Docs

The inception of the European Union (EU) brought about a wide range of economic benefits and unification for its members, there are still country-specific preferences related to payment methods.

Bancontact are currently the most preferred payment option in Belgium. They offer a wide range of benefits for their consumers, such as allowing smaller transactions, online payments, and contactless card transactions while ensuring the merchants are assured of a direct and guaranteed payment.

Chargebee now enables you to configure and process Bancontact payments with Stripe and enables you to offer payment options for customers who prefer EU specific payment methods.

Recurring Payments are not supported by Maestro due to restrictions defined by its network.

To accept Bancontact payments, the following conditions must be met:

Configure Stripe Payment Gateway.

Access the Chargebee app Settings Page.

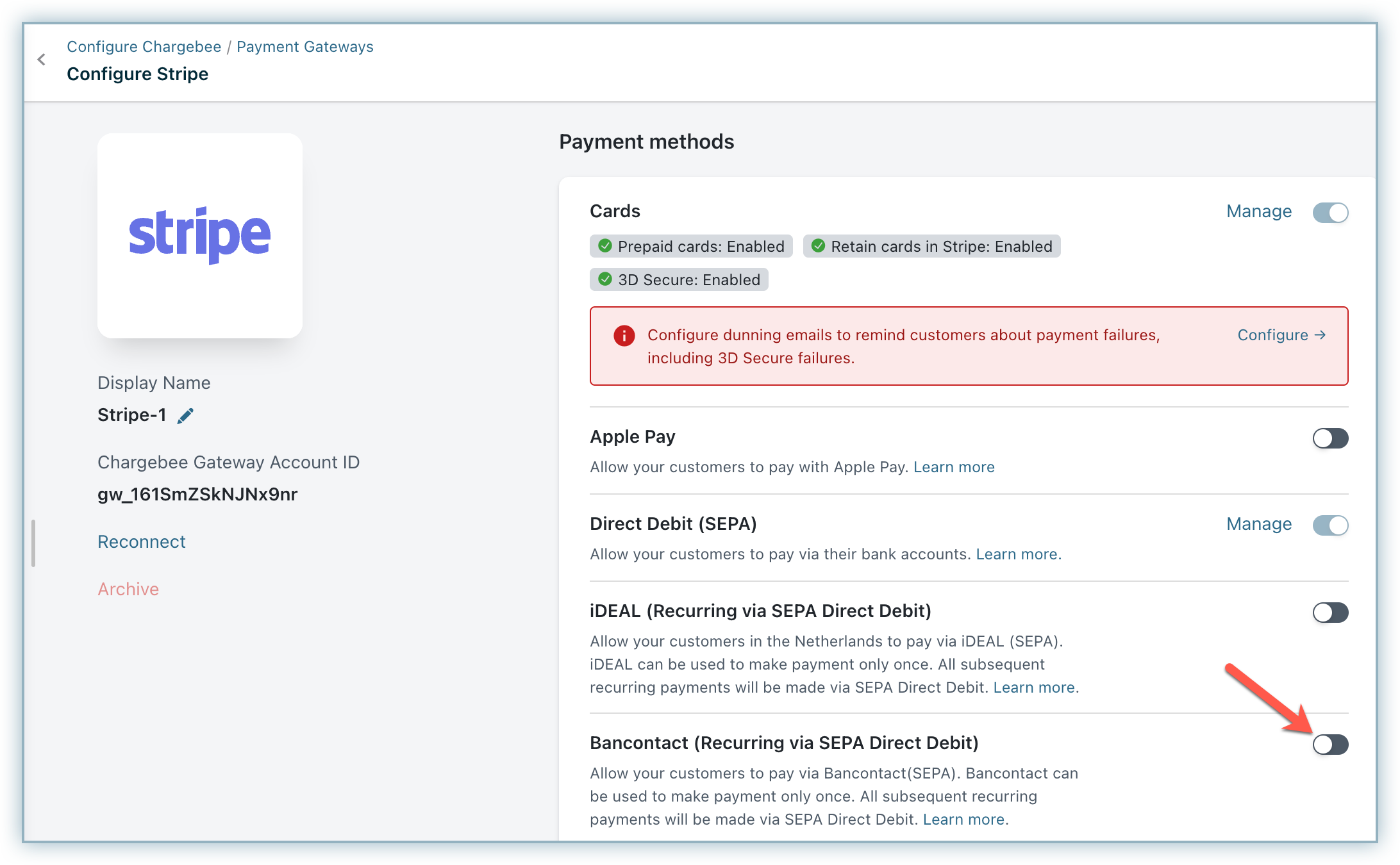

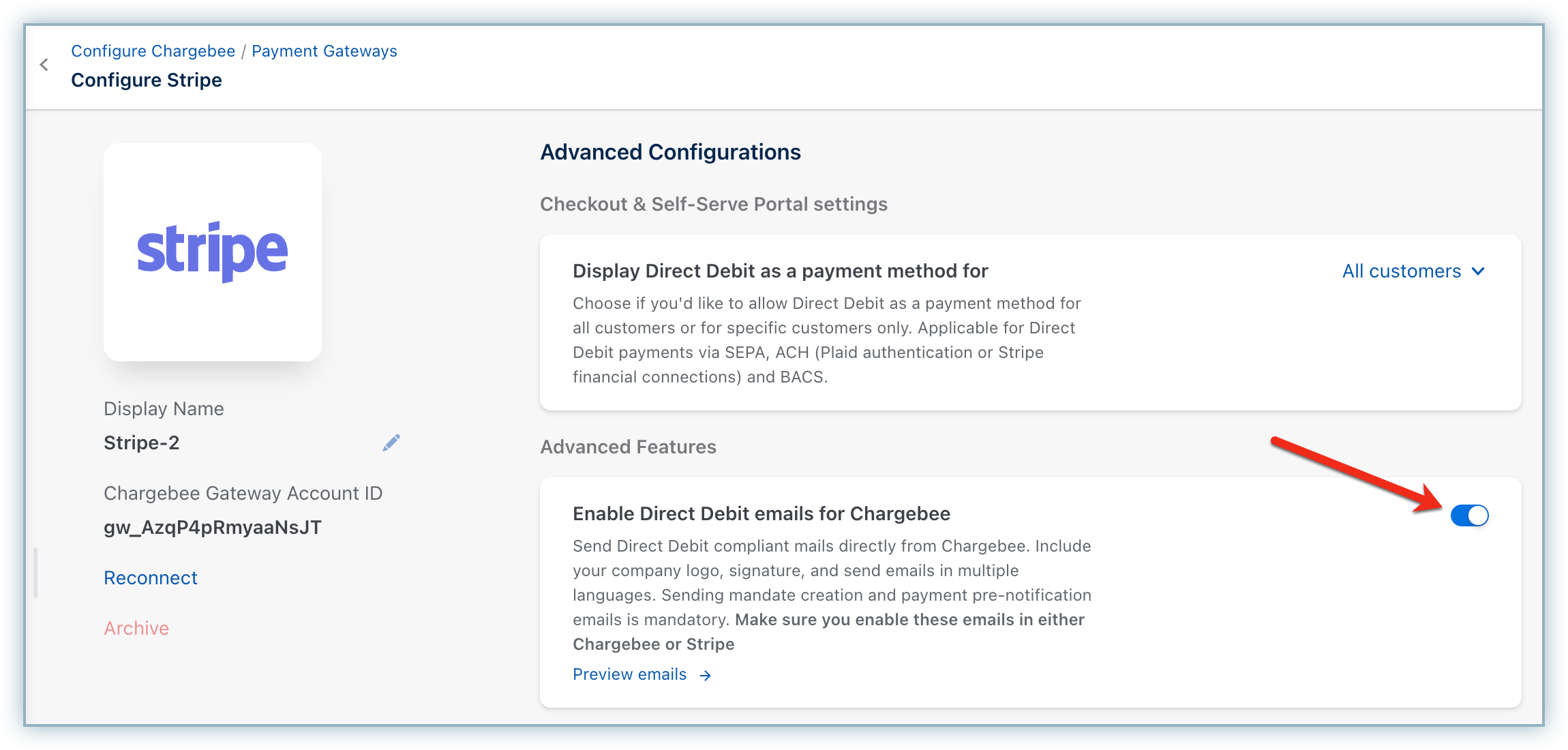

Naviage to Stripe Settings Settings > Configure Chargebee > Payment Gateway > Stripe.

