Docs

The Reserve Bank of India (RBI) announced guidelines to streamline the process and security measures for card payments. According to the guidelines, the payments will require Additional Factor of Authentication (AFA), especially for ‘card-not-present' transactions. These regulations impact the existing mandates set up for managing recurring payments. Learn more .

The following impact may apply to your Stripe integration:

Stripe's e-mandate creation is applicable to cards issued in India and INR currency only. Issuing banks and Stripe do not support the creation of e-mandates for Non-INR currency. As a workaround for non-INR transactions, you can utilize Pay Now to process payments manually.

Banks will trigger dynamic authentication to complete additional factor authentication (AFA) when setting up the mandate and for transactions that exceed INR 15,000. However, not all banks support dynamic authentication.

Note: Please reach out to Stripe for the list of supported banks.

Note: If the amount exceeds INR 15,000, then the e-mandate will require AFA during the pre-debit notification.

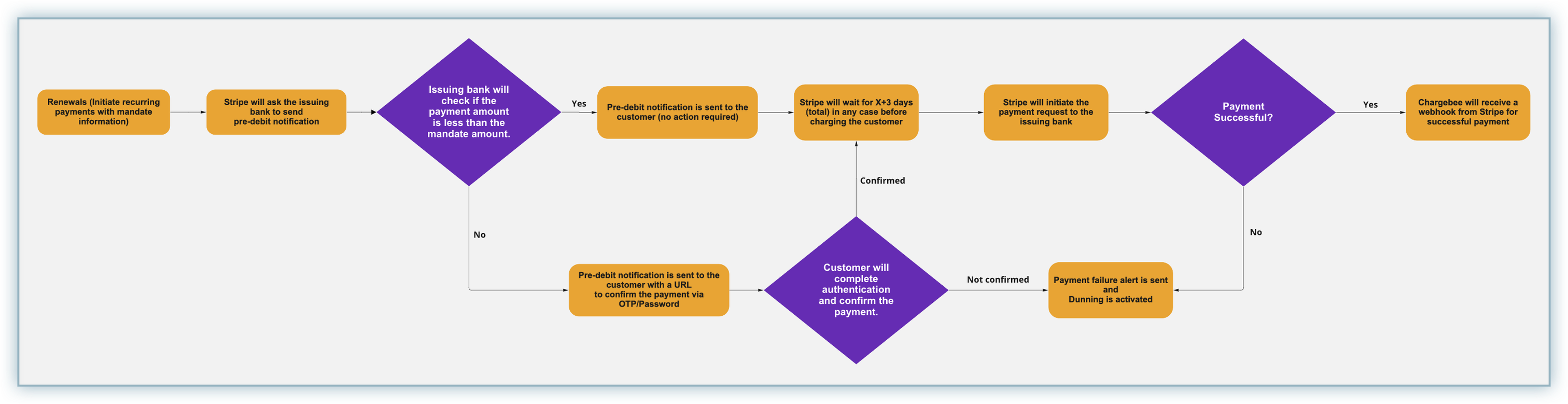

For sub-recurring payments, pre-debit notifications must be sent 24 hours before every renewal payment. However, you may experience delays of up to 3 days for payment confirmation.

All existing customers would need to set up their mandates again post-October 1, 2021 to ensure recurring payments can be processed without AFA.

Note: Failure to set up updated mandates with customers will require customers to complete AFA for recurring transactions post-October 1, 2021.

Click here to access Stripe's help document.

You must complete the following to prepare for this change:

Contact Chargebee support to enable the e-mandate workflow for your Stripe and Chargebee account. The Chargebee team will contact Stripe and get it enabled at both ends within a week and inform you. Make sure to plan your setup accordingly.

You must ensure that 3DS authentication is enabled in Chargebee for your configured Stripe account.

Configure your Webhooks within Stripe as all recurring payments are expected to take X+3 days to get a confirmation. This delay can be attributed to RBI guidelines for Issuing banks to send Pre-debit notifications to customers at least 24 hours before the payment can be made.

For example, if the payment is scheduled for the 1st of every month, the payment will be processed only on the 4th of every month.

Click here to read more about configuring webhooks.

Note: Ensure you select receive all events in your Stripe webhook settings.

Ensure you have Dunning enabled for your Chargebee site and configure dunning email notifications with Pay Now feature to help your customers complete payments.

Configure your dunning period for an increased number of days to allow a longer grace period for your customers to set up or re-authenticate a mandate or provide alternate payment methods and avoid subscription cancellations.

