Scope

What are the gateways that support Transaction Descriptors?

What are the fields supported for Transaction Descriptors as per gateway's?

Summary

A transaction descriptor is meant to describe a transaction in order to help your customer easily recognize the transaction.

The character limitations imposed by the various payment gateways we support, are as below:

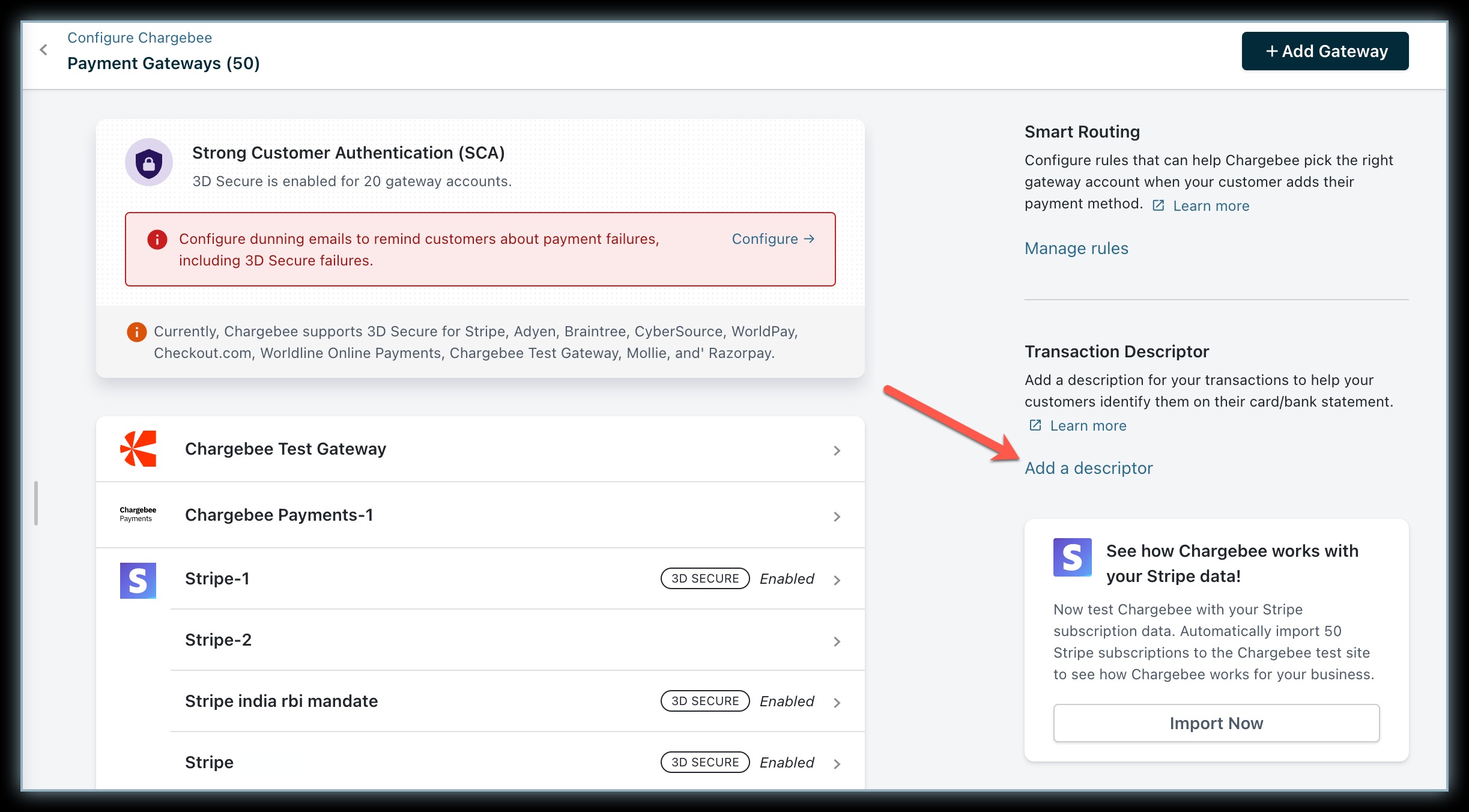

To configure the transaction descriptor, navigate to Settings > Configure Chargebee > Payment Gateways > Add a Descriptor

Solution

Chargebee provides you with the option of adding the transaction descriptor that will appear on your customers' card/bank statements. However, the customer's bank will decide how these descriptors appear on the bank statement. This means the bank can decide on the number of characters, capitalization of letters and words, and so on.

