Accounting software for your business can be an invaluable tool for managing your expenses, monitoring your financial health, paying taxes, and more. Or it can be a frustrating time suck. It all comes down to the tool you choose.

For example:

- Does the software give you the information you need?

- Does your team have the skills to use it?

- Does it integrate with your existing tech?

- Does it have the right features to support your business model?

Xero or QuickBooks: A Quick Overview

Xero and QuickBooks are both major players in the accounting software industry. Both easily manage key accounting functions like transaction and expense accounting and reconciliation.

But there are key differences, too. For a quick overview of how Xero and QuickBook’s features compare, check out the table below. Then, keep reading for a deep dive into both solutions.

| Xero | QuickBooks | |

|---|---|---|

| Ideal for |

|

|

| Pricing |

|

|

| Special features |

|

|

Xero

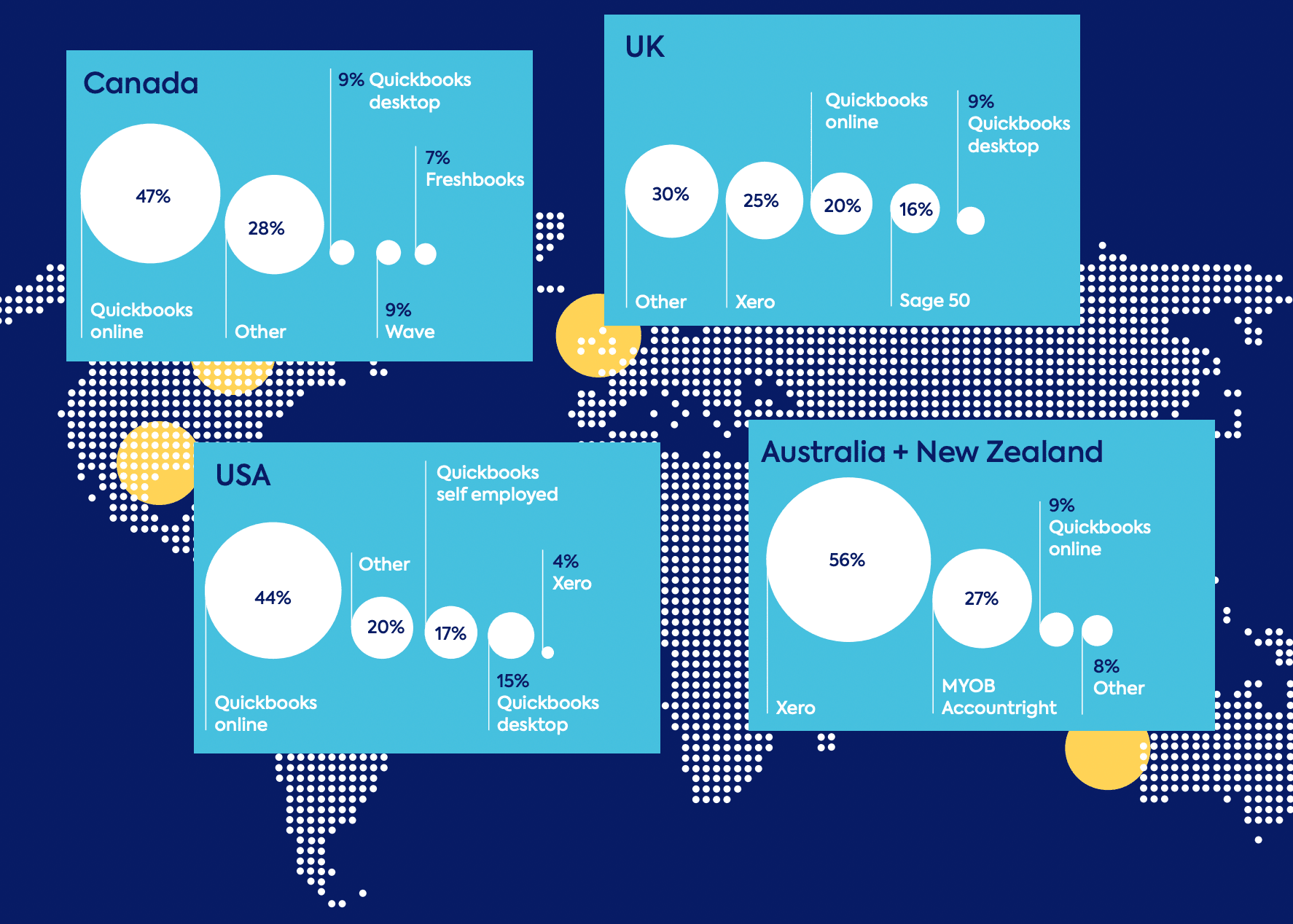

Xero is an accounting software platform that was launched in 2006. The company is based in New Zealand, and its popularity remains highest in New Zealand and Australia (56% market share) and the UK (25%).

