Credit card statistics indicate that as of July 2021, there are 1.12 billion credit cards in use in the United States alone and 2.9 billion credit cards in use globally.

While increased spend on credit cards has led to a surge in the number of e-payments being processed every day, it has also given rise to some challenges for users and businesses alike.

The biggest of their woes is credit card declines. In this post, we will tell you everything you need to know about dealing with credit card declines and most importantly, how you can recover ‘lost revenue’ due to these declines.

Feel free to deep dive into the segment you’d like to know more about,

What is a credit card decline?

Strategies to reduce credit card declines

A proactive approach to failed payments

What is a credit card decline?

A credit card decline occurs if, for a particular reason, a credit card payment cannot be processed and the transaction is declined by the payment gateway, the processor, or the bank issuing the money. It’s a common problem faced by businesses that process recurring payments.

There could be a variety of reasons for this. According to Visa and Mastercard, an average of 15% of recurring payments are declined, but for some industries, the rate can be double that.

For a better purview of how credit card payments are processed online, check out this piece on payment gateways — the credit card machines of the web.

Breaking down payment failure

Understanding the types of credit card declines

There are two common reasons for declines:

1. Soft declines

As David Goodale, CEO of Merchant Accounts writes, “If you think of the payment process as a chain of events, there are several “handshakes” that must occur in order for a transaction to complete. If one of these parties in the chain is down, interrupted, or unavailable during the transaction resolution, a problem will occur.”

In that same sense, soft declines occur when the bank issuing the funds has approved the payment, but the transaction fails somewhere else.

2. Hard declines

Hard declines, by contrast, occur when the issuing bank does not approve payment for processing. Hard declines usually require the payment card information to be updated before the transaction will be successful, regardless of how many retries are attempted.

Understanding decline codes and error messages

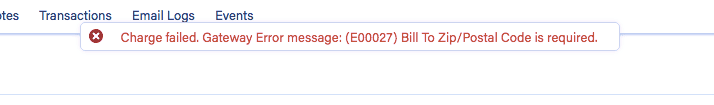

Irrespective of what’s causing the payment failure, every time a card is declined, your gateway (or processor) issues two accompanying, but different pieces of information,

- An error code: It is typically a number, a code that identifies the error to the system.

- An error message: It is typically in words, a message that identifies the problem to you and your customer.

Both codes and messages are recorded for you. Your gateway puts them down so you can take a look at the failed payment later.

Say your customer is in the process of checking out and has just hit the ‘pay’ button after giving their information. If their card is declined, they will see an error code and an error message. Something along the lines of,

Unfortunately, there are no standardized error codes that might help them make sense of what went wrong. Error codes differ from gateway to gateway. Authorize.Net, for example, throws up error codes as you see in the screenshot above: E00005 and E00027. In the same way, Braintree throws up error codes like 2046 and 2048.

