You can choose to accept Netbanking and United Payments Interface (UPI) payment methods with your Razorpay gateway. However, you must review the following conditions that apply:

Razorpay only supports NetBanking and UPI payment methods for domestic payments where the presentment and settlement currencies are INR. By default, the maximum amount for a UPI mandate is set to Rs.5000 and for a Netbanking mandate to Rs.10,00,000. You can also set a custom mandate limit for UPI and Netbanking (below the default maximum limit) for your account. Contact Chargebee Support to set the desired limit. Currently, this option is only available for UPI and Netbanking, and not for Cards.

As part of the mandate setup process, you need to configure the amount and frequency of payment collection. By default, the following values are set for UPI and Netbanking in the Chargebee and Razorpay integration:

UPI

Netbanking

Frequency

Razorpay supports multiple frequencies for UPI mandates, providing greater flexibility for your billing needs. The supported frequencies are:

For new merchants setting up Razorpay, As Presented is the default frequency for UPI mandates, offering more flexibility to accommodate various workflows.

You can configure your site to enforce a specific billing frequency, such as Monthly, for all your plans in the checkouts. Simply reach out to Chargebee support with the desired default frequency.

The specified frequency will override the default and apply to any new subscriptions created after the change, affecting all plans and products.

Currently, you cannot change the frequency of Netbanking mandates.

Amount

You can customize the default maximum amount for both UPI and Netbanking mandates by setting a specific value. To do this, contact Chargebee support with the amount you wish to set for the mandate.

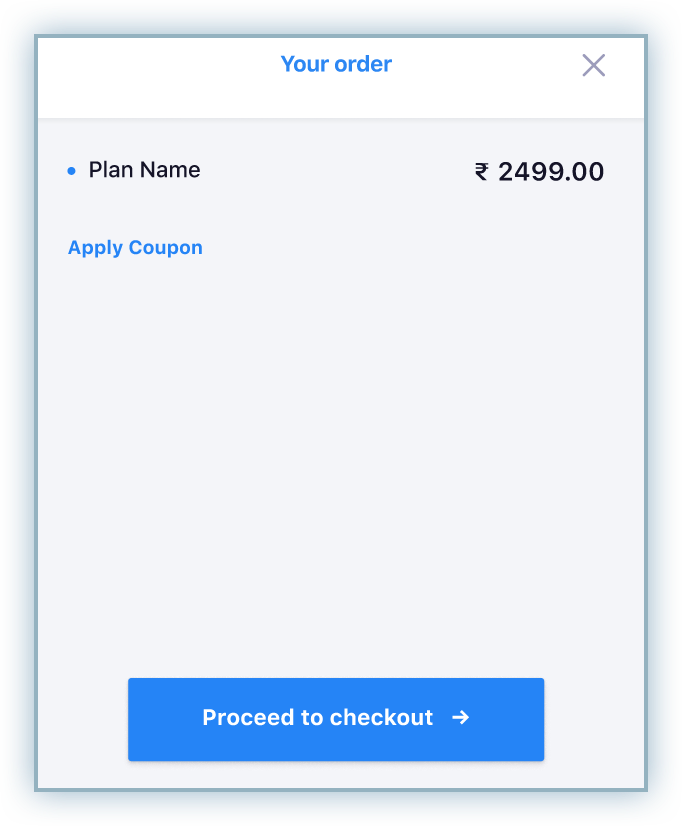

Let's review the checkout flow for Netbanking and United Payments Interface (UPI)

