How it works

Introducing Chargebee RevRec

ASC 606 / IFRS 15 Compliant

Get end-to-end, automated revenue recognition in accordance with ASC 606 / IFRS-15’s five-step model.

Protects You and Your Business

Reduce the risk of costly financial misstatements and ensure all your transactions–from simple to complex–are accurate and auditable.

Streamlines Revenue Accounting Process

Report all of your revenue from a single auditable, accounting system that seamlessly integrates with your CRM and any data sources.

Equips Finance to Scale

With a system designed by accountants for accountants, finance can be a leading source of growth for the business.

Don’t Let Manual Finance Systems Get In The Way Of Your Growth Goals

Chargebee RevRec unburdens your finance team and propels your business with automated, compliant revenue recognition. So you can spend less time in manual, error-prone finance systems and more time scaling up and enabling growth for your business.

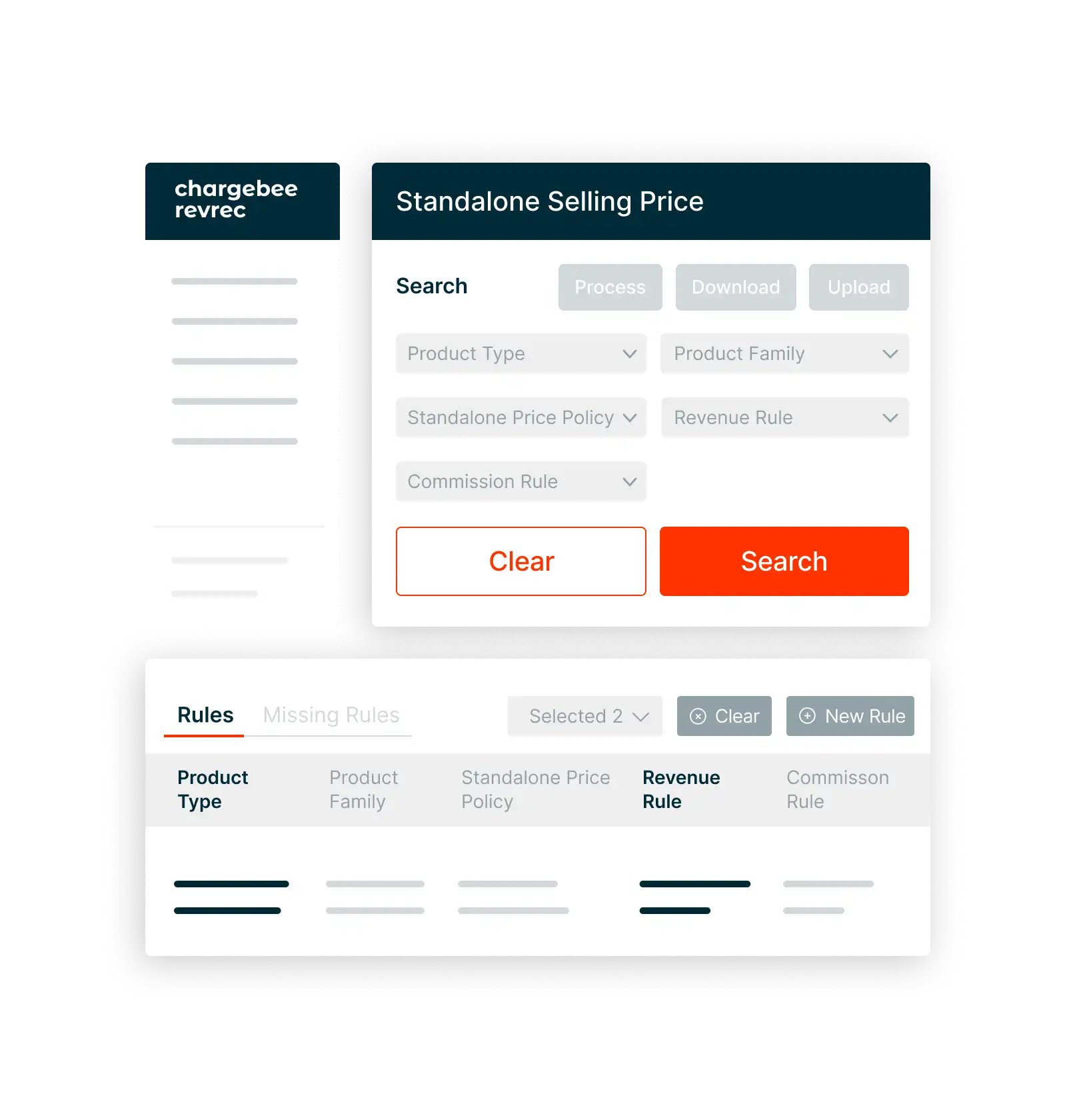

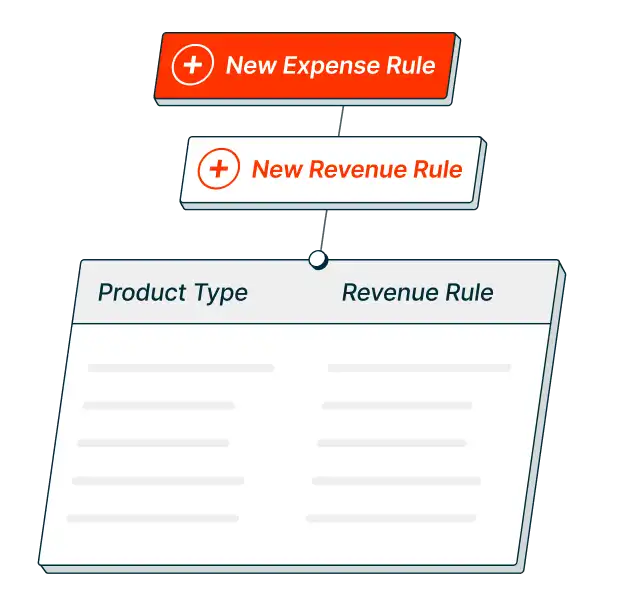

RULE-DRIVEN REVENUE MANAGEMENT

Define And Customize Revenue Recognition Rules For Your Business

Revenue recognition can get complex when you’re dealing with multiple performance obligations, mid-cycle subscription changes, cancellations, and premature renewals. Chargebee RevRec lets you define simple rules to easily manage contract revenue and commissions deferral and subsequent recognition or amortization. Define and customize rules for your business, such as:

Stand-Alone Selling Price (SSP) Library: Allows for easy allocation of revenue to products and services synched to your price book and revenue recognition policies. This enables automated allocation of revenue and avoids time-consuming data entry.

Revenue Recognition Rules: Identifies performance obligations for each product sold and determines how to defer and recognize revenue as the obligation is fulfilled.

Commissions Deferral and Amortization Rules:Identifies portions of commission to be deferred over the expected life of the customers and the recognition rules governing amortization.

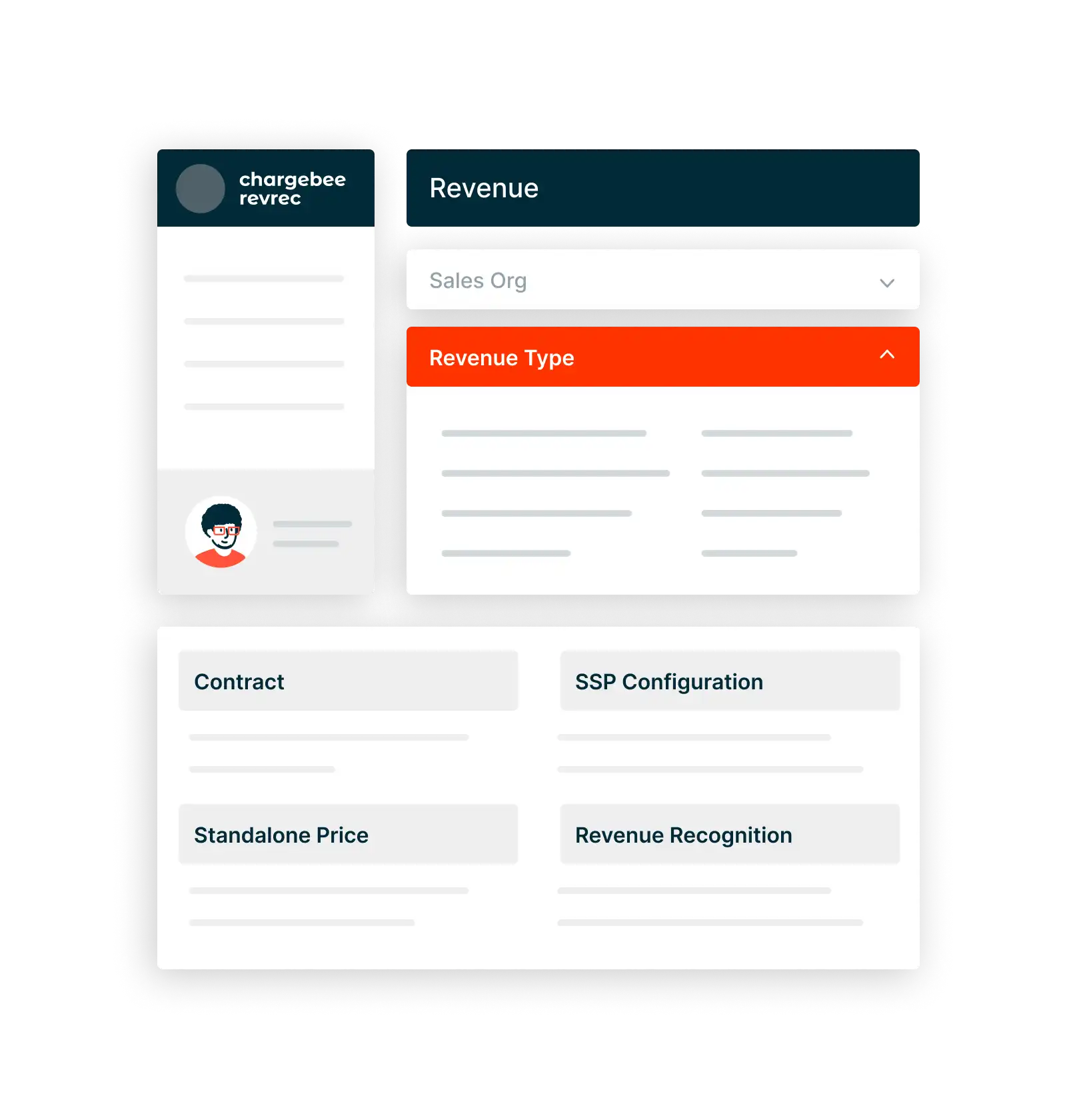

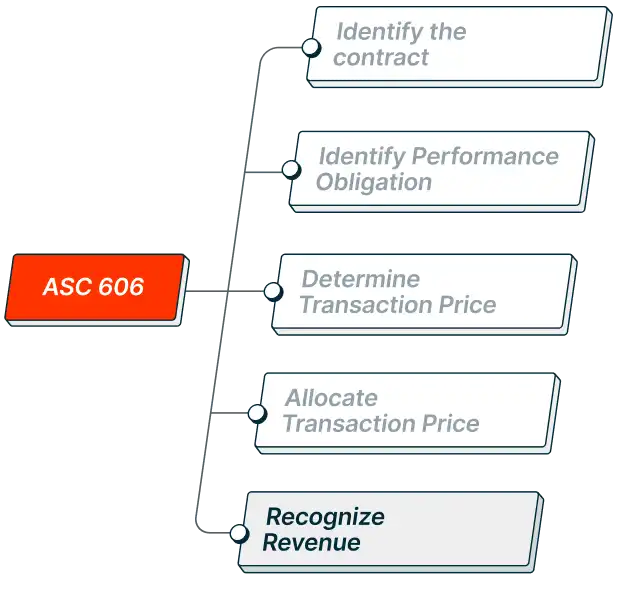

ACCOUNTING CENTRIC

Seamlessly Automate ASC 606 / IFRS-15 Compliance

A financial misstatement can be costly and detrimental to both you and your business. As customer contracts are identified, Chargebee RevRec begins an end-to-end, automated revenue recognition workflow based on ASC 606’s and IFRS 15’s five-step model:

Identify Contracts

Identify Performance Obligations

Identify Transaction Price

Allocate Transaction Price to Obligations

Recognize Revenue

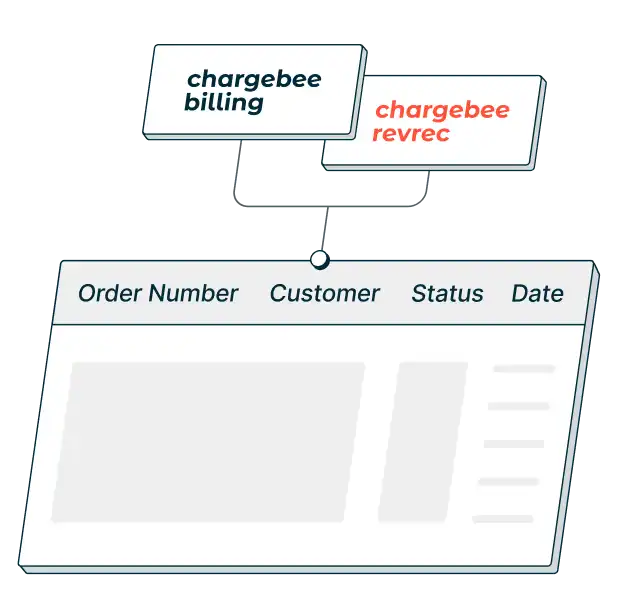

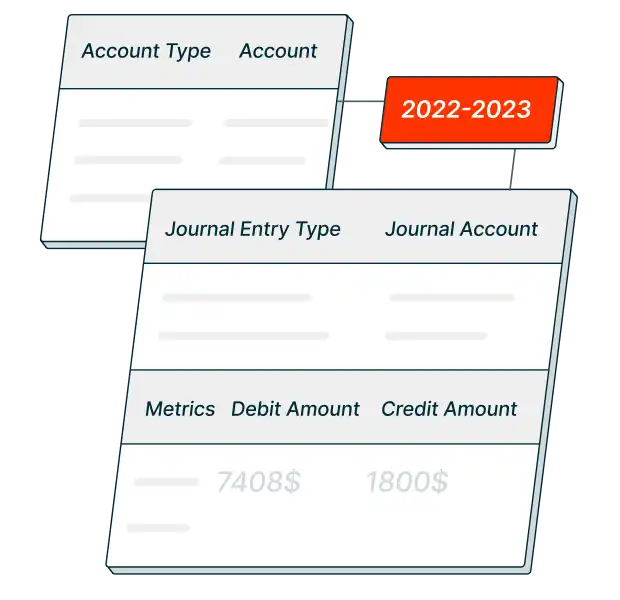

REVENUE SUBLEDGER

Establish A Revenue Subledger

How much confidence does a spreadsheet instill in your key stakeholders? Chargebee RevRec replaces any manual processes with a true accounting subledger. Run closes, book entries, track balances, and more in a single system that ensures audibility and is aligned with your accounting cycle. This subledger enables transparency, granularity, and reconciliations so you can ensure accuracy and a clear audit trail as you grow your business.

ADVANCED FINANCIAL REPORTING

Access Real-Time, Forward-Looking Reporting With Business Growth in Mind

Receive revenue reporting you can rely on at multiple levels (i.e., sales order, customer), across multiple dimensions (i.e. product line, geography, currency), and accounting periods. RevRec consistently drives financial precision and validation into your reports–past, present and future– so you can analyze trends, explain changes with precision and confidently plan strategic growth for your business. All perspectives of revenue are at your fingertips at once–bookings, billings, and revenue–so you can build custom reports and dashboards in real-time.