Offline payment methods, majorly bank & wire transfers (also called as Push payments) are used by SMBs and Enterprise businesses alike.

When customers pay offline, the transaction details are not sufficient to update the due invoices,

So there is a lot of manual effort involved in reconciling payments with due invoices.

With Stripe's ACH Credit Transfer feature , Chargebee updates payment due invoices (offline) accurately and removes the effort required to search and update due invoices.

Here's the list of steps to be done to setup and accept payments via Stripe ACH Credit Transfer:

You can enable the Stripe ACH Credit Transfer option in the Stripe Gateway settings page.

Navigate to Settings > Configure Chargebee > Payment Gateways > select a Stripe Account or create a new Stripe Account > Enable ACH Credit Transfer

Select how you'd like to apply the payment to customers payment due invoice. You can either apply it automatically or manually. When a customer chooses to apply manually, he can select the invoices for which he wants to apply the credits. Selecting Automatically applies the credits in the order of precedence (old to new).

You must configure webhooks in Stripe for Chargebee to receive the payment notifications (when customers make payments).

You can copy the webhooks URL from the gateway settings page and paste it in your Stripe account at Your account > Account settings > Webhooks > Add endpoint > Account.

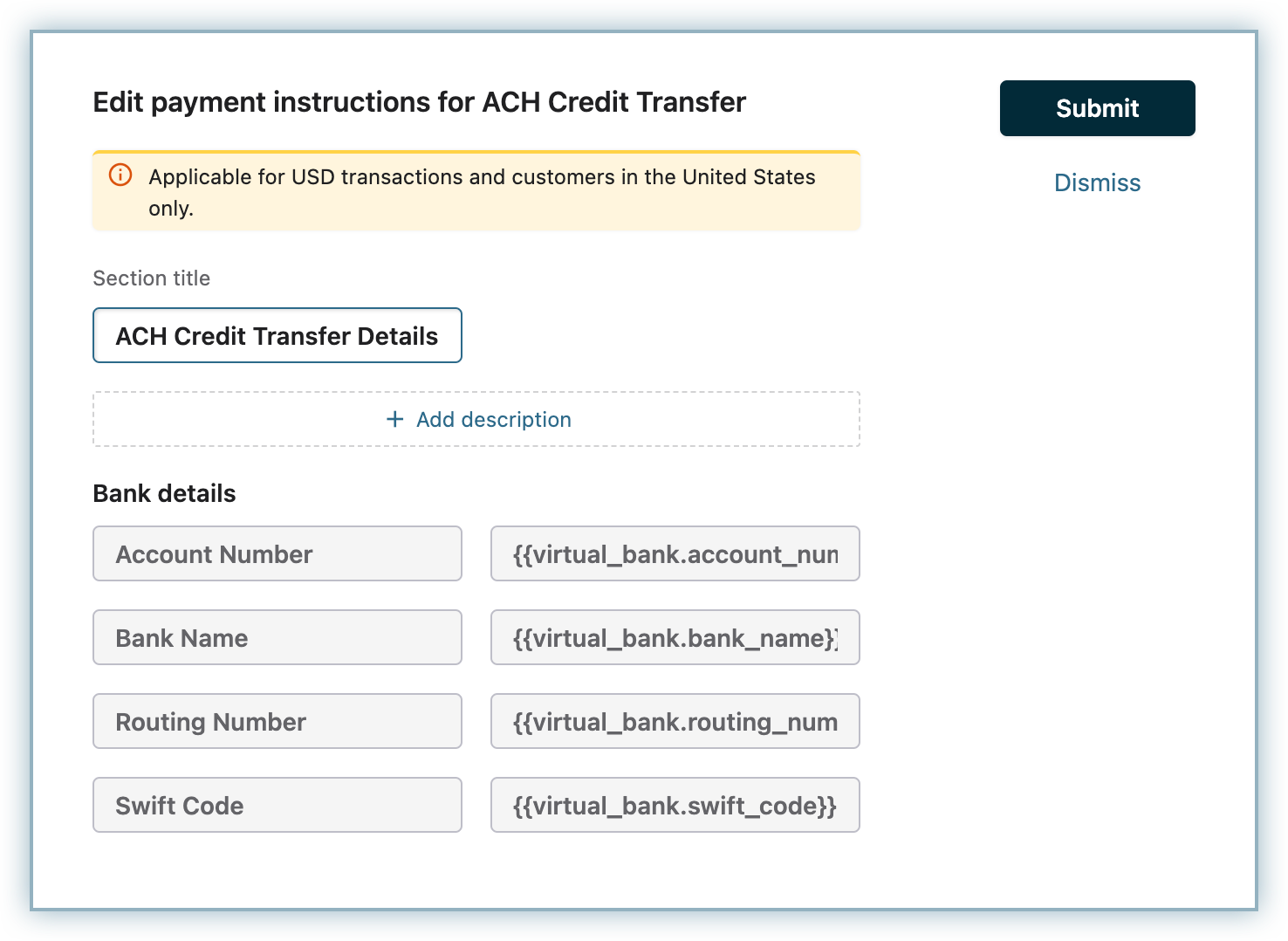

Chargebee will automatically create a Payment instruction to display the Virtual Bank account details in your invoices. You can review and edit them if required.

Navigate to Settings > Configure Chargebee > Customize Invoice > Payment Instructions > ACH Credit and review the Virtual Bank Account Details.

Learn more about Payment instructions here .

A virtual bank account is a unique account number which is generated so you don't need to share your sensitive bank account details with your users. A virtual bank account can be paid with ACH credit or wire transfer. Users can make payment of the amount due to this account, and the amount will be matched with the invoice.

Chargebee auto-generates virtual bank accounts in Stripe when there is a Payment Due, Posted, Not Paid invoice is created for a customer.

When customers are created, 'Email' and 'Country' attributes will be mandatory.

Email address is linked to the customer and used to create a Virtual bank account.

The country field is not mandated by Stripe, but Stripe has made this feature applicable for US customers, so we make sure that we generate virtual bank accounts only if the customer is from the US.

Stripe informs Chargebee when the customer deposits funds to the virtual bank account. This fund is applied to any unpaid invoices when a transaction is created. If there are no unpaid invoices, the money gets added to the balance account of the customer.

You can disable ACH Credit Transfer in the Gateway settings page.

1) How to refund an ACH Credit transfer payment?

ACH Credit transfer payment cannot be refunded via Chargebee. You should process the refund via Stripe or manually. Read more about the process and implications here .

2) What happens if customer transfers the money even after virtual bank account is disabled or deleted?

When you remove the ACH Credit transfer payment method, Chargebee will not show the payment instruction in the subsequent invoices. If customers have transferred the amount to that virtual bank account, Stripe will refund the amount to the customer.

3) What if the customer transfers an amount which does not match the invoice due amount?

If the amount is less, a partial payment will be recorded against the invoice.

If the amount exceeds, the additional amount will be stored as excess payment for the customer.

4) What will happen if an invoice is in dunning and the dunning attempt succeeded and the customer has transferred the amount as well?

The additional amount will marked as excess payment at the customer level.

5) Can I create or retrieve a Virtual Bank Account via API?

You can use Chargebee's virtual bank account API to manage the accounts.