The following changes may apply based on the Stripe integration with Chargebee:

As a transitory solution, we recommend that you switch to using Chargebee's Hosted Pages until you are able to make all necessary changes to your Custom Checkout with Stripe.js integration.

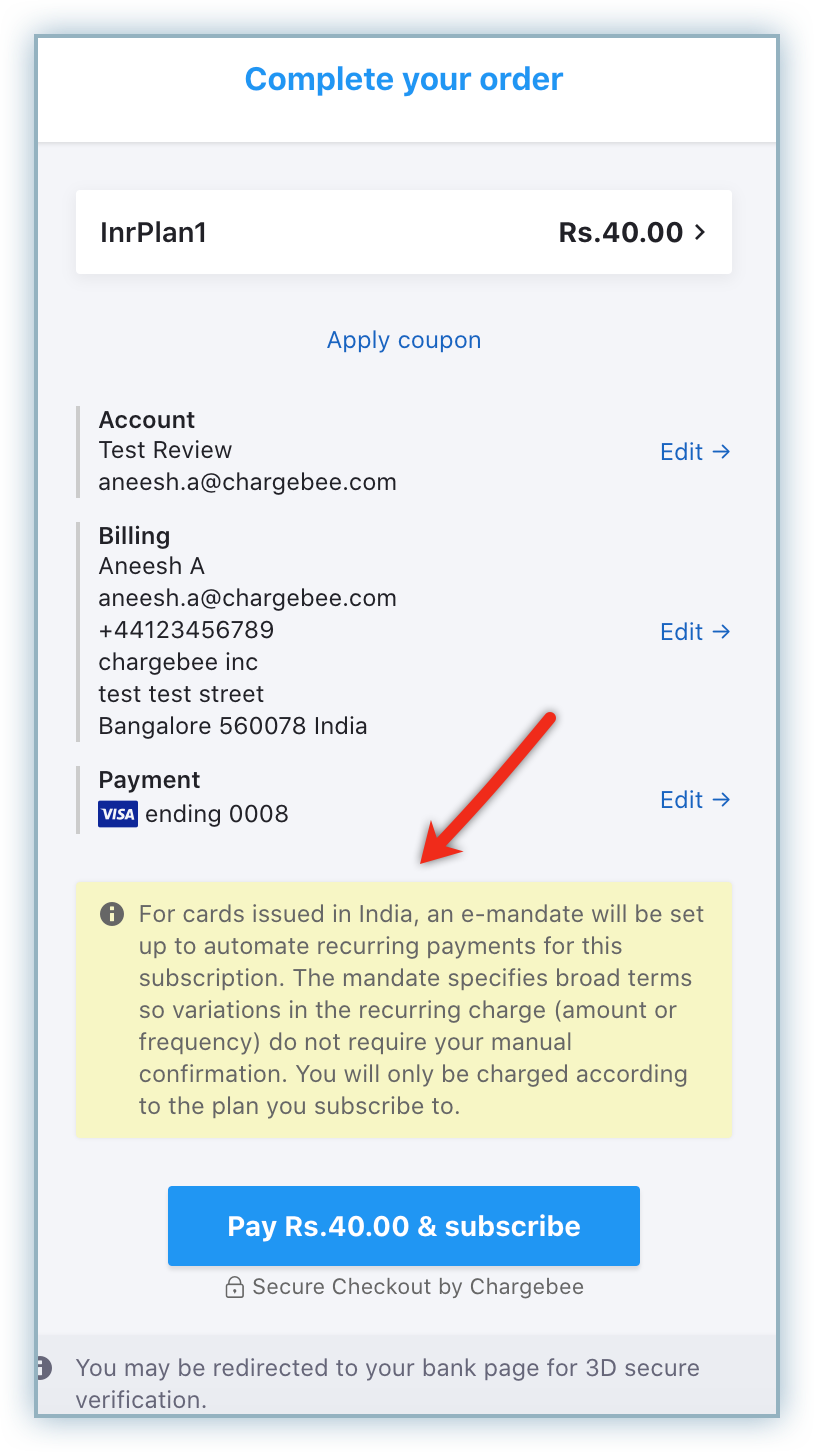

The e-mandate will encompass a broader scope to avoid the need for customers to complete the Additional Factor Authentication(AFA) for any minor changes in amount and frequency. The maximum amount and frequency of the mandate are set up as INR 15,000 and Sporadic (As presented) respectively.

