What is Fraud Management in Bank of America?

How does Fraud Management work in Bank of America?

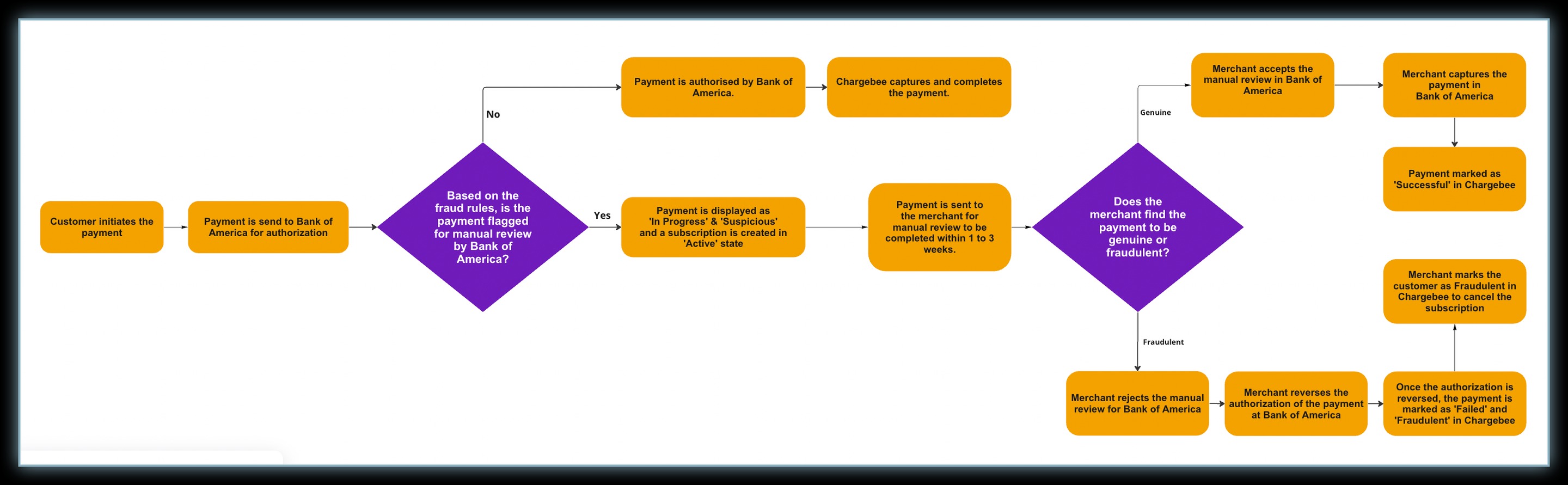

When the customer subscribes to a plan for a product and makes the payment, the following scenarios may take place with respect to fraud management:

Once the customer makes the payment via the checkout, that payment is sent for authorization to Bank of America.

While the payment is being authorized, based on the fraud rules configured in Bank of America, some payments may be flagged for manual review. Those payments which are flagged for manual review are marked as Suspicious in Chargebee with an In Progress state and the subscription is created in the Active state.

NOTE: Chargebee cannot raise a request to complete the payment unless the manual review has been completed by the merchant in the Bank of America.

Merchants have to review the payment flagged for manual review within a period of 1 to 3 weeks from the time when the payment is flagged for manual review.

If the payment is found to be genuine, the merchant accepts the manual review in the Bank of America portal. Once the manual review is accepted, the merchant needs to capture the payment in the Bank of America portal. Once the payment is accepted, Chargebee syncs the payment status and marks it as Successful.

NOTE: If the merchant does not capture the payment after accepting the manual review, within 1 to 3 weeks in the Bank of America portal, Bank of America will automatically reverse it, but, it will remain in the Successful state in Chargebee. This creates a discrepancy between Chargebee and Bank of America. Make sure to capture the payment successfully immediately after accepting the manual review to avoid this