Additionally, the gateway you use may have several rules and restrictions about the descriptors that it passes on. The character limitations imposed by the various payment gateways we support, are as below:

A Transaction descriptor added is applicable for every gateway in your Chargebee site.

To configure the transaction descriptor, navigate to Settings > Configure Chargebee > Payment Gateways > Add a Descriptor

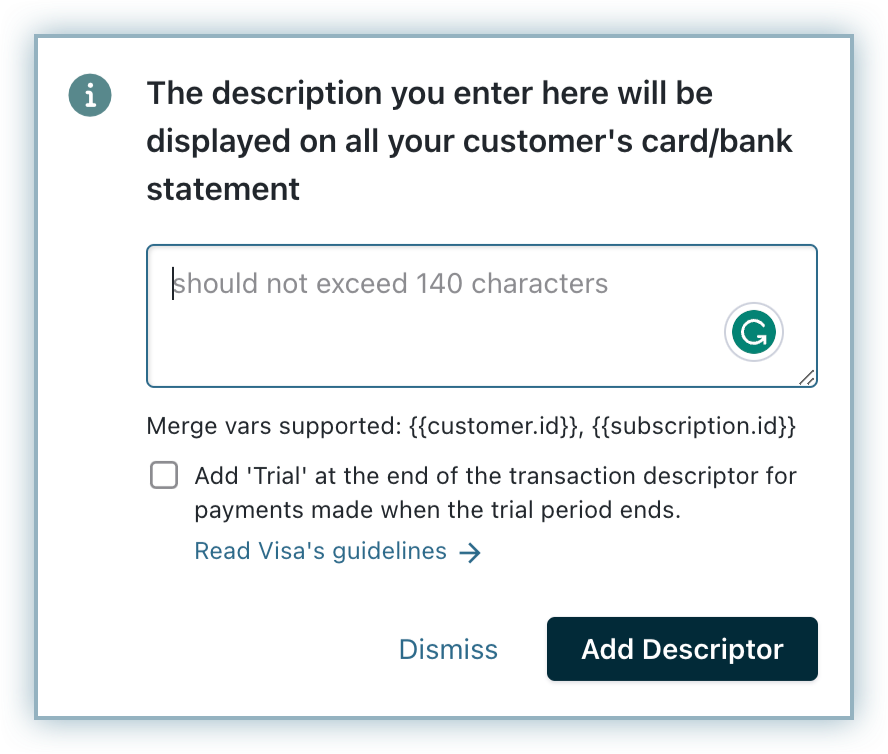

You can add a descriptor in the dialog box that opens.

Additionally, you can choose to pass Invoice ID, Plan Name, Customer ID, or Subscription ID along with the descriptor. Copy and paste the merge vars tag that you'd like to use next to the descriptor.

Note

The {{invoice.id}} merge var will work only if you have enabled Net D, so that Chargebee can send the final Invoice ID in the statement descriptor. Learn more

In case of multiple invoices or plans, the descriptor will be empty.

Suggestion: You can choose to put the business name as a suffix or a prefix along with the merge var depending on your business use case to make sure your customer receives the business name if the invoice.id or plan.name is not passed. Example: ?{{invoice.id}} business name? or ?business name {{invoice.id}}?