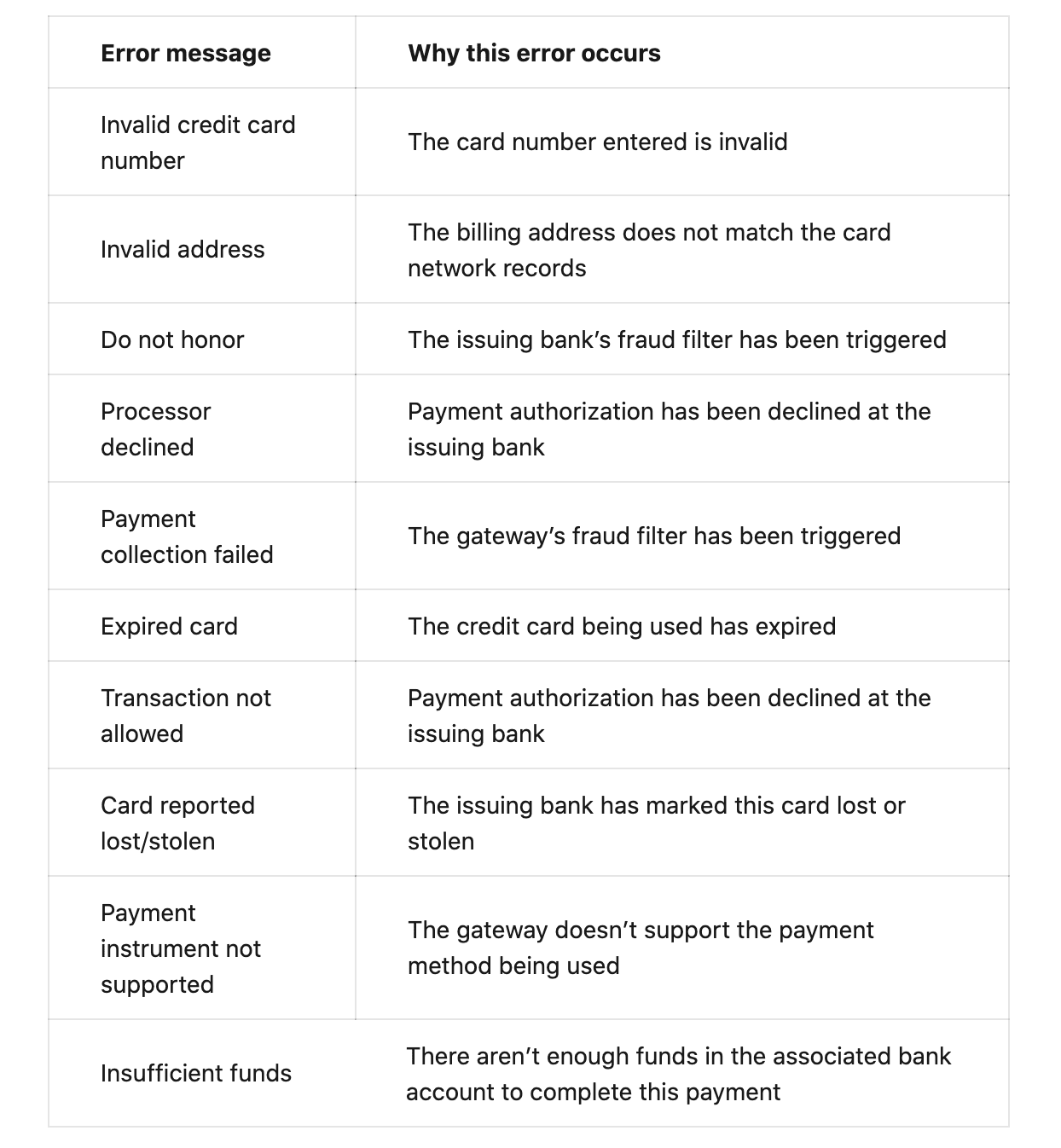

However, the issue lies in the vagueness of error messages.

But, why are they vague?

Ethoca, a charge and fraud protection company contacted several card issuers and asked. Here’s what they discovered:

“First, card issuers are protecting their cardholders’ privacy. They are reluctant to share with merchants that the cardholder is behind on paying their bill, maxed out on their credit card, or has lost their card.

The second reason is that if the purchases were made by fraudsters, providing this level of decline information could potentially allow fraudsters to reverse engineer the fraud system and learn how to bypass the fraud checks.”

That being said in most cases, the customer is left to wonder, “Why was my credit card declined?” It’s time to understand the few common error messages that you might come across to make your and your customer’s life better.

Strategies to reduce credit card declines

Most of these credit card declines can be avoided and those that turn into failed payments can be recovered by understanding the mechanics of failed payments.

Integrating these strategies with your accounts receivable and billing software can help prevent these declines and reduce the chance of loss of revenue.

Prevent false blocks and false declines

The varied reasons notwithstanding, 52% of the orders merchants thought were suspicious transactions turned out to be good orders that were caught in the fraud nets.

These declines were accompanied by messages like ‘do not honor’ and ‘processor declined’.

They were good orders that could have been fulfilled.

When this is done to safeguard against possible fraudulent transactions, it is often a result of a simpler problem such as outdated card information, insufficient funds, system failure, or simply because the business is located in a country different than that of the card issuer.

In essence, part of battling card declines is fine-tuning the fraud filters in your control so they don’t (for the most part) get in the way of good orders.

Here’s how you do it,

1. Prevent false credit card block

This fraud is declared by your gateway and is entirely in your control. Most gateways allow merchants to customize the rules they have in place to catch a suspicious transaction.

Your gateway allows you to either ignore block, or flag payments that,

- fail AVS (address verification) and CVV (the three-digit code printed on the back of your card) checks,

- transactions initiated from a suspicious location checks,

- transactions over a specified credit limit check, and so on.

Blacklists and whitelists are among the top methods used by companies in fraud management. Rather than blacklist and block transactions like these (that your gateway perceives are fraudulent), it might make sense to allow the transactions and flag them for a review later (whitelisting and calling these transactions safe can be just as bad).

To be cautious about stolen cards and credit card fraud, some merchants like Paypal already provide basic security measures, however, any scaling business should check out for these fraud detection methods.

Another thing to keep in mind is those payment gateways are prone to outages. Check out how you can tackle your sign-ups and subscription renewal when your payment gateway is down here.

2. Prevent false credit card declines

This fraud is the one that is declared by the payment processor, hence, less in your control. Transactions that have passed through your gateway (without being blocked) might still be declined if they fail one of the processor’s fraud checks. One of the reasons processors decline transactions is the risk they perceive on behalf of the merchant.

- The best way to mitigate this perceived risk is to pass as much customer information as you can onto your payment processor. This information can tell your processor that the transactions associated with the card are legitimate.

- You can also reach out to processors themselves (via your gateway) or use third-party software to make sure the two fraud nets don’t overlap.

The unintended consequence of two sets of fraud filters (one from your gateway and one from your payment processor) working together (and independently of each other) is that sometimes they can cast a net that’s too wide. It could end up preventing genuine customers from placing orders. The best filters are the ones that wouldn’t just flag a customer because they entered the wrong CVV. Instead, it would consider all the information provided in the customer’s account and then decide whether there could be a potential threat.

Riskified, a revenue protection software, holds that preventing false declines and false blocks can have a significant impact on your bottom line.

Widen your payment options

In research conducted by Globalization Partners and CFO research, it was found that 41% of the companies worldwide were expanding globally. This highlights the opportunity for scaling and accommodating a global audience. Reach a broader audience with their choice of payment options- credit cards, digital wallets, direct debit, and offline payments.

Chargebee offers multiple online and offline payment options to reach your customers in any corner of the world and with the help of this option, Makespace, an on-demand storage company scaled from 4 to 31 markets in a year!

Enhance your checkout experience

Instaply, a text messaging app that helps improve customer service, had the same problem every scaling company had. They had hit their first 100 customers and the opportunity to reach a new audience and new customers kept them up at night. What also contributed to their sleepless nights was involuntary churn through failed payments and the sheer pressure of solving for currency, tax, and payment complexities if they were to expand.

Adopting plan-specific checkouts helped them collect payments instantly. Many subscription billing platforms focus on simplifying the checkout process making it scalable. Additionally having features such as an account updater to inform customers about changes to the account information or smart retries to retry failed payments for a customized period to help get the money back would help to prevent revenue leakage.

A proactive approach to failed payments

With your fraud filters tuned to better sort legitimate payments from fraudulent ones, your credit card decline rates will fall.

The harsh truth is that you will not be able to fully eliminate credit card declines, though.

The question, at this point, becomes what you can do to recover any revenue that might be lost? The answer lies within the umbrella term ‘revenue recovery’.

Revenue recovery

Revenue recovery tactics shorten the gap between the money that is owed and the money you are getting.

For example for an expired card, there are two kinds of revenue recovery tactics you could have implemented immediately,

- A tactic that could have prevented the payment from failing (a preventive tactic — like an email reminding the customer to update payment information) or

- A tactic that could have recovered the payment after it failed (a more active tactic — like an automatic retry three days later).

Here’s a list of 20+ tactics that you can implement to get your revenue recovery up and running. This is important because it would reduce churn and provide your customers with a hassle-free billing experience. Go ahead and check out how Chargebee Receivables brings all-action revenue recovery under one roof.

Dunning management

To weed out the problem at the beginning, at Chargebee we use the Luhn algorithm to help you understand the validity and authenticity of the card details you have.

Apart from taking all precautions, a good portion of your churn could be attributed to voluntary churn which is indeed painful. But imagine a customer who is actually interested in your service/product but you lose them due to operational glitches. How can you stop this from happening?

Even a 1% churn can affect your overall revenue and dunning is a process that helps to monitor customer accounts and debit/credit cards that are expiring soon. It then notifies the customer of the upcoming expiration and encourages them to update their payment information.

A firm that used dunning management to their advantage is, Whiteboard Mortgage CRM. They used Chargebee’s Revenue story to get an accurate picture of their data and improved MRR by 35%. They coupled this with Chargebee’s dunning management and managed to reduce churn by almost 100%!

Smart Retries

If a credit card on file resulted in a failed payment due to a hard decline such as a card expiry, there’s no point trying that same card again a few weeks later.

In this way, one needs to understand that every form of failed payment requires a different dunning method, and doing this manually can be hectic and time-consuming for a subscription business.

Moreover, a bad dunning strategy can also push you to get blacklisted. Chargebee’s dunning management includes in its armory, the Smart Retry which brings in knowledge about why the payment failed in the first place and automates the dunning response to it.

Hope those card decline messages worry you a little less now!

We know the fight against recovering revenue isn’t an easy one, but we can help.

Talk to our revenue recovery experts and never worry about revenue lost due to credit card declines, ever again.