Well, this is one of those questions that has no short answer.

The shortest way to describe the difference between the CFO and the controller role is this quote from a research report by EY: ‘The difference between the CFO and the financial controller is that the latter is more like the financial operating officer. They ensure everything is running well, there are no surprises, and the audits are good. The CFO stays on top of the numbers but has a big external focus on positioning the company with investors.’

In this article, we’ll dive deeper into the long answer. Understand both roles, who they are, their responsibilities, and when to hire them to help you make an informed decision before setting up your finance leadership.

Who is a CFO?

A chief financial officer (CFO) is the senior executive responsible for managing the entire financial well-being of a company. As a member of a company’s leadership team, the CFO needs to be a master at managing the company’s financial resources, including keeping track of cash flows, ensuring compliance with financial regulations, and proposing corrective actions to improve the company’s overall performance. For example, a CFO can strategize cost-cutting measures, suggest ways to increase revenue, or identify investment opportunities to improve profitability.

CFOs also act as bridges between the finance team and other departments across the company to ensure everyone is aligned with the company’s financial goals and overall strategy. Research states that 86% of CFOs have increased collaboration across the C-suite leadership.

“The tone at the top plays a key role in ensuring how well the finance function influences other departments and processes,” – Mike Beach, CFO, Chargebee.

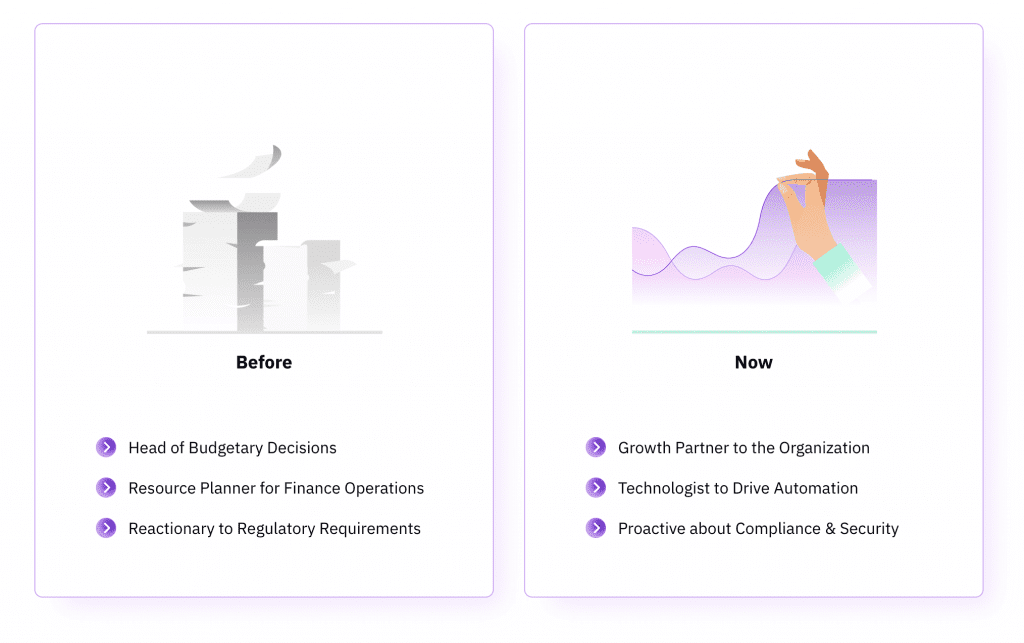

Moving from their traditional back-office role, modern CFOs are now responsible for leading strategic business decisions and championing enterprise-wide transformation through automation, breaking down data silos with a mature tech stack. They now play a pivotal role in supporting the organization’s sustainable growth.

Who is a Finance Controller?

A finance controller (or comptroller) is an experienced finance leader responsible for managing a company’s daily accounting operations and finance activities.

They lead the accounting department and oversee financial reports like balance sheets and income statements. The controller’s responsibilities include expense management, financial reporting & taxation, payroll, accounts receivables and payables, and vendor management, among other essential day-to-day finance duties.

Much like a modern CFO, a new-age SaaS finance controller is no longer just a backstage coordinator; they play a crucial role in managing a business’s revenue engine and growth.

Successful finance controllers have expanded their role beyond administrative and accounting policies and work closely with CFOs to develop strategic finance initiatives.

Today with businesses facing economic challenges, driving profitability by enabling efficient revenue practices has become a crucial responsibility for CFOs and finance controllers. They must build and lead modern finance teams with strategies to help businesses overcome economic pressures and sustain growth.

Related Read: Scaling during a downturn: Growth Strategies for the Modern CFO

Let’s dive deeper into the roles, responsibilities, and evolving expectations for a CFO vs Controller.

CFO Roles and Responsibilities

CFOs work closely with other C-suite members and are accountable to the Chief Executive Officer (CEO). They are responsible for a company’s financial stability and juggle various tasks, such as financial reporting, strategic planning, and leading the finance department.

“The ultimate question is what can CFOs do today to future-proof the finance function for tomorrow.”– Krish Subramanian, CEO and Founder of Chargebee (source)

While the role of a modern CFO continues to evolve, here’s a list of their primary responsibilities.

- Overseeing budgeting and expenses

- Align the leadership team on all financial and operational matters

- Heading financial planning & analysis (FP&A)

- Managing tax & regulatory compliance

- Fundraising and pitching strategic investments

- Ensure risk management, cybersecurity, and fraud mitigation

- Building credibility with the investors

- Championing automation with a robust tech stack

- Map people and processes across the company to support revenue growth

- Lead talent hiring and foster a future-proof finance function

- Drive strategic planning for unexpected scenarios.

Financial Controller Roles and Responsibilities

Financial Controller is a senior accounting expert who owns the financial closing process, producing financial reports and providing critical insights to support and guide business decisions. The primary duties of a financial controller include the following:

- Managing accounts, financial statements, and reports, including external reporting and public filings,

- Manage transactions such as accounts payable, accounts receivable, payroll, and balance sheets

- Manage internal finance processes, policies, accounting, and book-closing processes

- Maintain healthy cash flow and profitability

- Oversee financial risk management, internal control policies, and tax liabilities and compliance with regulations

- Support budget analysis and financial planning, identifying cost savings and monitoring company spending

- Supervise bank reconciliations, debt management, and collection

- Managing external auditors

When a company has a Financial Controller and a CFO, the controller advises the CFO concerning accounting standards, tax laws, tech stack, and other compliance regulations. They work like a well-oiled machine to ensure the company’s long-term sustainable growth.

According to a study by The Association of Accountants and Financial Professionals in Business, the role of a Financial Controller has become increasingly strategic and essential in the last ten years. The evolving role of the Financial Controller necessitates a shift from traditional responsibilities to more strategic and technological ones, highlighting the need for continuous adaptation and upskilling.

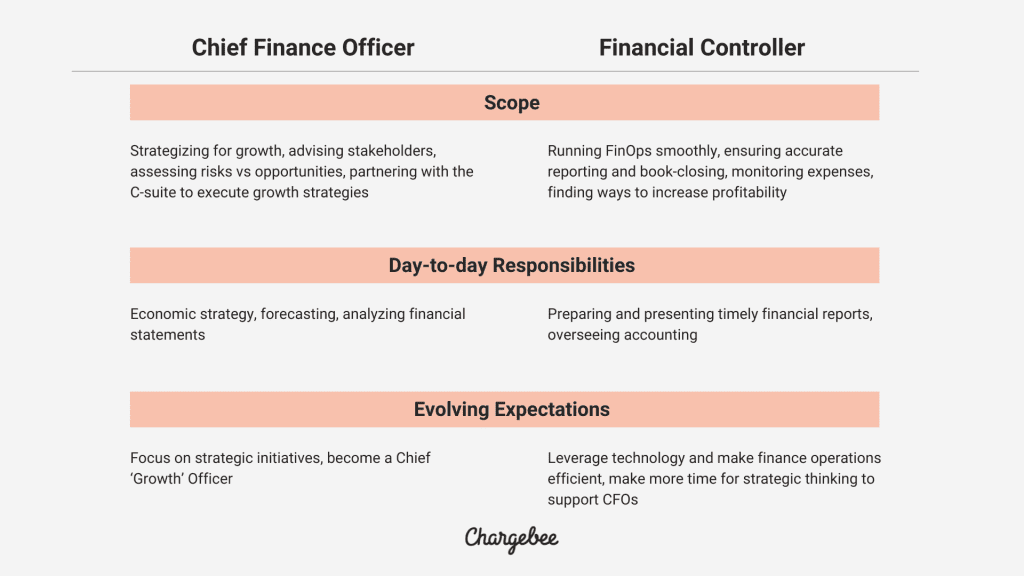

CFO vs Controller

If you’re looking for someone to manage your financial data and maintain compliance, a financial controller may fit your early-stage SaaS business. He can also spearhead finance operations (FinOps), leveraging technology to increase efficiency in running the finance function.

However, if you need an expert to provide insight into the financial health of your business, a CFO may be a better choice. According to EY, the three most important responsibilities of a CFO are

- Being a strategic partner

- Annual budgeting and outlook forecasting

- Risk management

The CFO drives the company’s strategic direction (including go-to-market, hiring, funding, etc.) and communicates them to the external and internal stakeholders. A successful CFO ensures the business is performing and growing in the right direction.

Here’s a brief comparison between the CFO and financial controller scope, day-to-day responsibilities, and evolving expectations.

When to Hire a Financial Controller

Most businesses bring in a financial controller when they expand, both in revenue and geography. As a business grows, its accounting needs become more complex, requiring a strategic finance leader with extensive experience in accounting and a deep understanding of global taxes, bookkeeping, internal controls, and regulatory compliances, like GAAP and ASC 606.

As a thumb rule, businesses in the revenue range of $5-$10 million onboard a financial controller to manage financial risk and start setting up a finance function that ensures financial stability and growth in a competitive market.

When to Hire a CFO

There are two alternative perspectives on when a company should hire a CFO.

The first suggests that a company should onboard a CFO only when it reaches a certain revenue threshold. According to various studies, this revenue threshold typically falls between $40 million and $100 million.

The second approach recommends hiring a CFO at the start-up phase of a business, regardless of the revenue the company generates. Various leaders advise that the earlier a business hires a CFO, the better it is for its growth.

According to Mike Beach, CFO of Chargebee, delaying the process of building a finance infrastructure can lead to a lot of challenges in the long term. If you wait too long before bringing in a CFO, it can create more work for the CFO, who must clean up financial data before they can focus on strategic financial planning. “To prepare for a CFO, a company should bring in a compliance person and establish the rigor around financial planning and analysis (FP&A), build budgets, and learn how to forecast. This can save leadership a lot of hassle in the long term,” says Beach

Related Read: Growing into the role of the Modern SaaS CFO: Lessons from Mike Beach

Setting up the Finance Function for your SaaS Business

Successful SaaS companies obsess over data-driven decisions to ensure sustainable growth. And the finance function is at the heart of these decisions, from cash flow management to bookkeeping, compliance, and accounting. In the current economic climate, the growth of a subscription business is defined by its long-term endurance, and you need to build an agile finance function to weather the headwinds. That’s why companies must invest in financial leadership early.

“I believe that ambitious companies should hire a Head of Finance early – ideally before their Series A,” says Joyce Mackenzie Liu, Founder of Pegafund.

In a Relay exchange, Merge’s 7 co-founder and CEO, Shensi Ding, recounts how Merge raised a $55 million Series B funding during a challenging SaaS environment only because of their critical decisions of setting up the finance function early on in their journey. “Having a great finance leader changes the game for a company. It makes you more careful with experiments and more thoughtful when hiring. It’s a critical early hire in my book.” she says.

Closing Notes

An early-stage company may appoint one person to handle the financial controller and CFO roles. However, the need for dedicated professionals in each role becomes more apparent as the business grows. As a partner to multiple finance leaders, Chargebee has a front-seat view of how modern finance leaders drive strategies to scale a SaaS business. Here’s a story encompassing the importance of a strong finance function that drove IPO readiness at a leading SaaS business.

Financial controllers and CFOs’ role has evolved from number crunching to strategic decision-makers, and technology has undoubtedly impacted that in various ways. With a robust tech stack as their best friend, finance leaders can straddle accounting and strategic finance and boost revenue growth with finesse. If you want to identify the maturity level of your finance operations, preempt potential challenges in the next growth stage, and prep for it, check out our ‘Finance Operations Maturity Framework’ to scale your organization effectively.

When you have the right people in the right places, it can transform the organization. As Steve Jobs says, “Great things in business are never done by one person. They’re done by a team of people.” Choose these critical finance roles wisely, as they would directly impact your customers, business, and investors’ needs.