Docs

Anrok is a leading sales tax solution that automates sales tax compliance across financial stacks for SaaS companies in any market. The product covers end-to-end SaaS sales tax for your business which includes your registrations, address validation, and much more.

You can integrate your Chargebee site with Anrok to automate tax application on your Chargebee invoices and credit notes. You can sync your invoices and credit notes to Anrok and generate reports or auto-file your tax returns.

Availability

Chargebee is Personal Identifiable Information (PII) compliant and requires the tax providers to be PII compliant as well. Chargebee shares your confidential PII data with Anrok for tax calculation.

Before integrating your Chargebee site with Anrok, ensure that the following prerequisites are verified on respective applications:

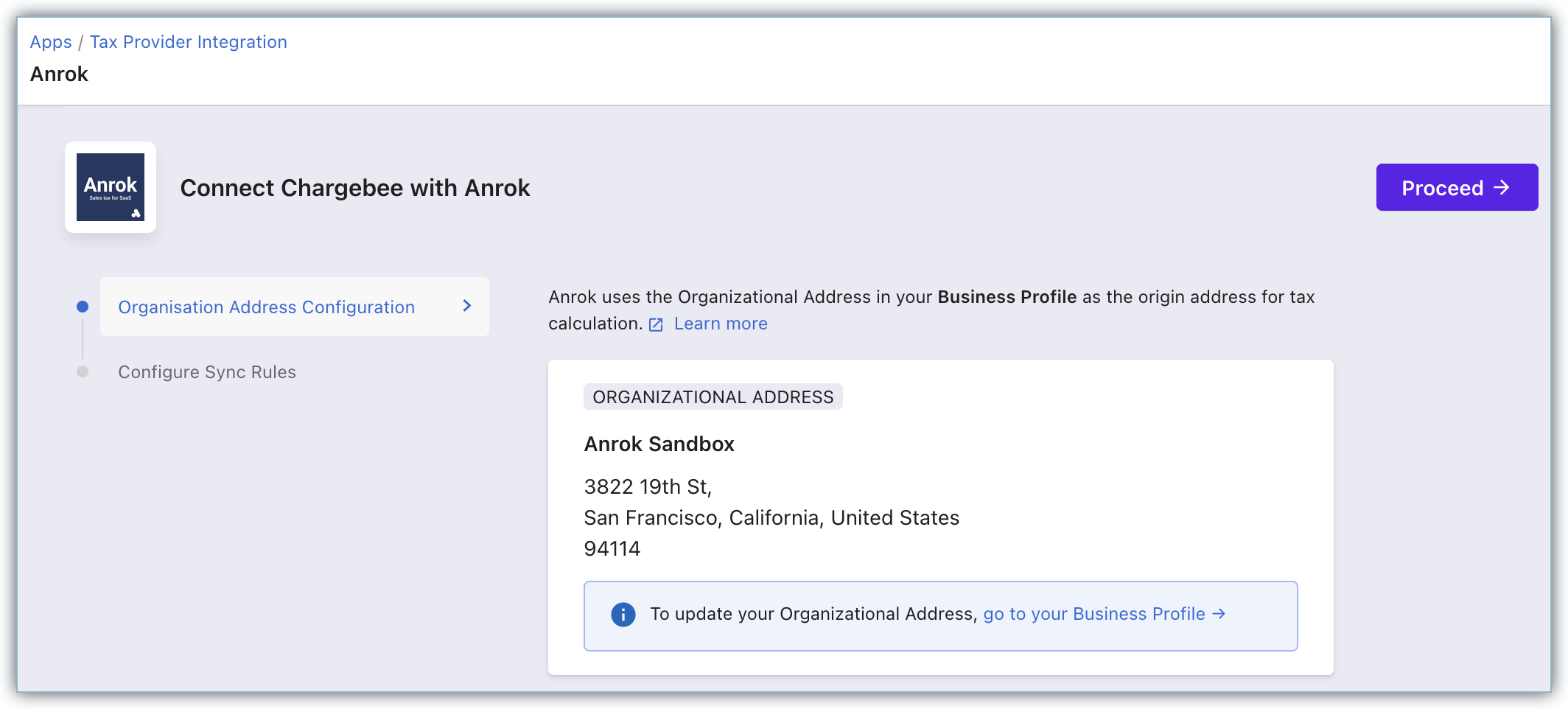

Organization Address: The organization address that is configured in your Chargebee site is used as the origin address for tax calculation by Anrok. Ensure that your organization address in Chargebee is added and up-to-date. You can verify and update your organization address on your Chargebee site by navigating to Settings > Configure Chargebee > Business Profile.

