This feature is a Private Beta Release. Contact support to enable ACH via Adyen for your Test and Live site.

ACH is a US-based payment method available for processing recurring or one-time payments. Chargebee allows you to configure ACH (Direct Debit) payments using Adyen. This document helps you to set up ACH payments via Adyen in your Chargebee account.

The following options are available to integrate your Adyen Gateway with Chargebee

| Integration Method | Description | PCI Requirements |

|---|---|---|

| Chargebee Hosted Pages | In this method, the bank information of the customers are collected by Chargebee's checkout and directly passed on to Adyen. | Low (Your PCI compliance requirements are greatly reduced due to usage of Chargebee's checkout) |

| Chargebee JS | Via Raw Bank details You will collect raw bank account details via your custom checkout and pass it to Chargebee.js. |

High |

| Chargebee API | In this method, collecting bank information will have to be handled at your end and has to be passed on to Chargebee. Chargebee then routes this bank account information to Adyen. Since Bank information will be collected by you directly, you will have to take care of PCI Compliance requirements. | High |

To accept ACH payments using Chargebee, you must:

Follow these steps to enable and configure Direct Debit (ACH) via Adyen in your Chargebee site:

Login to the Chargebee app.

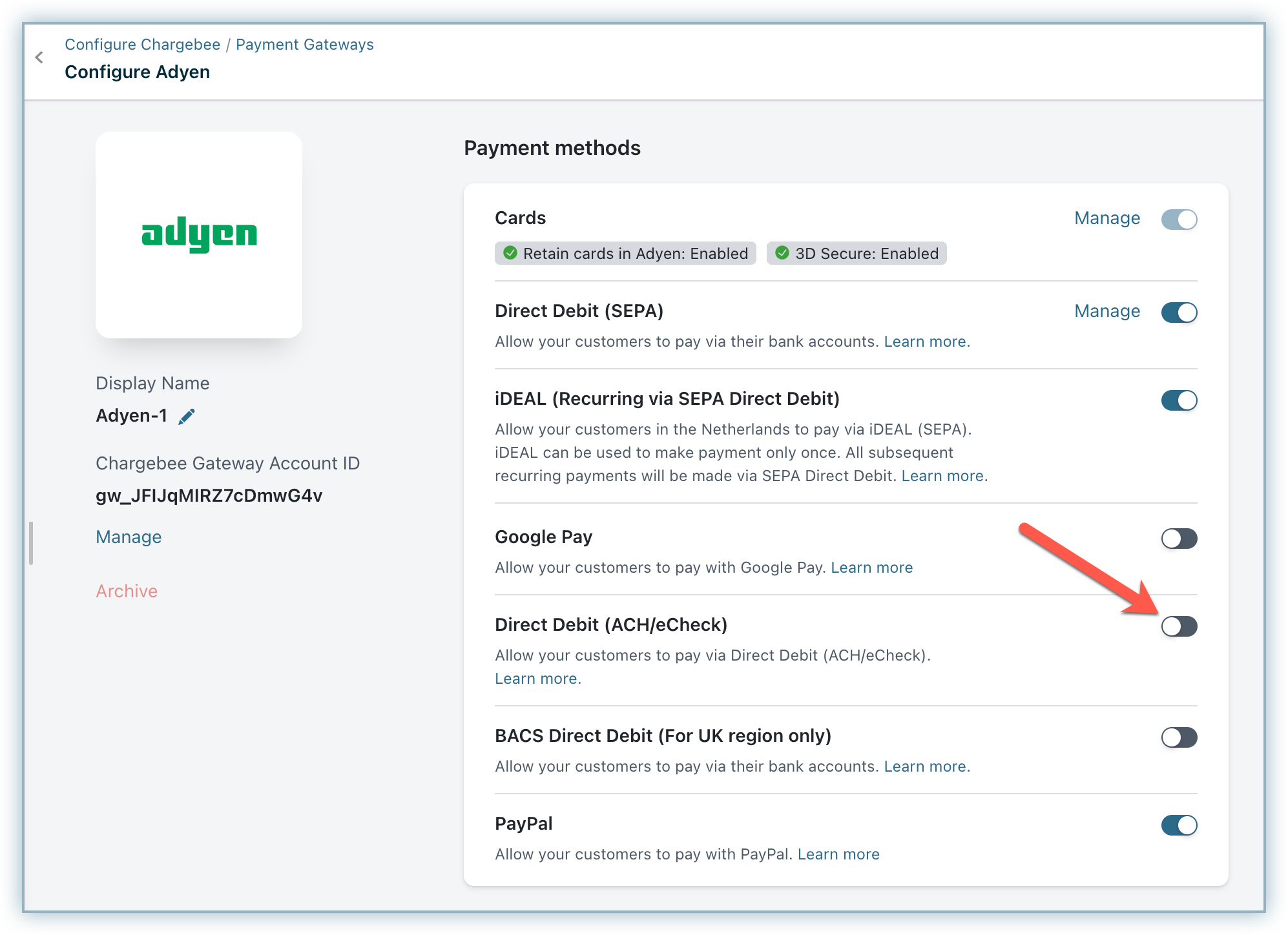

Go to Settings > Configure Chargebee > Payment Gateways > Adyen.

Enable Direct Debit (ACH/eCheck)

