What are credit card merchant services?

Credit card merchant services provide every payment component that a merchant might need to accept non-cash modes of payment online and offline. Offline, they offer POS infrastructure, merchant accounts, and check support. Online, they offer internet merchant accounts, chargeback support, and various kinds of online payment processing — credit and debit cards, e-checks, ACH payments, e-wallets and mobile payments.

Examples: Square, Flagship Merchant Services, National Processing.

What is a payment gateway?

One of these credit card merchant services, a payment gateway is a virtual credit card machine that facilitates payment processing. It collects payment information securely, stores it, and routes it to a payment processor every time a payment needs to be made.

Payment gateways are evolving to be more than information carriers, though. Today they are competently competing with merchant service providers as a payment processing solution.

Here’s more on payment gateways if you’re interested.

Examples: Braintree, Stripe, Authorize.Net.

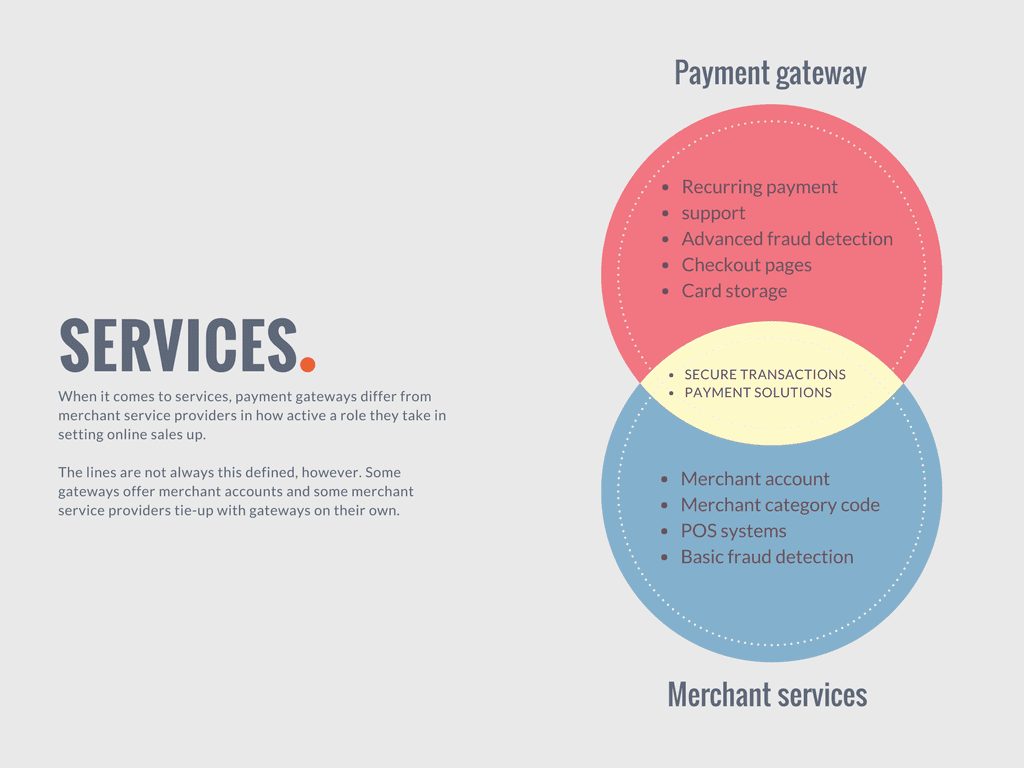

Credit card Merchant services vs payment gateways: Understanding services

When it comes to the services they offer, payment gateways differ from merchant service providers in how active a role they take in the running of your online business.

While both provide top-notch payment processing, merchant service providers offer business services from setting up a merchant account to assisting with chargeback disputes. Payment gateways, on the other hand, might.

Take the example of a merchant account (something you can’t sell online without).

A merchant service provider guarantees a merchant account if your application is approved.

Gateways, on the other hand, fall into three broad groups when it comes to merchant accounts:

- Some gateways offer to house revenue in their own merchant accounts so you don’t have to apply for one (like Stripe and PayPal). Super convenient.

- Some gateways offer a dedicated merchant account (like Braintree and Authorize.Net).

- Some gateways don’t offer a merchant account at all. You’ll have to get one from your bank to accept payments with these gateways.

What’s the bottom line?

You can get your payment gateway up and accepting payments anywhere between 10 minutes and a few days. Applying (yes, your application can be rejected) for merchant services, on the other hand, can take a few days to a few weeks.

This translates to how active a role each will take in supporting your online business.

Credit card merchant services will guide you through all the difficulty and paperwork that comes with selling online. Payment gateways will be more hands-off.

Here are definitions of the terms in the infographic:

Merchant account

A virtual bank account where revenue from online sales is sent. Revenue resides in your merchant account until settlement — the process of transferring of funds to your bank account. Gateways that don’t provide merchant accounts transfer funds directly to your bank account.

Merchant category code

A four-digit number that classifies each business by the type of goods and/or services provided. Your MCC plays a key role in deciding what your processing fees will be. If a gateway doesn’t provide an MCC you’ll have to contact your bank for one.

Payment Solutions

Both merchant service providers and payment gateways offer services beyond payment processing, easing the administrative workload in accounting, billing, and fraud detection.

POS systems

If for any reason you’d like to accept in-person payments via card or mobile, your merchant service provider will give you the infrastructure and training you need to do so.

Support for secure transactions

Both merchant service providers and payment gateways maintain additional layers of security and fraud detection systems to make sure that all the payments you process are secure for your customers and your business.

Checkout page(s)

The webpage that collects payment and billing information from your customers. It is usually hosted by a third party so you don’t have to worry about sensitive information touching your servers. Most payment gateways come with hosted checkout pages.

Recurring payment support

Merchant service providers, in particular, do not support recurring payments. The ones that do consider recurring payments to be high-risk (which means higher transaction costs). Payment gateways are the go-to payment processing tool for subscription businesses.

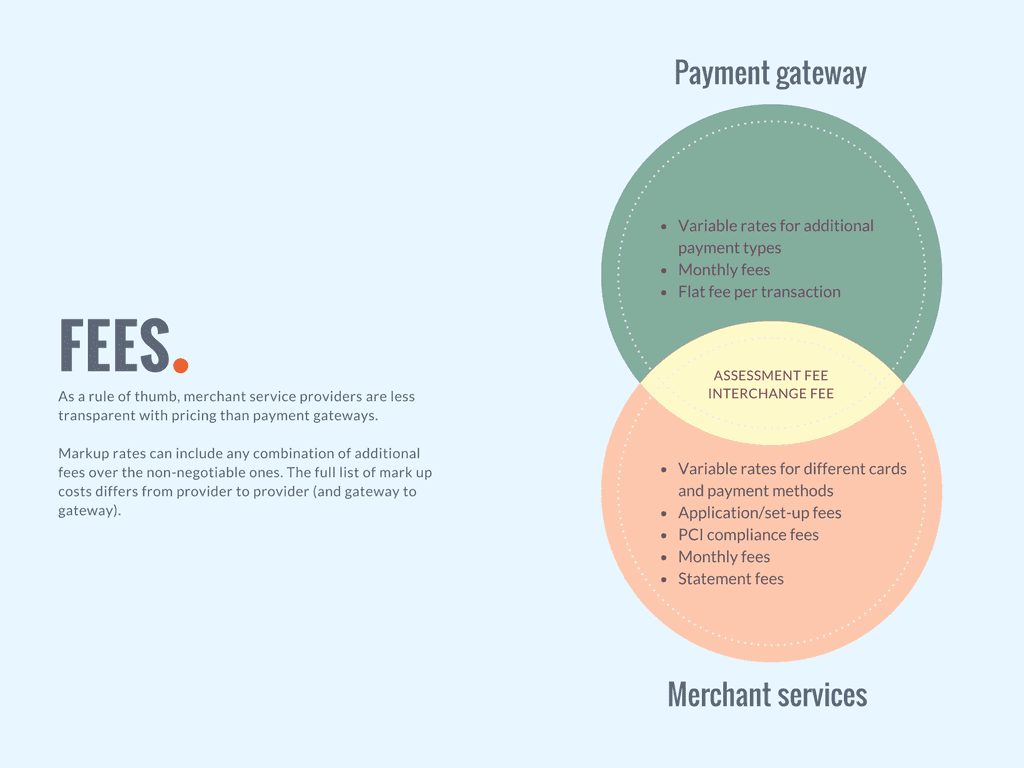

Credit card merchant services vs payment gateways: Understanding fees

Accepting credit card payments online is complex because there are multiple players involved in the process. All of them take a cut from the merchant they’re processing the payment for.

With both payment gateways and merchant service providers, you’re dealing with two kinds of fees.

Non-negotiable fees

- An assessment fee is owed to the card network facilitating the transaction (Visa or MasterCard, for example).

- An interchange fee is owed to the bank that issued the credit card being used for the transaction.

Together, these non-negotiable fees work out to between 2% and 4% per transaction. More on the assessment and interchange fees here.

Negotiable fees

Above the interchange fee and the assessment fee merchant service/payment gateway providers charge a markup that can include:

- additional rates for different kinds of cards (essentially the difference between qualified and non-qualified rates),

- additional rates for different kinds of payment methods,

- application fees,

- set up fees,

- annual fees,

- PCI compliance fees,

- IRS fees,

- statement fees,

- batch fees, and

- monthly minimums.

What’s the bottom line?

Merchant service providers are infamous for opaque pricing models.

From tiered pricing models to bundled fee models to interchange plus models, the options are so different from provider to provider that markup costs are difficult to generalize. When choosing a merchant service provider, beware of hidden costs, monthly minimums, and high set-up fees.

As a rule of thumb it’s safe to say that the markup rates that payment gateways offer are more transparent than their merchant services counterparts.

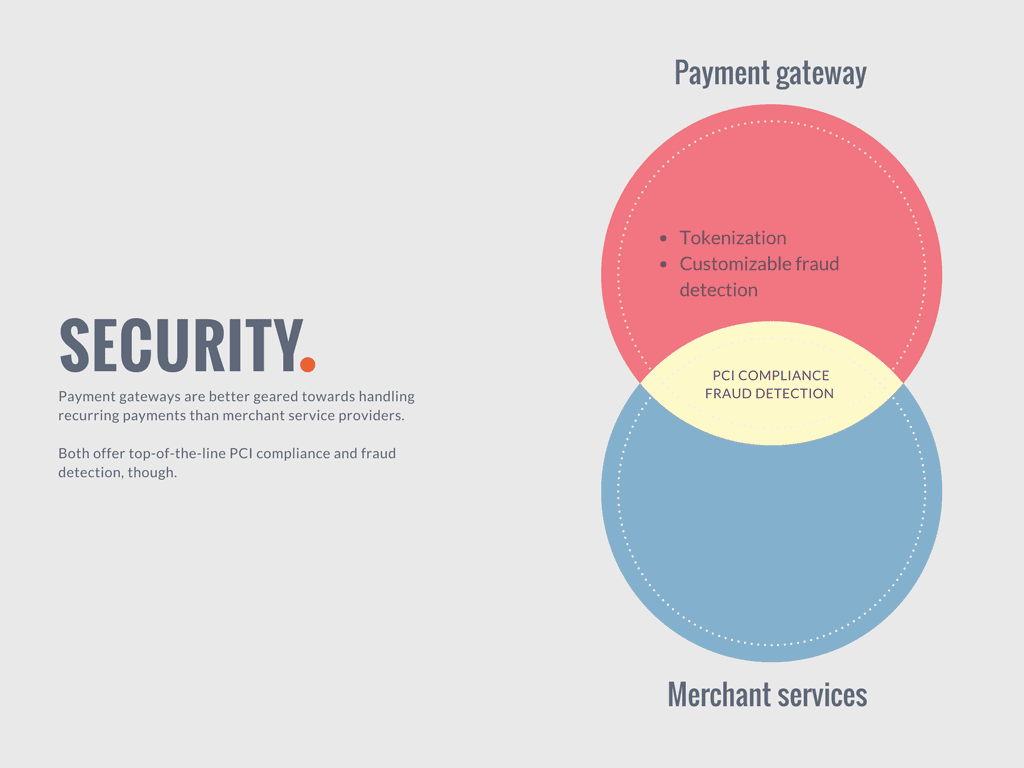

Credit card merchant services vs payment gateways: Understanding Security

SSL and PCI compliance

The first step in online security, websites use SSL to encrypt data so that collecting personal information on a website is safe. SSL is one of many regulations that the Payment Card Industry (PCI) imposes on entities that must collect and store sensitive card and bank account information.

Tokenization (useful for recurring payments)

Online merchants pass instructions on to payment gateways (if a card on file needs to be charged, for example) using tokens. Tokens are virtual representations of a card. Tokens identify a card to the gateway (so a transaction can be processed). With tokens, credit cards can be regularly charged while sitting securely in a payment gateway’s vault. Ideal for subscription businesses.

Anti-fraud tools

To combat fraud, both merchant providers and gateways recommend merchants collect CVC numbers and billing addresses that can be verified against information provided by a card network (like VISA or MasterCard).

Gateways excel over merchant service providers in enabling transaction rules (that a merchant can configure) based on volume, IP address (and so on) so that fraudulent transactions are screened out before a purchase goes through.

What’s the bottom line?

As security goes, both merchant service providers and payment gateways provide the same set of tools to keep information secure.

Payment gateways win over credit card merchant services in comparison, however, with secure support for recurring payments and customizable fraud detection rules.

Credit card merchant Services vs Payment Gateway: TL;DR

| Merchant Services | Payment Gateway | |

| Transparent Pricing | ✘ | ✔ |

| Support for multiple payment methods | ✔ | ✔ |

| Fraud detection and information security | ✔ | ✔ |

| Merchant account | ✔ | ✔ |

| Merchant category code | ✔ | ✘ |

| Adjacent services | ✔ | ✔ |

| Recurring payment support | ✘ | ✔ |

| Hosted checkout pages | ✘ | ✔ |

You are better off with a merchant service provider if:

- POS systems are a part of your sales model (if you run an e-commerce or a subscription box website)

- You run a high-risk business (i.e., you’re expecting more than 1 chargeback for every 100 sales)

You are better off with a payment gateway if:

- You process recurring payments using credit cards.

- You want to start accepting payments fast.

- You are willing to pay less for handling a few services (like chargeback support) on your own.

Follow this link to download or share this infographic.

Bonus: If you need help choosing a payment gateway, Chargebee can help! We’ve analyzed payment gateways across 22 countries to give you the ultimate payment gateway comparison tool. Check it out.