Customers' Address for Tax determination:

If you're using Hosted Pages, ensure you set up the following:

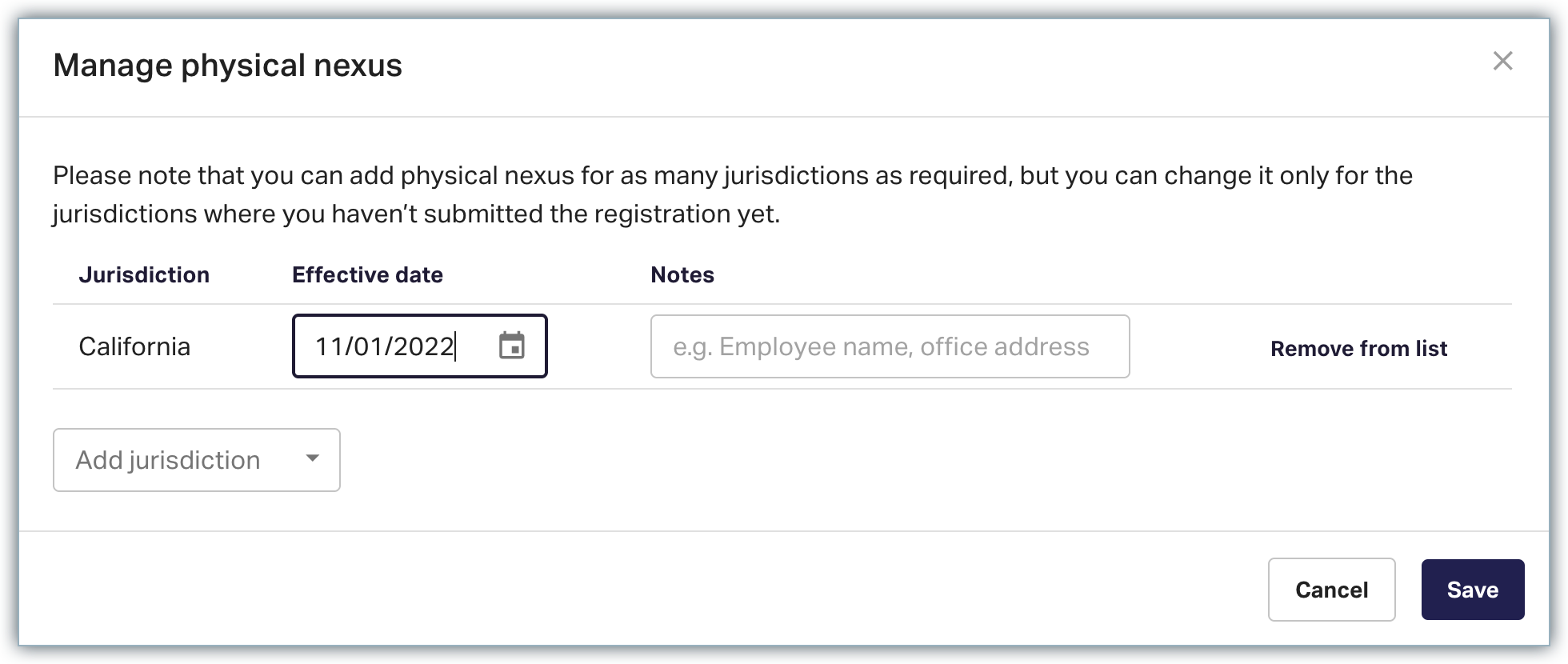

Click Jurisdictions > Manage physical nexus.

On the Manage physical nexus pop-up, select a country from the Add Jurisdiction drop-down and specify Effective dates(to determine from when to process transactions) and Notes.

Click Add jurisdiction drop-down to configure more countries as required.

Click Save.

Visit Anrok documentation to learn more.

The following data is synced between Anrok and Chargebee for tax automation on your Chargebee invoices and credit notes:

Following are the steps to integrate Anrok account with your Chargebee site:

Follow the steps below to connect the applications:

Log in to your Chargebee site, and click Apps > Go to Marketplace > Tax Management > Anrok.

