Docs

NetSuite application offers Legacy Tax and SuiteTax modules to help simplify the tax calculations. Currently, as part of the NetSuite Integration, we are integrating with the tax module. SuiteTax replaces existing tax functionality (hereafter referred to as Legacy Tax), and these features are not built to coexist in a single environment.

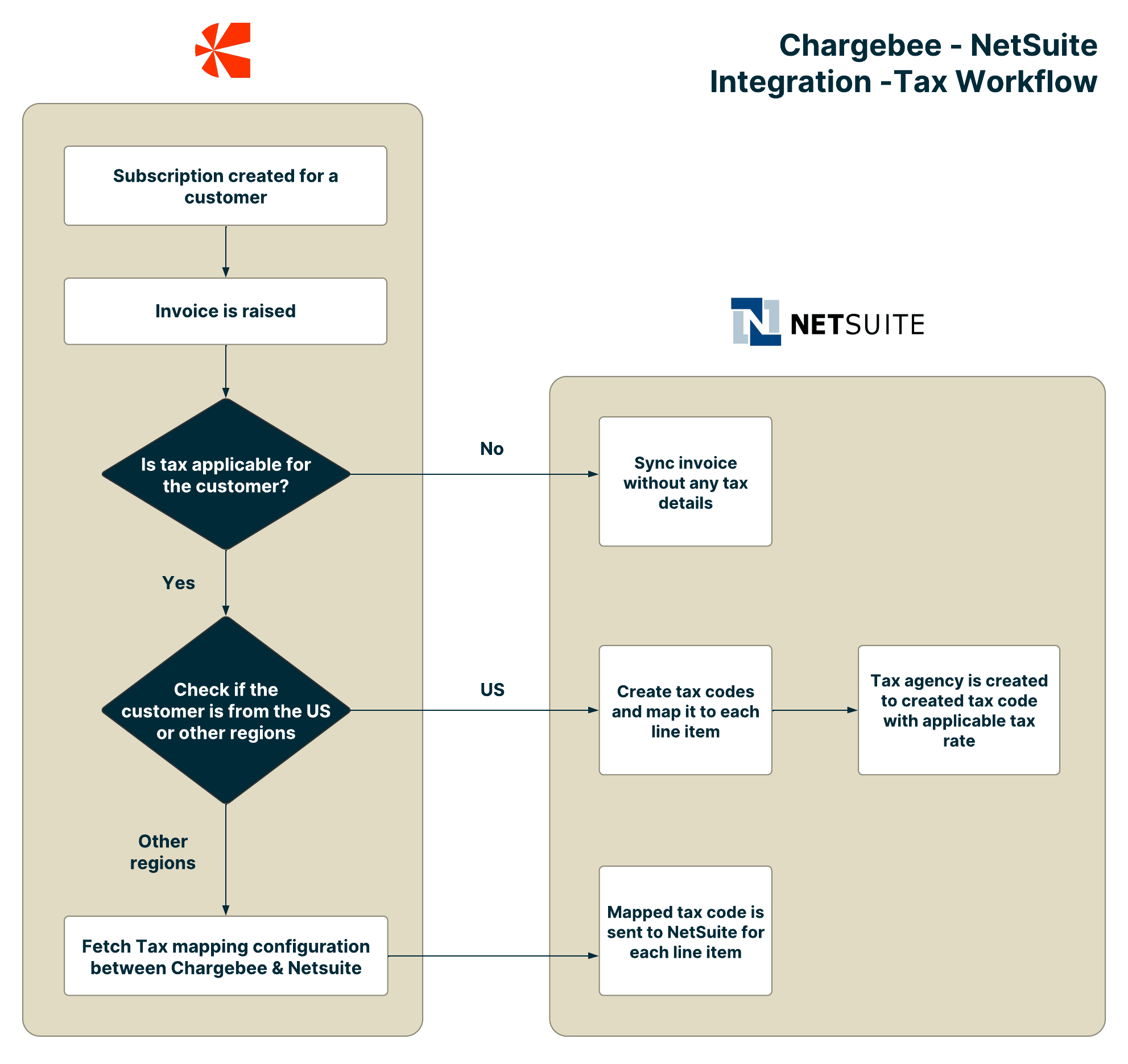

In Chargebee, taxes are applied whenever an invoice is generated for a subscription, renewal, or a one-time charge. Chargebee checks for the customer's region to map taxes based on their location if a tax applies to the customer. If a tax is not applicable, then the invoices are created without any tax details. The following flowchart displays the flow of tax sync workflow between Chargebee and NetSuite. It helps understand how the taxes are mapped based on different regions.

If the customer's Chargebee account is integrated with Avalara for tax calculation in the NetSuite connector, then we support tax sync only for the United States (US) region. For other regions, it is recommended to use the Chargebee's Tax module.

Contact support to avail this feature.

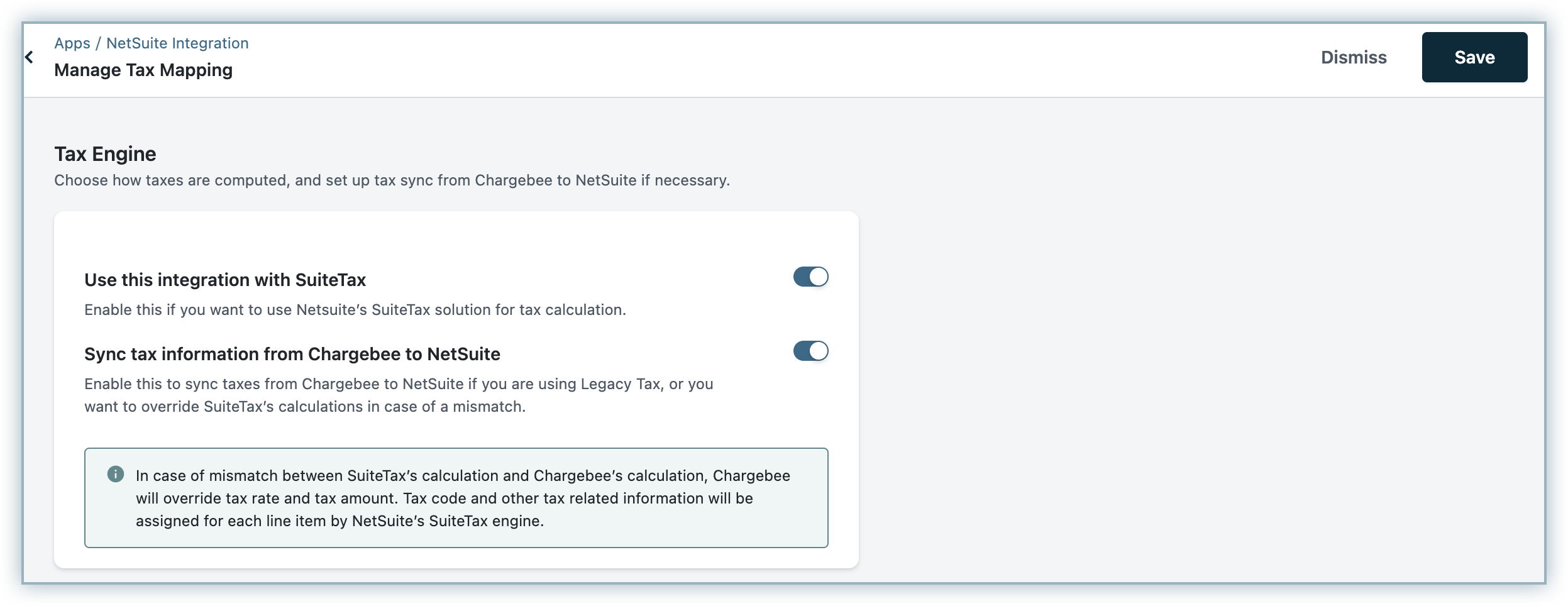

SuiteTax is a customization model offered by Netsuite. It automatically identifies the customer's shipping or billing information to calculate the taxes for each item in the invoice. SuiteTax engine is a bundle installed in NetSuite where the tax calculation occurs within NetSuite. It also can add localization tax for regions such as India. If the customer uses SuiteTax and installs the bundle for each region, then there are pre-defined taxes. The tax rates are created as part of the custom field, which is not loaded in the Standard Rate field.

Follow the steps below to configure tax and manage tax mapping in Chargebee:

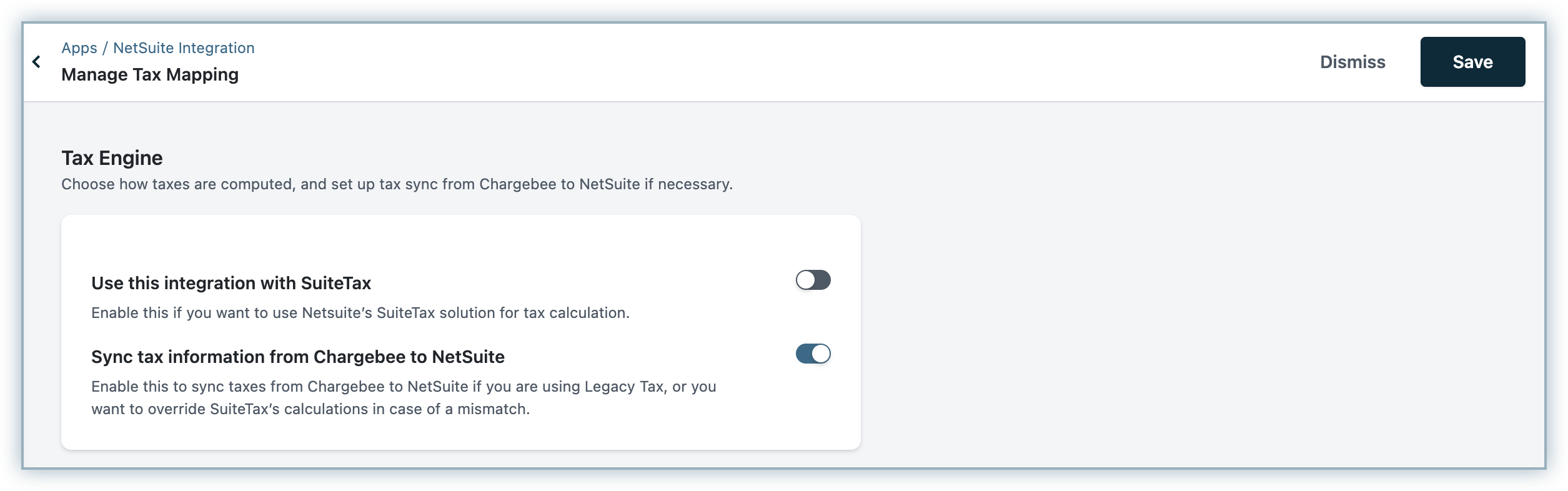

While configuring the integration, under Manage Tax Mapping,

You can choose between SuiteTax and the Legacy tax module by enabling the toggle button

You can also enable the tax configuration to send tax information from Chargebee to NetSuite. If you do not enable this option, taxes will not be synced from Chargebee to NetSuite.

For the United States (US) region, the tax codes and tax rates are passed to each line item and tax codes are created in NetSuite. A tax agency should be created (according to NetSuite's guidelines) for creating tax codes in NetSuite.

