Whether you’re an early stage or mid-stage subscription business, managing subscriptions can get frustrating. But why is it so? You’ve been using your payment gateway so far for recurring billing. Because it also offers that, right?

Hit pause right there.

What you just did is overlook the complexity that subscriptions bring to the table. Subscriptions keep changing over time and can be incredibly complex. Accommodating for this complexity means that you need a system that has the capacity to handle these changes effortlessly in a way that payment gateways are not set up for.

Payment Gateways excel in processing payments – because that’s what they’re made for.

The primary function of a payment gateway is to help you collect payments from your customers. They sit between the buyer and the seller, facilitating transactions.

Essentially, the role of a payment gateway boils down to authorize, to approve or decline, and to report online transactions. (On a side note, check out our Payment Gateway Providers 101 post to understand how a payment gateway works.)

Payment gateways like Stripe, Braintree and Adyen do offer recurring billing solutions, which cover some of the basic payment requirements of subscription driven businesses. However, these capabilities fall short in the context of more advanced subscription workflows.

In this post, we will dig in and see why this matters and how it impacts subscription commerce and SaaS companies.

Scaling becomes painful

Scaling a business is complex and stressful. Recurring billing is just one of the factors to worry about as you grow. As your business starts scaling, customers come in with different needs. The very nature of a subscription driven business calls for the ability to change rapidly while responding to customer needs, competitive environment and exploring Product-Market fit. Various scenarios can crop up in your company’s journey – you may explore a new business model, discover novel requests from customers or even forced, by regulation, to change the way you bill your customers.

From changing the billing frequency, adding multiple subscriptions to one account, supporting add-ons, coupons and discounts, offering alternate (online or offline) payment methods, and more—necessitate recurring billing changes that will be beyond your payment gateway’s capabilities.

To understand this better, let’s dive into a few examples.

- Risk of single payment gateways

When you’re using a single payment gateway for your subscriptions, it’s possible that your gateway locks you out if it perceives you to be a ‘high-risk’ merchant.

If you haven’t gotten a heads-up or enough time to migrate to another gateway, your business suffers. Add to that the disputed transactions that come with chargeback fee for which you will have to shell out money.

- Expanding to new markets

What do you do when your customers request for a payment method that isn’t supported by your gateway. Once the initial wave of mild panic and anxiety has passed, the obvious solution that presents itself is to switch your payment provider. A no-brainer, right?

And then 6 months down the line, you want to start selling in a new country and the payment gateway you just chose, doesn’t support that currency. What happens now? Do you switch gateways again and go through the entire process of migrating all your subscriber information all over?

However, switching to another payment gateway is a daunting task. You’d have to take into account the time taken to test the gateway and migrate to it.

- Getting flexible with subscriptions

You’ve convinced your customer to re-subscribe and reactivate. Or, you want to experiment with pricing and be able to make pricing changes easily. And during these pricing changes, you’ll also want to be able to grandfather in your older customers.

You would want to let customers upgrade, downgrade or pause their plans. Payment gateways fall short by not being able to offer such advanced subscription management options.

Managing the billing portion of your payment gateway takes the focus away from building your product, because it isn’t your core competency

Powering more than just subscriptions

When you’re tapping into new markets, plenty of factors contribute to a complex series of actions that you need to tend to. Regulatory, compliance, security and operational requirements can tie you up if you choose to develop and engineer solutions to a billing workflow centered around the capabilities of a payment gateway.

Take the case of taxes. With intricate tax rules, manually calculating and applying taxes based on countries or regions can tax your sanity. For instance, the ability to manage the tangled rules around taxation were critical issues for companies like Sharetribe to choose Chargebee as a recurring billing platform than rely on the ability of payment gateways. Billing platforms are able to effectively sift through various tax profiles like EU VAT, US Sales Tax, Australian GST, and more as you expand to new markets.

Payment gateways provide basic reports at best. Your business needs real-time metrics and accurate reports that are relevant, timely, and precise, which subscription management solutions can provide. Being in constant touch with the health of your business is also essential—key business decisions are made based on metrics like ARPU, CAC, Net MRR Churn, and more.

From a revenue recognition standpoint, which is dependent on the billing and the services rendered, the chain of events leading to revenue recognized is elaborate—and for a subscription business, it is much more complex.

Proration rules can become incredibly complex for subscription businesses and payment gateways cannot natively handle these scenarios. Accounting & revenue recognition for subscription business are unique—learn how this needs to be handled here.

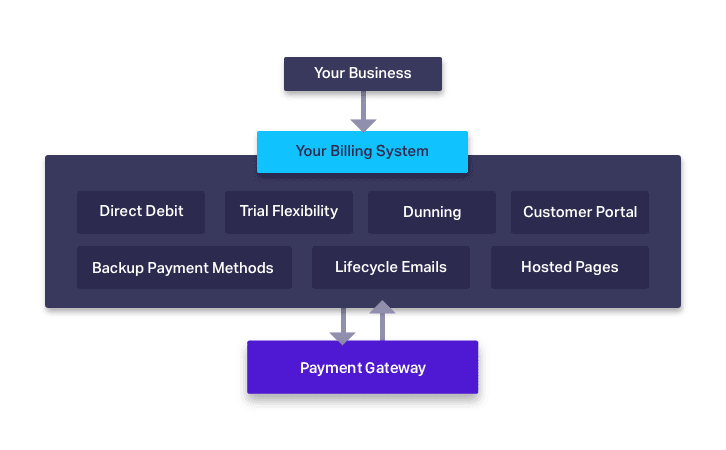

Your subscription billing solution takes care of all of these and more: additional options for payment gateways and methods, invoicing, coupon and discount management, accounting, email notifications, helpdesk integrations, referral marketing and the list goes on.

On top of all this, as solutions built for the specific purpose of taking care of subscription billing needs, subscription billing platforms handle the burden of ensuring compliance (PCI, SOC-1 and SOC-2 and more). The better ones go one level up and minimize the development and implementation effort required to get up and running.

Light at the end of the tunnel

Recurring billing consists of 3 core elements: bank (both for issuing and acquiring), a payment gateway, and a recurring billing platform.

Here’s the good news – A subscription management solution like Chargebee works on top of a payment gateway, and at its heart, makes it easier to handle subscriptions through a customer’s lifecycle.

With the depth and specialization a billing solution brings to the table, recurring billing should not be your problem to fix. Embracing subscription flexibility does not have to come at the cost of your product’s growth.

Instead of shoehorning your billing needs into a payment gateway, why not let a subscription management solution do the heavy lifting?

Read our guide on how subscription management software will help you understand and pick the right billing system for your business.