Enable Direct Debit (SEPA). This must be enabled on Chargebee and Stripe Gateway.

Note: Refer to this document for more information.

Enable Bancontact (Recurring via SEPA Direct Debit).

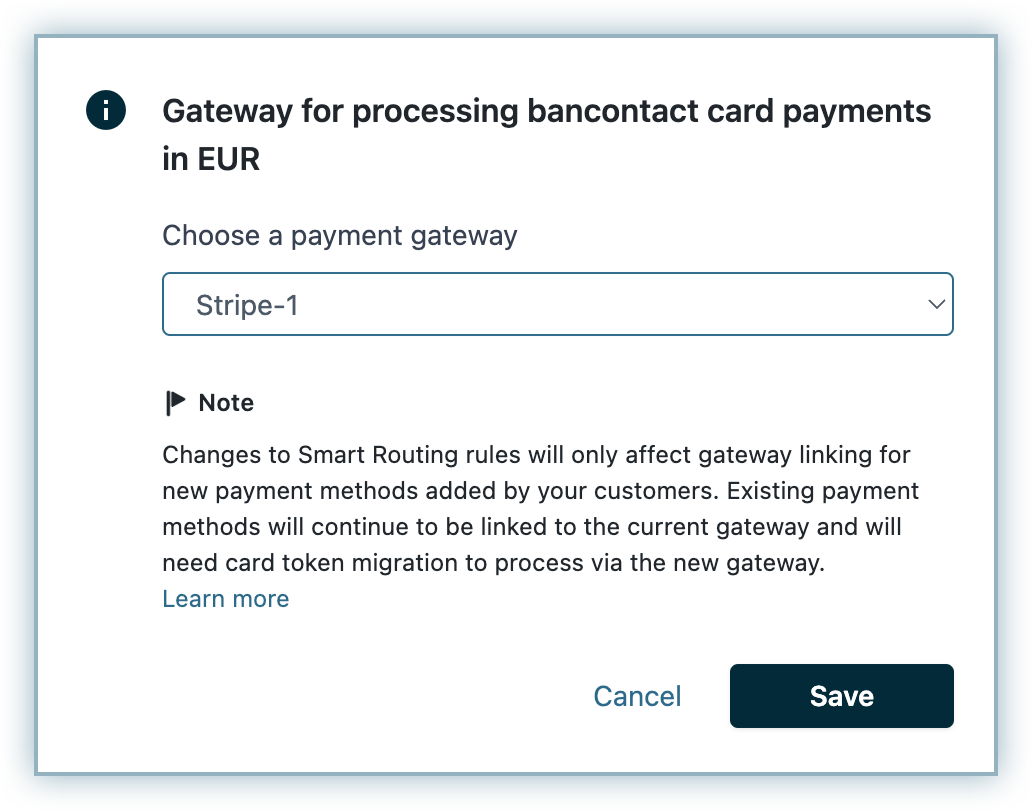

Ensure the Smart Routing settings are configured to accept Bancontact payments via Stripe.

Navigate to Settings > Configure Chargebee > Smart Routing > Manage Rules > For Bancontact Card Payments > Edit.

Select your Stripe account from the Choose a payment gateway drop-down list and click Save.

