If there was ever a great time to be vigilant of customer churn, it is now. Inflation hasn’t been this high in over 40 years, business activity seems to have had a meltdown, and venture capital seems to be drying up faster than Lake Mead.

If that wasn’t enough, customer acquisition costs (CAC) the poster-boy of poor unit economics seem to have grown faster than any of Daenerys’ dragons, leaving business bottom lines burning in their wake.

And since preventing existing customers from breaking up with you still seems 5-25X cheaper than finding new customers, building/refining that retention engine clearly seems like a sound plan.

But, here’s the thing – retention engines are also an expense. You will spend time and money on building a retention strategy from scratch or acquiring a full-stack retention management tool. You will also burn some cash by offering discounts at the point of cancellation. And all you (hopefully) have to show in return is an ‘X% decrease in customer churn’ without clear optics on what that means for your bottom line.

At a time when businesses globally are implored to spend more thought on where and how they spend their money, the subscription and retention status quo is really beginning to beg the question – How do you convert your retention strategy from a Hail Mary against customer churn to a concerted growth engine?

Thankfully, there are answers.

Treat Retention as a Lever, Not a Cushion

For most businesses – retention is the plumbing job you get to plug revenue leakage. It is, in a manner of speaking, a means to sustain your bottom line, instead of helping it grow. This is also reflected in the typical success metrics associated with retention.

Retention rate measures how many customers you’ve saved, with very little idea about how many dollars it helped your business generate. Naturally, your cancel strategy is focused on doing just enough for your customers to continue with you, than on delivering an ‘aha!’ moment for them to fall back in love with your product/service – thereby growing customer lifetime value (LTV).

While tracking the number of customers saved is an indication of whether your cancel experience is successful in addressing the immediate concerns of your customers; tracking post-deflection upsells helps you understand the efficiency of your cancel experience in building more meaningful relationships.

Define Your Customer Segments

It is important to understand that no two customers are the same. A customer who seldom interacts with/consumes your product/service might still be retained with a 15% discount at the point of cancellation, but will not give you the same return as saving a disgruntled frequent customer with that same 15% discount. Add to it the argument of contract/ticket sizes, and the clarity of the barriers between a low-value customer and a high-value customer only gets more pronounced.

Simply put, saving 100 infrequent customers is not the same as saving 90 high-value customers.

Much the same way saving 15 customers does not clarify the quality of customers saved by your retention engine and is more of an indicator of offer efficiency than business efficiency. On the other hand, zooming into your saved data to understand how many of your saved customers upgraded to the next subscription tier, or a longer plan tenure is a better qualifier of the actual value generated by your retention strategy.

This data is also instrumental in defining underlying themes/commonalities in your offers to further identify cancellation offers that bring in better quality leads, helping you personalize offers to appropriately add value to your customers.

Weigh the Cost of Your Retention Strategy Against its Returns

Going beyond conventional success metrics also helps you accurately gauge ROI on your retention engine. Be it investing in a retention management team, devising offer experimentation, or scaling up/down your retention efforts.

Having a clear dollar value association with your retention efforts will also help you exercise more judiciousness while investing in more resources to upgrade your cancel experiences.

Metrics like ‘percentage of saved users upgraded’ and projections on dollars generated in a defined horizon also help make a strong business case to convince the top brass of the importance of committing to a cancel strategy.

Building Data-driven Retention Experiences

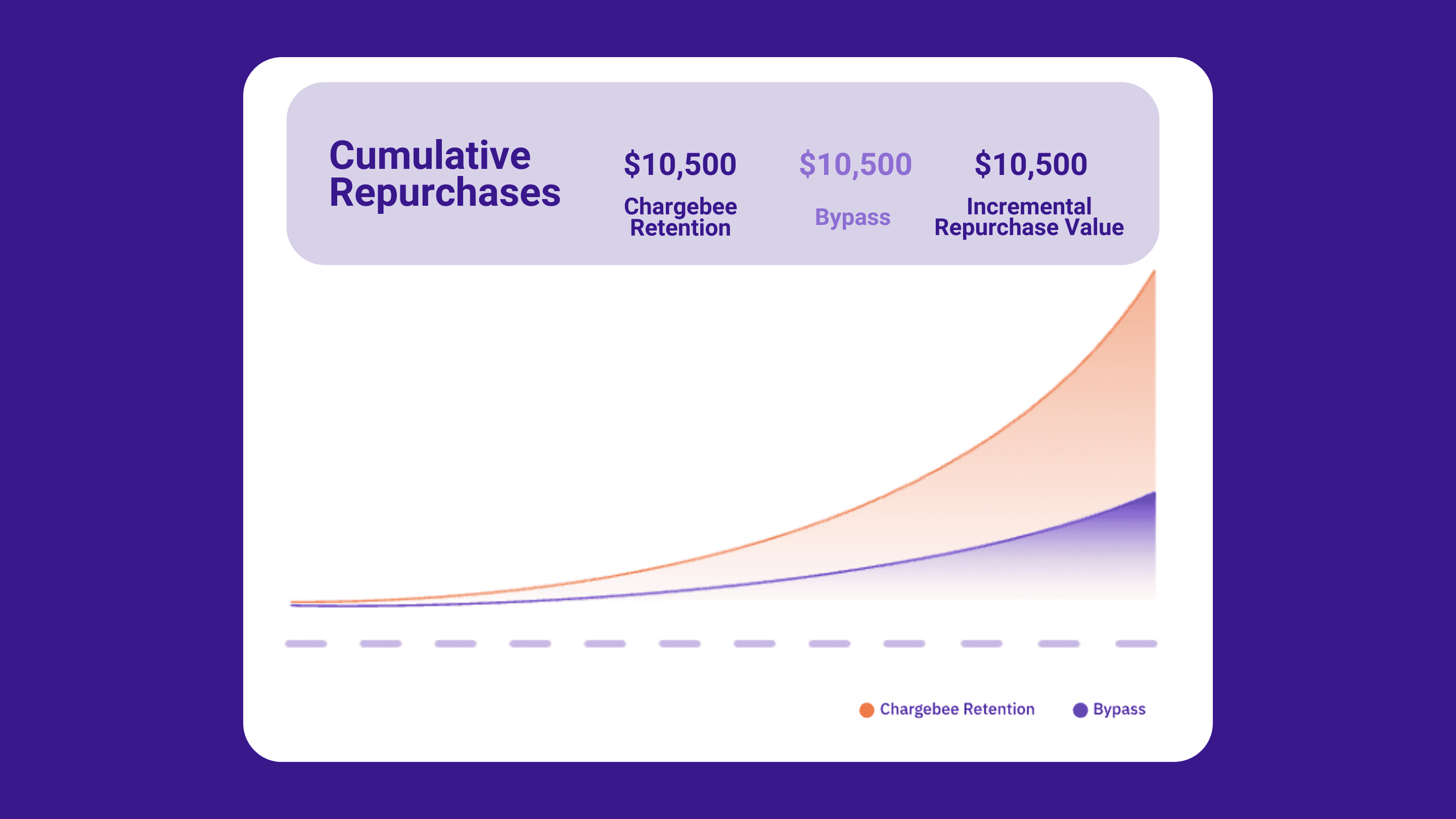

Having pioneered the deflection funnel, Chargebee Retention is now taking the next step in helping businesses redefine the true value of saving a customer by looking beyond time-based saves.

Chargebee’s Retention reporting exhibits the direct revenue impact of your customer retention strategy on your bottom line so you have both a qualitative and a quantitative view of your saved customers.

By tracking metrics that help determine revenue from retention like –

- Total revenue impact from retained customers (upsells, cross-sells, and more)

- Total reactivation value

- Average activation orders

- Average number of forward actions (upsells/cross-sells, upgrades), and more

… and clubbing it with Chargebee’s automated customer-segmentation methodology, businesses like Freshly are able to laser-in and focus their retention efforts on saving customers with an incremental lifetime value against customers with a limited contribution to their revenue line.

“With Chargebee Retention’s reporting, we could view multiple metrics together to understand which offers are attractive to our customers and which ones drive additional LTV for our business.”

– Adrienne Bouchie, (Former) Product Manager at Freshly