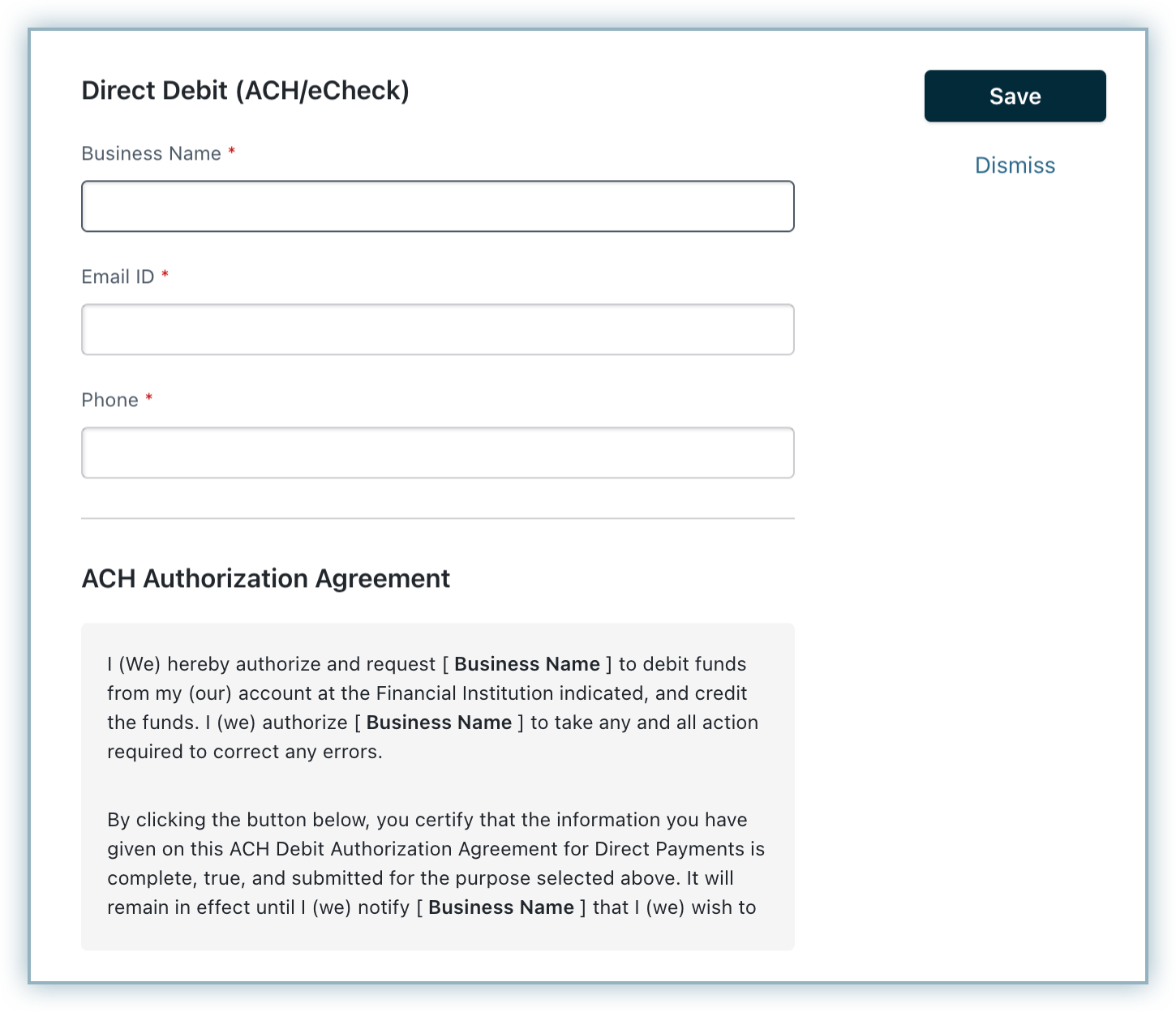

Enter your Company Name, Email, and Phone. The Company Name field value is used in the ACH authorization agreement.

Click Save to save changes.

When you activate ACH through Adyen, Direct Debit's smart routing for the USD currency is automatically enabled. If another gateway is set up for USD Direct Debit in smart routing, you can modify it through the smart routing page. To adjust these settings, follow these steps:

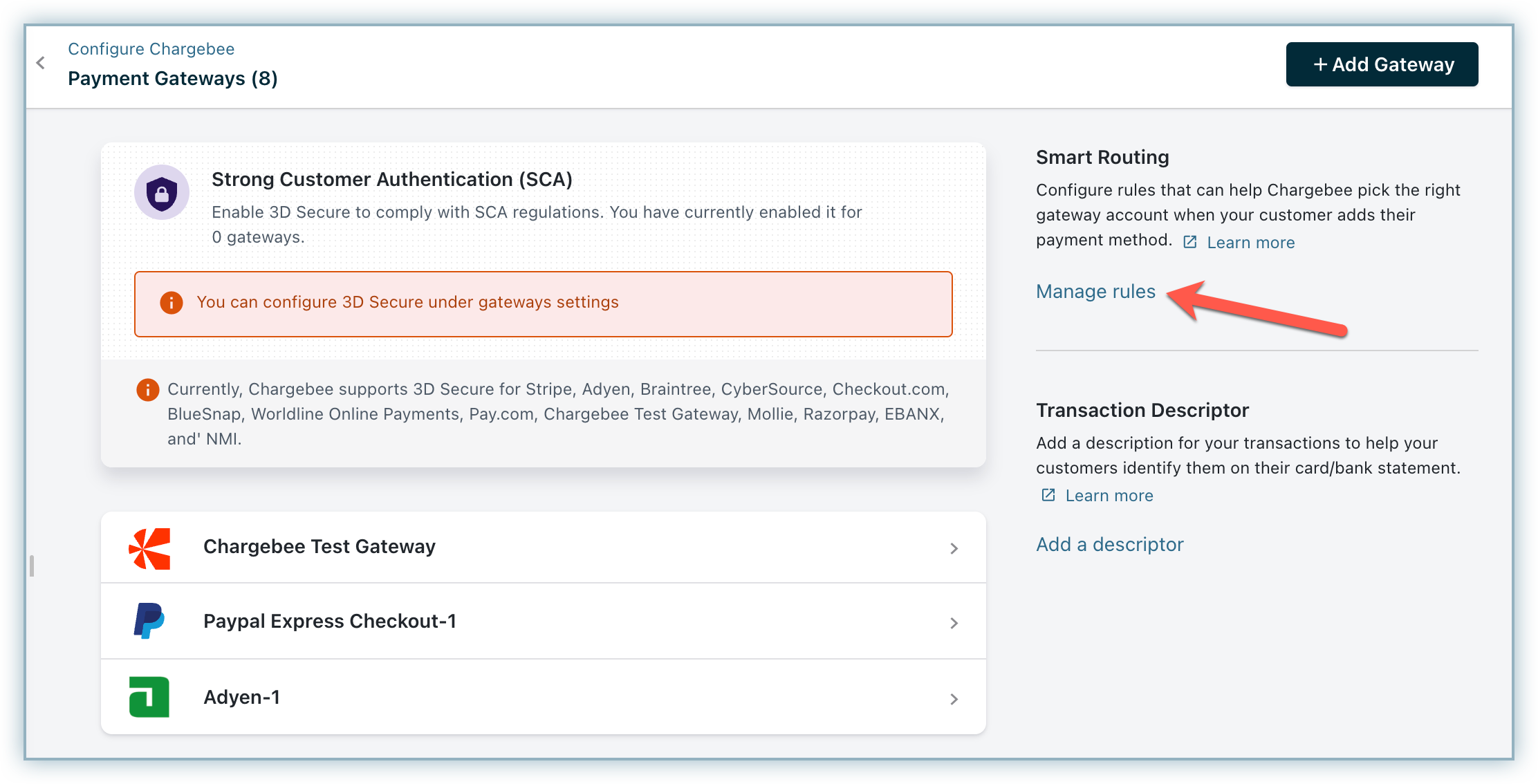

Go to Settings > Configure Chargebee > Payment Gateways.

Click Manage Rules under Smart Routing.

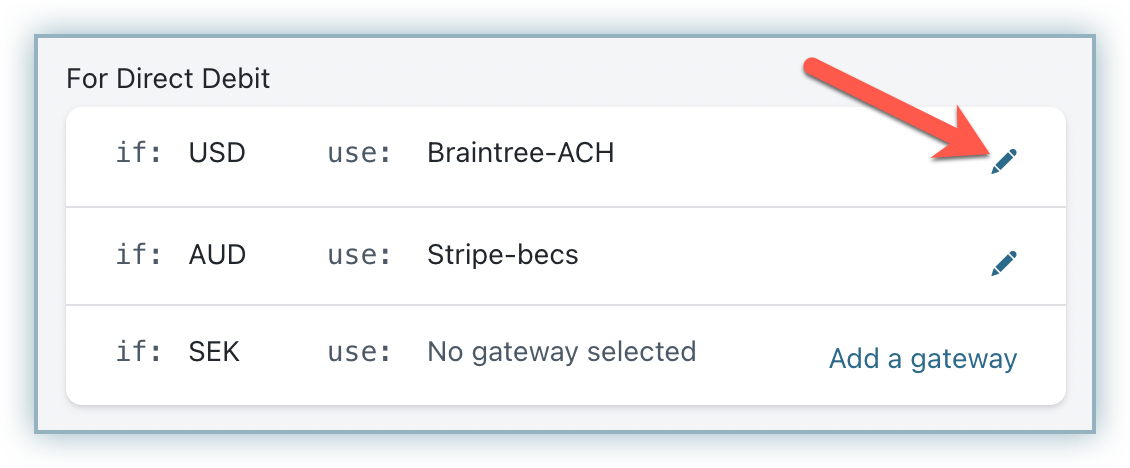

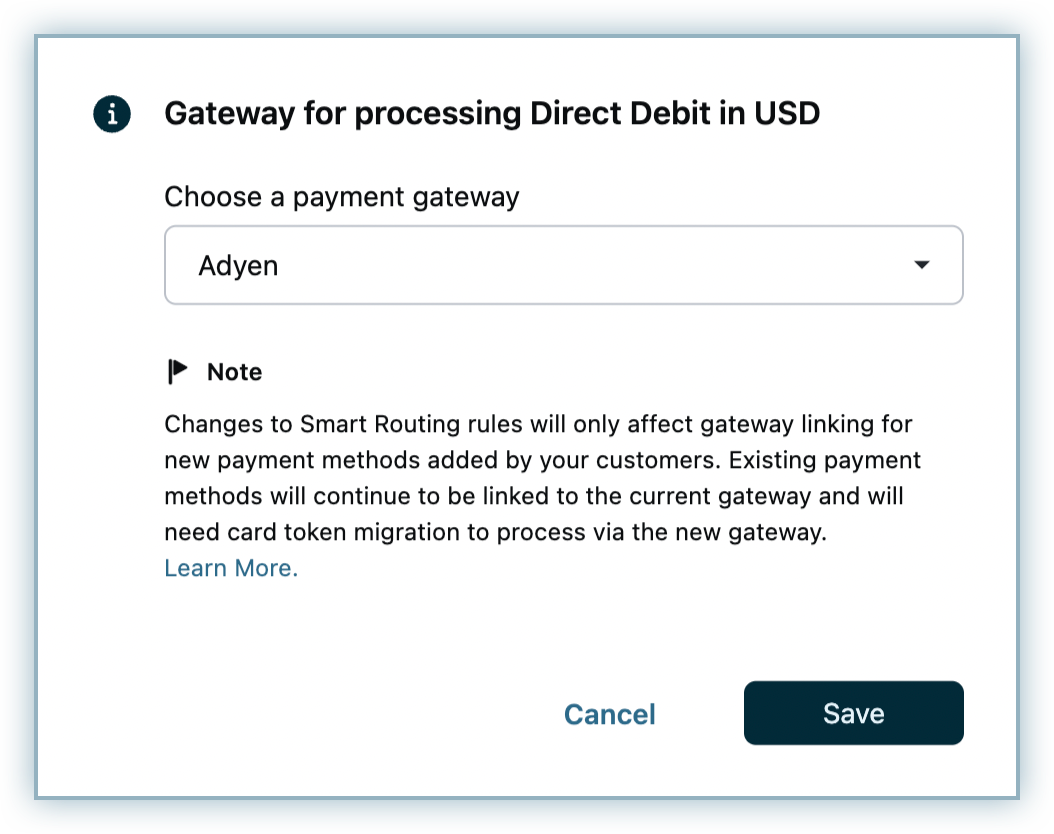

Go to the Direct Debit section and click the edit button for USD.

Select the Adyen gateway instance from your Chargebee site with ACH enabled from the Choose a payment gateway drop-down menu.

Click on Save.

If there are three consecutive payment failures using the direct debit payment method, it will be marked as invalid in Chargebee. In such cases, you should remove the existing payment method and ask your customer to add a new one.

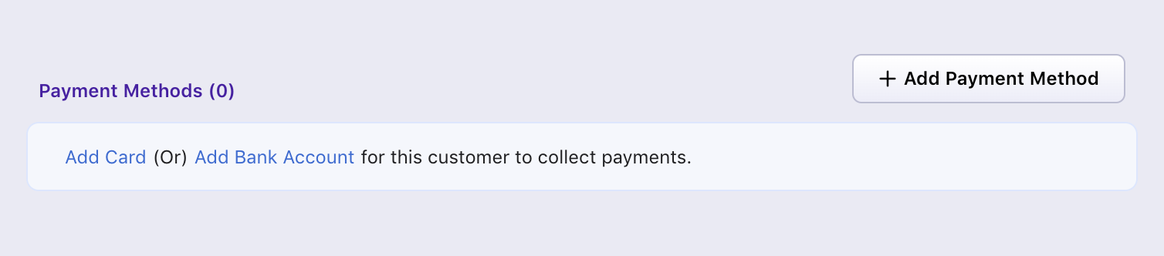

To add a customer's bank account on the Chargebee interface, navigate to the Payment Method section on the customer's details page and click Add Bank Account.

This option will be unavailable if the Allow customer to pay via their bank account option is enabled when creating this customer. Learn more

You are required to enter the following information while creating a bank account:

You can also use the Create a bank account payment source API to collect the bank details from the customer.

You can use these sample or test accounts for your testing or sandbox configuration.

accountNumber: '0000000016', routingNumber: '122105278'accountNumber: '1234567890', routingNumber: '021000021'Account Verification for this integration is done by GIACT, which is a company that provides identity verification and fraud prevention solutions. Here's a general outline of how the process might work:

For more info check this Account Validation Guide by Adyen.

Here are some important points regarding enabling GIACT verification:

Unlike card payments, where the authorization and transfer of funds happen immediately, the authorization and transfer process has a waiting period for payments via ACH. This waiting period is typically up to four business days.

This integration supports the following tokens in the mentioned format:

| Token | Description | Formal and Sample |

|---|---|---|

| Bank Account Information | Account holder name, Account number, Routing number, Account type | Format - bank_account[] |

| Permanent Token | Permanent token is the payment method ID available at the gateway. | Format payment_method[reference_id] Sample - shopperId/paymentInstrumentId |

| Chargebee Payment Intent ID | This is the Payment Intent ID returned after a successful bank authorization process in Chargebee JS | Format - payment_intent[id] |

Chargebee supports Chargeback Management with Adyen ACH integration. For ACH, Adyen notifies only about the Chargeback Lost event and not for Chargeback Initiated, hence you can configure the required settings in the Chargeback Management settings in the Chargebee app.

Learn more about configuring Chargeback Management.