There’s trouble in town.

There, I’ve said it. This unexpected state of SaaS is threatening businesses. Most organizations are reducing their budgets and running their revenue engine with buffers. Discretionary spending is being followed by a majority of the SaaS market that has taken a hit across its revenue cycle.

You already know this because most of your customers are experiencing this: either they don’t have a particular need for your product/service at the moment, or they believe that their spending can be better focused on another product.

Some food for thought for businesses that are trying to meet their customers half-way: To build a lasting relationship that survives this storm, it is vital that you offer maximum subscription flexibility, on top of your product’s capabilities.

We got that flexibility part covered for you. Here’s a list of a few tried and tested features of Chargebee used by our customers at this time of crisis that can aid you too:

- Give your customers the ability to “Pause” subscriptions

- Adjust/refund charges on invoices using “Credit Notes”

- Create discounts and coupon campaigns for your customers

- Set up multiple online and offline payment methods

- Defer monthly payments to a future date

- Offer self-service portals to let users move between plans

- Send contextual email notifications to customer segments

#1 Better “Paused” than “Canceled”!

The problem and the solution

Churn. With finance teams enforcing stringent budgets, the chances of an increase in cancellations are much higher. Nobody likes churn, but what if you don’t have to lose customers? Chargebee’s Pause Subscriptions feature allows customers to temporarily pause their subscriptions, stick with your product, and reactivate when they’re ready. Remember, it’s harder to bring back churned users, in contrast to revenue.

