Economic trends from the past two years indicate that the value of growth for SaaS companies has plummeted. According to Openview 2022 SaaS Benchmarks Report, if you want to secure the same valuation today as in 2021, you’d have to grow your ARR by more than 2x.

But how do you maintain a stable and predictable revenue stream (let alone double it) if customers don’t pay you on time? Take a moment to let that sink in.

That’s why it’s essential to reconsider your accounts receivable strategy. Switching from a notoriously slow, labor-intensive, and error-prone software to AR automation can be the game-changer your business needs.

The Problem with Traditional Accounts Receivable Processes

The traditional approach to accounts receivable(AR) usually involves –

- Manually generating invoices through a spreadsheet software or MS Word

- Dispatching printed paper invoices or emailing digital invoices manually

- Payment verification and manual follow-ups through emails and phone calls

- Manual reconciling of financial statements

It gets more challenging as you scale your business. You manage more customers globally while juggling different pricing strategies, discounts, coupons, etc. It could lead to delayed payments, invoicing disputes, administrative expenses, and many other problems. It’s like a domino effect; one small error could throw your whole AR process for a toss. SSON’s 2022 AR Pulse Check survey found that 40% of finance leaders consider manual inefficiencies the most significant challenge when it comes to their collection strategy. Let’s explore the major drawbacks of the traditional AR process.

1. Failed payments leading to customer churn and revenue loss

Failed Payment.

Every business collecting recurring payments knows these two words can disrupt the AR process. A manual payment recovery system comes with issues that can cause payment failures. It could be an expired card, inaccurate billing/customer information, or misconfigured payment method.

Over time, these problems can strain the relationship with your customers, causing them to churn. According to PYMNTS, almost 48% of subscription churn today is happening because of failed payments. And you know what this means for your business. You lose sales, and your customer lifetime value goes down. Not to mention the damage churn can cause to your reputation, revenue, and growth potential.

Related Read: How to Avoid SaaS Failed Payments: The Ultimate Guide

2. Stunted Business Growth

A 2021 QuickBooks survey found that 81% of mid-sized businesses were dealing with late payments, which was more pronounced in 2021 than in the previous years.

Late payments are a big issue for many businesses today. When a finance team is handling all the AR collections manually, there is no centralized system in place for them to check the upcoming and overdue receivables. It makes following up with customers even harder, leading to delayed payments. Add the extra time and effort for collecting those late payments, which would further strain the operating expenses. The reduced cash flow, debt burden, and increased collection costs resulting from late payments will eventually catch up with you.

3. Damaged Customer Relationships

With a manual AR process, you’d constantly chase down non-paying or late-paying customers via emails and phone calls. The problem here is not the follow-up. It’s how you follow up. A scripted collection call can frustrate your AR team and your customers.

Almost 33% of businesses fear chasing payments can negatively affect customer relationships. The confusion caused by poor communication and inefficient payment collection process results in a not-so-great customer experience. And once the customer goodwill is lost, they are less likely to buy from you again. It can also do considerable damage to your business’ reputation.

Related Read: Ace Customer Experience With a Robust Accounts Receivable Process

4. Strained relationships with vendors

Inefficient AR collection strategies affect your customers and your vendors too. With reduced cash inflow, you might find it challenging to pay your vendors on time, eroding the trust you’ve built to maintain a healthy business relationship with them. And it ultimately affects the level of service you can provide your customers.

5. Lower valuations during fundraising

With cash stuck in the AR cycle, meeting financial obligations can take time and effort. It makes your business less attractive to investors and lenders, who might have concerns about your ability to generate returns and repay debts. How can you build on investor confidence by running an efficient and sustainable business?

AR Automation can be one of the critical building blocks that help build a more efficient business. It can help you build a solid foundation for a robust accounts receivable process. It can take care of the most time-consuming tasks while also reducing human errors in customer payment tracking and improving your bottom line –

1. Streamlines the AR workflows

For every business, time is the most valuable resource. With AR automation, you can ensure that your finance team is no longer burdened with inefficient and repetitive tasks that take up a significant chunk of their time.

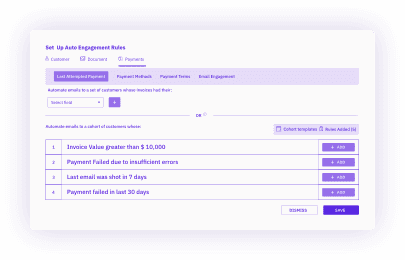

You can easily set up smart workflows that determine how frequently follow-up emails are sent (with pre-defined editable templates), create specific customer segments, decide when to escalate an unpaid invoice, and even set up a follow-up sequence based on how your customers interact with your communications. Chargebee Receivables reduces human errors and inaccuracies. You’ll have to spend less time combing through the details to ensure accurate output.

2. Gets your team access to real-time AR data

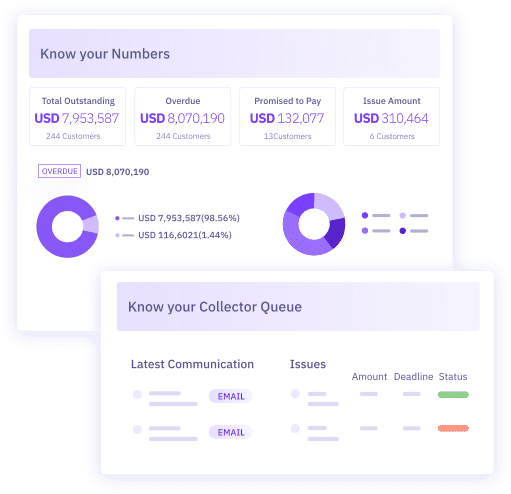

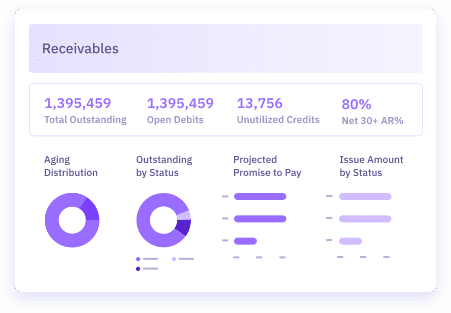

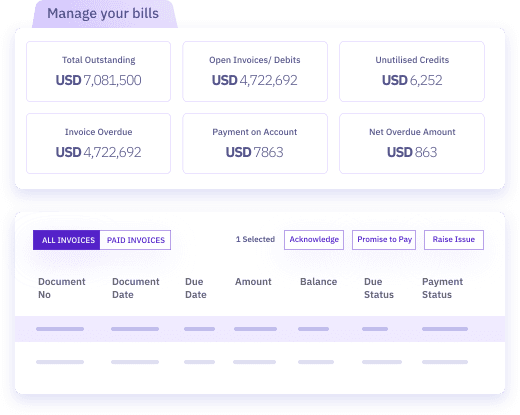

When you implement AR automation software like Chargebee Receivables, you can benefit from real-time visibility into your AR processes. An intuitive dashboard gives you a 360° view of your collections performance and subscription insights.

You can even enable the finance teams to prioritize and accelerate collection efforts with insights into customers’ payment behavior. By understanding the customers’ payment habits, open/overdue invoices, promises-to-pay dates, failed payment details, and open disputes, your team can prioritize who to contact and accelerate your cash flow.

Additionally, with Report Automation, you can gain even more insights and know what’s working and what’s not. The AR report includes actionable insights directly sent to your inbox, allowing you to keep track of critical receivables metrics, including cash projections, team performance, collection review, and open client disputes.

3. Promotes efficient collaboration

With a single dashboard, the need for constant back and forth between different teams reduces, and you can ensure seamless alignment between sales, finance, customer success, and operations teams. With custom roles, the admin can restrict users from accessing specific modules while ensuring they have access to the information they need to do their job.

Chargebee Receivables also enables you to measure and track each collector’s efforts.

The dashboard summarizes individual collectors’ performance, including their progress toward targets, pending and overdue accounts assigned to them, and their current status. You’ll also have real-time visibility of your customers’ aging distribution and ongoing issues.

4. Improves customer satisfaction

A great customer experience and resolving client disputes are crucial for unlocking revenue stuck in limbo. Chargebee Receivables allows for faster customer dispute resolution by timely reminders around critical issues to relevant stakeholders for a quick turnaround time. Additionally, it boosts the customer experience via a portal by giving your customers visibility into their invoices and total outstanding amounts, along with options to download their account statements.

Supercharge Your AR Collection with Chargebee

Depending on manual collections can result in reduced cash flow, lower team productivity, and greater customer dissatisfaction. Konica Minolta India faced similar issues before implementing Chargebee Receivables.

Before implementing the solution, Konica Minolta India struggled with delayed collections because of misalignment between its collections process and ERP workflows in SAP. The manual follow-up process also affected their customer experience, and their existing tech stack and processes didn’t allow for AR automation.

So the Konica Minolta India team decided to implement Chargebee Receivables as their AR CRM. Within a few months, they witnessed a massive increase (over 50%) in team productivity by automating the collections activities. Chargebee Receivables provided them with a single source of truth for all collections, which made payment follow-ups more streamlined and straightforward.

And thanks to the advanced analytics offered by Chargebee Receivables, the team could better predict their AR and get end-to-end visibility into the collection status from a region, city, and branch level, which made them better prepared for the market challenges, including those imposed by the pandemic.

“Implementing Chargebee Receivables has improved the coverage of each credit controller by 33% and our team’s productivity by over 50%. Besides serving more customers effectively, it helps us run the department operations profitably without increasing the team size.” – Nitin Gupta, Executive General Manager, Konica Minolta Business Solutions India.

If you, too, want to accelerate your revenue-to-cash process and streamline your AR, schedule a demo with us today.