(TL;DR: If you’d rather watch the video instead of reading the entire blog post, you can watch the recording of our webinar here.)

What does the billing process have to do with optimizing for revenue and efficiency? Turns out, a lot!

For instance, for Sales to operate seamlessly and close deals faster – say run coupon campaigns or send quotes without friction – your subscription engine should talk to your CRM. Your finance team is trying to align the numbers in your book to the revenue in your account. But with all the mid-cycle upgrades/downgrades and delinquent churns, it could be a hassle.

For this to be a less-frustrating process, you will need a billing operations team to keep track of all the mid-cycle changes. All these processes and tools should be stitched with your subscription revenue engine such as Chargebee. Because, in the absence of the well-stitched process, the International Data Corporation estimates that Companies lose approximately 20% – 30% in revenue every year due to operational inefficiencies

That’s a lot, right?

The absence of a streamlined billing process can be a huge contributor to this revenue leakage.

Now let’s look at why billing ops is still a huge problem in the SaaS model. At Chargebee, we have come up with a 5C framework that sums up the pain of every SaaS billing team across the globe.

- Complexity – As the business model evolves, you may have a unique billing model like a parent-child invoicing model which brings in difficulties to implement

- Competency – Every unique case brings in developer dependency for your finance team

- Compliance – 3DS, PCI and a whole bunch of dynamic changes in the compliance ecosystem makes things difficult to keep a tab on

- Commitment – The inability to handle crucial workflows can create utter confusion and patchwork like for your customers – what we call spaghetti billing

- Continuity- without a single source of truth that can scale as you grow, you’re bound to hit internal roadblocks leading to a subpar customer experience

Now that we have established the importance of having efficient billing ops and an over-arching RevOps system in place, in the next few sections we want to share the 6 strategies to maximize your capability around billing and minimize its numerous complexities.

Why complexities? When you raise an invoice, you eventually want to be paid quickly. And for that, you need to make sure the operational plumbing is taken care of to improve your cash flows.

And this has led us to uncover a key lesson: to make your billing process efficient, you need to ensure two aspects that should run like clockwork once you set it up:

Scheduling efficiency, that is:

- Charge exactly when your customers should be charged

- Charge exactly for what your customers use

Payment collections efficiency which includes:

- Removing any frictions to the customer while paying

- Automate collections to curb involuntary churn

If these two functions are well thought out, you can be assured that the rest of the billing experience for your customers needn’t be as nightmarish…

Some key takeaways:

- Offer flexible billing and shipping dates, with accurate proration

- Allow prepayments by invoicing in advance

- Offer payment terms to customers so they can review outstanding payments

- Automate and optimize recovery of failed payments

- Offer Multiple Payment Methods to your customers

- Configure smart rules to facilitate global transactions at scale

#1: Offer flexible billing and shipping dates, with accurate proration

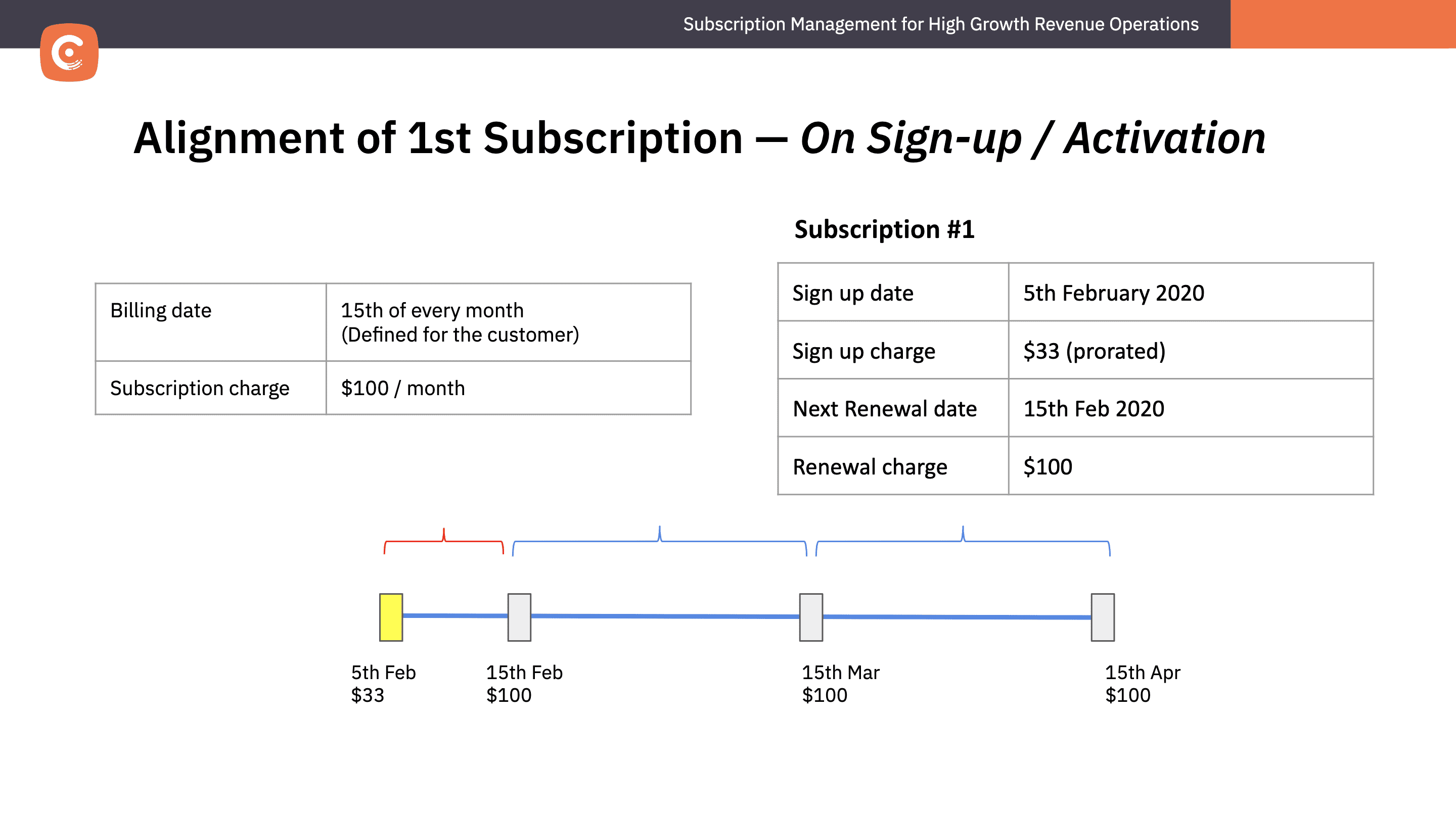

For SaaS and eCommerce businesses, the ability to bill customers on specific dates, irrespective of when they sign up is critical as you can provide flexibility to your users with a unique billing date that will better align with their financial cycles.

For this, you can set the billing date for your customers, regardless of the date they sign-up, with Calendar Billing

There are different ways as to how you can bill your customers. Some of these include:

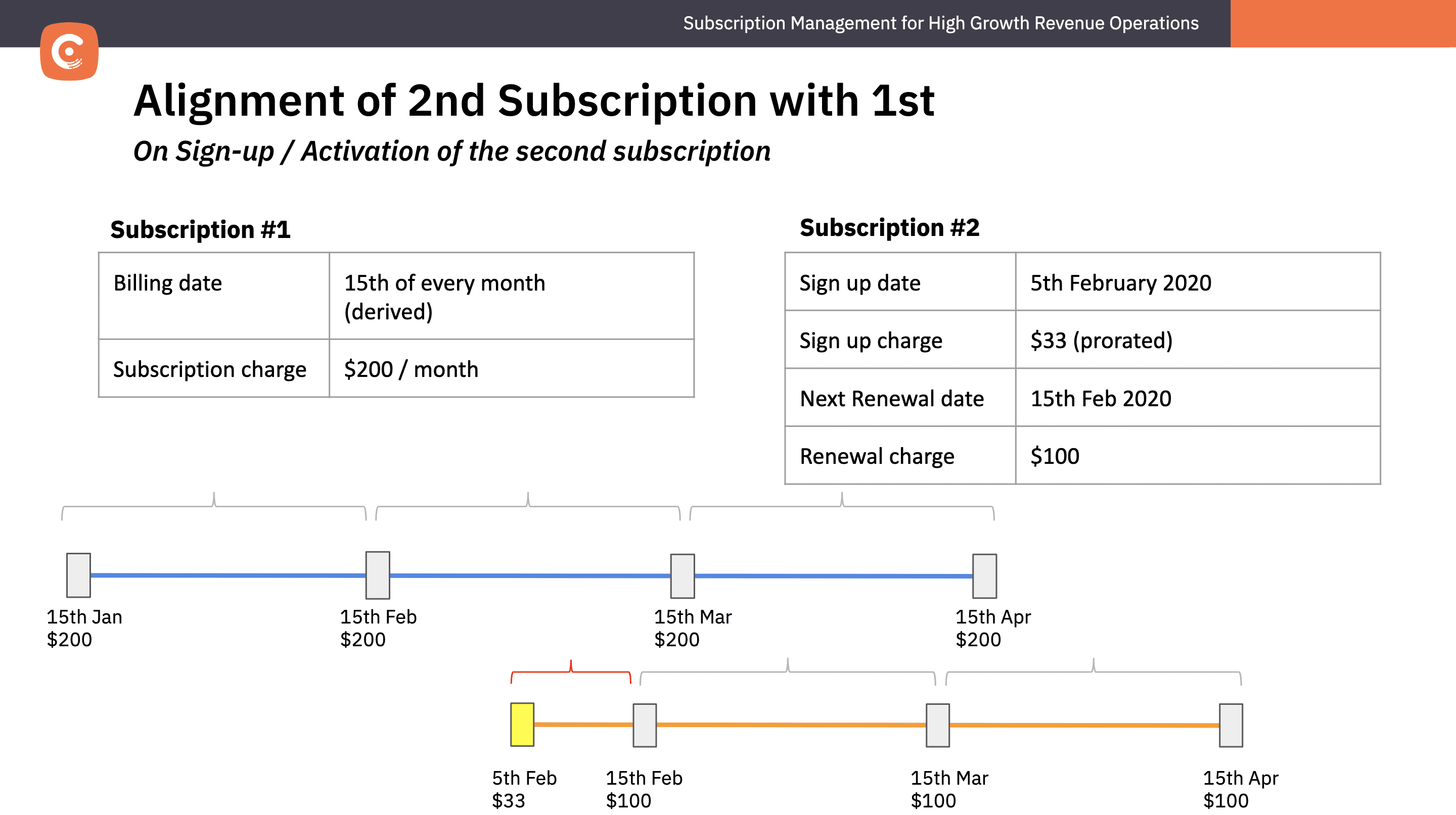

- Consolidating multiple billing dates into a single billing date for a user who has multiple subscriptions

- Aligning all subscriptions to a new fixed billing date which helps set up a single payday for the businesses enabling them to better predict, track and monitor their revenue.

How would this help you?

- Reduced churn and delayed payments due to better alignment

- Align your customers’ financial cycle to your billing cycle

- Manage resources, cash flows & bring in predictability to your revenue collections

Typically, for eCommerce businesses, irrespective of when your customer signs up, the charge is applicable for the full subscription cycle, whereas SaaS businesses prefer to prorate the amount depending on when their customers sign up. This is also a best practice.

