Introduction: For everything that’s changed, relationships are still the same

“We have reached the point where the service part of SaaS is most relevant, the point where the experience your customers have with your company will determine whether they stick or switch.”

Derek Arch sells milk.

He’s up at two thirty in the morning, bright-eyed in spite of the cold.

“When I was a youngster I could go out delivering the milk without so much as a coat on,” he says.

How long ago that might have been being anyone’s guess. Derek turns 89 this year.

“But now [the cold] can be bitter and I have to wrap right up.”

He’s got no plans to retire.

He starts so early because norms have changed, even if the 1950s milk float he still uses hasn’t. He can’t walk into people’s houses anymore and ladle milk into jugs laid out for him, people are working and he needs to finish his rounds soon.

He delivers to over three hundred homes and, being a bit of a local celebrity, has a solid relationship with all of his customers — they’ve stuck with him over his biggest competition: the supermarket, which sells milk for three times cheaper.

As it turns out, Derek has a lot to do with what we’re talking about today — relationships, recurring billing, and how they’re connected.

D. Arch & Son is a testament to the fact that over seventy years of some of the most accelerated change the world has ever seen, the way we do business has largely remained the same. Norms have changed, prices have changed, mediums, voices, and words have changed. But the relationships that drive business haven’t for the most part.

These kinds of relationships sit at the heart of all subscription businesses — from D. Arch & Son to Slack.

As billing builders, we think about the less romantic side of businesses’ like Derek’s (like billing and charging) every minute of every day and obsess over how it impacts the relationships that keep his business going.

What if a household asked him for three pints one day because they had family visiting? What if others were going on holiday and didn’t want a delivery for the next two weeks? What if he wanted to waive his prices for Christmas one year or gift his neighbor free milk for six months? How do the people who love his service so much pay him? And how does he charge them?

How Derek answers each of these questions either strengthens or weakens his relationships.

We’ve learned, over the years, that there’s no in between.

Part 1: Billing systems are relationship engines

Pushing the needle on growth metrics is getting harder.

A lot has been written on why this might be — from an increasingly competitive market to a drop in SaaS valuations, to channel fatigue.

There is a north star to rely on, though, amidst these waves of change. It has guided SaaS for the last two decades, and guided businesses like Derek’s for the last fifteen — long, trusting relationships.

We believe that the key to lasting relationships is understanding all the elements you have at your disposal to build and nurture them and ramping down on patterns that work.

This article is focused on one element in particular: the billing system.

Mark Suster in ‘What Happens When Startups Turn from Their Innovation Stage to Operational Excellence’ says, “I have unfortunately observed a few companies who had extreme success with initial product adoption but failed in key areas that limited growth and therefore the ultimate financial outcomes”. One of these grievous errors he’s seen companies make… “they failed to invest in internal systems that support growth.”

We’ve identified that there’s a gap between what businesses believe a billing system can do for growth (and relationships) and what we know it can.

The sooner the gap is seen and bridged, the sooner billing systems are used for the engines they are and not the mere utilities they appear to be.

Here are some of the biggest billing system myths we’ve encountered.

Myth #1: Billing systems are payment gateways and invoicing tools

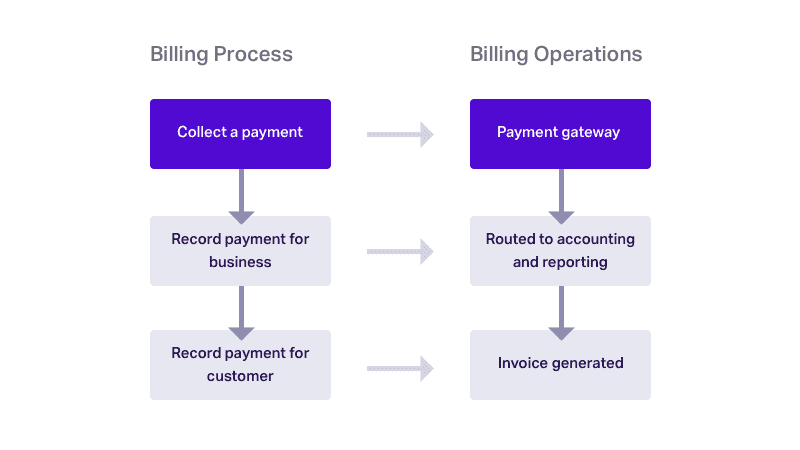

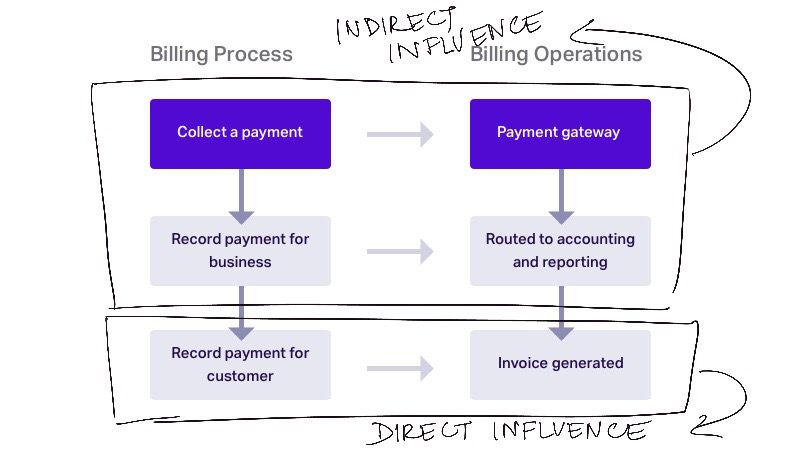

When correlating the what of billing with the how of billing operation, billing seems to be a simple process.

In theory, at least.

The reality is a little more complicated than this picture suggests; and it has to do, primarily, with the amount of data that your billing system possesses.

To create an invoice for a customer you need:

- Account and subscription information,

- Personal details, and

- Payment, tax, and discount amounts.

If you’re using a simple invoicing tool, you would have to collect this data, store it somewhere secure (like a CRM) and route it to the tool when invoices need to be generated.

You’re looking at checkout pages that you would have to build from scratch, a CRM that’s built for sales(as opposed to retention) interactions, and an invoicing tool that can’t do more with this information than put it together in the context of a payment.

Billing systems are evolving to do more with this data (than all three tools put together).

With a billing system, you can use ‘invoice’ data to:

- Create, optimize, and brand checkout and payment pages so they’re converting better (update payment method pages for example),

- Create a customer portal where users can change and update subscription information on their own without intervention from your support team and

- Segment and brand (and personalize) payment communication every time a payment is successful (for upselling/cross-selling or customer success) and every time it is not (for dunning and subscription reactivation).

Myth #2: My customers don’t have billing expectations

This might be true.

But, they have ideas of what a good customer experience is and isn’t. They do expect certain things from you.

“Your customers are savvier and expect more from you than ever before. They want seamless, personalized, and instant experiences.” Maria Fernandez-Riddick, the Customer Experience Lead at Verizon writes.

Consider all the touchpoints, interactions, and engagements that comprise the customer experience.

Every one of them contributes to expectations fall into two broad categories:

- General expectations

- Set by the way technology is changing and the norms that exist in a market.

- Set by touchpoints and interactions with your competitors.

- Specific expectations

- Set by touchpoints and interactions with you.

As your customers engage with your brand, expectations typically veer away from the general towards the specific.

Getting to the point where you’ve won that kind of relationship is a challenge, though.

You must meet the general expectations that customers approach a market with to win yourself an opportunity to set specific expectations with them.