With its intuitive interface and startup-friendly pricing, Xero is known as a platform for small businesses. It’s an all-in-one solution for managing invoicing, expense tracking, and payroll, and it syncs with your bank accounts to keep data updated in real-time.

Xero is a cloud-based solution that can be used from any device. It also offers a mobile app for Android and iOS.

Xero can integrate with more than 800 third-party applications, including tools for payments, subscription management, invoicing, payroll, CRM, and more.

QuickBooks

QuickBooks was developed by Intuit, a company founded in 1983 that also owns financial software like TurboTax and Mint. Intuit released QuickBooks in 1992 and its cloud-based version, QuickBooks Online, in 2001.

QuickBooks products, including QuickBooks Online and QuickBooks Desktop, currently have a 76% market share in the US.

Most people comparing QuickBooks with Xero are interested in the cloud-based QuickBooks Online (QBO), so this article will focus primarily on that solution and its associated mobile app for iOS and Android.

Xero or QuickBooks Online: Deep Dive Comparison

You probably noticed from the above summaries that Xero and QuickBooks sound pretty similar. They’re both strong solutions that meet all of the standard accounting needs and offer lots of extras.

But they do differ in the details, so we’re going to dig a little deeper and compare Xero and QuickBooks in the areas of:

- Pricing

- Reporting

- Transaction and expense tracking

- Accountant invites

- Time tracking

- Project management

- Customer service

- Invoicing

- Integrations

- Mobile app quality

- Number of users

- User interface

- Inventory management

- Reconciliation and bank feeds

- Payroll

- Contact management

Pricing

When looking into new software solutions, most businesses have one big question on their minds: how much does it cost? No matter how great the features are, business accounting software that breaks the bank isn’t worth it.

For quick reference, here’s how Xero compares to QuickBooks in terms of pricing:

| Xero | QuickBooks |

|---|---|

|

|

Let’s start by looking at Xero. Xero offers three pricing plans:

- Early: $12 per month

- Growing: $34 per month

- Established: $65 per month

All of Xero’s plans let you have unlimited users. That’s a big deal for small businesses with a limited budget but a lot of team members.

The cheapest plan, Early, lets you send 20 invoices and enter five bills. It does have some limitations. For example, you can’t bulk reconcile transactions, and you don’t have access to Xero’s most advanced analytics.

The Growing and Established plans don’t limit your invoices and bills. All plans offer a 30-day free trial.

So how does that compare to QuickBooks? QuickBooks Online has four plans:

- Simple Start: $30 per month

- Essentials: $55 per month

- Plus: $85 per month

- Advanced: $200 per month

The first thing you’ll notice is that Simple Start, the cheapest plan, is still more expensive than Xero’s Early (and almost as expensive as its mid-tier plan, Growing). And with Simple Start, you only get a single user. Essentials allows three users, Plus allows five, and even QBO’s highest-tier plan, Advanced, only lets you have 25 users.

Reporting

Both QuickBooks and Xero offer a number of reports to keep you updated on your financial situation.

QBO offers 120+ financial reports, all of which are available with the Plus and Advanced plans. The most basic plan, Simple Start, still offers 50+ of these reports.

QuickBooks reports come in three varieties:

- Standard reports: Out-of-the-box reports, ideal for internal use

- Custom reports: Customized reports that can be reused

- Management reports: Reports with a cover page, table of contents, preliminary pages, and end notes

You can pull these reports or schedule them to run at a specific time, like every quarter.

Xero also offers a variety of pre-built reports. It also have customization options and continues to roll out new reporting features.

Some companies may find that they need reports that neither QuickBooks nor Xero can offer. Both solutions offer integrations that can enhance their reporting capabilities.

Transaction and Expense Tracking

Businesses of all types and sizes need to track their transactions and expenses. Any accounting software will offer some kind of expense tracking, but they don’t all do it the same way.

Both QuickBooks and Xero offer both manual and automatic tracking. That means you can enter the transactions yourself or sync your account to a bank or credit card account to add transactions in real-time.