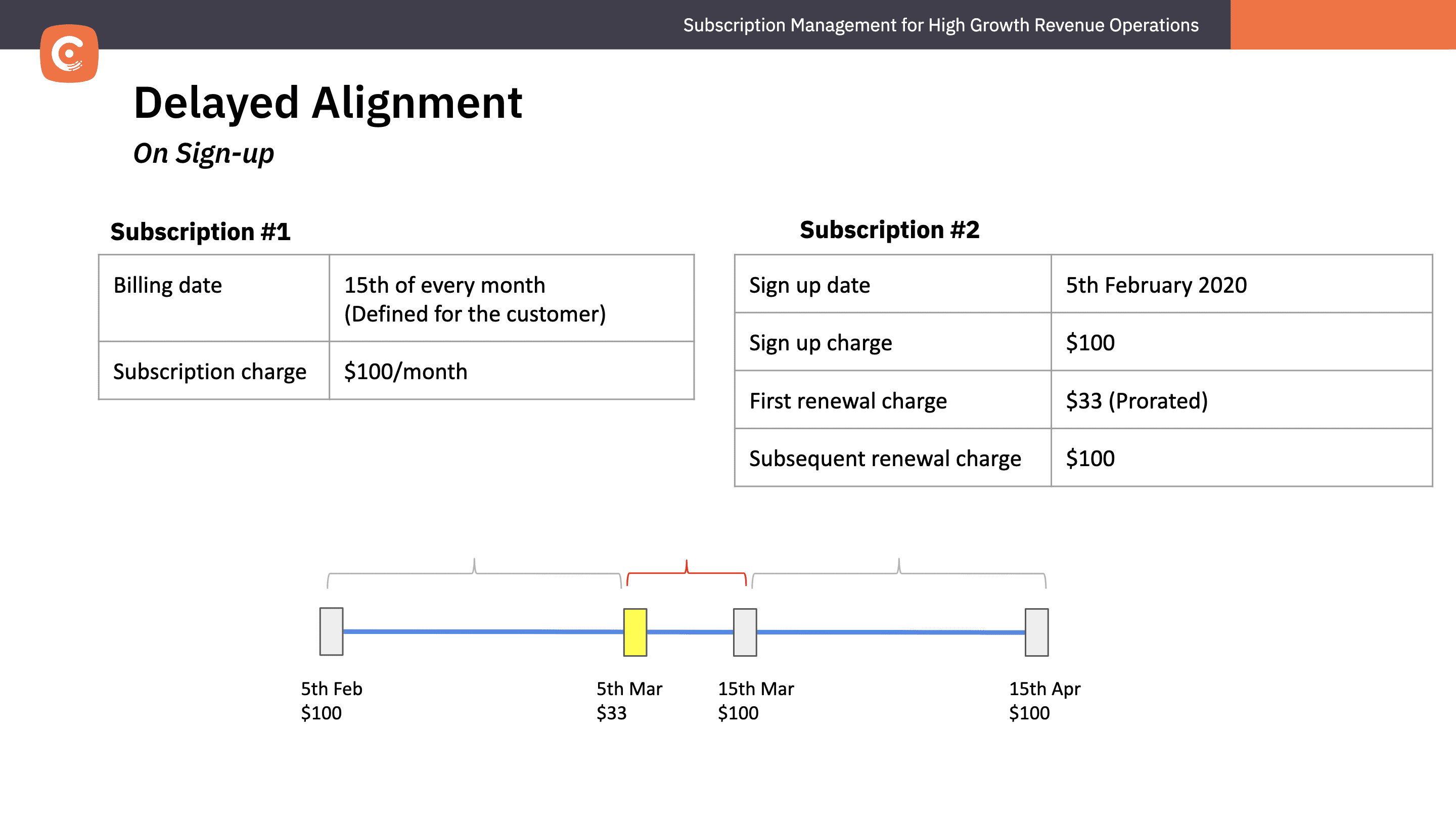

Chargebee’s Calendar Billing helps you create a workflow that aligns when your customers are billed, regardless of the date they sign-up.

The billing date is set differently based on the period of subscription. For a weekly subscription, it can be set as any day of the week, from Monday to Sunday. And for monthly subscriptions, the billing date can be a particular date, from 1st to 31st of the month.

After setting the billing date, you can decide the billing cycle from when the billing date is implemented. There are two options to go with:

- Immediate Alignment: The subscription billing date will be changed immediately to the new date and prorated charges/credits are raised accordingly.

Teledata ICT is Ghana’s leading Internet and Telephone services company serving more than 2,000 business clients and 45,000 users. They adopted a pre-paid billing model, that involved sending out the invoice 15 days prior to the actual renewal.

So, if a customer signed up on the 15th of January for a 3-months plan, the next billing date would be on the 1st of April, with a prorated amount for the month of January to include only the 16 days that they used the service. And the due date for the payment is included in the invoice.

- Delayed Alignment: The subscriptions will be aligned to the new billing date on first renewal i.e., the customer’s subscription will go through one full billing cycle before it is aligned with the billing date.

Pro-tip #1: Don’t invoice for every new charge instead add them to unbilled charges.

The Unbilled Charges feature separates the creation of subscription-related charges from the invoicing of them. This is useful when businesses allow customers to make changes to the subscriptions in the middle of the billing cycle

There can be multiple charges incurred for a subscription, such as when,

- Upgrade or downgrade

- Switch to a different plan

- Addon attached in the middle of the subscription term

- Add a one-time charge or any other additions or changes to the subscription

Customer Example: Screencloud sells digital signage software. They have a condition where they have microcharges less than 1 dollar due to proration (think of adding additional screens in the middle of the billing cycle). These transactions fail as gateways do not accept these small amounts. By simply implementing the Unbilled Charges capability, they saw a reduction in the failed transactions by almost 5%, thus improving their decline ratio.

Pro-tip #2: Send a consolidated invoicing with a summary of all charges.

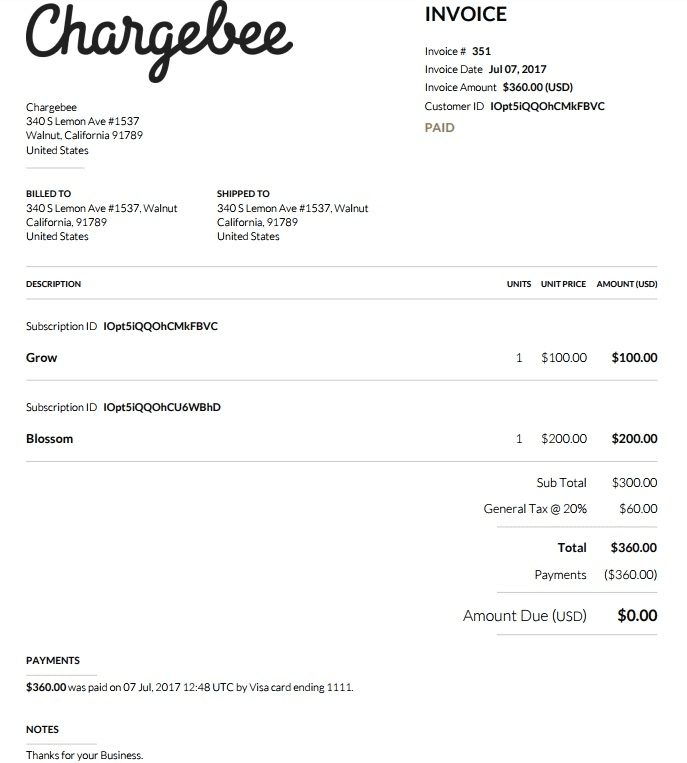

When you have customers with multiple subscriptions, you most likely would encounter a scenario of incurring multiple charges for the subscription. Now, instead of sending an invoice, every time such a change occurs, you can solve this using our consolidated invoicing feature

Consolidated invoicing in Chargebee helps by combining all the charges raised on any given day into a single invoice. Once consolidated invoicing has been enabled, going forward, those subscription renewals and unbilled charges for a customer, that meet ALL of the following recommended conditions, are consolidated into a single invoice:

- The charges for the Customer (subscription renewals and unbilled charges) are due to be invoiced on the same day.

- The charges have the same currency and payment method

Additionally, you can also summarize all unbilled charges that we previously mentioned into a single consolidated invoice rather than spamming your customer with an individual invoice for every purchase.

#2: Allow prepayments by invoicing in advance

We often come across scenarios where our customers want to be able to send an invoice prior to the actual subscription start or renewal date. Typically these count as advance payments a week or two before the subscription begins — this comes in handy if you want you to schedule your billing in advance to plan for resources like implementation or if you would like to run a campaign where you charge for 12 months and give your customers 2 months off.

From a billing point of view, you can think of this as giving annual contracts to your customers which increases the contracted MRR, thereby increasing your customer lifetime value, and in turn, retention. It also helps you have a better time value for money by collecting upfront payments.

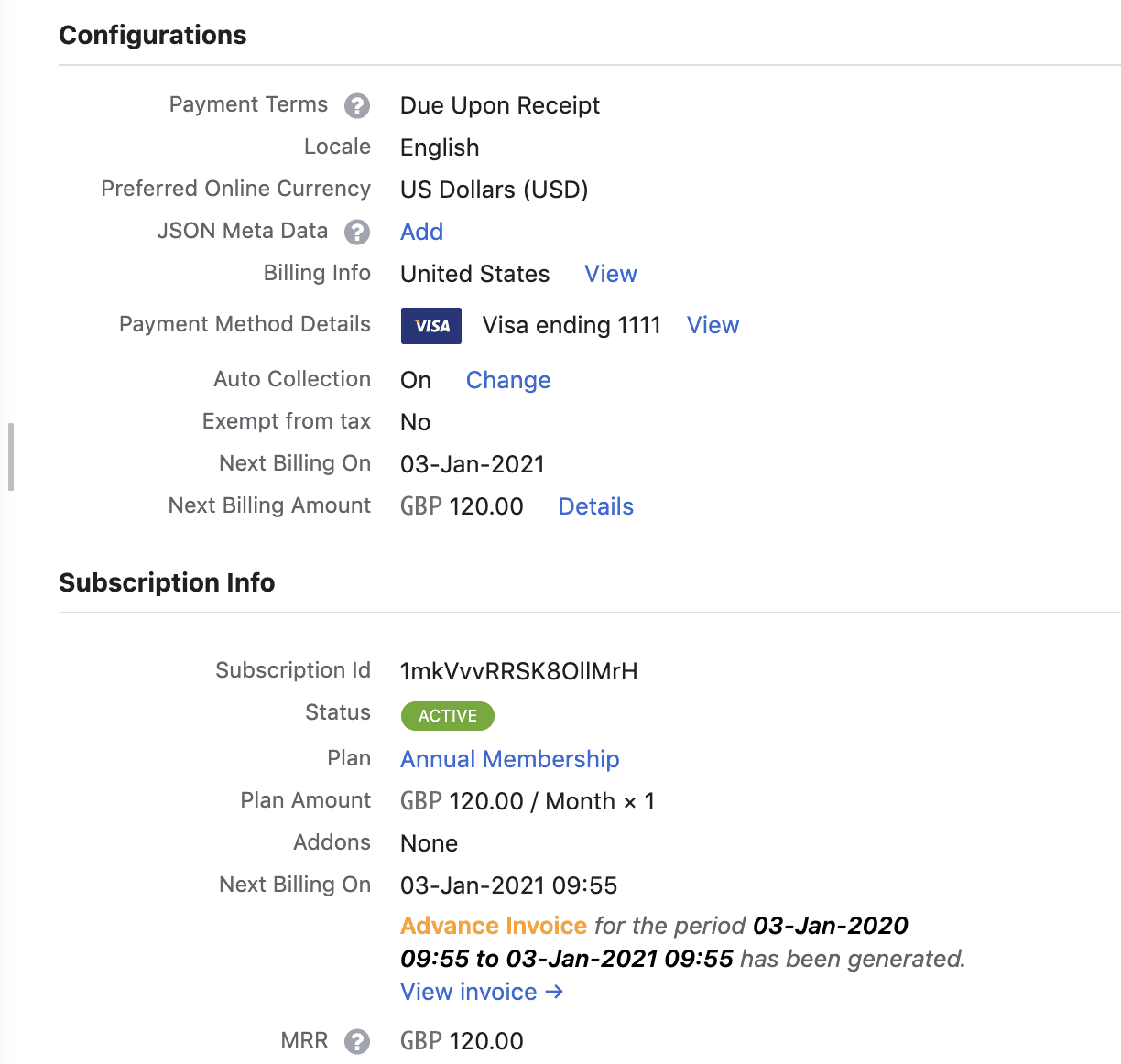

Chargebee’s Advance Invoices capability will allow you to collect pre-payments for one or more terms in a subscription in one go. Also, note that this isn’t a reminder for the invoice — but the invoice itself.

