Docs

Co-badged cards are payment cards that carry logos and functionalities of two or more payment networks. This means that a single card can be used with multiple payment schemes, typically providing the cardholder with more flexibility in how and where they can make payments.

For example, a co-badged card might feature both the Visa or Mastercard with a local payment network logo, such as Cartes Bancaires (France's domestic network) and Dankort (Denmark's local network).

Chargebee currently supports Cartes Bancaires with Stripe as part of the co-badged card compliance. Learn more

Following are the benefits of using co-badged cards:

Regulation 2015/751 of the European Payments Initiative (EPI) mandates that cardholders using co-badged cards must be clearly informed of their payment scheme options if the service supports multiple schemes.

The regulation focuses on the following key principles:

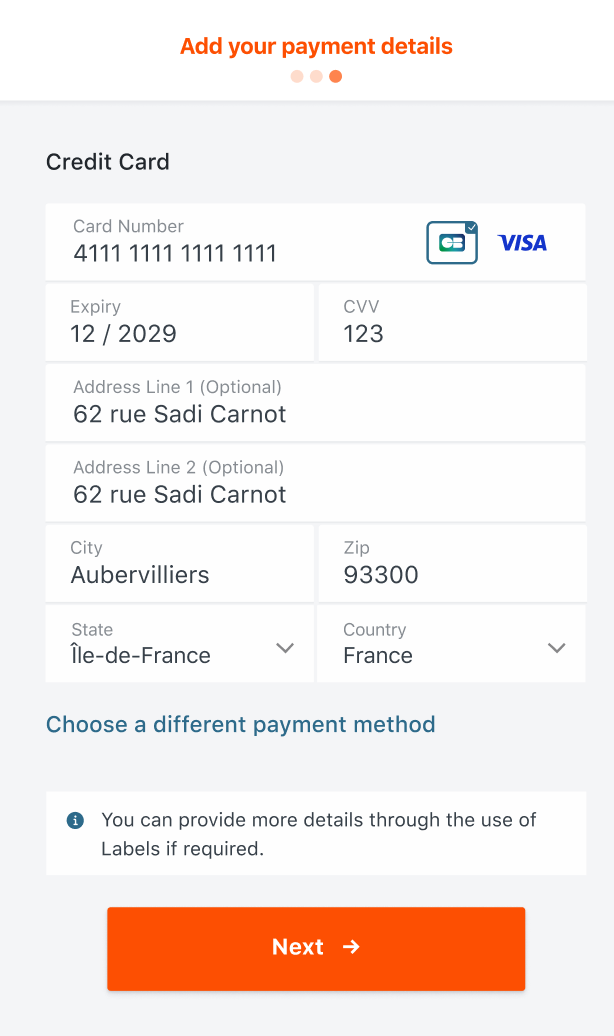

Display of Accepted Payment Schemes: Merchants must clearly indicate the payment schemes (eg., Cartes Bancaires, VISA, or Mastercard) they accept prior to initiating a transaction.

Automatic Selection of Default Scheme: For co-badged cards, if a merchant supports only one payment scheme, the payment page should automatically select that scheme. However, the customer must still be notified of this selection and their available options.

Limited Requirement: According to Article 10 of Regulation 2015/751 , merchants are only obligated to default to the supported scheme if they don't accept both schemes on a co-badged card. While merchants are not required to adopt additional payment brands, they must provide a choice to customers when both schemes are supported.