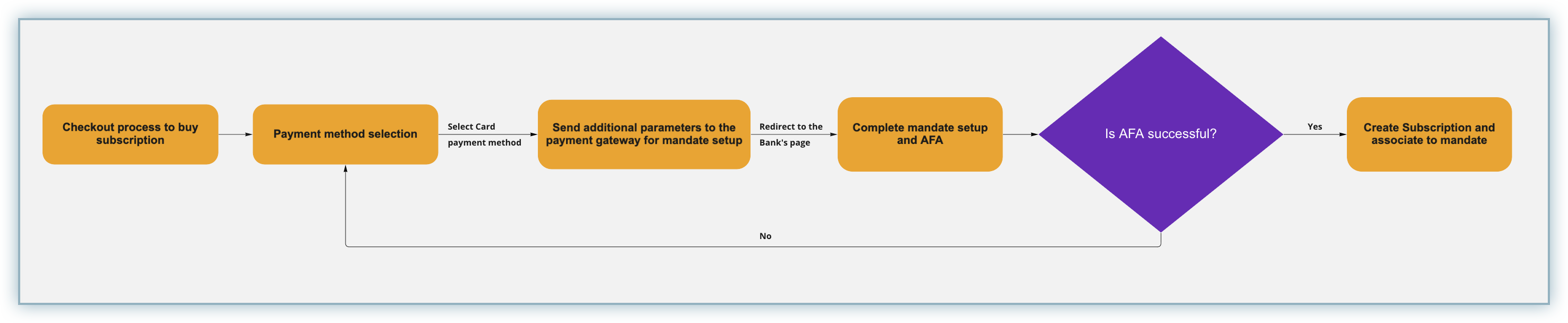

The following workflow applies to the setup of an e-mandate as part of the checkout flow.

The following workflow applies to the recurring payments associated with an e-mandate.

The e-mandate update process can be initiated by a customer using Chargebee's Checkout, Pay Now link, or Self-Serve Portal.

The customer is directed to complete the normal checkout process. As part of this checkout, they would be notified about the need to set up e-mandates and their relevance to successful recurring payments. At the end of the checkout process, the customer will be redirected to the AFA (3D Secure) process prescribed by their issuing bank.

After successful completion of the authentication process, the e-mandate is set up and all subsequent recurring payments are scheduled for dedicated subscription cycles based on the e-mandate.