Like other invoices in Chargebee, an advance invoice will incorporate changes scheduled for the subscription, apply one-time charges, add-ons, and coupons as applicable to the subscription.

Additionally, an advance invoice will contain information about the start date and next billing date so your customer knows when they will be charged next.

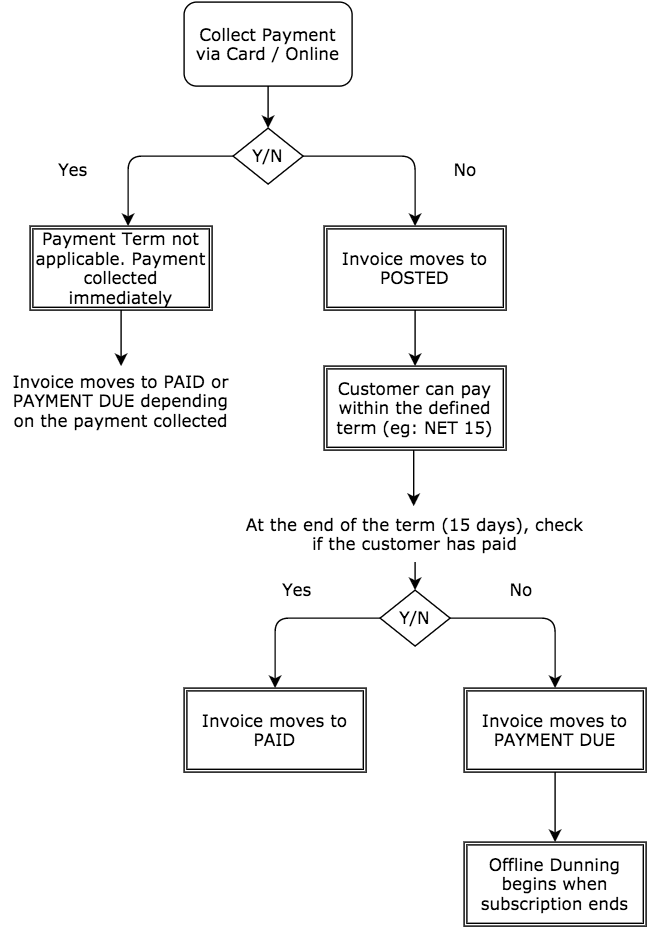

#3: Offer payment terms to customers so they can review outstanding payments

Raising an invoice when your customer’s payment cycle is different from yours can be quite awkward. But what if you’re able to schedule your customer’s payments such that both your payment cycles align?

What you are looking for is Net D – a payment term, which refers to the period (10, 15, 30, 45 or 60 days) within which a customer has to pay for their outstanding invoice (net amount) for the service/product received.

Why payment terms? Because your customers might have several internal dependencies like arranging for payments, an elaborate review process, an approval mechanism in place — all of which delay payments.

