Businesses across the globe have seen a massive shift in priorities over the past five years. From ‘Growth at all costs’ until 2022 to the ‘Year of Efficiency’* in 2023, the objectives shifted to reducing operational overheads, becoming nimble, and redefining processes.

But we’re in 2024, and things are different now. Our conversations with business leaders across the globe tell us a story of growth ambitions this year. Leaders are no longer content with surviving and want to show progress. We call it the year of ‘Efficient Growth’. We believe that businesses want to be bold and reaccelerate growth while carrying forward the learnings of efficiencies and fiscal prudence from the last 18 months.

And, to set you on the right track for success in the current market conditions, we at Chargebee have launched new product capabilities that help you grow efficiently.

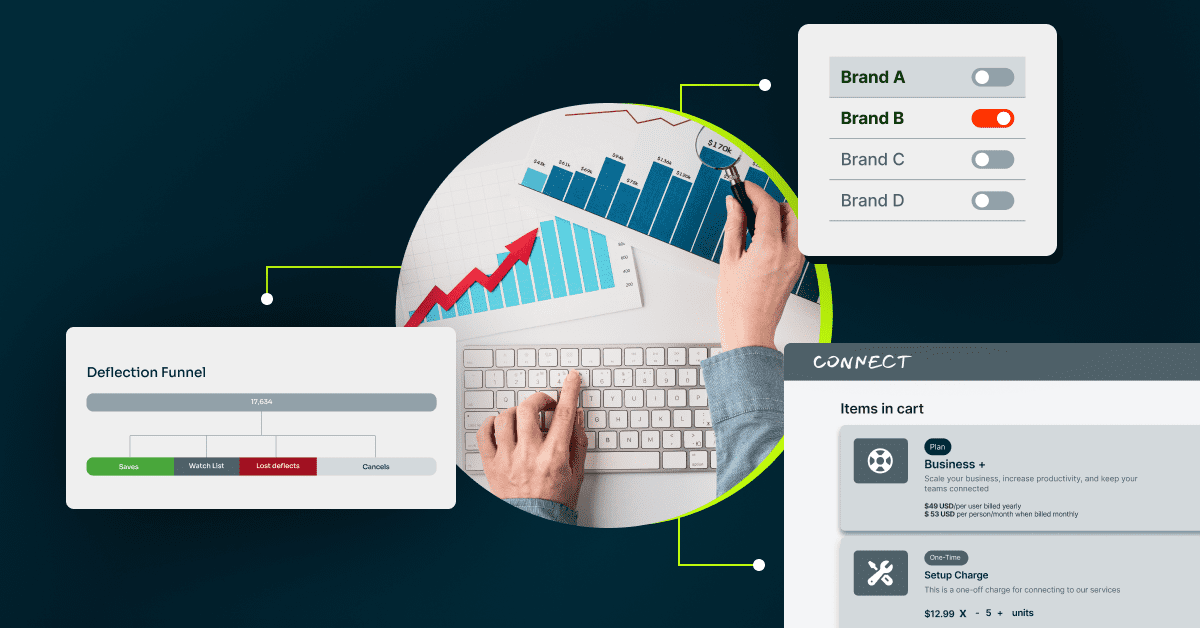

We’re excited to unveil our latest product innovations that help you acquire and retain more customers and scale FinOps efficiently.

Table of Contents

[Subscription Ramps]