It’s like pouring your heart into a comedy routine only to show up and discover that “15 of the best professional comedians in the world were on stage right before you. You’re up after Jerry Seinfeld, Dave Chapelle, Amy Schumer… your job just got a whole lot harder”, to use Brian Balfour’s analogy on how expectations are getting more and more difficult to meet in today’s competitive landscape.

Here’s an example.

It is now a general expectation to receive a phone call from a service you’re interested in within the first five minutes of signing up. Response rates were 100 times higher than reaching out to a lead in thirty minutes. There’s no opportunity to set a specific expectation for your brand if this general expectation (dictated by forces outside your business) isn’t met.

Let’s take a more subscription specific example. What to do when a customer cancels their account. At this point (depending on touchpoints, interactions, and engagements into your service your customer is), you’re dealing with a mix of general and specific expectations.

Intercom argues that the best way to re-engage with customers is a targeted, personal, motivational, and visual email.

Your billing system, with data on sales and subscription changes, is more than equipped to send and personalize your reengagement email so that you have the mindshare to focus on making it stand out in a stuffed inbox.

In summary, when it comes to general expectations that are essential to a great customer experience, your billing system can leverage all the data that it ‘must’ have (for invoices, the job you might have hired a billing system for) to ensure you’re delivering the product you’ve poured your heart into in the best way possible.

Why it’s important these myths disappears

“Helping is the new selling and customer experience is the new marketing.”

SaaS relationships strive to get back to roots: recreating that trusted handshake when partners look each other in the eye and agree to do business.

A billing system allows you to leverage the data that it is packed with to do just this.

What billing can do is meet customers’ general expectations while you take care of specific ones. You can go about building your brand while your billing system works to send out accurate invoices, timely and appropriate communication, and segment customers for a personalized experience.

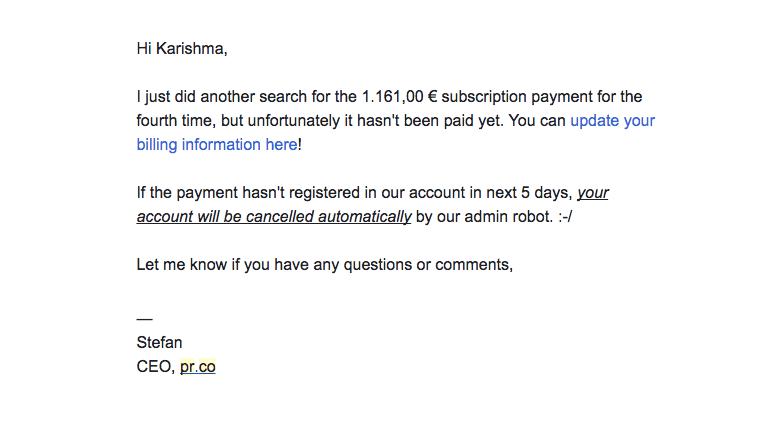

Take a look at this transactional email that pr.co sends users who have defaulted on an invoice that is due after they’ve automatically retried the card.

Compare it to this transactional email from Microsoft, sent out on cancellation of a service.

One is geared towards customer experience with personalization, a succinct message, a single (clear) CTA, and a friendly conversational tone while the other doesn’t tick any of those boxes.

Which might receive a better response?

Part 2: No, seriously, billing systems are relationship engines

Let’s revisit that picture of the billing process and billing operations again. It’s clear, as we saw in the previous section, that there are parts of billing that are explicitly customer facing and directly influence the customer experience.

In this section, I’ll argue that the other aspects of billing still influence customer relationships, if not directly.

Let’s begin with the ‘record payment for business’ section, usually linked exclusively with reporting and accounting.

Myth #3: Billing is closely tied to accounting and reporting, NOT subscriptions

It’s true that billing is closely tied to accounting and reporting systems — with the data that we were talking about in the previous section at its fingertips, a billing system is perfectly suited to helping recognize revenue, generate statements of sales, and reports on general health.

There’s more though.