Both solutions also allow you to tag different categories of expenses. However, Xero only allows four total tracking categories — two active and two archived. All of the QuickBooks Online plans, on the other hand, let users create up to 40 tags.

If you’re just starting out, both tools also allow you to import historical transactions. Overall, QuickBooks and Xero are relatively equal in terms of transaction and expense tracking unless tagging your transactions is an important feature to you.

Accountant Invites

If your business works with an accountant, you’ll want to loop them into your online accounting software account. Luckily, both Xero and QuickBooks make this possible.

Xero lets you invite your accountant via email and assign them “advisor” permissions. With QuickBooks, you can also send an email invitation to your accountant. QBO also has accountant-specific features they can use, like the ability to undo reconciliations, reclassify transactions, and write off invoices.

Time Tracking

Some businesses need to track the time spent on a particular job or project. This is important if you need to create invoices based on hours worked.

Xero users can only track time if they have the highest-tier Established plan for $65 per month, whereas QuickBooks Online offers time tracking starting with the $55 per month Essentials plan.

Project Management

Project management features let you track the financial side of your projects. This can include tracking time, creating quotes, logging job expenses, and more.

Both QuickBooks and Xero offer project management. QBO’s project management features start with the Plus plan. You can connect invoices, expenses, and transactions to individual projects, pull reports to see the project’s profitability and identify invoices that need to be sent and non-billable time.

Xero Projects is Xero’s tool for project management. Xero Projects helps you prepare estimates and quotes, send personalized invoices, track project costs, and view project visibility. You get it with the established plan, which is cheaper at $65 per month than QBO’s plus plan.

Xero also has a standalone project management tool, Workflowmax, that starts at $20 per month for a single user.

Xero is the winner for project management, with robust features at a lower price point.

Customer Service and Support

No matter how amazing your accounting software is, there will come a time when you need help from customer support.

Xero’s support is primarily online — no phone number is provided. The good news is that customer service is available 24/7 for users of all plans.

QuickBooks Advanced plan users can access 24/7 phone and chat customer service. Other plans still have online chat and phone options, but the hours are more limited.

