The subscription model is gaining more and more importance worldwide, with the global subscription market set to grow from $4,054 million in 2021 to $7,813 million by 2025.

If you are running a subscription business, then you are no stranger to questions like:

- How can I stop losing revenue to missed payments?

- Did I miss sending an invoice this month?

- How do I invoice flexibly without manual errors?

The answers to issues like these boil down to how well you’re handling recurring invoicing.

So, let’s discuss the ins and outs of a recurring invoice, starting from what it is to the need for powerful automation and the process of creating an efficient recurring invoicing system.

What is a Recurring Invoice?

A recurring invoice is sent on a regular basis. Therefore, any SaaS or subscription business that records recurring cash flow has usually set up a process to send invoices automatically at regular intervals.

The Challenges of Unscalable Infrastructure for Recurring Invoicing

For a subscription business that’s just starting out, it should be possible to set up a process to send recurring invoices manually. Building an invoicing system in-house or adopting a simple invoicing software would seem like a cost-effective way to go about it. However, this might prove highly ineffective in the long run.

The first problem would be managing your rising subscriber base. There are increasing requirements for flexible invoicing with each additional subscriber, such as accounting for plan changes like upgrades and downgrades, consolidation, keeping track of receivables, and the like. At this point, your business will soon outgrow the modest capabilities of a basic invoicing system. So using your in-house software will take away all the precious time that you could use for other core objectives of your business instead. Besides operations and time sensitivity, there’s also compliance with regional tax laws like the US Sales Tax, Australian GST, and broader regulations like the EU-VAT.

And that’s why it’s more viable to automate your recurring billing and invoicing.

The Need For a Robust Recurring Invoicing System

For you to effectively realize the multiple benefits of recurring invoicing –

- speeding up payment processes,

- reducing time spent on payment collection and in the long run,

- building customer engagement

– automation is a necessity.

And not just any automation will suffice. The invoicing software needs to be adaptive, robust, and agile. It needs to be flexible and allow you to implement changes in a matter of minutes and not months. To survive and thrive in the highly competitive SaaS market today, you need software that helps you stand out.

Using a recurring billing & invoicing software like Chargebee can help you:

- level up your billing operations efficiency – capitalize every revenue opportunity across the subscription workflow

- improve revenue recovery – mitigate the impact of failed recurring payments and automate the revenue recovery process

- reduce revenue leakage – create in-depth Leakage and A/R reports

- increase customer retention – extract more value from your customers

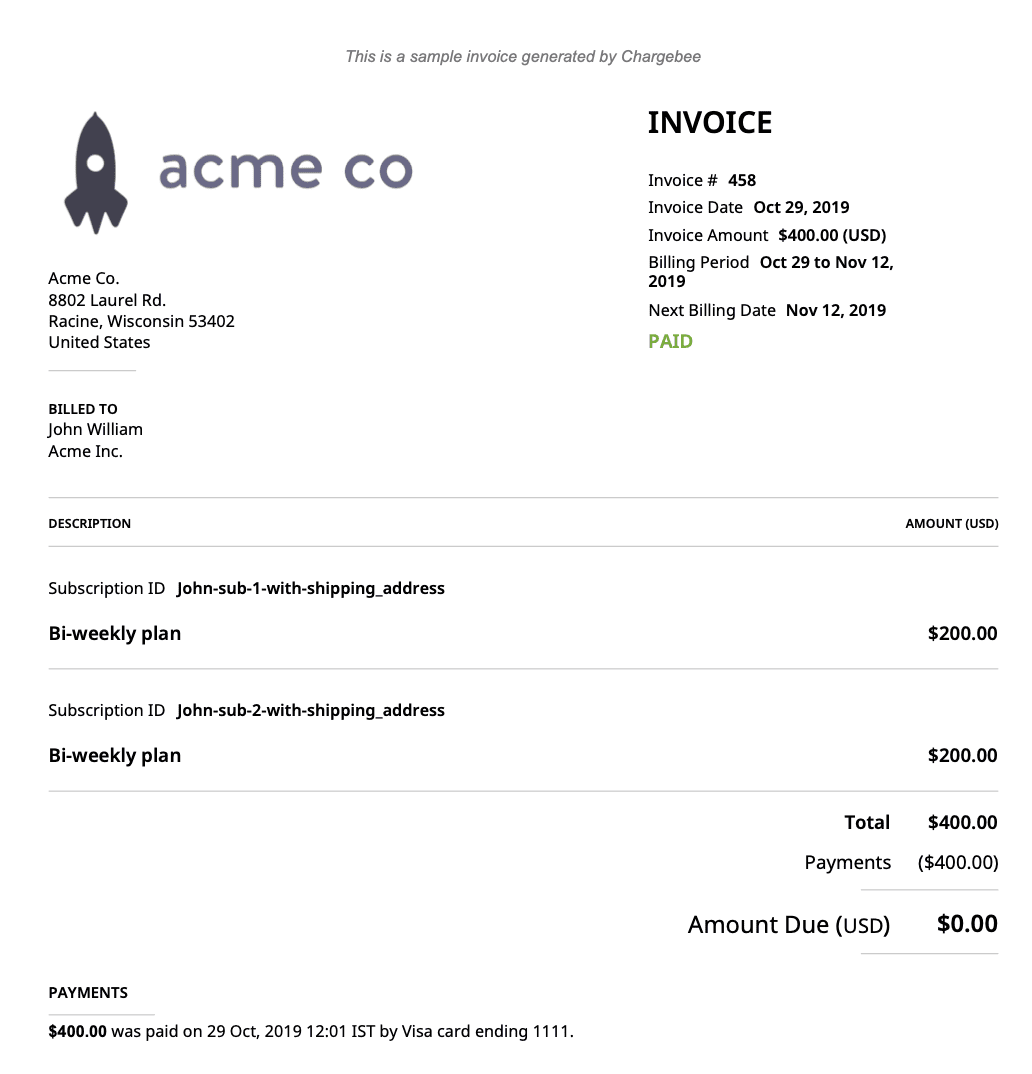

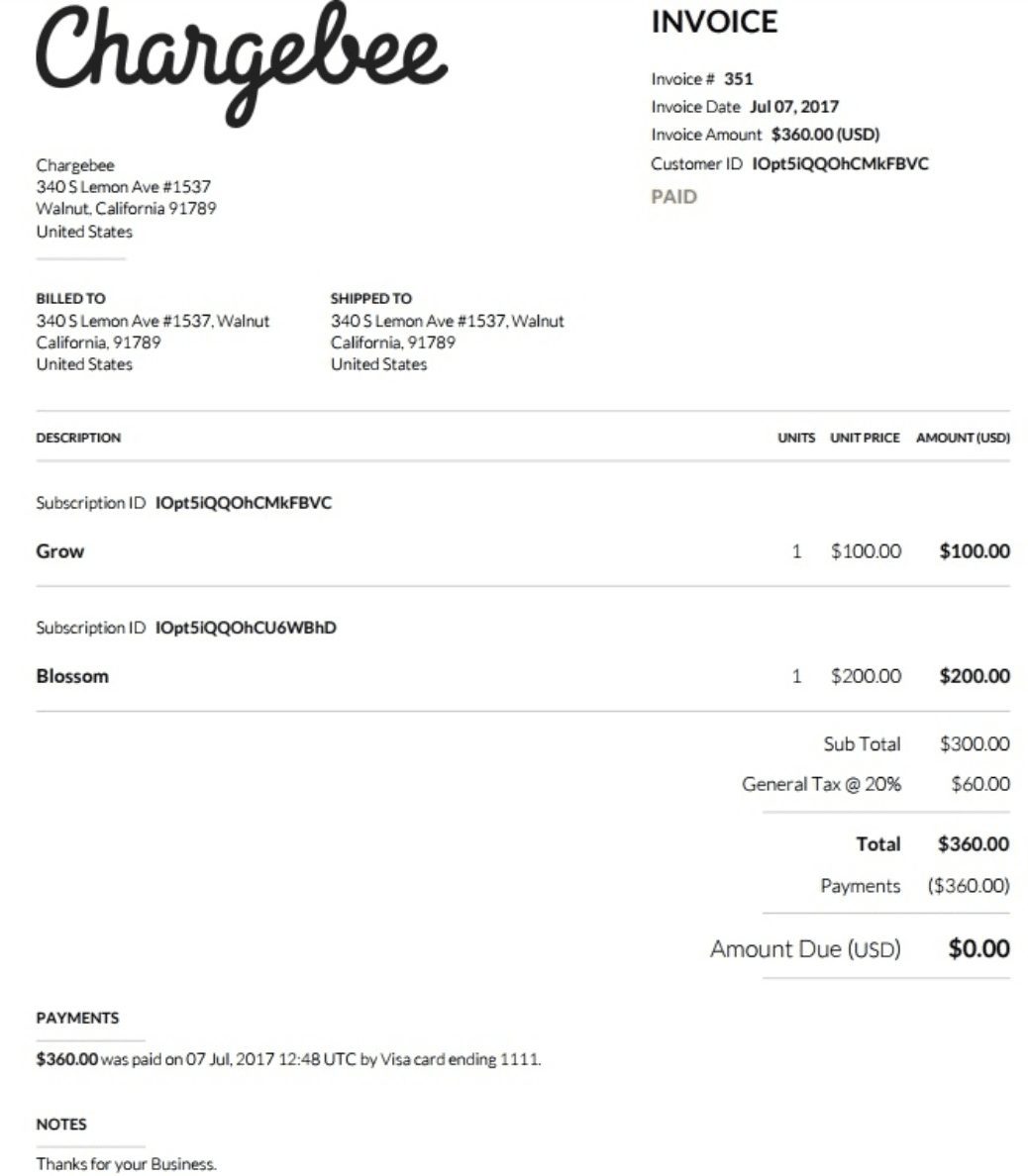

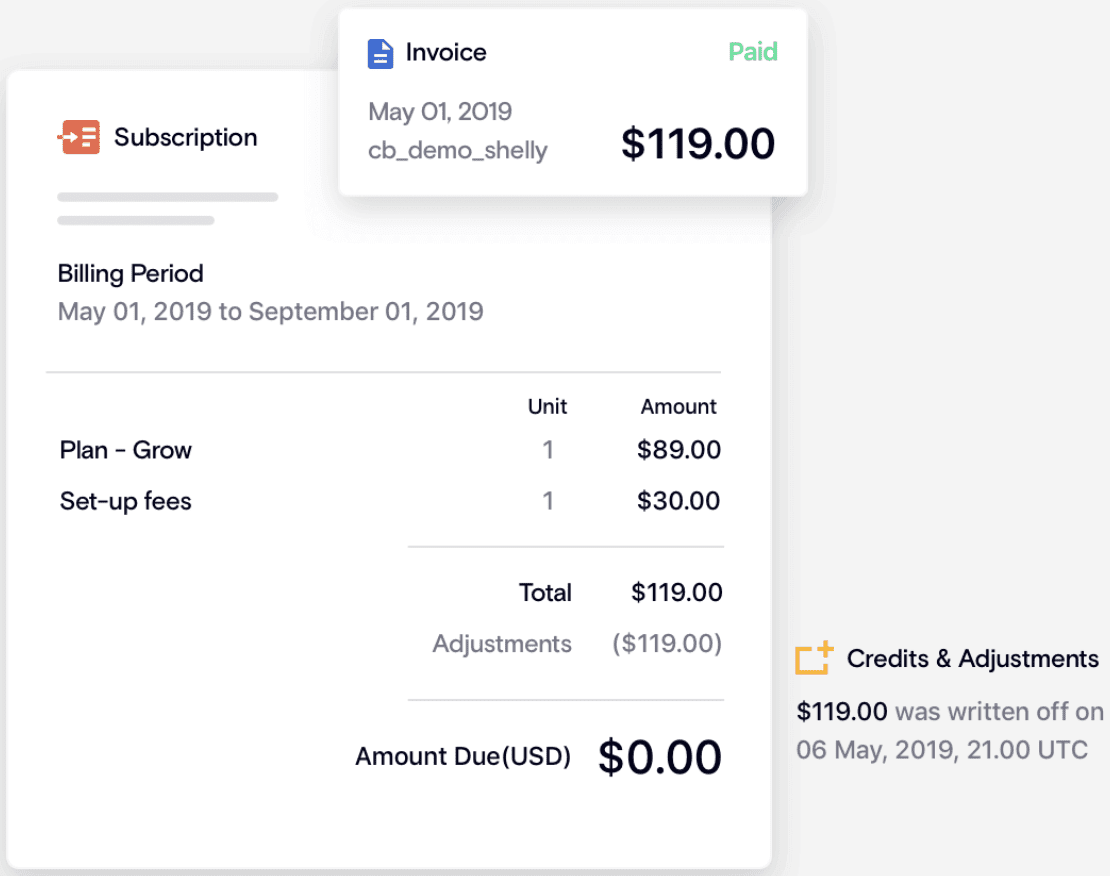

A robust invoicing system enables you to invoice your customers (for offline or online payments) with detailed line items and tax details with a customized look and feel. It lets you apply credits, create a credit note, charge an excess fee when necessary, remove payments, record a refund, write off or void an invoice with ease. It gives your customers the option to bring all their charges across multiple subscriptions and add-ons into a single invoice. We’ll discuss these aspects in detail further in the article.

How to Create Recurring Invoices within Chargebee

Chargebee enables you to create, handle, and report recurring invoices with ease if you’re starting afresh and looking for invoicing software off-the-shelf.

It eliminates manual intervention (unless Metered Billing is enabled) by ensuring automatic recurring invoice creation for subscriptions based on the plan’s billing frequency and payment terms – be it weekly, monthly, or yearly recurring schedule.

Here are the following instances under which Chargebee generates an invoice:

- A Subscription is created/renewed/updated

- A new charge is added using Add Charge option

- An Addon (recurring or non-recurring) is included in a subscription using Add Addon option

- An invoice is generated for Unbilled Charges (explained below under Pro Tips)

- An invoice is regenerated using Regenerate Invoice option

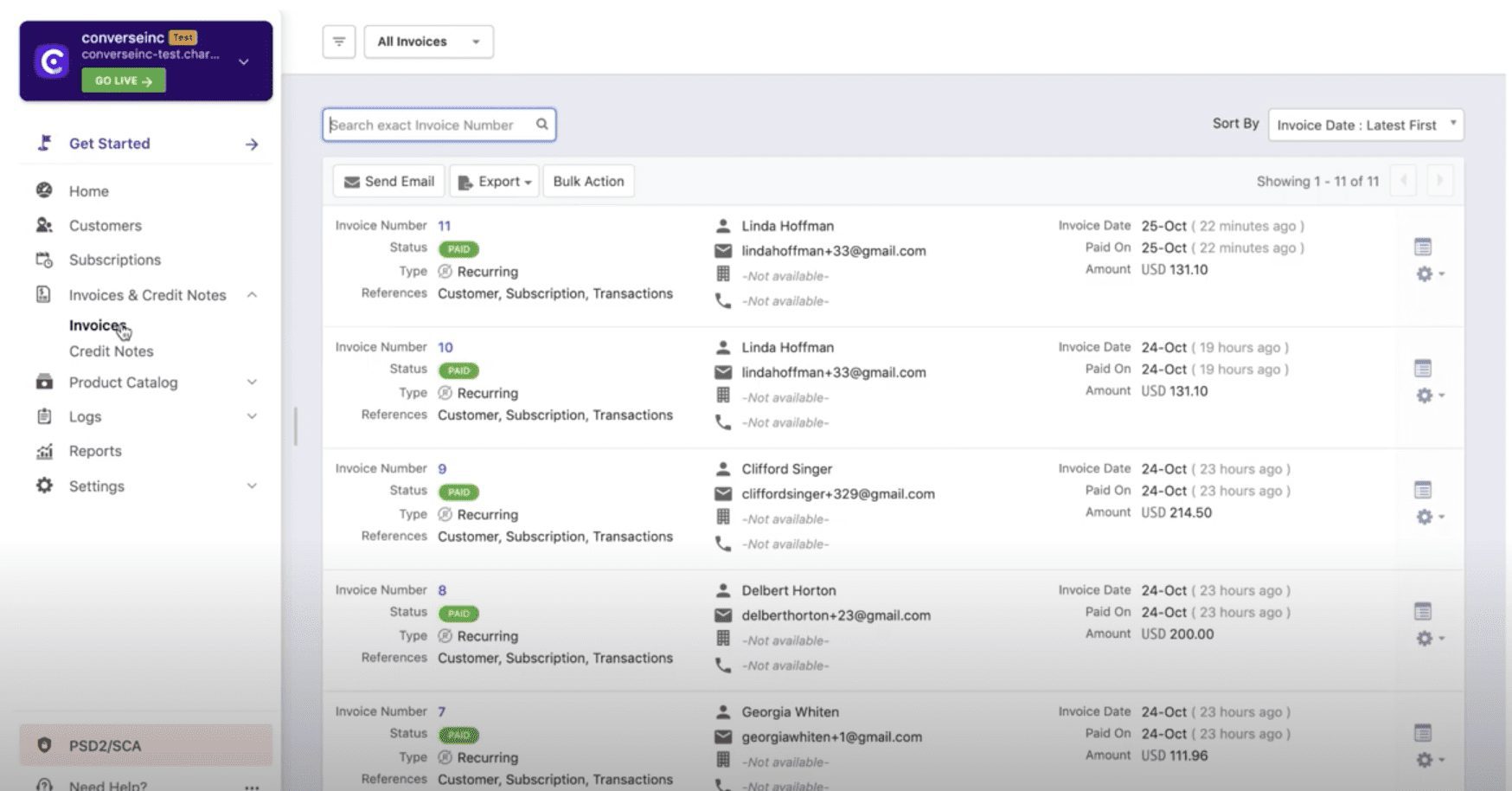

The generated invoices can then be accessed after successfully logging into your Chargebee site, in the navigation menu on the left, under the drop-down menu ‘Invoices and Credit Notes’. Here, all the invoices, along with any important details, can be viewed at a glance.

With this dashboard, you can:

- Customize the columns of your invoices

- Filter the invoices based on different attributes

- Select multiple invoices to carry out bulk operations like Delete, Mark as Void, Close Pending Invoices, Write Off Invoices, and Collect Payment for Invoice

- Email the customers, or export the invoices as CSV or PDF

Invoices also come in different statuses based on the payment transaction. The various invoice statuses in Chargebee include

- Paid

- Payment Due

- Not Paid

- Pending

- Voided

- Posted

For more information on the invoice statuses in Chargebee, head here.

Seamless Recurring Invoicing with Quickbooks and Xero

If you’re using accounting software such as Quickbooks Online or Xero, manually updating invoices in the accounting system can be very time-consuming. Moreover, the complexities of subscription invoicing such as proration, subscription upgrades or downgrades, or the addition of non-recurring charges do not make things any easier.

Chargebee’s integration with these accounting systems enables you to automatically sync invoices and payments data so that you have a single source of truth for all things accounting with minimal manual intervention.

You can read more about the Chargebee integrations here:

Pro Tips for Better Recurring Invoicing

Say no to cookie-cutter invoices

Customizing invoices can be a great branding opportunity. Chargebee enables you to tailor your invoices to your brand and your customer – including the color scheme, address format, payment details, and more. Here’s a template:

Ensure transparency

The flexibility of subscriptions allows customers to upgrade, downgrade, or cancel their plans. In such scenarios, it is your responsibility as a business to charge your customers proportionate to their usage. Chargebee enables you to handle proration with ease. You can ensure all invoice details are broken down into a clear, understandable format. By being transparent in your operations, build customer trust and boost loyalty.

Consolidate invoicing

What do you do when a customer has multiple subscriptions, incurring multiple charges for the subscription? Instead of sending one invoice every time a change occurs, level up your recurring invoicing process by sending consolidated invoices. Here’s a sample:

Don’t invoice for every new charge

Subscribers can make multiple changes to the subscription, such as:

- Upgrade or downgrade

- Switch to a different plan

- Addon attached in the middle of the subscription term

- Add a one-time charge or any other additions

Chargebee’s Unbilled Charges feature allows you to separate the creation of subscription-related charges from the invoicing of them. Once unbilled charges are created, they can be invoiced on-demand.

If left unbilled, they are:

- invoiced automatically along with the next invoice for subscription renewal or

- invoiced automatically or retained as unbilled during subscription pause or

- invoiced automatically or deleted during subscription cancellation

Invoice in advance

What if your customer wants to send an invoice before the actual subscription start or renewal date? In such a case, advance invoicing comes in handy, for instance, to schedule your billing to budget for on-time shipping, and the like.

Send payment reminders

Finally, remind your customers a particular number of days before the invoice is due to avoid unpaid invoices. You can also go further with Chargebee’s Smart Dunning feature. Apart from automatically retrying payments for an invoice if the payment fails, Chargebee also customizes the payment retry frequency (based on a logic derived from the analysis of past transaction data/pattern) to achieve a better success rate.

Summing it Up

Creating and managing recurring invoices manually can be an operational nightmare for a growing subscription business. Using an automated recurring billing system, such as Chargebee can make your life a lot easier by creating accurate, clear, and customizable recurring invoices with:

- Recurring billing logic that maps to your business rules.

- Accurate measurement of usage and billing accordingly.

- Invoices that fit any recurring billing scenario.

- Frictionless quote to cash process.

Head here to know more about recurring invoicing with Chargebee. If you’d like to try it for yourself, sign up for free! You can also go ahead and schedule a demo.