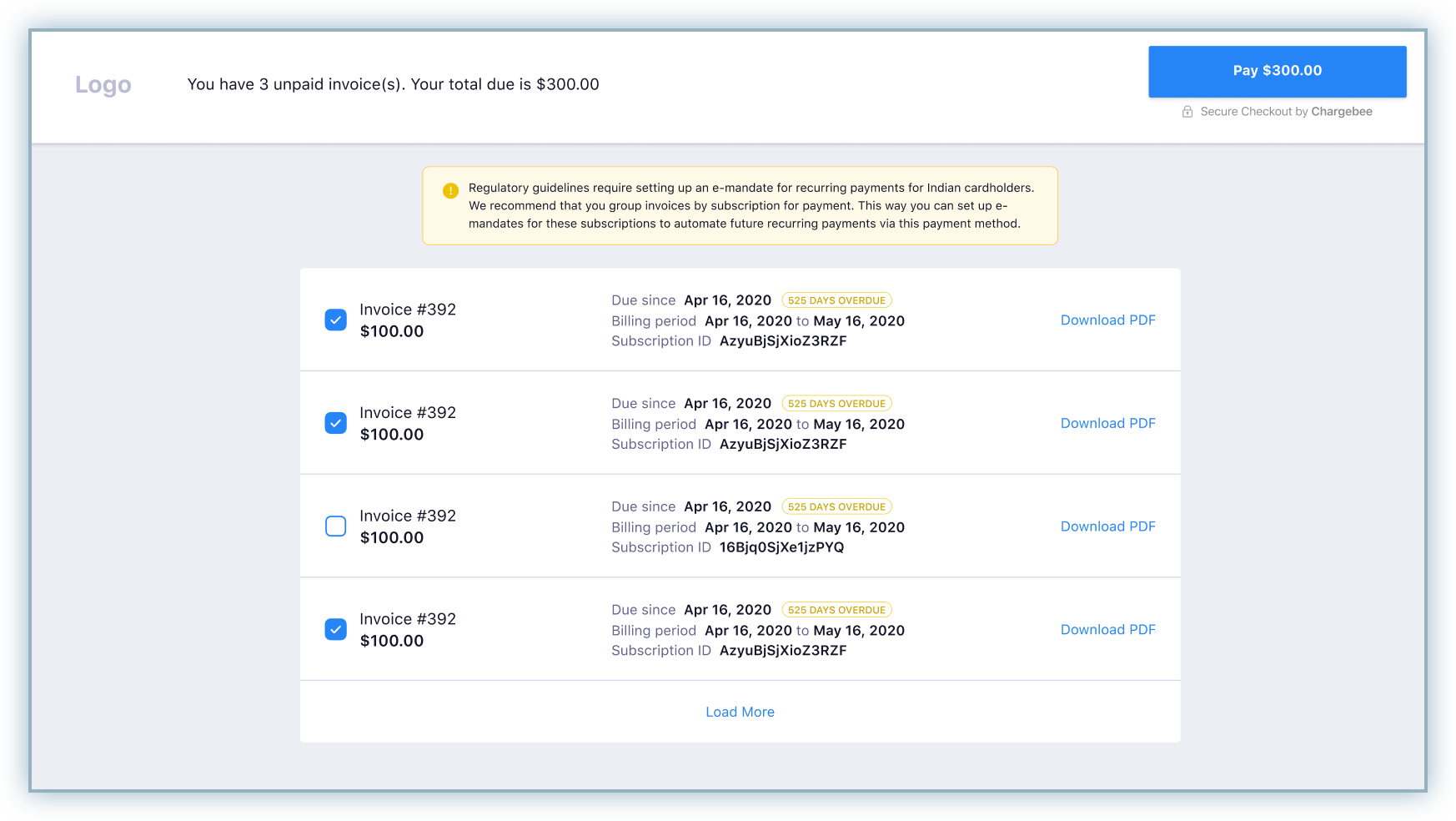

When a recurring payment fails, customers will receive dunning emails based on your configuration notifying them of the payment failure and including the link for the Pay Now interface.

The Pay Now interface lists unpaid invoices. Customers must select the invoices with identical Subscription IDs to set up a mandate for that subscription and complete the payment for those unpaid invoices during the AFA process completion.

