RevRec generates the revenue recognition plan for the proportional performance product based on the service delivery logs and accounting rules. Revenue is recognized for each period based on the number of hours and services delivered or the percentage of the work completed for the respective period.

You can choose from the following two methods of revenue recognition for your business:

Point in time: The revenue associated with the delivered units is recognized immediately at the time of delivery.

Ratable: The revenue associated with the delivery units is recognized over a period of time between the delivery date and the service end date of the product, as specified.

RevRec supports two revenue recognition methods for proportional performance products.

When this method is used, RevRec calculates the revenue for the period by multiplying the SSP-adjusted unit price of the line item by the units delivered in the delivery log and recognizes the calculated amount as revenue in full for the accounting period of the delivery.

A sales order is created with a product having a proportional performance as a recognition rule, and the recognition method is Point in Time. 500 hours of service is sold for $12 per hour for six months starting January. 50 hours of service is delivered in each period.

RevRec will recognize $600 in each period (i.e., $12 x 50). Any unconsumed units will be recognized in the last period when the contract ends, and revenue for June should be $2,400 (i.e. (50 + 200 unconsumed) units x $12).

| Period |

Jan |

Feb |

Mar |

April |

May |

June |

| Revenue |

$1,200 |

$600 |

$600 |

$600 |

$600 |

$2,400 |

While using this delivery recognition method, RevRec requires the service start and end date to determine the duration of the service period. Once service duration is determined, RevRec calculates the sale price and standalone selling price of the products to determine the revenue allocation.

Price per Unit=Allocated Revenue/ Quantity of the line item

The calculated price is then multiplied by the units delivered as the revenue, which is recognized over the service period between the delivery period and the service end date.

If the service end date is not provided for the delivery log, the system will look for the delivery term in the accounting rule. If the accounting rule does not provide the delivery term, the system will use the term and term unit specified for the product. When the system cannot determine the service end date, RevRec will discard the delivery log and log a data validation error.

A sales order is created with a product having a proportional performance as a recognition rule with the delivery recognition method configured as Ratable. 500 hours of service are sold for a unit of $12 per hour for six months starting January. 50 hours of service are delivered with a service start date of January 01, 2023, and an end date of February 14, 2023.

Assuming the ratable plan type is configured for the environment as daily, RevRec will recognize the revenue in the following manner. For January 2023, the system will recognize revenue of $413.33, i.e., $12 unit price x 50 units delivered /45 days x 31 days. For February 2023, $186.67 in revenue will be recognized for the 14 days. On June 2023, the system will recognize the revenue of $2,400 (i.e., $12 x 450 units) for the unconsumed units at the contract's end date.

| Acting Period |

Unit Price |

Unit Delivered /Unconsumed |

Service Start Date |

Service End Date |

Service Durations (In Days) |

Days in the Period til Service End Date |

Revenue for the Period |

| January 2023 |

$12 |

50 |

January 01, 2023 |

February 15, 2023 |

45 |

31 |

$413.33 |

| February 2023 |

$12 |

N/A |

N/A |

N/A |

N/A |

14 |

$186.67 |

| June 2023 |

$12 |

450 |

N/A |

N/A |

N/A |

N/A |

$5,400.00 |

Based on a set of predefined rules, RevRec's Professional Service Delivery feature can recognize the revenue associated with a subscription.

To create a revenue accounting rule on your RevRec site, follow these steps:

| Fields |

Description |

| Product Code* |

A unique code is used in RevRec to identify the product. |

| Product |

The name of the product to which you want to associate this rule. |

| Revenue Recognition Rule* |

To recognize the revenue based on the service delivery the Proportional Performance from the drop down. |

| Recognition Method* |

To recognize the revenue over a certain term or recognize it as the in full. You can select from the following options:

|

| Delivery Term |

Delivery term is used to determine the service end date for the delivery. This field is only applicable to the ratable recognition method. |

| Term Unit |

The term units is used in connection with the delivery term field to determine the service end date for the delivery log. You can select from the following options:

This field is only applicable to the ratable recognition method. |

Fields marked with * are mandatory fields. You cannot create a revenue rule without specifying these mandatory details. Click here to learn more about accounting rules.

Provide service delivery data in RevRec using the following ways:

Manually adding data using the Sales Order UI.

Bulk uploading data using the Sync UI.

Learn more about adding delivery logs manually using sales order UI and bulk upload.

View the service delivery logs and recognition schedule for each product from the sales order UI, while you can see aggregate information related to service delivery on the report. You can also drill down using the various attributes available on the report.

