Have you noticed an uptick in payment failures lately? If so, you’re not alone.

According to a survey by Chargebee, payment failures are now a top concern for 41% of subscription-based businesses, outranking customer acquisition. ⚠️

The same survey found that 45% of subscription-based businesses spend at least 5 hours per week managing failed payments. The hours spent dealing with payment failures can feel like a never-ending nightmare, draining valuable resources from your business’s essential operations. It’s like a ticking time bomb, ready to explode and wreak havoc. The longer you let it go unchecked, the more damage it can cause.

“The entire subscription and eCommerce economy work on digital payments today. And we all need to deal with the reality of payment failures. While 35% of transactions fail on average, it can go as high as 70%+ in many cases, causing revenue leakage and involuntary churn. So when we can’t avoid it, we must take a holistic approach to manage it,” says Aditya Tulsian, Director, Chargebee Receivables.

In this article, we’ll take a closer look at how payment failures pose a significant threat to your cash flow and impact your subscription business and why preventing them is crucial.

Payment Failures: A Slippery Slope to Financial Instability

The world of subscriptions is a delicate balancing act. The very ‘set and forget it’ nature of subscriptions demands an effortless payment experience. Yet, businesses face numerous challenges in ensuring a smooth billing experience. Every recurring online transaction involves a labyrinth of intermediaries; even the slightest error can derail the entire process. With so many moving parts like the network of banks, payment processors, and customer card networks, it’s no wonder that recurring payment failures are common. From insufficient funds to invalid card details, there are over 100 reasons why a payment might fail, leaving your business high and dry. The consequences are far-reaching and potentially catastrophic, from hampering cash flow to damaging customer relationships.

Let’s look at what happens when payment failures strike and how you can be better prepared to weather the storm.

Involuntary Customer Churn

According to a report, payment failure is responsible for 20% to 40% of subscriber churn, significantly impacting a business’ revenue. When your customer’s recurring payment fails, it can result in involuntary churn when the customer’s subscription gets canceled.

It can be your most loyal customer who has regularly utilized your services for months. However, their payment fails due to an expired credit card or insufficient funds, and their subscription gets automatically canceled. And the worst part is that they may only realize this once they attempt to access the product and receives a message saying, ‘Your subscription is canceled due to non-payment message.

The result? Your once-satisfied customer is frustrated and may opt out of your services entirely. It causes a loss of revenue, a decrease in customer loyalty, and a decrease in the customer lifetime value, which impacts the long-term financial success of the business.

Read the story of how Whiteboard reduced involuntary churn using Chargebee and increased its monthly recurring revenue (MRR) by 35%

Damage to Reputation and Customer Experience

Focusing on the customer experience (CX) is vital in growing a business sustainably. It includes the product or service you offer and the payment experience. After all, this is when the customer hands over their hard-earned money to you – a critical moment of truth that can make or break their overall perception of your company.

If a customer experiences multiple payment failures, it can be a frustrating experience that they are likely to share with others, leading to negative word-of-mouth marketing and further damaging your company’s reputation.

Increase in Operational Losses

According to Worldpay’s 2020 Global Payment Trends report, businesses lose up to 3.6% of their annual revenue due to payment failures. Managing payment failures can be time-consuming and expensive, requiring resources to contact customers, chase payments, and potentially hire debt collectors or take legal action. It can lead to additional costs and operational burdens, impacting profitability and growth.

Reduced Business Runway

The Office of National Statistics reports that cash flow issues account for 90% of business failures. And a high rate of payment failures translates to the loss of revenue, cash flow issues, and difficulty in paying bills, investing, and growing the business.

For example, if a business has a monthly revenue of $50,000 and a payment failure rate of 5%, $2,500 is lost each month, resulting in $30,000 in annual recurring revenue. In current economic conditions, losing such revenue can significantly impact the company’s overall growth.

How Chargebee’s Revenue Recovery Suite Helps Get Rid of Payment Failure for Subscription-Based Business

Chargebee’s Revenue Recovery Suite empowers finance teams by offering customized payment recovery plans for various customer segments, making it easier to tackle payment failures without being too aggressive.

We know the fight against recovering revenue is challenging, and here’s how we help you win it.

Uncover the Reason behind Failed Payments

The first and most crucial step is identifying the root cause to solve any problem. In this case, you need to determine why the payment failure occurred in the first place. Chargebee Receivables provides detailed information about failed transactions and reason codes at each customer level. This information can help finance teams develop a better recovery strategy, identify customers with expired cards, and engage with them proactively to avoid failed payments.

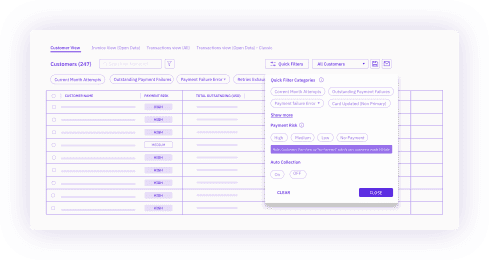

Segment Customers Based on Failed Payments Errors

Chargebee allows businesses to segment customers using prebuilt filters based on failed payment errors. By segmenting customers based on payment failures, companies can identify high-risk defaulters and build a tailored collection strategy with a systematic follow-up process to increase the rate of collections.

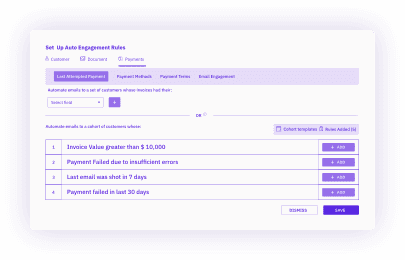

Set Retries and Auto-Engagement Workflows

Chargebee’s Revenue Recovery Suite automates retrying failed payments at specific intervals and proactive customer engagement. You can customize and set the frequency of payment reminder emails, segment customers based on relevant criteria, identify when to escalate a pending invoice and automate a follow-up sequence considering previous customer interactions. By automating customer engagement, businesses can increase their chances of collecting payments and reduce the workload of their finance teams.

Get Actionable Insights into Payment Failures Recovery

With the Payment Failure analytics dashboard, you can access all the data instead of your finance teams building and searching for it in multiple spreadsheets. You can view all the metrics to mitigate and recover payment failures all in one place.

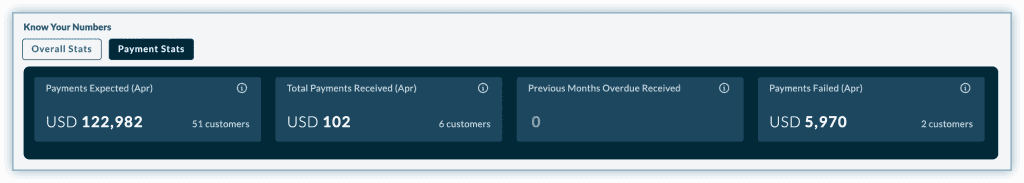

So, one of the most important metrics the dashboard tracks is Payments Failed. It tells you how many unique invoice payments have failed the current month.

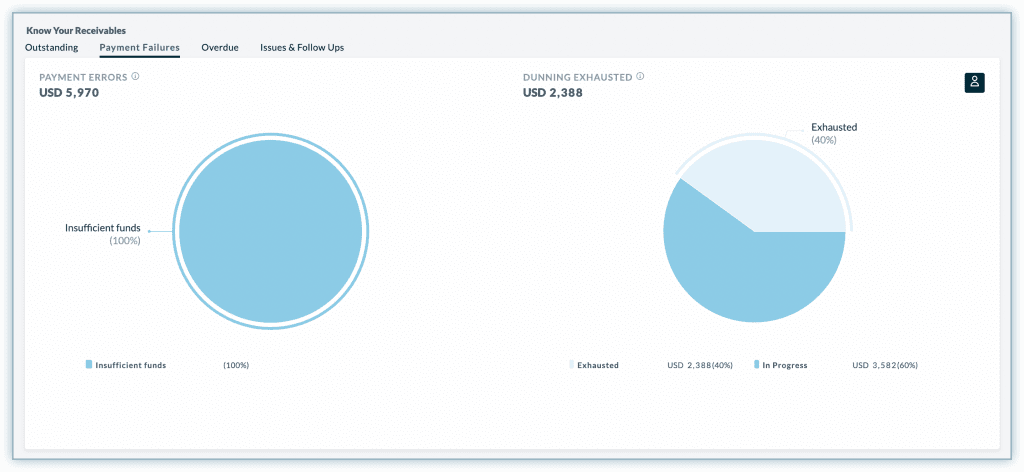

The dashboard also includes charts that explain why payments have failed and their severity. This information is incredibly useful because it allows you to identify the most common errors causing payment failures.

Once you know what’s causing the most payment failures, you can take action to address the problem. For example, suppose insufficient funds are causing the majority of payment failures. In that case, you can view a list of customers experiencing this issue and send them a reminder to ensure they have enough money in their account before the next payment retry date

The Payment Failure dashboard empowers you to take control of your payment failures and manage them efficiently. With quick filters that allow you to sort through relevant data quickly, you’ll better understand your payment failures and take the necessary steps to improve your payment processes.

Shield Your Subscription Business from Payment Failures with Chargebee Receivables

The mantra for mitigating payment failures at Chargebee Receivables understands that every customer is unique. Therefore the approach to engage them should also be unique to transform their payment failures into successes. As a result, we obsess over creating multiple cohorts of customers based on their payment patterns, retries, payment methods, email engagement, overdue, aging buckets, etc. And then build a tailored collection strategy so you don’t lose a penny!

Are you Ready to Revolutionize Your Payment Recovery With Chargebee?

Yes, I want to schedule a Demo!I’d like to explore a bit more