This section of AR Analytics provides you with a 360-degree view of your customers' payments. It is divided into four sub-categories that offer insights in the form of funnels across multiple aspects of payments and payment failures. These categories are as follows:

Chargebee Receivables allows you to customize the dashboard and the displayed metrics according to your preference. You will find more about this here in the document.

Let us dive into the sub-categories and understand the significance of the charts under them:

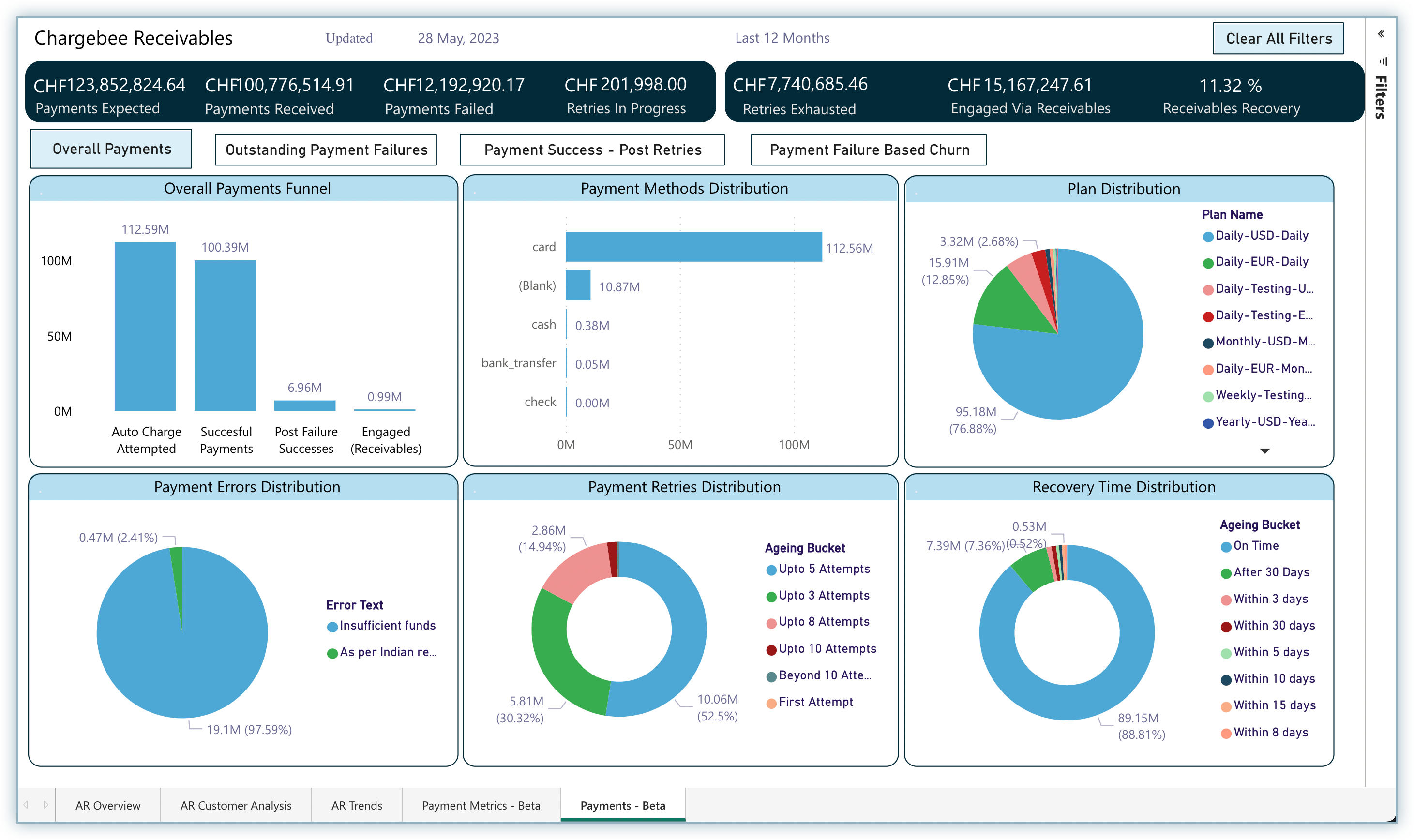

This dashboard is designed like a funnel that starts with a macro view of the payment-related data such as auto payments attempted, successful payments & post failure successes in the first chart and then breaks down into 4 different distributions that focus on the micro elements related to payment such as payment methods, plans, errors, and more.

