Managing payment failures by engaging manually is possible only for a small number of customers. The process however should be automated if the number of customers increases or when you need to target a complex cohort of customers.

You can automate how you want to engage with your customers in different scenarios using Auto Engagement. It allows you to fetch the desired set of customers (cohort-based targetting) and set the rules for engaging with them.

Let us see how it works and how you best can use it.

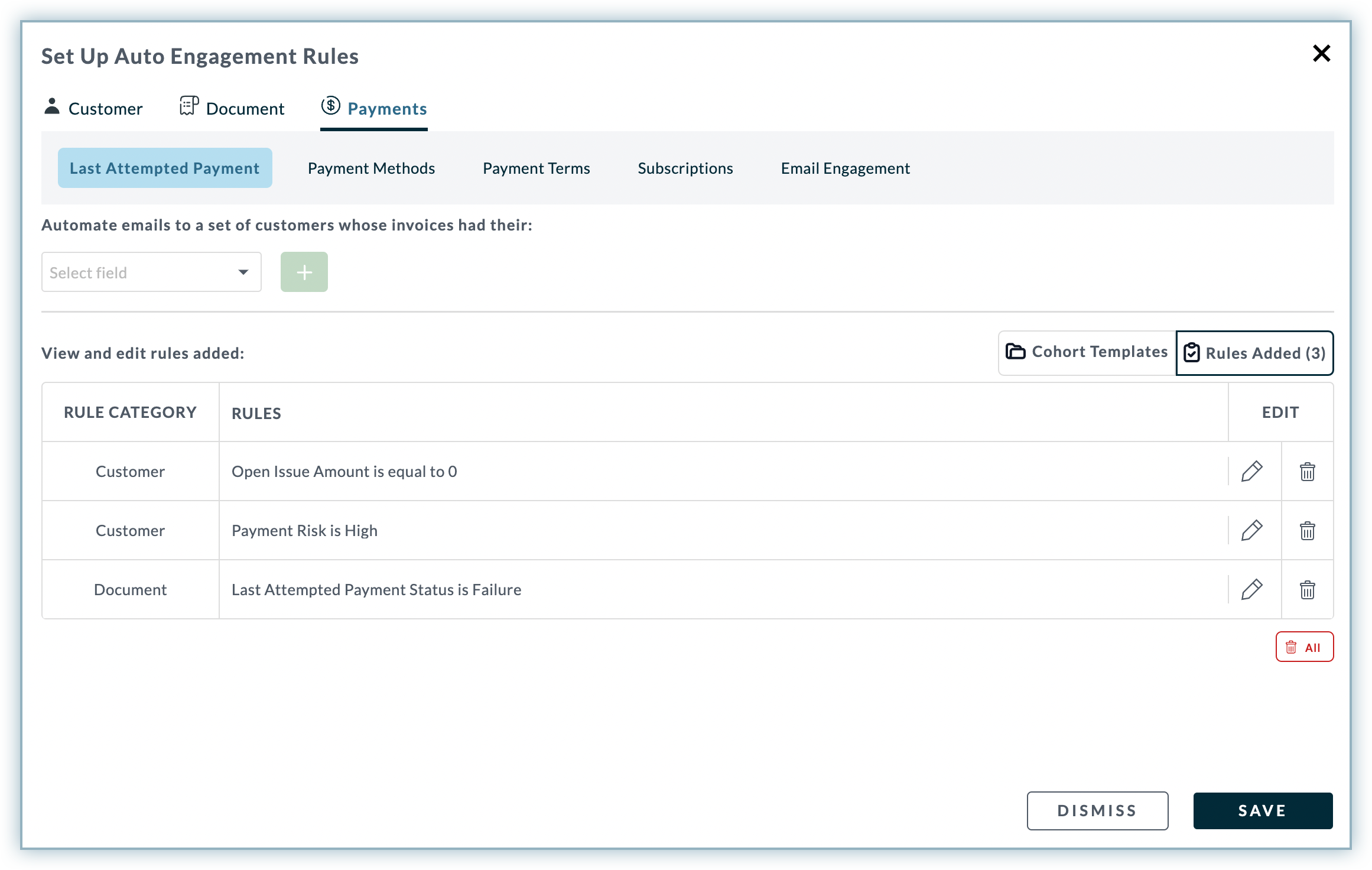

If you are new to Auto Engagement Rules, you have the option to create a useful cohort with readymade Cohort Templates. These templates have a collection of dynamic fields that you can edit and configure as you require.

For example, one of the cohort templates says: ???Payment risk is High and invoices with Active subscription had their last payment failed in the Last 30 Days due to Insufficient Funds error with transaction amount greater than $10000???

