What is Account Reconciliation?

Account reconciliation is an essential part of accounting, and it’s something that everyone in the financial team has to deal with – from the controller to the accountants.

Reconciliation is simple: it’s the process that compares internal financial statements against external statements from a bank or other financial institution, making sure everything is in alignment – and fixing any errors.

It’s a subject we’ve been covering lately – because Chargebee can help solve the reconciliation problem many organizations face. You might be experiencing it, dealing with human error, and checking financial statements (your balance sheet against the bank statement) multiple times. More on that later.

Let’s jump in and take a look at all of the details you’ll need to consider when thinking about account reconciliation, including how to manage your time and your team during a potentially arduous process. If you’re interested in cutting back on time and team effort, check out this blog post on automating reconciliation.

What Does Your Month-End Look Like?

The month-end is the craziest time of the month for accountants (unless it’s quarter-end or year-end). You’re working hard to get all of your balance sheets in order, and there is a lot of pressure to get those books turned around as quickly as possible and make sure it’s error-free. However, fast can be a relative term, and depending on your organization and how much more you need to do manually (or without automation), it may take you longer.

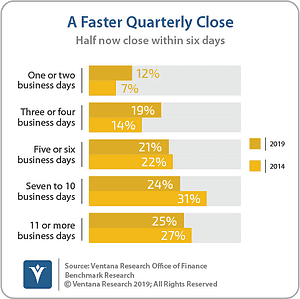

But what does month-end look like for your organization? If you find that you’re still slogging through manual processes, you may fall into this category: having a slower-than-average close (11 or more business days).

Related Resource: Learn about Account Reconciliation Tools

Closing Your Books Faster Than Ever Before? Thank Automation

There is some good news, though. In 2019, Ventana Research, leading benchmark research, and advisory services firm, noted that more organizations are closing their quarter faster than ever before. Take a look at the graph below, showing how fast organizations have started to close the quarter between 2014 and 2019.

In addition to the graph showing quarterly close, Ventana Research also notes that in 2019, 61% of respondents said their company completes its monthly closing within six business days. Compared to the 53% in 2015 – an 8% jump. Even more impressive is how 46% finish their monthly within four business days compared to the previous rate of 29% in 2015.

The jump in efficiency is rooted in automation, as 88% of companies closed within six business days use automation in almost every aspect of their closing.

But even without automation at the forefront of the month-end closing, you will need to have some controls in place to ensure that your accounting processes, including reconciliation, move smoothly. Let’s take a look at those internal controls next.

What Are Your Internal Controls?

For the finance team, setting up internal controls is paramount – because these controls can highlight issues from clerical errors to process hiccups and even help catch fraud. It is likely one of the first things your company or department needs to set up as the business is being created. These internal controls are procedures that your company implements to ensure integrity and prevent fraud.

Having these controls in place will help mitigate some of the risks – it is crucial for consistent financial statements.

As your organization grows, so will your internal controls. As noted by AccountingTools, one of the most comprehensive sources for accounting information online, internal controls cannot prevent fraud. Still, they assist with keeping an eye out for any potential issues like fraud. There are three main types of internal controls, including:

- Detective controls – controls to highlight the problems with the accounting processes.

- Preventative controls – controls put into place to help clerical accuracy and prevent employee fraud.

- Corrective controls – controls put in place to correct errors found by detective controls.

The financial controller is usually responsible for ensuring these controls are in place and effective. You can ensure these internal controls are in place through increased oversight, restricting access to financial systems, or having your statements reviewed by an outside source, like a CPA.

What is the Account Reconciliation Process Like?

Now that you know the internal controls you will need to put into place, it’s time to figure out your reconciliation process. What does that process currently look like for you and your team? A lot of manual entries? Preventable errors? With automation, like the one that Chargebee has with Xero, you can prevent a lot of that.

For reconciliation, you need to get a few things if you’re going to partake in the process manually. Let’s discuss that before diving into what the process will look like with automation.

Here are the materials you need to get started manually:

- Obtain your bank records – this will be the list of transactions from your bank.

- Grab your general ledger – this is going to be the list of your income and outgoings.

As for an automated approach, all you’ll need is software (like Chargebee’s RevRec) and perhaps an integration to go with that software, like Chargebee and Xero or Chargebee and Quickbooks, that can

Now that you have the materials you need to run the process manually or with automation, let’s go through the steps:

- You will need to start where you last left off, whether at the end of last quarter, last month, or last week.

- Through every bank deposit and every account in the general ledger, your accountants will verify that everything is complete and accurate.

- This will involve comparing the general ledger balance line with independent systems and corroborating documentation, such as credit card statements.

- Ensure that you’re using your internal controls, so if/when you find any discrepancies, your accountants have measures to investigate these errors and make corrections to the balance sheets.

- Once you complete reconciliation – all your discrepancies are found and corrected, any analysis performed, you must store everything for auditing purposes later down the line.

A company must complete reconciliation before certifying its financial information and issuing its financial statements.

For more details on the bank reconciliation, check out Xero’s blog.

What Causes Reconciliation Discrepancies?

A reconciliation discrepancy can be caused by many reasons, from errors at the bank to deposits still in transit or even fraud. Most discrepancies will fall into one of these categories:

- Fraud

- Timing Differences (for example, being in a different time zone)

- Missing Transactions

- Mistakes or Human Error

Mistakes and human error are probably the most common reconciliation discrepancies and can happen at any point during the transaction. It could be a formula error on your spreadsheet, the bank misreading a check, or even a number that was keyed in incorrectly.

It can be a tangled web to unweave, especially when other issues are present, such as missing transactions or fees from credit cards. Fraud happens and can be hard to detect and challenging to investigate.

But, reaching that moment of reconciliation is very sweet – even if the manual process can be time-consuming. However, to keep the process from consuming so much of your team’s time, you can automate your reconciliation process with Xero and Chargebee, Quickbooks and Chargebee, or other software and integrations.

Benefits of Automating Reconciliations

Automation has a few significant benefits, including:

- Speed of Close – As mentioned above, organizations that use automation close much faster than organizations that don’t. Some of these organizations that still close manually have quarterly closes that can last for more than 11 days.

- Standardization of Processes – You can automatically run your month-end and quarter-end processes with automation. And that means that you will be able to close faster and with improved accuracy and more time for the finance team to focus on other objectives.

- Reduction of Human Error – Human error can lead to a lot of wasted time and manual effort – making sure that all the reconciliation errors are corrected and manually entering corrections – you can avoid all of these with automation.

For example, human error led to wasted time and manual effort for Chargebee customer, Animalz. Before moving to Chargebee, Animalz had to deal with manual payment reconciliation and erroneously reported revenue based on incorrect accrual accounting that was manually entered, leading to inaccurate revenue reporting. These human errors are preventable and fixable, which Animalz did with Chargebee. You can read more about how they automated offline payments reconciliation and reduced human error here.

For more on account reconciliation, the importance of automating it, and how to automate it, read our blog: It’s Time to Automate Your Most Error-Prone Process: Reconciliation.

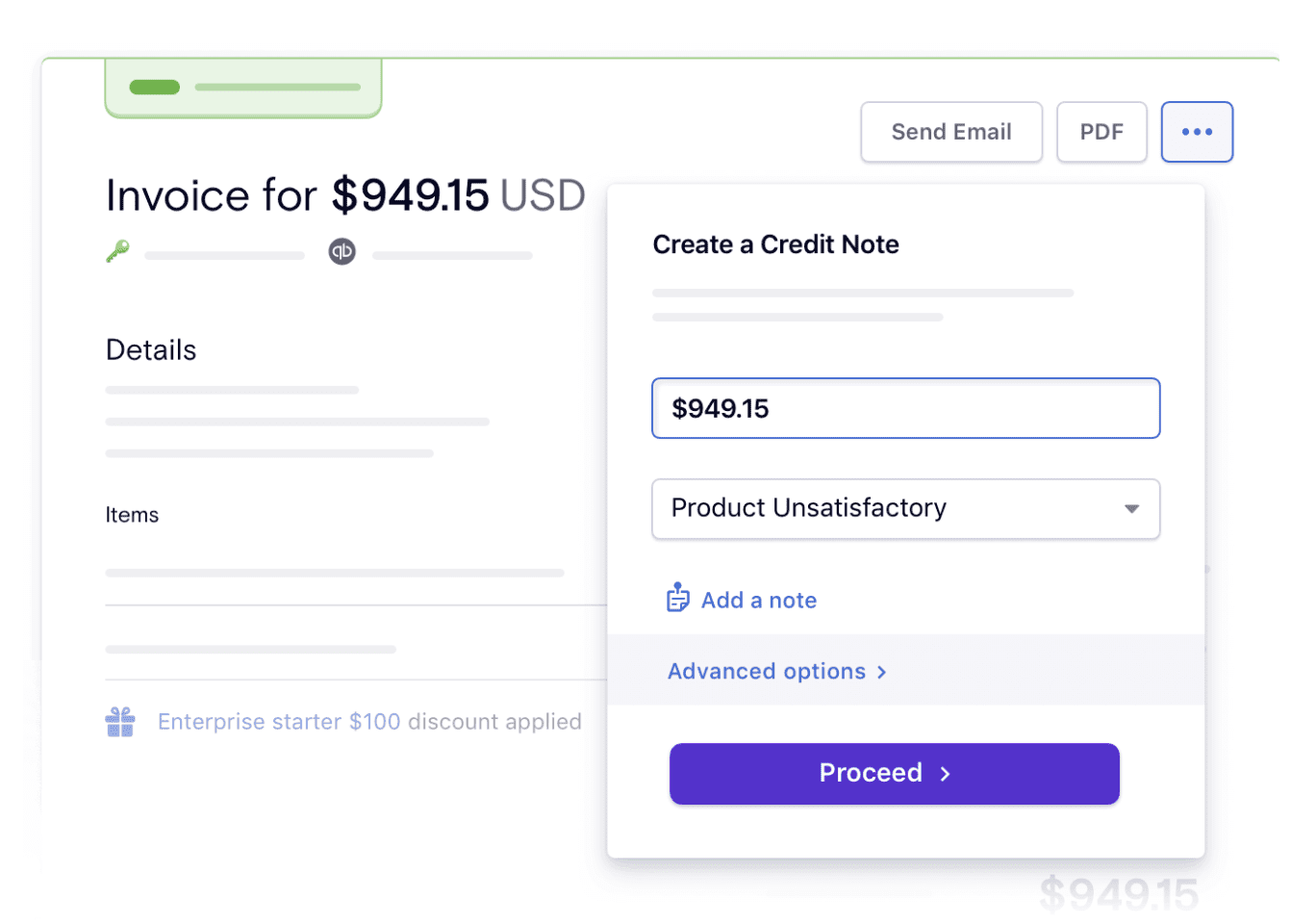

How Chargebee Can Help Take Control of Your Financial Reporting

Chargebee is here to help you take control of your financial reporting through automation that allows your business to focus on scaling while keeping your financials in order. Chargebee’s tools like the Payment Reconciliation Plugin for Google Chrome will help you reconcile payment gateway statements on Stripe with your accounting system with just the click of a button. Chargebee’s ability to sync right into your accounting solution helps you reduce the time it takes to handle refunds, adjustments, coupons, or any promotional credits. There’s so much that you can do with Chargebee

Companies like Userlane were able to leverage Chargebee to close their month-end financials in 80% less time, saving them time and allowing them to forecast their cash flow more accurately.

“Now we have a very efficient month-end process. Since everything in my billing is automated, I can do a month-end closing in one day or so. And without Chargebee, we would have spent at least five days checking and processing money. Having an efficient billing process with Chargebee is definitely useful.” – Katharina Baudrex, Head of Finance, Userlane.

Click here to read their case study to learn more about how Userlane used Chargebee to streamline their FinOps.

Chargebee and Integrations: How We Can Help

There are other tools and integrations that Chargebee has, such as the integration with Xero or Quickbooks, which gives you the robust ability to handle your accounting on the go and makes your account reconciliations a breeze. These integrations let you do a lot – for example; the Xero + Chargebee integration allows you to auto-sync everything from invoices, payments, refunds, and taxes (and more!) to Xero with ease. In addition to automatically reconciling your accounts with the Google Chrome extension mentioned earlier with both the Xero and Quickbooks integrations. With our Reconciliation feature, you can save up to 5 hours every week.

“Being able to automatically reconcile Stripe payments, transfers and fees is a huge win, and as with everything Chargebee does, it’s solid and feels like they’ve thought of everything.” – Will Jennings, Managing Director, Countfire.

Conclusion

Managing the account reconciliation process accurately and effectively is essential. However, as more organizations and accounting departments focus on efficiency and error-free reporting and reconciliation, we’re seeing a more significant push toward automation. If you’re interested in learning more about automating your financial processes, check out our ebook on compliance and automation here.