Inaccurate reporting of Revenue can lead to tax fines up to 300% of taxes, fines up to Rs 25 lakhs, and even imprisonment in cases of willful evasion of taxes.

– Source

What is RevRec?

On a high level, Revenue recognition is the process of accounting for and reporting revenue earned by a company. It involves determining when revenue should be recognized, how much revenue should be recognized, and in which accounting period it should be recognized. This is important for financial reporting and helps investors and stakeholders understand a company’s financial performance.

Why is Revenue Recognition important in India?

Revenue recognition is important for businesses in India for several reasons. If revenue recognition is not handled properly, there can be several potential risks for businesses. Firstly, inaccurate revenue recognition can lead to incorrect financial reporting, which can damage a company’s reputation and lead to legal and regulatory issues. Secondly, it can result in incorrect tax reporting, which can lead to penalties and fines. Additionally, improper revenue recognition can lead to incorrect decision-making, as businesses may not have an accurate understanding of their financial performance. This can lead to poor financial strategies, inefficient operations, and ultimately, lower profitability. Overall, proper revenue recognition is crucial for businesses to avoid these potential risks and ensure accurate financial reporting and decision-making.

The risk of non-compliance could be huge. One of the more pertinent ones in recent times is BYJU’s case where the revenue recognition was not consistent which cost a huge beating on their branding beyond the millions of dollars lost in valuation.

RevRec standards in India

In India, the revenue recognition standards are set by the Institute of Chartered Accountants of India (ICAI) and are known as Indian Accounting Standards (Ind AS). These standards are largely based on International Financial Reporting Standards (IFRS) and are similar to Generally Accepted Accounting Principles (GAAP) followed in the United States. However, there are some differences between Ind AS and other accounting standards.

Overall, while there are some differences between Ind AS and other accounting standards, they are largely similar and aim to provide transparency and accuracy in financial reporting.

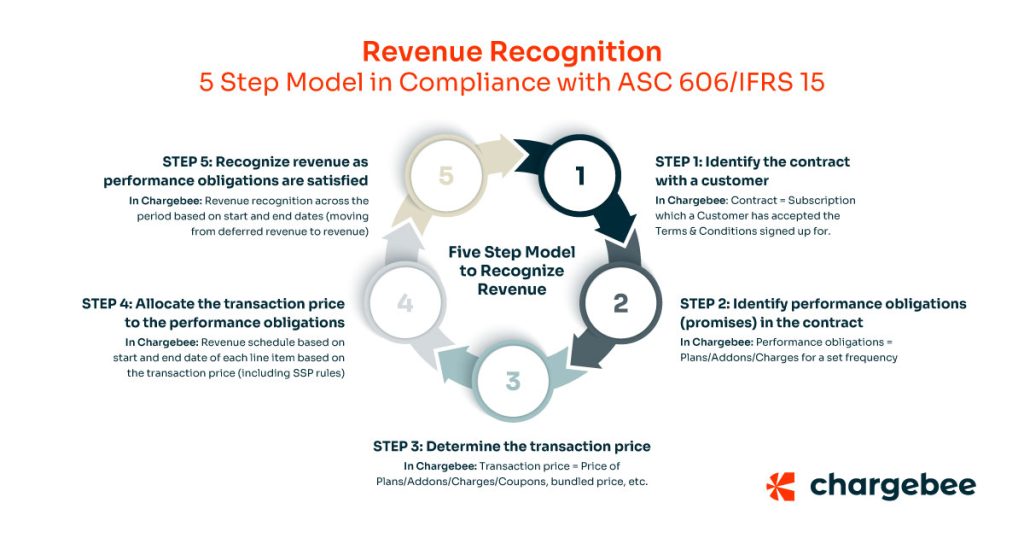

Chargebee RevRec complies with the 5-step accounting standards as below:

Common Revenue Recognition Use Cases Seen in India:

Below are a few use cases merchants are faced with in India:

- Various revenue recognition treatments

- Standalone selling prices for revenue reallocation

- Discount Recognition

- Contract vs Invoice Recognition

- Carve out and carve-ins

- Usage-based recognition

- Direct and indirect sale related Expense Recognition

- Manual Adjustments

- Journal entry mapping & period closes

- Multi-entity consolidation

- Credit notes recognition

- Unbilled Recievebles recognition

1. Various revenue recognition treatments:

Based on various use cases

– Ratable method (or) Over the period ( or) time-based recognition.

– Point in Time method

– Proportional Performance (or) percentage completion based (or) milestone recognition

You can learn more about this method in this article by Chargebee RevRec:

2. Standalone selling prices(SSP) for revenue reallocation:

Chargebee RevRec allows businesses to allocate revenue to different performance obligations based on their standalone selling prices. The software automates the process of calculating the standalone selling prices and ensures that revenue is allocated correctly. This is helpful in scenarios where a particular line item is heavily discounted or given away for free. You can learn more about this feature here.

3. Discount Recognition:

Chargebee RevRec’s discount recognition feature allows users to accurately recognize revenue from discounted sales. This feature ensures that revenue is recognized in accordance with accounting standards, and helps businesses maintain compliance. Discount recognition gets tricky when applied at an individual line item and/or when contract terms are enabled and/or when these discounts need to be reallocated based on the SSP and list prices for various performance obligations You can learn more about recognizing discounts here.

4. Contract vs Invoice Recognition:

Chargebee RevRec allows businesses to recognize revenue based on contracts or invoices. The software automates the process of recognizing revenue based on the terms of the contract or invoice and ensures that revenue is recognized correctly.

As an example, you might have a contract in which year 1: you collect INR 12,000, year 2: INR 24,000 & year 3: INR 36,000. From a RevRec standpoint, the revenue to be recognized in month 1 needs to be INR 2000(12,000+24,000+26,000/36) rather than INR 1000 in month 1.

5. Carve out and carve-ins:

Chargebee RevRec allows businesses to recognize revenue from carve-out and carve-in transactions. The software automates the process of recognizing revenue from these transactions and ensures that revenue is recognized correctly. This is helpful in scenarios where you might want to split or merge performance obligations. Just as an example, you could be selling MS Office for INR 20000 which has elements of MS Word(INR 8000) & MS Office(INR 12000) which is basically a carve-out arrangement. In this case, the revenue reallocation can be automated.

6. Usage-based recognition:

Chargebee RevRec allows businesses to recognize revenue based on usage metrics. The software automates the process of calculating usage-based revenue and ensures that revenue is recognized correctly. This can be a mix of Revenue recognition based on usage (or) in some complex cases the service period of each of the usages.

7. Direct and indirect sale-related Expense Recognition:

Chargebee RevRec allows businesses to recognize expenses related to revenue recognition. The software automates the process of recognizing these expenses and ensures that they are allocated correctly at a sales order level. A few examples could be sales commissions, reseller commissions, expenses, etc. You can learn more about how Chargebee RevRec solves for this here.

8. Manual Adjustments:

Chargebee RevRec allows businesses to adjust revenue recognition based on changes in contract terms or other factors. The software automates the process of making these adjustments and ensures that revenue is recognized correctly. You can learn more about adjustments here.

9. Journal entry mapping & period closes:

Chargebee RevRec allows businesses to map revenue recognition entries to journal entries and close accounting periods. The software automates the process of mapping entries and ensures that accounting periods are closed correctly. Also, it is very important that once the accounting period is closed, there shouldn’t be any changes to those entries. Rather these have to be handled as catchup entries in the current month or future months based on specific use cases. You can learn more about Journal entry mapping here.

10. Multi-entity consolidation:

Chargebee RevRec allows businesses to consolidate revenue recognition across multiple entities. The software automates the process of consolidating revenue and ensures that revenue is recognized correctly across all entities. You can learn more about multi-entity recognition here.

11. Credit notes recognition:

Chargebee RevRec allows businesses to recognize revenue from credit notes. The software automates the process of recognizing revenue from credit notes and ensures that revenue is recognized correctly. Please refer to this documentation on various modes of recognizing credit notes.

12. Unbilled Receivables Recognition:

Chargebee RevRec allows businesses to recognize revenue from unbilled receivables. The software automates the process of recognizing revenue from unbilled receivables and ensures that revenue is recognized correctly. You can learn more about Unbilled Receivables here.

Reporting & export function

Chargebee RevRec provides businesses with various reports that are essential for revenue recognition. Here are some of the key reports and their brief explanations:

- Unearned Revenue RollForward: Tracks the deferred revenue balance (or unbilled receivable) by accounting period, as well as the activities, including sales, billings, recognized revenue, and foreign currency adjustments that impact the balances. This report increases deferred revenue with new billings and decreases the total as revenue is earned.

- Unearned Revenue WaterFall: Forecasts the future deferred revenue balances based on the current orders and revenue recognition schedules.

- Revenue Backlog WaterFall: Forecasts the future remaining unearned total sales orders based on the current orders and their revenue recognition schedule. It provides a periodic roll forward of the backlog as is planned today through a specified future reporting date.

- Journal Entry Report: This report provides a summary of journal entries for a specific period. It includes information such as journal entry date, journal entry type, and journal entry amount.

These reports are essential for businesses to ensure that revenue is recognized correctly and to comply with accounting standards. Chargebee RevRec provides businesses with these reports and allows them to customize the reports based on their specific needs. With these reports, businesses can gain insights into their revenue recognition processes and make informed decisions. You can explore all reports supported by Chargebee RevRec here.

More importantly, a lot of customers would like to slice and dice these reports by various parameters like products, customers, etc which might needed by the audit team, in case they need a sample set of customers to verify. Exports help with these scenarios. One other common use case for these reports is forecasting. You can export the deferred revenue waterfall reports, and apply assumptions like churn rate, growth rate, etc on top of these reports before presenting them to the board or to CXOs/CFOs. You can learn more about exports here.

What are Versioning & Auditability?

Versioning and auditability are critical aspects of revenue recognition. It involves maintaining a record of all changes made to revenue recognition entries. Chargebee RevRec provides businesses with versioning and auditability features that allow them to track changes made to SSP, Accounting Rule configuration, as well as invoice, sales order, customer, and product data, that impact revenue recognition The software also allows businesses to maintain an audit trail of all changes made to revenue recognition entries, which can be used for internal and external audits.

What are Control Checks?

Control checks are essential for ensuring that revenue recognition entries are accurate and compliant with accounting standards. Chargebee RevRec provides businesses with various control checks that help them ensure that revenue recognition entries are accurate and compliant. These control checks include validation checks, reconciliation checks, and exception reporting. The software also allows businesses to customize the control checks based on their specific needs and requirements.

Overall, Versioning & Auditability and Control checks are critical aspects of revenue recognition, and Chargebee RevRec provides businesses with the necessary features and tools to ensure that revenue recognition entries are accurate and compliant with accounting standards. With these features, businesses can automate their revenue recognition processes and ensure that revenue is recognized correctly.

Key Takeaways

In conclusion, Chargebee RevRec provides businesses with a comprehensive solution for revenue recognition that is tailored to their specific needs and requirements. The software supports various revenue recognition methods and allows businesses to recognize revenue from different sources.

With Chargebee RevRec, businesses can automate their revenue recognition processes and ensure that revenue is recognized correctly.