Imagine Mark’s subscription renews on the first of every month. But he wants an upgrade to a higher paying plan immediately, the fifteenth. When do you charge him? And how?

It’s impossible to figure out what your options are without considering what your billing software can and can’t support. Does it support changing the renewal date of an existing subscription? Does it support prorating the upgrade, if you want to continue billing Mark on the first? Did you build your product with volume or tiered pricing in mind?

Billing questions are subscription questions in disguise.

Like Batman’s vigilantism is constrained by how much Wayne Enterprises can support, your subscriptions are constrained by how much your billing system can support.

As you start attracting new user personas, expanding into new geographies, and experimenting with your pricing, your subscriptions will evolve into hubs of complexity.

Your billing will have to either keep up or get in the way.

Myth #4: The billing features I need will remain the same as I grow

Closely tied to the previous myth is the mistaken belief that a standard set of billing features will suit a business as it grows.

This is simply not true.

With user personas come additional payment methods, backup payment gateways, advanced invoicing options, unconventional billing periods, credits and refunds, promotion support, and payment recovery or dunning.

With new geographies come new tax laws, new invoice rules, and support for different languages.

With new prices come grandfathering existing subscriptions, cloning subscription models, creating new ones, and support for one-time payments (pricing experiments can cost you a fortune without them).

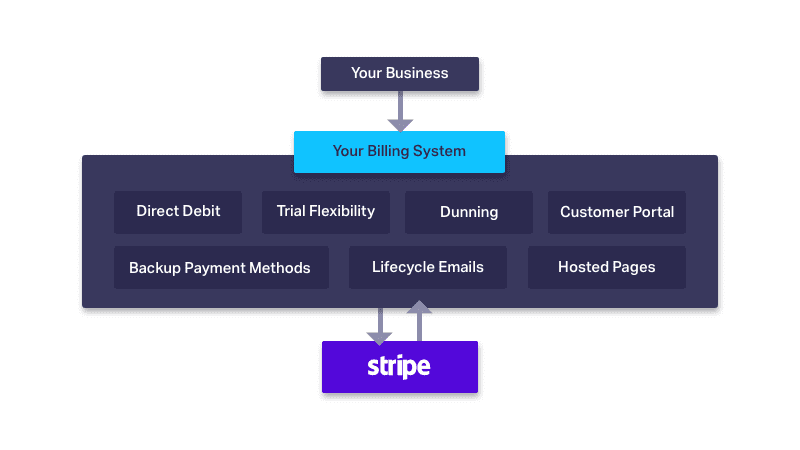

To illustrate, take a look at these standard features billing systems offer (note that the list is much, MUCH longer):

There are very few companies that are making use of all of them at the same time.

At each point in a company’s growth, different features will be relevant to certain objectives over others. As objectives change, the features that are relevant will too.

We’ve learned to think of billing systems as a one-stop shop with all the features that you might need to grow now and the feature you don’t need at the moment but will down the line.

The advantage of buying a billing system is that you can pick and choose features that you need to support your subscription at a moment’s notice, without worrying about the shadows of cost and resource management that might be hovering overhead.

And this can have a massive impact on customer experience.

Freedom is an example of this point in action. When Freedom got their subscriptions off the ground in 2011, the only payment options they were offering were debit and credit cards. It worked well for them in those early days. The minute they began to expand into the global market, though, their customers (and prospects) clamored for more flexibility. Expanding their payment option to accept Amazon and PayPal saw their conversions increase by nearly 33%.

Did they need multiple payment methods when they were starting off? No. Did getting multiple payment methods up quickly boost their revenue at a critical stage in their growth? 100% yes.

Myth #5: My payment gateway will take care of the ins and outs of payment collection

The final piece (that we haven’t touched upon as yet) of the billing process is payment collection — typically the part that people are most familiar with.

A payment gateway is the online equivalent of a credit card machine. Safe to assume, as most do, that if there’s a payment to be collected, it can handle it.

The problem is that this simplistic view discounts the logistics of connecting a customer to a payment gateway.

Logistics that aren’t all that important (checkout pages do the connecting for the most part) until a payment fails.

Payments can fail for any number of reasons. Some are as tiny as a gateway timeout. Some are as intimidating as a stolen credit card.

Either way, the impetus falls on a business to follow up with a customer and do everything possible to recover the payment in the most convenient way possible. Or face involuntary churn.

Here’s how you can use a billing system to insulate customer relationships against failed payments.

Why it’s important these myths disappears

Billing systems are a part of the SaaS growth engine from day zero, for better or worse.

This means that they can start out really simple and gradually (slowly enough that you don’t notice until it’s too late) evolve into behemoths of complexity.

The disarming simplicity of billing operations (at the initial stages of growth) has led countless companies into the scary cul-de-sac of not being able to offer their customers subscription or payment flexibility.

It’s important to recognize the interconnections between billing and subscription early on so that billing doesn’t get in the way of growth at any point in a company’s journey.

Most subscription inflexibility we’ve encountered comes from rigid billing.

Sometimes the gaps in customer experience can be small. Example: customers can’t pause their subscriptions because it might throw off billing cycles. Sometimes, though, they can be dealbreakers. Example: customer accounts are canceled immediately (not at the end of a term) because proration isn’t supported.

In summary, There’s no place for inflexible subscriptions in a relationship economy. And billing better keep up with how your subscriptions evolve.

Part 3: Billing systems can help you focus on customers

It’s time to switch tracks a bit.

So far we’ve covered how billing system, with the data they possess, can be used for making payments and subscriptions a little more personal and ergonomic.

The missing piece, acknowledging that no tool would be worth buying if it didn’t increase productivity, is how a billing system can simplify your operations within your business so you can focus on customer relationships (and those specific expectations that are tied to your brand).

Myth #6: Billing systems are a tool for finance teams

To bust this myth, we begin (again) with all the data that a billing system has at its fingertips. This time we’re thinking about where it might need to route that data, and when (outside of finance).

We encounter use cases like this every day:

- Sales is trying to work out a deal with a prospect. The plan is they come on board as a customer but only pay half price for three months. They want to send out a custom invoice immediately and schedule a follow up later.

- Support or customer success wants to offer a customer a discount and needs to modify a customer’s subscription. They need subscription information to show up on the helpdesk they’re using so they can close a ticket fast.

- Marketing wants to retarget prospects who’ve abandoned checking out of your website with a coupon or an offer. They’re asking for reports of data from your checkout pages.

Across functions, teams are using billing systems to see workflows through.

The question is why billing systems are evolving to be these tools that multiple functions in a business turn to? Why not a CRM, for example?

The answer is that with data of every sale, and with control over customer accounts, the billing system is in the perfect position between customer and business to close the loop on a change in a workflow.

Here’s how billing systems can close the loop on customer acquisition, monetization, and retention (pushing the needle on these metrics typically being an exercise that involves sales, product, and marketing working together).

Towards demonstration on how a billing system can close the loop, consider marketing’s coupon.

To send a coupon out, a coupon management system (today’s leading tool of choice) requires robust links between your customer accounts, billing system, reporting system, and accounting system.

A billing system, on the other hand, with all the data it needs for ‘invoices’ only needs to integrate with your accounting system. It can singularly segment the customers you want to send the coupon to, track how many people use it, change the subscriptions of people who do, alter charges on their invoices, and factor the changes into reports.

Billing systems close the loop on workflows across functions by collecting and collating data, on the one hand, and automatically making appropriate changes to customer accounts and reports, on the other.

Myth #7: Maintaining an in-house billing system isn’t too much of a distraction

This one barely made the list because one can imagine a set of circumstances where maintaining a billing system is easy — at a business with pockets that go forever and resources that are never exhausted.