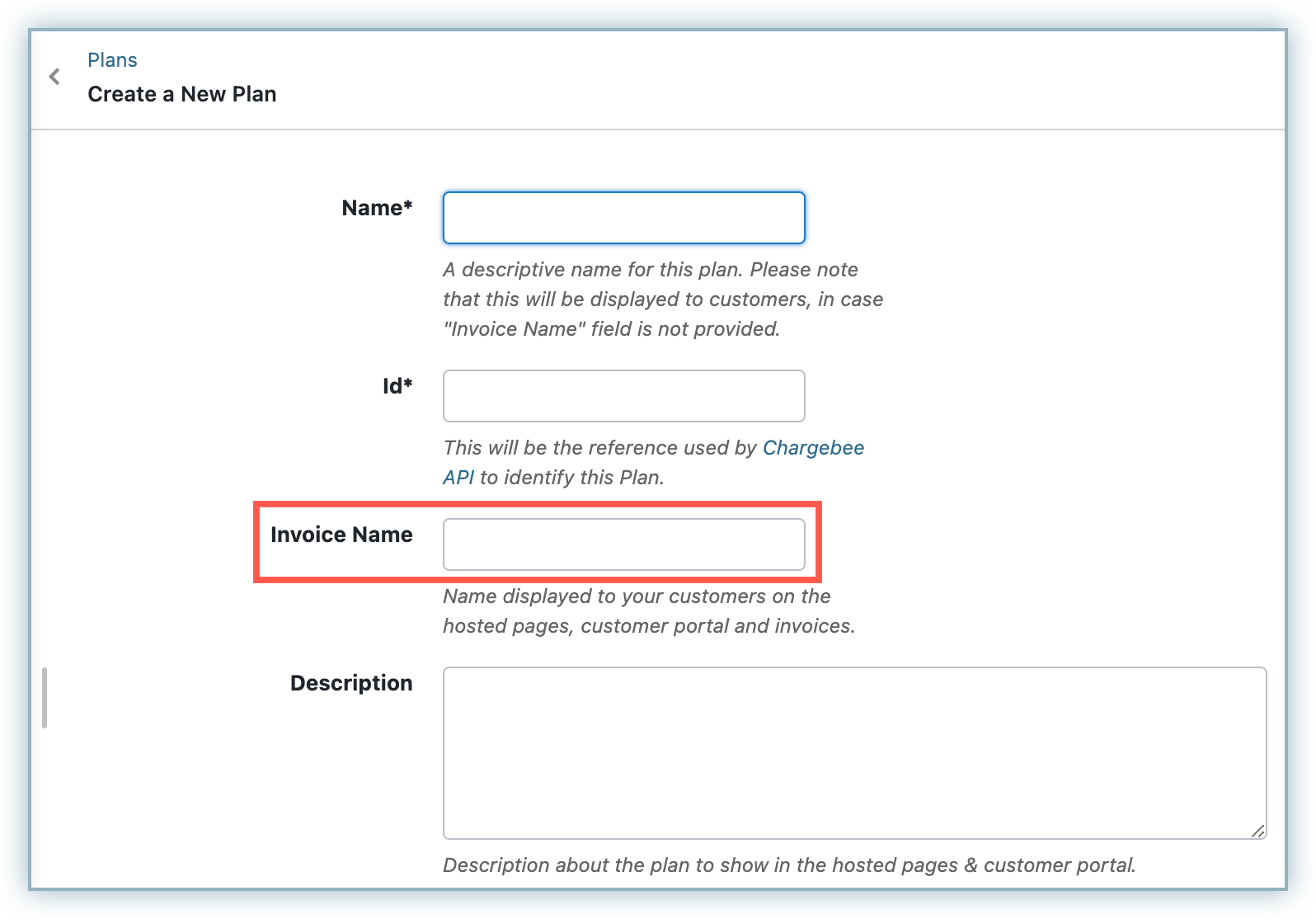

Here, the {{plan.name}} merge var will contain the value of the Invoice Name field that you add while creating a new plan.

In a Payment Intent flow, in case of 3DS and all redirection flows, we attempt the payment first, and a subscription is created in Chargebee only if the payment is successful.

This is the reason why the Subscription ID or Customer ID is not populated in the transaction descriptors for the first payment.

However, all the consecutive payments have the desired ID. For non-3DS flows or if the payment is already verified, the Customer ID or Subscription ID is populated right from the first payment.

Note

Note

Alphanumeric (A-Z, a-z, 0-9) string; characters allowed:

Maximum number of characters allowed: 10 characters

Alphanumeric( A-Z, a-z, 0-9) string; characters allowed:

Maximum number of characters allowed: 140 characters

Alphanumeric (A-Z, a-z, 0-9) string; characters allowed:

Maximum number of characters allowed: 30 characters

Alphanumeric (A-Z, a-z, 0-9) string; characters allowed:

Maximum number of characters allowed: 11 characters

Character restrictions:

Format: < DBA > * < Product Descriptor >.

Note

Format of the descriptor:

< PP *|PAYPAL * > < Merchant descriptor present in gateway > < 1 space > < soft descriptor >

Character length and limitations:

The alphanumeric soft descriptor can contain only the following characters:

The maximum number of characters allowed is 22 characters. Of this, the PayPal prefix uses 4 or 8 characters of the data format.

Note

To enable this feature in PayPal, contact PayPal Support

The maximum number of characters allowed for soft descriptor via API is 30.

The soft descriptor sent to the payment processor is: ?AMZ* < soft descriptor specified here >?.

Default format: ?AMZ* < SELLER_NAME > amzn.com/pmts WA?

Maximum no. of characters allowed: 16 characters

No limitations. Chargebee will truncate the descriptor if it exceeds 140 characters.

The maximum number of characters allowed is 25.

You can use the following characters in your descriptor:

Character restrictions:

The maximum number of characters allowed is 140.

Alphanumeric (A-Z, a-z, 0-9) string

Maximum number of characters allowed: 17 characters

Note