On the Anrok configuration page, click Get Started if you already have an Anrok account, or click Sign up to create a new account and continue.

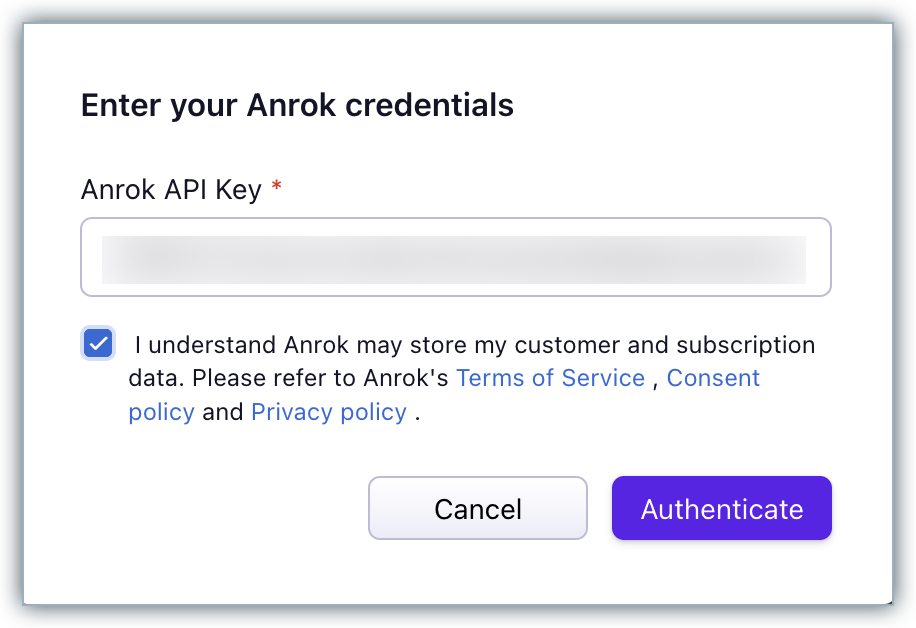

Enter your Anrok credentials by specifying the Anrok API Key that you retrieved for Chargebee. Click the "I understand Anrok.." checkbox for affirmation and click Authenticate.

Enter or confirm your organization address. Chargebee auto-populates the address that is specified in your settings, you can change this if required or click Proceed.

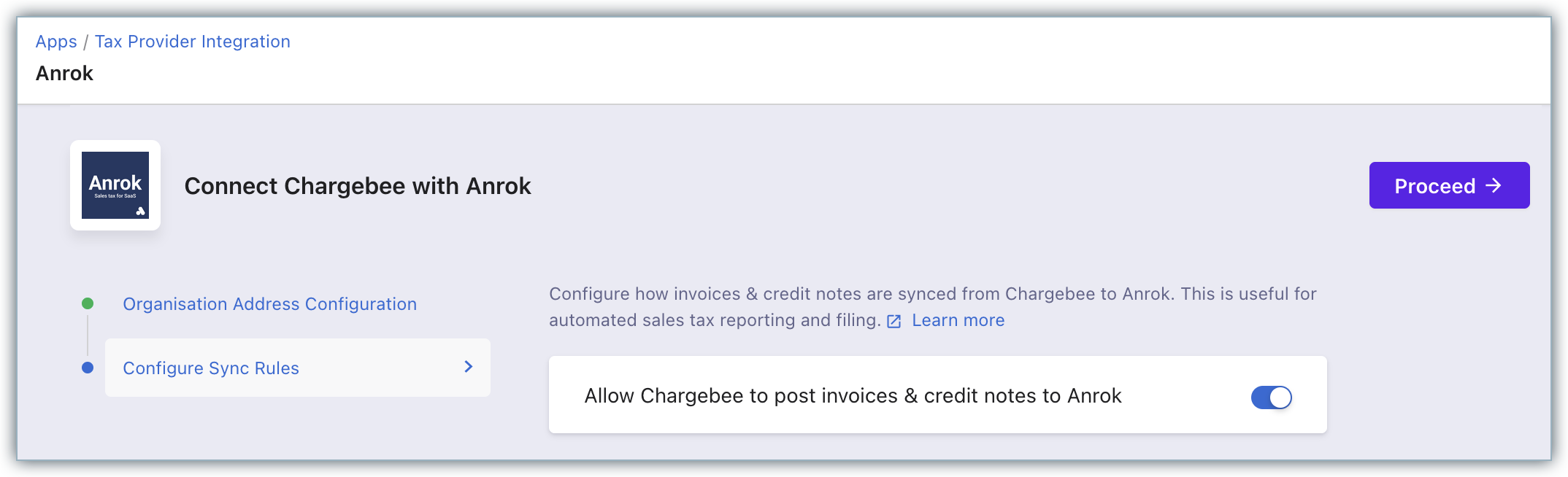

In Configure Sync Rules, enable the toggle button to allow Chargebee to sync invoices and credit notes to Anrok.

Click Proceed.

The Anrok account is successfully connected with your Chargebee site.

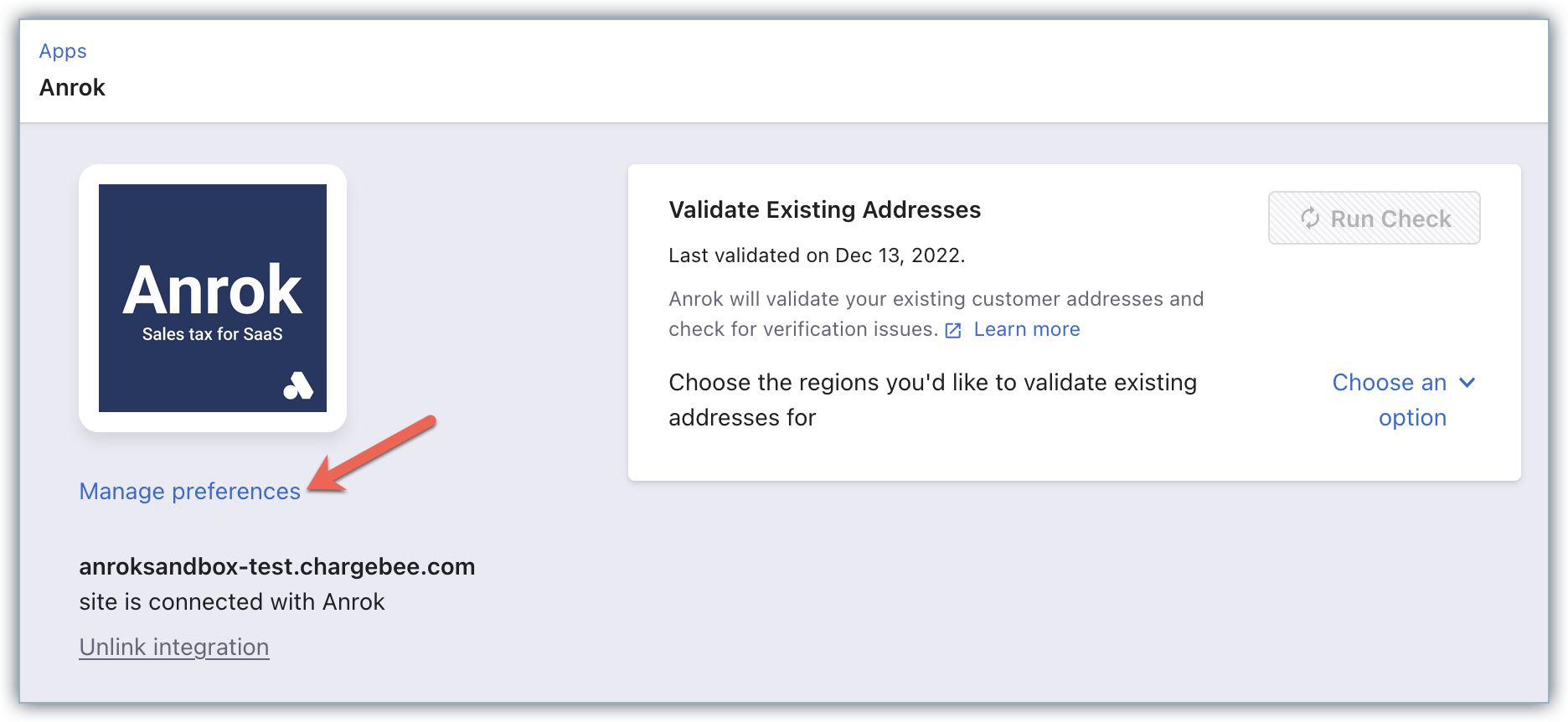

You can make changes to the integration preferences at any point of time by clicking Apps > Apps Connected > Anrok > Manage > Manage Preferences.