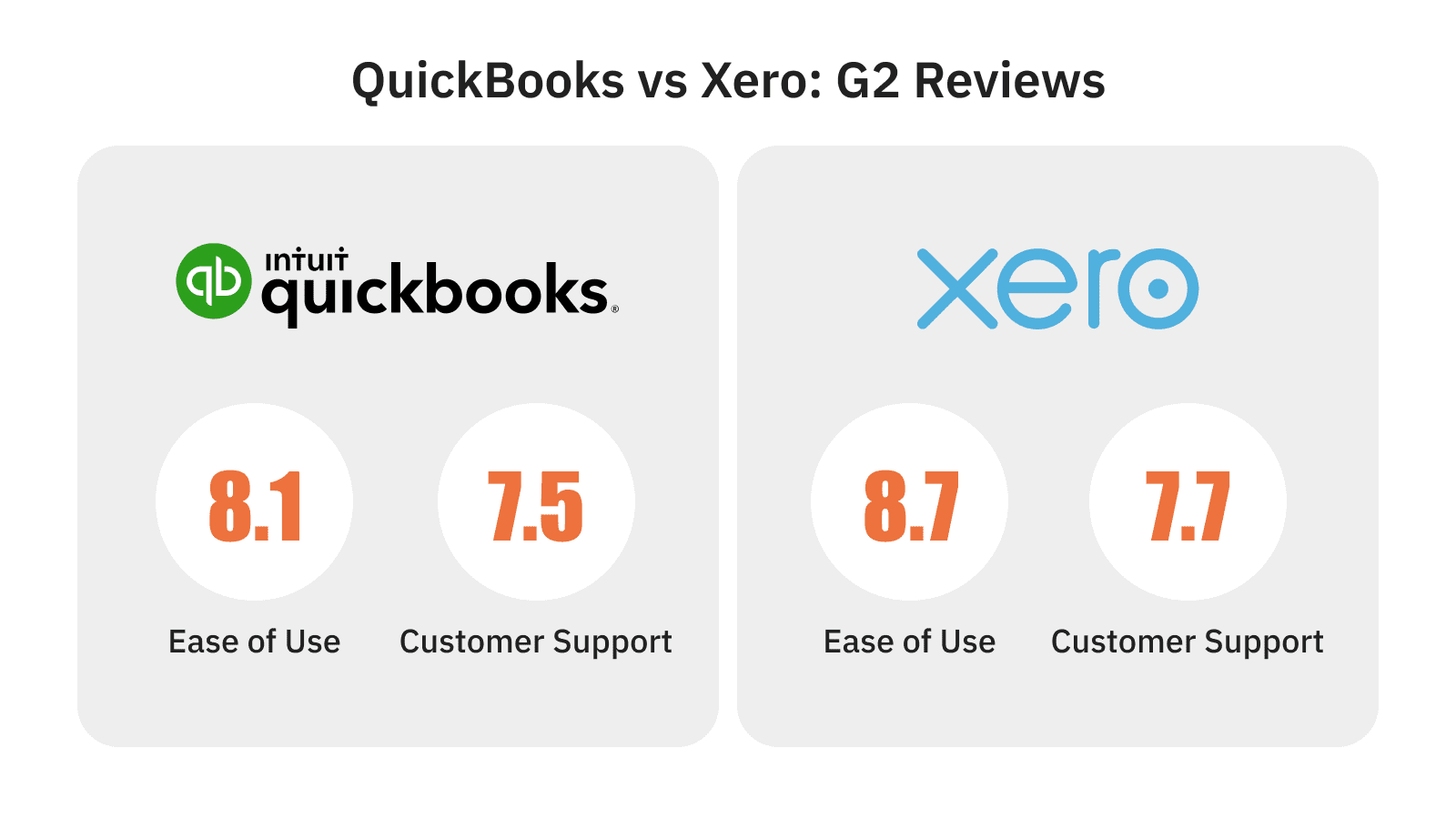

Xero’s customer service is held in higher regard. On software review site G2, it gets a 7.7 rating for “Quality of Support.” This is below G2’s accounting average of 8.2 but just above QuickBooks Online’s score of 7.5.

Invoicing

For businesses that rely on invoicing, generating and sending accurate invoices is a critical feature of accounting software.

Let’s start by talking about how many invoices you can send. With QuickBooks Online, there’s no limit. Even if you’re on the low-tier Simple Start plan, you can send unlimited invoices.

The same is true for Xero’s Growing and Established plans. As you may recall, Xero Growing is $34 per month, while QuickBooks Online’s cheapest plan, Simple Start, is $30. So unlimited invoices with QBO and Xero are around the same price.

However, with Xero’s Early plan, you can send up to 20 invoices per year. If that’s all you need, it’s a plan worth considering.

Of course, quality is also important. Both solutions have strong invoicing features. Xero lets you send invoices via email that includes online payment options. If a payment is made online, Xero will automatically apply it.

Xero also makes it easy to see a summary view of all your invoices and their current status.

QuickBooks also has excellent invoicing capabilities. Like Xero, you can choose to have online payments applied automatically. One advantage of QBO over Xero is that it lets you update details about the client directly in the invoice rather than needing to go through their contact record.

Overall, invoicing is a tie between Xero and QuickBooks. However, if you only need to send 20 or fewer invoices and can get away with using Xero’s low-tier Early plan, that’s your most cost-effective option.

Integrations

Integrations let you connect your accounting software to your existing tech stack. You can also use integrations to enhance the functionality of the software. For example, both platforms integrate with PayPal to let you automatically add PayPal transactions to your books and reconcile them.

Xero offers over 800 integrations and add-ons in its app store, including HubSpot CRM, MailChimp, Stripe, Chargebee and EzzyBills. QuickBooks has over 650 integrations, including Shopify, Square, Amazon Business, and SOS Industry.

We could give this one to Xero since it has more total integrations, but both solutions offer a wide variety of options.

The best choice depends on your needs — go through your existing business software and financial tools and see which platform they’ll integrate with. Also, consider whether you want to add other services, like payroll or inventory management, that are available through integrations.

Mobile App

Both QuickBooks and Xero offer apps for Android and iOS so you can track and manage your accounting information on the go.

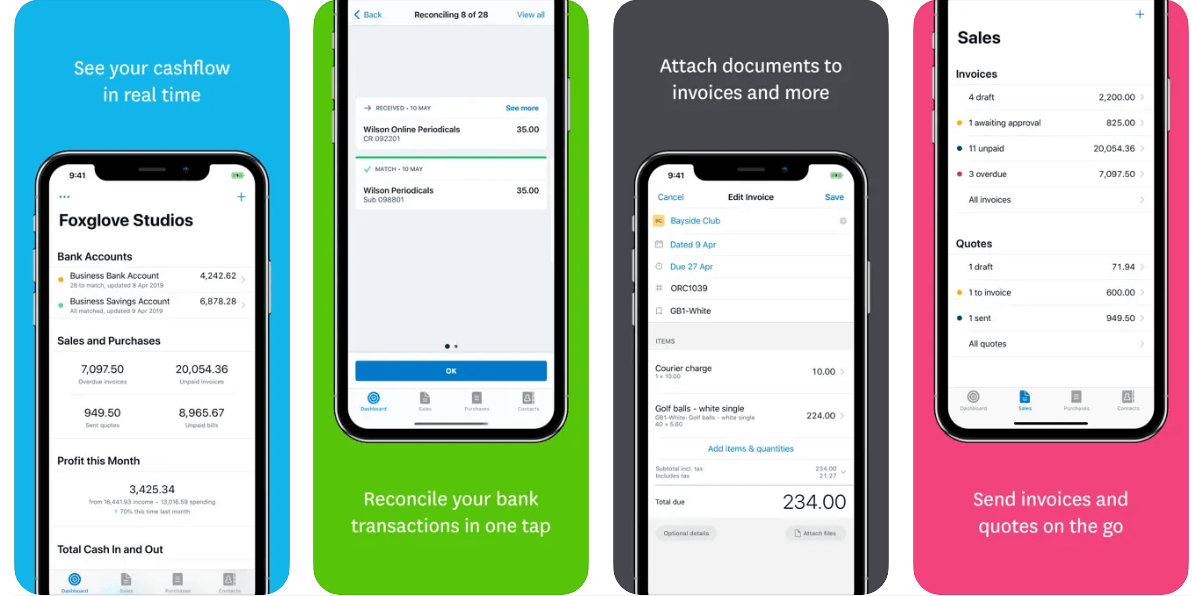

The Xero Mobile Accounting app lets you see your cash flow in real-time, reconcile your bank transactions in a single tap, track the status of your invoices and quotes, and call customers and suppliers directly from the app, among other things. It has been downloaded over 1 million times from Google Play.

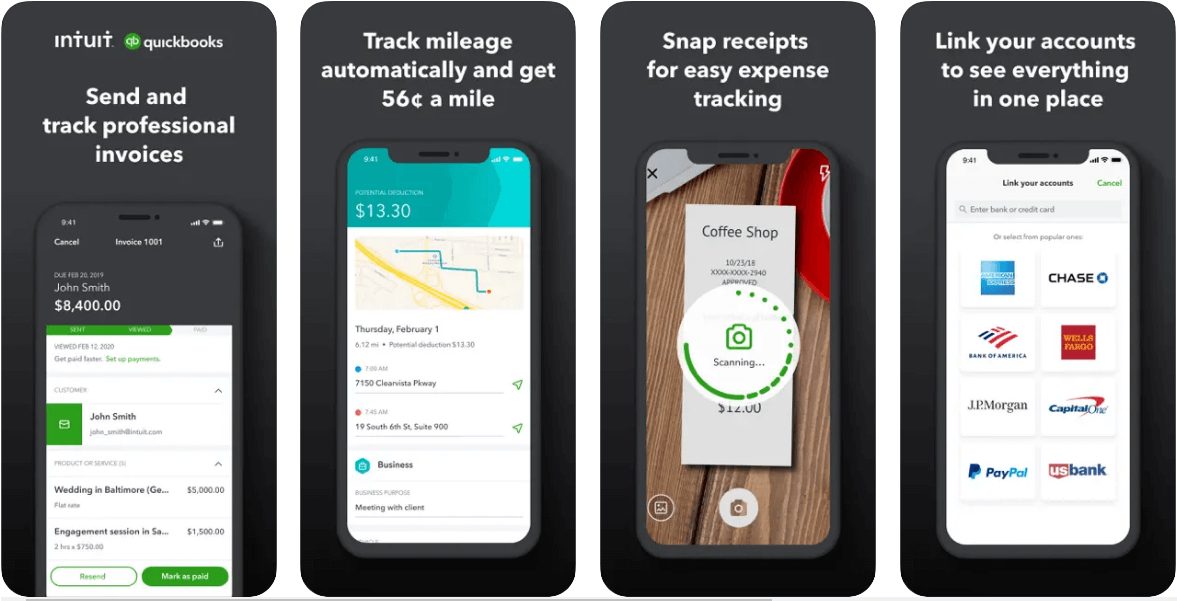

The QuickBooks Online app promises to help you log miles, create invoices, maintain finances and cash flow, and track your profit and loss reports. It has been downloaded over 5 million times from Google Play.

