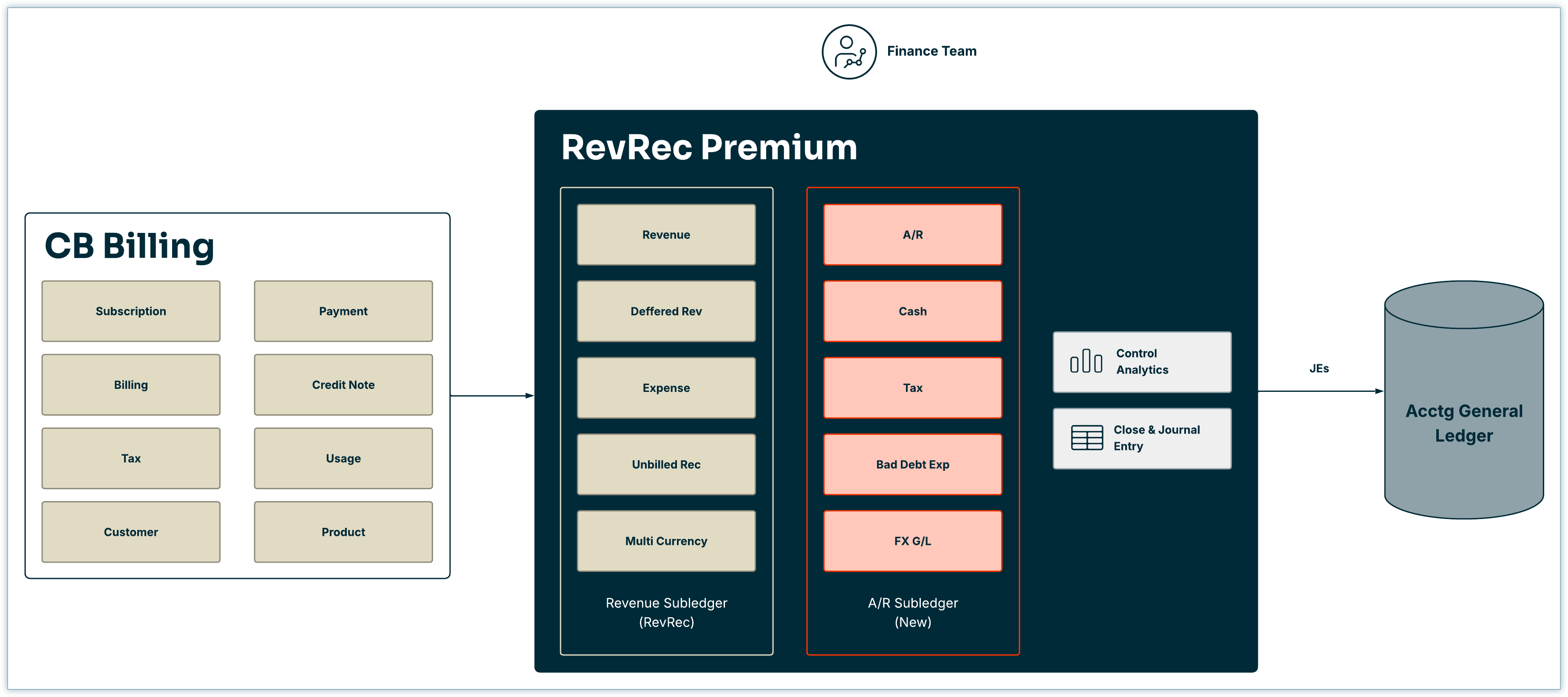

RevRec Premium is Chargebee's advanced revenue accounting solution designed to streamline both revenue recognition and accounts receivable (A/R) for subscription businesses. Built to support ASC 606 and IFRS 15 compliance, it combines two powerful sub-ledgers - one for revenue and deferred revenue, and another for A/R - into a single, unified system.

With RevRec Premium, you can get a complete view of your revenue and accounting in one place. It automates A/R accounting for billing, payments, credit notes, write-offs, and other lifecycle events, while also generating compliant revenue schedules and journal entries. This enables your finance teams to rely on a single source of truth for revenue accounting, backed by detailed reports and actionable insights.

Availability

RevRec Premium helps your business with the following functions:

RevRec is Chargebee's revenue sub-ledger that helps businesses automate and stay compliant with ASC 606 and IFRS 15 revenue recognition standards. It is ideal for customers looking for a focused solution to manage revenue recognition alone.

RevRec Premium builds on the capabilities of RevRec by adding an integrated Accounts Receivable (A/R) sub-ledger. It offers a complete revenue recognition and A/R accounting solution - serving as a single system of records for your revenue accounting. With RevRec Premium, there's no need to manage separate tools for revenue and A/R accounting, enabling your finance teams to work more efficiently with a unified, end-to-end view of subscription financials.

RevRec Premium is designed to simplify and streamline revenue and A/R accounting for subscription businesses - especially for those facing challenges with traditional accounting workflows in Chargebee Billing due to limited accounting data view, difficulties with GL integration, or lack of native integrations.

Here's how the A/R sub-ledger in RevRec Premium adds value:

Faster, More Accurate Month-End Close

The A/R sub-ledger eliminates the need for manual data transfer and reconciliation by providing accounting-ready data out of the box. This reduces the risk of human error and accelerates the month-end close process, giving your finance teams more time to focus on analysis and strategic decision-making.

Improved Compliance and Audit Readiness

With built-in controls, audit trails, and complete historical data retention, the A/R sub-ledger simplifies compliance with accounting standards. Every transaction is traceable, making audits easier and reducing the risk of inconsistencies or reporting gaps.

Comprehensive, Granular Insights

Get a detailed view of your accounting data, including customer-level, transaction-level, and even line-item-level (e.g., invoice discounts) journal entries. Use built-in reports such as A/R Aging and A/R Roll-Forward, or create custom reports to suit your business needs.

Simplified Integration with Accounting Systems

Instead of building and maintaining complex custom integrations, the A/R sub-ledger can generate and send summary journal entries directly to your accounting system. This reduces implementation time, lowers integration costs, and improves data consistency.

High Scalability for Growing Businesses

Designed to support high transaction volumes and growing finance operations, the A/R sub-ledger helps your business scale without sacrificing accuracy or control. It ensures that your accounting infrastructure keeps up with your growth.

If you're an existing Chargebee Billing or RevRec customer and would like to get started with RevRec Premium, please reach out to us. Our implementation team will guide you through the onboarding process and help you take the next steps.

Chargebee's accounting integration capabilities push detailed billing and payment transaction data to your General Ledger(GL) or ERP system, where journal entries are created and financial reports are generated within the respective external system.

In contrast, the A/R sub-ledger in RevRec Premium acts as a purpose-built accounting layer within Chargebee. It can generate journal entries based on your preferred level of detail, either at the transaction level or in aggregated form, and automatically creates A/R-related financial reports. These journal entries can then be posted to your GL or ERP system, reducing the dependency on external tools for accounting logic and reporting.