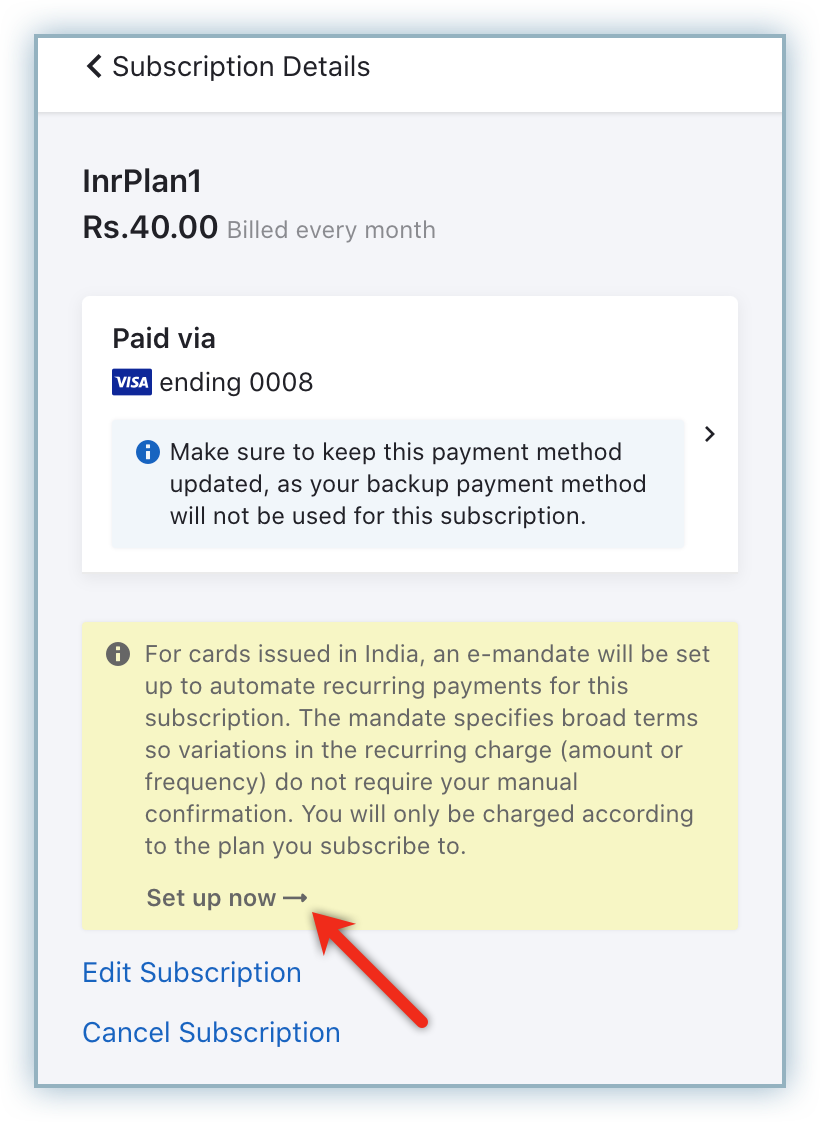

Customers can choose to utilize the Self Serve Portal to set up their e-mandates. The Self-Serve portal displays the customer's subscription details and directs them to review the notification and set up the e-mandate for their subscription.

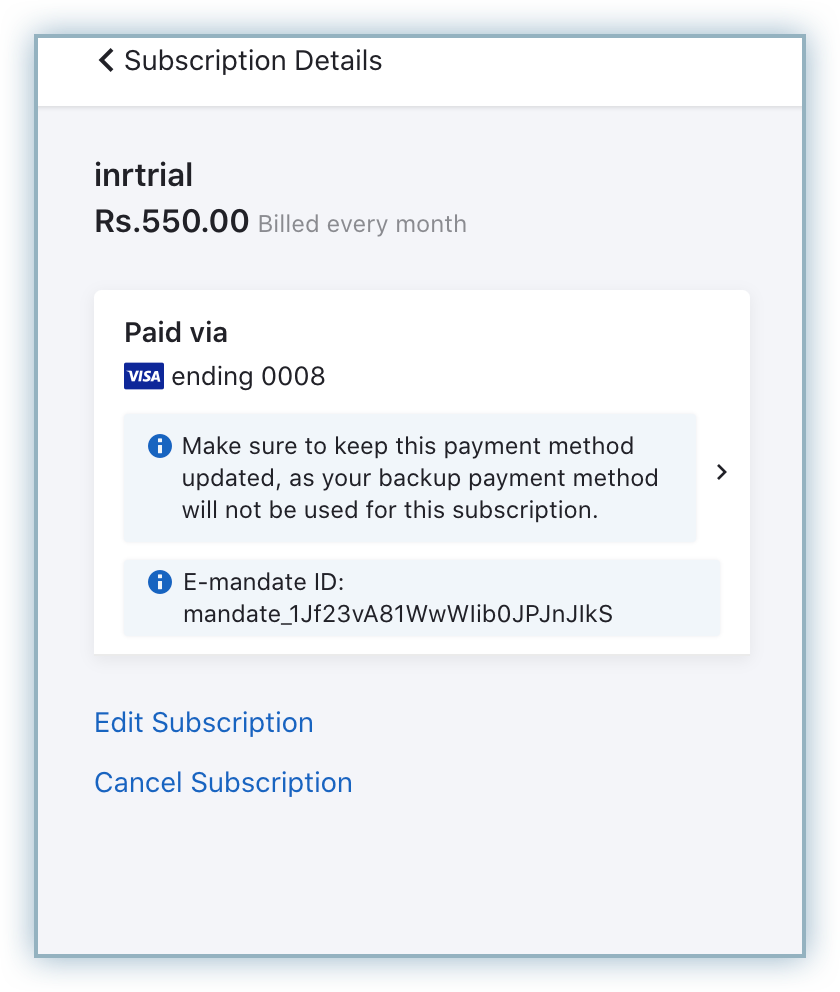

After the successful AFA process, the e-mandate is set up for recurring payments and customers will be able to view the e-mandate ID associated with that subscription with the payment method.

Billing/how-to-view-subscription-records-based-on-their-emandate-status.txt

Billing/what-are-the-new-stripe-india-rbi-emandate-changes.txt

Billing/how-will-the-rbi-emandate-regulations-impact-my-stripe-integration-with-chargebee.txt

Billing/what-are-the-options-for-endcustomers-to-setup-emandates-rbi-requirements.txt

Billing/how-to-prepare-for-emandate-changes-by-rbi-payment-gateway.txt