In SaaS, annual contracts continue to dominate. They do have their advantages. From increasing cash flow to improving retention to delaying churn, they bring even more predictability to your business.

“As you increase your annuals, you’ll be reducing your churn – with annual contracts churning almost five times lesser than monthlies,”

– Neel Desai of ProfitWell.

But they bring about some challenges too.

Like having to deal with payment flexibilities through purchase orders, ‘Net D’ payment terms, repeated follow-ups, long legal and approval cycles, negotiations, and discounts. And other operational complexities.

A more critical (and perhaps, more consequential) challenge, though, is to account for annual contracts accurately. You can’t afford to go wrong here. Say, your customer signed an annual contract, but has stopped paying you 4 months into the contract. And you forget to record this as a bad debt under your expenses. Imagine how this would impact your year-end fiscal reporting then…

This required accuracy can only be attained with an understanding of how revenues and expenses are accounted for, and how they impact your annual contracts. So, you are able to operationalize your finance processes for the long-term.

Accounting for Revenue

Before we go deeper into the impacts of annual contracts on revenue, it’s worth reminding ourselves what revenue really is, so nothing falls through the GAAPs. 😉

It isn’t revenue unless it’s recognized. And it’s recognized only when you have delivered your product or service to a customer, and there’s a reasonable certainty that you will get paid for that.

(I could go deeper into the nitty-gritty of revenue recognition, but this guide should come in handy. It covers several subscription scenarios in which revenue recognition could potentially become a challenge, such as mid-cycle plan upgrades or downgrades, refunds, cancelations, write-offs etc.)

So, what happens to the money that you’ve collected upfront through annual contracts?

What happens is, it gets “deferred.”

Whenever an invoice is raised, you would route it through “Deferred Revenues” — a temporary holding account, which holds the pending revenue until it can be recognized for the rest of the subscription period.

Annual contracts impact revenue recognition even more in the context of the changing compliance landscape.

FASB and IASB have introduced new accounting standards — ASC 606/IFRS 15, which go deeper into defining ‘delivery’ of services into individual performance obligations (implementation costs, maintenance costs, discounts, etc.) and estimating the standalone selling price(s) (SSP) for these obligation(s) i.e. the price at which you would sell your promised service individually to a customer.

Let’s consider the implications with an example.

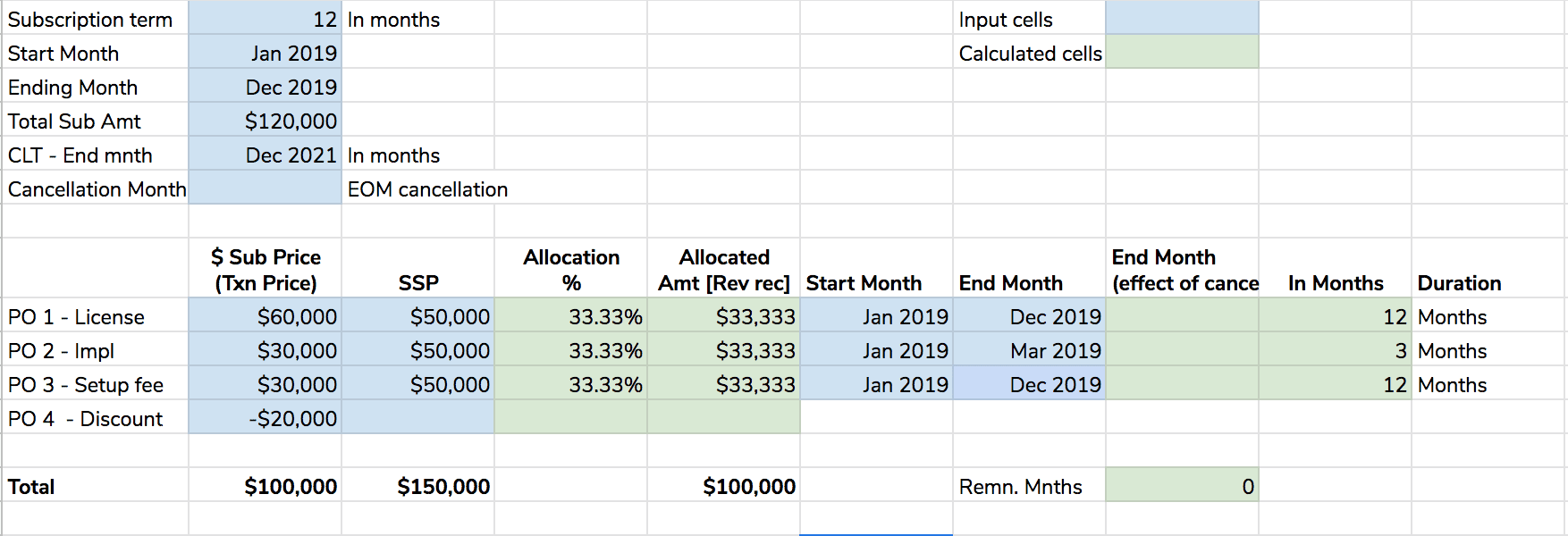

Your account executive, Sandra, has won an annual contract of $120,000. The subscription starts on January 1st, 2019 and ends on December 31, 2019.

