If your business is selling in multiple geographies, you could be managing your sales and invoices in not just one, but multiple currencies. The multi-currency feature in RevRec helps you consolidate various foreign currencies to view metrics in your home currency. RevRec currently uses ECB Exchange Rates, Fixer, and Open Exchange Rates - widely used foreign exchange data sources.

For the orders transacted in foreign currencies, RevRec translates metrics such as deferred revenue, revenue, and so on to the home currency amount based on the Foreign Exchange (FX) rate as of the transaction date (contract date or invoice date). All reports and accounting journal entries related to revenue, like the unearned revenue roll-forward, and journal entry reports are reported in the home currency. You can still track your orders and invoices in the transaction currency, to reconcile to the source records.

The accounting for the foreign currency change impact is handled by RevRec, as it relates to revenue recognition. For example, when you receive an advance payment for a subscription, it results in a non-monetary liability which is captured as deferred revenue.

Non-revenue-related foreign currency change impacts are not handled by the RevRec multi-currency feature. For example, a gain or loss incurred due to foreign currency exchange rate differences between invoice date and payment date; or the month-end re-measurement of monetary asset and liability. Ensure that you handle these directly within your accounting system.

Limitation

Expenses for multi-currency transactions need to be in the home currency. Currency translations for expenses in multi-currency are not currently supported.

Follow these steps to configure and use the multi-currency feature:

Step 1, Enable: Enable the feature on your RevRec site and configure your home/reporting currency. A single RevRec tenant will have a single home/reporting currency for revenue recognition purposes. If you have multiple subsidiaries with different home currencies, you need to set up a separate tenant for each subsidiary.

Step 2, Provide Currency Information with your data: While adding your transaction data in RevRec through User Interface (UI) input or bulk upload, you need to provide the transaction currency in addition to other data. In the case of third-party integrations, our supported direct integrations automatically sync the currency details along with the transaction data.

Step 3, Review results and post accounting entries: You can review results in the home currency across the dashboard, revenue, and accounting journal entry reports. And lastly, post the accounting journal entries in the home currency to your accounting system.

Please contact your account executive, implementation team specialist, or support to have the multi-currency feature enabled on your RevRec site.

After having the multi-currency feature enabled on your RevRec site, follow these steps to configure your home currency:

Click Settings > Configure RevRec > Home Currency.

Select the Home Currency from the drop-down.

Click Save.

If you would like to obtain exchange rates from a third-party source, please contact RevRec Support to configure your site with your preferred option from the available sources. You can select from the following options:

Alternatively, if you are not using any third-party systems as foreign exchange rate data sources, you can use the bulk upload option to add the foreign exchange rates along with your transaction data.

Changing the Foreign Exchange Rate Source

RevRec currently uses three foreign exchange data sources such as ECB Exchange Rates, Fixer.io, and Open Exchange Rates. You can transition between these predefined sources anytime as needed. When you choose to use a new forex data source, RevRec applies the exchange rates from the newly selected source for prospective transactions. Orders and invoices with start dates preceding the forex source switch will continue to utilize forex rates from the previous, existing data source, even if a reprocessing is triggered.

Once the multi-currency feature is enabled on your RevRec site, all channels to provide transaction data are available as follows:

While creating a new Customer, Product, Sales Order, and Invoice record on your RevRec site, you will see an additional Currency drop-down that allows you to specify the transaction currency.

When you import your transaction data in RevRec through bulk upload, and if the multi-currency feature is enabled, then the Currency column is a required field. You can additionally upload the Foreign Exchange rates manually using this file.

If you have integrated your RevRec site with any sales, billing, delivery, and accounting systems to auto-sync your data, then currency information is synced directly from these systems.

RevRec also allows you to upload your own custom FX rates using the following bulk upload file format. You need to upload the custom rates before the accounting period close. The custom FX rates uploaded by you manually will take precedence over the FX rates added via any other source. Once you upload the custom FX rates file, you need to reprocess the sales orders of the month manually in order to apply the newly uploaded FX rates. RevRec does not reprocess the sales orders based on custom FX rates automatically.