Streamline Quote-to-Cash Efficiency for Multi-Year Deals

What

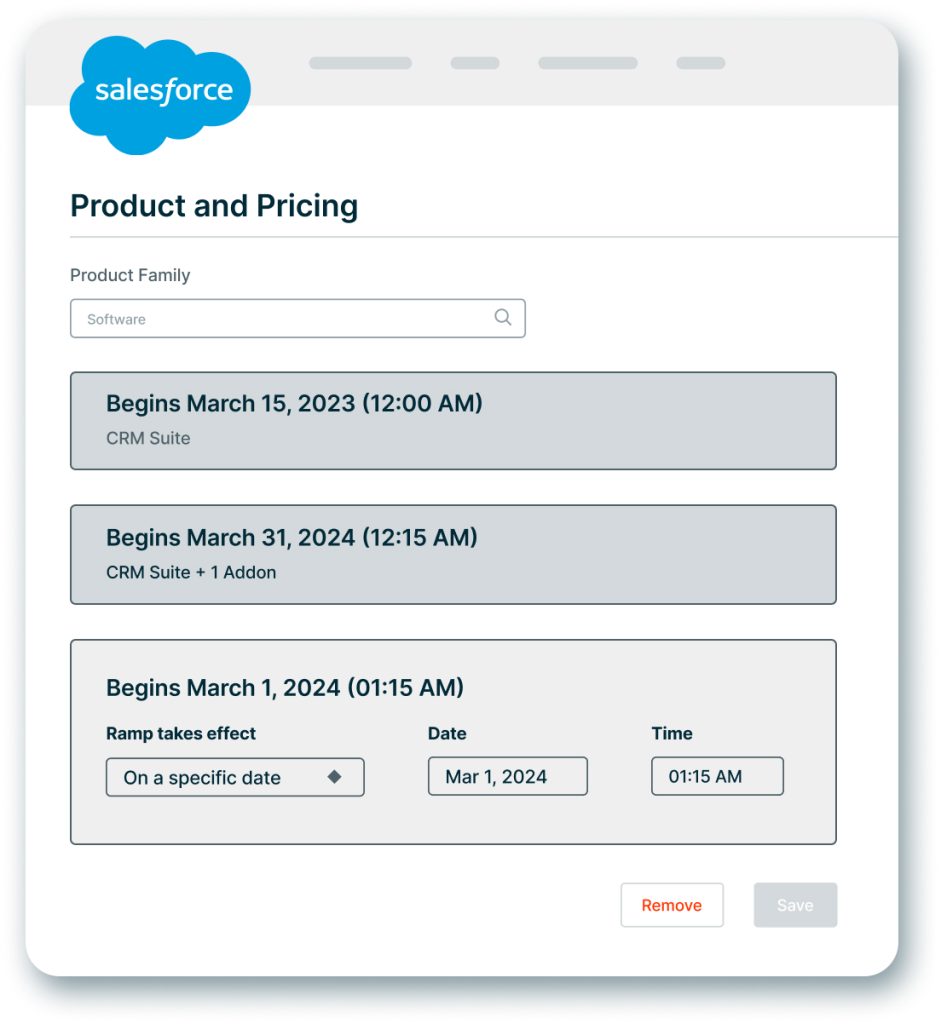

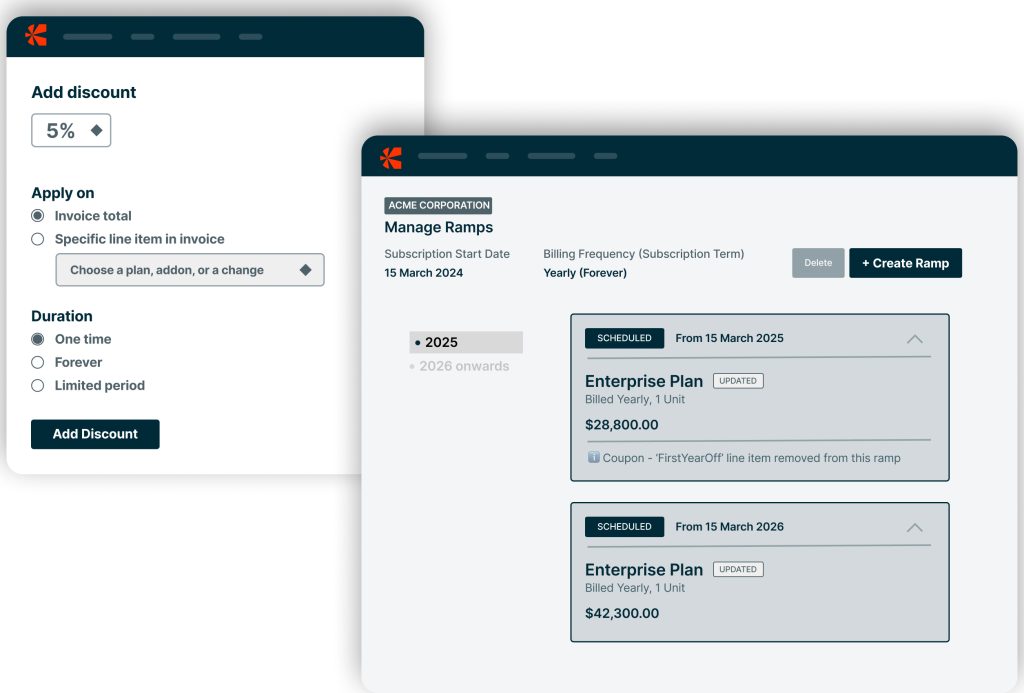

Introducing Subscription Ramps, which enables you to close multi-year deals and automate renewals easily with contract terms and multiple scheduled changes for price, plans, addons, and discounts.

Why

As much as multi-year deals are common in the Enterprise segment, they are also the most difficult to close. To flip the switch and move to a different vendor, customers need to consider many factors — migration and implementation costs (time and person-hours), time taken by the vendor to deliver the agreed custom solutions, software scalability, support responsiveness, and so on.

To make this a win-win for both parties, you can sweeten the deal with upfront discounts for a specified period, which gradually ramps down until the solution is fully delivered and implemented.

Another commonly observed use case in multi-year contracts is the inclusion of YoY inflationary price increase to the annual contract value.

Your sales reps need all the right tools within their CRM, like Salesforce, to schedule all these changes at the time of deal creation. Similarly, your finance team needs complete control to make any mid-cycle amendments to subscriptions in the case of upsell, cross-sell, or downgrade.

How it helps

Subscription Ramps provide a seamless sales-to-finance hand-off for multi-year contracts, ensuring all ramps and mid-cycle changes apply accurately to the invoice. With this capability,

- Sales reps can create subscriptions with up to 12 ramps for price, plans, add-ons, and coupons — all within the Chargebee UI on Salesforce. They can also issue discounts upfront to accelerate deal closure or schedule them for a later time – e.g., offer seasonal discounts to monetize on potential upsell opportunities.

- Finance/Success teams can manage all the ramps associated with Subscriptions on Chargebee. They can delete or create new ramps anytime and have them billed accurately.

[Full Page Checkout]

Unlock Frictionless One-Step Checkout Experiences

What

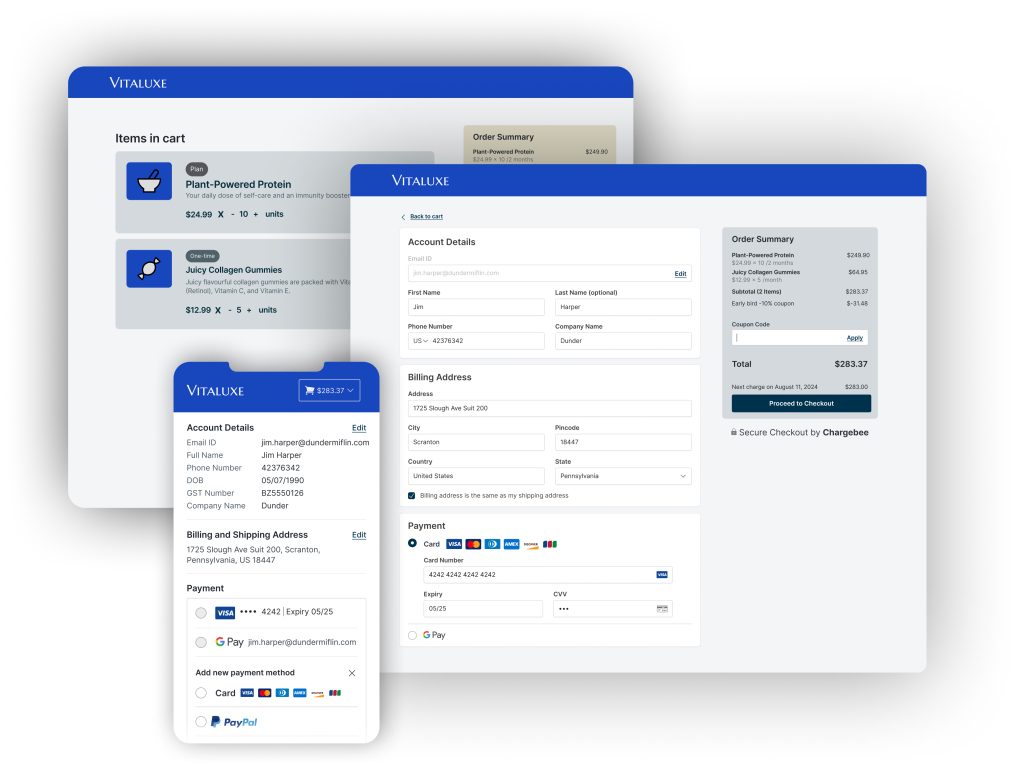

Chargebee’s Full Page Checkout helps you offer a seamless one-page checkout experience for your new and returning customers.

Why

A multi-step checkout process is one of the most common reasons for cart abandonment/drop-off. Customers don’t want to be redirected to multiple tabs or repeatedly asked to enter their payment and billing information. As you start building a solution for this in-house, you stumble upon even more significant challenges around compliance and payment processing.

How it helps

With Chargebee’s stunning Full Page Checkout, you can ensure a smooth and secure checkout experience for your customers from start to finish.

- Collect all checkout information like billing/shipping address and payment details on a single page for your new customers. For returning customers, give them a one-click checkout option to enable reuse of payment information.

- Make sure your checkout page reflects the look and feel of your brand. Using the built-in customization tool, you can manage colors and fonts and add product images, descriptions, and more to drive conversions.

- Ensure PCI compliance to keep your customers’ payment information secure.

- Monetize cross-sell opportunities by displaying relevant “Recommended products” on the checkout page.

- Deliver a consistent experience by optimizing checkout across web, mobile, and tablet devices.

Learn how to configure Full Page Checkout>>

[Multi-Brand Cancel Experience]

Minimize Voluntary Churn with Brand-Specific Cancel Experiences

What

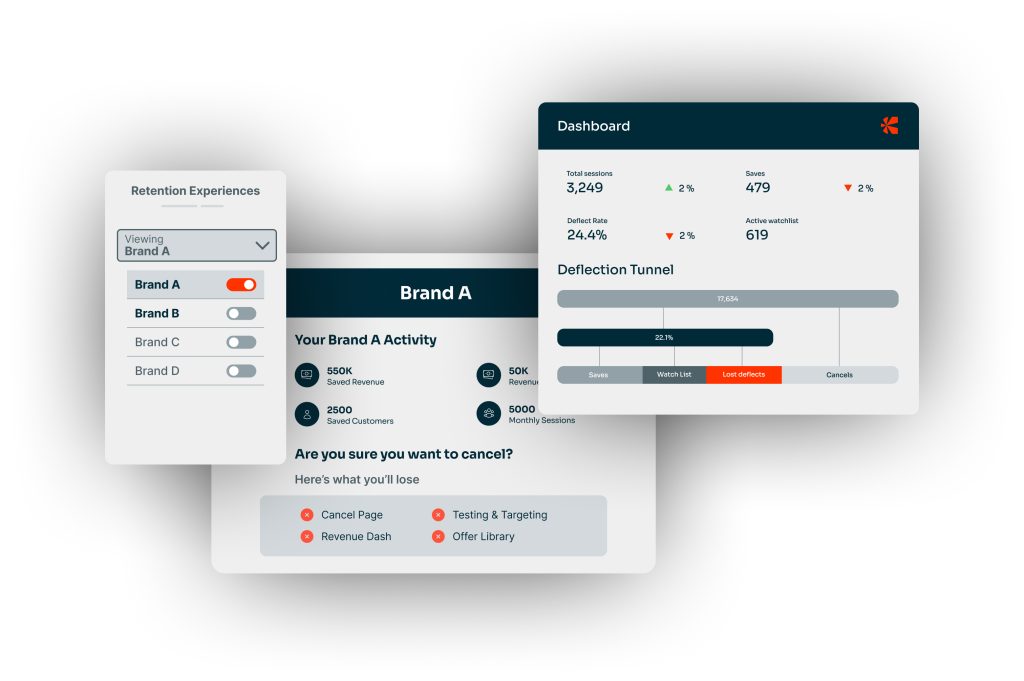

With Chargebee Retention, you can now take a more personalized approach to customer retention by customizing cancel experience and offers at the brand level.

Why

Personalization is critical to the success of customer retention programs. It gives your end-users a consistent experience with your brand and helps you increase their LTV with the most relevant offers.

Also, it’s crucial to have the correct set of tools to dive deep into segmentation rules, offer performance, and more — to understand what’s effective and what’s not and apply insights from one brand to improve the performance of another.

How it helps

With Chargebee’s Multi-Brand Cancel Experience, you can:

- Create custom offers, targeting rules, and cancel pages for each brand.

- Make every brand stand out by customizing cancel pages according to unique brand guidelines.

- Ensure brand-specific library assets, such as experiences, survey reasons, etc, remain isolated and distinct across different brands, maintaining brand integrity and coherence.

- Gain actionable insights into offer performance, retained revenue, deflection rate, and other critical metrics at the brand level. Make data-backed decisions by comparing key metrics across brands.

- Say goodbye to redundant efforts – you can now easily reuse offers, loss aversion cards, survey reasons, and more from one brand in another—so there is no need to waste time recreating them across multiple retention apps/sites.

[No-Code Invoice Template Builder]

Build Compliant Invoice Templates without Dev Dependency

What

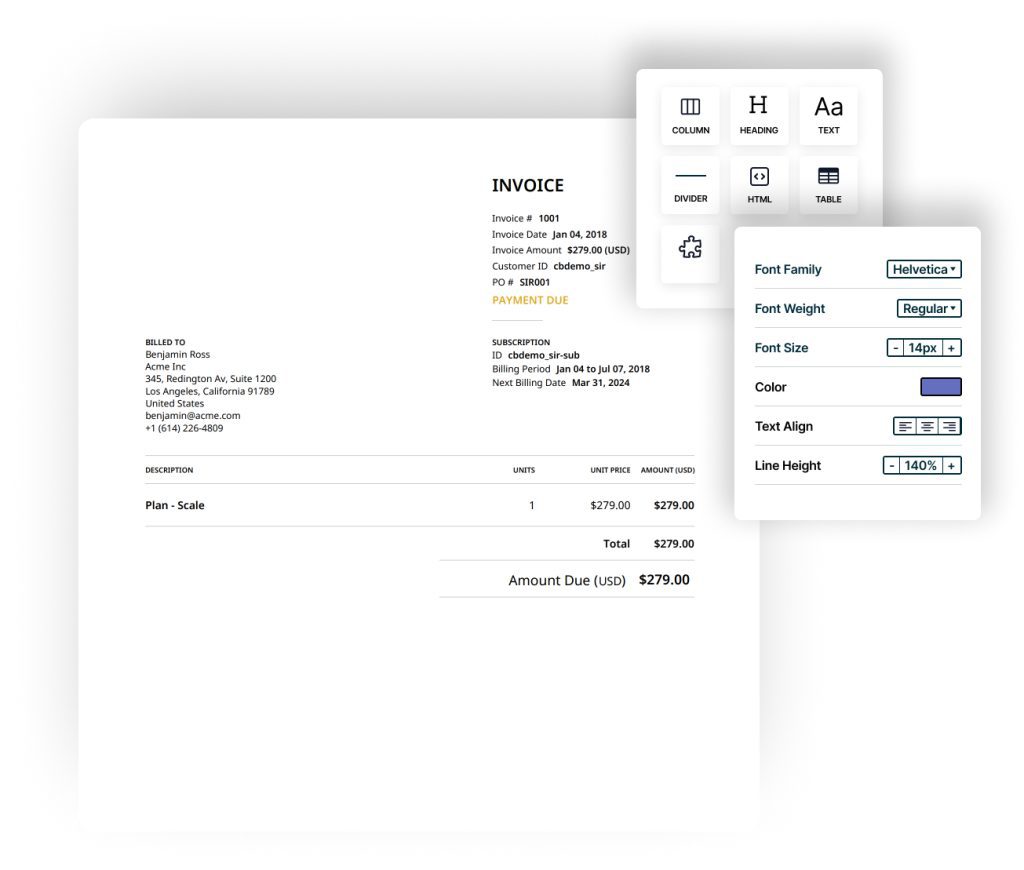

Create custom and compliant invoice templates with zero lines of code using the all-new drag-and-drop editor.

Why

As your business grows and expands into new markets, it becomes increasingly essential for you to have better controls over invoice templates to ensure compliance, branding consistency, and customer satisfaction.

Your compliance requirements will look like this:

- Showing tax amounts at line item level – EU, Australia, India, UAE

- Displaying Reverse Charge notes for all countries

- Displaying tax in local currency for an extensive list of countries

- Taxes Withheld (TDS) amounts captured on the invoice

And, you may also need enhanced customization capabilities like:

- Showing additional system and custom fields on an invoice — contract terms, customer, subscription, and product custom fields

- Customizing the date format, percentage representation, and decimal representations

- Multiple templates for each customer or product

- Customizing address formats – billing/shipping address

How it helps

Chargebee’s intuitive template builder provides a drag-and-drop interface to customize invoices within minutes. We recommend building on Chargebee’s default template to ensure you don’t compromise on compliance.

- Add, remove, or drag and drop new sections to your invoice templates. Have complete control over the fields displayed in these section blocks — add or remove merge variables according to your unique business needs or contract terms.

- Add brand-specific logos, colors, and fonts to your templates to make them reflect your brand identity.

- Add conditional statements to your invoices without a single line of code.

- Create and maintain a repository of invoice templates relevant to your customer segments and regions.

Learn how to customize invoices>>

[LATAM Payments]

Expand Your Market Reach in Latin America

What

Introducing new payment gateway integrations in LATAM – eBanx and dLocal and support for local payment method – Boleto.

Why

LATAM is one of the fastest-growing SaaS markets in the world, with a market value of ~$20B. More often than not, entering new markets requires registering as a local entity, which comes with high operational costs and administrative hassles. Additionally, customers will expect you to offer locally preferred payment methods and are not prone to shifting behaviors easily.

How it helps

You can expand your subscription business into LATAM without establishing a regional entity.

- Integrate with eBanx and dLocal payment gateways in LATAM to start processing payments locally and boost authorization rates.

- Accept payments through local card schemes like Elo and Hipercard.

- Accept Boleto payments via Stripe, LATAM’s commonly used cash/voucher-based payment method. Whether end customers pay online or at ATMs and convenience stores, Chargebee captures them accurately and automates reconciliation.

In addition to these new capabilities, we have also added support for more payment gateways, payment methods, and tax and invoicing compliance. Learn more about the latest updates here.

If you have any questions, please write to support@chargebee.com, and we’d be happy to assist. Watch this space for more updates and best practices.

References: