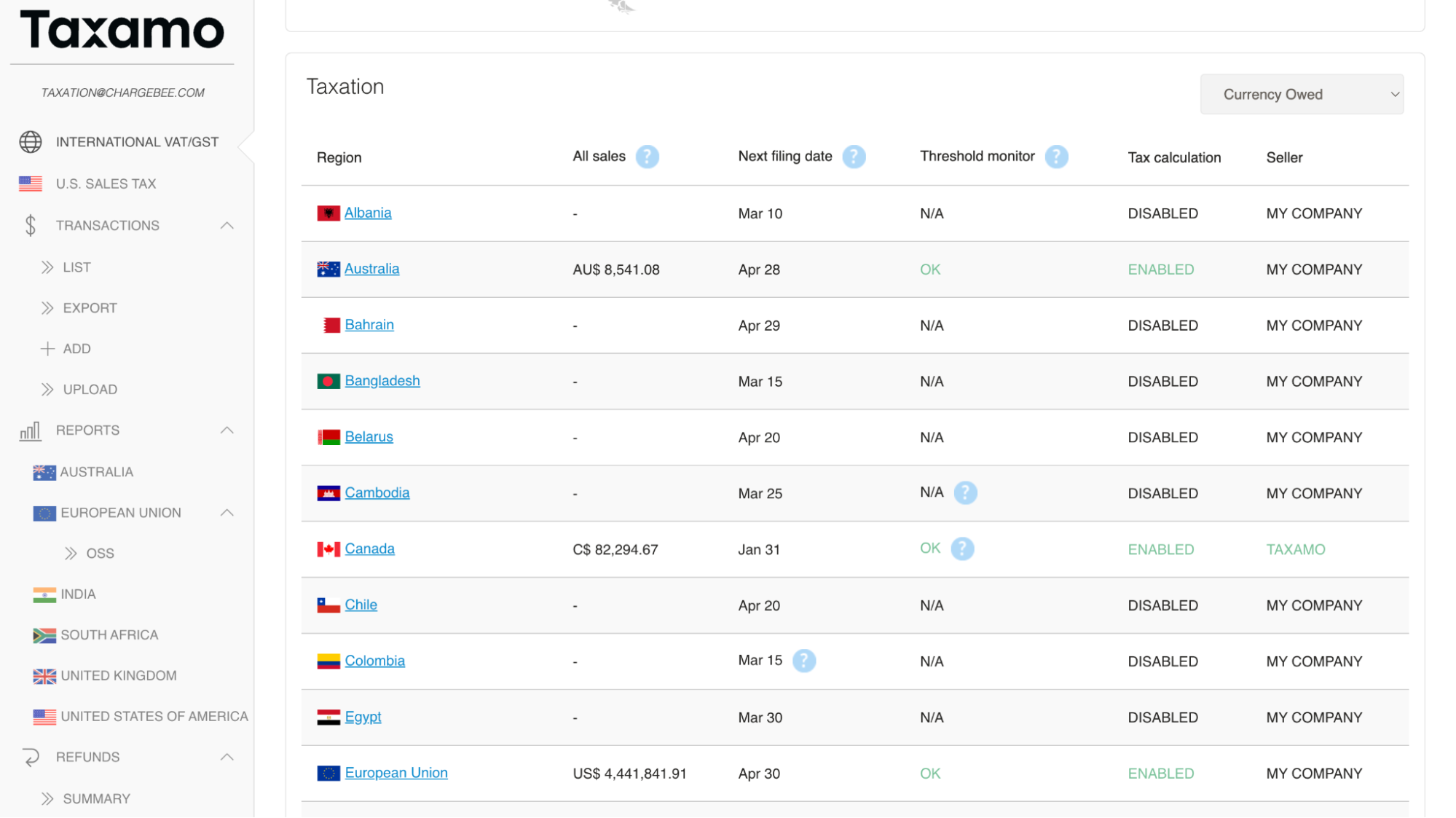

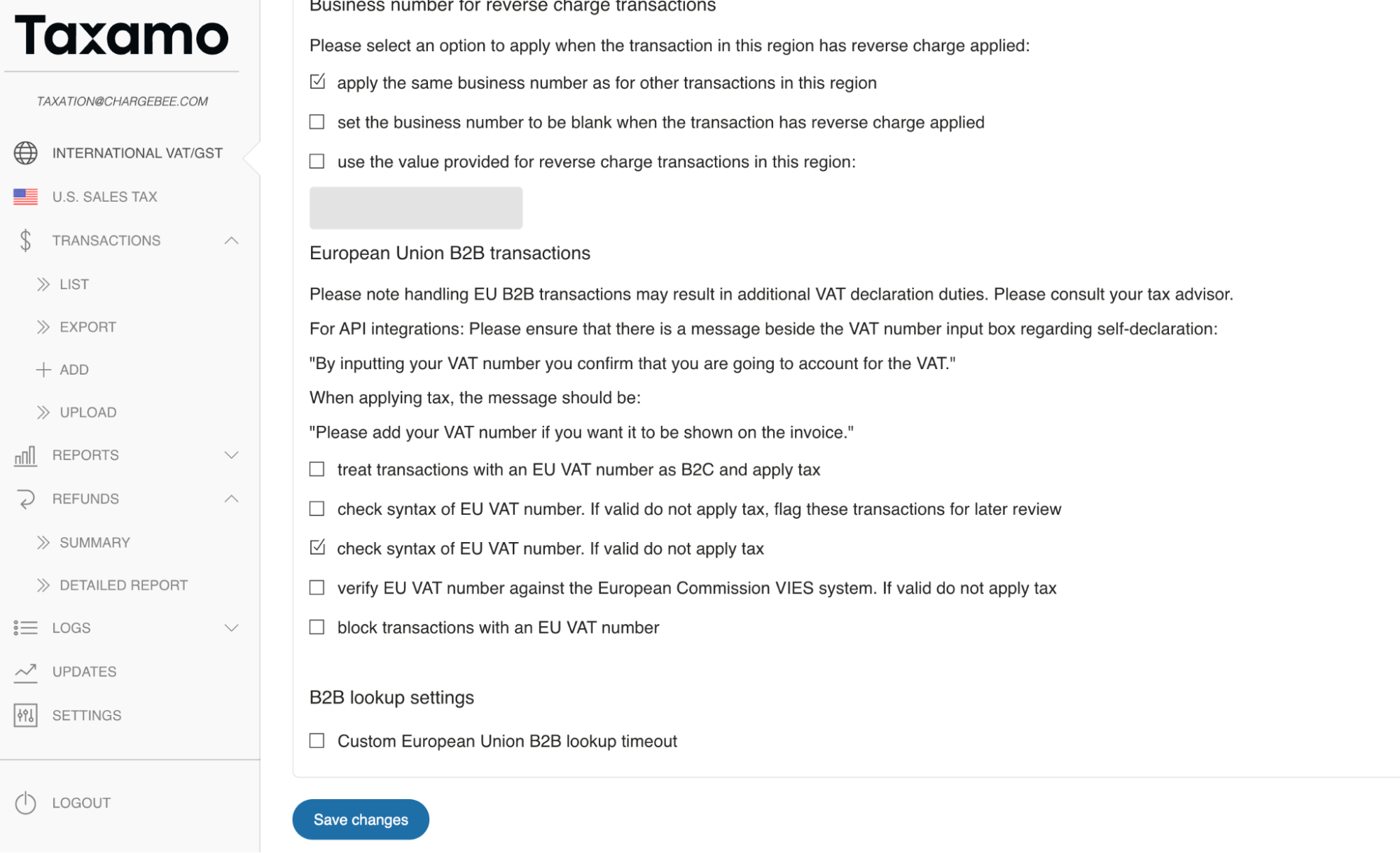

Enable Tax ID validation for the regions: To enable Tax ID validation for specific regions in Taxamo, navigate to the International VAT/GST section.

Here, select the desired region and ensure tax calculation is enabled by checking the corresponding option. Then, scroll down to the "B2B transactions" section and mark the box labeled "Verify tax registration number.

Following are the steps to integrate Vertex Advantage account with your Chargebee site:

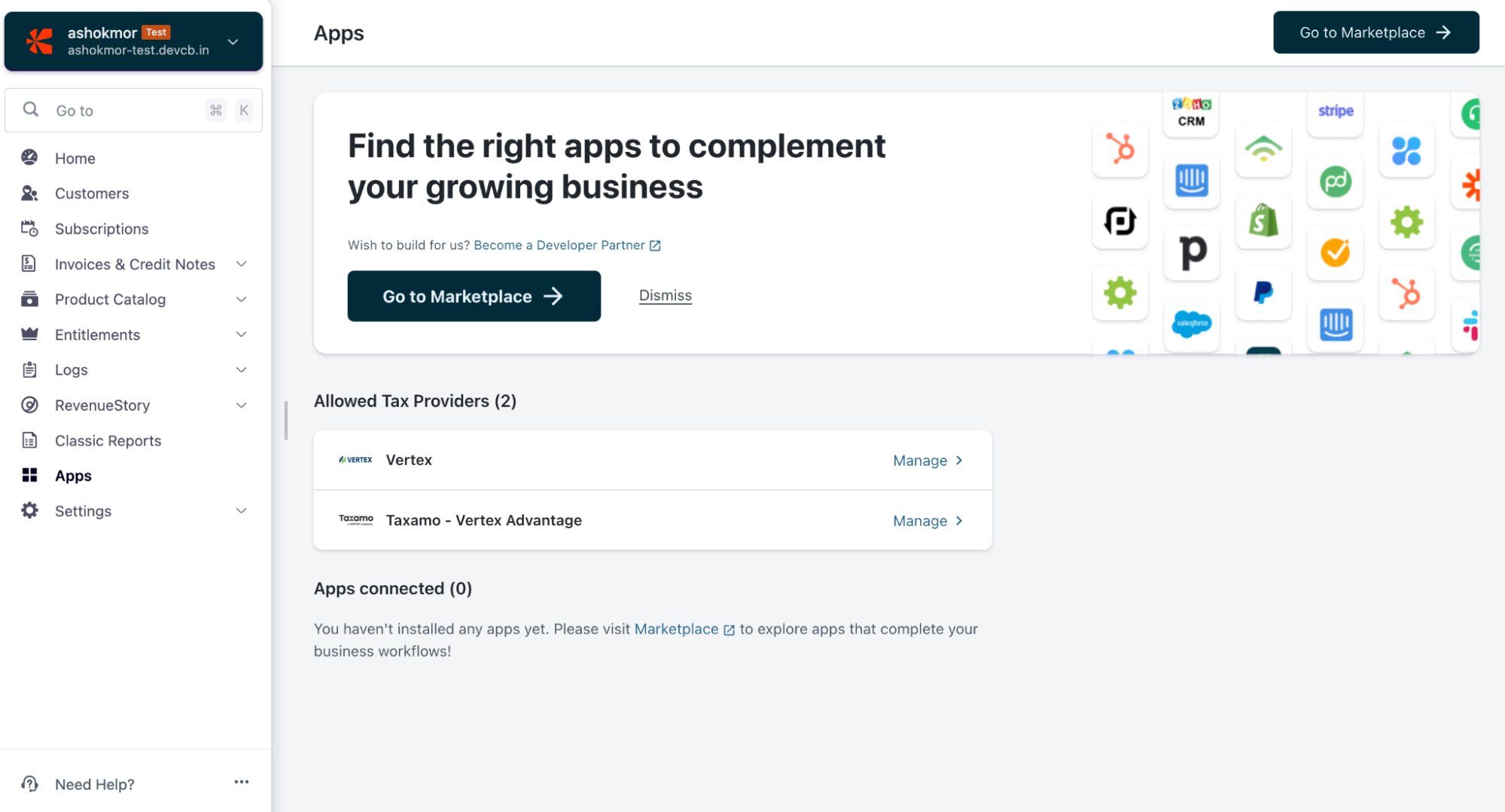

Once the Vertex Advantage app is enabled on your Chargebee site following your request, follow the steps below to connect the applications:

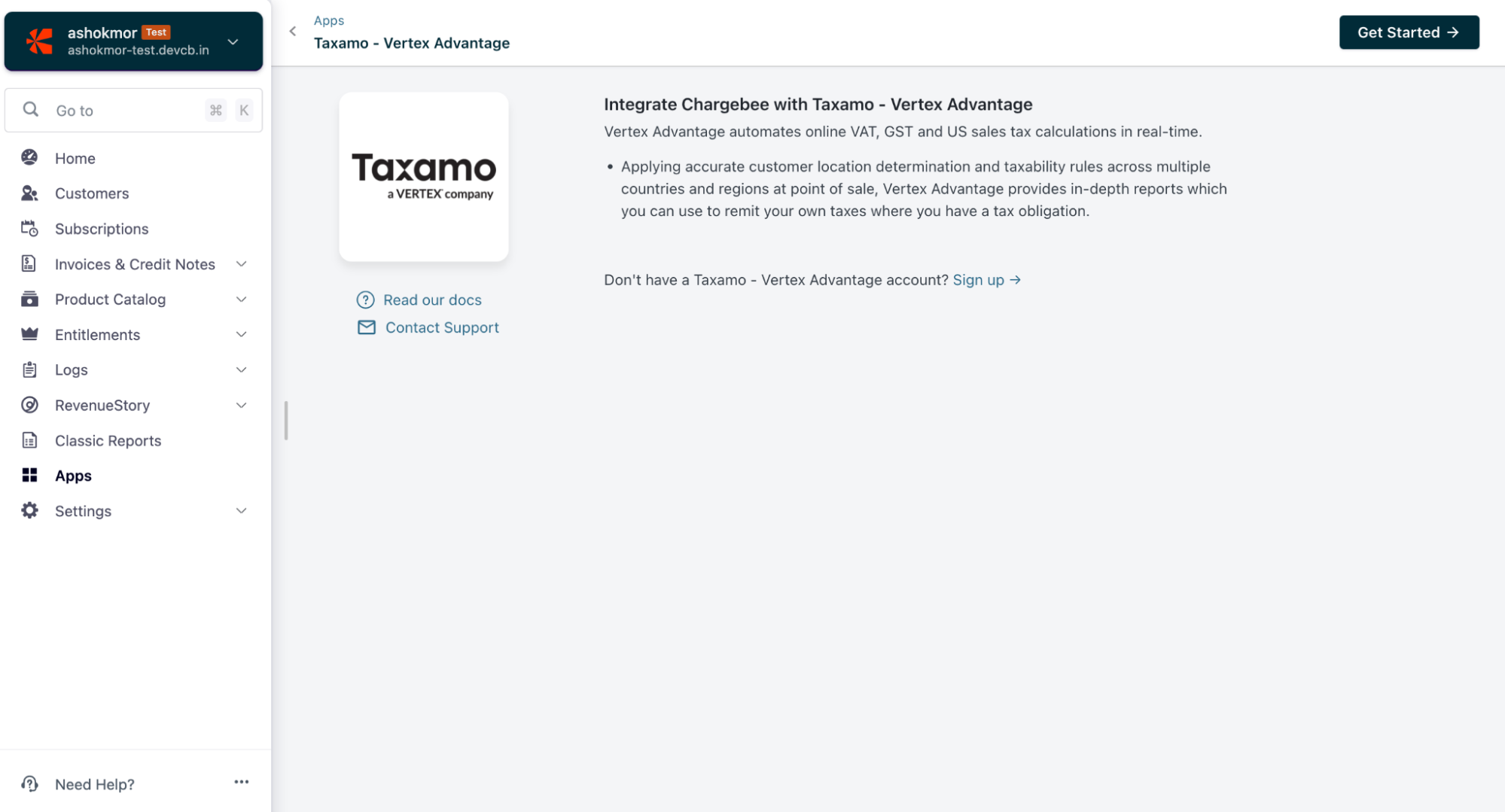

Login to your Chargebee site and click Apps > Go to Marketplace > Taxamo - Vertex Advantage.

On the Taxamo - Vertex Advantage configuration page, click Get Started if you already have an Vertex Advantage account, or click Sign up to create a new account and continue.

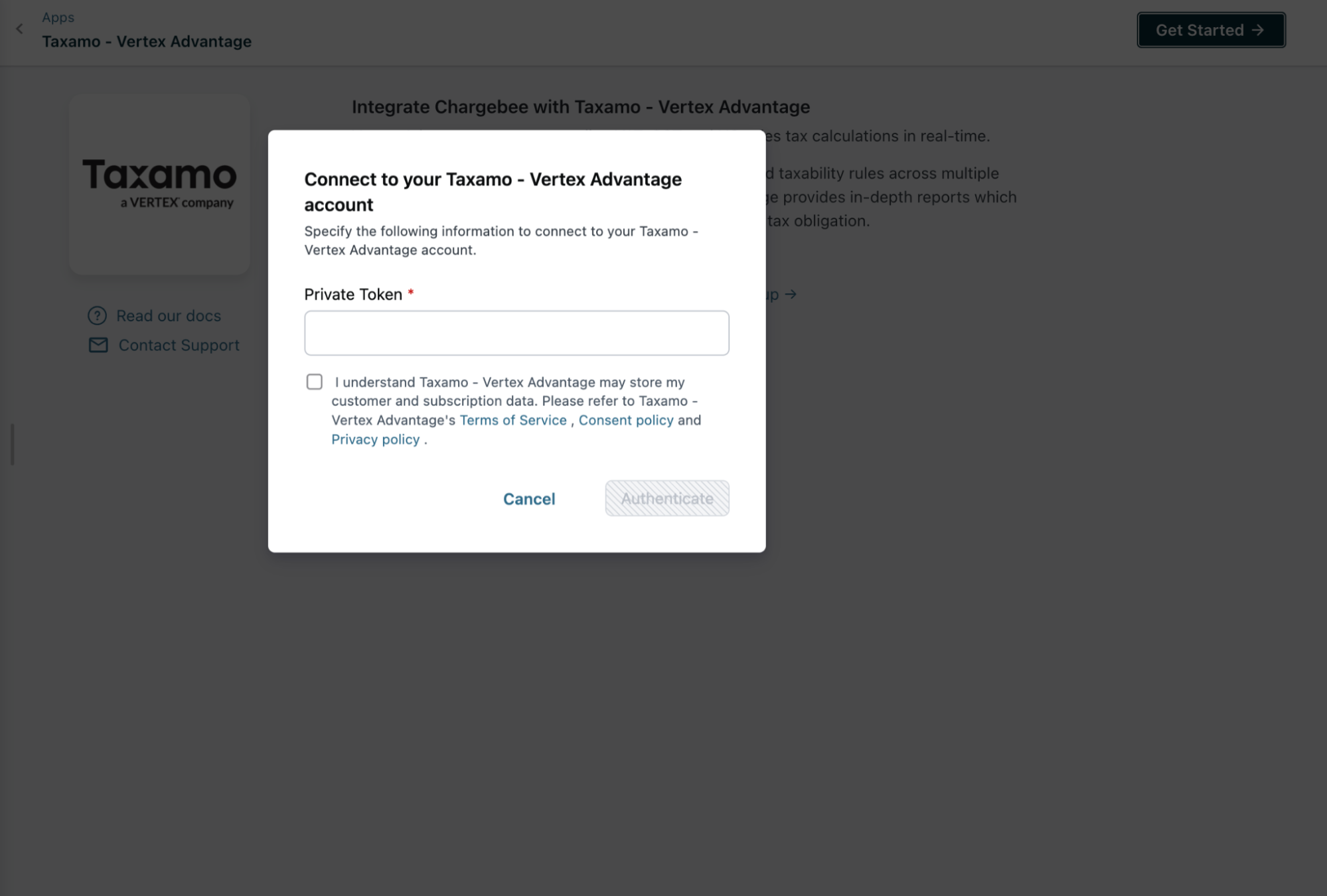

Enter your Vertex Advantage credentials by specifying the Private Key that you retrieved from Vertex Advantage for Chargebee. Click the "I understand Vertex Advantage.." checkbox for affirmation and click Authenticate.

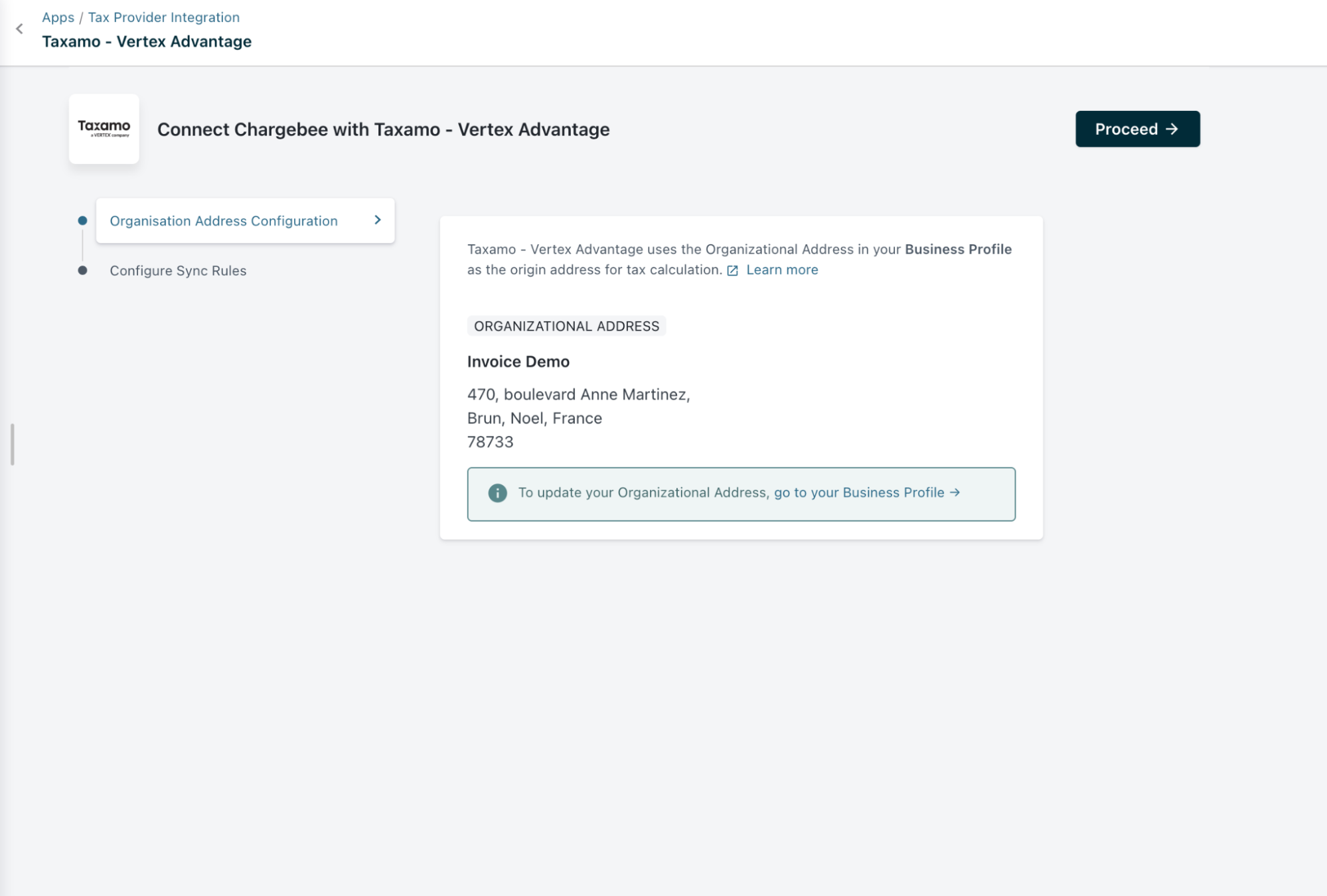

Enter or confirm your organization address. Chargebee auto-populates the address that is specified in your settings, you can change this if required or click Proceed.