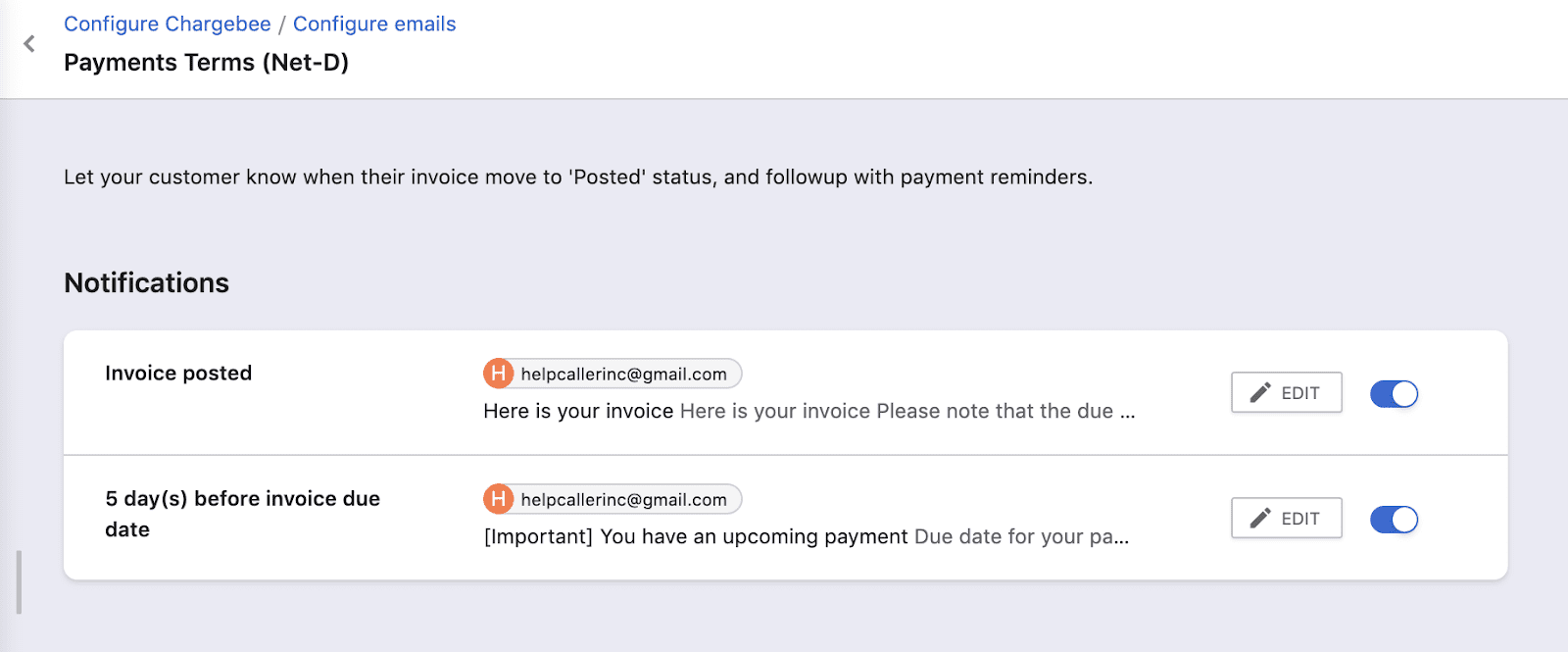

Pro-tip #3: Send out reminders a particular number of days before the invoice is due

One of our SaaS customers that offers a vacation rental management system uses the Net D capability with 60% of their customers paying through offline methods. This option provides their customers time to make the payment and ensuring that the SaaS business is cash flow positive.

Now that we have seen how you can automate and streamline your scheduling, let’s look at 3 super effective ways to increase collections:

#4 – Automate and optimize recovery of failed payments

Non-payment can have many reasons- expired credit cards, unexpected network downtimes, insufficient funds, or 100 other reasons that are eating away at your hard-earned revenue.

Also, multiple failed attempts could falsely tip the payment gateway off, that you’re a “high-risk” merchant account. That’s why a good dunning strategy is knowing when to try a payment collection and when not to.

How to combat such situations where a customer who wants to pay you can’t? You add tactics like smart payment retries a.k.a dunning to your revenue recovery playbook.

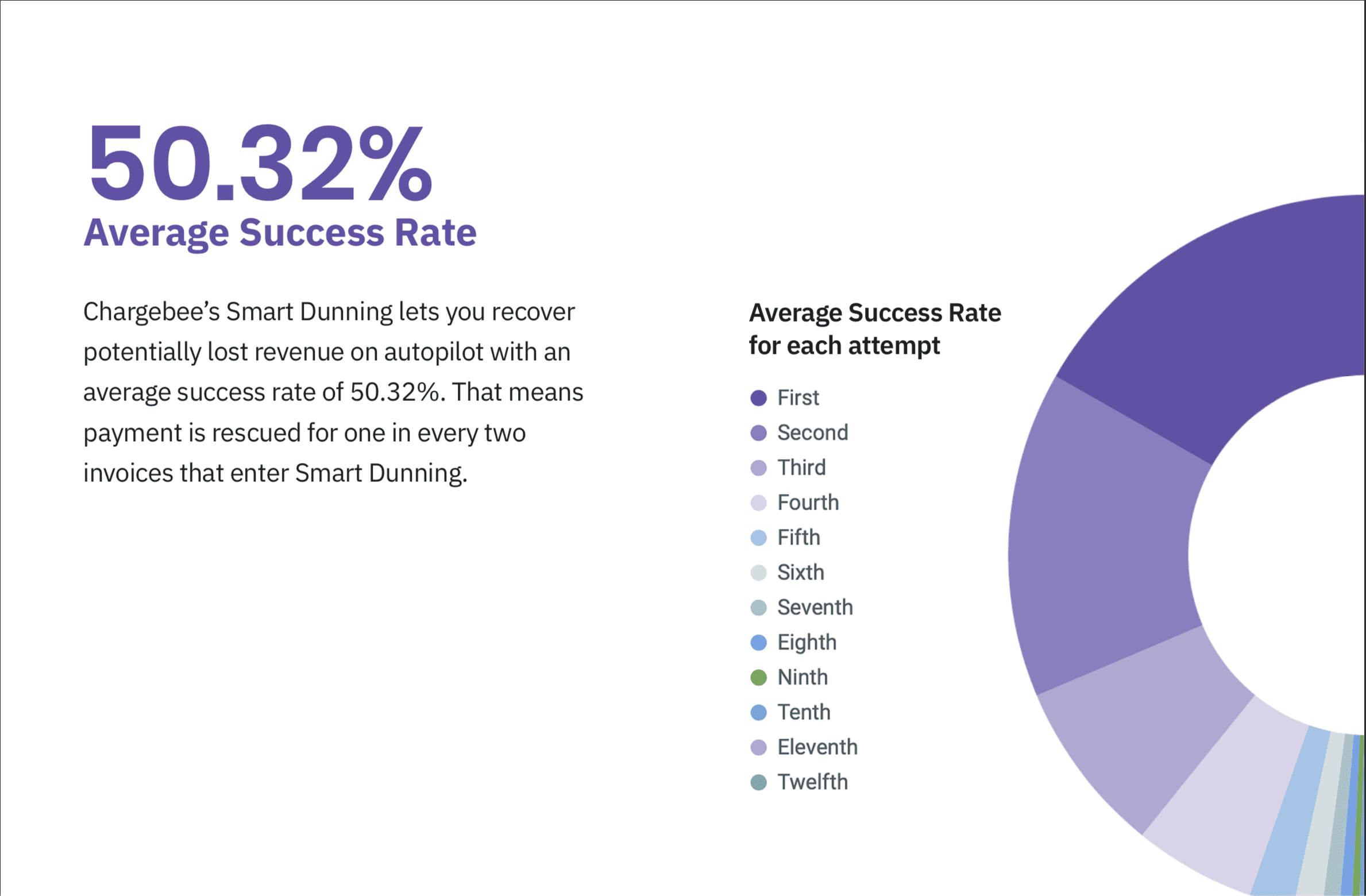

Chargebee’s Smart Dunning lets you recover potentially lost revenue on autopilot with an average success rate of 50.32%. That means payment is rescued for one in every two invoices that enter Smart Dunning. This drastically reduces delinquency.

With Chargebee’s Dunning process, you can send email reminders to your customers asking them to update payment details and schedule payment retries at intervals to ensure revenue can be recovered. After the final payment retry attempt, you can configure outcome i.e. the status of the subscription. Chargebee’s Smart Dunning retries up to 12 times without putting merchants at risk with the payment gateway.

What’s worth noting here is, the emails are decoupled from the payment retry attempts — so you can attempt to retry as many times as necessary, without actually bombarding your customers with an email for each retry.

Smart retry is an intelligent, built-in dunning logic that initiates payment retries based on the type of gateway transaction errors.

You can configure dunning for every payment method out there including online, offline and direct debit payments.

Pro-Tip #4: Segment your customers for a more contextual follow-up

Segments are custom filters that help you filter your customers. You can add multiple filters to create one segment and send them email notifications without disturbing other customers.

Whiteboard CRM has been able to automate the dunning process and that actually saved them a lot of time and in- turn retrieve over 35% of their MRR and reduce churn by almost 100%

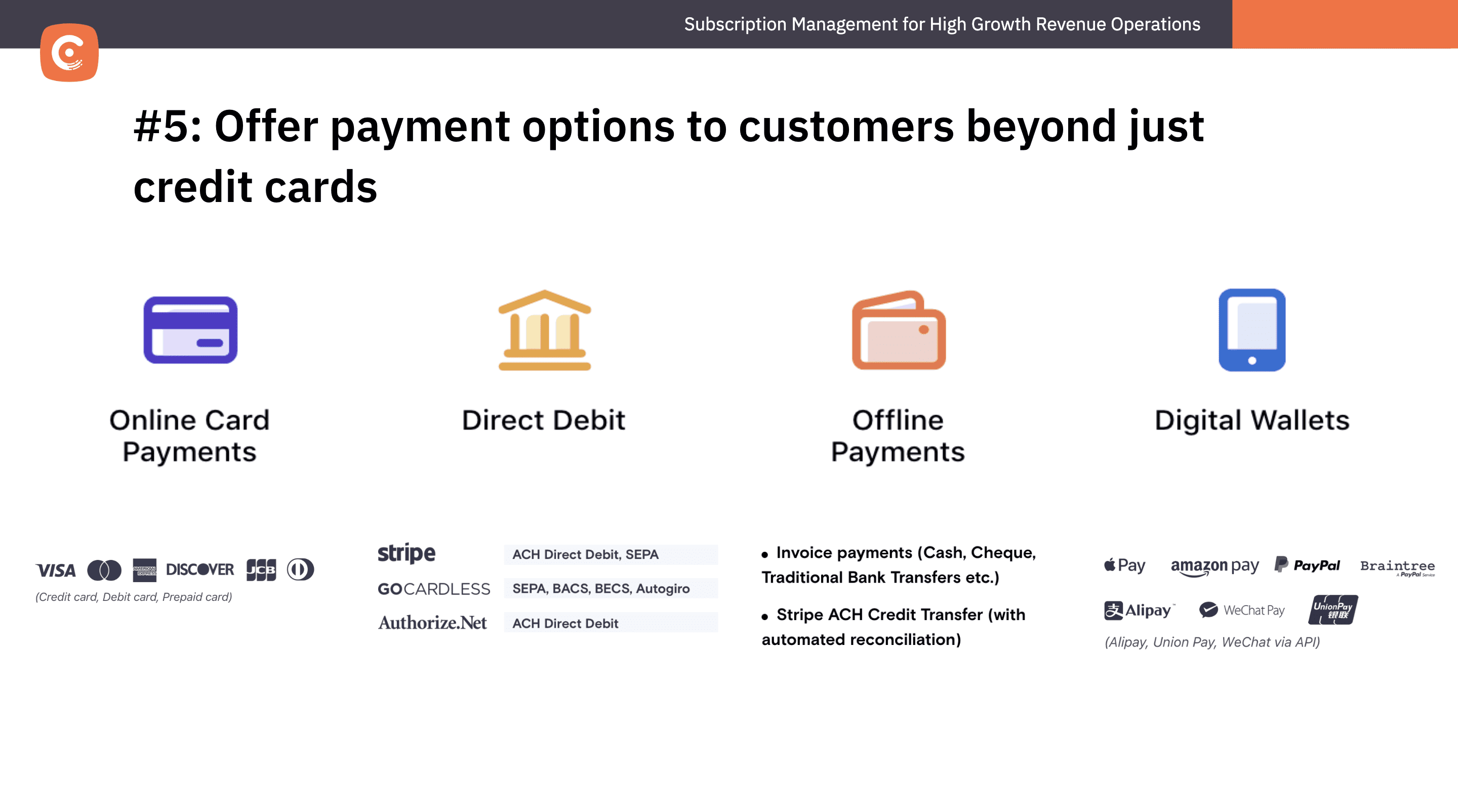

#5: Offer Multiple Payment Methods to your customers

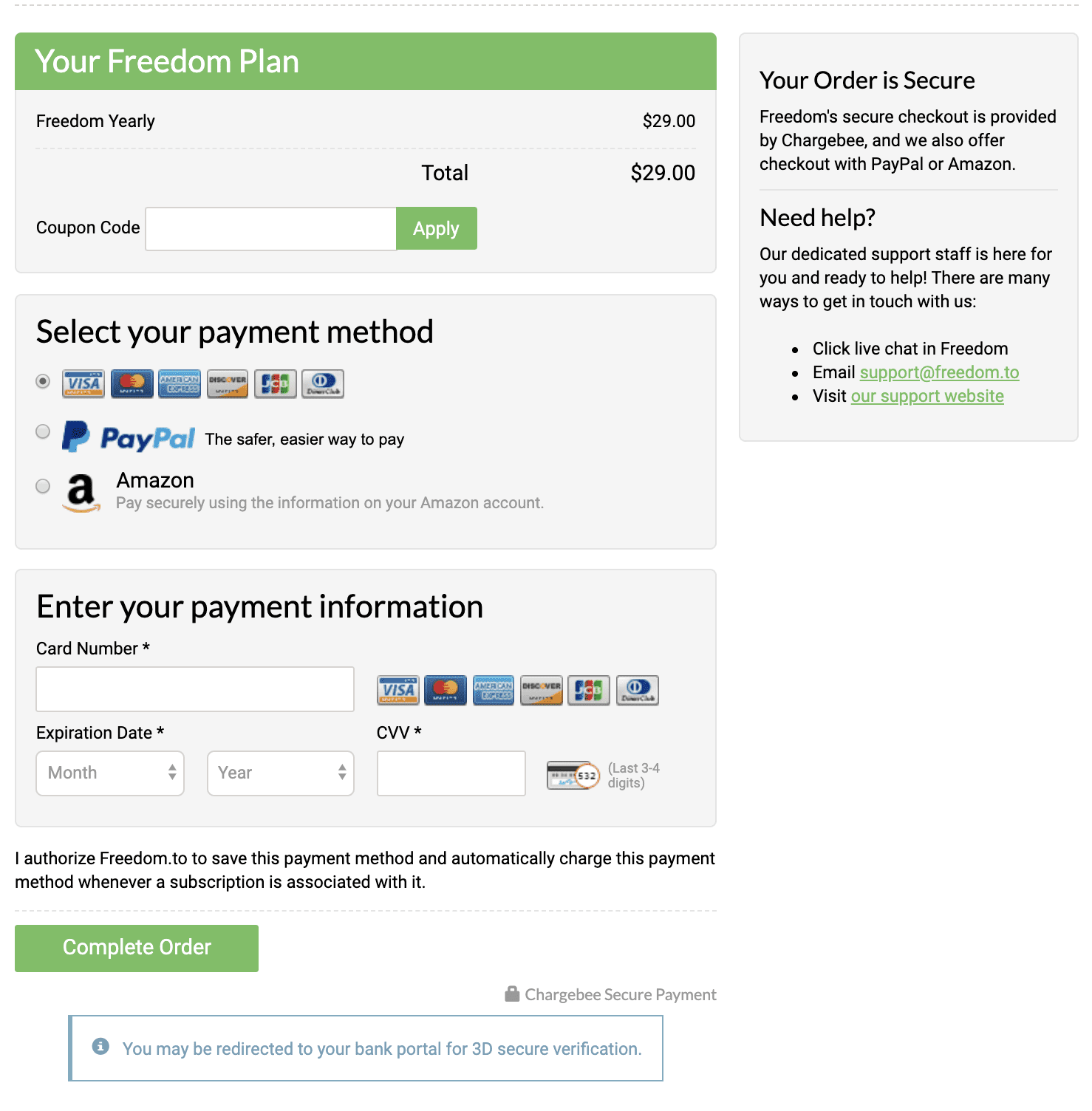