In this example, High, Active, Last 30 Days, Insufficient Funds, and $10000 are dynamic fields that you can click and select a different value for as shown below.

You can move to the Rules Added section and edit or delete the added rules.

If a cohort template simply fulfills your requirements for a cohort, you can use that and proceed. If not, the templates give you an idea of setting your rules by adding the relevant fields to create a cohort for your use case.

Here are all the fields and their respective values that you can add as a rule:

| Field | Entity | Value |

|---|---|---|

| Last Attempted Payment Date | Invoice | Current Month, Last 7 Days, Last 15 Days, Last 30 Days, Custom |

| Last Attempted Payment Status | Invoice | All, Success, Failure, Voided, In Progress, Timeout |

| Last Attempted Payment Amount | Invoice | greater than, lesser than, in between, equal to, not equal to |

| Last Attempted Payment Method | Invoice | None, All, Cash, Card, Cheque, Chargeback |

| Last Attempted Payment Failure Error | Invoice | None, All, Cash, Card, Cheque, Chargeback |

| Last Attempted Payment Date | Invoice | Based on the defined scnerios./td> |

| Last Payment Gateway Used | Invoice | All Payment Gateway supported by Chargebee. Learn more |

| Dunning Status of Last Attempted Payment | Invoice | In Progress, Exhausted, Stopped, Success |

| Count of Payment Attempts | Invoice | greater than, lesser than, in between, equal to, not equal to |

| Next Scheduled Retry | Invoice | Tomorrow, Current, Next Week, Next Month, Custom |

| Primary Payment Method | Customer | None, All, Cash, Card, Cheque, Chargeback |

| Backup Payment Method | Customer | None, All, Cash, Card, Cheque, Chargeback |

| Masked Credit Card Numbers | Customer | Primary CC same as last updated and Primary CC not the same as last updated. |

| Auto Collection | Invoice | On, Off |

| Net Term Days | Customer | greater than, lesser than, in between, equal to, not equal to |

| Payment Risk | Customer | High, Medium, Low |

| Payment Source Status | Customer | Valid, Invalid, Expiring, Expired |

| Average Payment Attempts Per Invoice | Customer | greater than, lesser than, in between, equal to, not equal to |

| Subscription Status | Invoice | Future, In-trial, Active, Canceled, Paused, Non-renewing |

| Last Email | Invoice | Last Email Sent, Last Email not Sent |

| Last Reply | Invoice | Last Reply Received, Last Reply Not Received |

| Last Email Bounced | Invoice | True, False |

| Last Email Replied | Invoice | True, False |

| No. Of Emails Sent | Invoice | greater than, lesser than, in between, equal to, not equal to |

| No. of Manual Emails Sent | Invoice | greater than, lesser than, in between, equal to, not equal to |