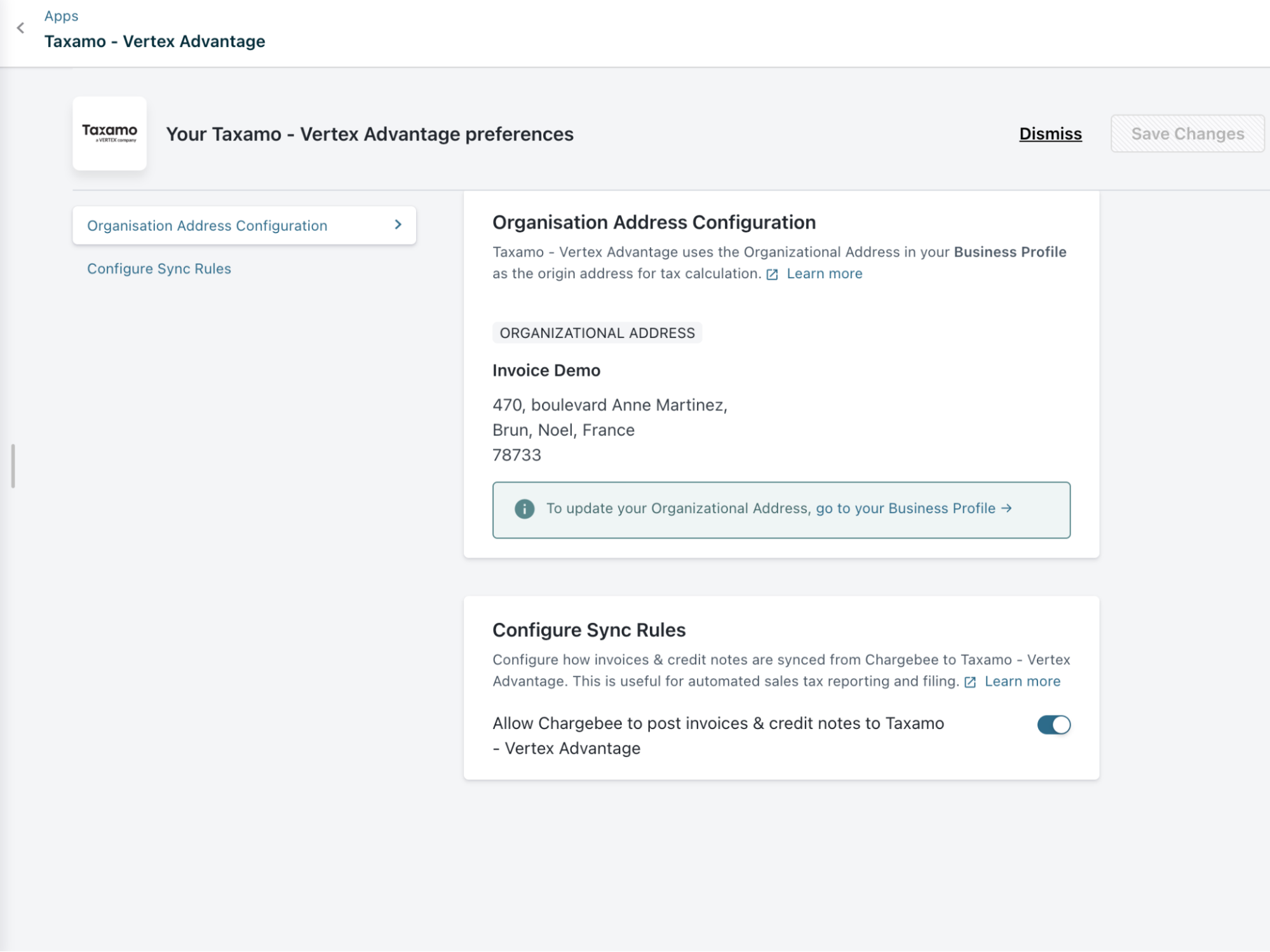

In Configure Sync Rules, enable the Allow Chargebee to post invoices & credit notes to Taxamo - Vertex Advantage toggle to allow Chargebee to sync invoices and credit notes to Vertex Advantage.

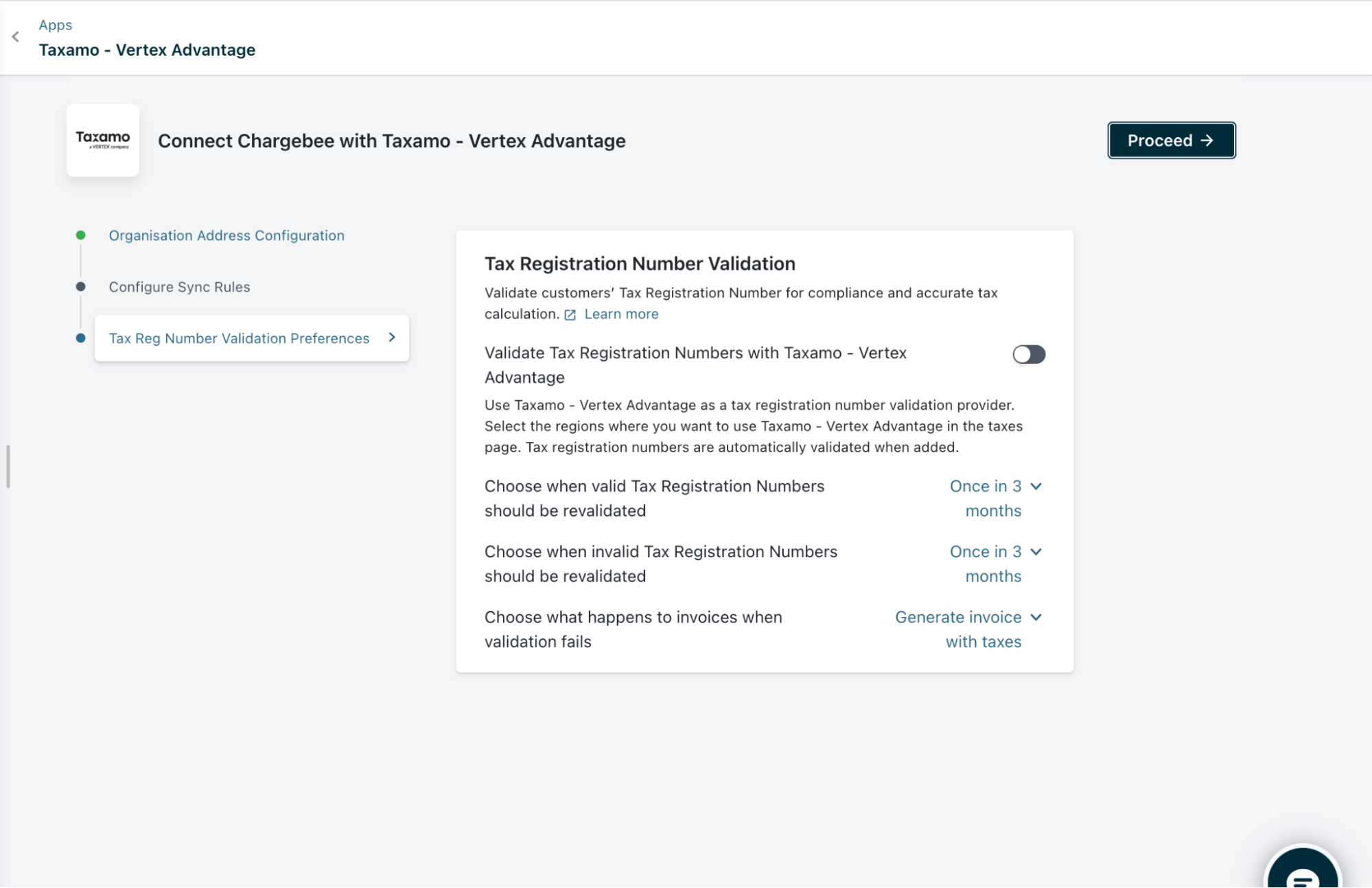

Applicable for Tax Registration Number Validation

In the Preferences section, Enable "Validate Tax Registration numbers with vertex validator". Configure the rest of the preferences.

Click Proceed

The Vertex Advantage account is successfully connected with your Chargebee site.

You can make changes to the integration preferences at any point of time by clicking Apps > Apps Connected > Taxamo - Vertex Advantage > Manage > Manage Preferences.