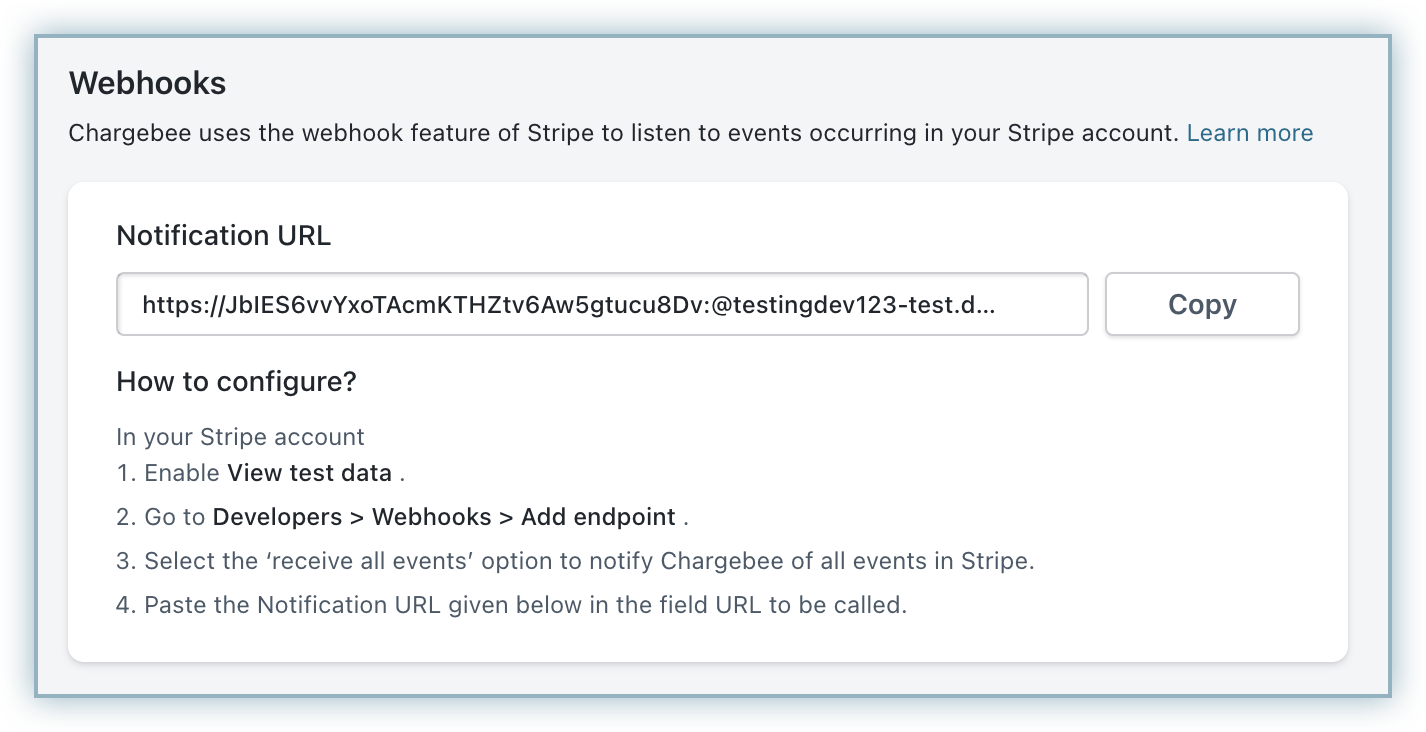

You need to configure webhooks in order to get the status of SEPA payments. Learn more about configuring webhooks.

In order to receive Direct Debit emails for this integration, enable Enable Direct Debit emails for Chargebee on the Configure Stripe page.