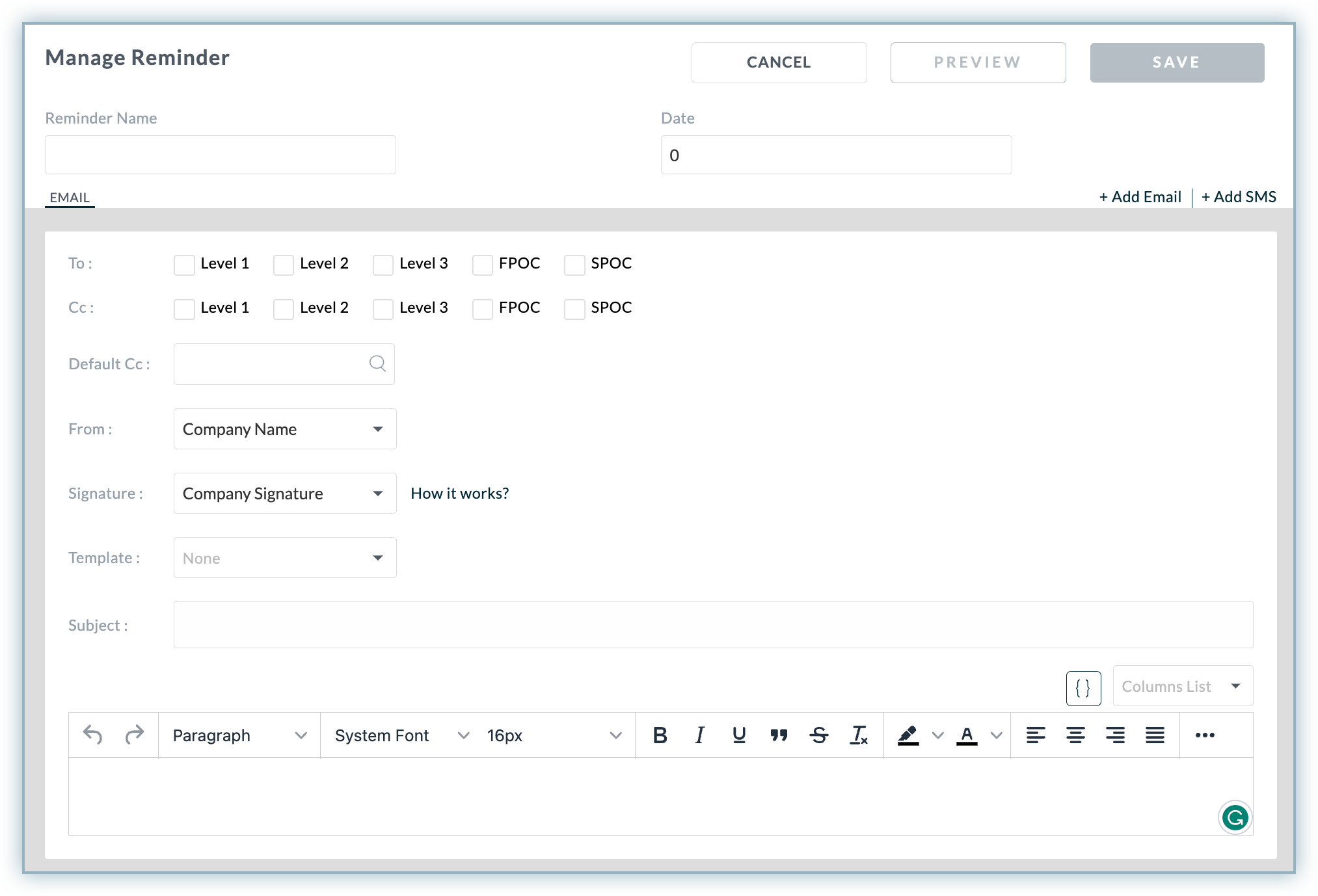

On the Automation page, in the Reminders section, you can add reminders (emails) that you want to send to the customers who fall under the configured cohort.

Click Add Reminder.

In the Manage Reminder window, add the Reminder Name.

Select one of the following reminder options:

You can know more about editing/deleting a reminder and disabling a reminder. Learn more .

Every customer is unique in the way they subscribe, pay & engage. Hence our engagement with them can't just be any more generic. While cohorts allow you to bundle up customers of similar criteria, it is also important to know how cohorts can use used on an advanced level to target a specific group of customers and engage with them effectively.

Following are the cohorts and their variables to be used:

| Cohort Description | Cohort Variables |

|---|---|

| Engaging with customers who had a payment failure but had a higher transaction value. These customers cannot be treated the same as the one with a basic plan. | Customers with Active subscription, whose last payment Failed due to

|

| Engaging with customers to inform them about their next retry date. | Customers with Active subscription, whose last payment Failed in the Last X Days due to

|

| Engaging with customers who haven't made a single payment to date against the subscription. | Customers with Active subscription, whose last payment Failed in the Last X Days due to <error reason> and payment risk status is No Payment and the last email was sent more than One day ago . |

| Engaging with customers with the first invoice payment failed. | Customers with Active subscription, whose last payment Failed in the Last X Days due to <error reason> where the invoice failed was the very First Invoice and the last email was sent more than One day ago . |

| Engaging with customers who updated a new card but did not assign it as their primary payment method. | Customers with Active subscription, whose last payment Failed due to <error reason> where the Last updated card isn't registered as primary and the last email was sent more than One day ago . |

| Engaging with customers with a certain monthly amount at stake with multiple invoices unpaid and needs immediate attention. | Customers with Active subscription, whose last payment Failed in the Last X Days due to <error reason> where the overdue amount is Greater than $Y and subscription MRR is Greater than $Z and the last email was sent more than One day ago . |

| Engaging with loyal customers to retain them by asking them to register a backup card while they start suffering failures. | Customers with Low risk, Active subscription, invoices with the last payment Failed in the Last X Days, with No backup card registered and the last email was sent more than One day ago . |

| Engaging with customers whose card is about to expire to prevent payment failure. | Customers with Active subscription having their Primary card expiring soon . |

| Engaging with high-risk customers who fail at their Xth attempt while their usual average number of attempts is below X. | Customers with High risk, Active subscription, invoices having their last payment Failed in the Last X Days, retries are In Progress, the number of payment attempts is Greater than X , the average number of attempts is Lesser than X and the last email was sent more than One day ago . |

| Engaging with customers who had a successful last payment but still have an invoice with pending payment. In this scenario, we know that the customer is willing to pay & continue the subscription. | Customers with Active subscription and invoices having their last payment Succeeded in the Last X Days w ith ageing in X-Y bucket. |