Let’s break the contract into four distinct performance obligations – a license fee, an implementation fee, a setup fee, and a discount for the first 3 months. I’ve calculated the revenue allocation, based on the standalone selling price (SSP) and the transaction price (Txn Price). (You can find the meanings of SSP and Txn Price below the image)

Transaction price (Txn Price) – This is the contractual price that you have agreed upon with your customer. This includes variable amounts as well, like discounts, price concessions, or performance bonuses. Example: A cloud provider might grant a concession on the monthly pricing to the customer if the software didn’t perform as expected.

Standalone selling price (SSP) – This is the price at which you would sell your product or service separately to a customer (without the variable component). You’ll have to list the SSP not just for particular product licenses that you might know the individual prices of, but also additional offerings like telephone support which you might have previously sold as part of a bundle.

Revenue Allocation: Allocating a transaction price is done based on the standalone selling price. So the allocation percentage is called ‘relative weightage’. The idea is, each individual component (product price, set up price) is treated as individual services that can be provided to customers with prices allotted to them and you could apportion that transaction price across each of these individual obligations.

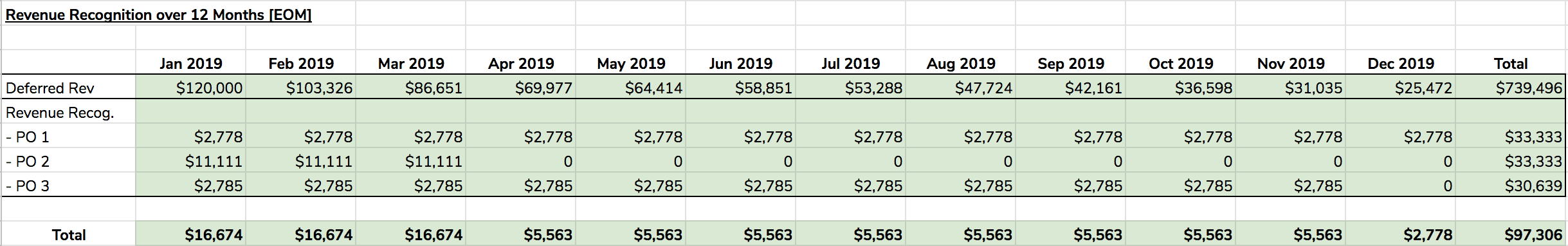

So the revenue recognized for each performance obligation is deferred over 12 months as in the table below.

You now need to calculate Sandra’s sales commission on the deal. Let’s assume you have so far paid out $1 in compensation for every $5 in MRR as an upfront payout.

But payouts, too, need to be treated differently for annual contracts. You need to ensure that wages and bonuses, sales commissions, affiliate commissions, and all other expenses are recognized and accounted for only when incurred.

Accounting for Expenses

Typically, in the case of accrual-based accounting, a practice that SaaS businesses follow, they match the commissions earned and paid in a quarter with the revenue earned in the previous quarter.

But according to the Matching Principle, you must match the commission costs with the revenue they generate. You must record any expense when it is incurred, rather than when a cash payment occurs.

So, if Sandra has made the sale in January, and earns a 10% commission in January, this expense needs to be booked in January, instead of February, when the revenue was booked.

There’s a risk associated with the upfront booking of expenses. You are seeing your first expense in the form of sales commissions before you’ve even started recognizing your revenue. Here’s the break-up:

- Sale: $120000 for 12 months

- Revenue recognized in Jan: ~$16000/month

- Expense = sales commission payout to Sandra: $24000

- Cost of revenue = monthly Cost of goods (the sum of the cost of the product and the direct cost incurred to sell the product): $10k, CAC: $10k

- Total expense: $44000

So why is this risky? For starters, your customer might churn before the end of the contract and you might have to issue a refund. Or Sandra could leave your company before the contract ends.

For mitigating these risks, you could structure sales commissions by tying them to the revenue component instead of the contracts won, and deferring the expenses booked.

In conclusion, for your annual contracts to be effective, you will need to look beyond earning the revenue. It would work well to look at them in relation to your expenses, so you are able to better appreciate what is available in order to run your business.

Disclosure: Every subscription business is unique. Granted, there are complex rules and guidelines that determine how revenue is to be recognized, but there remains a dimension of subjectivity in determining how exactly your company will recognize your revenue. In the end, your auditor will have the final say and you could always write to us or reach out to your auditor to answer more specific questions.

Want to learn more about how Chargebee can empower your finance team to automate ASC 606-compliant revenue recognition? Talk to our Subscription Billing Consultant here.