How Chargebee can help

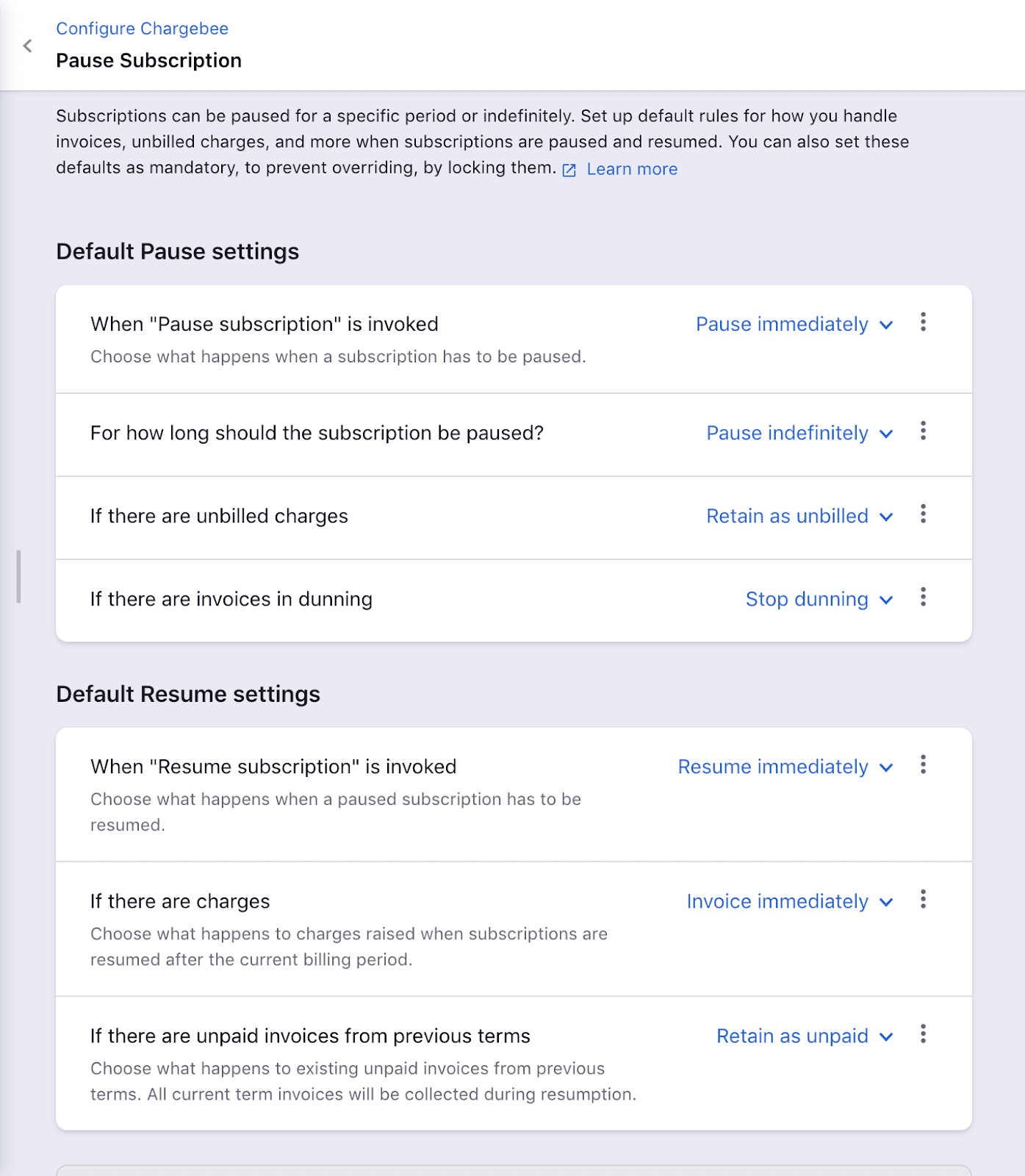

Inside Chargebee, you can configure the rules for when to pause the subscriptions, and until when they should be in that paused state. By retaining existing unbilled charges, you can charge your customers only when they resume their subscription (or even after resumption— all the more reason to stay with you).

The Impact

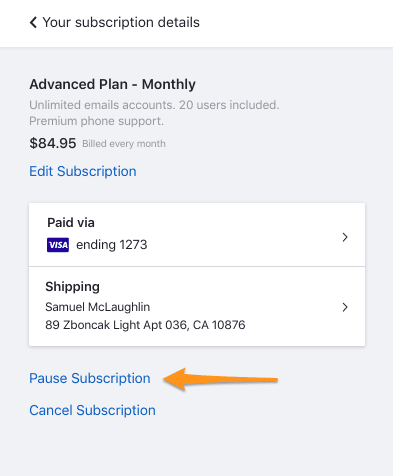

Once the feature is enabled, you can pause subscriptions from right within your Chargebee site or using APIs. You can even let your customers do it on the front-end themselves— either immediately or just before their next billing date. They can also resume the subscriptions, whenever they want to. And that’s a level of flexibility that your customers would celebrate! Here’s how you can configure “pause subscriptions” inside the Chargebee app.

Want to get a demo of Chargebee’s pause subscription feature? Hop on a quick call with our product consultants now!

#2 Keep your healthy customers close, your at-risk customers closer!

The problem and the solution

Many of your customers might not be making the same revenue they did last month. And it won’t come as a surprise if that graph declines over time. The best you can do for them until they get back on their feet is to give your product for free or move them to a lower plan. But how easy is that for you to set up?

