When we initially set out to price Chargebee, we picked the number of invoices as our value metric. And boy were we wrong.

—

Case 1: Michelin

Michelin’s truck tires had been conventionally renowned for their superior quality, which, in turn, justified the premium prices they charged for them.

Until the fast-growing Chinese and South Korean manufacturers came up with cheaper tires in the early 2000s.

Michelin’s knee-jerk reaction to tackle the (apparent) competitive disadvantage was to do what they did best – double down on their product innovation.

Their new tires lasted 20% longer. This would give them a much-needed edge, they hoped.

However, even though this seemed like it augmented the value their customers received in the short run, it could have done the opposite in the long run.

It didn’t take long for the Michelin team to figure that pricing the new tires just a few percentage points above the older ones, the customer demand would also go down by about 20% (because, longer-lasting tires equals lower purchase frequency).

In other words, Michelin’s higher prices came with a plummet in demand. Despite the innovation in quality.

The Michelin team realized that a more fundamental innovation was in order — their revenue model had to change.

The Michelin Fleet Solutions launched in 2001, stopped charging truck fleets for the number of tires they bought and set the pricing based on the mileage driven per month on those tires instead.

Rather than having the transportation companies bear the large upfront one-time cost of purchasing tires, (including the risk of replacing a damaged tire), Michelin shared the burden by taking up the responsibility for the supply, maintenance, and free replacement of tires.

The new revenue model shifted Michelin from selling tires to selling outcomes.

Michelin’s price per kilometer (PPK) metric allowed fleet managers to focus on their businesses and customers without having to worry about expensive or damaged tires. They paid for their actual usage of the tires rather than for the ownership of them. And they were also able to flexibly manage their tire costs depending on the prevailing market conditions (a bad season with reduced demand for the fleet meant reduced truck usage, which in turn reduced the tire charges).

By changing the way they charged their customers, Michelin shifted their vision from building better tires to improving transportation and mobility. And the tires became one of the elements in the value chain that supported that vision.

By 2011, Michelin’s EBIDTA (Earnings before interest, taxes, depreciation, and amortization) was three times higher than Goodyear’s and 25% higher than Bridgestone’s.

—

Case 2: Google

The internet stepped in, bringing along an abundance of online information and made text-based searching — hitherto a feature limited to electronic databases within organizations (like libraries) — a mainstream need.

Search providers entered the scene with the promise to give the users a more structured way to seek and find information, the earliest of whom charged their customers for the search itself, on a recurring basis (for example, users had to pay $9.95/month to use Infoseek’s search engine in 1995).

A couple of years down the line, folks like Yahoo! modified the revenue model by giving away search for free while making money with an ad-based revenue model.

Google went a couple of steps forward, and dished out the best search algorithm out there (that attracted more searchers) and ‘adsense’ (which set fee for keywords depending on their search popularity), and moved away from a fixed fee model to dynamic auction. Such features enabled advertisers to measure the effectiveness of their ads and their ROIs, giving them all the more reasons to pay Google more.

The flexible per unit pricing that varied from one keyword to the next, also enabled businesses of all sizes and shapes to try their hand at search advertising with minimal cost and risk. All in all, Google managed to outrun the rest of the competition by fine-tuning the relationship between their revenue model and their value delivered.

—

Value, Metrics, and More

The most successful product innovators we know start by determining what the customer values and what they are willing to pay, and then they design the products around these inputs and have a clear monetization strategy that they follow through with.

Michelin and Google have pulled off one of SaaS’s most favorite (and sustainable) pricing schools of thought – value-based pricing, where the price you charge for your product is tied to the value that your customers receive from it.

Over the years, industry experts have given more structure to this philosophy by defining the specific levers that (should) act as the foundation of your pricing and link it to the customer value.

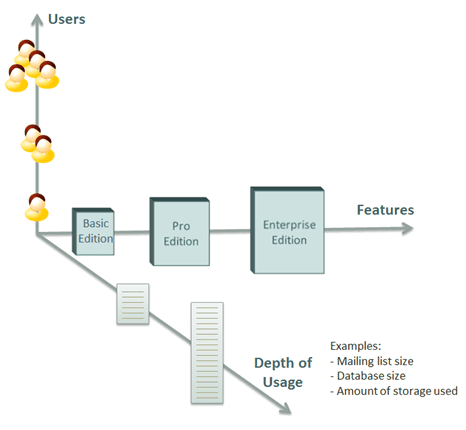

Five-time entrepreneur and General Partner at Matrix Partners, David Skok, calls these levers “pricing axes.” In order to capture the willingness to pay of the various customer segments, Skok believes that pricing has to be scalable.

If designed correctly, the pricing should scale down to allow you to capture the smallest/cheapest customers that are still profitable, up to the largest customers that are willing pay a great deal.

And this can be achieved by basing your pricing on one or more value metrics, the most common of which are feature bundles, number of users, and depth of usage.

However, not all metrics would be equally effective. And this is where context comes into play.

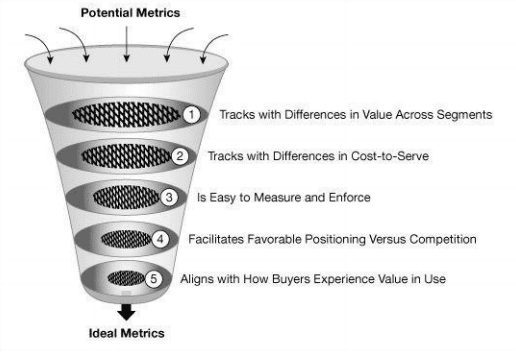

Even though it’s inherently necessary to build your pricing on a value metric, Patrick Campbell, the CEO and co-founder of Price Intelligently, argued that picking the right value metric is crucial for a revenue model’s success.

Imagine two SaaS companies that each have 100 customers. The first charges on a per seat per month schema, but there’s little need for more than one seat for each customer. The other sells the exact same product but charges along a metric of particular usage in the app with a bare minimum per month charge. The former has an artificial ceiling on the MRR (Monthly recurring revenue) potentially gained from their customers. The latter’s MRR will grow as their customers grow and/or use the product more. I’d much rather be in company number 2.

He has done a splendid job at condensing the function of a good value metric into three succinct points:

- It should be easy for the customer to understand

- It should align with the value the customer receives

- It should grow with the customer’s usage

Now here arise the questions:

Are these the sole requirements of a healthy revenue model? Or do those revolutionary revenue models possess something more?

—

Let’s go back to the land of truck tires and online searches.

The standard revenue model in the tire industry uses the number of tires as the value metric. The fleet owners understood what that meant, it aligned with the value they received (the long life of the tires), and they grew with their usage (the more I use the tires, the faster they get degraded, the sooner will I buy new ones).

Similarly, in the case of the pre-Google search industry, the number of searches was comprehensible, was in line with the value (search and find the information needed), and scaled with usage (no explanation needed here).

And yet, they failed to take off. Something about them, seemed off.

—

As mentioned earlier, pricing based on the number of tires means that upping the life of tires leads to lower frequencies of purchase. While on the other hand, with the per kilometer revenue model, the better the quality of the tire, the longer a tire lasts, and the larger the revenue per tire.

Making customers pay for their searches, morphs into an element of friction that restricts customers from performing more searches. Which defeats the very purpose of the search engine. By taking away that block, Google not only enables customers to search and find what they want without any hindrance, but is also able to consistently improve its search algorithm by learning from their searches.

In other words, the way your revenue models captures value, shouldn’t stand in the way of you and your customers from creating more of that value.

To find out how this insight plays out in SaaS, let’s pick and prod the pricing practices of two particular verticals:

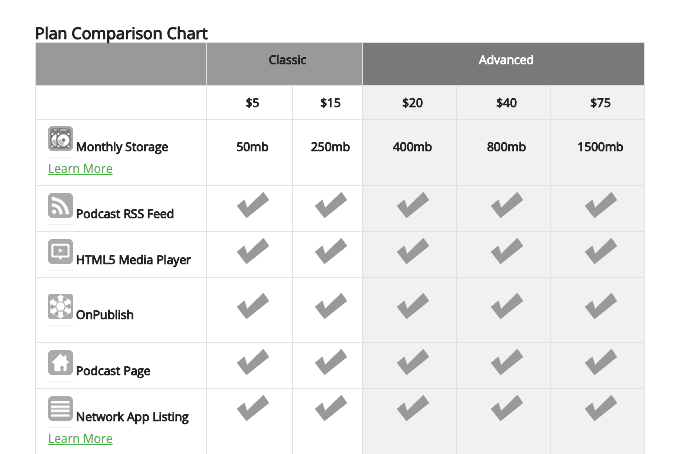

Podcast Hosting Platforms

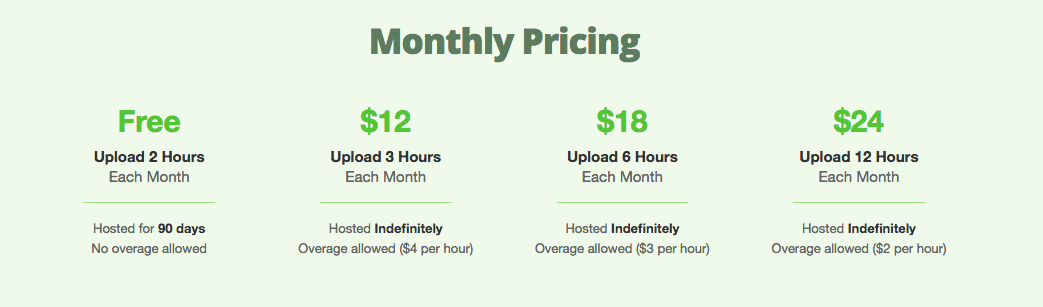

These products generally peg their prices against, the storage size (example: LibSyn),

the upload time/duration (example: Buzzsprout),

or the number of downloads (Transistor).

Now, which of these is the right value metric?

In order to answer that question, we should first answer this –

What’s the value that a podcaster receives from a hosting platform and which metric is the best proxy to measure that value?

A podcaster’s primary objective would be to get access to as many ears as possible – that’s the ultimate value that they’d like to derive from their work.

And the metric that gets closest to measuring her success is the number of listeners/downloads. And a podcast’s duration and storage size have got little (if not nothing) to do with the probability of it hitting its downloads target.

So anchoring the price around the storage size or duration will only restrict podcasters from experimenting with their podcasts, honing their craft, and figuring out the right approach to increase traction.

With the number of downloads, however, as the customer gets more downloads, they move up the tiers, only to get access to more premium features that would, in turn, help them to further boost their downloads. In short, they’re paying to get more of what they want.

So when a customer hits a tier limit of say 10,000 downloads in a month and is upgraded to a higher plan, the price is not only linked to their actual usage of the product, but also serves as a benchmark of their growth.

And that’s precisely what led Justin Jackson and Jon Buda arrive at the pricing of their soon-to-be-launched hosting platform, Transistor.

Project Management Software

For SaaS products like podcast hosting platforms, it’s comparatively easier to put a price tag on the customer value.

But there’s another group of products for which the customer value is intangible. Take employee feedback software, for instance – their value is helping businesses increase their employee openness, and foster a more honest and healthier company culture.

How would your software measure an intangible value like that? And how would you tie that value back to your software’s role in helping your customers achieve it?

Project management software fall right under that category.

These products have to deal with the Gordian knot of fixing a metric that serves as a proxy for team collaboration and productivity, and base their product’s price on it.