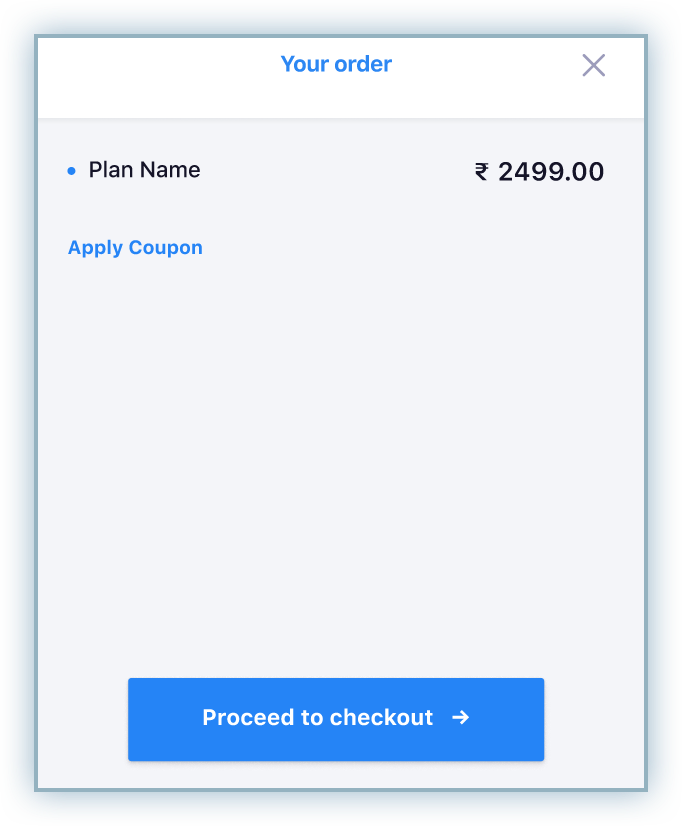

Review the details of the order and click Proceed to checkout.

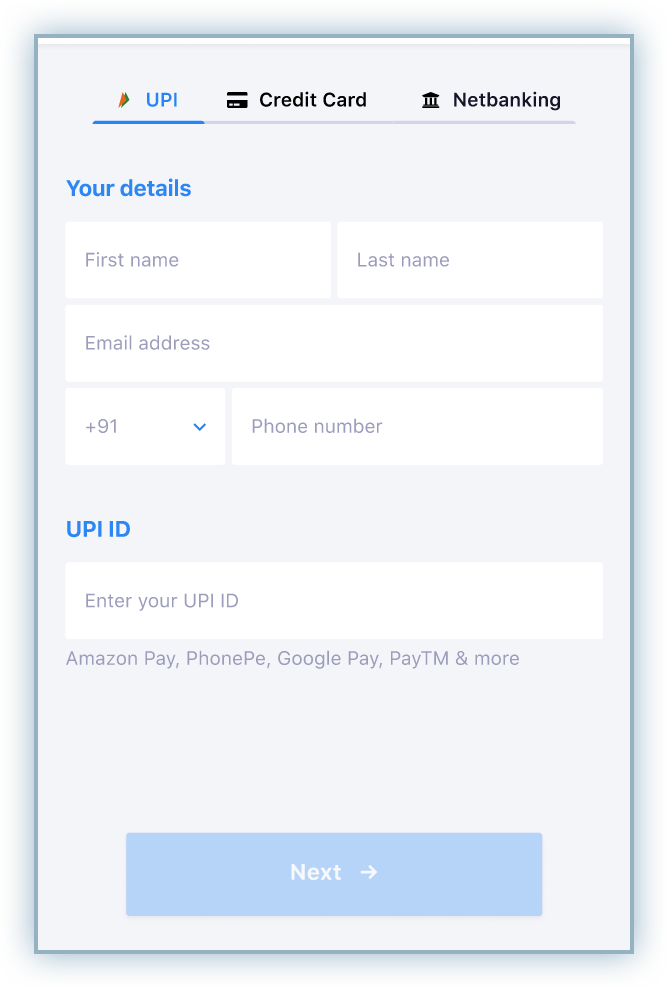

Enter the applicable account details and billing address. Click Next to proceed.