Alternatively, you can upload the custom FX rates file during the month end with daily rates populated for upcoming month. RevRec will automatically apply these custom rates and you do not have to reprocess the sales orders. You can use this approach if you follow the accounting policy to use one FX rate for one month.

In addition to the Currency field for Order, Invoice, Customer, and Product, ensure that the contract with which a billing/invoice is associated for multi-currency transactions is also captured. This is used to identify the transaction/contract date and calculate the impact of the foreign exchange rate changes wherever applicable. RevRec's data validation process automatically checks and reports any missing or invalid data related to multi-currency transactions.

To access any sync errors from such validation, click Reports > Data Errors > Sync Errors.

All metrics on the Dashboard are displayed as translated amounts in the home currency. This includes the revenue figures displayed for the top-customer list on the Dashboard. The total contract value is translated to the home currency amount if it is transacted in foreign currency.

The translation of the total contract amount is only done for the top-customer list on the Dashboard.

A new Forex category of reports gets added with the Forex Exchange Rates and Forex Translation by Order reports.

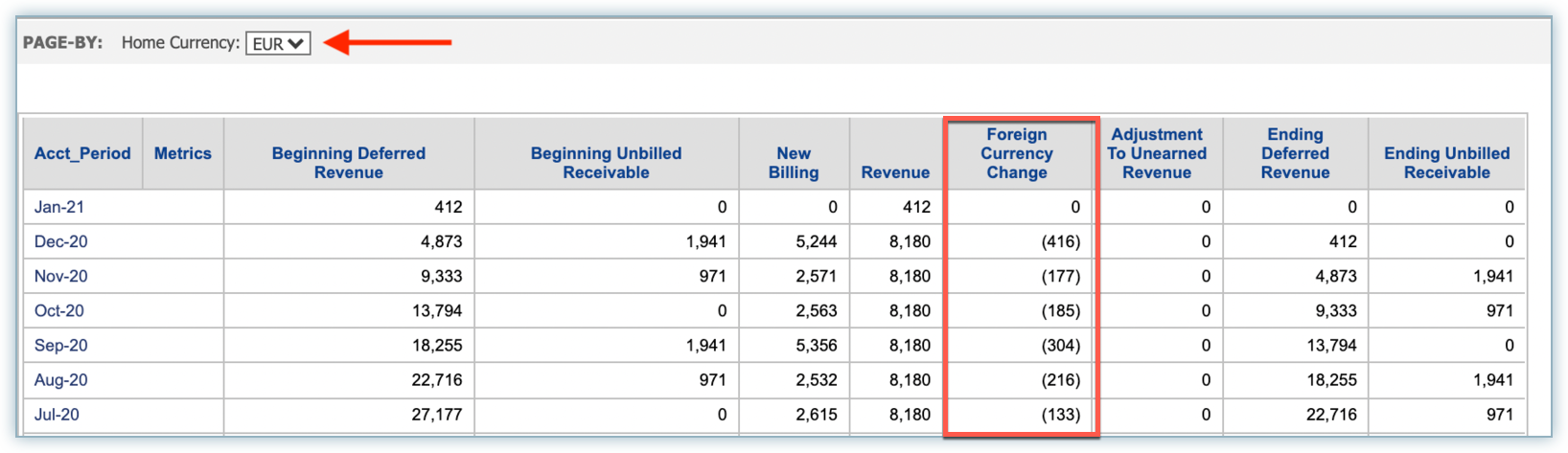

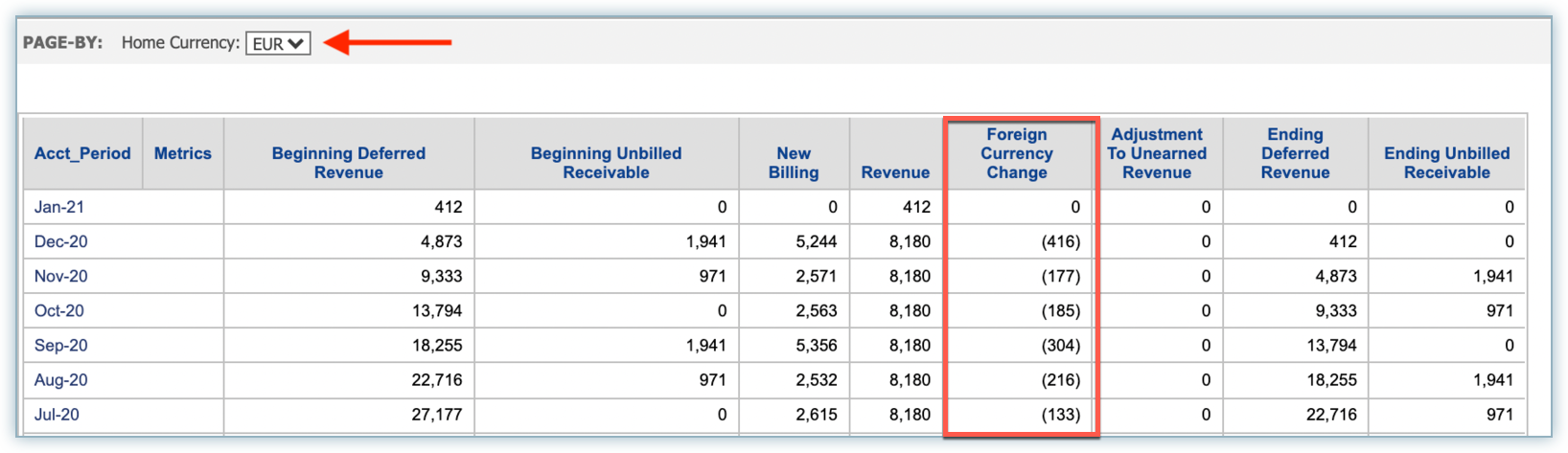

For the Revenue reports, all revenue-related metrics such as revenue, deferred revenue, and foreign exchange change impact are in the home currency only. A new metric called Foreign Currency Change is added to capture the impact of exchange rate change in the Unearned Revenue Roll-forward report. Positive foreign exchange change impact (gain) is reported as a positive amount and vice versa.

For the Sales and Billing reports, the actual transaction currencies are used. For example, if a user has received orders transacted in US Dollars and Euros, the Sales and Billings reports display the relevant information in USD and EUR respectively.

Accounting Journal Entry report and the journal entries are displayed in the translated home currency amount.

Journal entries for multi-currency transactions can either be generated and posted automatically or manually to your accounting system. Ensure that the home currency is consistent between the accounting system and RevRec.

