If you accept payments online, the checkout is the final touchpoint between your business and a successful sale. It can be frustrating to see a potential customer abandon the checkout process at the last moment, and bringing them back can significantly increase your acquisition costs. Crafting a perfect checkout experience is challenging, but when everything flows smoothly, it becomes the beating heart of your business.

Having assisted over 4,200 active customers in processing millions of transactions monthly, we’ve uncovered the secrets to creating a checkout experience that beats like the heart of Usain Bolt! It incessantly pumps revenue throughout the organization, fueling growth and success. In this guide, we’ll unpack all the essential elements of an optimal checkout experience.

Table of Contents

The art of creating a frictionless checkout experience

Creating a seamless checkout experience is like honing a crucial skill. It involves strategically boosting order value while ensuring customers effortlessly move from adding items to their cart to finalizing their purchase, without encountering any obstacles.

The importance of an efficient checkout experience can’t be overstated: Customers often give up on a purchase if the process takes too long. Translation: Businesses are losing a significant portion of online customers who intend to make purchases. Use the checklist below to optimize your checkout experience for maximum conversions.

Critical Components of a Seamless Checkout Experience Checklist

The perfect user interface for a smooth checkout page

We recommend dividing the checkout experience into three parts, making it easier for customers to navigate the purchase process. Here’s how each part can be structured:

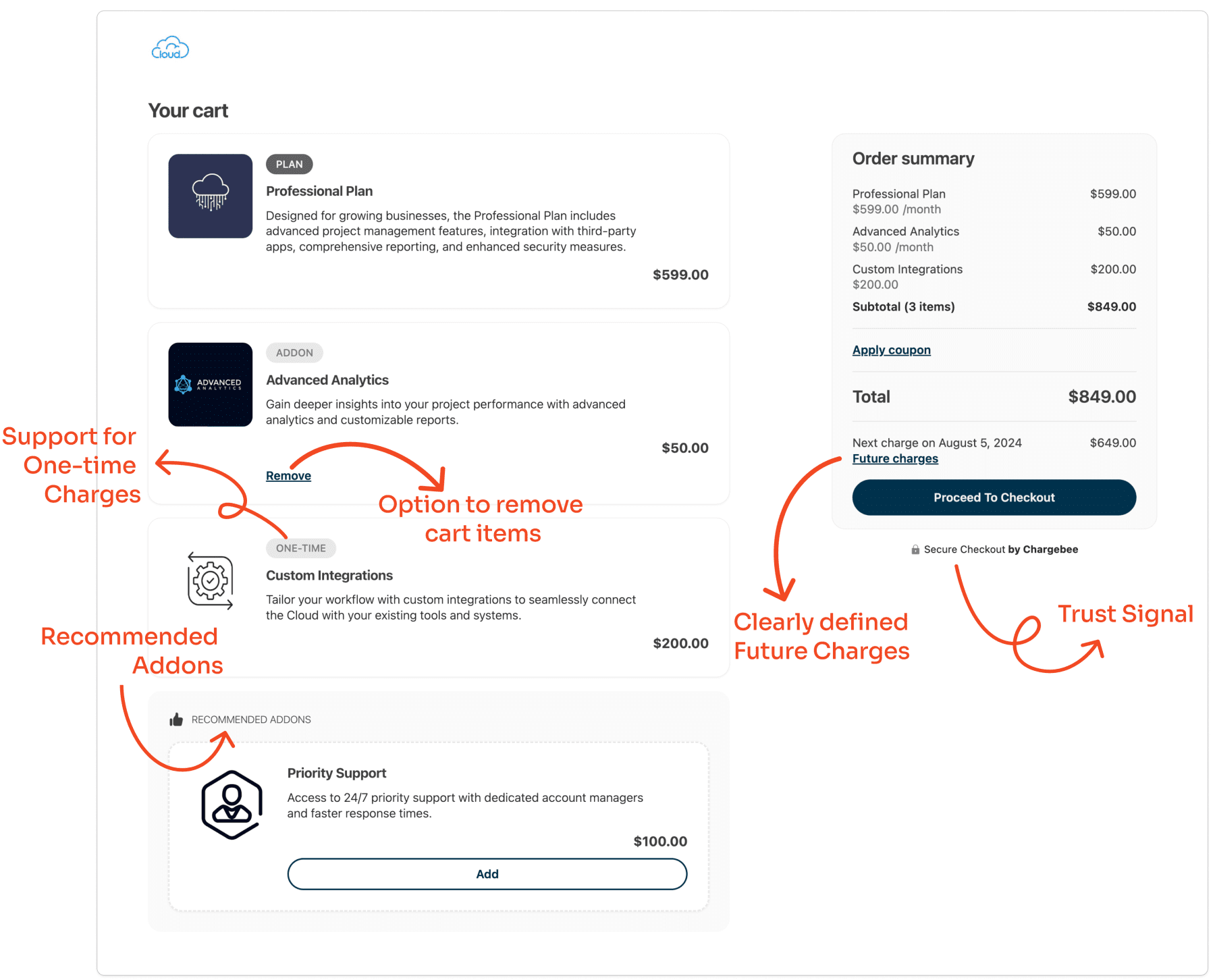

- Cart Page

- Have a section where the summary of the items added to the cart is displayed cleanly, including product names, quantities, prices, and the total cost.

- Provide options for users to adjust quantities, remove items, or apply discounts/promo codes directly from the cart page.

- Include recommendations for related or complementary items based on the user’s current selection to encourage additional purchases.

- Make sure to indicate any applicable taxes, shipping fees, or additional charges to ensure transparency in pricing.

- For subscriptions, display the next renewal date and amount to ensure clarity.

- Place a prominent call-to-action button to guide customers to the next step in the checkout process.

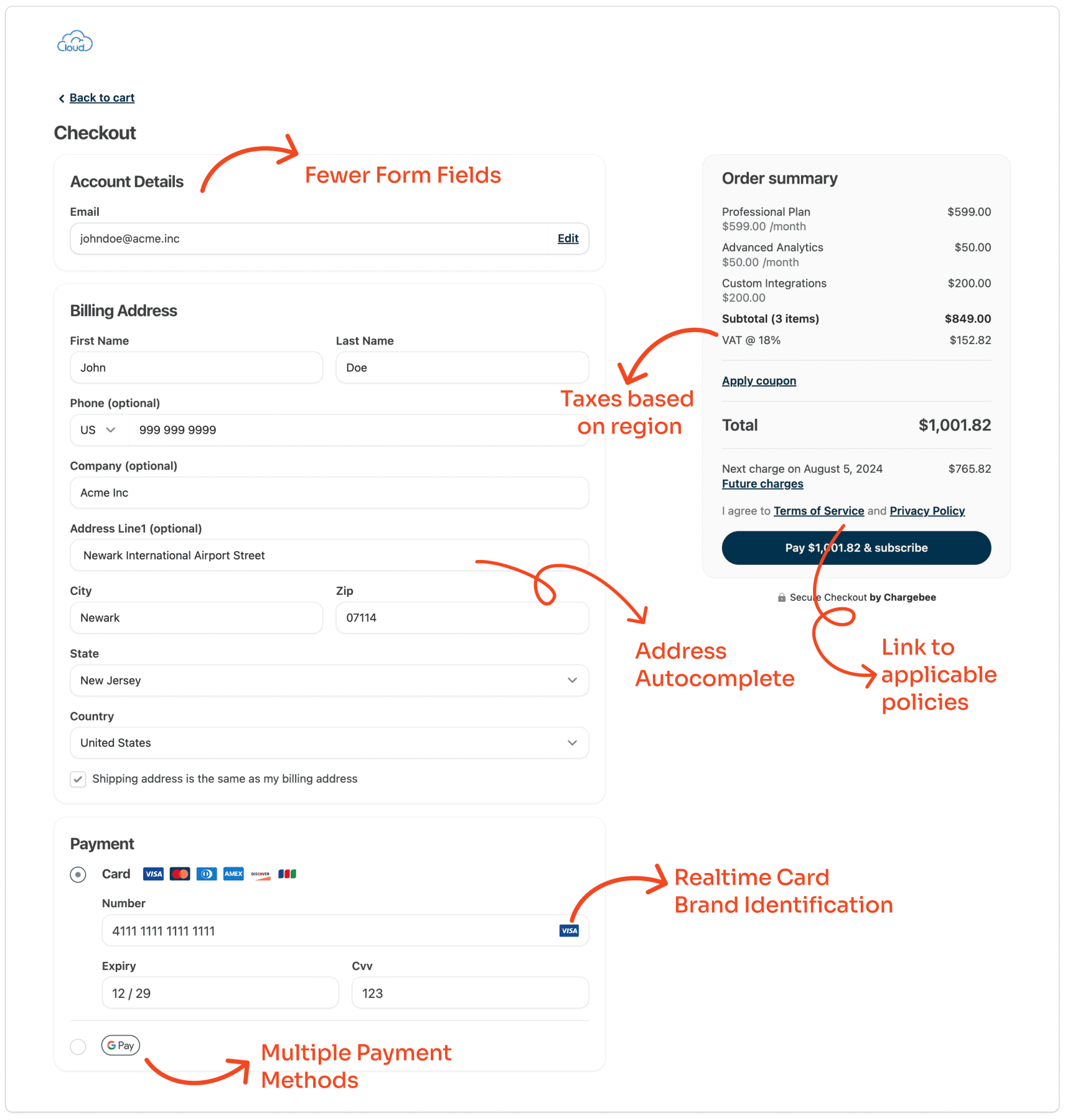

- Billing Page

- Keep the number of input form fields to a minimum to reduce friction and simplify the checkout process.

- Auto-fill fields such as name, email, and address to expedite data entry and improve user convenience wherever possible.

- Provide separate sections for billing and shipping address details if applicable, with the option for users to use the same address for both if desired.

- Provide only mandatory fields for payment details, such as credit/debit card information, and offer multiple payment options, such as PayPal, Apple Pay, and Direct Debit.

- Implement real-time validation for input fields and card details to ensure accuracy and prevent errors during data entry.

- Provide an order summary that includes itemized charges, shipping method, and the total amount due for users to review before payment.

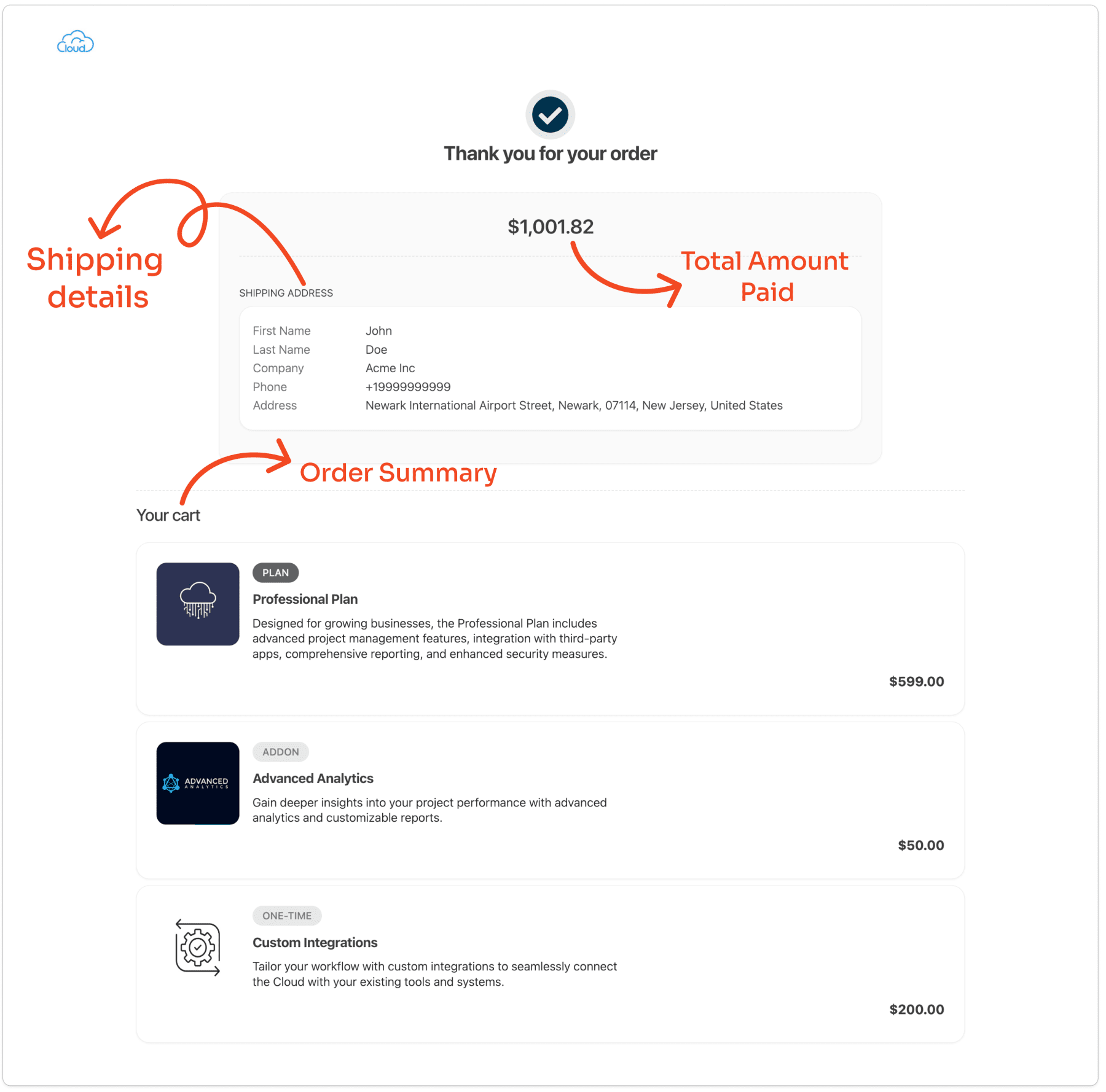

- Success Page

- Show a detailed order summary confirming the completed purchase, including items ordered, quantities, prices, and the total amount paid.

- Express gratitude to the customer with a personalized thank you message or note, acknowledging their purchase and expressing appreciation for their business.

- Provide relevant information about the next steps, such as order tracking details, estimated delivery date, or customer support contact information.

More ways to create a frictionless checkout experience

1. Localization and multiple payment options

Customers love it when you do business in their currency. Accepting payments in multiple currencies helps you expand your business globally and reach a larger market. However, this is about more than just increasing the number of payment options-businesses need to personalize the options they prefer, too.

It’s vital that you offer the payment methods most preferred by customers in a specific market. That could mean offering payments to wallets like Apple Pay in some markets, local payment methods like Boleto in others, or an option to pay via gift cards.

The complexity increases when you have to integrate with multiple payment gateway providers to support various payment methods across regions and countries. However, the wide-ranging support will pay off when it ensures that your customers can use their preferred payment methods, no matter where they are located.

Helpful resource:

2. Security and compliance

Security and compliance are critical to the entire checkout experience.

Have basic security protocols such as encryption, tokenization, and secure data storage in place. Additionally, compliance with industry standards like PCI DSS is crucial for safeguarding your customers’ sensitive data and preventing fraud.

Becoming compliant with PCI DSS entails meeting specific requirements determined by the volume of card transactions processed annually by your business or partner, such as PayPal. Failure to meet these requirements can result in non-compliance fees ranging from $500 to $500,000, depending on the severity of the violation. PCI DSS compliance levels vary and are regularly updated. You can access the latest PCI DSS guidelines here.

3. Cohesive branding to build trust

Research indicates that 75% of consumers judge a company’s credibility based on its website design. Customers perceive a business negatively if its website doesn’t feel secure or trustworthy.

A checkout page that looks and feels like a natural extension of your brand can significantly enhance customer confidence. When the checkout page reflects the same design elements, colors, and logos as the rest of your website, it reassures customers that they are still in a secure and familiar environment, reducing the likelihood of cart abandonment.

Utilize trust signals strategically on your checkout page, displaying logos and credentials like “Verified by Visa” or “Mastercard SecureCode.” You can also use security badges and SSL certificates to instill confidence in your customers regarding the safety and reliability of their transactions. 74% of businesses in North America didn’t display security logos on their checkout page, jeopardizing customer trust.

Realtime Card Brand Identification

4. Integration and extensibility

A modular and extensible checkout page should be capable of integrating with various systems, such as customer relationship management (CRM) platforms, accounting software, and third-party services. This enables smooth communication and data exchange between different platforms, applications, and processes.

After a customer completes a purchase, the checkout should be able to automatically generate a customer profile in the CRM and grant access to subscribed services while triggering emails containing essential details to kickstart the service usage. Concurrently, the accounting software should be promptly notified of the new revenue generated, facilitating invoicing and reporting processes.

5. Analytics and reporting

Analytics and reporting capabilities are essential for gaining valuable insights into customer behavior, conversion rates, and revenue metrics—insights that enable data-driven decision-making and continuous checkout process optimization.

Key metrics to consider for businesses to gain valuable insights:

- Cart abandonment rate: Measuring the percentage of users who add items to their cart but leave the checkout process without completing the purchase.

- Conversion rate: Tracking the percentage of users who successfully complete a purchase after initiating the checkout process.

- Average Order Value (AOV): Calculating the average amount customers spend during each checkout transaction.

- Checkout completion time: Measuring the time users take to complete the checkout process from start to finish.

- Payment method preferences: Understanding which payment methods users prefer during checkout.

A checkout experience worth the investment

The complexities associated with building a seamless checkout experience increase exponentially as you expand to more regions or add more payment options. Rather than concentrating on your core product, you’ll have to continually dedicate resources to developing and upkeeping the checkout process.

Building a system to accept customer payments is a significant effort and cost-intensive endeavor. However, an alternative to creating your own checkout experience is using a hosted payment page.

A hosted payment page is a web page hosted by a third party that provides secure checkout capabilities for business websites. It allows you to avoid the complexities of building and managing their payment gateways.

Hosted payment pages can help you find your zen! A hosted checkout solution like Chargebee Checkout offers a meticulously crafted checkout experience in a secure environment, sparing your business the substantial expense and effort of developing and maintaining its own checkout page.

“Chargebee has given us the gift of time. Time to not worry about subscription complexities but to ensure our product helps our customers crush their development goals.”

– Dick Davidson, CFO, GitKraken

Chargebee’s Checkout is designed to meet the strictest compliance standards, including PCI DSS, GDPR, and CCPA. By leveraging this pre-built solution, you can ensure that your checkout process adheres to all relevant regulations without the need for extensive in-house compliance efforts.

Chargebee Checkout is incessantly beating at the heart of thousands of businesses, fueling their growth with secure, seamless transactions.