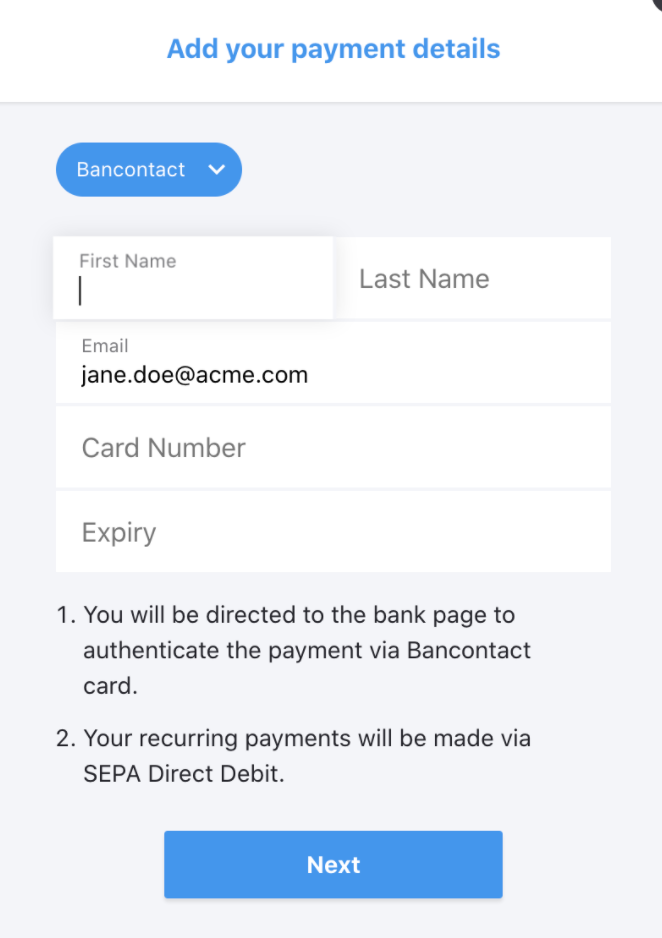

Stripe Bancontact can be used to make the payment only once. Chargebee handles recurring scenarios by converting all the recurring transactions into Direct Debit SEPA payments. TTherefore, it is important that you inform your customers during Checkout that future payments will be converted to Direct Debit SEPA payments.

Here is a sample content that you can display at your checkout:

According to the European payment council, when you enable SEPA Direct Debit payments for customers, an authorization agreement should be available for the customer to view and confirm the mandate. Read more on this .

It is a regulatory compliance of the SEPA scheme to send emails to customers regarding mandate creation and payment pre-notification. You can send this email either from Chargebee or Stripe. The advantage of sending this email from Chargebee is that it allows you to configure elements such as your company logo, signature etc. Learn more.

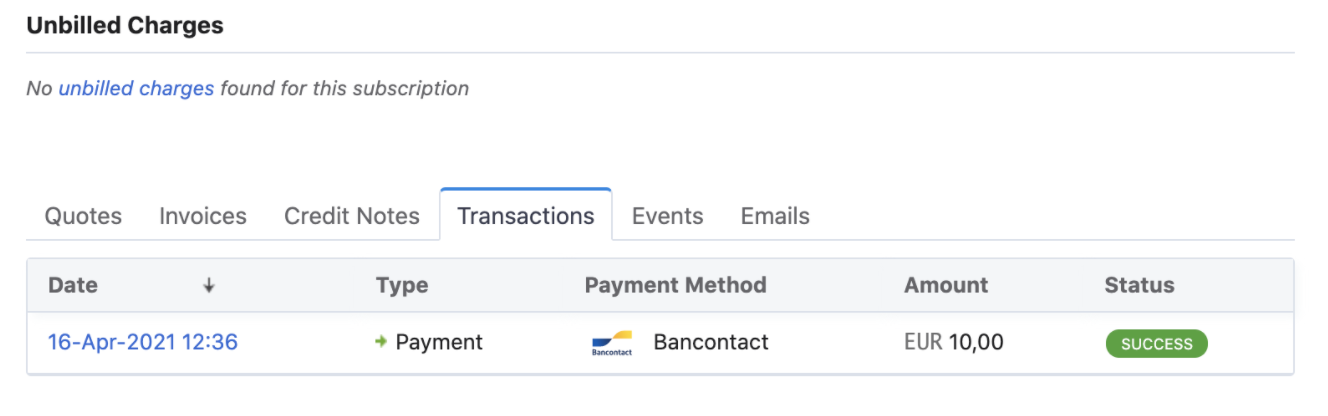

You may want to review the details of the subscription or confirm the status of the payment. Follow the steps below to complete this action: