The beauty of the subscription model is that relationships are built right into the revenue model. You provide consistent value to your customers, and in turn, they continue to pay you for that value. No other business model in history gives us, entrepreneurs, such alignment with their customers.

However, the trouble with the subscription world is that we still have very little reliable data or actionable feedback for growth. This world is still in its infancy (even though it feels like it’s much further along), leading us to build a bit blindly, bumping through our revenue seeped in qualitative feedback and semi-actionable anecdotes.

Yes – companies like Salesforce.com have been around for two decades and Bessemer made their first cloud investment in 1997. Yet, only 400 software companies (of which subscription companies are only a portion) have made it to the $500M revenue mark.

When compared to retail, heavy manufacturing, and a whole host of other industries that have been around for hundreds, if not thousands, of years, the subscription economy is still a child, yearning for nurturing and development.

That’s where companies like ProfitWell and Chargebee can help, because we’re sitting in the core of this subscription universe, seeing what’s working and what’s not for growth. To kick off our partnership, we couldn’t be more excited to reveal some findings we discovered through mining the data of 6,452 SaaS companies of all shapes and sizes.

What follows are five actionable pockets of leverageable growth that any subscription company can easily use to improve their retention, acquisition, and monetization strategies. Let’s jump in!

Finding #1: You need to localize your pricing, because we’re in a globalized world

The Internet birthed more than just cat GIFS and Facebook. For the first time in our existence, we can purchase products from anywhere in the world. Even though we have this reach, we’re still driven by our local sphere of influence (referrals from friends, buying from companies in our region, etc.).

We can align with this mindset as businesses, by ensuring that we localize our acquisition and monetization strategies, that our content is regionalized, and that our pricing is in the currency of the buyer.

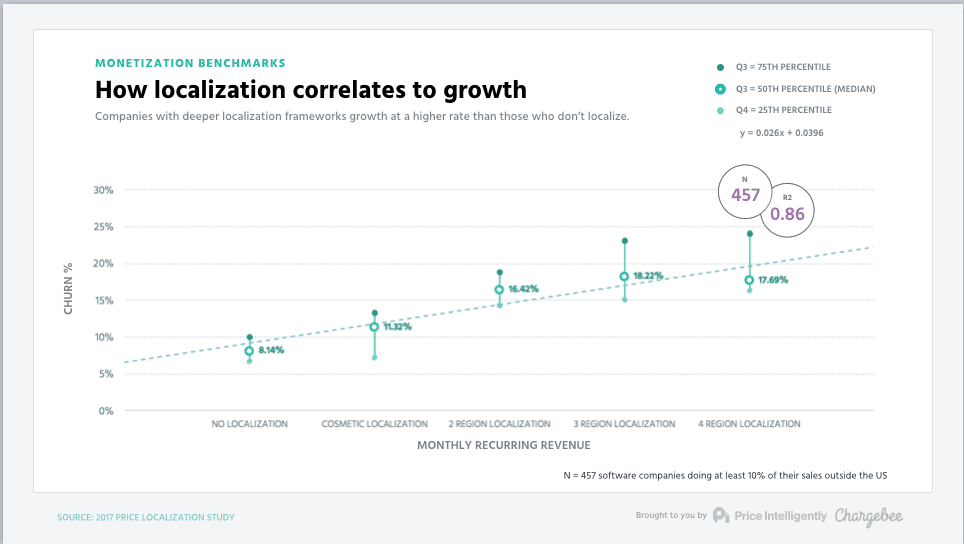

Data supports this notion, indicating that companies with localized pricing strategies see more demand, as evident through growth. In the below, you’ll notice that those companies who just cosmetically localize see nearly a 40% bump in growth. Comparatively, market-based localization more than doubles growth.

Given the growth potential, it’s important to understand the different types of localization:

- Cosmetic localization – simply making sure when someone visits your pricing page that the currency is localized to their region. Implementation involves making adjustments to:

- The Price You show: Using the latest exchange rates, you should be converting your price to the local currency.

- The Currency You Show: You should be displaying your prices in the local currency.

- The Language Your Pricing Page Is In: You should be translating your website to the local language, to appeal to more potential local customers.

These types of changes are the bare minimum and a good place to start with price localization.

- Market localization – with this type of localization, you actually make sure each region has a different relative price (eg. $100 in the US, £150 in the UK, etc.) based on market saturation and demand. To achieve true market localization, you’ll need to:

- Determine Each Region’s Willingness to Pay: Running price sensitivity campaigns is the easiest way to measure differing willingness to pay in each region.

- Understand Your Buyer Personas: This takes a bit of extra work, but by understanding the different aspects of your product that resonate in different places, you’ll be able to figure out your market’s preferences and position your product differently for each region.

- Cosmetic Localization: You’ll still need to ensure your landing page and currency symbols are appropriately set up for each region.

At which stage should you localize?

You should eventually utilize all of these tactics when it comes to global expansion (keep in mind there are more companies outside of the US than inside), but you need to be realistic about the effort involved, given your business’s stage. Here’s a handy guide:

- Pre-Growth Stage (< $5M ARR): You likely have a lot of maturing as a business to do at this stage (everything from hiring out the right exec team to still developing the scaled vision of the product), so cosmetic localization will be optimal at this stage. You should focus more on making sure your target customer is proper before heading into global expansion.

- Growth Stage (5.01M to $100M ARR): At this stage monetization and pricing should be the absolute central tenant of your growth, particularly because of the power in the lever. Market-based localization should be taking place, but if you’re falling behind, start with cosmetic localization. It’s actually a great pricing project to start off with if you haven’t done pricing work previously.

- Late Stage ($100.01M+): In the late stage if you haven’t done price localization of any kind, you’re likely way behind on price optimization in general. Start with getting someone who’s dedicated to pricing – at least part-time, if not full-time.

For more on price localization, here’s our whole guide on developing your subscription pricing strategy.

Finding #2 – Delinquent churn is a tricky beast that must be slayed early

Credit cards (at least for now) are one of the most convenient ways to pay for things, especially online. Yet, credit cards are surprisingly fickle with roughly 130 different reasons why they fail, from limit failures, expirations, processor failures, and so on.

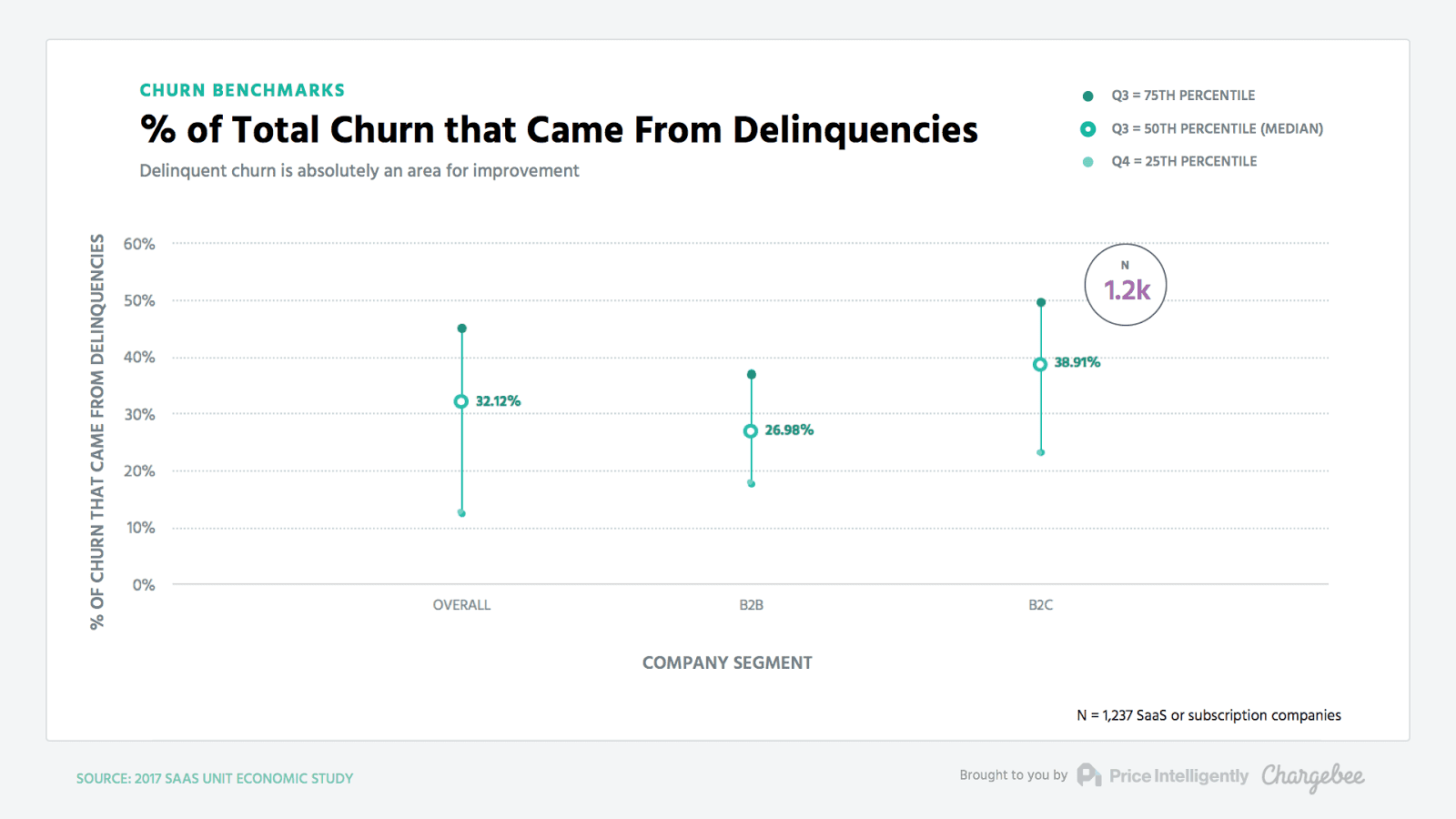

In fact, we discovered that on average 20-40% of your overall churn is made up of these delinquent credit cards, but only 5% of these delinquent customers come back.

The sad part is that recovering this revenue shouldn’t be (and isn’t) difficult. The issue is that most of us just aren’t treating these customers properly. At most, we’re sending a few reminder emails to get paid, but the majority of companies are simply letting the processor retry the card a few times, which doesn’t have great results at all.

How should you fix things up?

You need to treat delinquent customers as their own marketing channel.

Attacking your delinquencies means using targeted outreach to ensure you’re properly getting these customers back by optimizing message opens, clicks, and recovers. Recovery is a game of inches. Tactically, this means you should be using the following:

- Pre-dunning in-app notifications: You need to message users before they fail by tracking expiration dates and notifying them 30 days out from an upcoming charge. The best way to do this is through in-app notifications, because pre-dunning emails were found to cause more churn than they actually solved.

- Post-failure in-app notifications and emails: After the point of failure, you need to make sure you’re sending these folks emails and in-app messages that are properly targeted towards getting these individuals back. Remember to do both, because not everyone checks their email and not everyone logs into your product consistently.

- Avoid phone calls: Unless it’s a large customer, avoid phone calls. We found pretty unequivocally that the ROI on phone calls is extremely low. Most people don’t want to answer their phone anymore.

- Be a human: Keep in mind what you’re trying to do – get someone to pay you again. You need to make sure you’re communicating in a personalized manner. If you act like a bill collector, you’ll get treated like a bill collector. Instead, treat these individuals as fresh leads you’re trying to convert.

- Test, test, and test some more: The large gains we’ve seen on recovering these delinquencies primarily comes from all of the optimizations made to messaging, when these messages are sent, and everything related to influencing opens, clicks, and ultimately the recovery rate. Treat your delinquencies like a marketing channel.

Fortunately, these types of users shouldn’t be difficult to recover, because they already have a relationship with the product. But you’ll still have to put some effort in, to fight for this revenue. If you want to learn more, check out our experience tackling this churn with ProfitWell Retain (which integrates with Chargebee).

Finding #3 – You need to spend so much more time on your pricing

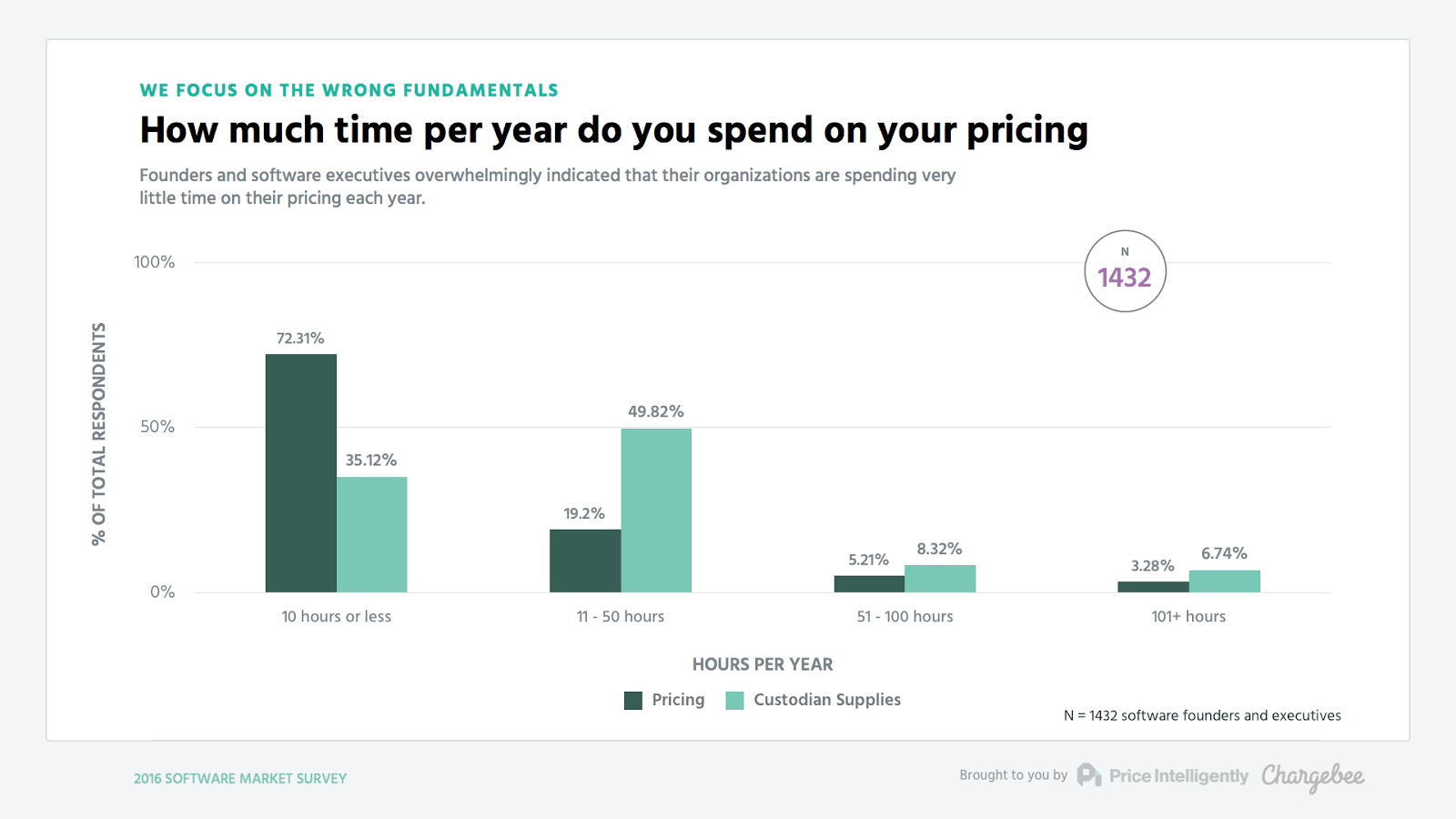

As an ecosystem, we spend a lot of time acquiring customers, which makes sense, because you obviously need more customers. Yet, what if I told you that you’re currently spending more time picking out your toilet paper than you do on your pricing (and it’s not even that close)?

Yup – you spend (on average) 15 hours per year on picking out custodial supplies, compared to an average of 12 hours in the entire history of your business on your pricing.

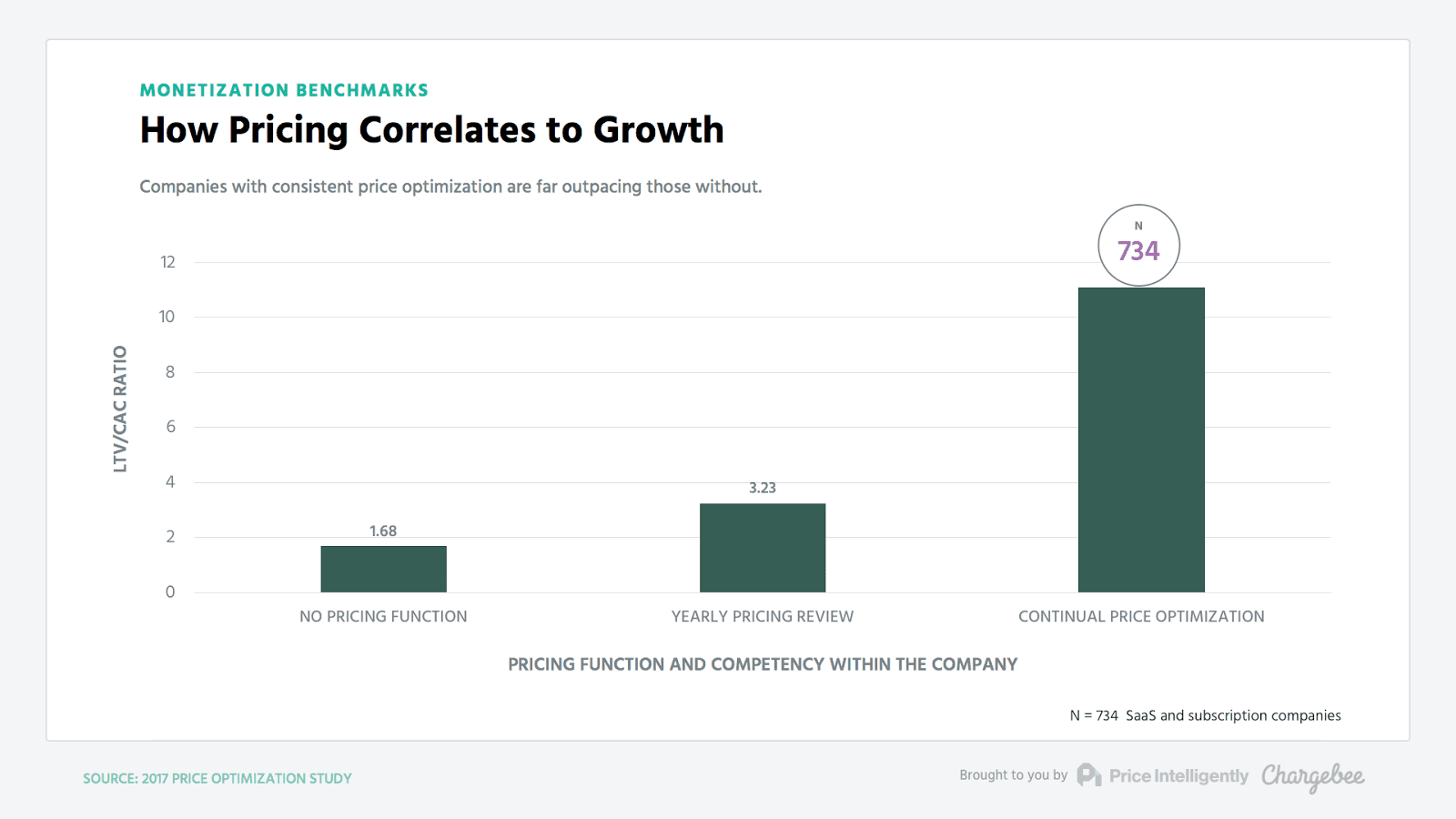

Here’s the issue though — those companies that focus on their monetization continuously, have 6x the LTV/CAC ratio when compared to the folks who haven’t looked at their pricing since they set up the first page.

How do you fix this? Fortunately, fixing your pricing isn’t as difficult as you may think. Pricing is a process. It simply requires focus and effort. While there’s a whole host of pieces within the pricing process, here are the keys to getting started:

- Start small. You can always do more: If you’ve never done much in terms of your pricing (you’re not alone), then jumping in and trying to change your entire pricing strategy in one swoop is an endeavor that will likely fail. Pricing is more than just the number on the page. It’s packaging, positioning, localization, and 43 other pieces. Start small with one problem or activity, then scale from there.

- Prepare for continual price optimization: You should be changing up your pricing every six to nine months. I know that’s shocking if you haven’t changed your prices in five years. Keep in mind though – your price is the exchange rate on the value that you’re creating, so if your product is improving (which it always is through new features, better brand, etc.), then your price should be changing, as well. Commit to making some optimization every quarter (big or small) and you’ll start to see the gains from your monetization.

- Assign someone to lead pricing research and have a pricing committee: You don’t need someone to work full-time on pricing, but someone needs to dedicate at least one day per week (on average) to collecting pricing feedback and research, collating findings, and presenting them to your wider pricing committee. Your pricing committee should be made up of the key stakeholders of a pricing change (sales, marketing, product, finance, etc.) and a single decision maker. This team should meet once per quarter, facilitated by the research and goals set by the committee and executed by the pricing manager.

- Data is King, Queen, and God: In the technological, interconnected world we live in, there’s no excuse for not collecting data from your customers to answer most of your pricing questions. These individuals are the only people who will truly be able to tell you their willingness to pay and what they value (or don’t value) in your product. You simply need to ask them in the right manner.

- Pricing is a process: I can’t repeat this enough – know that pricing is a process and should be a continual effort. You don’t have to do everything in one go, and shouldn’t, because your market, customer, and product are constantly evolving.

I realize I’m leaving out an incredible amount of detail, so here’s a 140-page guide we wrote on how you can run your pricing process. It’s free and includes every single step you’d need to implement the above.

Finding #4 – Annual subscriptions are your friends. Get more friends.

Everyone knows that annual subscriptions are great for cash flow. But that’s not the only reason to encourage your customers to think long-term. Subscriptions longer than one month have over 30% better revenue retention than monthly plans.

This intuitively should make sense: the fewer purchasing decisions you present to your customer in a year, the fewer chances they have to stop paying. To help in this effort, here’s a breakdown of how to think of annuals through your funnel:

- Potentially go entirely annual: This is a pretty big decision, so make sure you’re making this decision based on data. Yet, for companies who are selling workflow-based products or selling primarily through a longer sales cycle, annual-only options may be your best bet. It’s worked wonders for companies like HubSpot for cash flow, retention, and usage.

- Ask your customers to upgrade to annual at the magic moment: Most companies aren’t asking for annual upgrades except in the signup process, which may be the worst time to ask for a lot of products, since the customer hasn’t yet seen the value from your product. Instead, determine when your retention starts to flatten out (the point at which tire kickers and non-ideal customers have churned out) and ask for annuals during this period. You’ll notice an increase in the proportion of your annual customers simply because you asked at the right time.

- During checkout, make your customers opt out of annual, instead of opting in: One of the easiest optimizations to make on this front is to opt your customers into the annual plan when they’re checking out. You need to make sure that you make this clear, along with how much it’s going to save them. Yet, simply changing up the mindset and forcing them to click the “monthly” radio button instead of the annual will make gains to your proportion of heavier paying users.

- Don’t give away a percentage, give away a free month: When thinking through an annual discount, don’t give away a percentage off – 15%, for example. Instead, give away a month or two. It may seem like a semantic change, but human beings don’t understand percentages naturally, making the physical feeling of giving away an actual month more effective.

In all, optimizing for annuals is a great growth lever to keep in mind when you’re trying to optimize your pricing. For more on this topic, here’s a deeper breakdown of annual optimization on the PI blog.

Finding #5 – Expansion revenue is absolutely key

The first step to tackling churn is recognizing that there’s a problem.

But you might not know that your business needs an intervention if you aren’t separating your revenue into net-new and expansion revenue. If you just focus on “Overall Growth”, you’ll likely end up hiding massive retention problems in the early days when it’s “easy” to acquire enough customers to overcome those that churn.

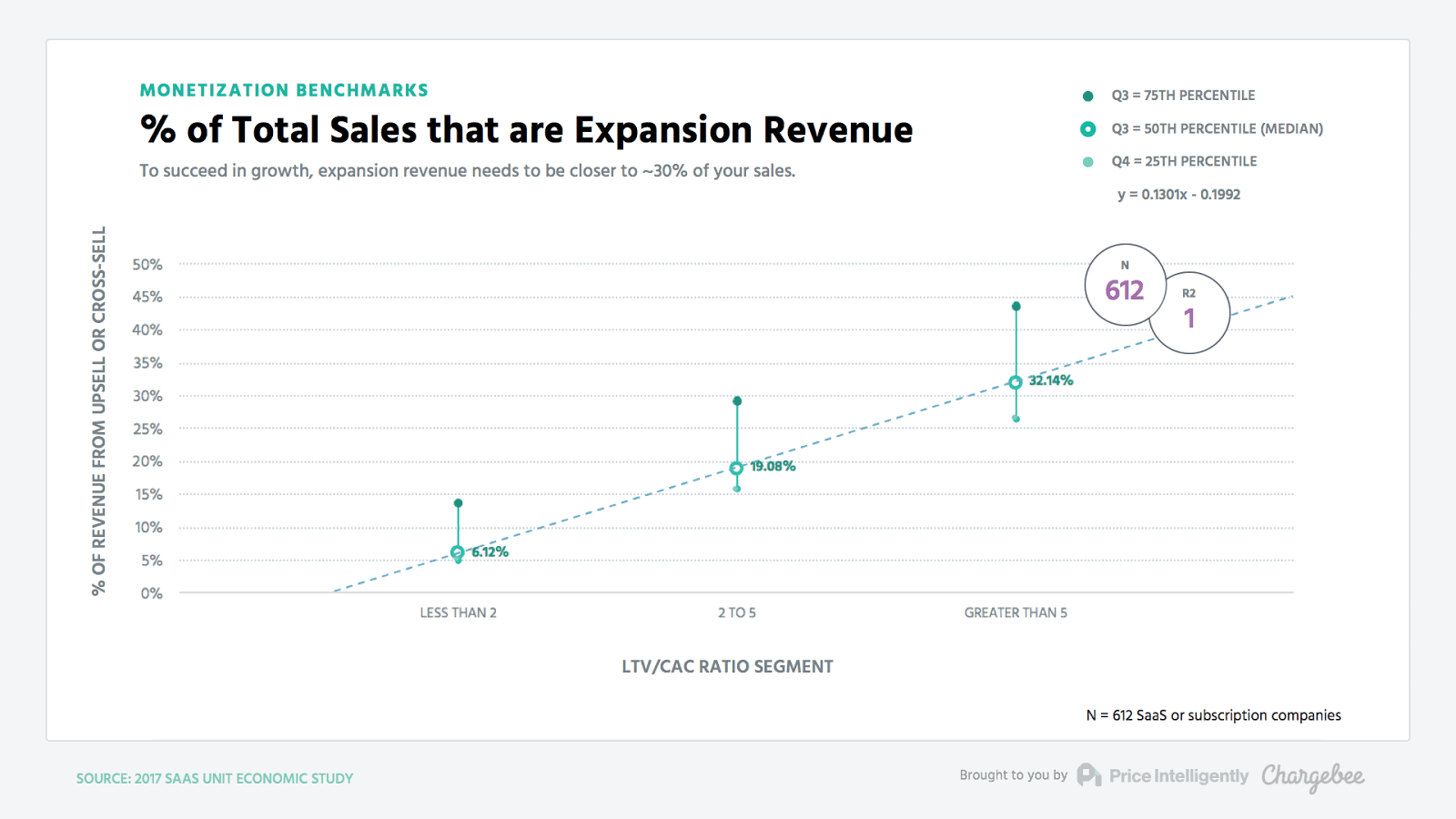

As a benchmark, expansion revenue should make up 20-30% (or more) of your monthly revenue, but for most subscription companies, it’s 10% or less. Tracking expansion growth separately ensures you’ll stay focused on improving that revenue rather than plugging the gap from churn with net-new revenue.

Want to see how you stack up? Chargebee now connects directly to ProfitWell for free subscription financial metrics. You can sign up for free here.

Easier said than done, right? Well, you need to approach your expansion revenue through two key levers: Churn reduction and upgrade revenue.

Tackling churn

Churn reduction is crucial, because while you’ll never get to absolutely zero churn, there’s a whole host of things you can do to reduce your active and delinquent churn, as much as possible.

Most companies don’t think about churn until deeper in their development, which results in massive problems down the road, because it’s not that simple to just change the DNA of your company when you’ve hundreds, if not thousands, of employees. Here’s a good framework to implement as early as possible:

- Make sure you’re measuring churn properly: There’s a group of your churned customers that you really shouldn’t worry about, especially if you’re a subscription product that can be purchased without talking to a human being. These “tire kickers” should be disregarded, which makes measuring your churn at three stages so important – typically your first 2 weeks, your first month, and your first 3 months. As a result, you’ll be able to see if you truly have a churn problem or if it’s simply a case of shaking off the wrong customers.

- Gather churn insights: Seems simple, but there are clearly reasons why people are leaving your product. The reasons may be fragmented as all hell, but you don’t know that until you ask. Make sure you’re using exit surveys or follow up emails to properly understand why someone’s leaving.

- Pick off the biggest/easiest levers to solve based on those insights: You’ll typically find that a lot of churn can actually be solved higher up in the funnel, by making sure you’re showing people the features they feel are missing or by simply providing customers the right access (not being able to get ahold of support is a surprisingly big reason why people churn). Other pieces of churn will be much bigger challenges to tackle – features you’re missing or need to build, deeper market research on your target customer, etc. You’ll have to prioritize and attack these pieces one by one.

The above seems easy to say, but it truly is much harder to do. Yet, you’d be surprised at the number of companies that aren’t even doing these basics. For more on tackling active churn, here’s a book we wrote on tracking and tackling churn with Growth Guru Brian Balfour.

On the delinquent side, tackling churn is a much more straightforward process that we wrote about above.

Expansion revenue

Ensuring you’re set up for success on the expansion revenue side is critical even if you lower your churn to the rails, because you need to somehow make up for that churn that does still exist (and hopefully make up for much more through net-negative churn). There’s a whole host of optimizations on this axis, but here’re a few infrastructural pieces to keep in mind:

- Utilize a value metric: You should be pricing based on some sort of value metric (per user, per 100 visits, etc.). If you’re able to find the right value metric that aligns with your customer, you’ll not only have a much easier time converting customers, but you’ll also make the upgrade conversation seamless. This is because that customer sees the value in your product along that metric, so if they’re using more of that metric, then the exchange on that value is a fairly easy decision. Spurring upgrades from feature differentiation is typically much harder, because you’re forcing that customer to not only think about if that feature is worth the extra cost, but also if it’s worth getting all of the other features included in that plan. Here’s more on getting your value metric properly set up.

- Make sure you’re asking for the upgrade: If you’re creating something of value and you’re targeting the right customer, getting a user to upgrade shouldn’t be a herculean task. Yet, a lot of us just aren’t asking our customers through the proper funnels to upgrade. Instead, we’re just hoping a customer is going to say, “yes…I’ll pay you more…where do I pay you more?” This just isn’t realistic, even if you have the best product in the world. You need to activate that potential energy. As such, if you are feature differentiated, make sure you study and determine what a good upgrade trigger looks like. Once identified, design your message around where that trigger should be pulled.

Expansion revenue needs to be at the forefront of your pricing strategy, as well as your overall growth strategy from the beginning, because changing the inertia of your customers always increases in difficulty as you grow.

Subscriptions: beautiful as long as you can convert the beast

As with all subscription growth advice, you always need to keep the DNA of your company in mind. Sometimes some of these tactics just aren’t going to make sense for your customer or vision of the future.

Other times you need to make the changes earlier in your life cycle, because if you get too big, the DNA of the company will be too hard to change and evolve. Either way, you always need to be considering your way up the mountain of growth.

Fortunately, subscriptions are slowly, but surely, becoming the bedrock of the growth sector in the world. Thankfully, this means there are more and more of us studying the vertical to understand what works and what doesn’t for growth.

If we all as an ecosystem continue to share what we know (and what we don’t), we’ll fortunately be able to continue to help one another supercharge the growth of our sector as a whole.

We’ll continue to reveal more and more findings as we dig further into this universe, but if you ever have any questions, feel free to reach out to me at pc@profitwell.com. We’re more than happy to help.