This dashboard contains the following charts:

| Chart | Description |

|---|---|

| Overall Payments Funnel | A customer funnel that provides a straight away insight into successful payments & post failure successes. |

| Payment Methods Distribution | A distribution of all the unique payment methods used by the chosen cohort of customers to make payments. |

| Plan Distribution | A distribution of various subscription plans across the chosen cohort of customers. |

| Payment Errors Distribution | A distribution of unique payment errors suffered by a chosen cohort of customers. |

| Payment Retries Distribution | A straight-away insight into the payment retries distribution across a chosen cohort of customers. |

| Recovery Time Distribution | A distribution of recovery period of invoices for the chosen cohort of customers. |

This chart contains the following metrics:

This chart indicates the payment methods used for the payments with respect to the selected cohort of customers/invoices. Through this chart, you can understand the payment methods that were mostly used by the customers and how you can take necessary action for them to prevent payment failures (if required).

This chart provides you with a list of plans associated with the invoices/customers. Using this chart, you can understand which plans your customers mostly subscribe to and how it is affecting the overall payment experience for you and take necessary action if required.

This chart helps you to find out the errors responsible for payment failures. If a particular error is responsible for most of the payment failures, then you can take necessary action to prevent such errors by engaging with the customers.

For example, if the error is Insufficient Funds, you can send emails to your customers with payment failure history to keep their funds in check before the upcoming payment dates.

This chart helps you to find out how many attempts an invoice consumes on average after a payment failure before it is successful. This can help you understand how efficient are the automatic retries and if you should intervene and make them more efficient.

This chart helps you to find out how many days it took to recover a failed payment on average per invoice. If the higher number of days has a higher percentage in the chart, it indicates that you should engage with your customers to prevent this and make the recovery time faster.

While each of the charts displays a specific set of data, these metrics are linked to each other in more ways than one. As discussed briefly at the beginning of this document, these charts are customizable and can provide a tailored view of all the charts collectively as per your preferences. You can apply multiple levels of filters to get data specific to the selected filter in all the other charts automatically.

Lets us take an example to understand it better.

In this example, as shown below in the first chart, the amount for Auto Charge Attempted was 112.59 million, out of which 100.39 million was from Successful Payments, out of which 6.96 million was from Post Failures Successes and eventually 0.99 million was from engaging via receivables - Engaged (Receivables).

Jack is the admin from ACME Pvt. Ltd. and he wants to dive deeper and view the other distributions specific to the Post Failure Successes (which is 6.96 million).

Jack clicks the bar for Post Failure Successes and the entire dashboard gets customized automatically. The Post Failure Successes is highlighted and other distribution metrics are tailored with respect to Post Failure Successes.

Now, Jack can understand the following from the distribution charts:

Now, Jack wants to dive deeper by selecting one of the errors (i.e. As per Indian regulations, export transactions require customer name and address). He presses the command key from the keyboard and clicks on the portion of the desired error from the chart. All other metrics are tailored again with respect to the select payment error.

To select a filter under another filter, make sure to press the Command (for MAC OS) or Control (for Windows) key while clicking on the desired chart element. If the key is not pressed, all previous filters will be reset and only the current element that you click on will be applied as a filter.

Now, Jack can note the following observations from the dashboard:

Similarly, you can select multiple parts of the dashboard as individual filters or sub-filters and customize the data as per your preference.