RevRec translates foreign transaction currency into home currency for revenue recognition, based on the foreign exchange rate at the time of the transaction.

For transactions that require the establishment of deferred revenue and ratable revenue recognition, the revenue is recognized over the contract term based on the foreign exchange rate as of the contract date. For example, if a customer purchases an annual subscription and is invoiced upfront on 1/1/2022, the revenue is recognized based on the foreign exchange rate as of 1/1/2022. The subsequent changes in the foreign exchange rate will have no impact on revenue recognition.

For transactions that have multiple payment-in-advance invoices over the contract period that require the recognition of deferred revenue, the revenue is recognized based on the exchange rate as of the contract date, and the change in the foreign exchange rate between the contract date and invoice date(s) is recorded as revenue adjustment(s). If you want to treat the change impact as foreign exchange gain/loss, you need to create General Ledger (GL) entries to re-class the impacts from revenue adjustments to foreign exchange gain/loss. Refer to Multi-Currency Examples for more details.

When order items are changed in a foreign currency contract (for example, adding or removing a new order item), the revenue recognition is adjusted retrospectively using the foreign exchange rate at the time of the establishment of the contract (order date).

For Chargebee users, when a customer changes the subscription plan (e.g. upgrade from a basic plan to a premium plan), Chargebee issues a prorated credit note to cancel the original plan and issues a new invoice for the remaining contract period based on the new plan with the same order ID. RevRec recognizes the change in the foreign exchange rate from the contract date to the plan change date as a revenue adjustment and will continue to recognize the revenue based on the foreign exchange rate as of the original contract date. Alternatively, instead of changing a subscription plan in Chargebee, you could cancel the original subscription and start with a new plan. In this scenario, RevRec uses the foreign exchange rate at the change date for the new plan and there will be no foreign exchange rate adjustment.