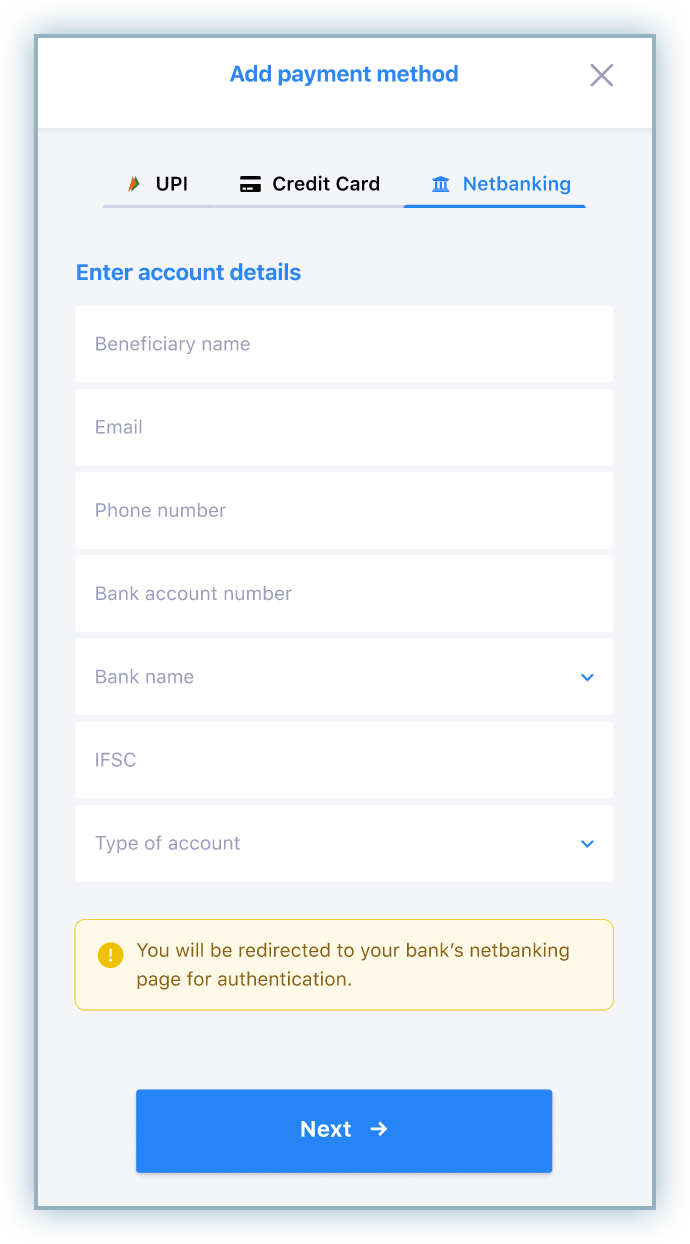

Click the Netbanking tab and enter your account details. Click Next to proceed.