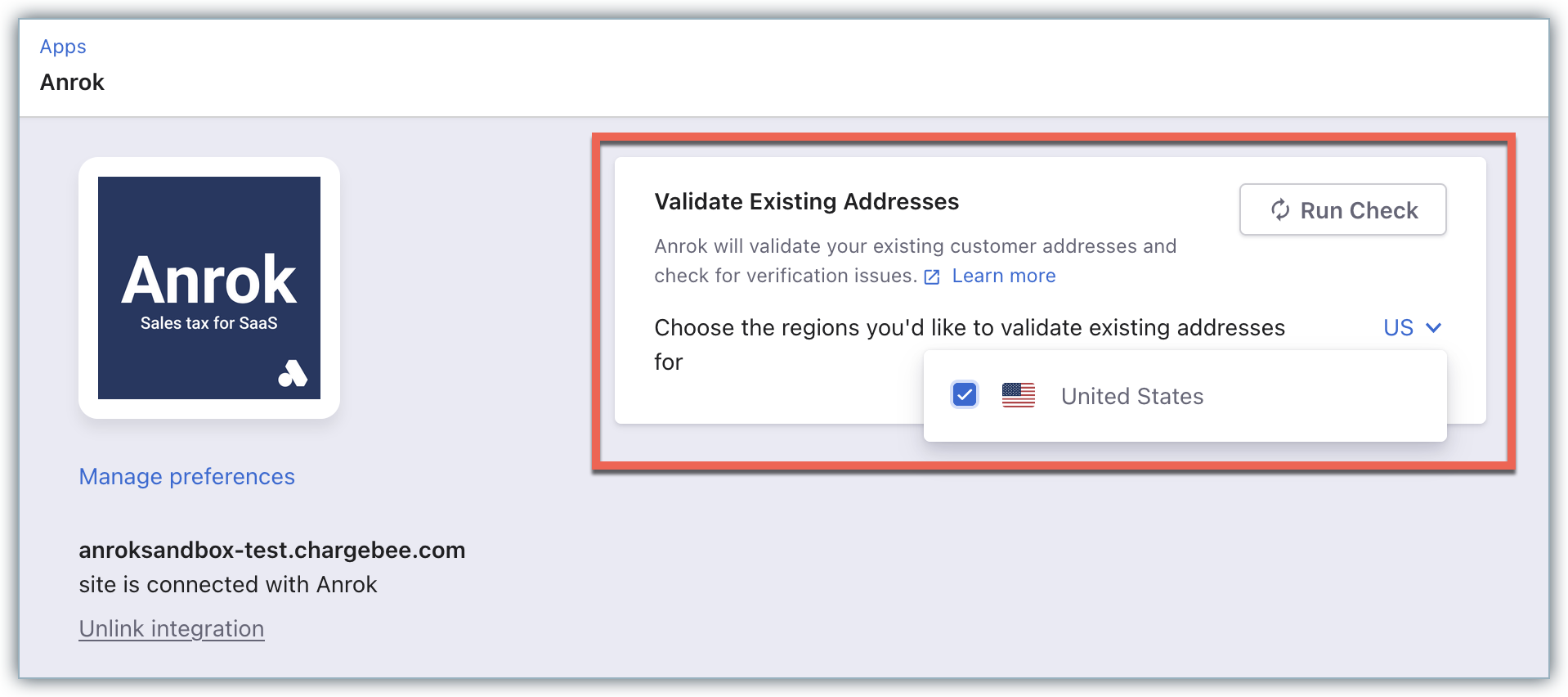

The Chargebee-Anrok integration validates the taxable address for all new customers who subscribe with you after enabling Anrok. For customers who have signed up before enabling Anrok, Chargebee will cancel their subscriptions during renewal if tax cannot be determined. Subscriptions on the verge of cancellation can be determined using the Validate Existing Addresses feature that allows you to view and fix invalid addresses.

Under Validate Existing Addresses, select your taxable region - United States from the drop-down, and click Run Check.

During the first check that is run after the integration is configured, all the existing subscriptions' taxable addresses gets validated. Subsequent address validations will check only the addresses that are added after prior validation and not all the addresses. You can look for any possible address errors and have them fixed.

In order to validate the address, Chargebee makes a taxability api check to validate if the address is taxable.

Note that validating addresses is not a full address validation but a taxability check.

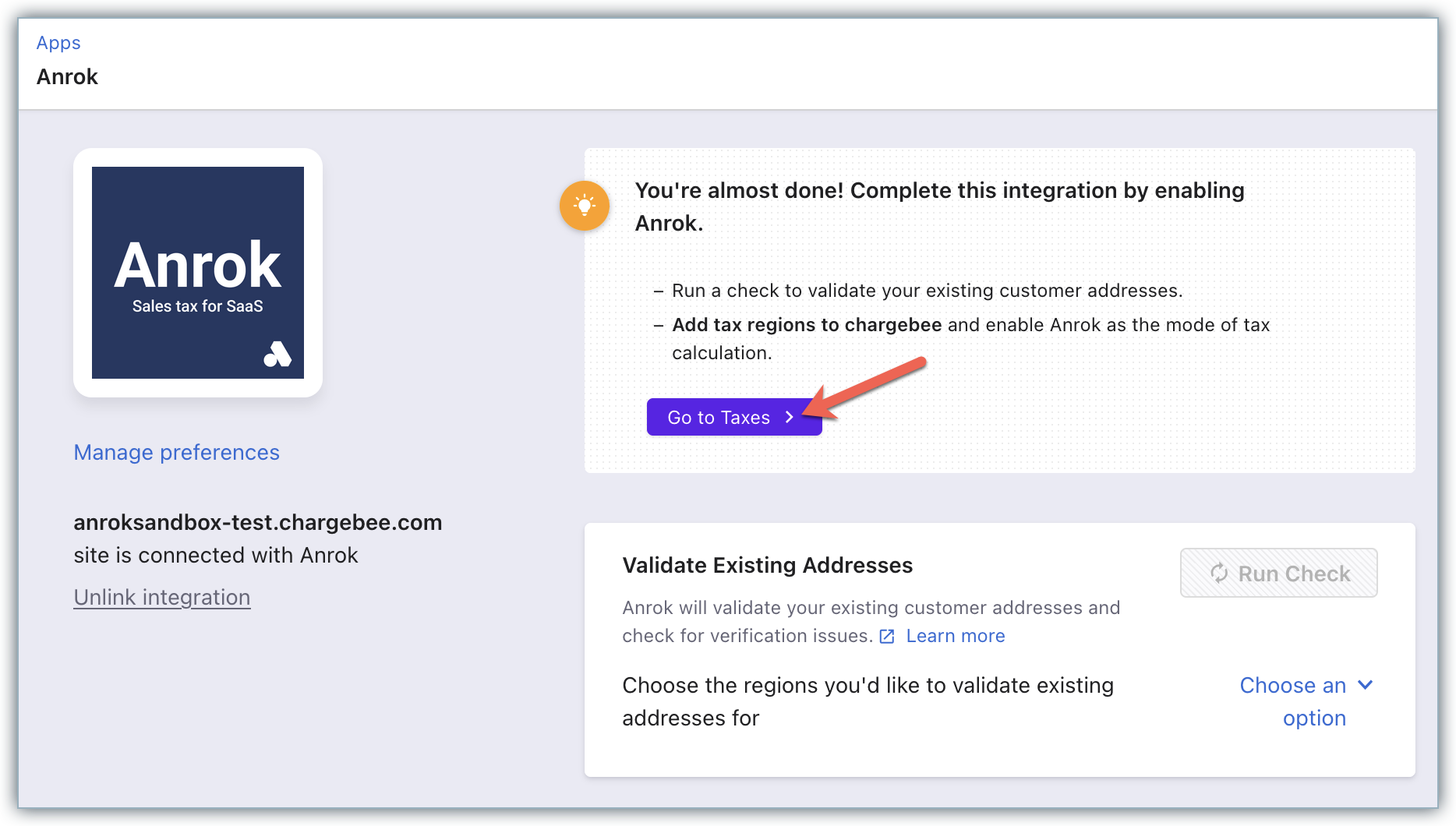

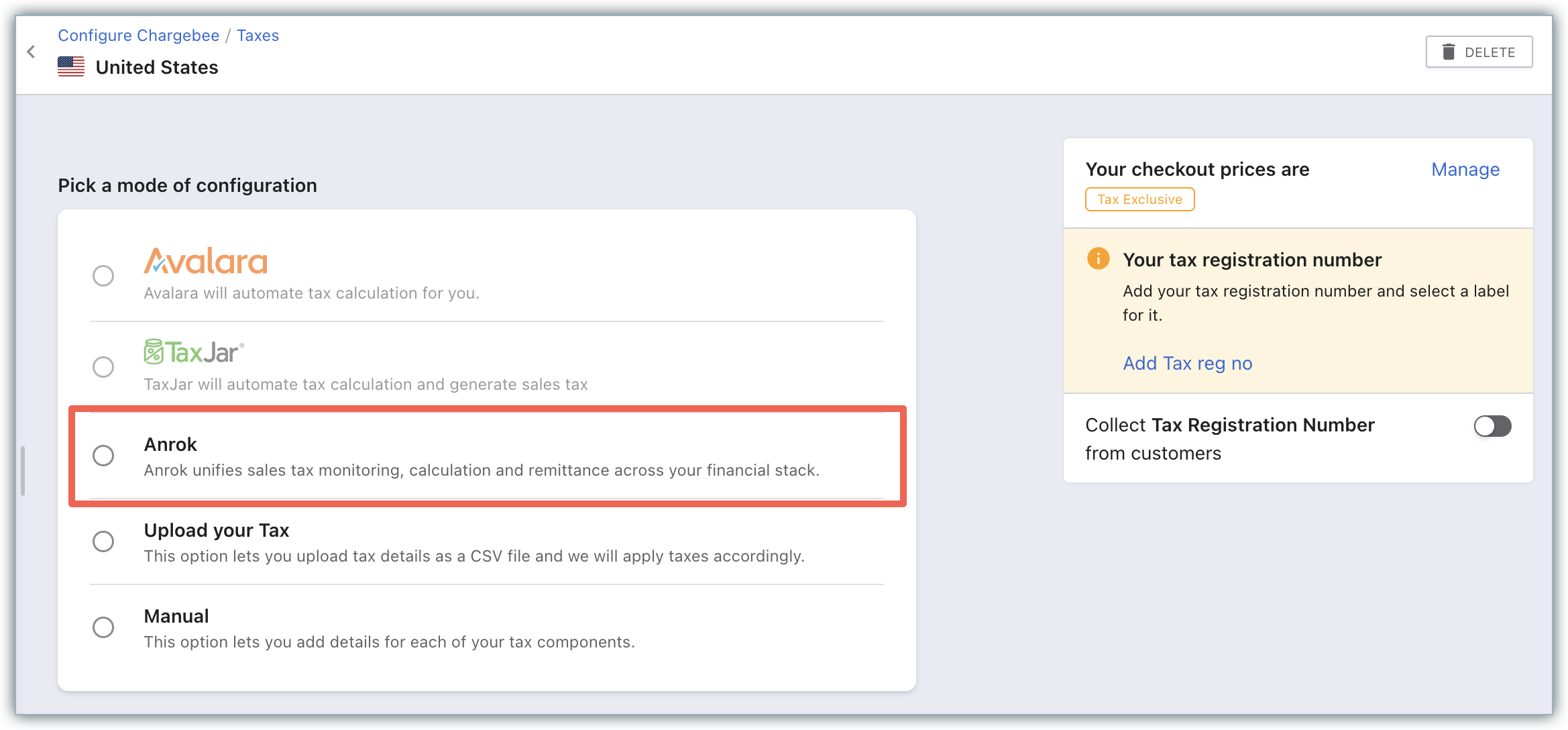

This is a crucial step in the integration. Unless you execute this step, Anrok will not be used for automatic tax calculation in Chargebee. After connecting the Anrok account with your Chargebee site, click Go to Taxes on the Anrok app page.

Alternatively, you can click Settings > Configure Chargebee > Taxes.

Go to the taxable region - United States and select Anrok as your preferred mode of tax calculation.

Follow these steps to unlink the Anrok integration from your Chargebee site,