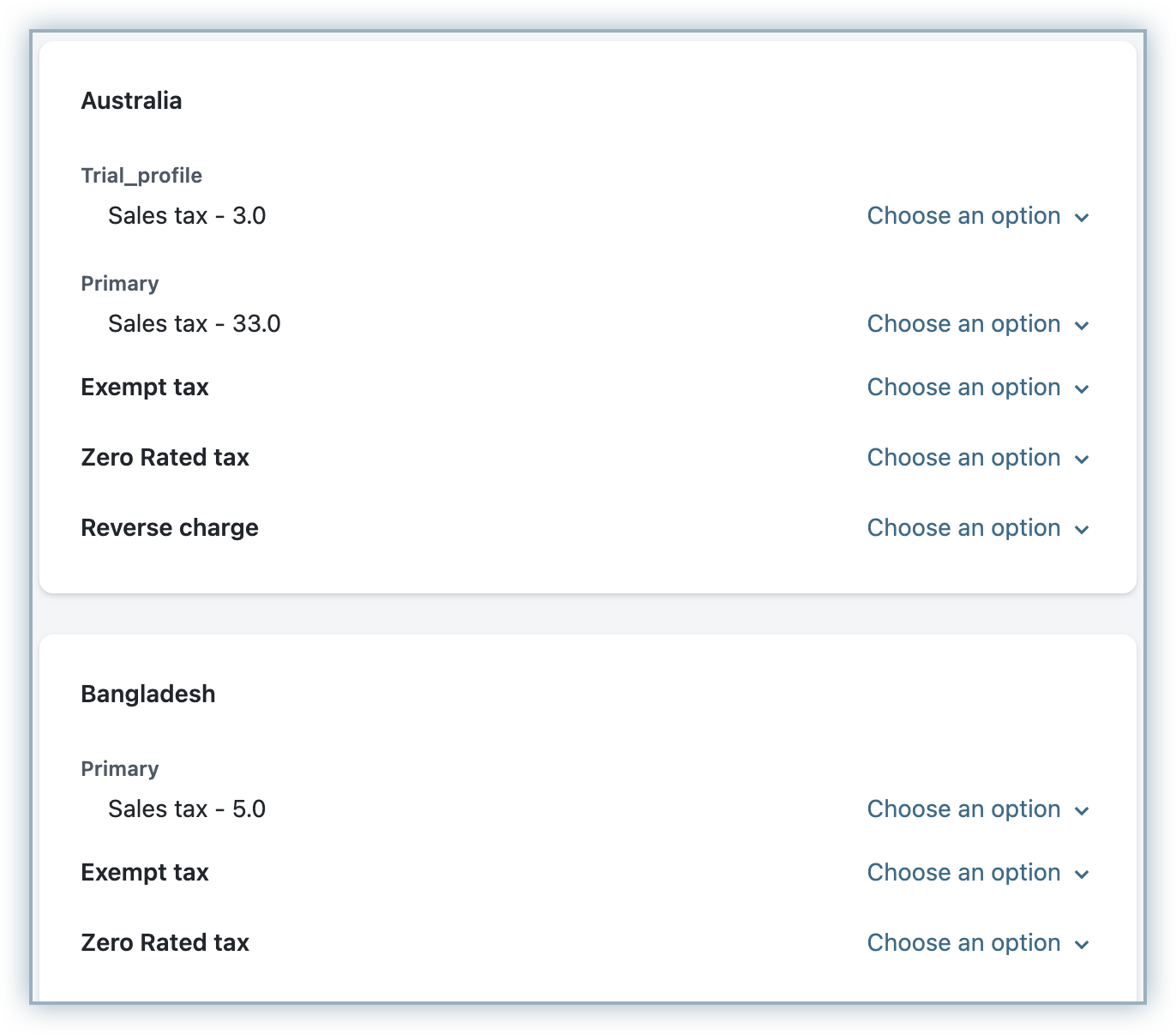

For other regions, Chargebee-NetSuite tax mapping has to be done manually. The read-only tax codes are derived from the tax configuration in Chargebee and the options to list the tax codes are configured in NetSuite. The tax rates between Chargebee and NetSuite tax codes are mapped when invoices are synced for other countries.

If tax mapping is not available for a specific country, then Chargebee will look for the default Tax Code mapping and send them as part of each line item.

For the US region, the NetSuite connector creates and maps the tax codes to each line item.

To create the tax codes in NetSuite, do the following:

1. Create a Tax Control Account and Tax Type

To create Tax Control Account and Tax type in NetSuite, do the following:

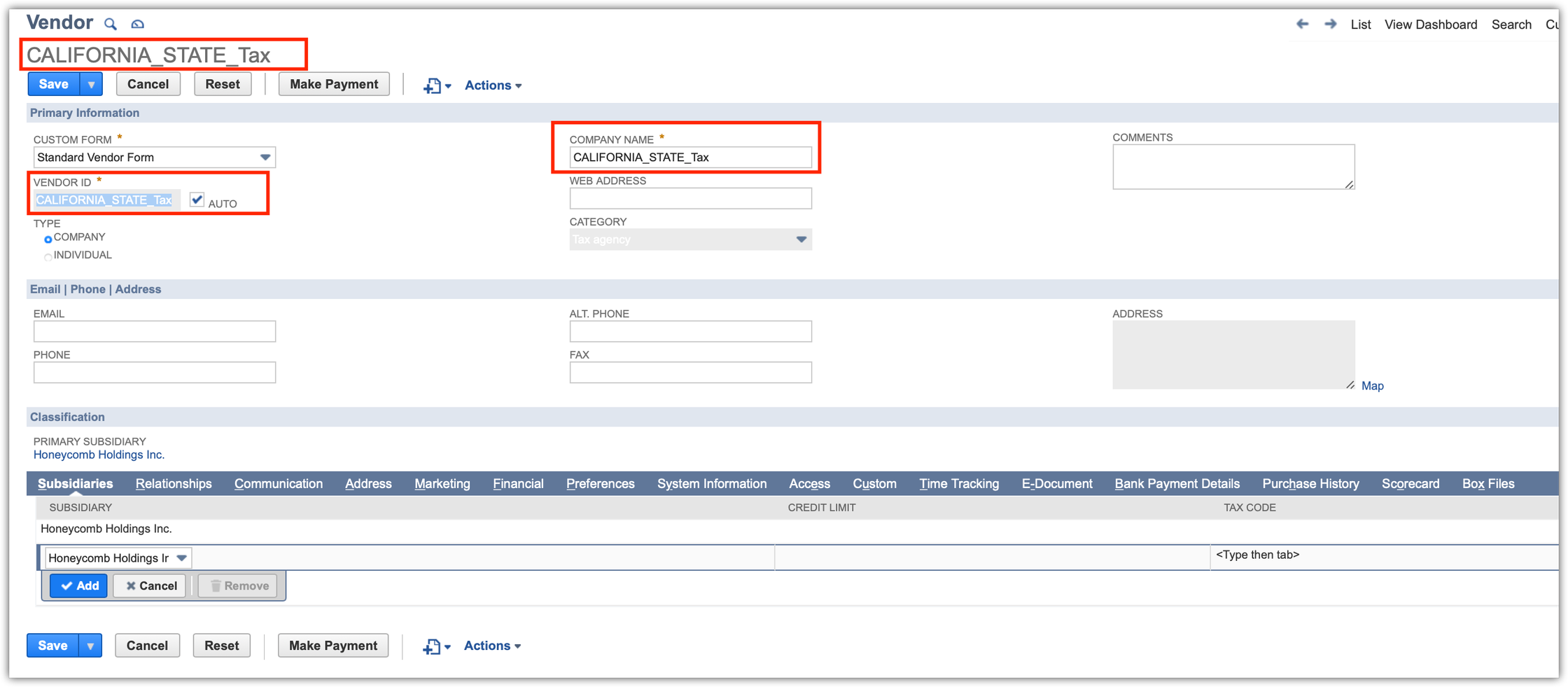

2. Create a Vendor (Tax Agency)

To create Tax Agency in NetSuite, do the following:

Navigate to List > Relationship > Vendor in your NetSuite account.

Before creating a Tax Code, a Vendor with the "Tax Agency" category should be created in Chargebee. See the screenshot below for example:

The naming format of the Vendor:

<TAX_JURISDICTION><TAX_JURISDICTION_TYPE>Tax

<TAX JURISDICTION> = CALIFORNIA and <TAX_JURISDICTION_TYPE> = STATE" followed by "_Tax

<tax_juris_code><TAX_JURISDICTION_TYPE><Tax format>

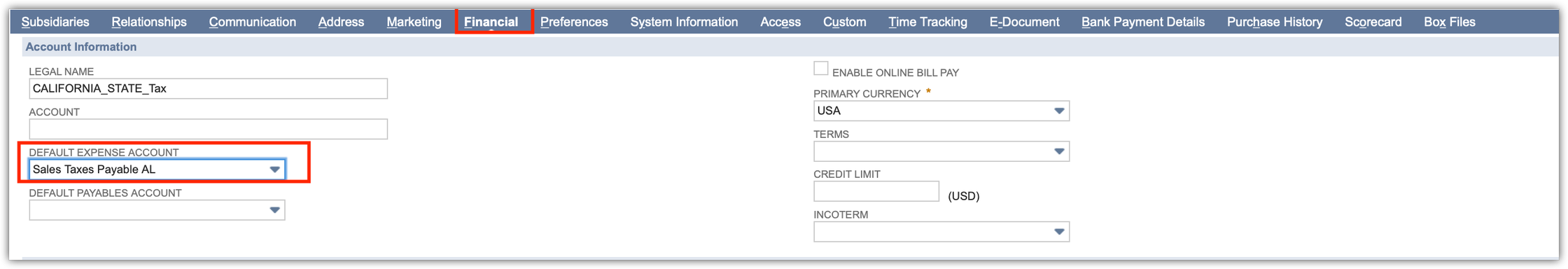

Associate a tax account to a Vendor by setting it up under the Financial module of your NetSuite account.

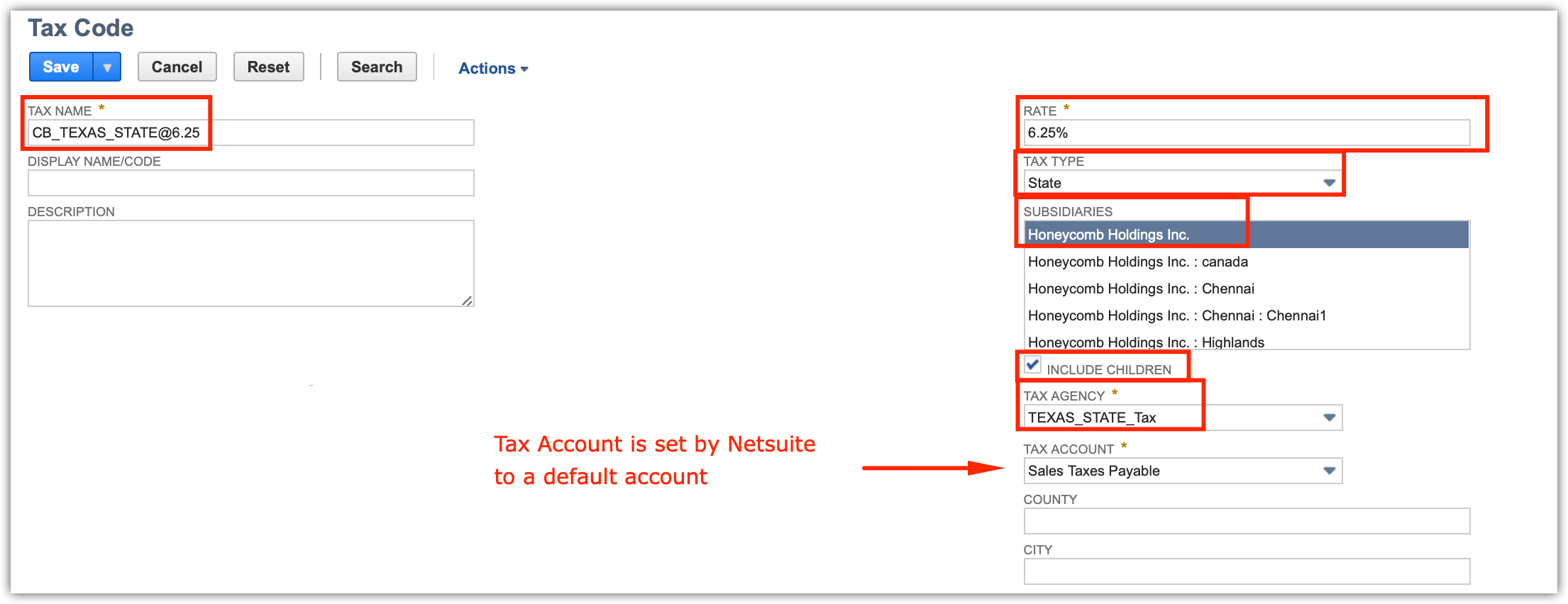

3. Create Tax Codes

CB<TAX JURISDICTION><TAX JURISDICTION TYPE>@<RATE>

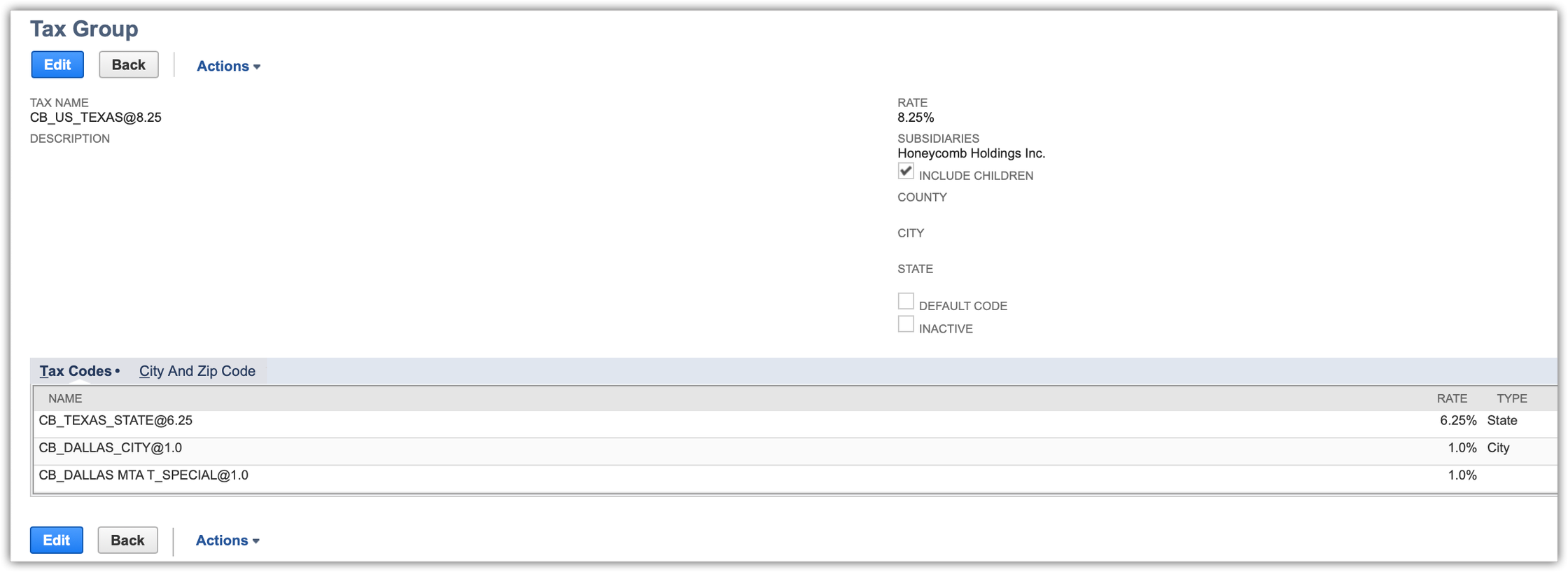

4. Create a Tax Group

A Tax Group is used to combine multiple Tax Codes.

To create a Tax Group in NetSuite,

Navigate to Accounting > Tax Group in your NetSuite account.

Chargebee creates the Tax Group in NetSuite for the US regions.

The naming format for Tax Group:

CB_US_<STATE>@<RATE>

Chargebee sends the following fields:

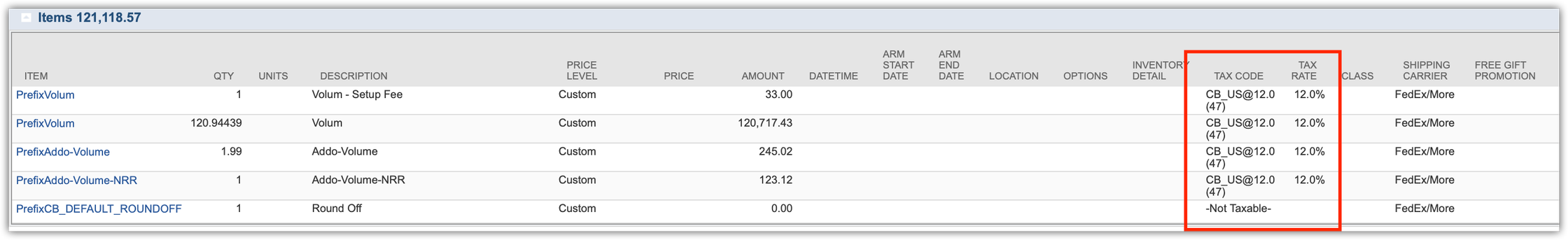

The tax group is passed into the invoice line item of the "Tax Code" column :

For other countries, follow the steps below as part of the tax configuration:

The above setup is mandatory for Chargebee to send the tax information. It is recommended to have a NetSuite consultant for detailed configuration of the Tax module within NetSuite based on your business needs.

Contact support to avail this feature.

The following actions take place when the SuiteTax module is enabled in Netsuite:

Limitations

The tax code and other tax-related information for each line item are not updated since the SuiteTax engine does not allow override.