All SaaS companies grapple with the uncomfortable reality of customer churn. If only you knew (for sure) why your customers were leaving, you’d pull out all the stops to fix the leaky bucket.

A customer exit survey, a common tool to collect feedback from existing customers, can help tell you what pain points require immediate attention.

How do you best implement a customer exit survey? What can you do to stop churn before it happens? We break it down for you.

What is a customer exit survey?

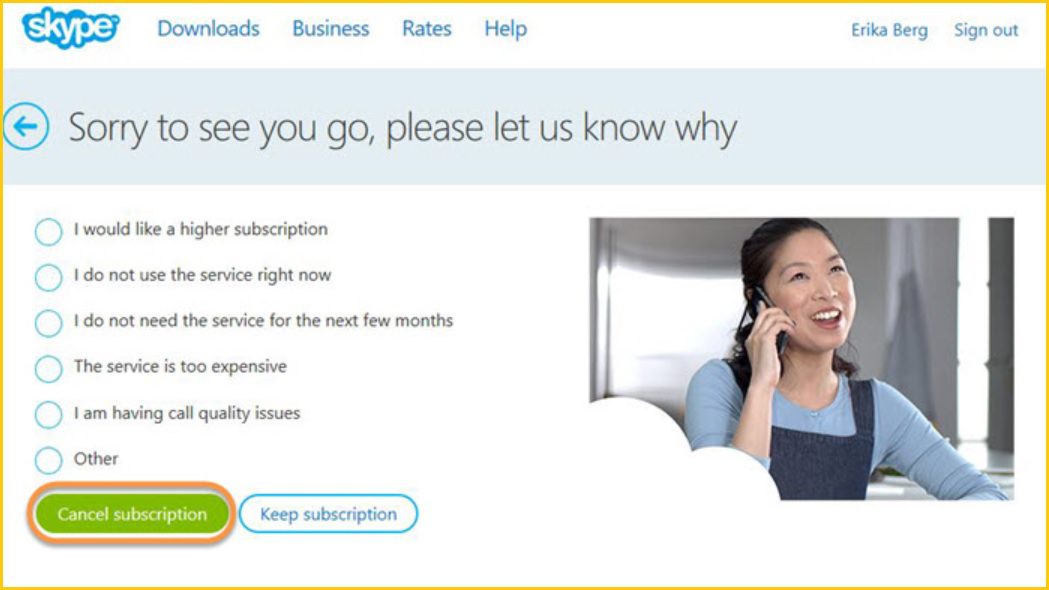

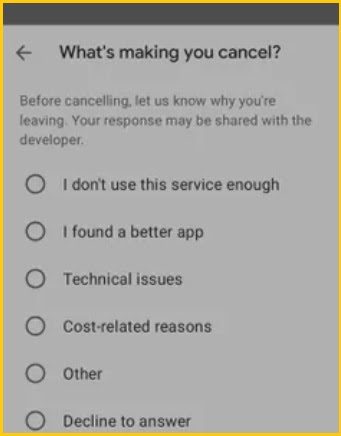

A customer exit survey is a questionnaire that customers complete either before or after an exit event, typically featuring a list of reasons why clients cancel. When customers unsubscribe, they choose the reason(s) for doing so.

It is an effective tool for collecting contextual feedback and gauging customer satisfaction following a cancellation.

Tailored correctly, they go a long way in inferring business-customer relationships and expectations accurately.

This is also why framing the right questions and empowering your customers to share actionable (sometimes even critical) feedback makes all the difference to your business.

Why conducting an exit survey is crucial for improving customer retention?

At any point, it can be incredibly difficult to pinpoint the exact reasons for customer cancellation. There could be a variety of reasons ranging from the customer having outgrown their need, to pricing, to individual point-in-time issues with support, delivery, refund, or more.

Knowing precisely what drove a customer to the point of cancellation is critical to figuring out your next move – i.e. identifying existing issues with your product/service that can be improved, or determining external stimuli affecting your subscriber relationships (e.g. more competitive pricing, or customers looking for shorter subscription plan tenures, etc.).

This knowledge can have significant implications for future retention rates, product-market fit, and business strategy.

However, businesses must balance the need for thorough feedback with the desire to avoid making the survey feel burdensome for customers. While there will always be more details, businesses must choose between critical questions and deliver a short survey after understanding where the information gap lies for them.

Choosing the right channel for the survey is also important, as app-based surveys should be short and concise while email surveys can afford to be longer. Knowing these key factors can help businesses effectively use exit surveys to improve customer retention and satisfaction.

Types of customer exit surveys

There are two ways to classify customer exit surveys: by when they are presented and by the channel through which they are presented.

By when they are presented

When it comes to timing, exit surveys can be presented either before or after a customer has ended their relationship with your business.

Asking customers to take part in an exit survey before they cancel their subscription can provide immediate feedback. These are also opportunities where affiliate messaging can be used with your exit survey to influence the customer against cancellation.

However, this approach may also be perceived as intrusive or annoying, which could lead to a negative experience and potentially drive the customer away even faster if not done correctly.

Potential drawback of asking customers to take part in an exit survey after they have cancelled their subscription is that they may be less likely to provide detailed and accurate feedback.

Once a customer has already decided to cancel their subscription, they may not be as invested in helping the business improve their services. Additionally, they may be more emotional or frustrated, which could color their feedback.

Ultimately, the best approach to exit surveys will depend on the specific business and their customer base. It may be beneficial to use a combination of both pre- and post-cancellation surveys to gather a range of feedback and insights.

By the channel used

Exit surveys can also be categorized by the channel which they are spread through. This involves:

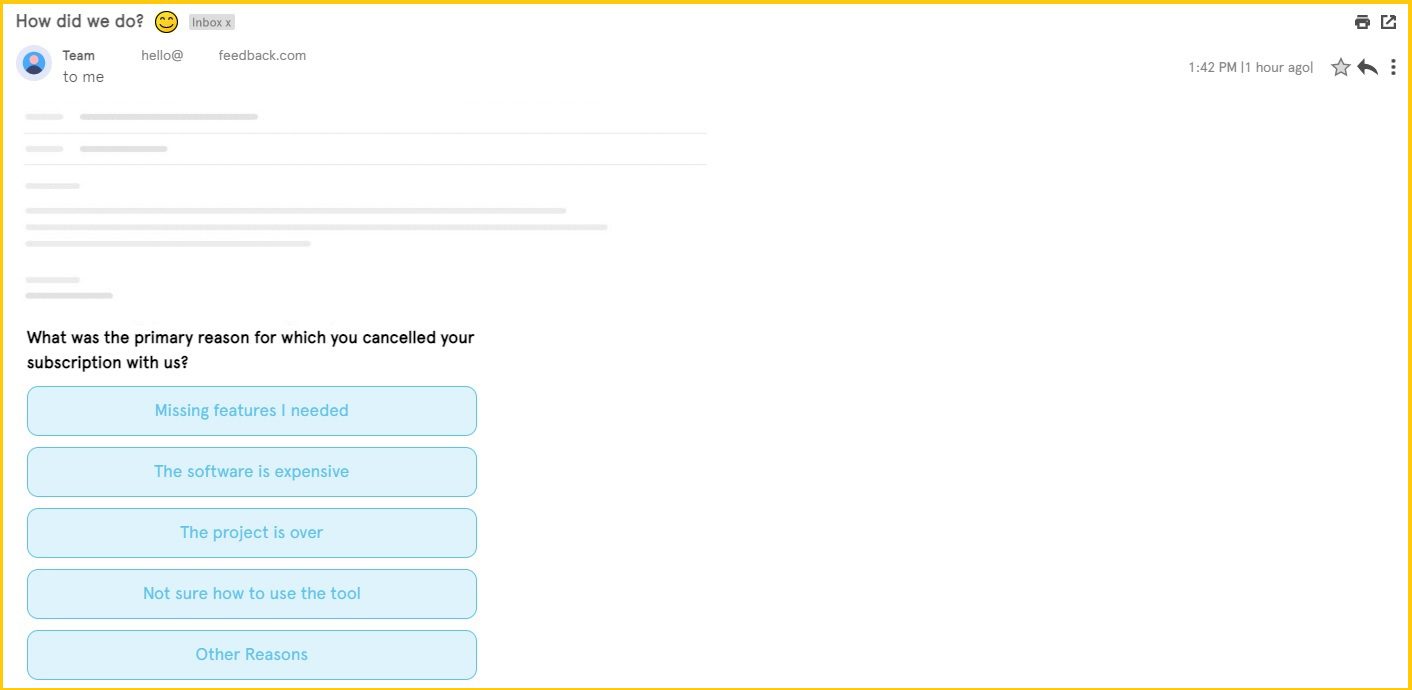

- Emails

- In-app cancellations

- On-site (mobile and desktop pages)

In-app exit surveys provide immediate gratification. Since customers are still in the same interface they interact with your business through (assuming you have an app-based service) they are seeking immediate redressals.