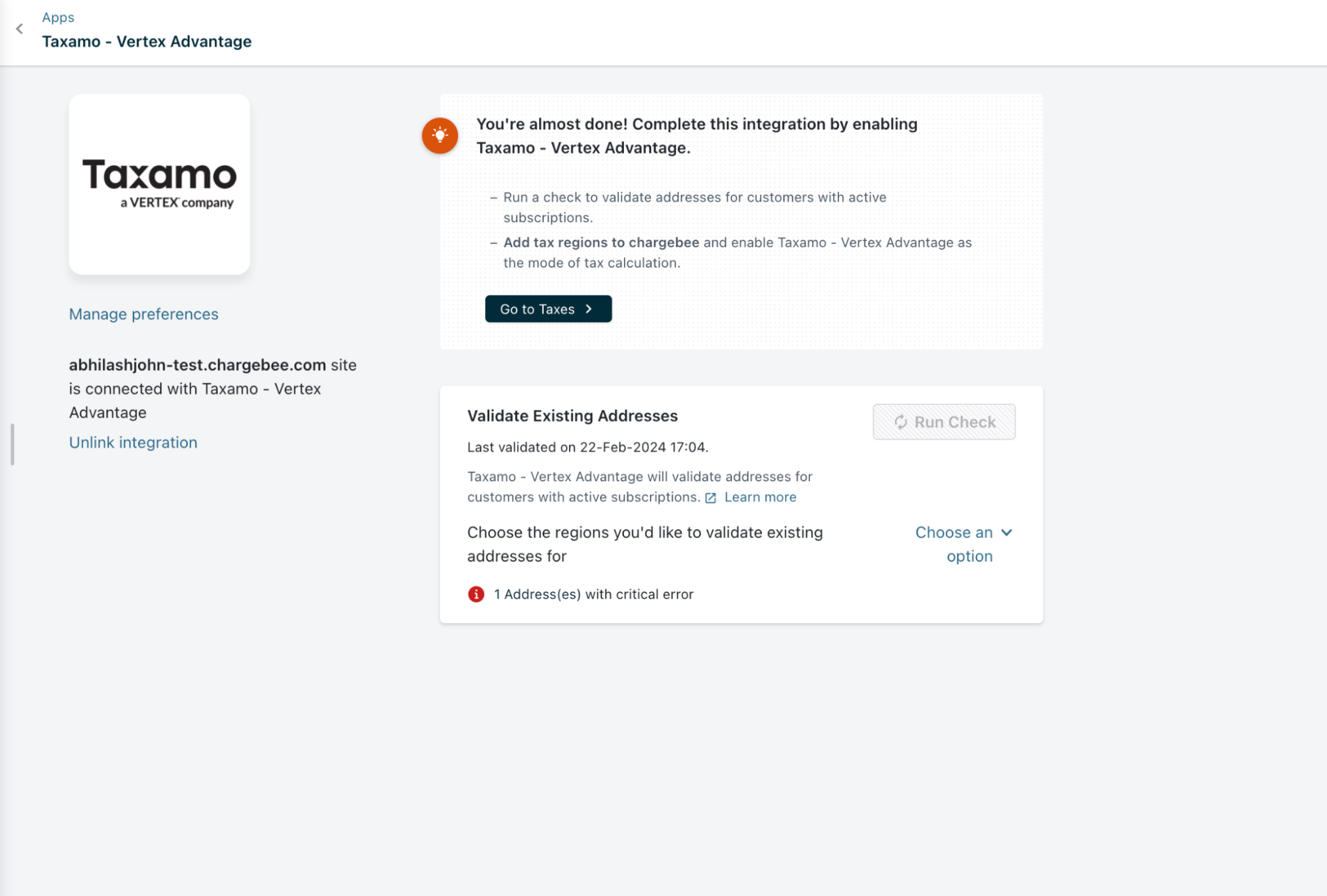

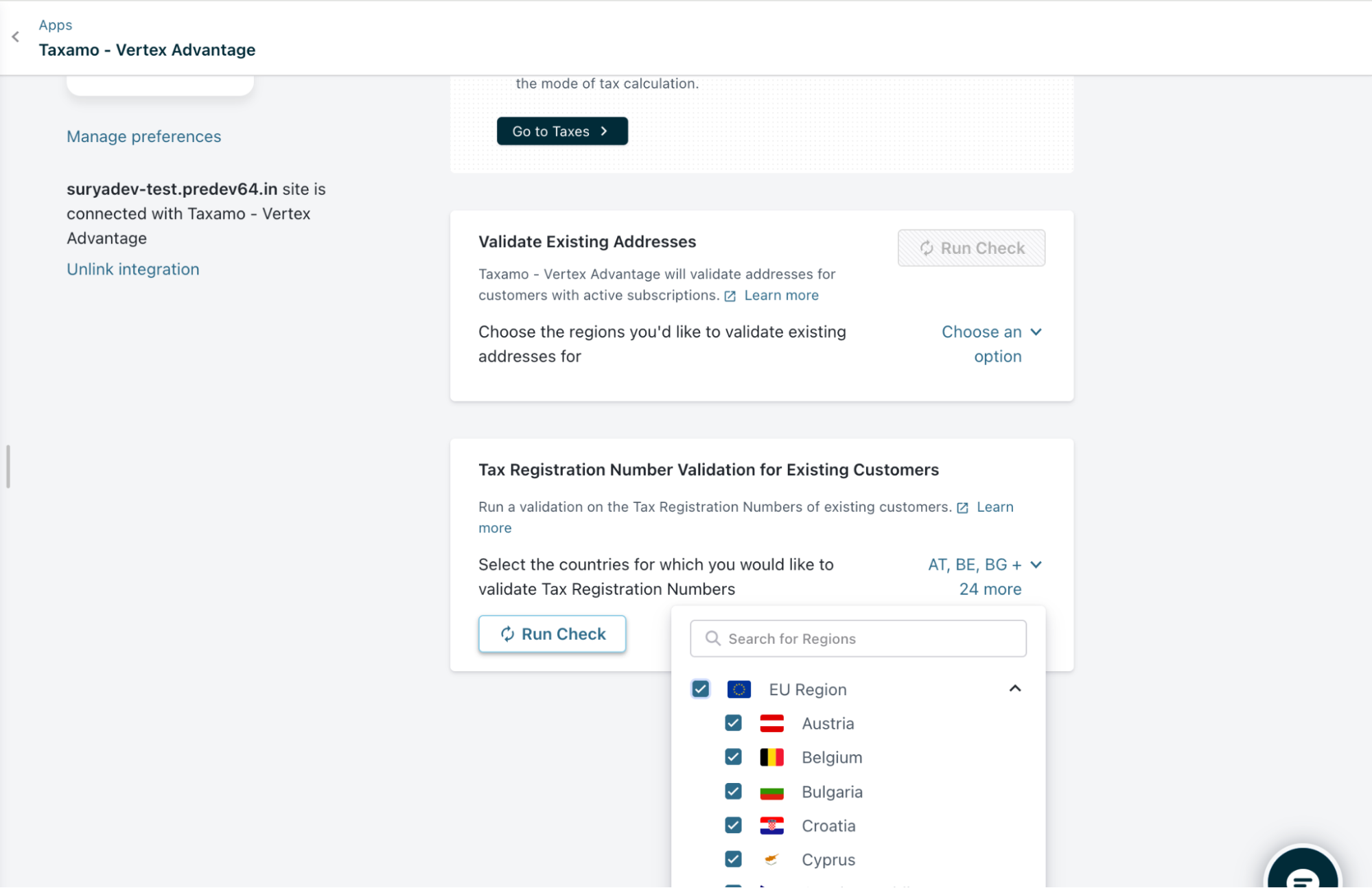

The Chargebee - Vertex Advantage integration validates the taxable address for all new customers who subscribe with your service after enabling Vertex. For customers who have signed up before enabling Vertex Advantage, Chargebee will cancel their subscriptions during renewal if tax cannot be determined. You also generate invoices without taxes in such cases instead of cancellation of subscriptions. To enable this please reach out to the chargebee support team. Subscriptions on the verge of cancellation can be determined using the Validate Existing Addresses feature that allows you to view and fix invalid addresses.

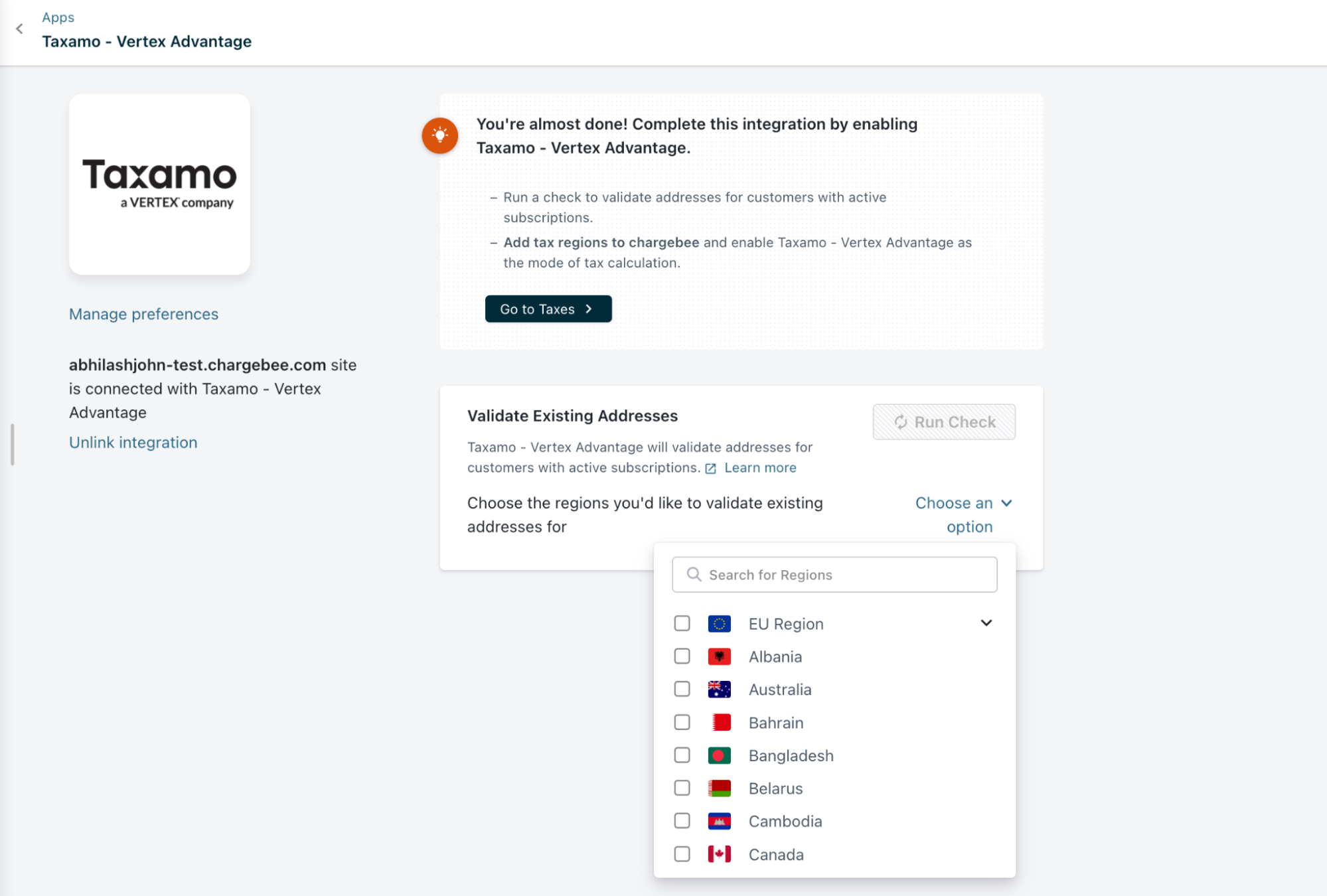

Under Validate Existing Addresses, select your taxable region - United States from the drop-down, and click Run Check.

During the first check that is run after the integration is configured, all the existing subscriptions' taxable addresses get validated. Subsequent address validations will check only the addresses that are added after prior validation and not all the addresses. You can look for any possible address errors and have them fixed.

Validating addresses is not a full address validation but a taxability check.

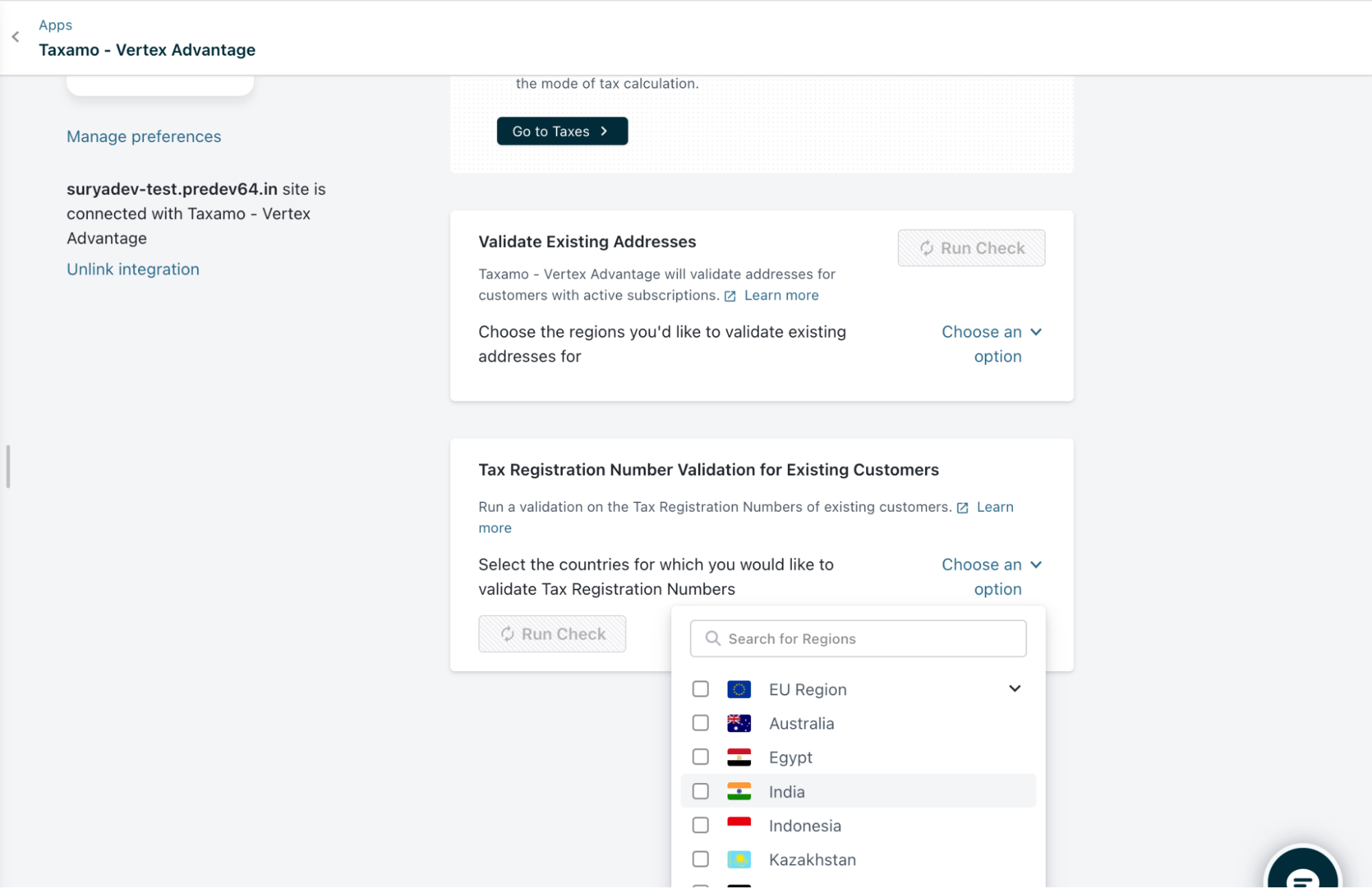

The Chargebee - Vertex Validator integration validates the Tax IDs for all new customers who subscribe with your service after enabling Vertex in a region.

For customers who have signed up before enabling Vertex validator, you have the option to validate the vat numbers and take corrective actions before the next renewal for the customer. Incase the number turns out to be invalid, the behaviour will default to the preferences you have saved in the earlier screen.

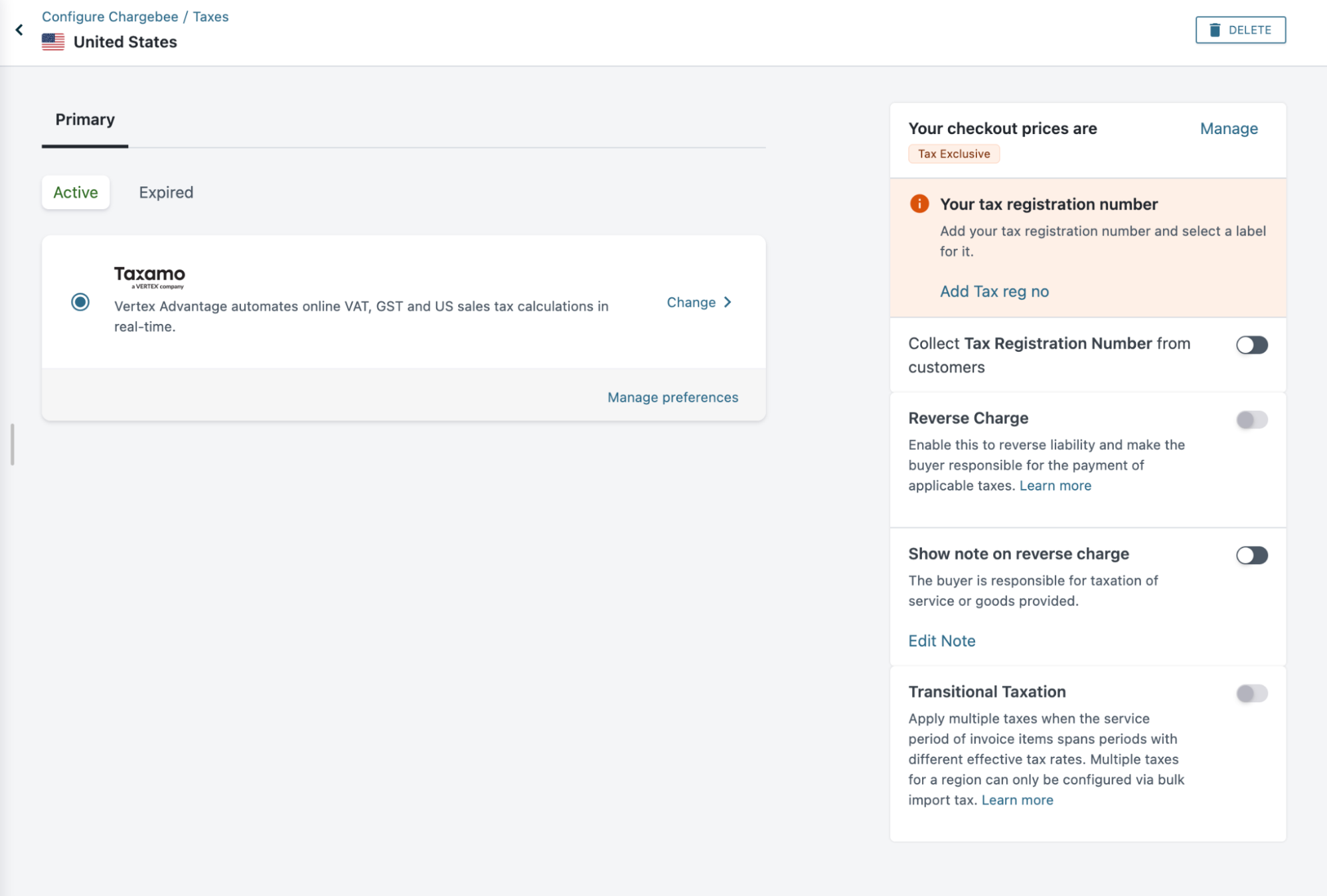

This is a crucial step of this integration. Unless you execute this step, Vertex Advantage will not be used for automatic tax calculation in Chargebee. After connecting the Vertex Advantage account with your Chargebee site, click Go to Taxes on the Vertex Advantage app page.

Alternatively, you can click Settings > Configure Chargebee > Taxes.

Go to the taxable region - United States and select Taxamo as your preferred mode of tax calculation.

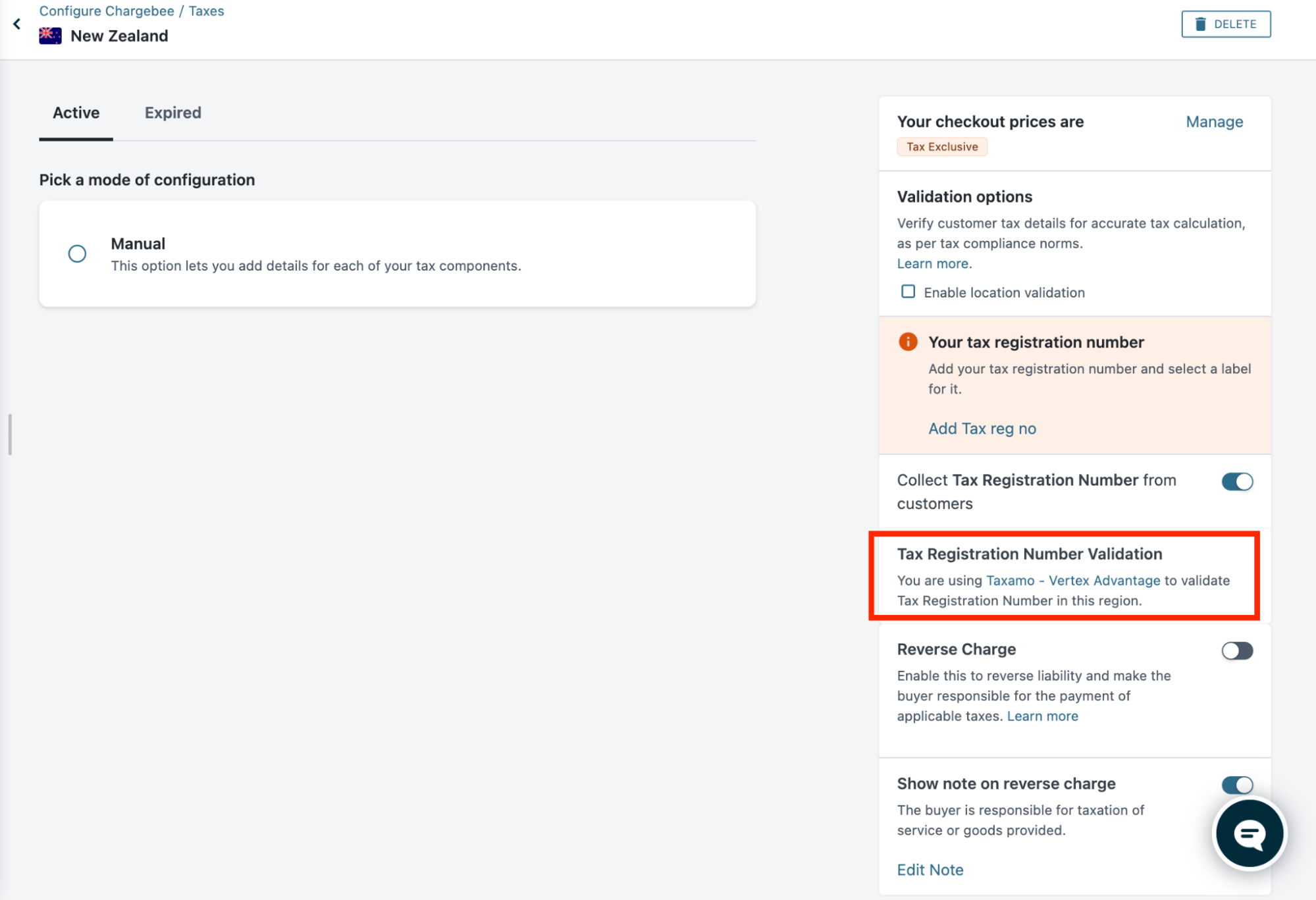

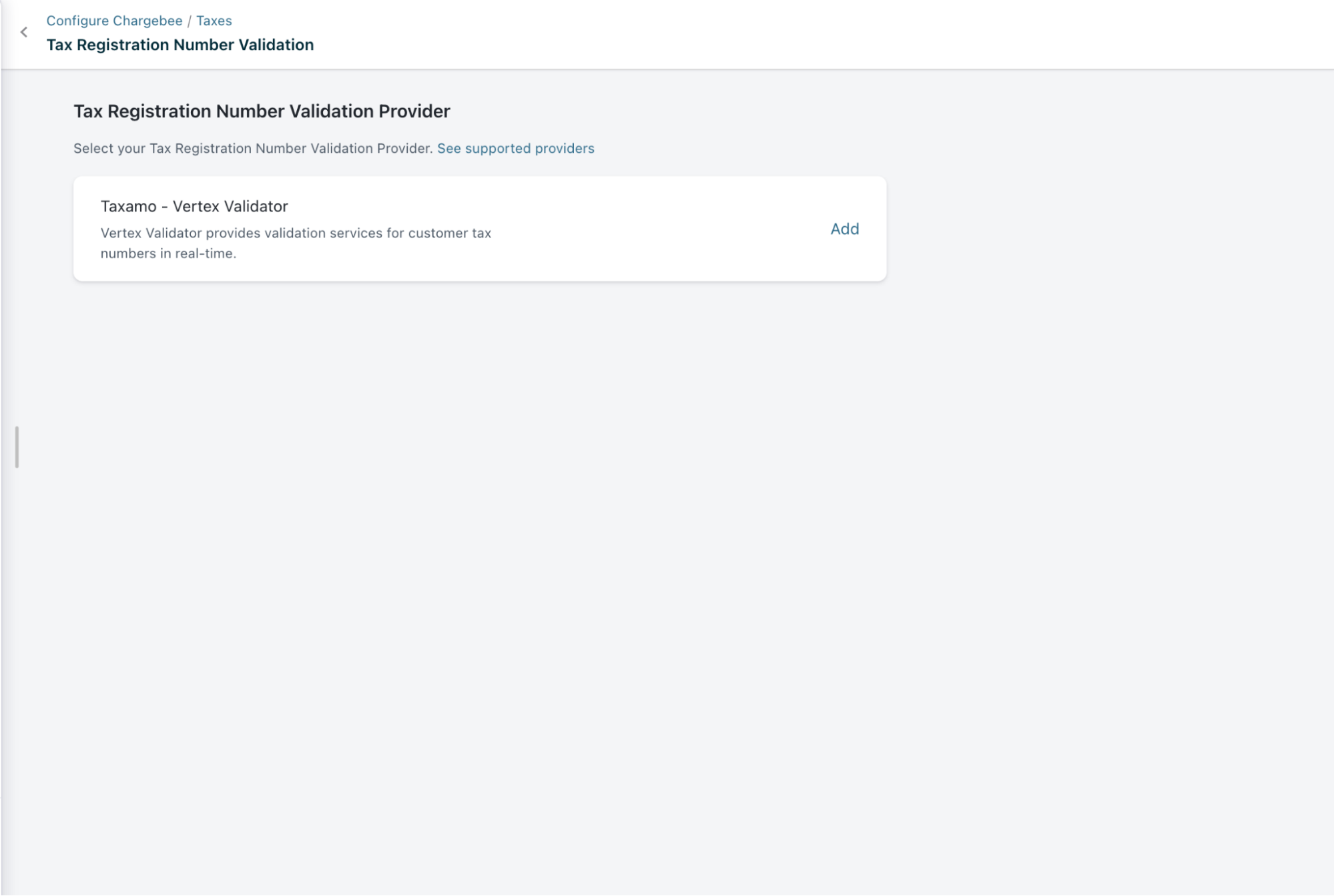

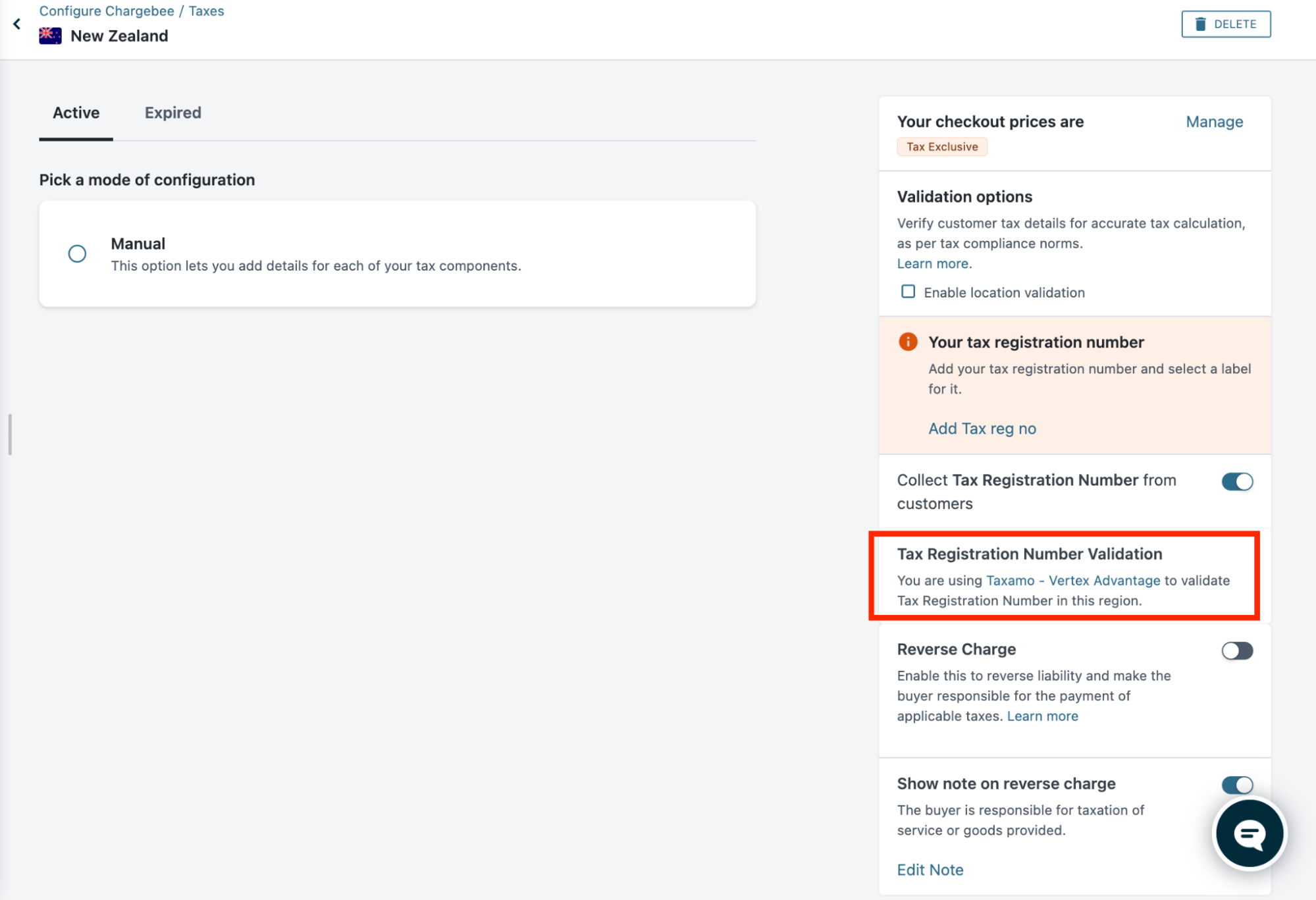

Once the initial setup is done, you can enable VAT validation for specific regions. Navigate to Configure Chargebee > Taxes > Choose the desired region/country > Click on Manage Provider under Tax Registration Number Validation.

Then, click Add next to the option for Taxamo - Vertex Validator. This process mirrors how you manage tax providers, streamlining the setup for VAT validation.

Once the Validation is enabled for a region you will see the information as seen in the screenshot below.

The tax registration number is part of the customer's billing address. Once the validation is enabled for a region, whenever you add/update the tax registration number for a customer, the integration verifies the number immediately and returns you the status. Below is an example where an error notification was shown when the user tried to enter a invalid Tax registration number.

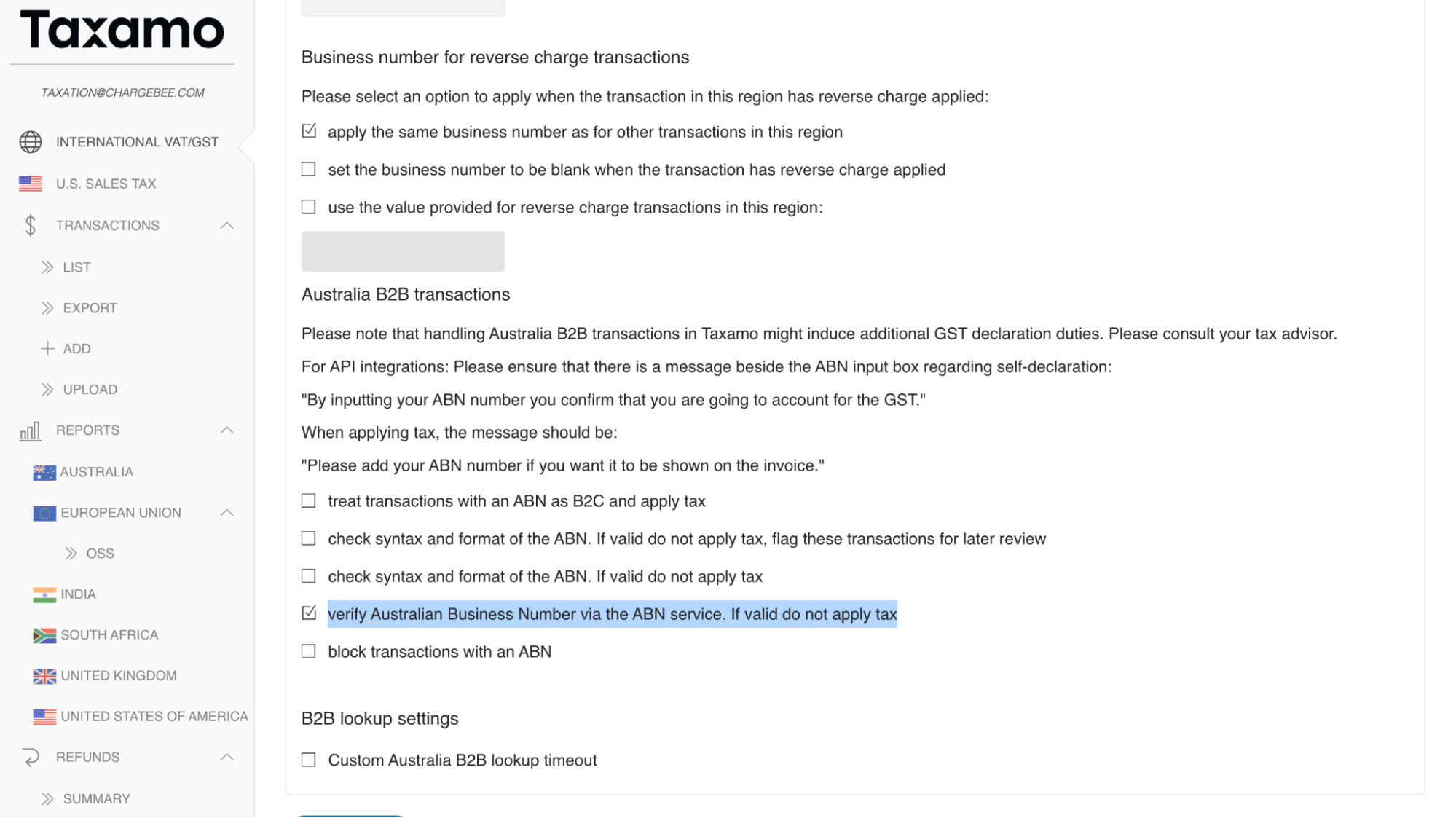

Taxamo or Vertex Advantage supports Reverse Charges for EU regions and Non EU regions. To apply reverse charge correctly you need to manage b2b configuration of each countries on the respective configuration page on Taxamo.

To unlink the Vertex integration from your Chargebee site, follow these steps: