Scaling a business to new heights involves navigating a myriad of challenges depending on company size, regions they operate in, and so on. The journey is complex, with many strategies available to grow and diversify revenue, like venturing into new geographies, expanding the product line, and launching new business models. In today’s dynamic business landscape, one of the key challenges businesses face when expanding their operations globally is e-invoicing compliance.

For the uninitiated, Electronic Invoicing, or eInvoicing, is the exchange of eInvoices between suppliers and buyers. These invoices are issued, sent, and received in a structured data format, enabling automatic and electronic processing. This method streamlines communication and automation in the accounts payable process. Instead of traditional paper-based invoices, eInvoicing streamlines the invoicing process by leveraging electronic data interchange (EDI) or other structured data formats. This modern approach significantly reduces the likelihood of errors, enables real-time tracking of invoices, and streamlines invoice reporting.

Why is eInvoicing critical to global expansion?

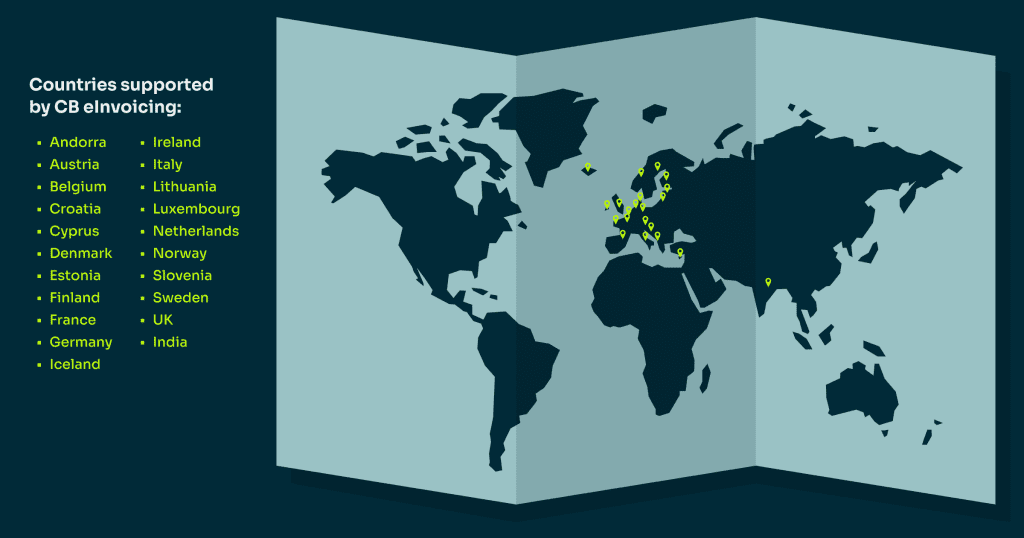

Many countries like Italy, Denmark, Finland, Germany, India, etc, have mandated eInvoicing for B2G and B2B transactions. Businesses must comply with these local regulations to operate in these geographies and avoid hefty fines.

Countries Mandating eInvoicing:

Several countries worldwide have recognized the benefits of eInvoicing and have mandated its use to streamline business operations. Some noteworthy examples include:

Italy: Introduced mandatory B2B eInvoicing in 2019, requiring businesses to submit electronic invoices through the Sistema di Interscambio (SDI) platform.

India: Introduced the Goods and Services Tax (GST) regime, requiring businesses to generate eInvoices through the GST Network (GSTN).

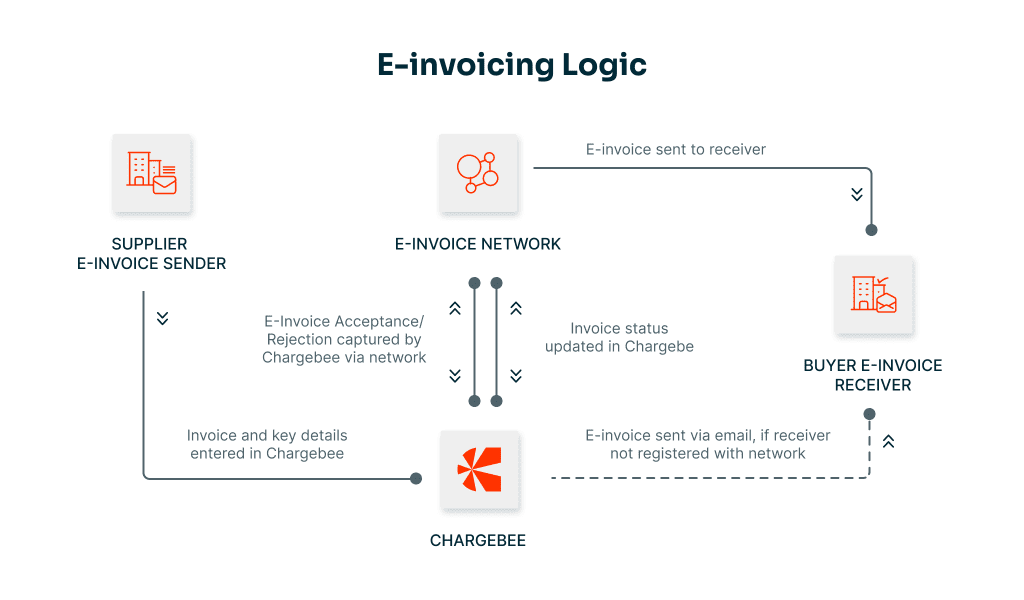

How eInvoicing works:

There are multiple region-specific eInvoicing networks like Peppol, SDI, and IRP among others that facilitate the transfer or exchange of invoices and credit notes in various formats. These formats are decided by the local governments to ensure audit readiness and compliance with taxation and accounting standards.

Sounds simple, right? But the real challenge begins when your Finance team processes these eInvoices. We spoke to some of our customers to understand how they were handling eInvoicing, and here are three common ways that came up:

- Using a regional third-party vendor: Integrating with a local e-invoicing provider to ensure compliance with the e-invoicing regulations. This method is preferred because the service providers take care of maintenance and servicing; however, it comes at an additional cost, either a fixed recurring charge or charged based on the number of invoices sent. As they expand their global footprint further, they would have to maintain integrations with multiple third-party vendors.

- Generating eInvoices manually: This is the most cumbersome and error-prone route. The Finance team generates invoices in XML or PDF and manually uploads them onto the local eInvoicing networks. This process may seem convenient and cost-effective initially, but as the volume of invoices increases, your team would have to create multiple versions of eInvoices every time there is a change in the invoice or manually approve the invoices individually before they are sent to the networks.

- Generating eInvoices from the Accounting software: This method is the most preferred by Finance teams, where they use Accounting/ERP software like Netsuite or QuickBooks to create eInvoices. They choose this route because they don’t have to switch between multiple tools, and it also gives them control over all the invoices and region-specific formats to meet compliance requirements. However, the caveat is that when other variables like tax, overdue invoices, and failed payments come into the picture, maintaining the necessary APIs and integrations to generate accurate invoices can get complicated.

Let’s take the example of Voxloud, a cloud-based business phone system company that runs on a subscription business model. When they became customers of Chargebee, they were amid a strategic acquisition by Wildix and wanted to pursue their business expansion goals in Italy confidently. While adhering to Italy’s eInvoicing mandates was a key challenge, it wasn’t all.

“With customers potentially canceling or facing payment issues, or forgetting to pay, churn was becoming a problem, and to add to it, the EU VAT levied in each of these invoices that weren’t paid for proved to be heavier.”

The best way for them to fix this was by integrating Chargebee with Quickbooks (their accounting tool, which was earlier used to generate e-Invoices), but this time, they treated Chargebee as a single source of truth for subscriptions and invoices. This is because Chargebee sits at the intersection of your CRM workflows, tax automation engine, and accounting tools, facilitating real-time data transfer between systems and helping you generate accurate and compliant invoices.

“We’ve found a great partnership (with Chargebee), as you solved a massive problem for us. If you haven’t solved for Italian eInvoicing compliance, we would have had to send the invoices manually. You came and helped, and we are glad to have you as a business partner for our invoicing platform.”

– Gabriele Proni, Co-Founder and CTO

As we enter 2024, focusing on cost-effective growth, businesses must invest in proper revenue growth solutions that put compliance and scalability at the heart of their innovations. At Chargebee, we’re constantly evolving our platform with that very goal in mind to offer end-to-end revenue growth management solutions to help you acquire, retain, and grow your revenue in the most efficient way possible by automating subscription lifecycle from sales workflows to billing and payment processing to churn prevention.

Schedule a call with us to learn how Chargebee can help you solve the compliance challenges that hinder your expansion goals!