Freedom, a B2C productivity software, at their hyper-growth stage, were cracking new markets back in 2015. At that time they only offered credit card payments which hindered their revenue potential. However, once they added more options, their conversions went up over 33% and were able to onboard international customers and scale globally. Chargebee let them get multiple payment methods off the ground in just a few days.

Chargebee offers a whole lot of options for your customers to pay:

Pro-tip #5: Set up fallback options, if recovery from one payment method fails

Under the subscription model, we advise businesses to encourage users to set up backup payment methods for recurring charges. This helps recover revenue that could have otherwise been lost. Even Google uses this!

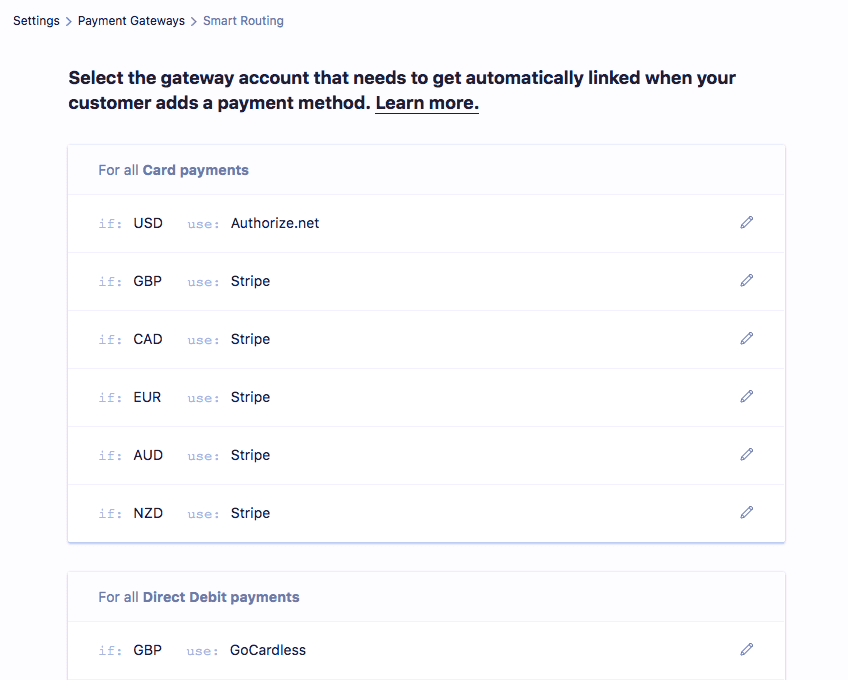

#6: Configure smart rules to facilitate global transactions at scale

When your customer adds a payment method on checkout or updates their payment details, a gateway account must be linked to it. All the customer’s future payments made using this payment method are processed through this gateway account.

With the Smart Routing feature, you can configure rules for automatically picking a gateway account based on the payment method that the customer chooses and the currency of the transaction, so that gateway account can be assigned by Chargebee automatically. This helps in mapping the right currency to the preferred gateway thereby reducing transaction errors and hedging gateway associated performance leakages as you go global.

What tactics would you like to explore with Chargebee? Write to me at Divya at Chargebee dot com. I would love to hear about it.