Questions in the survey come in various quick-to-respond formats like dropdowns, checkboxes, or radio buttons. On the flip side, they’re less likely to provide qualitative feedback (e.g., a customer can select ‘missing features’ as a cancellation reason but, without long-form answer fields, might not list their desired those features).

Similarly, exit surveys shared as a pop-up on desktop or mobile sites can be designed based on specific inputs the customer enters before the cancellation button. For example, when presented with a retention offer at the point of cancellation, a customer choosing the ‘ignore’ button indicates a higher level of dissatisfaction than the one pressing the ‘show me the offer’ button. The messaging in your survey can therefore be appropriately changed based on your customer NPS.

An email exit survey typically has a low response rate. As a positive, those who do open exit survey emails are more likely to describe their reasons for canceling. Email is better for qualitative feedback on customer experience as it relates to cancellations and downgrades.

Understanding the relevance of each type of exit survey can help businesses design effective questions and collect valuable feedback. While designing exit surveys remains highly specific to each business, industry, and churn rate, following some rule-of-thumb exercises can help businesses create effective surveys.

Best Practices for Conducting Customer Exit Surveys

There is little point to an exit survey if customers ignore it, which can happen if customer interest needs to be accurately captured. Therefore an exit survey message should highlight how your customer stands to benefit from participating in the exit survey. The drivers of intent can be anything between:

- The chance to influence peer experiences

- Being made to feel a part of industrial transformations

- Allowing the business to understand and resolve customer pains

- Making the business aware of any value gaps

- A chance to vent out their concerns (sometimes even rage) at unmet expectations

Once a customer is convinced to share their feedback, the next job to be done for a successful exit survey is to retain their interest in completing it.

Quick tip: Keep track of your submissions-to-completion rate. This helps you understand how effective your current cancellation flow is both at attracting survey responses and at retaining your responder’s interest long enough for them to complete the survey.

Once you have your backend processes resolved, apply design principles to help build a tighter survey. Here are a few things you need to keep in mind –

1. Shorter exit surveys are better for conversion

From the customer’s perspective, the exit survey is an additional step in the cancellation path. They will want to finish it as soon and as easily as possible. Often this requires you to prioritize a smaller subset from a larger list of questions you want to ask your customers.

‘But wait! I am a multi-product business and will probably need more than just 3-5 questions to figure my customer expectations better.’

Agreed. This is why the ideal length of a customer exit survey is always attuned to your specific business and how your customers engage with you. However, if your exit survey is naturally voluminous, it is ideal to split complex questions into multiple sub-sections with clear navigation buttons (‘done,’ ‘next,’ ‘previous,’ ‘submit,’ and more).

2. Follow through with a note of thanks to your customers

Getting your customers to complete a survey to help your business, especially when they have no intention to continue with you, is an onerous task. Like net-new sales, the key often, is to build bridges that didn’t exist before. Empathy, therefore, goes a long way.

Start with thanking them for their time and engagement. This helps you start with a common reference point – the shared relationship that exists between you.

Quick tip: Personalization can help deliver your message with a lot more thoughtfulness. Use data from your subscription management tool (e.g., customer details, plan details, pricing, etc.) to power your emails/in-app messages.

This can work especially well if you’re interested in collecting qualitative feedback through a detailed survey and sending a link to the survey in the email.

3. State the time required to complete your survey

Your customers will be more inclined to complete an exit survey that takes only a few minutes of their time. A statement highlighting just how long the survey should take works two ways –

first, it tells customers that you’re respectful of their time, and secondly it builds preparedness by informing them about how much of an effort it would take to complete the feedback survey.

4. Use MCQs and avoid making customers work hard to provide feedback

Exit survey questions should be immediately clear, and choices – such as cancellation reasons – should be concise for an accurate and speedy response. While long/short answer boxes capture context, you don’t need them for every individual instance.

Instead of asking customers to type out why they canceled their subscription, first provide multiple choices that you think might be the driving factor, and then add an ‘other’ option with a short answer field to capture anything that falls beyond your prescribed options.

For customers who canceled because of the usual reasons, this saves a lot of time and mind-space.

Quick tip: Avoid clubbing two reasons (e.g., don’t cite – ‘Bad experience with onboarding and customer support team’ as a single reason. Instead, use ‘poor onboarding’ and ‘lack of support’ as two separate reasons) to prevent inaccuracy.

5. Speak your customer’s tongue

Avoid using jargons or templatized online customer exit surveys. Customize the copy to reflect the brand voice your customers are familiar hearing in all your communications with them. It will do its bit to reinforce the image you’ve cultivated, and may even discourage customers from being too harsh in their word-of-mouth critiques.

Quick tip: With Chargebee Retention, you can easily create a customer exit survey that showcases your brand voice. You can configure the cancellation page to your needs by editing the headline, copy, and survey elements.

Now that you have enough context about exit survey architecture, it is time to solve for the point of communication – what you actually end up asking your customers. As mentioned previously, the type and length of your questions will depend on your specific business, yet, here are a few recommendations that can help you get started

What are some good exit survey questions?

It is good practice for your customer exit survey to have a mix of both pointed and open-ended questions. While the former help you (and your customer) get to the crux faster, the latter increases the legroom to capture concerns/feedback/suggestions that are unprecedented.

Here are some key customer exit survey questions you should be looking to ask:

1. What is the primary reason for canceling your subscription?

This is the most crucial question to ask. Attributing each churn event to a reason can help you identify trends and avoid similar churn in the future. It points to the type of issue responsible for churn, such as inadequate features (product-related) or pricing-related issues.

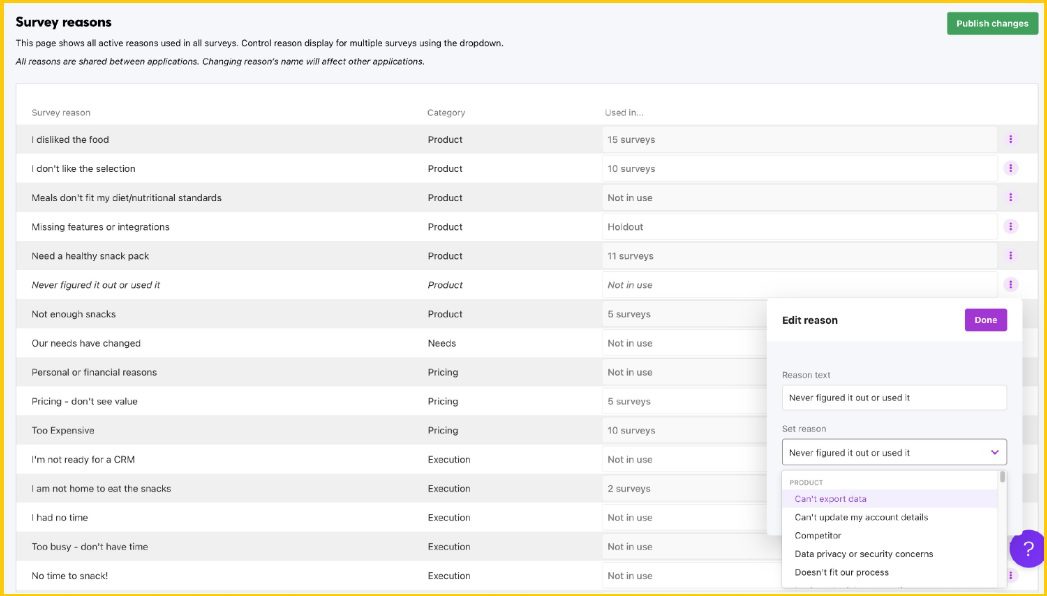

Chargebee Retention makes light work of creating customer exit surveys by providing distinct categories of cancellation reasons for SaaS, digital, and eCommerce businesses, and subsets of reasons within each. If you’ve already defined cancellation reasons, you can use the Reason Library to make edits for a correct category-reason match.

If presented before the customer has already exited, the response to this question can help businesses frame better retention offers. For example – if their primary concern is pricing, you could choose to issue a discount or offer to downgrade to a lower-tiered plan, however, if they cite product issues you can provide a direct line to a customer success manager for assistance.

2. How would you rate your experience with <product> on 1-5?

Customer churn is not always a knee-jerk action to a specific event in the customer journey. Often it is a culmination of different experiences aggregated over time. Hence, it is important to understand how favorably your product/service was perceived by your customers barring the key churn reason cited by them.

A Likert scale can help you understand that, without adding length to your exit survey. While 1-5 is a shorter, randomized range, expanding it to 1-10 or even changing the ratings to a range of – ‘extremely dissatisfied’ to ‘extremely happy’ – could also help you collect information in a format that best serves your interpretation requirements.

Customers may sometimes need to cut ties because they’re not ready for your product but purchased it anyway. They may have a need for your product in the future and should be regarded as potential future customers. Continue engaging them to identify when they’re ready for your product, and reach out with win-back incentives/offers.

3. How could we better serve you in the future?

This provides more direct insight into your value proposition in your customer’s eye. While this would probably require a long-answer field, any customer who provides a response is willing to help you succeed and could be a future advocate.

However, it is important to note that mandating a response to this question can do more harm than good, by extending the time required to complete the survey.

4. What did you like about our product/service?

It is as important to identify the scalable components of your business as it is to recognize shortcomings. Since no product is unidimensional (i.e., don’t solicit a single emotion), asking churning customers what they liked about your product helps you associate closely with the needs that were met.

This directly talks to you about the components in your product/service that can yet be scaled or even ones that can be salvaged, and hence, define how you build and prioritize your product roadmap.

Depending on how granular you want to get, you can choose between having dropdowns with specific feature items, a multi-checkbox, or even Likert scales that rank each of your product components/features’ likeability.

5. How likely are you to recommend our product to your colleagues or friends?

This is a question that fits like a glove both in customer satisfaction and cancellation questionnaires. It helps understand your approval ratings better and categorize exiting customers based on their return intent.

Customers who are more likely to recommend your product will naturally be open to giving you another chance once you have solved for their primary cancellation reason, or – if they have outgrown your use case – will continue to be a brand champion to their peer group.

You will be able to better gauge which churned customers to keep nurturing with your win-back flows, who to send your referral messaging to, and who to remove from your future marketing and sales funnels.

Gaining actionable insights from exit surveys

The purpose of exit surveys isn’t just to collect customer insights, it is to make your present and future business strategies more data-led. Hence, you need a system to convert survey data into actions that boost customer retention. A broad approach would be categorizing customers into different groups based on their responses.

Group 1: has customers that thought they needed your product only to realize they didn’t. It could be their mea culpa or a sign that you need to work harder on targeting your product to your ideal customer.

Group 2: consists of customers that do not have an immediate need for your product but could become active paying subscribers in the future. These are the ones who should be put through a post-exit nurture flow and warmed for a win-back.

Group 3: has a need for your product but canceled because your product didn’t meet their expectations. This is the group that speaks to your present operation as a business. By being attentive to the feedback this group generates in your exit survey, you will be able to expedite solutions for your present customers better. You will also identify the more obvious issues with your product and start collecting better revenue.

Your business must be equally adept at personalizing retention offers or the cancel flow depending on the reason given at the point of cancellation. This is easier said than done since both segmenting exiting customers and then funneling each segment through a relevant (even personalized) save/deflection/win-back/nurture flow require active automation.

Thankfully, it is a solution we have worked on for quite some time, and for pioneering subscription brands the world over. Chargebee Retention not only helps you customize your cancel flow (and, correspondingly, your exit survey), it also helps you arrest customer churn before it even happens.

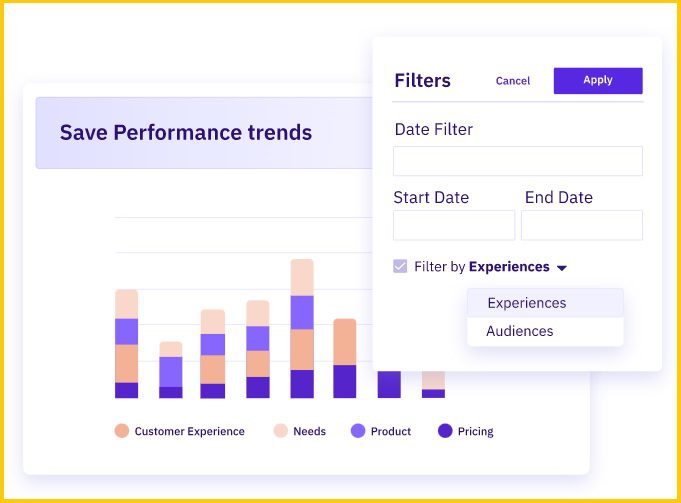

By creating automated offers depending on cancellation reasons, Chargebee saves more of your customers and then helps you analyze the efficiency of your retention engine. It also provides insights and reportage on key retention metrics, telling you how your offer-cancel reason combinations are performing across categories.

Conduct customer exit survey and show personalised retention offer with Chargebee Retention

The customer cancellation survey is a powerful tool to prevent, predict, and pulverize churn. If you’re implementing an exit survey for the first time, determine the survey type that works best for you, follow the best practices, and measure the results of retention improvements.

Chargebee Retention is an excellent exit survey tool, letting you easily create personalized questionnaires and offering a host of other retention features. Not sure you want to implement a cancellation survey? Create a churn funnel using Chargebee Retention and successfully combat subscription cancellation.