Docs

anrok, Integration, faq

Anrok Integration FAQ

What regions does Anrok support?Currently, we support only the US region, and to add additional ne

41075087

2023-04-18T10:20:46Z

2023-04-19T06:59:54Z

82

0

0

258722

Anrok Integration FAQ

Scope

What regions does Anrok support?

How to configure the tax category for Quick-charges created in Chargebee after configuring the Product catalog in Anrok?

How are the Promotional credits calculated in Anrok?

How are Adjustable & Refundable Credit Notes calculated in Anrok?

Solution

What regions does Anrok support?

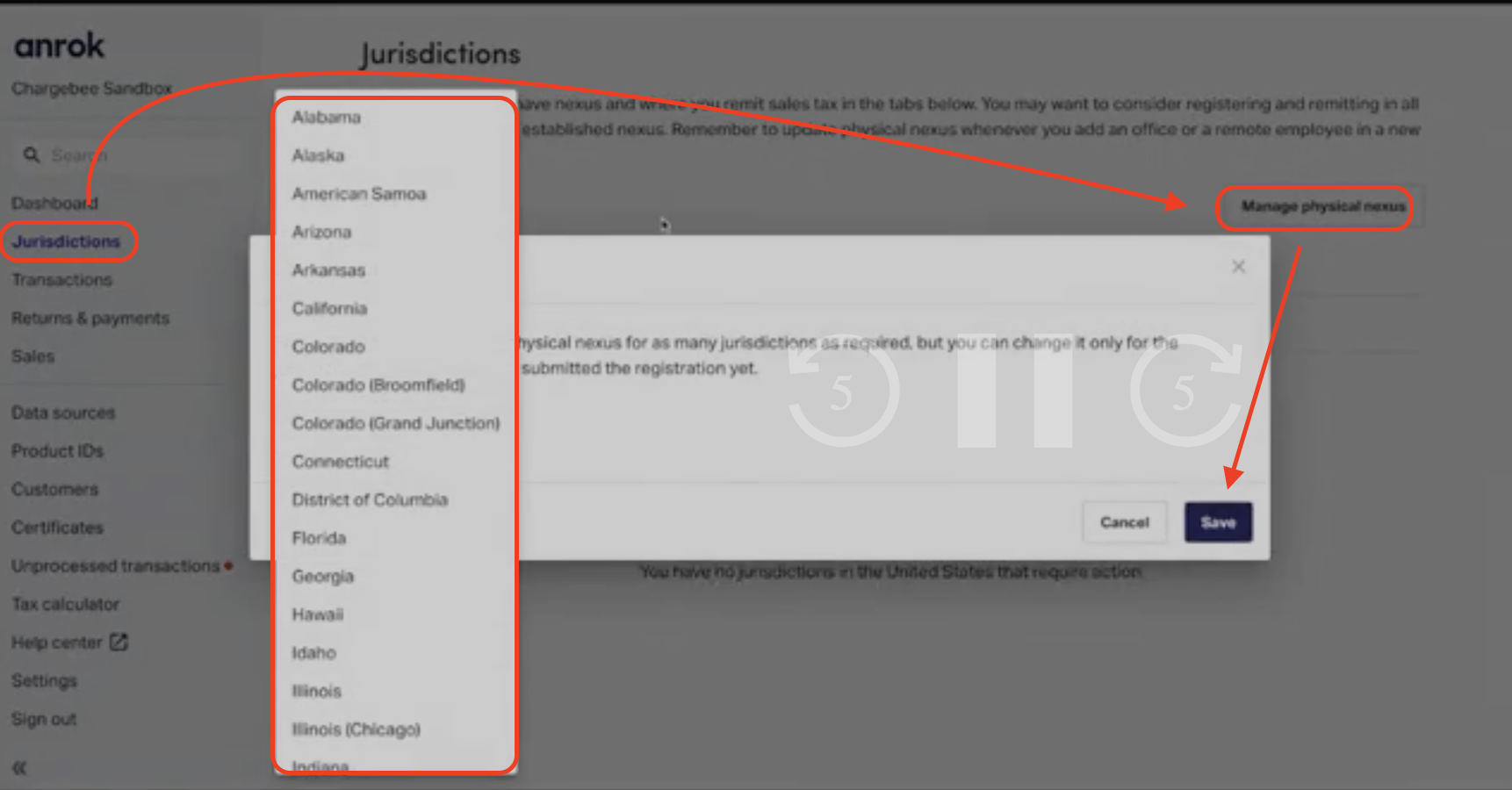

Currently, we support only the US region, and to add additional nexus jurisdictions, navigate from Jurisdictions > Manage physical nexus > Choose the state > Click 'Save'.

How to configure the tax category for Quick-charges created in Chargebee after configuring the Product catalog in Anrok?