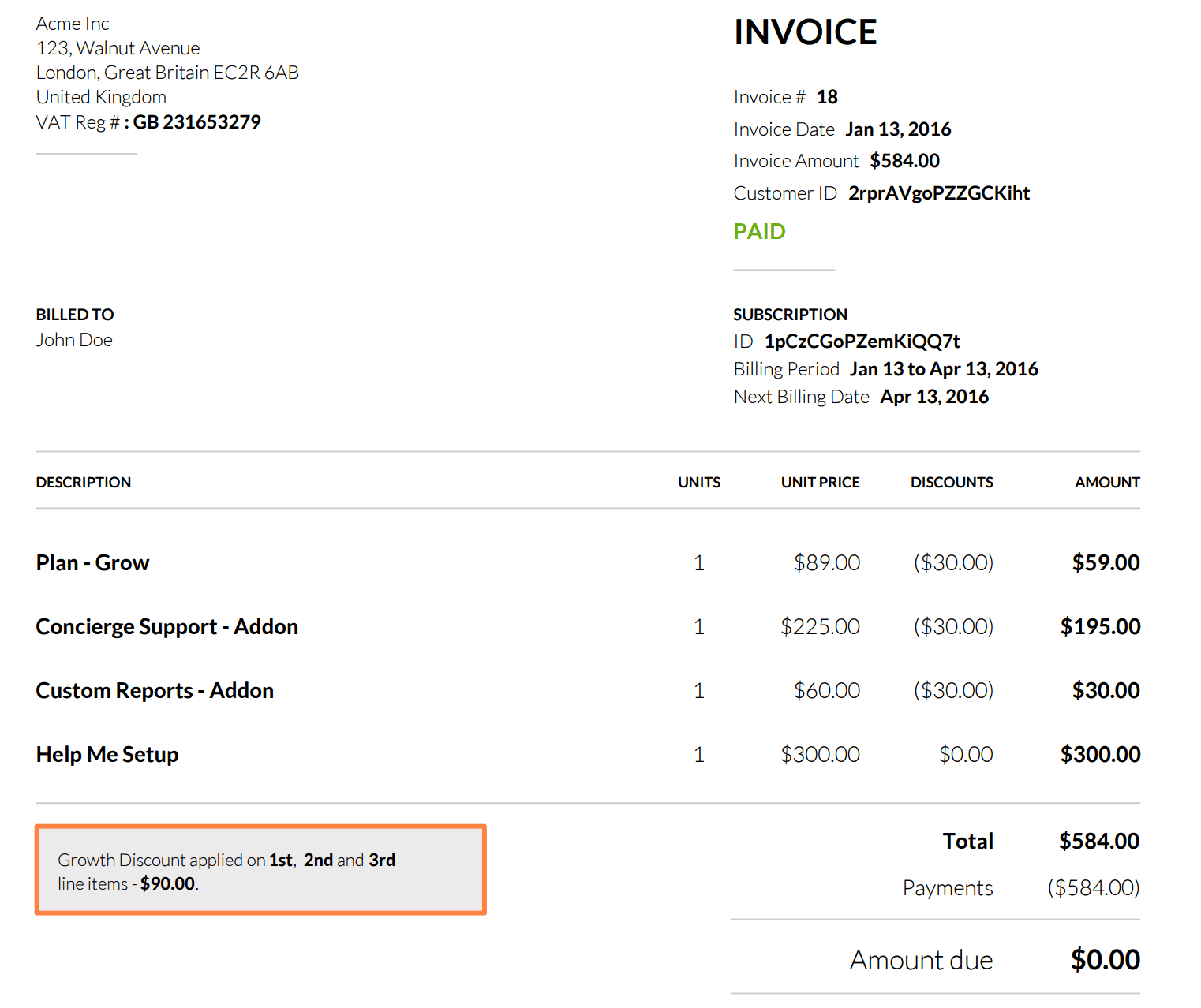

With the help of Credit Notes, Chargebee lets you move customers from one plan to another with prorated charges, the ability to refund individual line items on an invoice, or write-off the whole invoice altogether. You can even create a new plan inside Chargebee for your at-risk customers.

How Chargebee can help

Chargebee lets you create Credit Notes which are either adjustable or refundable. An adjustable credit is when your customer hasn’t paid for the invoice, while refundable credit is for all paid invoices. You can apply previously created credit notes for invoices, or you can manually select invoices and apply credit notes just for those.

The Impact

It’s easy, deciding to move customers to lower plans, but it’s hard to make that work seamlessly in the back and ensure that the books you see every day are accurate. With Credit Notes, you can modify plans/addons, reflections of discounts, and prorated charges for subscription changes. Chargebee helps you track all the changes in subscriptions, invoices, and revenue right back to your daily reports. See how you can setup Credit Notes inside Chargebee.

Finding the docs too hard to follow? No problem.

Our team is right here to explain how Credit Notes work inside Chargebee over a 10-minute call at the time of your choice!

#3 Payment flexibility across the funnel!

The problem and the solution

Facing a drop in your acquisition? Poor conversion rates? Rise in churn? Although equal attention is needed for all the three problems to keep your engine running, there’s only so much you can do to tackle them from a product perspective. What you need on top, is payment flexibility throughout the funnel.

Promotions and incentives play a vital role in driving your users to the product and in boosting sales. And one easy way of doing it is by using Discounts and Coupons. Chargebee gives you the flexibility and ease of providing buyers with discounts, promotions, and special offers with coupons.

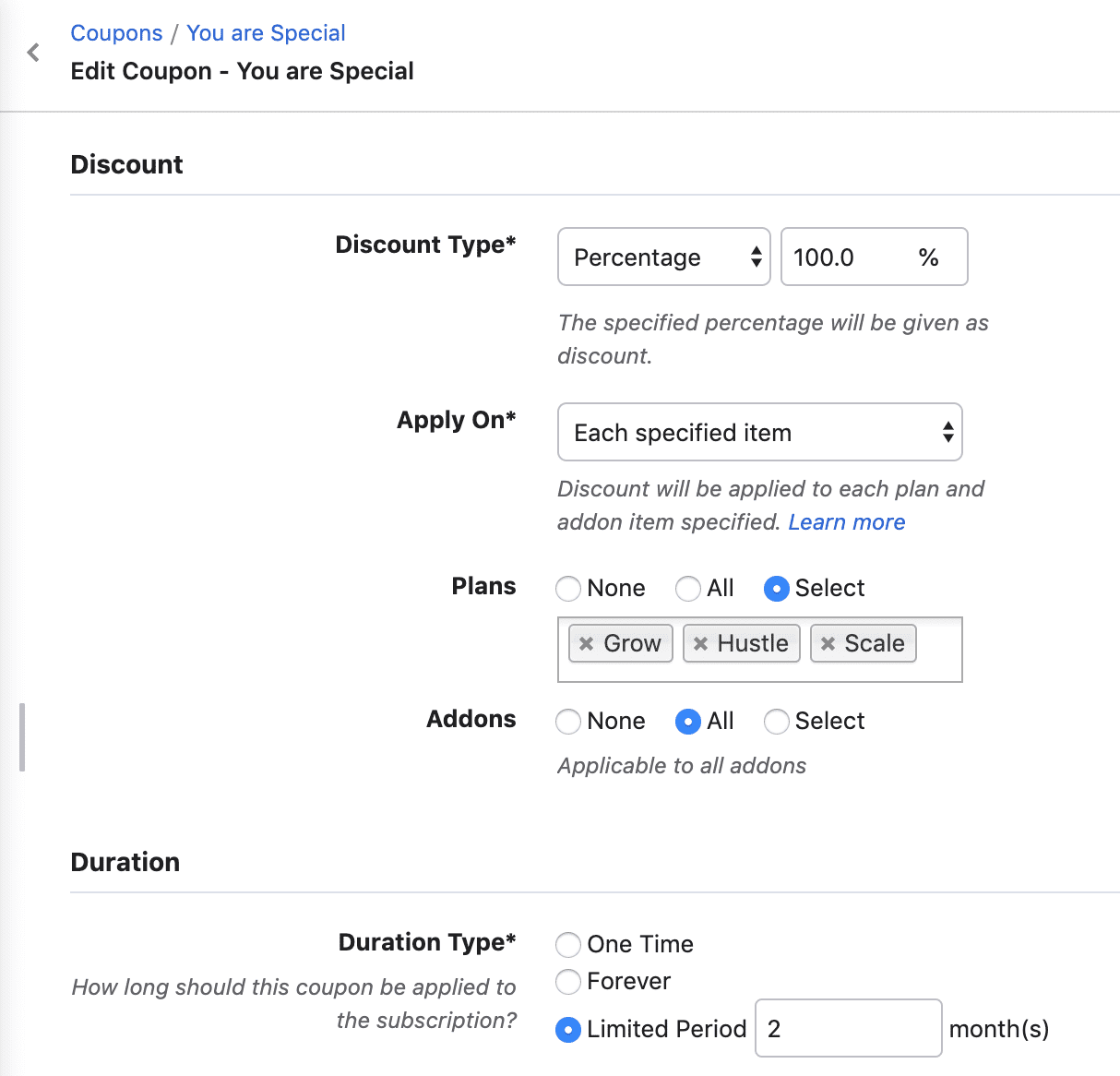

How Chargebee can help

It takes less than a minute to create a coupon inside Chargebee. You can apply the coupon on the entire invoice, or for each specified plan/addon. Chargebee allows you to create a fixed-amount discount or a percentage-based discount, along with the option to modify the duration of the discount as well.

The Impact

As said before, coupons go all the way— from acquisition, conversion, to retention.

- By setting up a fixed amount discount for your paid plans, convert your free-trial users into paying customers.

- Reheat conversations with your cold leads and deals, get them to use your product for say, a month, for free by applying a 100% discount.

- Make sure that your existing customers stay with you by offering loyalty rewards.

- A customer wants to extend free-usage for the entire quarter? Setting up a recurring coupon in Chargebee is as easy as pie.

Talk to our consultation team and set up coupons to boost conversions all over the funnel!

#4 Offline payments are taking a hit!

The problem and the solution

Banks are working less. Offline payments are falling. The pandemic has resulted in a global transition away from payments via cash, bank transfers, or cheques. And, there is a good possibility of cashless payment adoption and usage ticking up worldwide— high time offline business moved online.

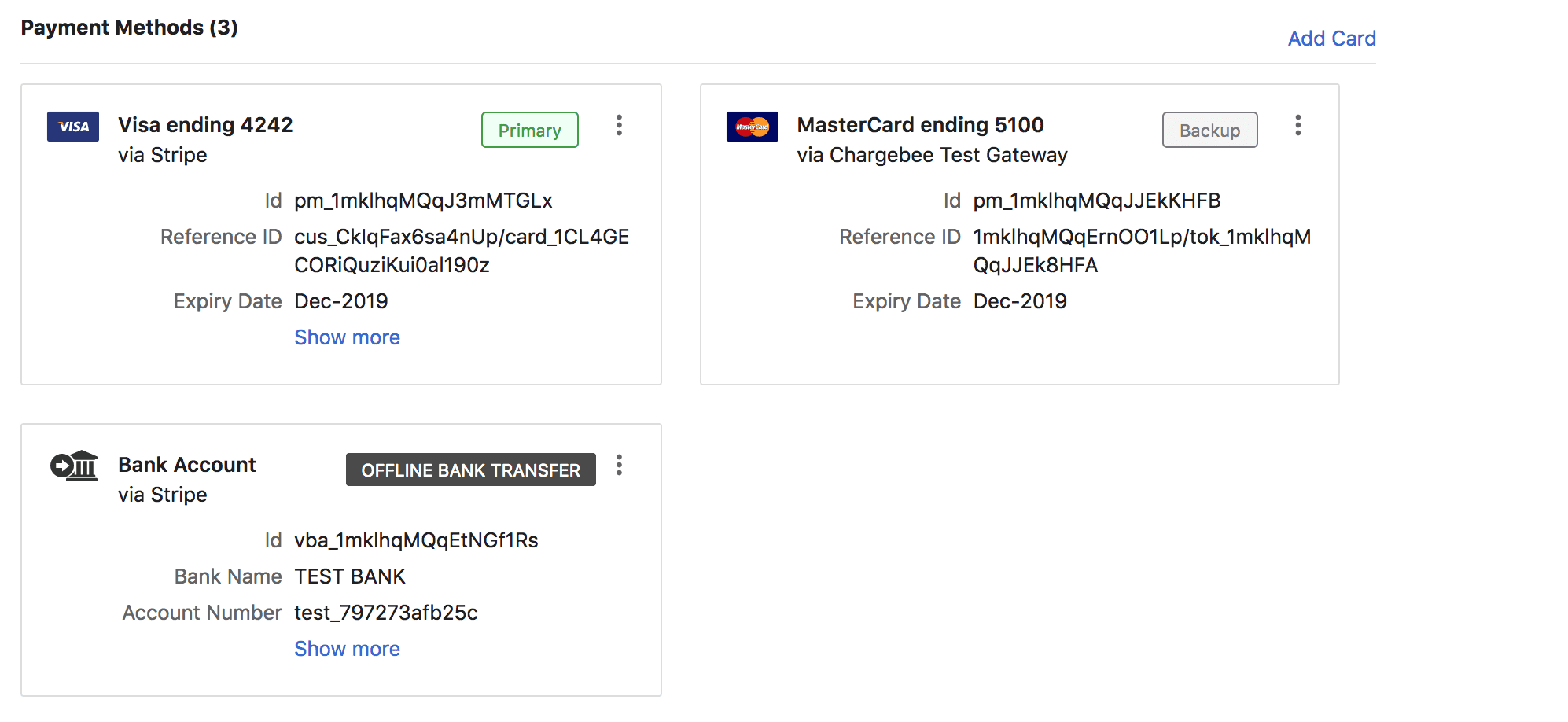

Chargebee supports around 27+ payment gateways, digital wallets, and direct debit to help businesses collect recurring payments online. At the same time, you can also set up your offline payment methods right inside Chargebee, maybe as a backup for now.

How Chargebee can help

By setting up one or more payment methods for each and every customer, Chargebee offers revenue assurance and flexibility to you and your customers. Integrate your payment gateway with Chargebee, set up payment methods, and start receiving payments automatically. We’ll take care of renewals, payment retries, and failure notifications for you.

The Impact

Move existing offline customers to credit cards and digital wallets, and ensure that no revenue is lost due to external conditions. Chargebee’s Dunning feature eliminates involuntary churn by setting up smart payment retries and notification emails. Also, know that every additional payment gateway can help you expand your acquisition channel.

Make sure you set up all the payment methods you need. Do know that our onboarding team is right here to help you with that!

#5 Get rid of those inflexible contracts!

