Trusted by

How it works

Beat involuntary churn, automatically

Help teams make data-backed decisions

Recover failed payments on time to prevent revenue leakage and build a healthier bottom line.

Align your teams to collaborate and work seamlessly

Identify possible defaulters in advance and build a focused collection strategy to avoid payment delays.

Steer clear of disputes

Track ongoing disputes and get 360-degree AR visibility at a customer level.

Integrate with your ecosystem

Leverage real-time AR insights to make smarter decisions.

Win back failed payments and reduce the risk of involuntary churn

Don't let payment failures eat into your subscription revenue. Proactively alert customers on card expiries and missing payment information to avoid disrupting their service and your recurring revenue.

PAYMENT FAILURE RECOVERY

Improve revenue recovery from failed payments

Chargebee Receivables integrates with Chargebee Billing to help you leverage insights on payment failures to avoid the risk of involuntary churn. Get detailed information about failed transactions and reason codes at each customer level to assist your teams in developing a better recovery strategy. Identify customers who have expired cards and engage with them proactively to avoid failed payments.

UNIFIED AR VIEW

Stop relying on static spreadsheets

Spreadsheets are a good productivity tool but are not to the extent of running your Finance office with them. Manual data processing and delayed insights lead to missed collection opportunities. Chargebee Receivables offers an interactive dashboard with real-time AR visibility to help you anticipate, strategize, collect, and recover payments on time.

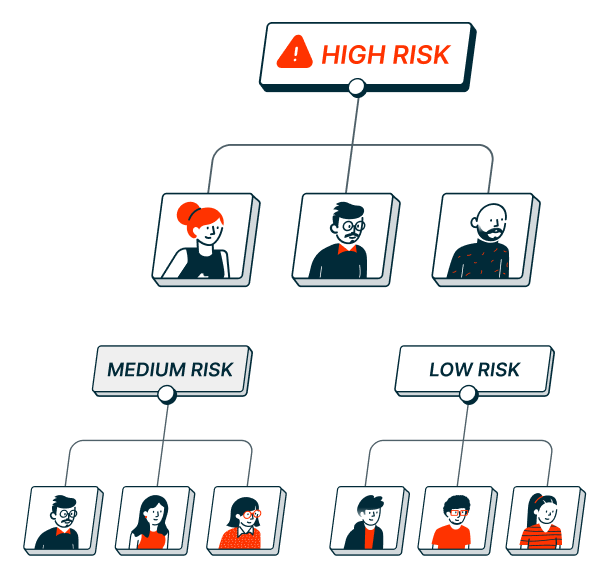

CUSTOMER SEGMENTATION

Combine automation with customization

Don't let rigid automation ruin the customer experience. Chargebee Receivables enables you to segment customers into different cohorts based on their payment history and helps you decipher your high-risk defaulters. This way, you can build a tailored collection strategy with a systematic follow-up process to increase your rate of collections.

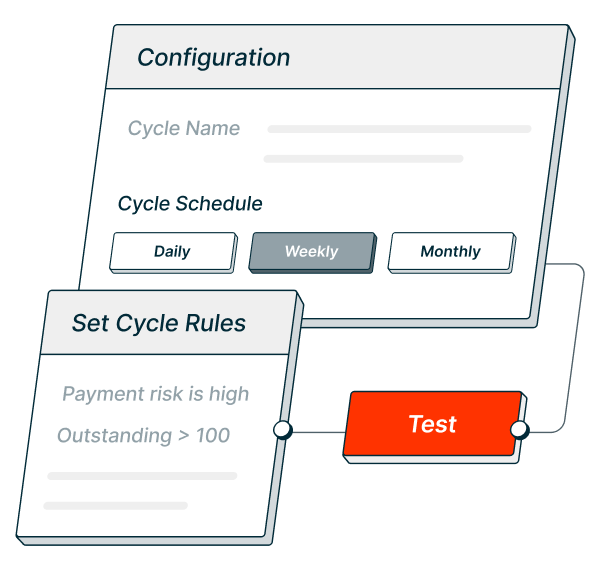

AUTO ENGAGEMENT

Scale your AR outreach with automated communication

Cut down on tasks that consume your team’s valuable time. With Chargebee Receivables, you can set up smart workflows to put your customer communication on auto-pilot. Set the frequency of emails, create customer segments, decide when to escalate a pending invoice, and set up a follow-up sequence based on customer interactions.

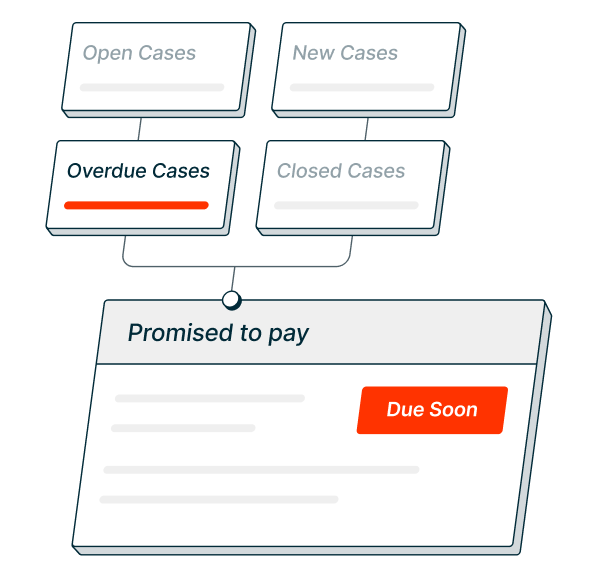

COLLECTION CRM

Everything that an AR team needs to get results

Equip your team with the data they need to collect efficiently. Chargebee Receivables offers a unified view of all the customer interactions with payment information to help collectors make informed decisions and respond to customer queries quickly. AR teams can now plan, prioritize, and collect revenue faster.

REPORT AUTOMATION

No more guesswork

Build custom reports and get them delivered to your inbox regularly to ensure you are always on top of your game. Chargebee Receivables includes pre-built reports to help track customer interactions and transactions while forecasting cash projections based on the invoice due and Promise-to-pay.