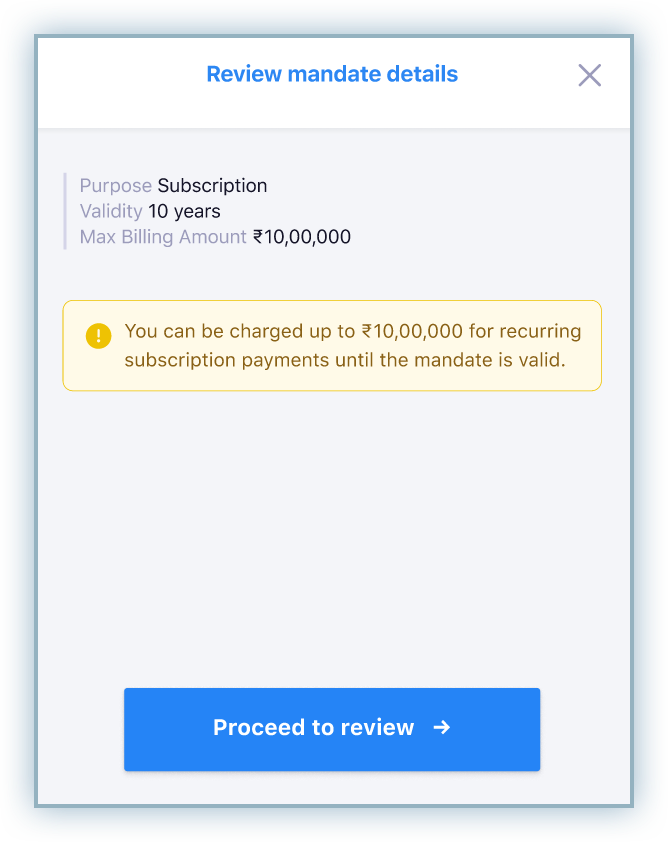

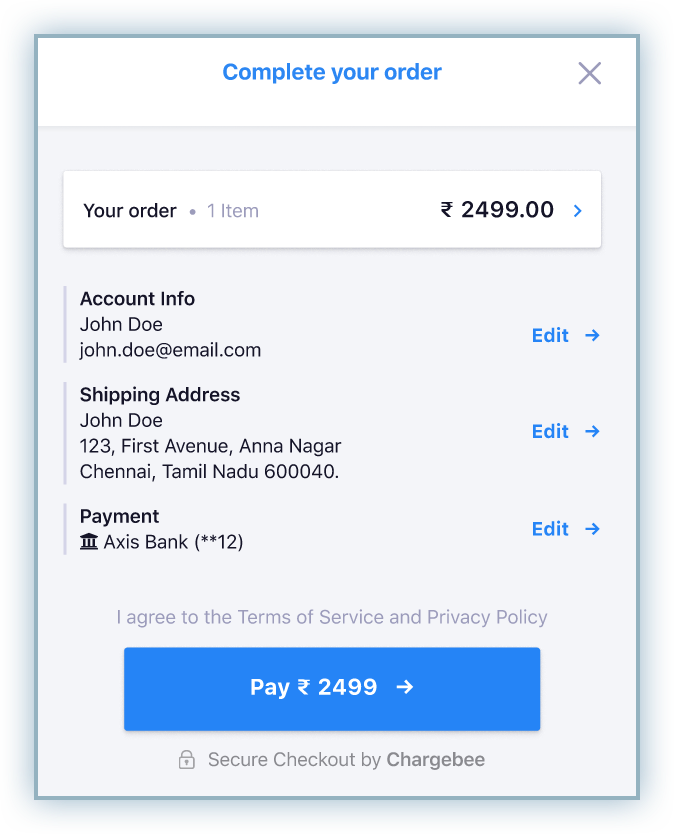

Review the mandate details which include the following conditions:

Click Proceed to review.

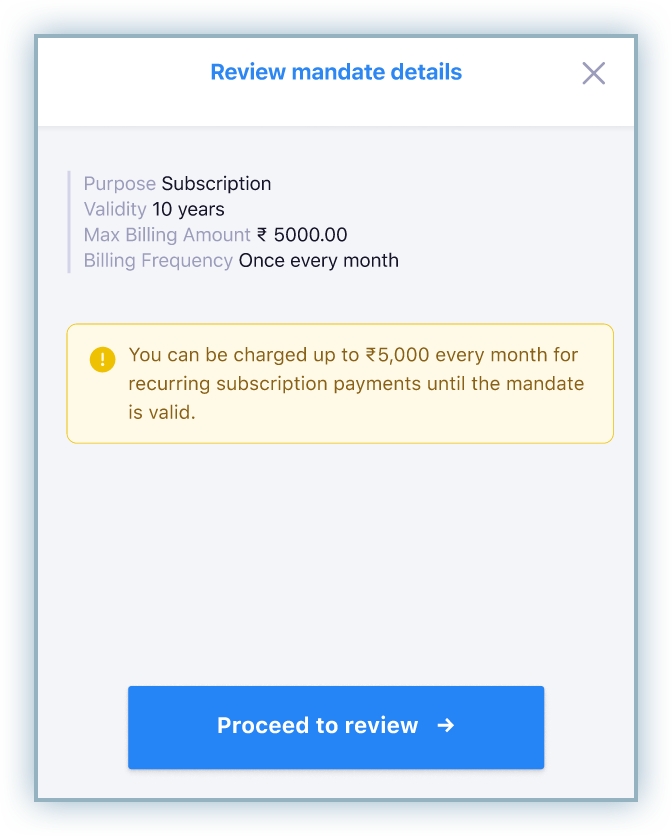

Click Pay to complete the transaction and you are rediected to your bank's website.

Complete the authentication on the bank's page to complete the transaction.

After successful authentication, customers are redirected back to the checkout page to confirm the transaction is complete.