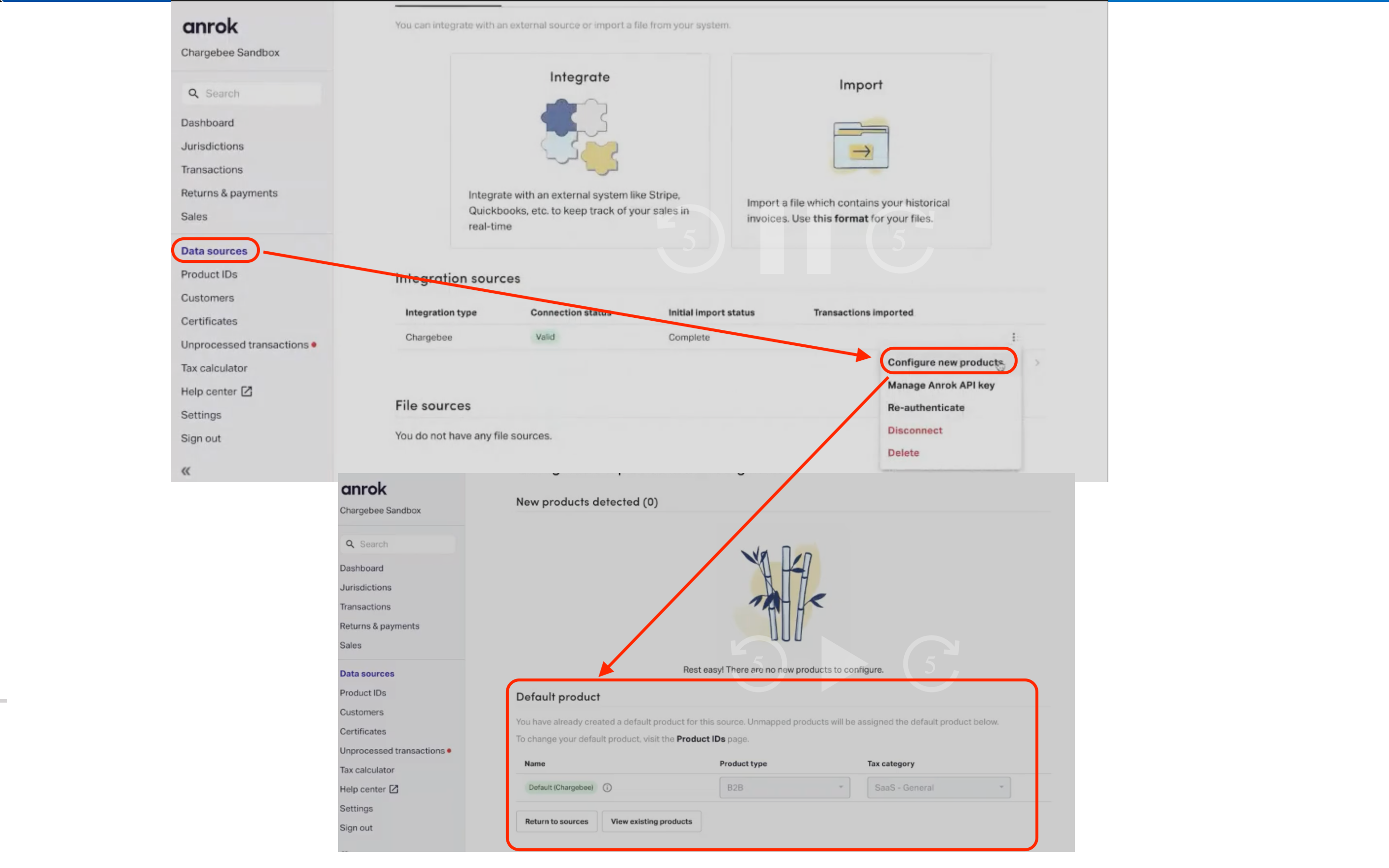

If you use Chargebee's “Quick Charge” feature, make sure to also specify a default product on this page to use for those transactions

Once connected, you'll be prompted to assign a tax category for each of your Chargebee products. For assistance in selecting tax categories, see: “What tax configuration should I select?”

Once the new Plans, Addons, Charges, and Quick-charges are created in Chargebee, you will see them configured under the Default product. Navigate from Data sources > Ellipsis > Configure new products.

How are the Promotional credits calculated in Anrok?

Promotional credits applied in Chargebee are pre-tax, which means that tax will be calculated based on the discounted value of the line item rather than the full value.

How are Adjustable & Refundable Credit Notes calculated in Anrok?

Adjustable and promotional credit notes in Chargebee are post-tax, meaning that the amount credited back to your customer is inclusive of tax. This means that if your issue, for example, a $50 credit on an invoice then that amount will be proportionally applied to include a refund of the relevant tax and the remaining amount towards the purchased items. Alternatively, if you wanted to credit back 50% of a purchase, you'd need to credit half of the invoice total, inclusive of tax.

If you have further questions about these concepts and how your current workflows will be reflected in Anrok, please contact us at support@anrok.com.