In the case of a cancellation, the foreign exchange rate as of the contract date is used to reverse revenue and generate adjusting entries to zero out the revenue recognition.

All metrics on the Dashboard are displayed as translated amounts in the home currency. This includes the revenue figures displayed for the top-customer list on the Dashboard. The total contract value is translated to the home currency amount if it is transacted in foreign currency.

The translation of the total contract amount is only done for the top-customer list on the Dashboard.

For the Revenue reports, all revenue-related metrics such as revenue, deferred revenue, and foreign exchange change impact are in the home currency only. A new metric called Foreign Currency Change is added to capture the impact of exchange rate change in the Unearned Revenue Roll-forward report. Positive foreign exchange change impact (gain) is reported as a positive amount and vice versa.

For the Sales and Billings reports, the actual transaction currencies are used. For example, if a user has received orders transacted in US Dollars and Euros, the Sales and Billings reports display the relevant information in USD and EUR respectively.

Accounting Journal Entry Report and the journal entries are displayed in the translated home currency amount.

The following examples illustrate a few multi-currency transactions and types of entries created for each.

Month 1

On 12th, December 2020, an entity enters into a foreign currency subscription contract with a customer for three months starting from 1st, January 2021. The customer is billed via an invoice on the 12th of December 2020 for the entire contract value of EUR 300 (EUR 100/month) which is payable by the 1st of January 2021. The home currency is USD and the exchange rate as of 12th, December 2020 is USD 1.2 /EUR.

On 31st December, the entity has an outstanding A/R balance of EUR 300. The exchange rate on 31st December 2022 is USD 1.19/EUR, resulting in a decrease of USD3.00 on A/R due to the decrease in the value of the home currency against the foreign currency since the invoice day. Note this re-measurement process is handled in Accounting System and is self-reversed in the next month.

Month 2

On the 15th of January, a Euro 300 payment is received and converted at the exchange rate of USD 1.185 /EUR, for a total of USD 355.50. The accounting system recognizes the payment and foreign currency loss due to loss of value in home currency against foreign currency.

On the 31st of January, RevRec recognizes revenue based on obligation performance, at USD 1.2/ EUR (the original foreign exchange rate as of the contract establishment date). The foreign currency rate changes do not have any impact on revenue recognition.

Month 3 (28th of February) and Month 4 (31st of March)

Similar to Month 2, RevRec continues to recognize revenue based on the original foreign exchange rate as of the contract date.

Month 1

On the 1st of January, 2021, an entity enters into a foreign currency contract with a customer for EUR 100/month for the two-month term starting from the 1st of January, 2021. The plan includes two monthly pre-billed invoices, with the first EUR 100 payable on the 1st of January, 2021. The home currency is USD and the exchange rate as of the 1st of January, 2021 is USD1.2/EUR.

On the 1st of January, payment of EUR 100 is received and converted to USD at the exchange rate of USD 1.20/Euro. There is no gain/loss from foreign currency as the payment is received on the same day as the invoice.

On the 31st of January, RevRec recognizes the earned revenue based on the foreign currency rate as of the contract date.

Month 2

On the 1st of February, the invoice for the second month of EUR 100 is billed, with the FX rate at USD 1.21/ EUR. The accounting system records the A/R and revenue at USD 121. RevRec re-classes USD 121 out of the revenue into the deferred revenue.

On the 1st of February, EUR 100 payment is received and converted to USD at the exchange rate of USD 1.21/Euro. Similarly, there was no foreign currency gain or loss associated with the payment, as it is received immediately.

On the 28th of February, RevRec processes revenue recognition. It is based on the foreign exchange rate as of the invoice date and treats it as the transaction date. The FX impact is recognized as revenue directly.

Another accounting view is not to book the FX rate change impact through revenue but recognize it as a gain or loss.

If you would like to use this approach, contact the RevRec support team and ask for early access to this feature.