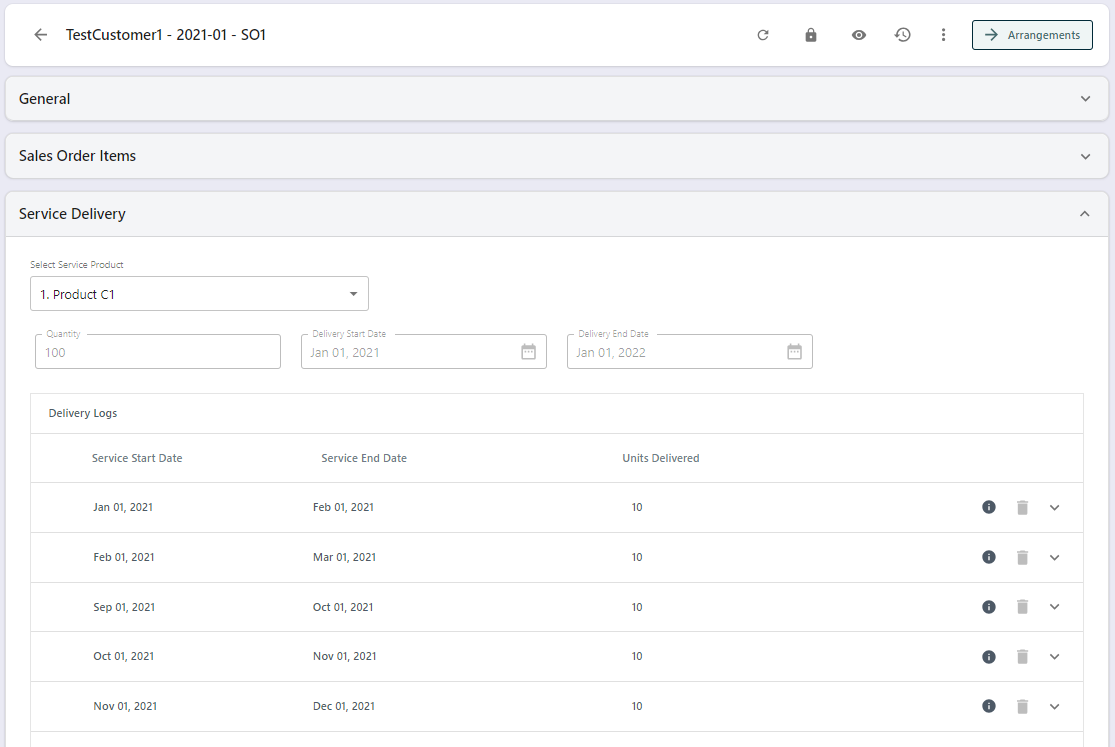

View or edit the Service Delivery associated with sales using the Sales Order screen.

The Service End Date field is only visible for the delivery log when the product has a recognition method for the proportional rule as Ratable.

Click Arrangements at the top left corner of the screen to view revenue arrangements for the sales order. There are two sections for the revenue.

Revenue Elements

Revenue Plan

Click to learn more about Revenue Arrangement.

The following reports are available with RevRec's Proportional Performance feature:

There are two versions of the report, i.e., Units delivered and Percentage Delivered.

Units Delivered version of the reports shows the service delivery units where the delivery method is Units Delivered and Percentage Delivered. It converts the percentage delivery into units to help you understand the activity in the period. You can use this report to view the New Units, Delivered Units, Overage Units, and Expired for each accounting period.

Percentage Delivered version of the reports shows the service delivery units where the delivery method is Percentage Delivered and only allows you to view one period at a time. On accessing the report, you will be prompted to enter the month-end date for the accounting period.

You can also use the drill functionality to break down the aggregated values. This report displays only past and current data.

There are two versions of the report, i.e., Units Delivered and Percentage Delivered.

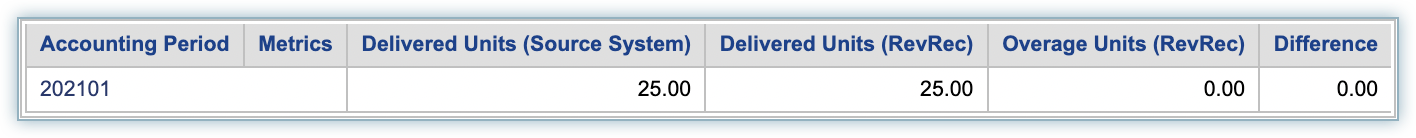

Delivered Units: Compares the quantity of services recorded in the source system with those delivered and recognized in RevRec. On accessing the report, you will be prompted to enter the month-end date for the accounting period.

Percentage Delivered: Compares the service completion percentage recorded in the source system with those delivered and recognized in RevRec. On accessing the report, you will be prompted to enter the month-end date for the accounting period.