The problem and the solution

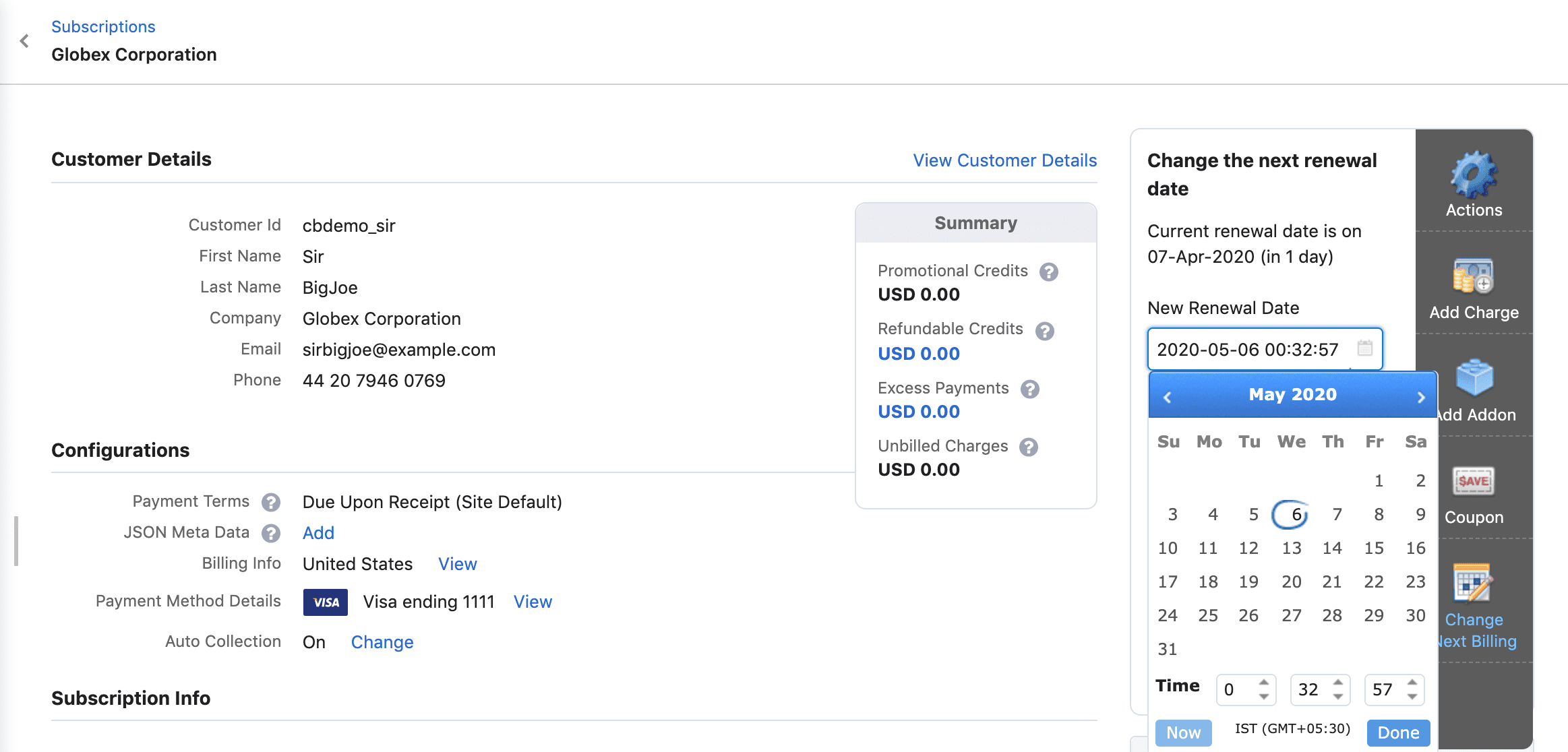

If it’s hard to bring in deals, it’s twice as hard closing deals. And inflexibility in your contracts should be the last reason for losing them. Your future customers will need time, now more than ever, to make a payment and buy your product. Monthly renewals may not cut it.

Chargebee enables you to change the Next Billing Date for your prospects & customers. All you have to do is change the billing date to a future date so that they can get started with your plan, and you can get paid later.

How Chargebee can help

You can navigate to any active subscription and modify the billing date using the tab on the side. The customer will be invoiced only on the date of billing; alternatively, you can invoice them earlier, and offer a payment grace period of ‘D’ days using Net D (D = 1 to 180).

The Impact

Extending subscriptions and trials are proving to be more important, and deferred billing can be a game-changer in this area. It can help move forward the deals in your pipeline, and be a solid retention strategy as well. Curb those monthly churn numbers by deferring your payments.

We’ve helped thousands of SaaS & Subscription businesses set up their billing engine. We’d love to help you out with your billing setup over a quick call!

#6 Put a stop to countless support tickets!

The problem and the solution

“Acme Inc. wants to downgrade plans.”

“Hooli.xyz wants to update payment methods.”

“DunderMifflin wants to pause subscriptions.”

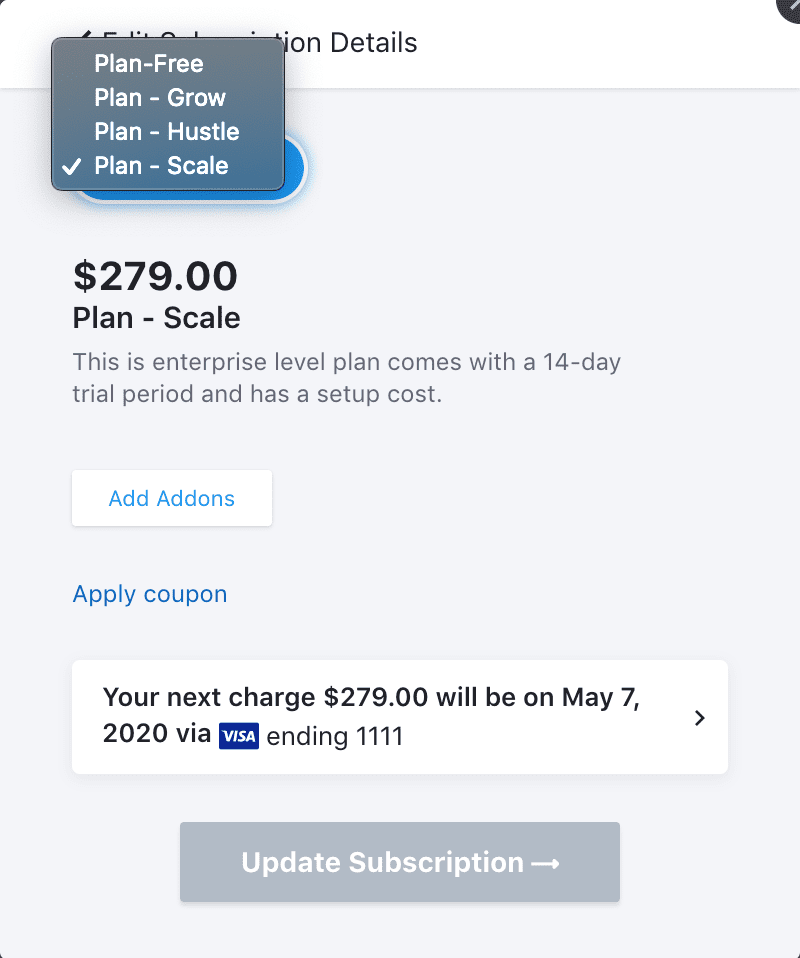

For businesses that depend on a support agent or a success rep to handle these requests, now is the best time to move to a self-service solution. With Chargebee’s self-serve portal, enable your customers to do all these tasks and more!

How Chargebee can help

You can set up a customer self-service portal on a hosted page or right within your app. You can read more about setting up self-service portals using Chargebee here. Using this portal, your customers can edit every aspect of their subscriptions including plans & addons, download invoices, and change their payment methods too.

The Impact

Having a customer portal can reduce the internal load for businesses with a large customer base, and in a low-to-mid ARPU range. Your success teams and support agents can focus on your most important customers, while your portal can help everyone else. Think of the portal like a support/sales agent— that takes care of not only updating subscription details but also upselling & cross-selling along with in-built billing capabilities.

Wondering how Chargebee can help you enable this? Here’s where you can get a complete demo of Chargebee with our best-in-class consultants!

#7 Your notifications are important, now more than ever!

The problem and the solution

It’s always hard, letting the right customers know the right thing. How will you let your at-risk customers know that they have an option to move to a lower plan, or pause temporarily?

Before that, how will you find out who these people are? You might have a rough idea of this segment— maybe it’s inside your CRM, or your accounting tool, perhaps?