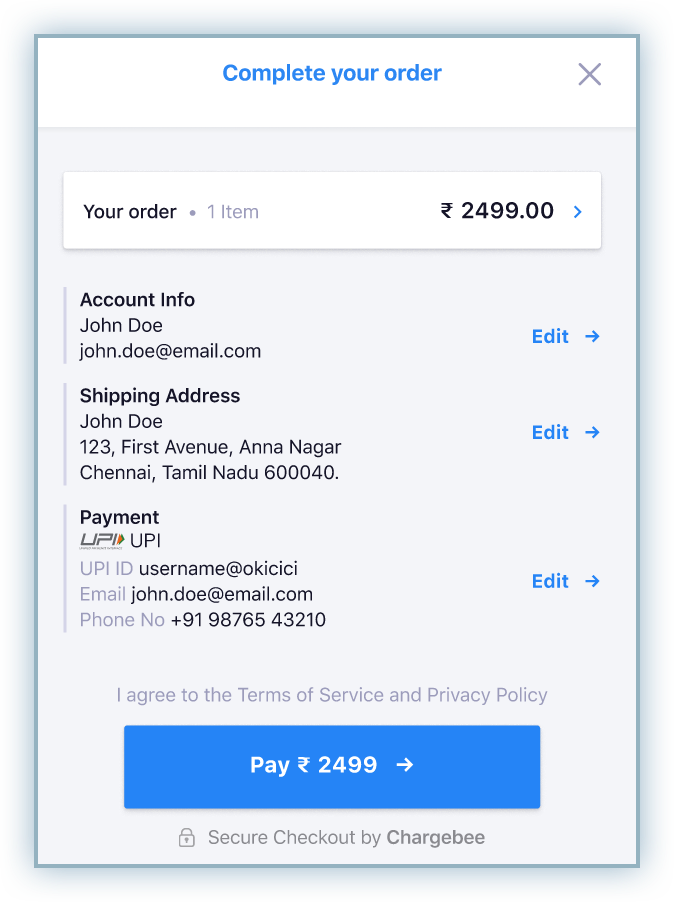

Review the details of the order and click Proceed to checkout.

Enter the applicable account details and billing address. Click Next to proceed.

Click the UPI tab, enter details including phone number and UPI ID. Click Next to proceed.

Note: Any errors with the UPI id will prevent you from making further progress.

Review the details of the mandate which include the following conditions:

Review the details and proceed to complete the transaction.

Access the UPI application where the payment is initiated and approve the payment request to complete the transaction.

