When it comes to assessing your subscription business’s growth, a simple metric like return on investment is not enough. Recurring revenue is the foundation on which subscription business models are built. That’s why it is crucial to retain your customers for an extended period – also called the customer lifetime.

There are two metrics that can help determine the health of a subscription business: Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV). In this article, we look at CLV in detail and why it is crucial to get it right from the beginning.

Feel free to jump to a section most relevant to you:

- What is Customer Lifetime Value?

- Why is CLV Important to Know?

- Types of Customer Lifetime Value

- Customer Lifetime Value Calculation (and a free template!)

- Applications of CLV

- Six Strategies to Increase CLV

What is Customer Lifetime Value?

Customer Lifetime Value (CLV or CLTV) is the average revenue you can generate from customers over the entire lifetime of their account. In simple terms, it is the money you would make from a customer before churning.

For example, if a customer signs up for your product for nine months, the amount he will pay during that period will determine his lifetime value.

Why is CLV Important to Know?

CLV is an important metric because it provides you with a customer-centric perspective to guide some critical marketing and sales strategies of your subscription business, such as acquisition, retention, cross-selling, upselling, and support.

It helps you decide how much to spend on acquisition

Unless you know how much money you can generate from a customer, you wouldn’t know how much to spend to acquire them. In the SaaS industry, on average, companies spend 5 to 7 times more in acquiring customers than what they would spend on retaining the existing customer base.

Before we get into the nitty-gritty, let’s understand what Customer Acquisition (CAC) is. Just as the name suggests, CAC is the amount of money you spend to acquire a customer. According to David Skok, a guideline for SaaS businesses to ensure profitability is to maintain:

i.e., the cost of acquiring a customer should be considerably lower than the revenue that will be derived from the customers during the period when they remain subscribed to your service. The math seems elementary, but if you miss the implications, your SaaS business will struggle to generate profits in the long run.

It helps you understand your customer behavior better

You can segment your customer data into different categories based on their ‘lifetime’ values. You can identify customers who are likely to churn early and act proactively. To boost customer retention in specific segments, you can extend special discount rates or offers. Another significant benefit of customer segmentation is that you can use lookalike modeling to acquire more similar and high-value customers.

Types of Customer Lifetime Value

There are various ways to calculate CLV, and you can divide them into these two types:

Historical Customer Lifetime Value

Historical CLV calculates a customer’s lifetime value depending on what the customer has spent with a business. There are two ways of calculating historical CLV: using ARPU and using cohort analysis.

This is how you can calculate annual historical CLV using ARPU: (total revenue/number of months in the customer lifetime so far) x 12. It is a relatively simple calculation.

Cohort analysis calculates ARPU per month for all the customers who first signed up in a particular month. It is a visual representation of all variations across the months/years in the customer’s lifetime with your business.

Calculating CLV historically doesn’t take into account customer behaviors, variations, and preferences.

Predictive Customer Lifetime Value

The predictive CLV model is more complicated than its historical counterpart. Predictive CLV uses customers’ historical behavior and predicted retention to estimate future customer lifetime and revenue by applying artificial intelligence and machine learning.

This model, by nature, takes into account customer trends and behaviors throughout the lifetime of customers.

Customer Lifetime Value Calculation

Now that we know the CLV metric’s key role, let’s see how to calculate it. The basic formula for calculating the CLV is:

CLV = ARPU * Gross Margin * Average duration of customer contracts

Or

CLV = ARPU / % Churn

Where,

-ARPU is the Average Revenue Per User.

ARPU (monthly) = Total MRR / Total Active Subscriptions (Users)

-Gross Margin is simply the revenue after deducting the Cost of Goods Sold (COGS). It is usually expressed as a percentage of total revenue.

Gross Margin (%) = (Revenue – COGS) / Revenue

-The average customer contract duration is the average value of how long your customers continue to subscribe to your product or service.

-% churn is the rate at which you are losing customers.

Here’s an example from a practitioner’s approach.

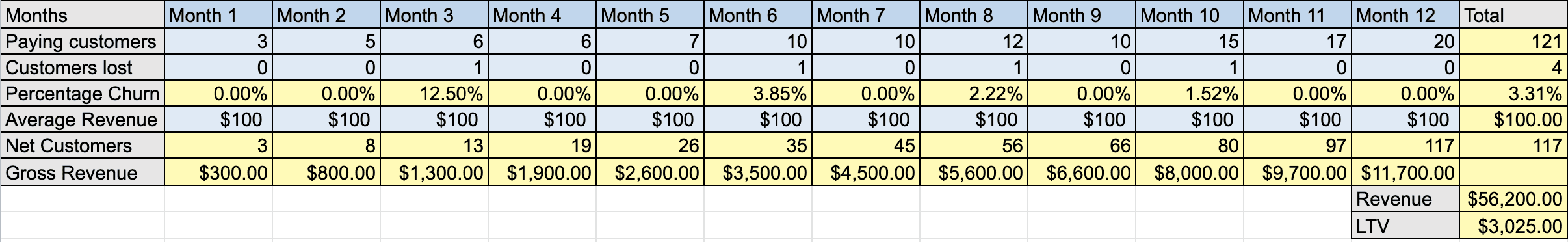

Let’s calculate CLV with the help of this ready-to-use Excel template (which you can download and modify for your business btw).

For the sake of simplicity and easy understanding, let’s work with the following considerations:

- A period of 12 months.

- Assume an average revenue of $100 from a customer. You can change this as appropriate to your business.

- Instead of directly using % churn, we’re the actual number of customers who may leave month-on-month to come up with a % churn using the formula.

Now let’s get to it!

- Enter the number of paying customers and lost customers that month.

- Net customers are the total number of paying customers minus the churn.

- Gross revenue is the average revenue multiplied by net customers for that month.

- At the end of 12 months, LTV is calculated by ARPU / % annual churn.

And voila!

Become a Certified SaaS Analytics Expert – Enrol for Free

Applications of CLV

Knowing CLV helps develop strategies for the brand, customer development, and forecasting, to name a few. Let’s explore some applications of CLV:

Boosting Retention and Loyalty

CLV is an indicator of how satisfied customers are with your services. The more a business knows about its customers and what engages them, the better are the chances of long customer relationships. CLV helps businesses prioritize their efforts to acquire and hold on to high-value customers.

Forecasting Demand and Sales

This one’s particularly important for retail and eCommerce businesses. By being mindful of their CLV, businesses can better predict future demand and inventory. It helps in efficient resource allocation.

Segregating Customers

CLV helps businesses identify their most valuable and most loyal high-tier customers. Businesses can use this data to redirect their resources to engage and retain these customers while also strategizing about moving the low-tier customers to the higher tier.

Six Strategies to Increase CLV

A glance at the CLV calculation formula tells us that the ARPU and Gross Margin values should grow, and your churn should reduce to increase customer lifetime value.

- To improve the ARPU, focus on upselling your service to your users. This means using efficient ways to make your current customers purchase more, be it through discounts or coupons on upgrades.

- To lower the COGS, you must have effective and efficient service operations. This will improve the gross margins of your SaaS.

- To lower the churn rate, you must focus on customer retention. For involuntary churn, having a smart, dunning mechanism in place is a must! Check out our top tips to reduce churn here.

Here are some overarching strategies to improve your CLV:

1. Up-sells and Cross-sells

Upselling means selling more features or product extensions to existing customers, while cross-selling means selling other related products in addition to core products. Both can increase CLV as they extend the relationship with the customer and add more value. It is also less expensive to sell to an existing customer than to a new customer.

2. Product Education

Another strategy that helps boost retention in the long haul is implementing product education initiatives for your customers. Customers might be churning because they do not see the value in our product that you intend them to see, and hence product education, training, and guided tutorials go a long way in making them see the value in your product. It compels customers to hang on longer and increases lifetime value.

3. Add a Personal Touch

Personalizations, along with an intuitive UI, will help you deliver a great customer experience. For example, Chargebee allows customized invoices to suit our customer’s needs. Personalization and knowing your customers will also come in handy when you want to upsell or cross-sell. Small things like personalized in-app messages go a long way in making the customer feel valued and increasing the average customer lifetime.

4. Add Sticky Features to the Product

Add features in your product that make it difficult for the customers to leave. For example, a custom dashboard that the customer can build with their data to improve their business’s overall efficiency. Something like that makes the customer dependent on your product because it makes their life more comfortable and drives long-term growth. This inspires customer loyalty and boosts the average customer lifespan.

5. Reassess your Value Proposition

To truly understand your loyal customers, you need to keep up with their growth. It would help if you reassessed your value proposition often to ensure that your product matches the customer’s changing needs. You can even consider bundling/unbundling some features or tweaking your packaging and pricing. This involves some experimentation that can only be successful if you know your customers well and have data to back it.

6. Win them Over with your Customer Support

Excellent customer support is crucial for customer satisfaction and, thus, retention. Invest in omnichannel support at an early stage and have a well-trained and responsive support team in place.

Pro tip: monitor social media for any complaints or queries and be quick to act on them. Maintain a knowledge base consisting of FAQs and product documentation for easy reference to the customer. In short, be everywhere and be quick. Easier said than done, but it’s worth the effort and goes a long way in developing a long-lasting customer relationship.

Wrapping Up

Successful subscription businesses obsess over their customers‘ lifetime value because it provides crucial insights for their customer success, product development, marketing, and pricing strategy. With the tactics mentioned above, you’ll be able to boost your CLV and keep your customers happy.

And when you keep your customers happy, your revenue grows. It’s all about finding the ultimate retention strategy that works for your subscription business.

Unlock strategic insights and practical solutions to enhance your CLV and drive sustainable growth.

Ready to elevate your customer retention and revenue?