Docs

bill, billing, customer, info, state, gst, cgst, sgst, gstin, intra, inter, utgst, igst, b2c

35484171

2020-09-07T08:04:43Z

2025-02-12T08:22:54Z

630

0

0

247906

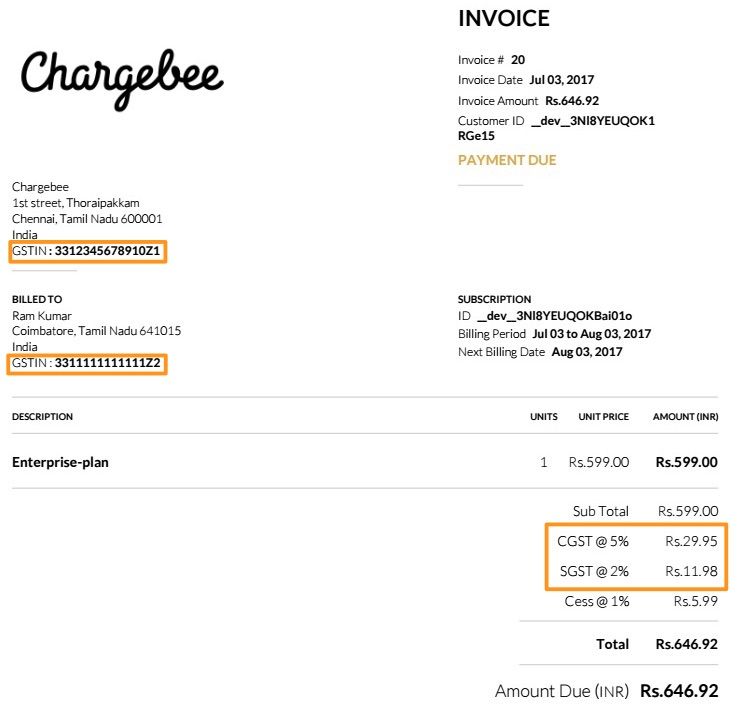

How does the tax breakup look for SGST and CGST in invoices?

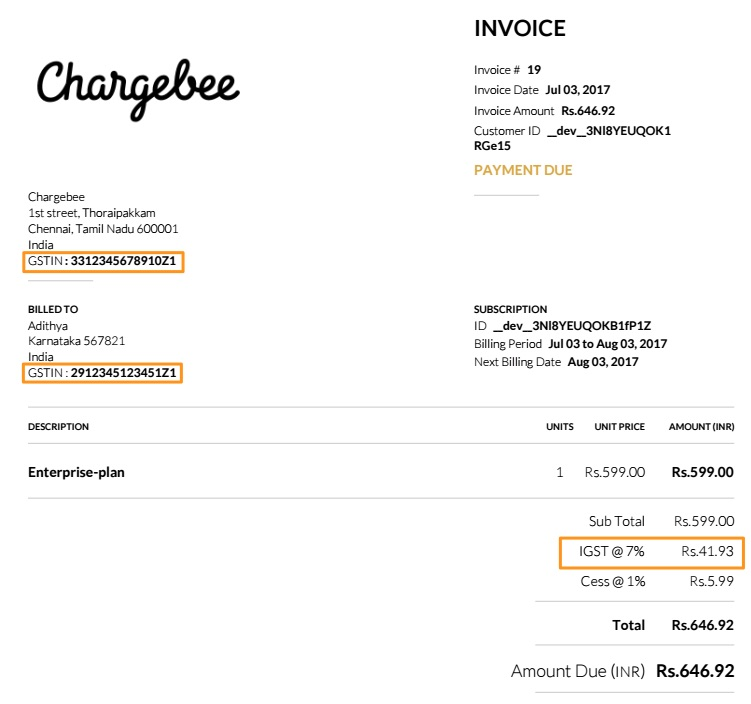

Tax breakup: IGST

Summary

Once the GST configuration is completed, the GSTIN field appears in the customer's billing info.

Intra-State - when a sale takes place within the same state or union territory, a tax break up of both SGST/UTGST and CGST will be displayed

Inter-State - when a sale takes place between two different states or union territories, a tax break up of IGST will be displayed

Note:

You cannot alter the old invoices that were generated for a customer. If the customer updates his billing address then, the new tax breakup applies to the future upcoming invoices.

Tax will not be applied if the customer's billing/shipping address does not have 'State' mentioned.

IGST is levied only in B2C transactions where the end customer does not have a GST Identification Number(GSTIN).