So which app do users prefer? It’s essentially a tie.

On Google Play, the Xero app for Android has a 4.1 rating, while the QuickBooks app is just behind it at 4.0. But on iOS, Xero is rated 4.5, and QuickBooks takes a slight lead at 4.7.

These apps are pretty similar in quality. It comes down to personal preference.

Maximum Users

A major selling point of Xero is that you can have unlimited users on your account. This is true on all plans.

With QuickBooks, the number of users you can have scales with your plan:

- Simple Start: 1 user and 2 accounting firms.

- Essentials: 3 users and 2 accounting firms.

- Plus: 5 users and 2 accounting firms.

- Advanced: 25 users and 3 accounting firms.

This makes Xero the favorite for large businesses with more than 25 users and small businesses that need several users on the account.

Allowing unlimited users is also great for scalability. If you’re a small firm that only has one accounting software user, you could choose QuickBooks Simple Start or Xero Early or Growing. But as soon as you have five users, you need to upgrade to QuickBooks Plus for $85 per month — over twice the cost of Xero Growing.

One Xero review says:

“The fact that I can add unlimited users is fantastic, especially during the current rise in home based users.”

User Interface

The user experience is as important as any feature of your accounting solution. New users, even non-experts, should be able to quickly understand how to use the software. And everyone appreciates a clean, attractive UI.

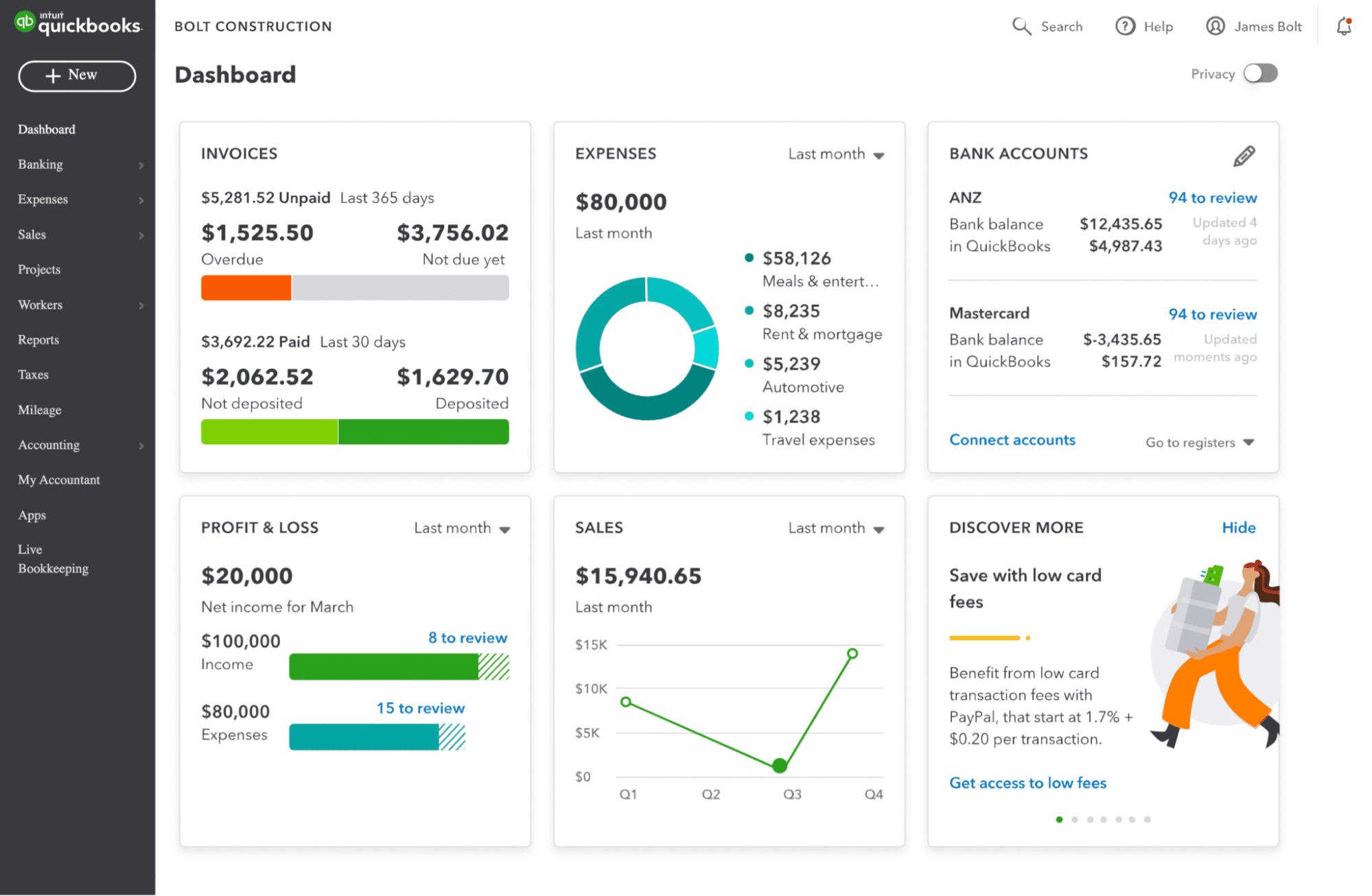

Both tools have an intuitive, user-friendly interface. A QuickBooks Online dashboard is pictured below. It’s clean and easy to understand.

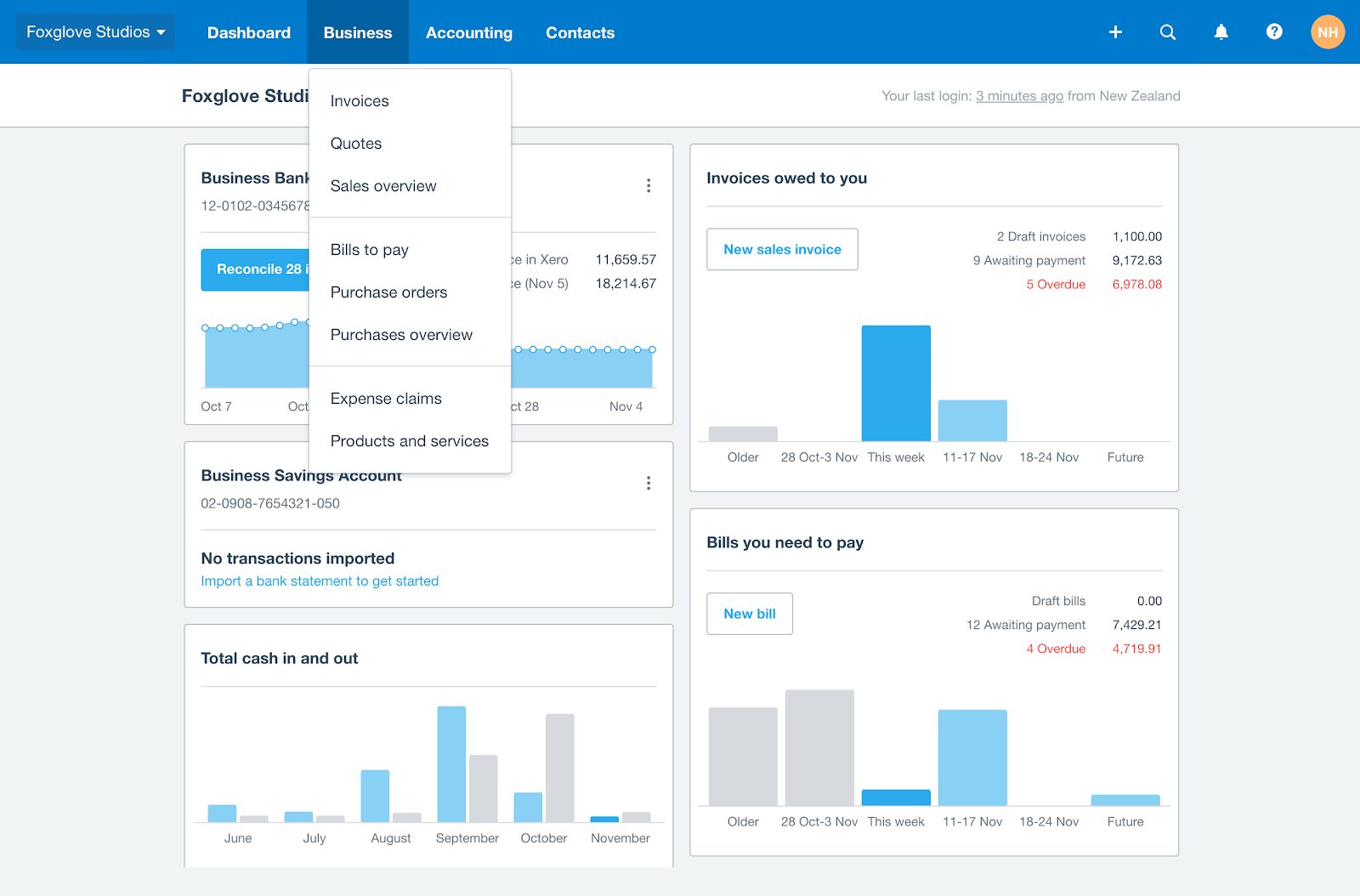

Xero has a sleek, modern look that may be more popular with startups and others new to accounting. Many reviews of Xero talk about its interface, including this one:

“I believe Xero have captured a very nice niche of the industry with it’s very business orientated user interface and simplistic feel. It makes accounting somewhat fun for the business owner.”

Another says:

This accounting software is very user-friendly for every type of person. You don’t have to have an excellent knowledge of accounting principles to use this software.

User interface, to some extent, will always be a matter of personal preference. But if we look at the stats, we have to give the win to Xero, thanks to its shallow learning curve.

On G2, Xero gets an 8.7 in the “Ease of Use” category. Compare that to the industry average of 8.4. QuickBooks falls behind both at 8.1.

Inventory Management

Inventory management features help you track and manage the items you have in stock.

Xero offers inventory management with all of its plans. You can add products, track what you have in stock, see what’s selling, and add item details to invoices. But Xero lacks some inventory features that QuickBooks has, like low-stock alerts, more advanced sorting of item types, and deeper analysis of sales.

Before you decide that QuickBooks is the better choice for inventory management, you should know that its inventory features are only available with the Plus and Advanced plans.

If you’re looking for a low-cost solution that includes inventory management, go for Xero.

Don’t forget that both solutions offer integrations with third-party inventory management applications.

Reconciliation and Bank Feeds

Reconciliation is the process of comparing two sets of records to check that the figures are correct and in agreement. When it comes to accounting software, that usually means checking your bank or payment service accounts against the transaction records in the software.

Reconciliation works a bit differently in Xero and QuickBooks.

With Xero, when you go to the Reconcile tab, the page is divided into two columns: “Review your bank statement“ and “Match with your transactions in Xero.” You can confirm each match one by one.

QBO also has a Reconcile tab that shows you a single list of transactions. You can go through and check off each transaction that matches up with an expense from that month’s bank statement.

Another difference is that Xero requires you to upload bank statements to complete reconciliation. QuickBooks Online lets you perform bank reconciliation without importing your bank activity.

Contact Management

Your business probably has a long list of contacts like customers and suppliers. Contact management systems help you keep track of their information.

The clear winner in this category is Xero, which offers a more impressive feature set, including smart lists for targeting specific customers. With Xero, you can also see your contact’s complete transaction history and view all of your email correspondence with them from a central location.

QuickBooks lets you see all of your customers and what they owe you. You can filter the list by a few criteria, like who has overdue invoices and who paid recently. You can also add custom invoicing details to your contact record, such as whether the customer is exempt from sales tax.

Payroll

Payroll software manages and automates payments to your employees. Both Xero and Quickbooks online offer payroll features as an add-on to their regular plans.

Xero’s payroll is through a deep integration with a third-party service called Gusto. The integration starts at $39 per month plus $6 per month per person. Gusto lets you automate payroll filing, taxes, and deductions. There’s also a self-service feature that lets employees view their paystubs and W-2s online.

QuickBooks has a native add-on called QuickBooks Payroll. QuickBooks Payroll comes in Core and Premium versions. The cheapest combo, QuickBooks Simple Start + Payroll Core, is $75 per month plus $5 per person. The monthly subscription price is a bit higher than Xero’s Gusto integration, but the price per user is lower, and it also has a few extra features like local tax filing.

SaaS Accounting and Finance Operations Made Easy With Chargebee

SaaS and other subscription-based businesses have their own financial challenges, like managing recurring billing and revenue recognition.

If you’re a SaaS or subscription business owner — or if you’re a traditional business looking to adopt a subscription business model — Chargebee can help.

Whether you choose QuickBooks or Xero, Chargebee can sync your subscription management engine with your accounting software. Easily handle deferred revenue, generate invoices, streamline payments, and reconcile your bank account.

As a Chargebee and Xero user says:

“Earlier we weren’t able to deep dive into the impact churn or expansion had on our recurring revenue. With Chargebee, we’ve grown our MRR by over 35% in the last 8 months & reduced churn by over 100%.”

Chargebee provides integrations with both Xero and QuickBooks, allowing you to automate your SaaS accounting with your preferred accounting solution.