This dashboard represents outstanding payment failures and is designed like a funnel that starts with a macro view of the payment-related data such as failed payments, unrecovered payments and retries exhausted in the first chart and then breaks down into four different distributions that focus on the micro elements related to payment such as payment methods, plans, errors, and more.

This dashboard contains the following charts:

| Chart | Description |

|---|---|

| Outstanding Payment Failures Funnel | A customer funnel that provides a straight away insight into failed payments and unrecovered failures |

| Payment Methods Distribution | A distribution of all the unique payment methods used by the chosen cohort of customers to make payments. |

| Plan Distribution | A distribution of various subscription plans across the chosen cohort of customers. |

| Payment Errors Distribution | A distribution of unique payment errors suffered by a chosen cohort of customers. |

| Payment Retries Distribution | A straight-away insight into the payment retries distribution across a chosen cohort of customers. |

| Recovery Time Distribution | A distribution of recovery period of invoices for the chosen cohort of customers. |

This chart contains the following metrics as bars:

As explained in the example for the Overall Payments dashboard, you can customize the charts by clicking on the relevant elements from the charts and getting the required data out of them.

The five distribution charts (Payment Method Distribution, Plans Distribution, Payment Errors Distribution, Payment Retries Distribution, and Recovery Time Distribution) other than the first funnel are the same in all the dashboards.

Follow these steps for a guided interpretation:

This dashboard represents payments that succeeded once retries were exhausted. The dashboard is designed like a funnel that starts with a macro view of the failed payment-related data such as failed payments, post-failure successes and post-retries successes in the first chart and then breaks down into four different distributions that focus on the micro elements related to payment such as payment methods, plans, errors, and more.

This dashboard contains the following charts:

| Chart | Description |

|---|---|

| Payment Success - Post Retries | A customer funnel that provides a straight away insight into failed payments and post retry successes. |

| Payment Methods Distribution | A distribution of all the unique payment methods used by the chosen cohort of customers to make payments. |

| Plan Distribution | A distribution of various subscription plans across the chosen cohort of customers. |

| Payment Errors Distribution | A distribution of unique payment errors suffered by a chosen cohort of customers. |

| Payment Retries Distribution | A straight-away insight into the payment retries distribution across a chosen cohort of customers. |

| Recovery Time Distribution | A distribution of recovery period of invoices for the chosen cohort of customers. |

This chart contains the following metrics as bars:

This chart allows you to take a 360-degree look at the payments which got successful after failing and whose retries were exhausted in the last 12 months.

As explained in the example for the Overall Payments dashboard, you can customize the charts by clicking on the relevant elements from the charts and getting the required data out of them.

Follow these steps for a guided interpretation to understand past failure successes:

This dashboard is different from the other tree as it presents the metrics with respect to customers, while the other dashboards show the total invoice amounts.

This dashboard is designed like a funnel that starts with a macro view of the related data such as failed payments, unrecovered payments and retries exhausted in the first chart and then breaks down into 4 different distributions that focus on the micro elements related to payment such as payment methods, plans, errors, and more.

This dashboard contains the following charts:

| Chart | Description |

|---|---|

| Payment Failure Based Churn Funnel | A customer funnel that provides a straight away insight into failed payments & post failure churn. |

| Payment Methods Distribution | A distribution of all the unique payment methods used by the chosen cohort of customers to make payments. |

| Plan Distribution | A distribution of various subscription plans across the chosen cohort of customers. |

| Payment Errors Distribution | A distribution of unique payment errors suffered by a chosen cohort of customers. |

| Payment Retries Distribution | A straight-away insight into the payment retries distribution across a chosen cohort of customers. |

| Recovery Time Distribution | A distribution of recovery period of invoices for the chosen cohort of customers. |

This chart contains the following metrics:

How to Interpret the Charts?

This chart allows you to understand various metrics related to unrecovered failures and how those payments led to customer-churn eventually. This enables you to take the required action in time and keep a better payment recovery process in place to avoid churn at all costs.

As explained in the example for the Overall Payments dashboard, you can customize the charts by clicking on the relevant elements from the charts and getting the required data out of them.