Assuming your business doesn’t fit this utopian bill, though, here’s why maintenance can be hard:

- There are no small changes

Because you’re dealing with a host of moving parts, making a change to a billing system can be complicated and expensive.

Consider the ‘credit’ (or refund).

Seems simple enough to build considering that you hand out invoices, right. A credit, after all, is like a reverse invoice — a record of money that you owe your customer.

“Dig deeper and you’ll see that not all credits can be treated the same: the credits given against a paid amount have to be handled differently from a waiver or write off against an unpaid invoice.” Saravanan KP writes.

There are also the questions of whether to offer the credit as an amount you can redeem against a future subscription, as a discount on a current subscription, or as cash.

Suddenly, billing questions have turned into subscription and product questions again. - Documentation is really hard

Let’s say you’ve answered all the questions around credits, though, and you’re ready to build the feature.If the engineers who got your billing off the ground aren’t around, the only way that you can make sure that you’re making changes to the code that won’t cause other parts of it to malfunction is with robust and comprehensive documentation.

I haven’t gotten to the problem yet.

The problem isn’t whether new changes can cause malfunctions. You can figure that stuff out.

The problem is accounting for use cases that might pop up down the line. These are use cases you don’t even know about yet.

Choosing the quick and easy way to set something up (especially a billing feature that’s time sensitive) can create problems later… when you discover that you didn’t consider all possible use cases.

“Like a financial debt, the technical debt incurs interest payments, which come in the form of the extra effort that we have to do in future development because of the quick and dirty choice. We can choose to continue paying the interest, or we can pay down the principal by refactoring the quick and dirty development into the better development. Although it costs to pay down the principal, we gain by reduced interest payments in the future.” writes Martin Fowler.

Conclusion: The problem that subscription billing is solving

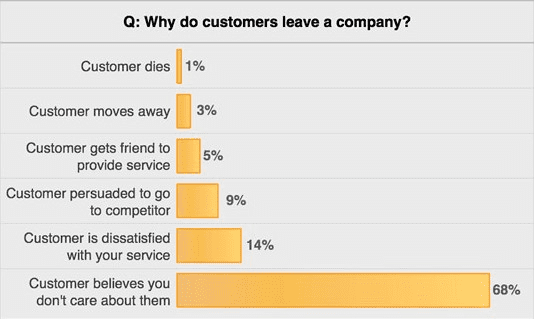

The Rockefeller Foundation ran a simple survey a few years ago. They were trying to figure out why customers left.

The results they published were startling as they were obvious.

Let’s conclude, as we began, with Derek Arch. He had bills to give out, relationships to build. The backbone of his business is very much the same as ours, new-fangled technology notwithstanding.

The question billing systems have matured to tackle is how to build relationships like those in spite of the virtual space we do business in. A space that, for all its convenience, can feel…less than human more often than not.

Why building these relationships falls on a billing system (having lurked in the shadows when licenses ruled the internet) is a fair question to ask.

We don’t get it too often, to be honest, because people still haven’t realized that the evolution has been happening. It’s the principle reason these myths exist.

The answer is simple and comes in two parts:

- On the one hand, because they can. They’ve got the data to see these workflows in sales, marketing, and product through.

- On the other, because it falls on every tool, person, and process in a company to push customer relationships forward. To echo Des Traynor, it’s all that will decide if your customers stick with you or switch to someone else.

Seven billing system myths that are worth getting rid of once and for all. Here they are once again.

- Myth #1: Billing systems are payment gateways and invoicing tools

- Myth #2: My customers don’t have billing expectations

- Myth #3: Billing is closely tied to accounting and reporting, NOT subscriptions

- Myth #4: The billing features I need will remain the same as I grow

- Myth #5: My payment gateway will take care of the ins and outs of payment collection

- Myth #6: Billing systems are a tool for finance teams

- Myth #7: Maintaining an in-house billing system isn’t too much of a distraction