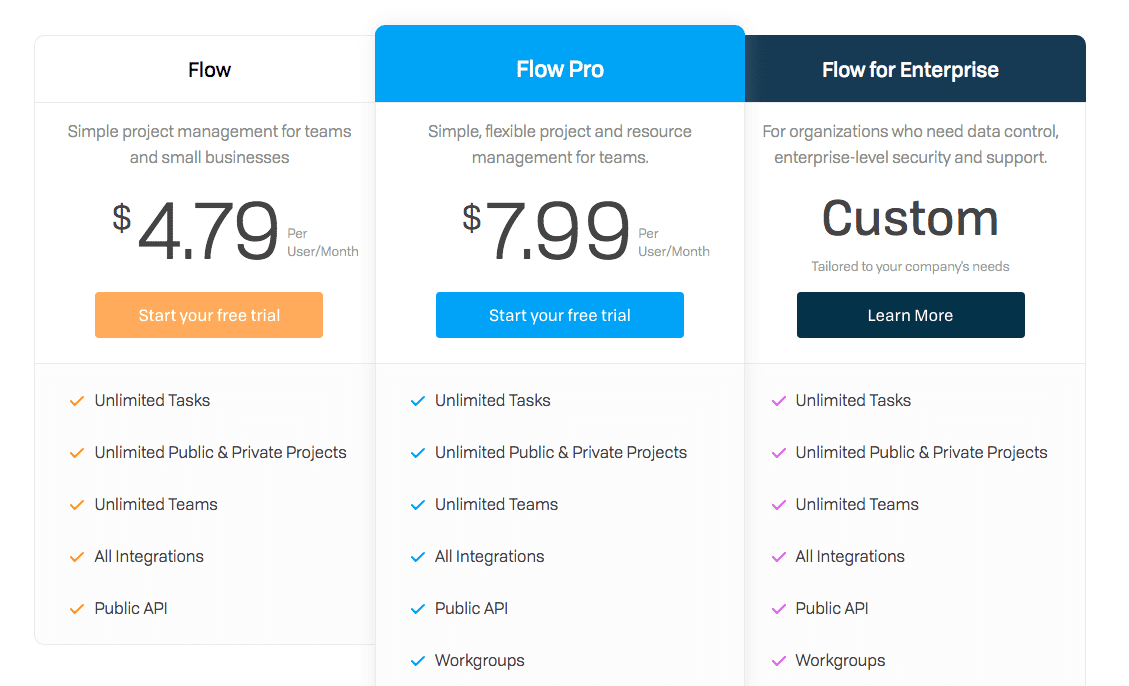

And they mostly end up settling with the number of users (example: Flow),

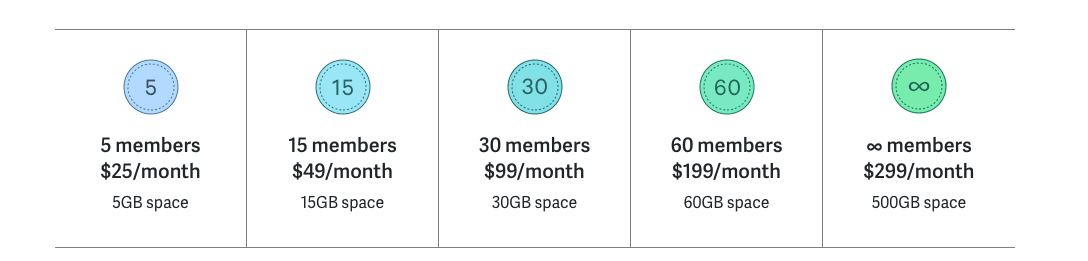

or the storage space (example: active.collab),

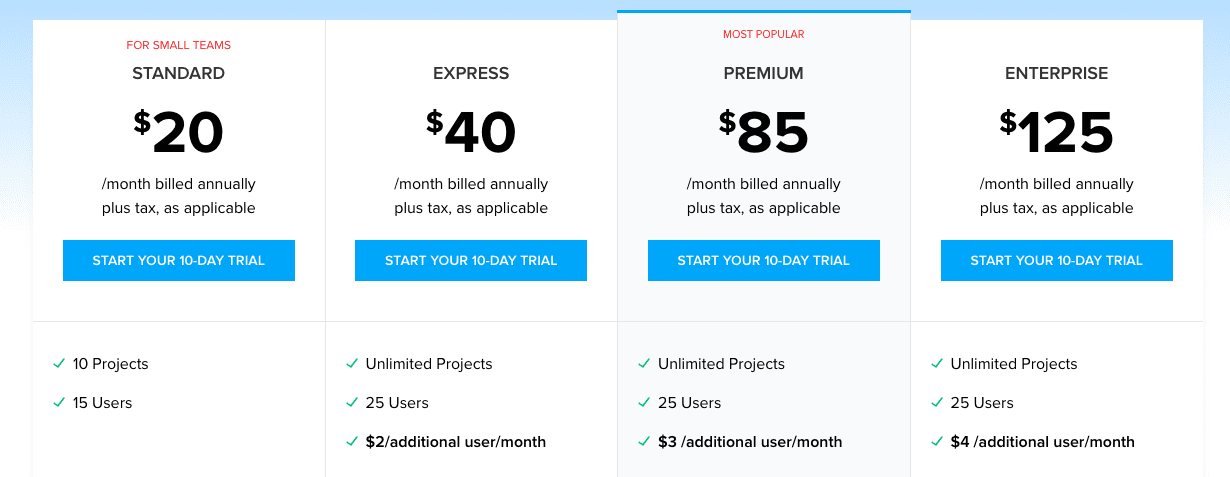

or the number of projects (example: Zoho Projects).

Similar to the case of podcast hosting platforms, limiting the number of users/projects/storage space not only has any connection with the actual value received by the customers (a team’s productivity and collaboration aren’t solely dependent on the team size or the number of projects they work on), they also restrict them from scaling the promised value (a team might want to experiment by temporarily expanding their team size or break down a big project into multiple smaller ones, to find out if it improves their productivity and/or collaboration).

These value metrics are linked to anything but the true value that their customers recognize.

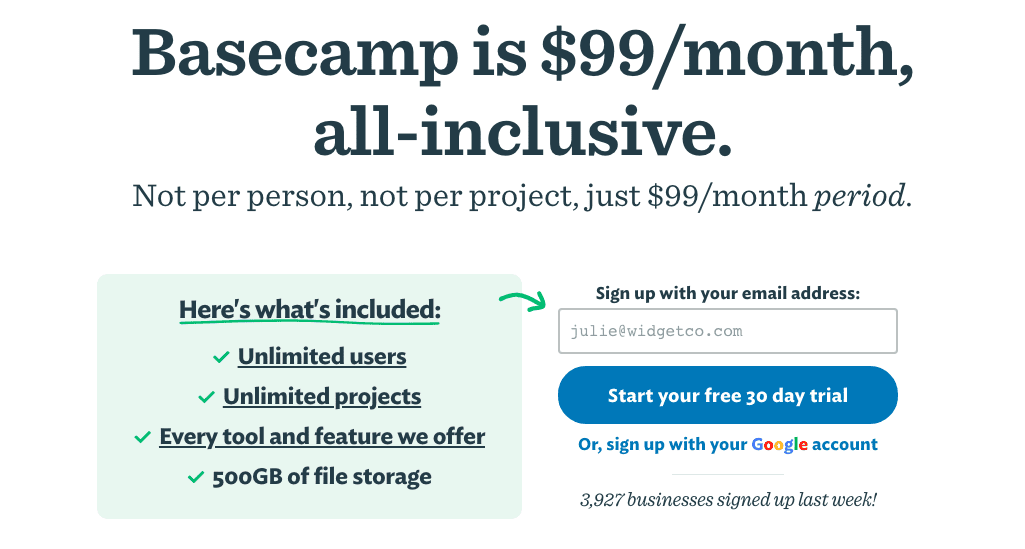

Basecamp seems to have figured this out.

And how? By not anchoring their price on any of those metrics whatsoever. By doing so, they are steering clear of any possible deterrent to further value creation, both from Basecamp’s side as well as their customers’.

—

When we initially set out to price Chargebee, we picked the number of invoices as our value metric. And boy were we wrong.

Picking the number of invoices as a value metric for a billing solution was akin to picking the number of shows for a podcast hosting platform or the number of projects for a project management software.

Thanks to the nuance that this post is all about, we figured that the closest proxy for our customer’s value and the right metric that would enable us to scale that value is the revenue that they generate.

Patrick Campbell gives away his core offering, ProfitWell (a SaaS analytics platform for Stripe) for free, uses it to reduce the onboarding friction, gets the customers hooked to the value, shows them where they’re losing money, and then upsells advanced analytics services that start at around $1000/month to help them recapture the lost revenue.

A $1M ARR company cares just as much about their data as a $50M ARR company. yet, the only difference between the two on the same dashboard is that the $50M ARR company has a couple of extra digits on their numbers. Essentially, you’re taxing the larger company for the same product. It’s the same user; they care just as much; but you’re saying ‘just because you have more money we’re going to charge you even though you’re getting the same value.’ For smaller companies it’s even worse, because you’re congratulating them on growing their business with a price increase.

Charging customers for using ProfitWell (which is essentially a financial dashboard) didn’t make sense to Patrick and his team – the product didn’t help the customers make more money and unless they can pinpoint to where it helped them grow, ProfitWell cannot and should not be charging them for their growth.

As of January 2018, they’ve been doubling their revenue year-on-year, and have crossed $8 million in ARR (Annual Recurring Revenue).

Now repeat after me,

Your value metric should not only align with the value that you create and your customers receive, but it should also allow you to keep increasing that value over time.

It should urge you to better yourself as a maker and deliverer of that value.

It should inspire you to not scale the usage, but rather scale the value.