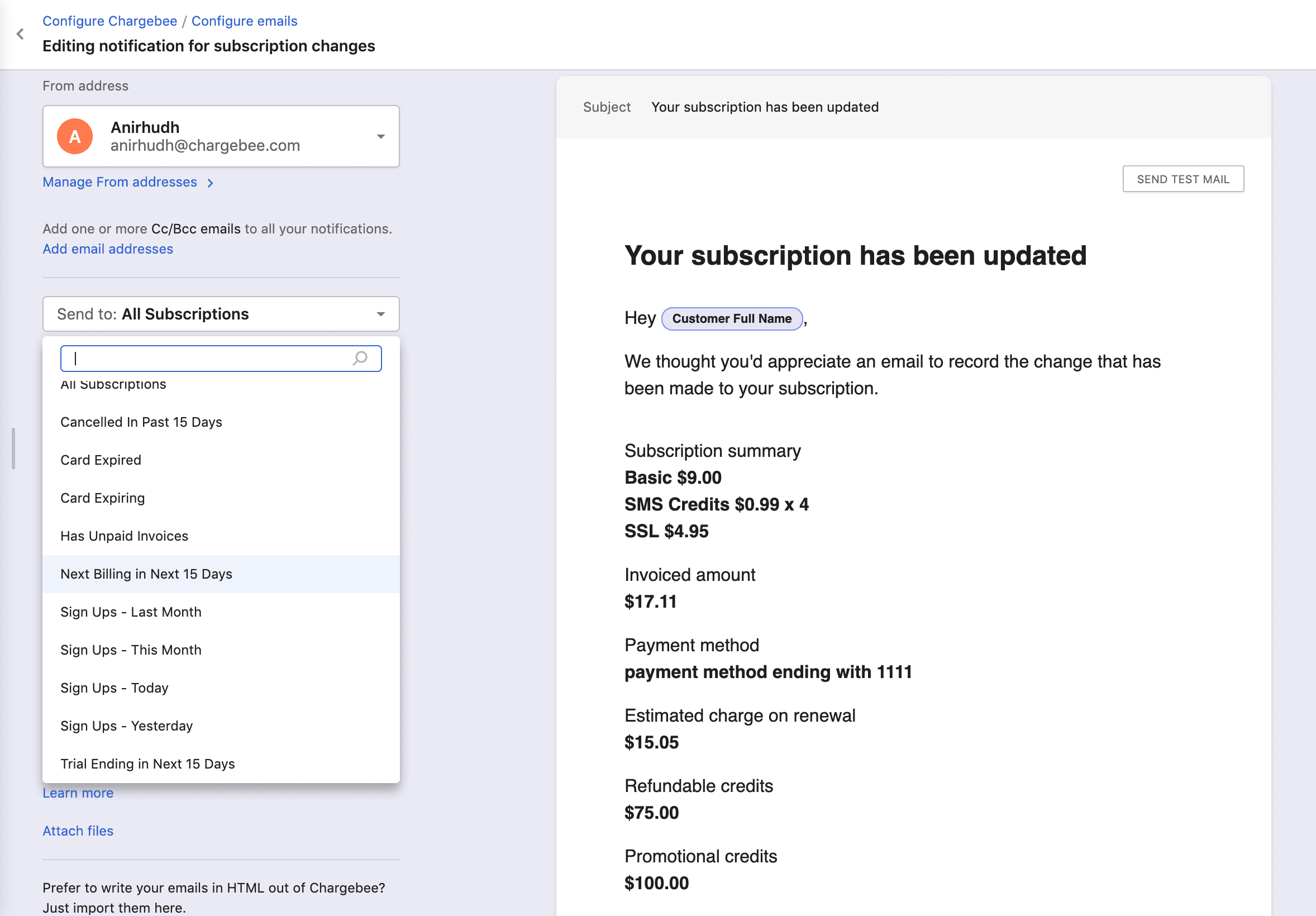

With Chargebee’s Segmented Email Notifications, you can send the right message to the right audience. Slice and dice across all the attributes that you can find inside Chargebee and create segments based on plans, region, or even the custom attributes you’ve created.

How Chargebee can help

Chargebee can send emails to your customers on your behalf. The emails can be triggered for subscriptions, payments, invoices, and more events. You can customize the style, template, and content before sending it across to your prospects & customers. See how every email notification is a growth opportunity!

The Impact

This is the part where pure tactics slowly morph into a little bit of psychology. Well-crafted, real-time, helpful emails can result in better customer experience. And better experience leads to improved retention. Emails can help reactivate expired trials, prevent payment failures, ensure constant revenue flow, and more. Customizing subject lines, secure payment links, and other aspects of your email build quality relationships, that your customers deserve.

We know that customizing each and every email is hard, and that’s why we’ve completely automated it. See how Email Notifications work inside Chargebee over a quick product overview with our team!

Features are, in the end, features. What customers deserve is the value of a product; how it can help them with their day-to-day operations. Right from the moment someone enters your acquisition flow, to the dollars hitting your account every billing cycle, Chargebee covers every aspect of your subscription billing and management.

Come for a recurring billing solution, and stay for stellar customer experience.

If you’re looking for a solution to help you out with any of the above capabilities or set up your entire billing engine— let’s discuss.