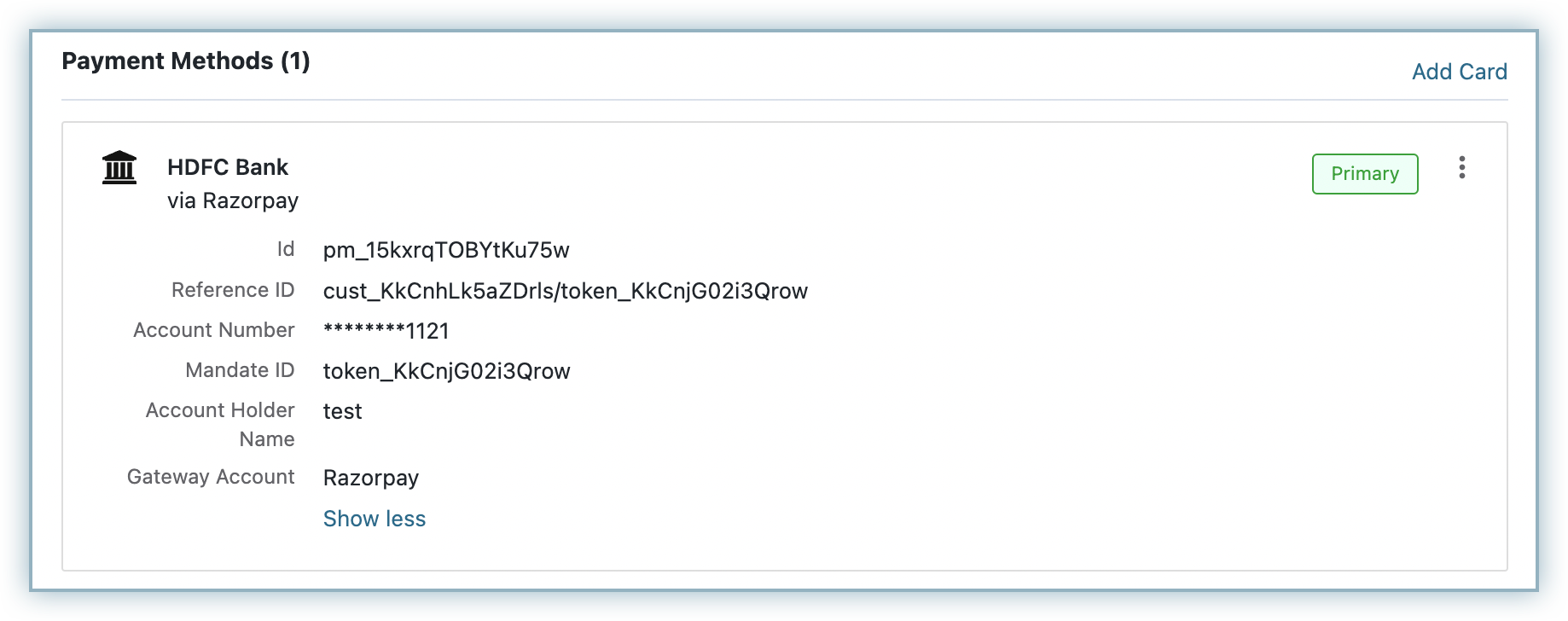

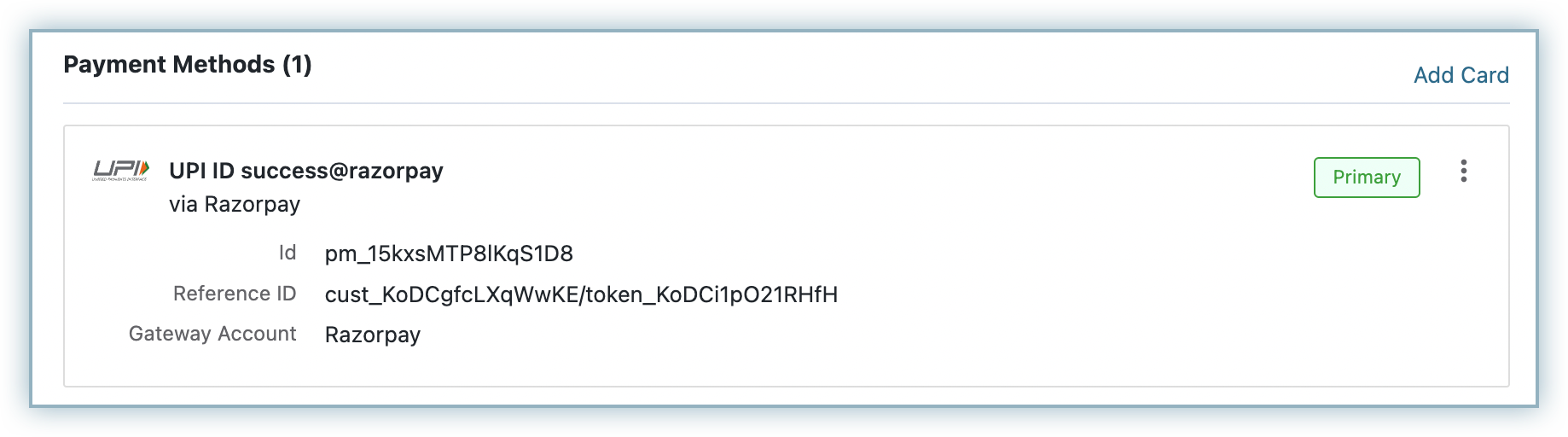

After successfully completing the transaction, the payment method is now aligned to the subscription and can be viewed on the subscription page as shown below:

UPI

Netbanking