The debate on whether businesses should switch to a subscription model is long over. According to Gartner, all new software entrants and 80% of historical vendors now offer subscription-based business models. This trend can be observed across all industries and markets.

If you like the idea of recurring revenue hitting your coffers and are curious about how recurring billing works and whether it could work for your business model – you’ve come to the right place.

Let’s dive right in.

What is recurring billing?

Recurring billing is when subscription businesses charge their customers for a product or service regularly. The billing cycle frequency can be monthly, quarterly, or annually.

Basically, it is the process of ensuring subscriptions to your product or service are billed accurately and on time for each customer, accounting for global taxes, proration, payment failures, etc.

What types of businesses use recurring billing?

If you take a closer look, you’ll discover that the products you use every day utilize recurring billing. That’s the best part of subscription services — they’re convenient for the customer and provide continuous revenue to the business.

Here are some types of companies that use a recurring billing model, with examples:

- SaaS: Slack, Dropbox, Chargebee

- eCommerce & DTC: Amazon’s ‘subscribe & save,’ subscription boxes like Birchbox, Barkbox

- Entertainment: Netflix, Amazon Prime, Hulu

- Health and fitness: Practo, 24-Hour Fitness

- Education and e-learning: Udemy, Shaw Academy

- Publications: The New York Times, newsletters like ‘A Media Operator’

How does recurring billing work?

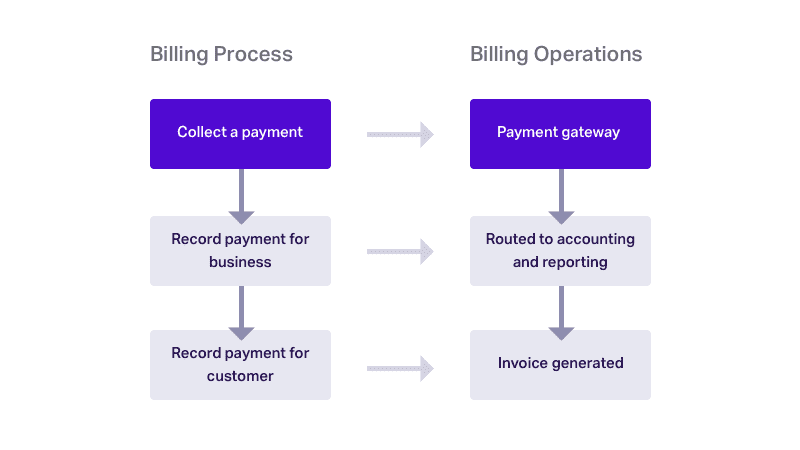

Once the customer has subscribed to your product or service, recurring billing allows you to process and accept recurring payments from them.

Payment gateways are used to process the payment securely. Once the transaction is authorized and processed, it can be routed to accounting and reporting for accurate revenue recognition.

Recurring billing software like Chargebee helps streamline this process by:

- Automating the recurring billing process and eliminating manual errors.

- Handling complex billing scenarios like upgrades, downgrades, add-ons, and taxes.

- Removing developer dependencies and giving you complete control over your billing and invoicing.

Check out how UpCodes simplified and scaled their recurring billing operations with Chargebee.

What’s Better: Monthly or Annual Subscriptions?

Annual subscriptions improve your revenue, remove the need for monthly invoicing, and put more cash in the bank. However, monthly subscriptions are flexible and relatively risk-free, giving customers a low barrier to entry.

Businesses tend to prefer annual subscriptions to increase cash flow and offer exclusive discounts or prorated refunds to encourage long-term commitment.

The best strategy is to provide both options to your customers to choose what seems more suitable.

Does Recurring Billing Work with Different Pricing Models?

There are several different kinds of SaaS pricing strategies you may be using based on your business model. Some of the most common use cases for recurring billing are seen in these pricing models:

- Usage-based billing: Here, you charge customers based on their usage of your product or service. Customers are billed post-usage on a regular schedule.

- User-based billing: SaaS software typically employed by larger teams may use a user-based billing model, where you bill the customer on a recurring basis based on the number of ‘seats’ that are serviced.

- Tiered billing: Different products or services are billed according to different tiers of pricing. When the customer chooses another bundle of features or exceeds a particular volume of features, they need to upgrade to a higher pricing tier.

If you follow any of the above, a recurring billing management platform should facilitate it and remove unnecessary complexity from your plate.

Are Recurring Payments and Subscription Billing the Same?

The terms recurring payments and subscription billing are often used interchangeably. That’s because they’re closely related and go hand-in-hand with each other.

In the recurring payment model, customers sign up and put their payment details on file, such as credit card information. They then authorize the merchant to deduct automatic payments at the agreed-upon frequency. For instance, setting up your insurance policy for automatic renewal instead of having to do it manually every year.

Similarly, subscription billing is the automatic recurring billing process after a customer signs up for a service. It could be for a subscription box of beauty supplies, a streaming service, or your favorite magazine. Customers are charged regularly on a frequency they prefer, like monthly or yearly, with the option to cancel at any time.

There are some clear benefits of recurring billing and the subscription business model, but some shortcomings exist. Let’s take a look at both sides of the coin and how you can overcome the shortcomings.

Benefits of Recurring Billing for Businesses

- Predictable revenue: Recurring billing brings more predictability to your cash flow. Recurring revenue helps cushion any unpredictable turbulence in the market. It allows businesses to scale with better forecasting leading to efficient capital allocation and a higher ROI.

- Revenue expansion opportunities: For SaaS businesses that use tiered pricing plans, it is an opportunity to expand revenue by upselling and cross-selling existing customers to higher-value plans and add-ons.

- Convenience and personalization: Recurring billing boosts customer satisfaction because customers won’t get hounded for repeated payments. It saves them time and money (longer commitments entail discounts!) and provides a personalized customer experience, such as custom-made subscription boxes.

Drawbacks of Recurring Billing

- Customer churn: Subscribers have the option to cancel anytime. If they fail to see value in your product, there’s always a chance of customer churn. That’s why focusing on customer retention is crucial for subscription businesses.

- Complex process: Recurring billing is more complicated than receiving one-off payments. There are non-recurring add-ons, multiple pricing tiers, discounts, and taxes, to name a few complications. That’s where a robust subscription management platform like Chargebee can help.

Should you build your own recurring billing system?

If you have a SaaS or subscription business or you’re planning to start one, one of the most critical and frustrating things you’ll bump against is your pricing strategy. But if your pricing is right and you provide value, your customer base is going to grow.

If at this point, you don’t use a recurring billing platform to support your pricing model, it’s like putting jet fuel in a steam engine.

As Jason Fried says:

“Complexity is like a leak in your roof. It starts small. But over time, it does real damage. And once that damage has begun, it’s hard to stop. Best not to let it happen in the first place.”

The billing needs of growing businesses are constantly evolving. An in-house system can generate invoices automatically, but the bubble will soon burst. Homegrown billing systems cannot handle the complexity of recurring billing for rapidly growing businesses that come with global expansion, pricing experiments, discounts, and add-ons.

Why homemade systems don’t work?

Recurring billing can seem easy enough to set up on your own. All you need to do is collect payments, send invoices, and record transactions. Most startups integrate with a payment gateway provider and manage to cobble together a functional billing system with a medley of tools.

Unfortunately, a “homemade” recurring billing system rarely works.

As your customer base grows, your subscription billing needs grow along with it. Your customers demand multiple payment options, the product team wants a pricing experiment, and the leadership requires coherent reports. Suddenly, you’re managing multiple payment methods and currencies, discounts, refunds, pricing changes, and consolidated invoices – for multiple products.

Any discrepancies in your reports take hours to resolve because you need to consolidate data from multiple tools. Handling sensitive data like customer information, payment details, or card information comes with its own set of compliance standards like GDPR and PCI DSS. That’s a big ask from your development team.

Every subscription business outgrows its homemade billing system; it’s not a matter of if but when. Businesses that ride out the turbulent waves of the market look towards efficiency and sustainable growth. In a precarious market, the opportunity cost of sticking with your homemade billing system could be too expensive for your business.

Setting Up Recurring Billing with Chargebee

Opting for a robust subscription billing tool early on in your growth journey can save time and reduce manual labor for your core team. In addition to recurring billing, a sophisticated billing tool like Chargebee enables you to:

- Maximize cash flow by automatically recovering failed payments and collecting offline invoices seamlessly with end-to-end AR software

- Minimize voluntary churn through personalized cancel experiences

- Monetize your product better with feature provisioning

- Automate compliance for revenue recognition and global tax laws

- Integrate with existing tools in your tech stack through APIs or out-of-the-box integrations

- Gain a 360° view of your business through exhaustive reports and ready-to-use dashboards

Recurring Billing Shouldn’t Be an Afterthought

Some of the world’s most successful subscription businesses got ahead of the competition simply because they were built to scale.

The problem is that traditional accounting software doesn’t provide the flexibility your business needs. The solution? Utilize scalable, efficient recurring billing software like Chargebee. Not only can we automate your subscription billing — we’ll also act as your growth partner, scaling with you.

Chargebee is a subscription management revenue operations platform that integrates seamlessly with your existing systems and streamlines your billing operations.